Digital asset miners are integral to the

digital asset economy and represent the largest—and a

fast-growing—segment of the publicly traded digital asset

ecosystem.

VanEck today announced the launch of the VanEck Digital Assets

Mining ETF (DAM), expanding the firm’s crypto and

blockchain-focused investment offerings and providing investors

access to companies essential to driving digital

transformation.

DAM offers targeted exposure to digital assets mining companies,

which validate and process blockchain transactions to create new

units of cryptocurrency.

“Mining is critical to the growth and functioning of digital

assets. Miners secure, record and store data on the blockchain and

are currently the largest segment of the publicly traded digital

asset ecosystem,” said Ed Lopez, Head of Product Management at

VanEck. “Though fast-growing, many of the leaders in the digital

asset mining category remain in the early stages of their growth.

That factor, combined with sustained, high current levels of demand

for all types of digital assets, make this a compelling time for us

to be launching DAM to focus specifically on digital assets

miners.”

Digital assets mining companies use specialized computer chips

in conjunction with software to solve complex math problems. In so

doing, transactions that exist on current blocks can be verified

and the miners themselves are rewarded with newly issued

cryptocurrency.

“Blockchains introduce transparency, efficiency and lower costs

compared to traditional centralized databases and processes, but

without miners, blockchain transactions cannot be verified and

audited, making their role absolutely essential,” added Lopez.

DAM seeks to track as closely as possible the price and yield of

the MVIS Digital Assets Mining Index (MVISDAM). To be eligible for

inclusion in the Index, a company must generate at least 50% of its

revenues from digital assets mining activities or mining-related

technology or have projects that, when developed, have the

potential to generate at least 50% of their revenues from digital

asset mining activities or mining-related technologies. The Fund

will not invest in digital assets (including cryptocurrencies)

directly or indirectly through the use of digital asset

derivatives.

VanEck is a clear leader in the digital assets space, both in

terms of the investment solutions it has pioneered and the research

it regularly shares with the marketplace. The firm recognized in

2017 that digital assets could provide a store of value alternative

to existing currencies and gold, as well as technology solutions

that may lower costs in the payments and financial investing

industries.

DAM joins a VanEck digital assets-focused ETF lineup that also

includes the VanEck Digital Transformation ETF (DAPP), which offers

diversified exposure to companies at the forefront of the digital

assets transformation, such as digital asset exchanges, miners, and

other key infrastructure companies; and the VanEck Bitcoin Strategy

ETF (XBTF), the lowest-cost Bitcoin-linked ETF1 on the U.S. market,

providing actively managed exposure to Bitcoin futures.

DAM is listed on the NASDAQ and has a net expense ratio of

0.50%.

About VanEck

VanEck has a history of looking beyond the financial markets to

identify trends that are likely to create impactful investment

opportunities. We were one of the first U.S. asset managers to

offer investors access to international markets. This set the tone

for the firm’s drive to identify asset classes and trends –

including gold investing in 1968, emerging markets in 1993, and

exchange traded funds in 2006 – that subsequently shaped the

investment management industry.

Today, VanEck offers active and passive strategies with

compelling exposures supported by well-designed investment

processes. As of January 31, 2022, VanEck managed approximately

$78.6 billion in assets, including mutual funds, ETFs and

institutional accounts. The firm’s capabilities range from core

investment opportunities to more specialized exposures to enhance

portfolio diversification. Our actively managed strategies are

fueled by in-depth, bottom-up research and security selection from

portfolio managers with direct experience in the sectors and

regions in which they invest. Investability, liquidity, diversity,

and transparency are key to the experienced decision-making around

market and index selection underlying VanEck’s passive

strategies.

Since our founding in 1955, putting our clients’ interests

first, in all market environments, has been at the heart of the

firm’s mission.

Important Disclosures

1Based on total fund operating expenses vs. Bitcoin-linked

competitors as of 11/12/2021.

The Fund will not invest in digital assets (including

cryptocurrencies) (i) directly or (ii) indirectly through the use

of digital asset derivatives. The Fund also will not invest in

initial coin offerings. Therefore the Fund is not expected to track

the price movement of any digital asset.

Investors in the Fund should be willing to accept a high

degree of volatility in the price of the Fund’s Shares and the

possibility of significant losses. An investment in the Fund

involves a substantial degree of risk. An investment in the Fund is

not a deposit with a bank and is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government

agency. Therefore, you should consider carefully the following

risks before investing in the Fund, each of which could

significantly and adversely affect the value of an investment in

the Fund.

