As filed with the Securities and Exchange Commission

on February 21, 2024

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DARIOHEALTH

CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization) |

45-2973162

(I.R.S. Employer Identification No.) |

122 W 57th St, #33B

New York, New York 10019

(Address of Principal Executive Offices)

Individual Stock Option Agreements

(Full title of the plan)

Mr. Erez Raphael

Chief Executive Officer

DarioHealth Corp.

122 W 57th St, #33B

New York, New York 10019

(Name, Address and Telephone Number of Agent For

Service)

Copies to:

Oded Har-Even, Esq.

Ron Ben-Bassat, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

Telephone: (212) 660-3000

Facsimile: (212) 660-3001

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act

| Large accelerated

filer ¨ |

Accelerated filer ¨ |

Non-accelerated

filer x |

Smaller reporting

company x |

Emerging growth

company ¨ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Explanatory Note

On or about February 15, 2024,

the registrant completed its acquisition of Twill, Inc. (“Twill”). The registrant has prepared this registration statement

in accordance with the requirements of Form S-8 under the Securities Act to register 2,963,459 shares of the registrant’s common

stock (“Common Stock”) issuable upon the purchase of shares pursuant to individual stock option agreements granted as a material

inducement of employment to former employees of Twill in connection with the registrant’s acquisition of Twill.

PART I

INFORMATION REQUIRED

IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information required in Part I of this registration statement have been or will be sent or given to participating

employees as specified in Rule 428(b)(1) under the Securities Act in accordance with the rules and regulations of the United States Securities

and Exchange Commission (the “Commission”). Such documents are not being filed with the Commission either as part of this

registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the

documents incorporated by reference into this registration statement pursuant to Item 3 of Part II of this registration statement, taken

together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which

have been filed by the Company with the Commission are incorporated by reference in and made a part of this registration statement, as

of their respective dates:

| (2) |

Our

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30,

2023, as filed with the SEC on May 11, 2023, August 10, 2023 and November 2, 2023, respectively; |

| |

|

| (3) |

Our Current

Reports on Form 8-K, as filed with the SEC on January 13,

2023, January 27,

2023, February 6,

2023, February 24,

2023, March 10,

2023, May 5,

2023, May 9,

2023, June 20,

2023, July 24, 2023, December 11, 2023 and February 21, 2024; and |

All documents subsequently

filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended,

prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all

securities then remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be part hereof

from the date of filing of such documents.

Any statement contained in

a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of

this registration statement to the extent that a statement herein, or in any subsequently filed document which also is or is deemed to

be incorporated by reference, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except

as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts

and Counsel.

Not Applicable.

Item 6. Indemnification of Directors

and Officers.

Section 145 of the Delaware

General Corporation Law (which we refer to as the DGCL) provides, in general, that a corporation incorporated under the laws of the State

of Delaware, as we are, may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending

or completed action, suit or proceeding (other than a derivative action by or in the right of the corporation) by reason of the fact that

such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another enterprise, against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such

person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation

and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s conduct was unlawful. In

the case of a derivative action, a Delaware corporation may indemnify any such person against expenses (including attorneys’ fees)

actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person acted

in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation, except

that no indemnification will be made in respect of any claim, issue or matter as to which such person will have been adjudged to be liable

to the corporation unless and only to the extent that the Court of Chancery of the State of Delaware or any other court in which such

action was brought determines such person is fairly and reasonably entitled to indemnity for such expenses.

Our certificate of incorporation

and bylaws provide that we will indemnify our directors, officers, employees and agents to the extent and in the manner permitted by the

provisions of the DGCL, as amended from time to time, subject to any permissible expansion or limitation of such indemnification, as may

be set forth in any stockholders’ or directors’ resolution or by contract. In addition, our director and officer indemnification

agreements with each of our directors and officers provide, among other things, for the indemnification to the fullest extent permitted

or required by Delaware law, provided that no indemnitee will be entitled to indemnification in connection with any claim initiated by

the indemnitee against us or our directors or officers unless we join or consent to the initiation of the claim, or the purchase and sale

of securities by the indemnitee in violation of Section 16(b) of the Exchange Act.

Any repeal or modification

of these provisions approved by our stockholders will be prospective only and will not adversely affect any limitation on the liability

of any of our directors or officers existing as of the time of such repeal or modification.

We are also permitted to apply

for insurance on behalf of any director, officer, employee or other agent for liability arising out of his actions, whether or not the

DGCL would permit indemnification.

Item 7. Exemption from Registration

Claimed.

Not Applicable.

Item 8. Exhibits.

