UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 13, 2023

Denali Capital Acquisition Corp.

(Exact Name of Registrant as Specified in Charter)

| Cayman Islands |

|

001-41351 |

|

98-1659463 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 437 Madison Avenue, 27th Floor |

|

|

| New York, New York |

|

10022 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (646) 978-5180

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☒ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered: |

| Units, each consisting of one Class A ordinary share and one redeemable warrant |

|

DECAU |

|

The NASDAQ Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

DECA |

|

The NASDAQ Stock Market LLC |

| Warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share |

|

DECAW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On July 11, 2023, Denali Capital Acquisition Corp.

(“Denali”) issued a convertible promissory note (the “Convertible Promissory Note”) in the total principal

amount of $825,000 to FutureTech Capital LLC, a Delaware Limited Liability Company (“FutureTech’). The Convertible

Promissory Note bears an interest equivalent to the lowest short-term Applicable Federal Rate, and matures upon the earlier of (i)

the closing of Denali’s initial business combination and (ii) the date of the liquidation of Denali. At the option of

FutureTech, upon consummation of a business combination, the Convertible Promissory Note may be converted in whole or in part into

additional Class A ordinary shares of Denali, at a conversion price of $10 per ordinary share (the “Conversion Shares”).

The terms of the Conversion Shares will be identical to those of the private placement shares that were issued in connection with

Denali’s initial public offering. In the event that Denali does not consummate a business combination, the Convertible

Promissory Note will be repaid only from funds held outside of the Trust Account or will be forfeited, eliminated or otherwise

forgiven.

The foregoing description of the Convertible Promissory Note is only

a summary and is qualified in its entirety by the Convertible Promissory Note, which is filed as Exhibit 10.1 to this Current Report on

Form 8-K and is incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

The description of the Convertible Promissory Note and related transactions

set forth in Item 1.01 to this Current Report on Form 8-K, and Exhibit 10.1 filed herewith, are incorporated into this Item 2.03

by reference.

Item

8.01 Other Events

On July 13, 2023, Denali issued a press release announcing that

an aggregate of $825,000 has been deposited into the Company's trust account in order to extend the

period of time it has to consummate a business combination by an additional three months, from the current deadline of July 11,

2023 to October 11, 2023 (the “Extension”), a copy of which is attached hereto as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

No Offer or Solicitation

This Current Report does not constitute an offer

to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation

of any vote, consent or approval in any jurisdiction in connection with the Business Combination or any related transactions, nor shall

there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation

or sale may be unlawful under the laws of such jurisdiction. This Current Report does not constitute either advice or a recommendation

regarding any securities. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities

Act of 1933, as amended, or an exemption therefrom.

Forward Looking Statements

Certain statements included in this Current Report

are not historical facts but are forward-looking statements, including for purposes of the safe harbor provisions under the United States

Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” “target,” and

similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence

of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to,

expectations related to the terms, satisfaction of conditions precedent and timing of the Business Combination. These statements are based

on various assumptions, whether or not identified in this Current Report, and on the current expectations of Denali’s and Company’s

management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only

and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions.

Many actual events and circumstances are beyond the control of Company. These forward-looking statements are subject to a number of risks

and uncertainties, including: changes in domestic and foreign business, market, financial, political and legal conditions; the inability

of the parties to successfully or timely consummate the Business Combination, including the risk that any required stockholder or regulatory

approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or

the expected benefits of the Business Combination; failure to realize the anticipated benefits of the Business Combination; risks relating

to the uncertainty of the projected financial information with respect to Company; risks and costs relating to the regulatory approvals

and compliance applicable to Company’s products; Company’s ability to obtain sufficient working capital; Company’s level

of indebtedness; Company’s ability to successfully and timely acquire, develop, sell and expand its technology and products, and

otherwise implement its growth strategy; risks relating to Company’s operations and business, including information technology and

cybersecurity risks; risks related to the loss of requisite licenses; risks relating to potential disruption of current plans, operations