An investment in the VanEck Digital Assets Mining ETF (DAM) may

be subject to risks which include, among others, risks related to

investing in digital asset miners, investing in equity securities,

Canadian issuers, small- and medium-capitalization companies,

information technology and financials sectors, foreign securities,

depository receipts, market, operational, index tracking,

authorized participant concentration, new fund, absence of prior

active market, trading issues, passive management, fund shares

trading, premium/discount and liquidity of fund shares,

non-diversified and concentration risks which may make these

investments volatile in price or difficult to trade. Small- and

medium-capitalization companies may be subject to elevated

risks.

Digital asset miners and other hardware necessary for digital

asset mining are subject to the risk of malfunction, technological

obsolescence, the global supply chain issues and difficulty and

cost in obtaining new hardware. Malfunctions and normal wear and

tear will, at any point in time, cause a certain number of digital

asset miners to be taken off-line for maintenance or repair. Any

major digital asset miner malfunction could cause significant

economic damage. The physical degradation of miners will require

replacement of miners. Additionally, as technology evolves, there

may be a need to acquire newer models of miners to remain

competitive, which can be costly and may be in short supply. Given

the long production period to manufacture and assemble digital

asset miners and the current global semiconductor chip shortage,

there can be no assurance that miners can acquire or maintain

enough digital asset mining computers or replace parts on a

cost-effective basis for efficient and profitable digital asset

mining operations.

An investment in the VanEck Digital Transformation ETF (DAPP)may

be subject to risks which include, among others, risks related to

investing in digital transformation companies, investing in equity

securities, Canadian issuers, small- and medium-capitalization

companies, information technology and financials sectors, foreign

securities, market, operational, index tracking, authorized

participant concentration, new fund, absence of prior active

market, trading issues, passive management, fund shares trading,

premium/discount and liquidity of fund shares, non-diversified and

concentration risks which may make these investments volatile in

price or difficult to trade. Small- and medium-capitalization

companies may be subject to elevated risks.

The technology relating to digital assets, including blockchain,

is new and developing and the risks associated with digital assets

may not fully emerge until the technology is widely used. Digital

asset technologies are used by companies to optimize their business

practices, whether by using the technology within their business or

operating business lines involved in the operation of the

technology. The cryptographic keys necessary to transact a digital

asset may be subject to theft, loss, or destruction, which could

adversely affect a company’s business or operations if it were

dependent on the digital asset. There may be risks posed by the

lack of regulation for digital assets and any future regulatory

developments could affect the viability and expansion of the use of

digital assets.

An investment in the VanEck Bitcoin Strategy ETF (XBTF) may be

subject to risks which include, among others market and volatility,

investment, futures contract, derivatives, investments related to

bitcoin and bitcoin futures, derivatives, counterparty, investment

capacity, target exposure and rebalancing, borrowing and leverage,

indirect investment, credit, interest rate, illiquidity, investing

in other investment companies, management, new fund,

non-diversified, operational, portfolio turnover, regulatory,

repurchase agreements, tax, of cash transactions, authorized

participant concentration, no guarantee of active trading market,

trading issues, fund shares trading, premium/discount and liquidity

of fund shares, U.S. government securities, debt securities,

municipal securities, money market funds, securitized/asset-backed

securities, and sovereign bond risks, all of which could

significantly and adversely affect the value of an investment in

the Fund.

MVIS is the index business of VanEck, a U.S. based investment

management firm and provider of VanEck ETFs. An index's performance

is not illustrative of a fund's performance. Indices are not

securities in which investments can be made.

Investing involves substantial risk and high volatility,

including possible loss of principal. An investor should consider

the investment objective, risks, charges and expenses of a Fund

carefully before investing. To obtain a prospectus and summary

prospectus, which contain this and other information, call

800.826.2333 or visit vaneck.com. Please read the prospectus and

summary prospectus carefully before investing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220309005129/en/

Media: Chris Sullivan/Julia Stoll MacMillan Communications

212.473.4442 chris@macmillancom.com

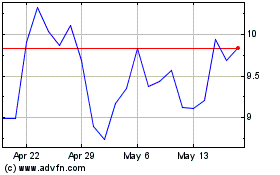

VanEck Digital Transform... (NASDAQ:DAPP)

Historical Stock Chart

From Jan 2025 to Feb 2025

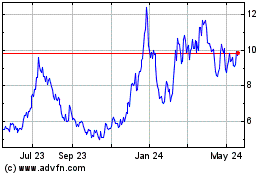

VanEck Digital Transform... (NASDAQ:DAPP)

Historical Stock Chart

From Feb 2024 to Feb 2025