Item 9. Undertakings.

| (a) |

The undersigned registrant hereby undertakes: |

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

(ii) |

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| |

(iii) |

To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement; |

| |

provided, however, that subparagraphs

(a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in the periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement. |

| |

(2) |

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (b) |

The undersigned registrant hereby further undertakes that, for the purposes of determining any liability under the Securities Act of 1933, each filing of the Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) |

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this registration statement on Form S-8 to be signed on its behalf by the undersigned, thereunto

duly authorized, in New York, New York on the 21st day February 2024.

| |

DARIOHEALTH CORP. |

| |

|

|

| |

By: |

/s/ Erez Raphael |

| |

|

Name: Erez Raphael |

| |

|

Title: Chief Executive Officer |

POWER

OF ATTORNEY AND SIGNATURES

We, the undersigned officers

and directors of DarioHealth Corp., hereby severally constitute and appoint Erez Raphael and Zvi Ben David, and each of them individually,

our true and lawful attorney to sign for us and in our names in the capacities indicated below any and all amendments or supplements,

including any post-effective amendments, to this registration statement on Form S-8 and to file the same, with exhibits thereto and other

documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney full power and authority to

do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes

as he might or could do in person, hereby ratifying and confirming our signatures to said amendments to this registration statement signed

by our said attorney and all else that said attorney may lawfully do and cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this registration statement on Form S-8 has been signed below by the following persons in the capacities and on the dates indicated.

| Person |

|

Capacity |

|

Date |

| |

|

|

|

|

| /s/ Erez Raphael |

|

Chief Executive Officer |

|

February 21, 2024 |

| Erez Raphael |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Zvi Ben David |

|

Chief Financial Officer, Secretary and Treasurer |

|

February 21, 2024 |

| Zvi Ben David |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Yoav Shaked |

|

Chairman of the Board of Directors |

|

February 21, 2024 |

| Yoav Shaked |

|

|

|

|

| |

|

|

|

|

| /s/ Hila Karah |

|

Director |

|

February 21, 2024 |

| Hila Karah |

|

|

|

|

| |

|

|

|

|

| /s/ Dennis Matheis |

|

Director |

|

February 21, 2024 |

| Dennis Matheis |

|

|

|

|

| |

|

|

|

|

| /s/ Dennis M. McGrath |

|

Director |

|

February 21, 2024 |

|

Dennis M. McGrath |

|

|

|

|

| |

|

|

|

|

| /s/ Adam K. Stern |

|

Director |

|

February 21, 2024 |

| Adam K. Stern |

|

|

|

|

| |

|

|

|

|

| /s/ Jon Kaplan |

|

Director |

|

February 21, 2024 |

| Jon Kaplan |

|

|

|

|

Exhibit 5.1

February 21, 2024

DarioHealth Corp.

122 W 57th St, #33B

New York, New York 10019

| |

Re: |

DarioHealth Corp. Registration Statement on Form S-8 |

Ladies and Gentlemen:

In connection with the registration

under the Securities Act of 1933, as amended (the “Act”), by DarioHealth Corp., a Delaware corporation (the “Company”),

of 2,963,459 shares of its common stock, par value $0.0001 per share (the “Registered Shares”), that are to be offered

and may be issued pursuant to the exercise of individual non-statutory stock option agreements, issued as an inducement, in the form specified

in the Registration Statement, the following opinion is furnished to you to be filed with the Securities and Exchange Commission (the

“Commission”) as Exhibit 5.1 to the Company’s Registration Statement on Form S-8 (the “Registration

Statement”) under the Act.

We have acted as counsel to

the Company in connection with the Registration Statement, and we have examined originals or copies, certified or otherwise identified

to our satisfaction, of the Registration Statement, the Certificate of Incorporation of the Company as presently in effect, the bylaws,

minute books and corporate records of the Company, and such other documents as we have considered necessary in order to furnish the opinion

hereinafter set forth.

We express no opinion herein

as to any laws other than the General Corporation Law statute of the State of Delaware, and we express no opinion as to state securities

or blue sky laws.

Based on and subject to the

foregoing, we are of the opinion that, when issued in accordance with the terms of the non-statutory stock option agreements, the Registered

Shares will be duly authorized, validly issued, fully paid and nonassessable by the Company.

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement and to the reference to our firm in the Prospectus forming a part of the Registration

Statement. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is required under

Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Sullivan & Worcester LLP

SULLIVAN & WORCESTER LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in

the Registration Statement (Form S-8) pertaining to the inducement awards of DarioHealth Corp. report dated March 9, 2023, with respect

to the consolidated financial statements of DarioHealth Corp. included in its Annual Report (Form 10-K) for the year ended December 31,

2022, filed with the Securities and Exchange Commission.

| Tel-Aviv,

Israel |

KOST FORER GABBAY

& KASIERER |

| February 21, 2024 |

|

| |

A Member of Ernst & Young

Global |

Exhibit 99.1

STOCK OPTION AGREEMENT

THIS

STOCK OPTION AGREEMENT (the “Agreement”) and the associated grant award information (the “Customizing

Information”), is made and entered into as of the “Grant Date” specified in the Customizing Information included

hereto at Exhibit A (the “Grant Date”), by and between DarioHealth Corp., a Delaware corporation (the “Corporation”),

and the individual identified in the Customizing Information (the “Optionee”).

WHEREAS,

the Optionee, as an employee of Twill, Inc., is being issued this Option as an inducement to their employment with the Corporation

and its affiliates;

WHEREAS,

the Corporation considers it desirable and in its best interests that Optionee be given an opportunity to acquire a proprietary option

to purchase shares of common stock of the Corporation, par value $0.0001 per share (the “Shares”).