and infrastructure of Company as a result of the announcement and consummation of the Business Combination; risks that Company is unable

to secure or protect its intellectual property; risks that the combined company experiences difficulties managing its growth and expanding

operations; the ability to compete with existing or new companies that could slow the development of Company’s products or cause

downward pressure on prices, fewer customer orders, reduced margins, the inability to take advantage of new business opportunities, and

the loss of market share; the amount of redemption requests made by Denali’s shareholders; the impact of the COVID-19 pandemic;

the ability to successfully select, execute or integrate future acquisitions into the business, which could result in material adverse

effects to operations and financial conditions; and those factors discussed in the sections entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in Denali’s Annual Report on Form 10-K for the year ended December 31, 2022, filed

with the Securities and Exchange Commission (the “SEC) on March 17, 2023 and in those documents that Denali or Holdco has filed,

or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. The risks and uncertainties above are not exhaustive, and there may be additional

risks that neither Denali nor Company presently know or that Denali and Company currently believe are immaterial that could also cause

actual results to differ from those contained in the forward-looking statements. In addition, forward looking statements reflect Denali’s

and Company’s expectations, plans or forecasts of future events and views as of the date of this Current Report. Denali and Company

anticipate that subsequent events and developments will cause Denali’s and Company’s assessments to change. However, while

Denali and Company may elect to update these forward-looking statements at some point in the future, Denali and Company specifically disclaim

any obligation to do so. These forward-looking statements should not be relied upon as representing Denali’s and Company’s

assessments as of any date subsequent to the date of this Current Report. Accordingly, undue reliance should not be placed upon the forward-looking

statements.

Important Information for Investors and Stockholders

The Business Combination will be submitted to shareholders

of Denali for their consideration and approval at a special meeting of shareholders. Denali and Company have assisted in the preparation

of the registration statement on Form S-4 (the “Registration Statement”) filed with the SEC by Holdco on March 29, 2023,

which includes a preliminary proxy statement to be distributed to Denali’s shareholders in connection with Denali’s solicitation

for proxies for the vote by Denali’s shareholders in connection with the Business Combination and other matters as described in

the Registration Statement, as well as the preliminary prospectus relating to the offer of the securities to be issued to Denali’s

shareholders and certain of Company’s equity holders in connection with the completion of the Business Combination. After the Registration

Statement has been declared effective, Denali will mail a definitive proxy statement and other relevant documents to its shareholders

as of the record date established for voting on the Business Combination. Denali’s shareholders and other interested persons are

advised to read, once available, the preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive

proxy statement/prospectus, in connection with Denali’s solicitation of proxies for its special meeting of shareholders to be held

to approve, among other things, the Business Combination, because these documents will contain important information about Denali, Company

and the Business Combination. Shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as

well as other documents filed with the SEC regarding the Business Combination and other documents filed with the SEC by Denali and Holdco,

without charge, at the SEC’s website located at www.sec.gov.

Participants in the Solicitation

Denali and Company and their respective directors and executive officers,

under SEC rules, may be deemed to be participants in the solicitation of proxies of Denali’s shareholders in connection with the

Business Combination. Investors and security holders may obtain more detailed information regarding Denali’s directors and executive

officers in Denali’s filings with the SEC, including Denali’s Annual Report on Form 10-K filed with the SEC on March 17, 2023.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Denali’s shareholders

in connection with the Business Combination, including a description of their direct and indirect interests, which may, in some cases,

be different than those of Denali’s shareholders generally, will be set forth in the Registration Statement. Shareholders, potential

investors and other interested persons should read the Registration Statement carefully when it becomes available before making any voting

or investment decisions.

