0000277948false00002779482024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

CSX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 1-8022 | 62-1051971 |

| (State or other jurisdiction | (Commission File No.) | (I.R.S. Employer |

| of incorporation) | | Identification No.) |

500 Water Street, 15th Floor, Jacksonville, FL 32202

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(904) 359-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

_☐_ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

_☐_ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

_☐_ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

_☐_ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, $1 Par Value | | CSX | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company _☐_

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. _☐_

Item 2.02. Results of Operations and Financial Condition

On August 5, 2024, CSX Corporation issued a press release and its CSX Quarterly Financial Report on financial and operating results for the quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 and a copy of the CSX Quarterly Financial Report is attached as Exhibit 99.2, each of which is incorporated by reference herein. These documents are available on the Company's website, www.csx.com.*

The information contained in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 hereto, has been “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits

(d) The following exhibits are being furnished herewith:

104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

| | | | | |

| * | Internet addresses are provided for informational purposes only and are not intended to be hyperlinks. |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CSX CORPORATION

By: /s/ ANGELA C. WILLIAMS

Angela C. Williams

Vice President and

Chief Accounting Officer

(Principal Accounting Officer)

Date: August 5, 2024

CSX Corp. Announces Second Quarter 2024 Results

JACKSONVILLE, Fla. – August 5, 2024 – CSX Corp. (NASDAQ: CSX) today announced Second quarter 2024 operating income of $1.45 billion compared to $1.47 billion in the prior year period. Net earnings were $963 million, or $0.49 per diluted share, compared to $984 million, or $0.49 per diluted share, in the same period last year. Total volume of 1.58 million units for the quarter was 2% higher compared to second quarter 2023.

“CSX remained focused on efficiently serving our customers over the second quarter, allowing us to deliver strong sequential increases in volume, operating income, margin, and earnings per share,” said Joe Hinrichs, president and chief executive officer. “I am proud of our railroad’s performance, including our team’s effective response to the disruptions at the Port of Baltimore. As we continue to execute through shifting markets, CSX is well-positioned to achieve solid year-over-year margin expansion over the remainder of 2024.”

Second Quarter Financial Highlights1

•Revenue totaled $3.70 billion for the quarter, which was flat year-over-year as the positive effects of merchandise pricing gains and growth in intermodal and merchandise volume were offset by declines in export coal prices, a reduction in other revenue, and lower fuel surcharge.

•Operating income of $1.45 billion decreased 1% compared to the same period in 2023 while increasing 8% from Q1 2024. CSX’s operating margin was 39.1% for the quarter, declining 50 basis points year-over-year but increasing 280 basis points sequentially.

•Diluted EPS of $0.49 was flat compared to the prior year but increased 9% compared to the previous quarter.

CSX executives will conduct a conference call with the investment community this afternoon, August 5, at 4:30 p.m. Eastern Time. Investors, media and the public may listen to the conference call by dialing 1-888-510-2008. For callers outside the U.S., dial 1-646-960-0306. Participants should dial in 10 minutes prior to the call and enter in 3368220 as the passcode.

In conjunction with the call, a live webcast will be accessible and presentation materials will be posted on the company's website at http://investors.csx.com. Following the earnings call, a webcast replay of the presentation will be archived on the company website.

This earnings announcement, as well as additional detailed financial information, is contained in the CSX Quarterly Financial Report available through the company’s website at http://investors.csx.com and on Form 8-K with the Securities and Exchange Commission.

1Year-over-year and sequential comparisons for operating income and earnings per share utilize revised financial results for past periods, as described in the notes of our quarterly financial report.

About CSX and its Disclosures

CSX, based in Jacksonville, Florida, is a premier transportation company. It provides rail, intermodal and rail-to-truck transload services and solutions to customers across a broad array of markets, including energy, industrial, construction, agricultural, and consumer products. For nearly 200 years, CSX has played a critical role in the nation's economic expansion and industrial development. Its network connects every major metropolitan area in the eastern United States, where nearly two-thirds of the nation's population resides. It also links more than 240 short-line railroads and more than 70 ocean, river and lake ports with major population centers and farming towns alike.

This announcement, as well as additional financial information, is available on the company's website at http://investors.csx.com. CSX also uses social media channels to communicate information about the company. Although social media channels are not intended to be the primary method of disclosure for material information, it is possible that certain information CSX posts on social media could be deemed to be material. Therefore, we encourage investors, the media, and others interested in the company to review the information we post on X, formerly known as Twitter, (http://twitter.com/CSX) and on Facebook (http://www.facebook.com/OfficialCSX). The social media channels used by CSX may be updated from time to time. More information about CSX Corporation and its subsidiaries is available at www.csx.com.

Non-GAAP Disclosure

CSX reports its financial results in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). CSX also uses certain non-GAAP measures that fall within the meaning of Securities and Exchange Commission Regulation G and Regulation S-K Item 10(e), which may provide users of the financial information with additional meaningful comparison to prior reported results. Non-GAAP measures do not have standardized definitions and are not defined by U.S. GAAP. Therefore, CSX’s non-GAAP measures are unlikely to be comparable to similar measures presented by other companies. The presentation of these non-GAAP measures should not be considered in isolation from, as a substitute for, or as superior to the financial information presented in accordance with GAAP.

Forward-looking Statements

This information and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, margins, volumes, rates, cost-savings, expenses, taxes, liquidity, capital expenditures, dividends, share repurchases or other financial items, statements of management's plans, strategies and objectives for future operations, and management's expectations as to future performance and operations and the time by which objectives will be achieved, statements concerning proposed new services, and statements regarding future economic, industry or market conditions or performance. Forward-looking statements are typically identified by words or phrases such as “will,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate,” “preliminary” and similar expressions. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. If the company updates any forward-looking statement, no inference should be drawn that the company will make additional updates with respect to that statement or any other forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by any forward-looking statements include, among others: (i) the company's success in implementing its financial and operational initiatives; (ii) changes in domestic or international economic, political or business conditions, including those affecting the transportation industry (such as the impact of industry competition, conditions, performance and consolidation); (iii) legislative or regulatory changes; (iv) the inherent business risks associated with safety and security; (v) the outcome of claims and litigation involving or affecting the company; (vi) natural events such as severe weather conditions or pandemic health crises; and (vii) the inherent uncertainty associated with projecting economic and business conditions.

Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the company's SEC reports, accessible on the SEC's website at www.sec.gov and the company's website at www.csx.com.

Contact:

Matthew Korn, CFA, Investor Relations

904-366-4515

Bryan Tucker, Corporate Communications

855-955-6397

CSX Corp. Announces Second Quarter 2024 Results

JACKSONVILLE, Fla. – August 5, 2024 – CSX Corp. (NASDAQ: CSX) today announced second quarter 2024 operating income of $1.45 billion compared to $1.47 billion in the prior year period. Net earnings were $963 million, or $0.49 per diluted share, compared to $984 million, or $0.49 per diluted share, in the same period last year. Total volume of 1.58 million units for the quarter was 2% higher compared to second quarter 2023.

“CSX remained focused on efficiently serving our customers over the second quarter, allowing us to deliver strong sequential increases in volume, operating income, margin, and earnings per share,” said Joe Hinrichs, president and chief executive officer. “I am proud of our railroad’s performance, including our team’s effective response to the disruptions at the Port of Baltimore. As we continue to execute through shifting markets, CSX is well-positioned to achieve solid year-over-year margin expansion over the remainder of 2024.”

Second Quarter Financial Highlights1

•Revenue totaled $3.70 billion for the quarter, which was flat year-over-year as the positive effects of merchandise pricing gains and growth in intermodal and merchandise volume were offset by declines in export coal prices, a reduction in other revenue, and lower fuel surcharge.

•Operating income of $1.45 billion decreased 1% compared to the same period in 2023 while increasing 8% from Q1 2024. CSX’s operating margin was 39.1% for the quarter, declining 50 basis points year-over-year but increasing 280 basis points sequentially.

•Diluted EPS of $0.49 was flat compared to the prior year but increased 9% compared to the previous quarter.

CSX executives will conduct a conference call with the investment community this afternoon, August 5, at 4:30 p.m. Eastern Time. Investors, media and the public may listen to the conference call by dialing 1-888-510-2008. For callers outside the U.S., dial 1-646-960-0306. Participants should dial in 10 minutes prior to the call and enter in 3368220 as the passcode.

In conjunction with the call, a live webcast will be accessible and presentation materials will be posted on the company's website at http://investors.csx.com. Following the earnings call, a webcast replay of the presentation will be archived on the company website.

This earnings announcement, as well as additional detailed financial information, is contained in the CSX Quarterly Financial Report available through the company’s website at http://investors.csx.com and on Form 8-K with the Securities and Exchange Commission.

1Year-over-year and sequential comparisons for operating income and earnings per share utilize revised financial results for past periods, as described in the notes of our quarterly financial report.

| | | | | | | | | | | |

| Table of Contents | The accompanying unaudited | CSX CORPORATION | CONTACTS: |

| financial information should be | 500 Water Street, C900 | INVESTOR RELATIONS |

| read in conjunction with the | Jacksonville, FL 32202 | Matthew Korn, CFA |

| Company’s most recent | www.csx.com | (904) 366-4515 |

| Annual Report on Form 10-K, | | MEDIA |

| Quarterly Reports on Form 10-Q, and | | Bryan Tucker |

| any Current Reports on Form 8-K. | | (855) 955-6397 |

About CSX and its Disclosures

CSX, based in Jacksonville, Florida, is a premier transportation company. It provides rail, intermodal and rail-to-truck transload services and solutions to customers across a broad array of markets, including energy, industrial, construction, agricultural, and consumer products. For nearly 200 years, CSX has played a critical role in the nation's economic expansion and industrial development. Its network connects every major metropolitan area in the eastern United States, where nearly two-thirds of the nation's population resides. It also links more than 240 short-line railroads and more than 70 ocean, river and lake ports with major population centers and farming towns alike.

This announcement, as well as additional financial information, is available on the company's website at http://investors.csx.com. CSX also uses social media channels to communicate information about the company. Although social media channels are not intended to be the primary method of disclosure for material information, it is possible that certain information CSX posts on social media could be deemed to be material. Therefore, we encourage investors, the media, and others interested in the company to review the information we post on X, formerly known as Twitter, (http://twitter.com/CSX) and on Facebook (http://www.facebook.com/OfficialCSX). The social media channels used by CSX may be updated from time to time. More information about CSX Corporation and its subsidiaries is available at www.csx.com.

Non-GAAP Disclosure

CSX reports its financial results in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). CSX also uses certain non-GAAP measures that fall within the meaning of Securities and Exchange Commission Regulation G and Regulation S-K Item 10(e), which may provide users of the financial information with additional meaningful comparison to prior reported results. Non-GAAP measures do not have standardized definitions and are not defined by U.S. GAAP. Therefore, CSX’s non-GAAP measures are unlikely to be comparable to similar measures presented by other companies. The presentation of these non-GAAP measures should not be considered in isolation from, as a substitute for, or as superior to the financial information presented in accordance with GAAP.

Forward-looking Statements

This information and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, margins, volumes, rates, cost-savings, expenses, taxes, liquidity, capital expenditures, dividends, share repurchases or other financial items, statements of management's plans, strategies and objectives for future operations, and management's expectations as to future performance and operations and the time by which objectives will be achieved, statements concerning proposed new services, and statements regarding future economic, industry or market conditions or performance. Forward-looking statements are typically identified by words or phrases such as “will,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate,” “preliminary” and similar expressions. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. If the company updates any forward-looking statement, no inference should be drawn that the company will make additional updates with respect to that statement or any other forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by any forward-looking statements include, among others: (i) the company's success in implementing its financial and operational initiatives; (ii) changes in domestic or international economic, political or business conditions, including those affecting the transportation industry (such as the impact of industry competition, conditions, performance and consolidation); (iii) legislative or regulatory changes; (iv) the inherent business risks associated with safety and security; (v) the outcome of claims and litigation involving or affecting the company; (vi) natural events such as severe weather conditions or pandemic health crises; and (vii) the inherent uncertainty associated with projecting economic and business conditions.

Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the company's SEC reports, accessible on the SEC's website at www.sec.gov and the company's website at www.csx.com.

CONSOLIDATED INCOME STATEMENTS (Unaudited)

(Dollars in Millions, Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

| Jun. 30, 2024 | Jun. 30, 2023 (a) | $ Change | % Change | | Jun. 30, 2024 (a) | Jun. 30, 2023 (a) | $ Change | % Change |

| | | | | | | | | |

| Revenue | $ | 3,701 | $ | 3,699 | $ | 2 | — | % | | $ | 7,382 | $ | 7,405 | $ | (23) | — | % |

| Expense | | | | | | | | | |

| Labor and Fringe | 766 | 748 | (18) | (2) | | | 1,571 | 1,477 | (94) | (6) | |

| Purchased Services and Other | 699 | 691 | (8) | (1) | | | 1,420 | 1,388 | (32) | (2) | |

| Depreciation and Amortization | 410 | 404 | (6) | (1) | | | 820 | 799 | (21) | (3) | |

| Fuel | 301 | 312 | 11 | 4 | | | 626 | 676 | 50 | 7 | |

| Equipment and Other Rents | 85 | 90 | 5 | 6 | | | 169 | 172 | 3 | 2 | |

| Gains on Property Dispositions | (8) | (12) | (4) | (33) | | | (9) | (20) | (11) | (55) | |

| Total Expense | 2,253 | 2,233 | (20) | (1) | | | 4,597 | 4,492 | (105) | (2) | |

| | | | | | | | | |

| Operating Income | 1,448 | 1,466 | (18) | (1) | | | 2,785 | 2,913 | (128) | (4) | |

| | | | | | | | | |

| Interest Expense | (209) | (201) | (8) | (4) | | | (419) | (402) | (17) | (4) | |

| Other Income - Net | 28 | 31 | (3) | (10) | | | 69 | 72 | (3) | (4) | |

| Earnings Before Income Taxes | 1,267 | 1,296 | (29) | (2) | | | 2,435 | 2,583 | (148) | (6) | |

| | | | | | | | | |

| Income Tax Expense | (304) | (312) | 8 | 3 | | | (592) | (625) | 33 | 5 | |

| Net Earnings | $ | 963 | $ | 984 | $ | (21) | (2) | % | | $ | 1,843 | $ | 1,958 | $ | (115) | (6) | % |

| | | | | | | | | |

| Operating Margin | 39.1 | % | 39.6 | % | | | | 37.7 | % | 39.3 | % | | |

| | | | | | | | | |

| Per Common Share | | | | | | | | | |

| Net Earnings Per Share, Assuming Dilution | $ | 0.49 | | $ | 0.49 | | $ | — | | — | % | | $ | 0.94 | | $ | 0.96 | | $ | (0.02) | | (2) | % |

| | | | | | | | | |

Average Shares Outstanding, Assuming Dilution (Millions) | 1,948 | | 2,025 | | | | | 1,955 | | 2,042 | | | |

| | | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollars in Millions)

| | | | | | | | |

| | |

| Jun. 30, 2024 | Dec. 31, 2023 (a) |

| ASSETS |

| | |

| Cash and Cash Equivalents | $ | 1,238 | | $ | 1,353 | |

| Short-Term Investments | 4 | | 83 | |

| Other Current Assets | 1,938 | | 1,923 | |

| Properties - Net | 34,949 | | 34,721 | |

| Investment in Affiliates and Other Companies | 2,455 | | 2,397 | |

| Other Long-Term Assets | 1,778 | | 1,735 | |

| Total Assets | $ | 42,362 | | $ | 42,212 | |

| | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| | |

| Current Maturities of Long-Term Debt | $ | 557 | | $ | 558 | |

| Other Current Liabilities | 2,182 | | 2,665 | |

| Long-Term Debt | 17,951 | | 17,975 | |

| Deferred Income Taxes - Net | 7,716 | | 7,699 | |

| Other Long-Term Liabilities | 1,336 | | 1,330 | |

| Total Liabilities | 29,742 | | 30,227 | |

| | |

| Total Shareholders' Equity | 12,620 | | 11,985 | |

| Total Liabilities and Shareholders' Equity | $ | 42,362 | | $ | 42,212 | |

CONDENSED CONSOLIDATED CASH FLOW STATEMENTS (Unaudited)

(Dollars in Millions)

| | | | | | | | |

| Six Months Ended |

| Jun. 30, 2024 (a) | Jun. 30, 2023 (a) |

| OPERATING ACTIVITIES | | |

| Net Earnings | $ | 1,843 | | $ | 1,958 | |

| Adjustments to Reconcile Net Earnings to Net Cash Provided by Operating Activities: | | |