NOW,

THEREFORE, for good and valuable consideration, the adequacy of which is hereby acknowledged, and the mutual covenants hereinafter

set forth, the parties agree as follows:

1. Definitions.

The following capitalized terms have the following meanings. Other capitalized terms are defined elsewhere herein.

(a) “Affiliate”

means (i) any person or entity that directly or indirectly controls, is controlled by or is under common control with the Corporation

and/or (ii) to the extent provided by the Board, any person or entity in which the Corporation has a significant interest as determined

by the Board in its discretion. The term “control” (including, with correlative meaning, the terms “controlled by”

and “under common control with”), as applied to any person or entity, means the possession, directly or indirectly, of the

power to direct or cause the direction of the management and policies of such person or entity, whether through the ownership of voting

or other securities, by contract or otherwise.

(b) “Board” means the Board of Directors of the Corporation.

(c) “Business

Day” means any day other than a Saturday, a Sunday or a day on which banking institutions in New York City, New York are authorized

or obligated by federal law or executive order to be closed.

(d) “Cause”

means (i) conviction of, or plea of guilty or no contest to, any felony or any crime involving moral turpitude or dishonesty or the

commission of any other act involving willful malfeasance or material fiduciary breach with respect to the Corporation or an Affiliate;

(ii) participation in a fraud, misappropriation or embezzlement of Corporation and/or its Affiliate funds or property or act of dishonesty

against the Corporation and/or its Affiliate; (iii) material violation of any rule, regulation, policy or plan for the conduct of

(as the case may be) any director, officer, employee, member, manager, consultant or service provider of or to the Corporation or its

Affiliates or its or their business (which, if curable, is not cured within five (5) Business Days after notice thereof is provided

to the Optionee); (iv) conduct that results in or is reasonably likely to result in harm to the reputation or business of the Corporation

or any of its Affiliates; (v) gross negligence or willful misconduct with respect to the Corporation or an Affiliate; (vi) material

violation of U.S. state, federal or other applicable (including non-U.S.) securities laws; or (vii) material breach of Optionee’s

obligations under his employment agreement/offer letter with the Corporation.

(e) “Change

in Control” means (i) an acquisition (whether directly from the Corporation or otherwise) of any voting securities of the

Corporation (the “Voting Securities”) by any “Person” (as the term person is used for purposes of Section 13(d) or

14(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)), immediately after which such

Person has “Beneficial Ownership” (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of more than

fifty percent (50%) of the combined voting power of the Corporation’s then outstanding Voting Securities; (ii) the individuals

who constitute the members of the full Board cease, by reason of a financing, merger, combination, acquisition, takeover or other non-ordinary

course transaction affecting the Corporation, to constitute at least fifty-one percent (51%) of the members of the full Board; or (iii) approval

by the full Board and, if required, stockholders of the Corporation of, or execution by the Corporation of any definitive agreement with

respect to, or the consummation of (it being understood that the mere execution of a term sheet, memorandum of understanding or other

non-binding document shall not constitute a Change in Control): (A) a merger, consolidation or reorganization involving the Corporation,

where either or both of the events described in clauses (i) or (ii) above would be the result; (B) a liquidation or dissolution

of or appointment of a receiver, rehabilitator, conservator or similar person for, or the filing by a third party of an involuntary bankruptcy

against, the Corporation; or (C) an agreement for the sale or other disposition of all or substantially all of the assets of the

Corporation to any Person (other than a transfer to a subsidiary of the Corporation).

(f) “Continuous

Service” means that the Optionee’s service with the Corporation or an Affiliate, whether as an employee, member of the

Board, consultant or any other nonemployee relationship, is not interrupted or terminated. The Optionee’s Continuous Service shall

not be deemed to have terminated merely because of a change in the capacity in which the Optionee renders service to the Corporation or

an Affiliate as an employee, consultant, member of the Board or any other nonemployee relationship or a change in the entity for which

the Optionee renders such service, provided that there is no interruption or termination of the Optionee’s Continuous Service.

For example, a change in status from an employee of the Corporation to a consultant of an Affiliate or a member of the Board will not

constitute an interruption of Continuous Service. The Board or its delegate, in its sole discretion, may determine whether Continuous

Service shall be considered interrupted in the case of any leave of absence approved by that party, including sick leave, military leave.

relocation or any other personal or family leave of absence.

(g) “Disability”

means that the Optionee is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental

impairment. The determination of whether an individual has a Disability shall be determined under procedures established by the Board.

The Board may rely on any determination that the Optionee is disabled for purposes of benefits under any long-term disability plan maintained

by the Corporation or any Affiliate in which the Optionee participates.

(h) “Fair

Market Value” means, as of any date, the value of a Share of common stock determined as follows: (i) if the Share is listed

on any established stock exchange or a national market system, including without limitation, the New York Stock Exchange or the NASDAQ

Stock Market, or quoted on a national exchange or other recognized securities quotation system (such as the Nasdaq Stock Market/OTC Bulletin

Board/OTCQB Market), the Fair Market Value of a Share shall be the closing sales price for such stock as quoted on such exchange, market

or quotation system (or the exchange or market with the greatest volume of trading in the Shares) on the last market trading day prior

to the day of determination (or the closing price on the date immediately preceding such date if no sales activity occurred on the day

of determination), as reported by Bloomberg or such other source as the Board deems reliable, and (ii) in the absence of such markets

for the Share, the Fair Market Value shall be determined in good faith and in accordance with applicable law by the Board and such determination

shall be conclusive and binding.