This Current Report is not a substitute for the Registration Statement

or for any other document that Denali or Holdco may file with the SEC in connection with the potential Business Combination. INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of other documents filed with the SEC by

Denali and Holdco through the website maintained by the SEC at http://www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 13, 2023

| |

DENALI CAPITAL ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Lei Huang |

| |

Name: |

Lei Huang |

| |

Title: |

Chief Executive Officer |

4

Exhibit 10.1

THIS CONVERTIBLE PROMISSORY NOTE (“NOTE”) AND THE

SECURITIES INTO WHICH IT MAY BE CONVERTED HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE.

THIS NOTE HAS BEEN ACQUIRED FOR INVESTMENT ONLY AND MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED EXCEPT AS PERMITTED UNDER THE SECURITIES

ACT AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY MAY

BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE MAKER MAY REQUIRE AN OPINION OF COUNSEL

REASONABLY SATISFACTORY IN FORM, SCOPE AND SUBSTANCE TO THE MAKER TO THE EFFECT THAT ANY SALE OR OTHER DISPOSITION IS IN COMPLIANCE WITH

THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

CONVERTIBLE PROMISSORY NOTE

| Total Principal Amount: $825,000 |

Dated as of July 11, 2023 |

FOR VALUE RECEIVED and subject to the terms and

conditions set forth herein, Denali Capital Acquisition Corp., a Cayman Islands exempted company (the “Maker”), promises

to pay to FutureTech Capital LLC, a Delaware Limited Liability Company, or its registered assigns or successors in interest (the “Payee”),

the Total Principal Amount (as defined below), plus accrued but unpaid interest, if any, in lawful money of the United States of America,

on the terms and conditions described below. All payments on this Note shall be made by check or wire transfer of immediately available

funds or as otherwise determined by the Maker to such account as the Payee may from time to time designate by written notice in accordance

with the provisions of this Note.

1.

Principal. The principal balance of this Note of $825,000 (the “Total Principal Amount”), together with

any accrued but unpaid interest pursuant to Section 2 below, shall be payable on the earlier of: (i) the effective date of the consummation

of the Maker’s initial merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination

with one or more businesses or entities (the “Business Combination”) or (ii) the date that the winding up of the Maker

is effective (such date, the “Maturity Date”), unless accelerated upon the occurrence of an Event of Default (as defined

below). Payee shall wire the Total Principal Amount to Maker on or prior to the date hereof, according to the wire instructions provided

by Maker to Payee. Any balance under the Note may be prepaid at any time; provided, however, that the Payee shall have a

right to first convert such balance pursuant to Section 7 hereof upon notice of such prepayment. Under no circumstances shall any individual,

including but not limited to any officer, director, employee or shareholder of the Maker, be obligated personally for any obligations

or liabilities of the Maker hereunder. The Payee understands that if a Business Combination is not consummated, this Note will be repaid

solely to the extent that the Maker has funds available to it outside of its trust account established in connection with its initial

public offering of its securities (the “Trust Account” and such offering, the “IPO”), and that all

other amounts will be contributed to capital, forfeited, eliminated or otherwise forgiven or eliminated.

2.

Interest. Interest shall accrue on the unpaid and outstanding Total Principal Amount of this Note at the lowest short-term

Applicable Federal Rate (within the meaning of Internal Revenue Code Section 1274) as in effect on the date hereof and will be payable

in arrears on the Maturity Date. Interest shall be calculated on the basis of a 365-day year and the actual number of days elapsed, to

the extent permitted by applicable law.

3.

[Reserved.]

4.

Application of Payments. All payments shall be applied first to payment in full of any costs incurred in the collection of

any sum due under this Note, including (without limitation) reasonable attorney’s fees, then to the payment in full of any late

charges, then to the payment of accrued and unpaid interest on the Total Principal Amount of this Note and finally to the reduction of

the unpaid Total Principal Amount of this Note.

5.