| Depreciation and Amortization | 820 | | 799 | |

| Deferred Income Tax Expense | 14 | | 70 | |

| Gains on Property Dispositions | (9) | | (20) | |

| | |

| | |

Other Operating Activities - Net (b) | (495) | | (334) | |

| Net Cash Provided by Operating Activities | 2,173 | | 2,473 | |

| | |

| INVESTING ACTIVITIES | | |

| Property Additions | (1,066) | | (997) | |

| Purchases of Short-Term Investments | — | | (102) | |

| Proceeds from Sales of Short-Term Investments | 81 | | 153 | |

| Proceeds and Advances from Property Dispositions | 43 | | 52 | |

| Business Acquisitions, Net of Cash Acquired | (50) | | (31) | |

| Other Investing Activities | (56) | | (20) | |

| Net Cash Used in Investing Activities | (1,048) | | (945) | |

| | |

| FINANCING ACTIVITIES | | |

| | |

Shares Repurchased (c) | (810) | | (1,930) | |

| Dividends Paid | (468) | | (448) | |

| Long-term Debt Repaid | (4) | | (146) | |

| | |

| Other Financing Activities | 42 | | 19 | |

| Net Cash Used in Financing Activities | (1,240) | | (2,505) | |

| | |

| Net Increase (Decrease) in Cash and Cash Equivalents | (115) | | (977) | |

| | |

| CASH AND CASH EQUIVALENTS | | |

| Cash and Cash Equivalents at Beginning of Period | 1,353 | | 1,933 | |

| Cash and Cash Equivalents at End of Period | $ | 1,238 | | $ | 956 | |

| | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

a)Revision of Prior Period Financial Statements: During second quarter 2024, CSX completed a review of the accounting treatment for engineering scrap and certain engineering support labor and identified misstatements between the balance sheet and operating expense that were determined to be immaterial to previously issued financial statements. However, the Company determined that the effect of recording all corrections during the second quarter of 2024 would be material to the annual 2024 consolidated financial statements. As a result, 2024 and 2023 previously reported quarters reported herein have been revised to correct these and other previously identified immaterial errors as shown in the tables below.

2024 and 2023 Impact of Adjustments

(Dollars in Millions, Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Quarters Ended | | Year Ended |

| Mar. 31, 2024 | | Mar. 31, 2023 | Jun. 30, 2023 | Sept. 30, 2023 | Dec. 31, 2023 | | Dec. 31, 2023 |

| Quarterly and Annual Impact | | | | | | | | |

| Operating Income | $ | (17) | | $ | (17) | $ | (16) | $ | (24) | $ | (5) | | $ | (62) |

| Net Earnings Per Share, Assuming Dilution | $ | (0.01) | | $ | (0.01) | $ | — | $ | (0.01) | $ | — | | $ | (0.03) |

| | | | | | | | | | | | | | | | | |

| Quarter Ended

March 31, 2024 | |

| As Previously Reported | Adjustment | As Revised | |

| Consolidated Income Statement | | | | | |

| Labor and Fringe | $ | 798 | $ | 7 | | $ | 805 | |

| Purchased Services and Other | 711 | 10 | | 721 | |

| | | | | |

| Total Expense | 2,327 | 17 | | 2,344 | |

| | | | | |

| Operating Income | 1,354 | (17) | | 1,337 | |

| | | | | |

| Earnings Before Income Taxes | 1,185 | (17) | | 1,168 | |

| Income Tax Expense | (292) | 4 | | (288) | |

| Net Earnings | $ | 893 | $ | (13) | | $ | 880 | |

| | | | | |

| Operating Margin | 36.8 | % | (50) | bps | 36.3 | % | |

| Net Earnings Per Share, Assuming Dilution | $ | 0.46 | (0.01) | | $ | 0.45 | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited), continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

June 30, 2023 | | Six Months Ended

June 30, 2023 |

| As Previously Reported | Adjustment | As Revised | | As Previously Reported | Adjustment | As Revised |

| Consolidated Income Statement | | | | | | | | | |

| Labor and Fringe | $ | 741 | $ | 7 | | | $ | 748 | | $ | 1,464 | | $ | 13 | | | $ | 1,477 |

| Purchased Services and Other | 684 | 7 | | | 691 | | 1,372 | | 16 | | | 1,388 |

| Depreciation and Amortization | 402 | 2 | | | 404 | | 795 | | 4 | | | 799 |

| Total Expense | 2,217 | 16 | | | 2,233 | | 4,459 | | 33 | | | 4,492 |

| | | | | | | | | |

| Operating Income | 1,482 | (16) | | | 1,466 | | 2,946 | | (33) | | | 2,913 |

| | | | | | | | | |

| Earnings Before Income Taxes | 1,312 | (16) | | | 1,296 | | 2,616 | | (33) | | | 2,583 |

| Income Tax Expense | (316) | 4 | | | (312) | | (633) | | 8 | | | (625) |

| Net Earnings | $ | 996 | $ | (12) | | | $ | 984 | | $ | 1,983 | | $ | (25) | | | $ | 1,958 |

| | | | | | | | | |

| Operating Margin | 40.1 | % | (50) | bps | 39.6 | % | | 39.8 | % | (50) | bps | 39.3 | % |

| Net Earnings Per Share, Assuming Dilution | $ | 0.49 | $ | — | | | $ | 0.49 | | $ | 0.97 | $ | (0.01) | | | $ | 0.96 |

| | | | | | | | | | | |

| December 31, 2023 |

| Condensed Consolidated Balance Sheet | As Previously Reported | Adjustment | As Revised |

| Assets | | | |

| Other Current Assets | $ | 1,948 | $ | (25) | $ | 1,923 | |

| Properties - Net | 34,935 | (214) | 34,721 | |

| Other Long-Term Assets | 1,692 | 43 | 1,735 | |

| Total Assets | $ | 42,408 | $ | (196) | $ | 42,212 | |

| | | |

| Liabilities and Shareholders' Equity | | | |

| Other Current Liabilities | $ | 2,666 | $ | (1) | $ | 2,665 | |

| Deferred Income Taxes - Net | 7,746 | (47) | 7,699 | |

| Total Liabilities | 30,275 | (48) | 30,227 | |

| | | |

| Total Shareholders' Equity | 12,133 | (148) | 11,985 | |

| Total Liabilities and Shareholders' Equity | $ | 42,408 | $ | (196) | $ | 42,212 | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited), continued