2. Grant

of Option. The Corporation hereby grants to the Optionee the right and option to purchase up to an aggregate of the number of Shares

shown in the Customizing Information under “Shares Granted” (subject to adjustment as

provided in Section 8 hereof), on the terms and conditions set forth herein (hereinafter the “Option”). The Optionee

acknowledges that the Option will not be an “incentive option” within the meaning of Section 422 of the Internal Revenue

Code of 1986, as amended (the “Code”). This Option is not being issued pursuant to the Corporation’s

2020 Equity Incentive Plan (the “Plan”); provided, however, that this Option is granted as a material inducement

to employment in accordance with Nasdaq Listing Rule 5635(c)(4).

3. Exercise

of Options. The vested portion of this Option shall be exercisable at the “Exercise Price” per Share shown in the

Customizing Information (subject to adjustment as provided for herein) (the “Exercise Price”).

4. Vesting

of Options. Subject to the Optionee’s Continuous Service on each vesting date, the Option shall vest in accordance with the

“Vesting Schedule” set forth in the Customizing Information. For purposes of calculating the number of Shares subject to the

Option that shall vest on each vesting date, any resulting fraction of a Share shall be rounded up to the nearest full Share.

Subject to applicable law, the Board, in its sole

discretion, shall have the power to accelerate the time at which the Option may first be exercised or the time during which the Option

or any part thereof will vest.

5. Term

of the Option. The Option shall expire on the ten (10) year anniversary of the Grant Date, or upon its earlier termination as

provided in this Agreement.

6. Method

of Exercising Option. The Optionee may exercise the vested portion of the Option in whole or in part (to the extent that it is exercisable

in accordance with its terms) by giving written notice to the Corporation in the form annexed hereto as Exhibit B, together

with the tender of the full purchase price of the Shares covered by the Option. The purchase price may consist of (a) cash, (b) certified

or bank check payable to the order of the Corporation in the amount of the purchase price, (c) a net exercise procedure, consisting

of authorization from the Optionee to the Corporation to retain from the total number of Shares as to which the Option is exercised that

number of Shares having a Fair Market Value (as defined below) on the date of the exercise equal to purchase price (and any withholding

if so requested) for the total number of Shares as to which the Option is exercised, (d) if agreed to by the Board, a broker-assisted

cashless exercise, (e) other method, property or consideration if the Board determines acceptance thereof is beneficial to the Corporation

or (f any combination of the methods described in (a) through (f) above.

As soon as practicable after receipt by the Corporation

of such notice and of payment in full of the purchase price of all the Shares with respect to which the Option has been exercised, a certificate

or certificates ( or book entry) representing such Shares shall be issued in the name of the Optionee and shall be delivered to the Optionee.

All Shares shall be issued only upon receipt by the Corporation of the Optionee’s representation that the Shares are purchased for

investment and not with a view toward distribution thereof.

In the event this Option is exercised via a net

exercise as set forth in Section 6(c) above, the Optionee shall deliver written notice to the Corporation as set forth above

in this Section 6, in which event the Corporation shall issue to Optionee the number of Option Shares computed according to the following

equation:

; where

| X = | the number of Shares to be issued to the Optionee. |

| Y = | the Shares purchasable under this Option or, if only a portion of this Option is being exercised, the portion of the Shares being

exercised. |

| A = | the Fair Market Value (as defined in the Plan) of one Share

on the exercise date. |

In the event the above formula would result in

the issuance of a fractional Share of common stock, then in lieu of issuing such fractional Share, the Corporation in its sole and absolute

discretion may elect to pay an amount of cash equal to the fair market value of such fractional Share as reasonably determined by the

Corporation.

7. Availability

of Shares. The Corporation, during the term of this Agreement, shall keep available at all times the number of Shares required to

satisfy the Option. The Corporation shall utilize its best efforts to comply with the requirements of each regulatory commission or agency

having jurisdiction in order to issue to allow the Optionee to sell the Shares, with respect to the Option.

8. Adjustments.

If prior to the exercise of any portion of the Option granted hereunder the Corporation shall have effected one or more stock splits,

stock dividends, consolidation, reorganization, recapitalization, reincorporation, dividend in property other than cash, liquidating dividend,

combination of shares, exchange of shares, change in corporate structure or other increases or reductions of the number of its shares

outstanding without receiving compensation therefor in money, services or property, the number of Shares subject to the Option hereby

granted shall (a) if a net increase shall have been effected in the number of outstanding the Corporation’s Shares, be proportionately

increased and the Exercise Price of the Shares issuable upon exercise of the Option shall be proportionately reduced; and (b) if

a net reduction shall have been effected in the number of outstanding Shares of the Corporation’s common stock, be proportionately

reduced and the Exercise Price of the Shares issuable upon exercise of the Option shall be proportionately increased. Any adjustment shall

be done in accordance with Treasury Regulation Section 1.409A- 1(b)(5)(v)(D).