Events of Default. Each of the following shall constitute an event of default (“Event of Default”):

(a)

Failure to Make Required Payments. Failure by the Maker to pay all or a portion of the Total Principal Amount, plus accrued

but unpaid interest, if any, due pursuant to this Note (to the extent such amount is payable in cash) within five business days of the

Maturity Date and/or, if applicable, failure by the Maker to perform its obligations with respect to the conversion of up to the Total

Principal Amount, plus accrued but unpaid interest, if any, of this Note, in whole or in part at the option of the Payee, into Private

Placement Shares pursuant to Section 7 hereof.

(b)

Voluntary Bankruptcy, Etc. The commencement by the Maker of a voluntary case under any applicable bankruptcy, insolvency,

reorganization, rehabilitation or other similar law, or the consent by it to the appointment of or taking possession by a receiver, liquidator,

assignee, trustee, custodian, sequestrator (or other similar official) of the Maker or for any substantial part of its property, or the

making by it of any assignment for the benefit of creditors, or the failure of the Maker generally to pay its debts as such debts become

due, or the taking of corporate action by the Maker in furtherance of any of the foregoing.

(c)

Involuntary Bankruptcy, Etc. The entry of a decree or order for relief by a court having jurisdiction in the premises in

respect of the Maker in an involuntary case under any applicable bankruptcy, insolvency or other similar law, or appointing a receiver,

liquidator, assignee, custodian, trustee, sequestrator (or similar official) of the Maker or for any substantial part of its property,

or ordering the winding-up or liquidation of its affairs, and the continuance of any such decree or order unstayed and in effect for a

period of 60 consecutive days.

6.

Remedies.

(a)

Upon the occurrence of an Event of Default specified in Section 5(a) hereof, the Payee may, by written notice to the Maker, declare

this Note to be due immediately and payable, whereupon the unpaid Total Principal Amount of this Note, plus accrued but unpaid interest,

if any, and all other amounts payable hereunder, shall become immediately due and payable without presentment, demand, protest or other

notice of any kind, all of which are hereby expressly waived, anything contained herein or in the documents evidencing the same to the

contrary notwithstanding.

(b)

Upon the occurrence of an Event of Default specified in Section 5(b) and Section 5(c) hereof, the unpaid principal balance of this

Note, and all other sums payable with regard to this Note, shall automatically and immediately become due and payable, in all cases without

any action on the part of the Payee.

7.

Conversion.

(a)

Optional Conversion. Upon consummation of a Business Combination, the Payee shall have the option, but not the obligation,

to convert up to the Total Principal Amount, plus accrued but unpaid interest, if any, of this Note, in whole or in part at the option

of the Payee, into Class A ordinary shares in the capital of the Maker (each, an “Ordinary Share”), at a conversion

price of $10.00 per Ordinary Share. The Ordinary Shares shall be identical to the private placement shares issued to the Sponsor at the

time of the Maker’s IPO (the “Private Placement Shares”). As promptly as reasonably practicable after notice

by the Payee to the Maker to convert the principal balance of this Note, in whole or in part, into Private Placement Shares, which notice,

if given, must be given at least five business days prior to the consummation of the Business Combination, and after the Payee’s

surrender of this Note, the Maker shall have issued and delivered to the Payee, without any charge to Payee, a share certificate or certificates

(issued in the name(s) requested by the Payee), or shall have made appropriate book-entry notation on the books and records of the Maker,

in each case for the number of Private Placement Shares of the Maker issuable upon the conversion of this Note. The conversion shall be

deemed to have been made immediately prior to the close of business on the date of the surrender of this Note and the person or persons

entitled to receive the Private Placement Shares upon such conversion shall be treated for all purposes as the record holder or holders

of such Private Placement Shares as of such date. Each such newly issued Private Placement Share shall include restricted legends that

contemplates the same restrictions as the Private Placement Shares that were issued in connection with the IPO.

(b)

Fractional Shares; Effect of Conversion. No fractional Private Placement Shares shall be issued upon conversion of this

Note and the number of Private Placement Shares deliverable will be rounded to the nearest whole number of Private Placement Shares, with

one-half (0.5) or more of a Private Placement Share being rounded upward. Upon conversion of this Note in full, this Note shall be cancelled

and void without further action of the Maker or the Payee, and the Maker shall be forever released from all its obligations and liabilities

under this Note.