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 |

| Consolidated Cash Flow Statements | As Previously Reported | | Adjustment | | As Revised |

| Operating Activities | | | | | |

| Net Earnings | $ | 1,983 | | | $ | (25) | | | $ | 1,958 | |

Depreciation and Amortization | 795 | | | 4 | | | 799 | |

Deferred Income Taxes | 78 | | | (8) | | | 70 | |

| Other Operating Activities | (353) | | | 19 | | | (334) | |

| Net Cash Provided by Operating Activities | 2,483 | | | (10) | | | 2,473 | |

| Investing Activities | | | | | |

| Property Additions | (1,015) | | | 18 | | | (997) | |

| Proceeds and Advances from Property Dispositions | 35 | | | 17 | | | 52 | |

| Net Cash Used in Investing Activities | (980) | | | 35 | | | (945) | |

| | | | | |

Net Decrease in Cash and Cash Equivalents | (1,002) | | | 25 | | | (977) | |

| | | | | |

Cash and Cash Equivalents | | | | | |

Cash and Cash Equivalents at Beginning of Period (a) | $ | 1,958 | | | $ | (25) | | | $ | 1,933 | |

(a) Cash and cash equivalents balance at the beginning of 2023 was revised to reflect a $25 million payment that occurred in December 2022.

b)Other Operating Activities - Net: During the six months ended June 30, 2024, the Company made $387 million of federal tax payments related to the 2023 tax year, which were previously postponed under an Internal Revenue Service tax relief announcement for those impacted by Hurricane Idalia. During the six months ended June 30, 2023, the Company paid $238 million of retroactive wages and bonuses, and associated taxes, related to finalized labor agreements.

c)Shares Repurchased: During second quarters and six months ended 2024 and 2023, the Company engaged in the following repurchase activities:

| | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

| Jun. 30, 2024 | Jun. 30, 2023 | | Jun. 30, 2024 | Jun. 30, 2023 |

Shares Repurchased (Millions) | 16 | | 28 | | | 23 | | 63 | |

Cost of Shares (Dollars in Millions) | $ | 563 | | $ | 863 | | | $ | 810 | | $ | 1,930 | |

| Average Cost per Share Repurchased | $ | 34.51 | | $ | 31.46 | | | $ | 35.08 | | $ | 30.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

VOLUME AND REVENUE (Unaudited) |

| Volume (Thousands of Units); Revenue (Dollars in Millions); Revenue Per Unit (Dollars) |

|

Quarters Ended June 30, 2024 and June 30, 2023 |

| | | | | | |

| Volume | | Revenue | | Revenue Per Unit | |

| 2024 | 2023 | % Change | | 2024 | 2023 | % Change | | 2024 | 2023 | % Change | |

| Chemicals | 174 | | 160 | | 9 | % | | $ | 722 | | $ | 642 | | 12 | % | | $ | 4,149 | | $ | 4,013 | | 3 | % | |

| Agricultural and Food Products | 115 | | 118 | | (3) | | | 406 | | 415 | | (2) | | | 3,530 | | 3,517 | | — | | |

| Automotive | 105 | | 103 | | 2 | | | 336 | | 323 | | 4 | | | 3,200 | | 3,136 | | 2 | | |

| Minerals | 97 | | 95 | | 2 | | | 207 | | 191 | | 8 | | | 2,134 | | 2,011 | | 6 | | |

| Forest Products | 74 | | 72 | | 3 | | | 269 | | 257 | | 5 | | | 3,635 | | 3,569 | | 2 | | |

| Metals and Equipment | 68 | | 74 | | (8) | | | 230 | | 240 | | (4) | | | 3,382 | | 3,243 | | 4 | | |

| Fertilizers | 50 | | 55 | | (9) | | | 126 | | 128 | | (2) | | | 2,520 | | 2,327 | | 8 | | |

| Total Merchandise | 683 | | 677 | | 1 | | | 2,296 | | 2,196 | | 5 | | | 3,362 | | 3,244 | | 4 | | |

| Intermodal | 716 | | 684 | | 5 | | | 506 | | 492 | | 3 | | | 707 | | 719 | | (2) | | |

| Coal | 179 | | 185 | | (3) | | | 563 | | 637 | | (12) | | | 3,145 | | 3,443 | | (9) | | |

| Trucking | — | | — | | — | | | 221 | | 227 | | (3) | | | — | | — | | — | | |

| Other | — | | — | | — | | | 115 | | 147 | | (22) | | | — | | — | | — | | |

| Total | 1,578 | | 1,546 | | 2 | % | | $ | 3,701 | | $ | 3,699 | | — | % | | $ | 2,345 | | $ | 2,393 | | (2) | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Six Months Ended June 30, 2024 and June 30, 2023 |

| | | | | | |

| Volume | | Revenue | | Revenue Per Unit | |

| 2024 | 2023 | % Change | | 2024 | 2023 | % Change | | 2024 | 2023 | % Change | |

| Chemicals | 341 | | 320 | | 7 | % | | $ | 1,415 | | $ | 1,292 | | 10 | % | | $ | 4,150 | | $ | 4,038 | | 3 | % | |

| Agricultural and Food Products | 229 | | 240 | | (5) | | | 813 | | 852 | | (5) | | | 3,550 | | 3,550 | | — | | |

| Automotive | 199 | | 189 | | 5 | | | 629 | | 597 | | 5 | | | 3,161 | | 3,159 | | — | | |

| Minerals | 177 | | 178 | | (1) | | | 381 | | 364 | | 5 | | | 2,153 | | 2,045 | | 5 | | |

| Forest Products | 147 | | 145 | | 1 | | | 531 | | 518 | | 3 | | | 3,612 | | 3,572 | | 1 | | |

| Metals and Equipment | 138 | | 147 | | (6) | | | 450 | | 479 | | (6) | | | 3,261 | | 3,259 | | — | | |

| Fertilizers | 97 | | 105 | | (8) | | | 262 | | 257 | | 2 | | | 2,701 | | 2,448 | | 10 | | |

| Total Merchandise | 1,328 | | 1,324 | | — | | | 4,481 | | 4,359 | | 3 | | | 3,374 | | 3,292 | | 2 | | |

| Intermodal | 1,417 | | 1,338 | | 6 | | | 1,012 | | 991 | | 2 | | | 714 | | 741 | | (4) | | |

| Coal | 367 | | 370 | | (1) | | | 1,195 | | 1,270 | | (6) | | | 3,256 | | 3,432 | | (5) | | |

| Trucking | — | | — | | — | | | 436 | | 460 | | (5) | | | — | | — | | — | | |

| Other | — | | — | | — | | | 258 | | 325 | | (21) | | | — | | — | | — | | |

| Total | 3,112 | | 3,032 | | 3 | % | | $ | 7,382 | | $ | 7,405 | | — | % | | $ | 2,372 | | $ | 2,442 | | (3) | % | |