9. Dissolution

or Liquidation. In the event of a dissolution or liquidation of the Corporation, the Corporation shall immediately notify the Optionee

of such dissolution or liquidation. The Corporation may provide the Optionee thirty (30) days to exercise all or a portion of any outstanding

vested Options held by the Optionee at that time, and upon the expiration of such thirty (30) day period, all remaining outstanding Options

shall terminate immediately. Alternatively, the Corporation may provide that all or any portion of any vested Option shall convert into

the right to receive liquidation proceeds (if applicable, net of the Exercise Price and any applicable tax withholdings). Any adjustment

shall be done in accordance with Treasury Regulation Section 1.409A-1(b)(5)(v)(D).

10. Change in Control.

(a) In

the event of a Change in Control, then, without the consent or action required of the Optionee:

(i) Any

surviving corporation or acquiring corporation or any parent or affiliate thereof, as determined by the Corporation in its discretion,

shall assume or continue any Options outstanding under this Agreement in all or in part or shall substitute to similar stock awards in

all or in part, in accordance with the requirements of Section 409A of the Code, if applicable; or

(ii) In

the event any surviving corporation or acquiring corporation does not assume or continue the Option or substitute similar awards, then

vested Shares covered by the Option (including those that accelerate) shall terminate if not exercised at or prior to such Change in Control;

or

(iii) The

Corporation may, in its sole discretion, accelerate the vesting, partially or in full, of the Option as the Corporation may determine

to be appropriate prior to such events; or

(iv) In

the event of a Change in Control under the terms of which holders of Shares will receive upon consummation thereof a cash payment for

each Share surrendered in the Change in Control (the “Acquisition Price”), the Optionee shall be provided a cash payment

with respect to each vested Option held by the Optionee equal to (A) the number of Shares subject to the vested Option (after giving

effect to any acceleration of vesting that occurs upon or immediately prior to such Change in Control) multiplied by (B) the excess,

if any, of (I) the Acquisition Price over (II) the Exercise Price and any applicable tax withholdings, in exchange for the termination

of such Awards.

(b) Upon

the occurrence of a Change in Control, the repurchase and other rights of the Corporation with respect to outstanding Restricted Stock

(as defined below) shall inure to the benefit of the Corporation’s successor and shall, unless the determines otherwise, apply to

the cash, securities or other property that the Shares were converted into or exchanged for pursuant to such Change in Control in the

same manner and to the same extent as they applied to the Restricted Stock; provided, however, that the Corporation may provide for termination

or deemed satisfaction of repurchase or other rights under this Agreement evidencing any Restricted Stock or any other agreement between

the Optionee and the Corporation, either initially or by amendment.

(c) Notwithstanding

the above, in case of Change in Control and in the event all or substantially all of the shares of the Corporation are to be exchanged

for securities of another company, then the Optionee shall be obliged to sell or exchange, as the case may be, any Shares the Optionee

holds or purchased under this Agreement, in accordance with the instructions issued by the Corporation, whose determination shall be final.

(d) Notwithstanding

the above, the Corporation may, in its sole discretion, decide other terms regarding the treatment of the outstanding Option Shares in

case of a Change in Control.

11. Restrictions.

The Optionee, by acceptance hereof, represents and warrants as follows:

(a) The

Option and the right to purchase Shares hereunder is personal to the Optionee and shall not be transferred to any other person, other

than (i) by will or the laws of descent and distribution, or (ii) pursuant to a domestic relations order. This Option shall

not be collaterally assigned, pledged or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to

execution, attachment or similar process. Any attempted transfer, assignment, pledge, hypothecation or other disposition of the Option

or of any rights granted hereunder contrary to the provisions of this Section 11, or the levy of any attachment or similar process

upon the Option or such right, shall be null and void. Notwithstanding the foregoing, the Optionee may, with approval by the Board and

in a form satisfactory to the Corporation, designate a third party who, in the event of the death of the Optionee, shall thereafter be

entitled to exercise the Option.

(b) The

Optionee has been advised and understands that the Option and the resulting Shares issuable upon its exercise, is intended to be registered

on a Registration Statement on Form S-8, resulting in the securities issuable hereunder being registered under the Securities Act

of 1933, as amended (the “Securities Act”). However, in the absence of such registration, the Optionee has been advised

and understands that the Option has been issued in reliance upon exemptions from registration under the Securities Act and applicable

state statutes; the Shares have not been registered under the Securities Act or applicable state statutes and must be held and may not

be sold, transferred or otherwise disposed of for value unless they are subsequently registered under the Securities Act or an exemption

from such registration is available, except as set forth herein; the Corporation is under no obligation to register the Option or the

Shares under the Securities Act or the applicable state statutes; in the absence of such registration, the sale of the Shares may be practicably

impossible; the Shares will bear a legend (on any certificate or book entry) in substantially the following form restricting the sale

of the Shares:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE OR BOOK ENTRY

HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) AND ARE “RESTRICTED SECURITIES”

WITHIN THE MEANING OF RULE 144 PROMULGATED UNDER THE SECURITIES ACT. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT

BE SOLD OR TRANSFERRED WITHOUT COMPLYING WITH RULE 144 IN THE ABSENCE OF EFFECTIVE REGISTRATION OR OTHER COMPLIANCE UNDER THE SECURITIES

ACT.

THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT

TO CERTAIN RESTRICTIONS ON TRANSFERABILITY AS SET FORTH IN A STOCK OPTION AGREEMENT, A COPY OF WHICH IS ON FILE WITH THE RECORDS OF THE

CORPORATION.

(c) Regardless

of whether the offering and sale of Shares have been registered under the Securities Act or have been registered or qualified under the

securities laws of any state, the Corporation at its discretion may impose restrictions upon the sale, pledge or other transfer of such

Shares (including the placement of appropriate legends on stock certificates or the imposition of stop-transfer instructions) (“Restricted

Stock”) if, in the judgment of the Corporation, such restrictions are necessary or desirable in order to achieve compliance

with the Securities Act, the securities laws of any state or any other law.

12. Shareholder’s

Rights. This Option is non-transferable by the Optionee, except in the event of the Optionee’s death as provided in Section 16

hereof and during the Optionee’s lifetime is exercisable only by the Optionee. The Optionee shall have no rights as a shareholder

with respect to any Shares covered by the Option until exercise of the Option pursuant to this Agreement and delivery to the Optionee

of the Shares as provided herein.

13. Right of First Refusal.

(a) Notwithstanding

anything to the contrary in the Certificate of Incorporation and the By-Laws of the Corporation, the Optionee shall not have a right of

first refusal or preemptive right in relation with any sale of Shares in the Corporation.

(b) Sale

of Shares by the Optionee shall be subject to the right of first refusal of other shareholders as set forth in the Certificate of Incorporation

and/or the By-Laws of the Corporation, to the extent applicable.

(c) The

Corporation may refuse to approve the transfer of Shares to any competitor of the Corporation or to any other person or entity the Corporation

determines, in its discretion, may be detrimental to the Corporation.

14. Termination

of Continuous Service. In the event an Optionee’s Continuous Service terminates (other than upon the Optionee’s death

or Disability or as a result of termination for Cause), and unless otherwise specified in this Agreement, the Optionee may exercise the

Option (to the extent that the Optionee was entitled to exercise the Option as of the date of termination) but only within such period

of time ending on the earlier of (a) the date three (3) months following the termination of the Optionee’s Continuous

Service, or (b) the expiration of the term of the Option as set forth in Section 5 of this Agreement. If, after termination

of Continuous Service, the Optionee does not exercise his Option within the time periods specified in this Section 14, the Option

shall terminate. If such exercise of the Option following termination of Continuous Services as provided in this section would be prohibited

at any time solely because the issuance of Shares would violate the registration requirements under the Securities Act, then the Option

shall terminate on the earlier of (i) the expiration of the term of the Option and (ii) the expiration of three (3) months

after the termination of the Optionee’s Continuous Service during which the exercise of the Option would not be in violation of

such registration requirements.

15. Disability

of Optionee. In the event that the Optionee’s Continuous Service terminates as a result of the Optionee’s Disability,

the Optionee may exercise his Option (to the extent that the Optionee was entitled to exercise such Option as of the date of termination),

but only within such period of time ending on the earlier of (a) the date twelve (12) months following such termination or (b) the

expiration of the term of the Option as set forth in this Agreement. If, after termination, the Optionee does not exercise his Option

within the time specified herein, the Option shall terminate.

16. Death

of Optionee. Unless otherwise provided in this Agreement, in the event (a) the Optionee’s Continuous Service terminates

as a result of the Optionee’s death or (b) the Optionee dies within three (3) months after the termination of the Optionee’s

Continuous Service, then the Option may be exercised (to the extent the Optionee was entitled to exercise such Option as of the date of

death) by the Optionee’s estate, by a person who acquired the right to exercise the Option by bequest or inheritance or by a person

designated to exercise the Option upon the Optionee’s death pursuant to Section 11(a), but only within the period ending on

the earlier of (i) the date twelve (12) months following the date of death or (ii) the expiration of the term of the Option

as set forth in this Agreement. If, after death, the Option is not exercised within the time specified herein, the Option shall terminate.

17. Termination

of Continuous Service for Cause. Notwithstanding anything herein to the contrary, in the event of termination of Optionee’s

employment with the Corporation or any of its Affiliates, or if applicable, the termination of services given to the Corporation or any

of its Affiliates as a consultant, contractor or as a member of the board of the Corporation or any of its Affiliates for Cause, all outstanding

Option awards granted to the Optionee hereunder (whether vested or not) will immediately expire and terminate on the date of such termination

and the Optionee shall not have any right in connection to the outstanding Option, unless otherwise determined by the Corporation.

18. Compliance

with Laws. Notwithstanding the foregoing, in no event shall the Optionee be permitted to exercise an Option in a manner that the Corporation

determines would violate the Sarbanes-Oxley Act of 2002, if applicable, or any other applicable law or the applicable rules and regulations

of the Securities and Exchange Commission or the applicable rules and regulations of any securities exchange, inter-dealer quotation

system or other recognized securities quotation system on which the securities of the Corporation are listed, quoted or traded.