8.

Covenants of the Maker. The Maker covenants that any Private Placement Shares issuable upon conversion of the Note, when so

issued, will be validly issued, fully paid and non-assessable and free from all taxes, liens and charges with respect to the issuance

thereof.

9.

Waivers. The Maker and all endorsers and guarantors of, and sureties for, this Note waive presentment for payment, demand,

notice of dishonor, protest, and notice of protest with regard to the Note, all errors, defects and imperfections in any proceedings instituted

by the Payee under the terms of this Note, and all benefits that might accrue to the Maker by virtue of any present or future laws exempting

any property, real or personal, or any part of the proceeds arising from any sale of any such property, from attachment, levy or sale

under execution, or providing for any stay of execution, exemption from civil process, or extension of time for payment; and the Maker

agrees that any real estate that may be levied upon pursuant to a judgment obtained by virtue hereof, on any writ of execution issued

hereon, may be sold upon any such writ in whole or in part in any order desired by the Payee.

10.

Unconditional Liability. The Maker hereby waives all notices in connection with the delivery, acceptance, performance, default,

or enforcement of the payment of this Note, and agrees that its liability shall be unconditional, without regard to the liability of any

other party, and shall not be affected in any manner by any indulgence, extension of time, renewal, waiver or modification granted or

consented to by the Payee, and consents to any and all extensions of time, renewals, waivers, or modifications that may be granted by

the Payee with respect to the payment or other provisions of this Note, and agrees that additional makers, endorsers, guarantors, or sureties

may become parties hereto without notice to the Maker or affecting the Maker’s liability hereunder.

11.

Notices. All notices, statements or other documents which are required or contemplated by this Note shall be: (i) in writing

and delivered personally or sent by first class registered or certified mail, overnight courier service or facsimile or electronic transmission

to the address designated in writing, (ii) by facsimile to the number most recently provided to such party or such other address or fax

number as may be designated in writing by such party or (iii) by electronic mail, to the electronic mail address most recently provided

to such party or such other electronic mail address as may be designated in writing by such party. Any notice or other communication so

transmitted shall be deemed to have been given on the day of delivery, if delivered personally, on the business day following receipt

of written confirmation, if sent by facsimile or electronic transmission, one business day after delivery to an overnight courier service

or five days after mailing if sent by mail.

12.

Construction. THIS NOTE SHALL BE GOVERNED AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK,

WITHOUT REGARD TO CONFLICT OF LAW PROVISIONS THEREOF.

13.

Severability. Any provision contained in this Note which is prohibited or unenforceable in any jurisdiction shall, as to such

jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof,

and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other

jurisdiction.

14.

Trust Waiver. Notwithstanding anything herein to the contrary, the Payee hereby waives any and all right, title, interest or

claim of any kind (“Claim”) in or to any monies in, or any distribution of or from, the Trust Account, and hereby agrees

not to seek recourse, reimbursement, payment or satisfaction for any Claim against the Trust Account for any reason whatsoever. The Payee

hereby agrees not to make any Claim against the Trust Account (including any distributions therefrom), regardless of whether such Claim

arises as a result of, in connection with or relating in any way to, this Note, or any other matter, and regardless of whether such Claim

arises based on contract, tort, equity or any other theory of legal liability. To the extent the Payee commences any action or proceeding

based upon, in connection with, relating to or arising out of any matter relating to the Maker (including this Note), which proceeding

seeks, in whole or in part, monetary relief against the Maker, the Payee hereby acknowledges and agrees that its sole remedy shall be

against funds held outside of the Trust Account and that such Claim shall not permit the Maker (or any person claiming on its behalf or

in lieu of it) to have any Claim against the Trust Account (including any distributions therefrom) or any amounts contained therein.

15.

