Bermuda, February 14, 2023: Cool

Company Ltd. (“CoolCo” or the “Company”) is pleased to announce

that it has filed a registration statement with the U.S. Securities

and Exchange Commission (“SEC”), with the intention of directly

listing its shares on the New York Stock Exchange (“NYSE”). Subject

to the registration statement being declared effective by the SEC,

the Company’s shares will be registered with the SEC and listed for

trading on the NYSE in addition to the Euronext Growth Oslo under

the ticker “CLCO” from March 15, 2023. No new CoolCo securities

will be issued in connection with the share listing on the

NYSE.

In connection with a listing on the NYSE, CoolCo

also expects to change its ticker code on Euronext Growth Oslo from

“COOL” to “CLCO”. Further details on the change of ticker code will

be provided in due course.

In order to facilitate transfer of shares

between the two trading venues, CoolCo intends to amend the

registration structure for its shares whereby all shares will be

primarily held and settled within the Depository Trust Company

(“DTC”) in the United States and secondarily held and settled in

Euronext Securities Oslo (the “VPS”) through a Central Securities

Depository (“CSD”) link (the “Reregistration Process”). Following

the Reregistration Process, the Company’s shares will be able to be

moved between the DTC and VPS to enable trading between the

respective trading venues. A trading suspension in the CoolCo

shares will be required for a period of time in connection with the

Reregistration Process, expected to be two trading days, and the

Company will make a request to Oslo Børs to approve such

suspension. No action will be required by an investor holding

shares in the VPS in connection with the reregistration and

investors’ registered holdings in the VPS will continue. See below

for further details on the Reregistration Process.

CoolCo CEO Richard Tyrrell commented:“By listing

on the NYSE, we are expanding our investor base and providing US

investors with access to CoolCo’s unique combination of attractive

dividends and exposure to the fast-growing global demand for LNG

transportation. Upon listing, CoolCo will be one of the largest of

a limited number of U.S. publicly traded companies that are

connecting global markets with LNG, which is crucial to energy

security and has an important role in the global transition to a

lower-carbon future. Our new presence in the U.S. market will

generate immediate value for all CoolCo shareholders by providing

easier access to CoolCo shares and additional trading liquidity.

Additionally, the dual listing further strengthens CoolCo’s

financial flexibility, supplementing our strong balance sheet,

significant internal cash generation, and proven access to

competitively priced debt in ensuring that we are well positioned

to seize attractive growth opportunities in a prudent manner that

maximizes shareholder value.”

Details on the contemplated Reregistration Process and

associated temporary Trading Suspension in CoolCo’s

shares

No action is required by an investor holding

shares in the VPS in connection with the Reregistration Process,

and investors’ holdings in the VPS will continue. The Company’s

shares will continue to trade under the same ISIN as today

(BMG2415A1137).

The dates set out in the following paragraphs

are preliminary only and subject to change depending on the date

that the Company’s registration statement is declared effective by

the SEC and the NYSE commences trading of CoolCo shares. Hence

these dates should be treated as indicative only. Further

confirmation of the exact timing of the contemplated Reregistration

Process and Trading Suspension will be provided in due course.

The Reregistration Process is expected to be

completed during the period March 13, 2023, to March 14, 2023. Due

to technical settlement requirements in the VPS, a trading

suspension in the CoolCo shares will be required from and including

March 13, 2023, to and including March 14, 2023 (the “Trading

Suspension”). The Company will make a request to Oslo Børs to

approve the Trading Suspension prior to implementation of the

Reregistration Process. During the Trading Suspension, the

Company’s shares will be temporarily suspended from trading on

Euronext Growth Oslo. From the perspective of an investor holding

the Company’s shares in the VPS, the last settlement cycle for

shares traded prior to the Trading Suspension will take place on

March 14, 2023. Investors trading in the Company’s shares prior to

start of the Trading Suspension should not agree to settlement

periods that would imply settlement after March 14, 2023. Any such

trades with settlement after March 14, 2023, are expected to be

cancelled.

Following completion of the Reregistration

Process, the Trading Suspension will end, and the Company’s shares

will resume trading as normal, which is expected to occur from and

including the start of trading on March 15, 2023.