19. Investment

Assurances. The Corporation may require the Optionee, as a condition of exercising or acquiring Shares under this Agreement: (a) to

give assurances satisfactory to the Corporation as to the Optionee’s knowledge and experience in financial and business matters

and/or to employ a purchaser representative reasonably satisfactory to the Corporation who is knowledgeable and experienced in financial

and business matters and that the Optionee is capable of evaluating, alone or together with the Optionee’s representative, the merits

and risks of exercising the Option; and (b) to give assurances satisfactory to the Corporation stating that the Optionee is acquiring

Shares subject to the Option for the Optionee’s own account and not with any present intention of selling or otherwise distributing

the Shares. The foregoing requirements, and any assurances given pursuant to such requirements, shall be inoperative if (i) the issuance

of the Shares upon the exercise of the Option has been registered under a then currently effective registration statement under the Securities

Act or (ii) as to any particular requirement, a determination is made by counsel for the Corporation that such requirement need not

be met in the circumstances under the then applicable securities laws. The Corporation may, upon advice of counsel to the Corporation,

place legends on stock certificates as such counsel deems necessary or appropriate in order to comply with applicable securities laws,

including, but not limited to, legends restricting the transfer of the Shares.

20. Withholding

Obligations. The Corporation or any Affiliate may take such action as it may deem necessary or appropriate, in its discretion, for

the purpose of or in connection with withholding of any taxes that the Corporation or Affiliate is required by any applicable law to withhold

in connection with the Option (collectively, “Withholding Obligations”). Such actions may include, without limitation:

(a) requiring the Optionee to remit to the Corporation in cash an amount sufficient to satisfy such Withholding Obligations; (b) subject

to applicable law, allowing the Optionee to provide shares to the Corporation, in an amount that at such time, reflects a value that the

Corporation determines to be sufficient to satisfy such Withholding Obligations; (c) withholding Shares otherwise issuable upon the

exercise of the Option at a value that is determined by the Corporation to be sufficient to satisfy such Withholding Obligations; or (d) any

combination of the foregoing. The Corporation shall not be obligated to allow the exercise of the Option by or on behalf of the Optionee

until all withholding tax consequences arising from the exercise of the Option are resolved in a manner acceptable to the Corporation.

21. Conditions

on Delivery of Stock. The Corporation will not be obligated to deliver any Shares pursuant to this Agreement or to remove restrictions

from Shares previously issued or delivered under this Agreement until (a) all conditions of this Agreement have been met or removed

to the satisfaction of the Corporation, (b) in the opinion of the Corporation’s counsel, all other legal matters in connection

with the issuance and delivery of the Shares have been satisfied, including any applicable securities laws and regulations and any applicable

rules and regulations of a national exchange or other recognized securities quotation system (such as the Nasdaq Stock Market/OTC

Bulletin Board/OTCQB Market), on which the Shares are listed or admitted to trading and (c) the Optionee has executed and delivered

to the Corporation such representations or agreements as the Corporation may consider appropriate to satisfy the requirements of any applicable

laws, rules or regulations.

22. Tax Consequences.

(a) Any

tax consequences arising from the grant, exercise or settlement of the Option, from the payment for Shares covered thereby or from any

other event or act (of the Corporation and/or its Affiliates, or the Optionee) hereunder shall be borne solely by the Optionee. The Corporation

and/or its Affiliates shall withhold taxes according to the requirements under the applicable laws, rules and regulations, including

withholding taxes at the source. Furthermore, the Optionee shall agree to indemnify the Corporation and/or its Affiliates and hold them

harmless against and from any and all liability for any such tax or interest or penalty thereon, including without limitation, liabilities

relating to the necessity to withhold, or to have withheld, any such tax from any payment made to the Participant. It is the intention

of the Corporation that no payment or entitlement pursuant to this Agreement will give rise to any adverse tax consequences to any person

pursuant to Section 409A of the Code.

(b) The

Corporation shall not be required to release any share certificate or register the Shares in book entry form to the Optionee until all

required payments have been fully made.

23. Rounding

Conventions. The Corporation may, in its sole discretion and taking into account any requirements of the Code, determine the effect

of any adjustments on Shares and may provide that no fractional Shares will be issued (rounding up or down as determined by the Corporation).

24. Amendment

of Award. The Corporation at any time, and from time to time, may amend the term of this Agreement; provided, however, that

the rights under the Agreement shall not be impaired by any such amendment unless (a) the Corporation requests the consent of the

Optionee and (b) the Optionee consents in writing (such consent to not be unreasonably withheld or delayed).

25. Notices.

Any notice to be given to the Corporation shall be addressed to the Corporation in care of its Secretary at its principal office, and

any notice to be given to the Optionee shall be addressed to him or her at the address given beneath his or her signature hereto or at

such other address as the Optionee may hereafter designate in writing to the Corporation. Notice may be given by e-mail.

26. Corporate

Policies. This Option shall be subject to any applicable clawback or recoupment policies, share trading policies, and other policies

that may be implemented by the Board from time to time, in accordance with applicable law.

27. Choice

of Law. This Agreement and all documents evidencing awards and all other related documents will be governed by, and construed in accordance

with, the laws of the State of Delaware; provided that the tax treatment and the tax rules and regulations applying to a grant

in any specific jurisdiction shall be the local tax laws of such jurisdiction in addition to the Federal income tax laws of the U.S.