VOLUME AND REVENUE

Total revenue was flat for second quarter 2024 when compared to second quarter 2023, as pricing gains in merchandise, as well as higher intermodal and merchandise volumes, were offset by pricing declines in export coal due to the impact of lower benchmark rates, decreases in other revenue, and lower fuel recovery.

Fuel Surcharge

Fuel surcharge revenue is included in the individual markets and does not include amounts for trucking. Fuel lag is the estimated revenue effect resulting from the difference between highway diesel prices in the quarter and the prices used for fuel surcharge, which are on a two-month lag for non-intermodal traffic.

| | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

| (Dollars in Millions) | Jun. 30, 2024 | Jun. 30, 2023 | | Jun. 30, 2024 | Jun. 30, 2023 |

| Fuel Surcharge Revenue | $ | 275 | | $ | 295 | | | $ | 552 | | $ | 656 | |

| Fuel Lag Favorable (Unfavorable) | $ | 17 | | $ | 28 | | | $ | 23 | | $ | 69 | |

Merchandise Volume

Chemicals - Increased due to higher shipments of plastics, crude oil, petroleum products and natural gas liquids.

Agricultural and Food Products - Decreased primarily due to lower shipments of domestic grain and ethanol.

Automotive - Increased due to higher North American vehicle production as well as new business wins.

Minerals - Increased due to higher shipments of cement, partially offset by lower shipments of aggregates.

Forest Products - Increased due to higher shipments of pulpboard and building products.

Metals and Equipment - Decreased due to lower steel and scrap shipments, partially offset by increased pipe shipments.

Fertilizers - Decreased due to declines in short-haul phosphates and lower potash shipments.

Intermodal Volume

Intermodal volume increased due to international shipments driven by higher imports through east coast ports and inventory replenishments. Domestic shipments decreased due to the impacts of a soft trucking environment.

Coal Volume

Export coal shipments increased despite the impacts associated with the Francis Scott Key Bridge collapse in Baltimore as CSX shipped more metallurgical coal through other locations. Domestic coal decreased primarily due to lower shipments of coal to utility plants, as well as lower shipments to river and lake terminals.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

| (Millions of Tons) | Jun. 30, 2024 | Jun. 30, 2023 | Change | | Jun. 30, 2024 | Jun. 30, 2023 | Change |

| Coal Tonnage | | | | | | | |

| Domestic | 9.5 | | 11.0 | | (14) | % | | 19.1 | | 22.5 | | (15) | % |

| Export | 10.6 | | 9.8 | | 8 | | | 22.2 | | 19.1 | | 16 | |

| Total Coal | 20.1 | | 20.8 | | (3) | % | | 41.3 | | 41.6 | | (1) | % |

Trucking Revenue

Trucking revenue decreased $6 million versus the prior year due to lower fuel and capacity surcharges.

Other Revenue

Other revenue was $32 million lower, resulting from lower carload demurrage, as well as reduced intermodal storage and equipment usage, and other items.

EXPENSE

Expenses of $2.3 billion increased $20 million, or 1%, in second quarter 2024 when compared to second quarter 2023.

Labor and Fringe expense increased $18 million due to the following:

•An increase of $23 million was due to higher headcount.

•An increase of $18 million was driven by inflation.

•Incentive compensation and other items decreased $23 million.

Purchased Services and Other expense increased $8 million due to the following:

•An increase of $13 million was due to inflation.

•All other net costs decreased $5 million.

Depreciation and Amortization expense increased $6 million as a result of a larger asset base.

Fuel costs decreased $11 million primarily resulting from a 4% decrease in locomotive fuel prices, as efficiency gains were largely offset by the impact of higher volume.

Equipment and Other Rents expense decreased $5 million due to several non-significant items.

Gains on Property Dispositions decreased to $8 million from $12 million in the prior year.

Employee Counts (Estimated)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

| Jun. 30, 2024 | Jun. 30, 2023 | Change | | | Jun. 30, 2024 | Jun. 30, 2023 | Change |

| Average | 23,312 | 22,700 | 612 | | | 23,347 | 22,656 | 691 |

| Ending | 23,275 | 22,743 | 532 | | | 23,275 | 22,743 | 532 |

| | | | | | | | |

Fuel Expense

| | | | | | | | | | | | | | | | | |

| Quarters Ended | | Six Months Ended |

(Dollars and Gallons in Millions, Except Price Per Gallon) | Jun. 30, 2024 | Jun. 30, 2023 | | Jun. 30, 2024 | Jun. 30, 2023 |

Estimated Locomotive Fuel Consumption (Gallons) | 93.6 | | 95.8 | | | 190.4 | | 192.4 | |

Price per Gallon (Dollars) | $ | 2.66 | | $ | 2.76 | | | $ | 2.76 | | $ | 2.96 | |

| Total Locomotive Fuel Expense | $ | 249 | | $ | 264 | | | $ | 525 | | $ | 570 | |

| Non-Locomotive Fuel Expense | 52 | | 48 | | | 101 | | 106 | |

| Total Fuel Expense | $ | 301 | | $ | 312 | | | $ | 626 | | $ | 676 | |

| | | | | |

OPERATING STATISTICS (Estimated)

In the second quarter of 2024, velocity increased by 3% while dwell increased by 10% versus prior year. Carload trip plan performance was 80% compared to 84% in the prior year while intermodal trip plan performance was 94% compared to 96% in the prior year. The Company continues to focus on operational improvements and executing the operating plan to deliver safe, reliable and efficient service to customers.