Tax Treatment. In each case for U.S. federal income tax and all other applicable tax purposes, the Maker and the Payee agree

to treat this Note as an equity interest in the Maker (and not as indebtedness), and shall take no contrary position on any tax return

or before any taxing authority (unless otherwise required by law). The Maker and the Payee shall reasonably cooperate to structure (i)

any conversion of this Note in connection with a Business Combination and (ii) any contribution, forfeiture or elimination of this Note

pursuant to Section 1 hereof in a manner that is tax-efficient for the Maker and the Payee, taking into account the terms of any Business

Combination.

16.

Amendment; Waiver. Any amendment hereto or waiver of any provision hereof may be made with, and only with, the written consent

of the Maker and the Payee.

17.

Assignment. No assignment or transfer of this Note or any rights or obligations hereunder may be made by any party hereto without

the prior written consent of the other party hereto and any attempted assignment without the required consent shall be void.

18.

Successors and Assigns. Subject to the restrictions in Section 17 hereof, the rights and obligations of the parties hereunder

is binding upon and inures to the benefit of the successors, assigns, heirs, administrators and transferees of any party hereto (by operation

of law or otherwise).

19.

Acknowledgment. The Payee is acquiring this Note for investment for its own account, not as a nominee or agent, and not with

a view to, or for resale in connection with, any distribution thereof in violation of applicable securities laws. The Payee understands

that the acquisition of this Note involves substantial risk. The Payee has experience as an investor in securities of companies and acknowledges

that it is able to fend for itself, can bear the economic risk of its investment in this Note, and has such knowledge and experience in

financial and business matters that it is capable of evaluating the merits and risks of this investment in this Note and protecting its

own interests in connection with this investment.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the Maker, intending to be

legally bound hereby, has caused this Note to be duly executed by the undersigned as of the day and year first above written.

| |

Denali Capital Acquisition Corp. |

| |

|

| |

By: |

/s/ Lei Huang |

| |

Name: |

Lei Huang |

| |

Title: |

Chief Executive Officer |

Agreed and Acknowledged as of the date first written above:

| FutureTech Capital LLC |

|

| |

|

| By: |

/s/ Yuquan Wang |

|

| Name: |

Yuquan Wang |

|

| Title: |

Chief Executive Officer |

|

Exhibit 99.1

Denali Capital Acquisition Corp. Announces Extension of Deadline

to Complete an Initial Business Combination

NEW YORK, July 13, 2023 /PRNewswire/ -- Denali Capital

Acquisition Corp. (NASDAQ: DECA) (“Denali” or the “Company”) announced today that an aggregate of $825,000

has been deposited into the Company's trust account to further extend the period of time the Company has to consummate its initial

business combination by an additional three months, from the current deadline of July 11, 2023 to October 11, 2023. This is the

second of the two three-month extensions permitted under the Company’s governing documents.

About Denali Capital Acquisition Corp.

Denali Capital Acquisition Corp. is a blank check company incorporated

as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization,

or similar business combination with one or more businesses or entities.

Forward-Looking Statements

This press release includes forward looking statements that involve

risks and uncertainties. Forward-looking statements are subject to numerous conditions, risks and changes in circumstances, many of which

are beyond the control of the Company, including those set forth in the “Risk Factors” section of the Company’s most recent

annual report on Form 10-K and quarterly reports on Form 10-Q filed with the Securities and Exchange Commission. The Company expressly

disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which

any statement is based.

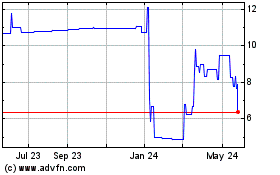

Denali Capital Acquisition (NASDAQ:DECAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

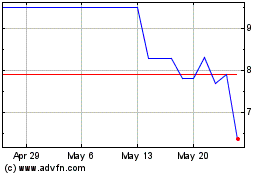

Denali Capital Acquisition (NASDAQ:DECAU)

Historical Stock Chart

From Nov 2023 to Nov 2024