28. No

Guaranty. It is understood and agreed that nothing contained in this Agreement, nor any action taken by the Board, shall confer upon

the Optionee any right with respect to the continuation of services by the Optionee to the Corporation or any Affiliate, nor interfere

in any way with the right of the Corporation or an Affiliate to terminate the Optionee’s services at any time.

29. Headings.

The headings in this Agreement are for the purpose of reference only and shall not limit or otherwise affect the meaning of any provision

of this Agreement.

30. Severability.

If it is determined that any provision of this Agreement is invalid and unenforceable, the remaining provisions of this Agreement, as

applicable, will continue in effect.

31. Counterparts.

This Agreement may be executed in any number of counterparts, and each such counterpart shall, for all purposes, be deemed to be an original

and all of which together shall constitute one (1) agreement. Facsimile signatures and those transmitted by mail or other electronic

means shall have the same effect as originals.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

| |

DARIOHEALTH CORP. |

|

| |

|

|

| |

|

|

| |

By: |

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

|

|

| |

|

|

| |

OPTIONEE |

|

| |

|

|

| |

|

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Address: |

|

|

| |

|

|

| |

|

|

EXHIBIT A

Stock Option Schedule

In accordance with the Agreement, of which this

Schedule is a part (which together, constitute the “Option Agreement”), the Corporation hereby grants to <<Name>>

(the “Optionee”) the following Option to purchase Shares of stock.

| Grant Date: |

<<GrantDate>> |

| Shares Granted: |

<<Shares>> |

| Exercise Price: |

<<ExercisePrice>> |

Vesting Schedule:

| Vesting Date | |

Percentage of Total Option |

| | |

Shares Subject to Exercise |

| | |

| |

|

| | |

Incremental | |

Cumulative |

| | |

Amount | |

Amount |

| <<Vest1>>1 | |

<<Vest1_I>> | |

<<Vest1_C>> |

| <<Vest2>> | |

<<Vest2_I>> | |

<<Vest2_C>> |

| <<Vest3>> | |

<<Vest3_I>> | |

<<Vest3_C>> |

| <<Vest4>> | |

<<Vest4_I>> | |

<<Vest4_C>> |

| <<Vest5>> | |

<<Vest5_I>> | |

<<Vest5_C>> |

1[This would be a phrase like “On or after February

20, 2023”]

EXHIBIT B

Exercise Form

| To: DarioHealth Corp. |

Dated: ________________________ |

The undersigned, pursuant to the provisions set

forth in the Agreement, dated as of the Grant Date identified therein, a copy of which is attached hereto, hereby irrevocably elects

to purchase _______ Shares of common stock covered by the Option. The undersigned [check as applicable]:

¨

herewith makes payment of [$________] representing the full Exercise Price for such Shares at the price per Share provided for in

such Agreement. Such payment takes the form of lawful money of the United States or delivery of Shares of the Corporation’s

common stock in accordance with the terms of the Agreement.

OR

¨

elects that the Corporation withhold Shares as provided in Section 6 of such Agreement [NTD: To be modified at the time of

exercise consistent with Section 6] .

| |

|

| |

Signature |

| |

|

| |

|

| |

Print Name |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Address |

Exhibit 107

Calculation of Filing

Fee Tables

Form S-8

(Form Type)

DarioHealth Corp.

(Exact Name of Registrant

as Specified in its Charter)

Newly Registered Securities

| |

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation |

|

Amount

Registered

(1)(2) |

|

|

Proposed

Maximum

Offering

Price

Per

Share (3) |

|

|

Proposed

Maximum

Aggregate

Offering

Price |

|

|

Fee Rate |

|

|

Amount of

Registration

`Fee |

|

| Newly Registered Securities |

| Fees to Be Paid |

|

Equity |

|

Common Stock, $0.0001 par value per share (3) |

|

Rule 457(h) |

|

|

2,963,459 |

|

|

$ |

2.07 |

|

|

$ |

6,134,360.13 |

|

|

$ |

0.00014760 |

|

|

$ |

905.44 |

|

| |

|

Total Offering Amounts |

|

|

|

|

|

|

|

|

|

$ |

6,134,360.13 |

|

|

|

|

|

|

$ |

905.44 |

|

| |

|

Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

--- |

|

| |

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

--- |

|

| |

|

Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

905.44 |

|

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of additional securities which may be offered and issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| (2) |

Represents shares issuable pursuant to individual stock option agreements, which options will be granted as a material inducement of employment to former employees of Twill in connection with the registrant’s acquisition of Twill. |

| |

|

| (3) |

The fee is based on the number of shares of common stock which may be issued under the plan this registration statement relates to and is estimated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the registration fee based upon the average of the high and low sales price of DarioHealth Corp.’s common stock as reported on the Nasdaq Capital Market on February 14, 2024. |

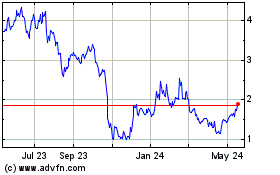

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

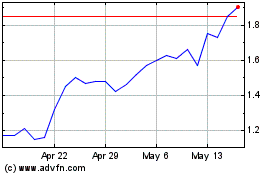

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Jan 2024 to Jan 2025