While the personal injury frequency increased in second quarter 2024 compared to the prior year, the FRA train accident rate decreased. Safety is a top priority at CSX, and the Company is committed to reducing risk and enhancing the overall safety of its employees, customers, and communities in which the Company operates.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended | | Six Months Ended |

| | Jun. 30, 2024 | Jun. 30, 2023 | Improvement / (Deterioration) | | Jun. 30, 2024 | Jun. 30, 2023 | Improvement / (Deterioration) |

Operations Performance (a) | | | | | | | | |

| | | | | | | | |

Train Velocity (Miles Per Hour) | | 18.2 | | 17.7 | | 3 | % | | 18.2 | | 18.1 | | 1 | % |

Dwell (Hours) | | 10.2 | | 9.3 | | (10) | % | | 9.9 | | 9.2 | | (8) | % |

| Cars Online | | 126,164 | | 126,984 | | 1 | % | | 125,442 | | 126,640 | | 1 | % |

| On-Time Originations | | 74 | % | 78 | % | (5) | % | | 75 | % | 81 | % | (7) | % |

| On-Time Arrivals | | 64 | % | 71 | % | (10) | % | | 67 | % | 74 | % | (9) | % |

| Carload Trip Plan Performance | | 80 | % | 84 | % | (5) | % | | 81 | % | 85 | % | (5) | % |

| Intermodal Trip Plan Performance | | 94 | % | 96 | % | (2) | % | | 94 | % | 96 | % | (2) | % |

| Fuel Efficiency | | 0.97 | | 1.00 | | 3 | % | | 0.99 | | 1.01 | | 2 | % |

| | | | | | | | |

Revenue Ton-Miles (Billions) | | | | | | | | |

| Merchandise | | 32.7 | | 32.3 | | 1 | % | | 64.7 | | 64.6 | | — | % |

| Coal | | 8.8 | | 9.2 | | (4) | % | | 18.2 | | 18.4 | | (1) | % |

| Intermodal | | 7.2 | | 7.0 | | 3 | % | | 14.3 | | 13.9 | | 3 | % |

| Total Revenue Ton-Miles | | 48.7 | | 48.5 | | — | % | | 97.2 | | 96.9 | | — | % |

| | | | | | | | |

Total Gross Ton-Miles (Billions) | | 96.8 | | 95.7 | | 1 | % | | 192.6 | | 190.1 | | 1 | % |

| | | | | | | | |

Safety (b) | | | | | | | | |

| FRA Personal Injury Frequency Index | | 1.25 | | 0.91 | | (37) | % | | 1.22 | | 1.00 | | (22) | % |

| FRA Train Accident Rate | | 2.62 | | 3.41 | | 23 | % | | 3.35 | | 3.71 | | 10 | % |

(a) Beginning second quarter 2023, all operations performance metrics include results from the network acquired from Pan Am. The impact of including Pan Am data was insignificant.

(b) Effective January 1, 2024, safety metrics include results from the Pan Am network. The impact was insignificant.

Certain operating statistics are estimated and can continue to be updated as actuals settle. The methodology for calculating train velocity, dwell, cars online and trip plan performance differs from that used by the Surface Transportation Board. The Company will continue to report these metrics to the Surface Transportation Board using the prescribed methodology.

OPERATING STATISTICS (Estimated), continued

Key Performance Measures Definitions

Train Velocity - Average train speed between origin and destination in miles per hour (does not include locals, yard jobs, work trains or passenger trains). Train velocity measures actual train miles and times of a train movement on CSX's network.

Dwell - Average amount of time in hours between car arrival to and departure from the yard.

Cars Online - Average number of active freight rail cars on lines operated by CSX, excluding rail cars that are being repaired, in storage, those that have been sold, or private cars dwelling at a customer location more than one day.

On-Time Originations - Percent of scheduled road trains that depart the origin yard on-time or ahead of schedule.

On-Time Arrivals - Percent of scheduled road trains that arrive at the destination yard on-time to within two hours of scheduled arrival.

Carload Trip Plan Performance - Percent of measured cars (excludes unit trains and other non-scheduled service as well as empty automotive shipments) destined for a customer that complete their scheduled plan at or ahead of the original estimated time of arrival or interchange (as applicable).

Intermodal Trip Plan Performance - Percent of measured containers (excludes port shipments along with empty containers and other non-scheduled service) destined for a customer that complete their scheduled plan at or ahead of the original estimated time of arrival, notification or interchange (as applicable).

Fuel Efficiency - Gallons of locomotive fuel per 1,000 gross ton-miles.

Revenue Ton-Miles (RTM's) - The movement of one revenue-producing ton of freight over a distance of one mile.

Gross Ton-Miles (GTM's) - The movement of one ton of train weight over one mile. GTM's are calculated by multiplying total train weight by distance the train moved. Total train weight is comprised of the weight of the freight cars and their contents.

FRA Personal Injury Frequency Index - Number of FRA-reportable injuries per 200,000 man-hours.

FRA Train Accident Rate - Number of FRA-reportable train accidents per million train-miles.

NON-GAAP MEASURES (Unaudited)

The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The Company also uses certain non-GAAP measures that fall within the meaning of Securities and Exchange Commission Regulation G and Regulation S-K Item 10(e), which may provide users of the financial information with additional meaningful comparison to prior reported results. Non-GAAP measures do not have standardized definitions and are not defined by GAAP. Therefore, the Company’s non-GAAP measures are unlikely to be comparable to similar measures presented by other companies. The presentation of these non-GAAP measures should not be considered in isolation from, as a substitute for, or as superior to the financial information presented in accordance with GAAP. Reconciliations of non-GAAP measures to corresponding GAAP measures are below.