Following completion of the Reregistration

Process, the Company’s shares will be registered in the Company’s

Register of Members in Bermuda in the name of DTC’s nominee, Cede

& Co. and DTC will act as the primary securities depository for

the shares. All shares in the Company will be primarily recorded in

the DTC and secondarily recorded in the VPS through a CSD link. DNB

Bank ASA, Registrars’ Department (the “VPS Registrar”) will

continue to administrate the Company’s VPS register.

To facilitate the secondary registration of the

shares in the VPS, the Company will enter into a deposit and

registrar agreement (the "Registrar Agreement") with the VPS

Registrar. A custodian of the VPS Registrar will be registered as

the holder of the primarily registered securities in the DTC

pursuant to which the VPS registered shares are derived from.

Following the Reregistration Process, the book

entry interests recorded in the VPS and listed on Euronext Growth

Oslo will still be regarded as the Company’s shares pursuant to the

Central Securities Depositories Regulation (“CSDR”). The shares in

the VPS will not carry any direct voting rights in the Company, but

shareholders in the VPS may instruct the VPS Registrar to vote for

their shares. The Company will furnish voting materials to the VPS

Registrar and the VPS Registrar will notify the owners of the

shares of upcoming votes and arrange to deliver the Company's

voting materials to the owners of the shares. The VPS Registrar's

notice will describe the information in the voting materials and

explain how owners of the shares may instruct the VPS Registrar

(who would then instruct the holder of such shares registered in

the Register of Members) to vote the underlying shares. The VPS

Registrar will only vote or attempt to vote on the instruction of

the owners of shares and will not itself exercise any voting

rights.

ABOUT COOLCO

CoolCo is a growth-oriented owner, operator and

manager of fuel-efficient liquefied natural gas (“LNG”) carriers.

Using its integrated, in-house vessel management platform, CoolCo

provides charterers and third-party LNG vessel owners with modern

and flexible management and transportation solutions, delivering a

lesser-emitting form of energy that supports decarbonization

efforts, economic growth, energy security, and improvements in

quality of life. CoolCo intends to leverage its industry

relationships to make further accretive acquisitions of in-service

LNGCs, and to selectively pursue newbuild opportunities.

Additional information about CoolCo can be found

at www.coolcoltd.com.

For further information, please contact:

ir@coolcoltd.com

Forward-looking Statements

This press release may be deemed to include

statements that are forward-looking within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995, including

statements with respect to the Company’s planned listing on the

NYSE, statements with respect to the Reregistration Process,

including the expected timing thereof and expected timing of the

Trading Suspension and statements with respect to the VPS Registrar

including voting of shares through the VPS Registrar, benefits of a

NYSE listing , statements with respect to our business and

attractive dividends and exposure to the fast-growing global demand

for LNG transportation and other non-historical statements.

Forward-looking statements are typically identified by words or

phrases, such as “about”, “believe,” “expect,” “plan,” “goal,”

“target,” “strategy,” and similar expressions or future or

conditional verbs such as “may,” “will,” “should,” “would,” and

“could.” Forward-looking statements are based on our current

estimates or expectations of future events or future results and

are subject to risks and uncertainties and actual results could

differ materially from those indicated by these statements.

CoolCo’s registration statement on Form 20-F filed with the SEC on

the date hereof, including the section captioned “Risk Factors,”

contains additional information about factors that could affect

actual results, including risks relating to our industry, business

operations, financing and liquidity, regulation and other risks

described in the registration statement. The forward-looking

statements included in this press release are made and based on

information available at the time of the release, and the Company

assumes no obligation to update any forward-looking statement.

This information is subject to the disclosure

requirements in Regulation EU 596/2014 (MAR) article 19 number 3

and section 5-12 of the Norwegian Securities Trading Act.

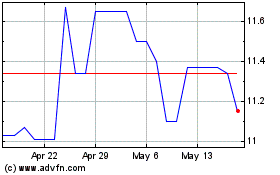

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Feb 2025 to Mar 2025

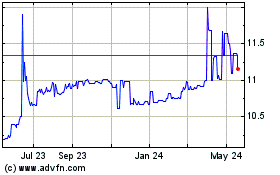

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Mar 2025