Economic Profit

Management believes Economic Profit (also referred to as CSX Cash Earnings or CCE) provides an additional perspective to investors about financial returns generated by the business by representing a measure showing profit generated over and above the cost of capital used by the business to generate that profit. Economic Profit is designed to incentivize strategic investments that earn more than management’s desired minimum required return and is broadly utilized by management to make investment decisions. Therefore, disclosing Economic Profit on how management performs in this regard provides additional useful information to investors regarding the Company’s performance compared to its goals.

Economic Profit should be considered in addition to, rather than a substitute for, operating income, which is the most directly comparable GAAP measure. Economic Profit is defined by the Company as Gross Cash Earnings (“GCE”) minus the Capital Charge on Gross Operating Assets (“GOA”). Increases in Economic Profit indicate that the Company is effectively allocating capital and rewarding shareholders by generating returns in excess of the incremental cost of capital associated with reinvestment in the business.

GCE is calculated as operating income plus depreciation, amortization and operating lease expense, less unusual items and taxes. The Capital Charge uses a minimum required return multiplied by the GOA. CSX's GOAs include gross properties and other non-cash assets, net of non-interest bearing liabilities. The Company used a 15% tax rate and an 8% required return, for both periods presented, which is consistent with rates used for investment decisions and performance evaluation within those same periods. The tax rate is the approximate equivalent of the Company’s actual income tax expense as a percentage of pre-tax GCE. The required return rate represents management’s desired minimum return on any investment. CSX annually re-evaluates these rates to ensure they accurately represent taxes and a required return in light of internal and external factors and would adjust the rate if the annual review resulted in a preset deviation from the current rates. This focuses the Economic Profit measure on value generated by management instead of external factors, such as legislative tax policy or interest rate volatility.

NON-GAAP MEASURES (Unaudited), continued

The following table reconciles operating income (the most directly comparable GAAP measure) to Economic Profit (non-GAAP measure).

| | | | | | | | |

| Six Months Ended |

| (Dollars in Millions) | Jun. 30, 2024 (a) | Jun. 30, 2023 (a) |

| Operating Income | $ | 2,785 | | $ | 2,913 | |

| Add: Depreciation, Amortization, and Operating Lease Expense | 877 | | 851 | |

| | |

Remove: Unusual Items (b) | — | | — | |

Taxes (c) | (549) | | (565) | |

| Gross Cash Earnings or "GCE" | 3,113 | | 3,199 | |

| | |

| Operating Assets | | |

| Current Assets (Less Cash and Short-term Investments) | (1,950) | | (1,866) | |

| Gross Properties | (50,841) | | (49,011) | |

| Other Assets | (4,222) | | (3,818) | |

| Operating Liabilities | | |

| Non-Interest Bearing Liabilities | 10,887 | | 10,607 | |

Gross Operating Assets or "GOA" (d) | (46,126) | | (44,088) | |

Capital Charge (e) | (1,845) | | (1,764) | |

| Economic Profit (Non-GAAP) calculated as GCE less Capital Charge | $ | 1,268 | | $ | 1,435 | |

(a) Reflects adjustment of prior period financial statements as discussed in the notes to the consolidated financial statements on page 6.

(b) Unusual items are defined by management as unique events with greater than $100 million full year operating income impact, consistent with the terms of the Company's long-term incentive plan agreements. There were no unusual items for either period presented.

(c) The tax percentage rate was 15% for both periods presented. This rate is applied to the sum of operating income, depreciation, amortization and operating lease expense, and unusual items.

(d) Gross operating assets reflects an average of the year-to-date quarters reported for each year presented.

(e) The capital charge of 8% for both years is calculated as the minimum return multiplied by gross operating assets. This is an annualized rate equivalent to 2% per quarter.

Free Cash Flow

Management believes that Free Cash Flow ("FCF") is supplemental information useful to investors as it is important in evaluating the Company’s financial performance. More specifically, FCF measures cash generated by the business after reinvestment. This measure represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt. FCF is calculated by using net cash from operations and adjusting for property additions and proceeds and advances from property dispositions. FCF should be considered in addition to, rather than a substitute for, cash provided by operating activities. The decrease in FCF before dividends from the prior year of $378 million is primarily due to less cash from operating activities and higher property additions. Cash from operating activities in the six months ended June 30, 2024 includes the impact of $387 million of federal tax payments related to the 2023 tax year that were previously postponed under an Internal Revenue Service tax relief announcement for those impacted by Hurricane Idalia. Cash from operating activities in the prior year period includes the payment of $238 million for retroactive wages and bonuses with associated taxes related to finalized labor agreements.

The following table reconciles cash provided by operating activities (GAAP measure) to FCF before dividends (non-GAAP measure).

| | | | | | | | |

| Six Months Ended |

| (Dollars in Millions) | Jun. 30, 2024 (a) | Jun. 30, 2023 (a) |

Net Cash Provided by Operating Activities | $ | 2,173 | | $ | 2,473 | |

| Property Additions | (1,066) | | (997) | |

| Proceeds and Advances from Property Dispositions | 43 | | 52 | |

Free Cash Flow or "FCF" (before payment of dividends) | $ | 1,150 | | $ | 1,528 | |

(a) Reflects adjustment of prior period financial statements as discussed in the notes to the consolidated financial statements on page 6.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

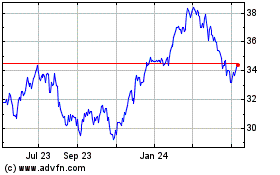

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2025 to Apr 2025

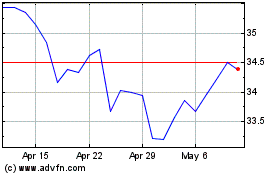

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2024 to Apr 2025