UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

December 21, 2023

Commission File Number: 001-33900

DESWELL INDUSTRIES, INC.

(Translation of registrant’s name into English)

10B, Edificio Associacao Industrial De Macau

No. 32-36 Rua do Comandante Mata e Oliveira

Macao, Special Administrative Region, PRC

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F. ☒ Form

40-F ☐

10B, Edificio Associacao Industrial De Macau

No. 32-36 Rua do Comandante Mata e Oliveira

Macao, SAR, PRC

To the shareholders

of Deswell Industries, Inc.:

The annual meeting of the

shareholders of Deswell Industries, Inc. (“Deswell” or the “Company”) will be held at RM 516-517 Hong Leong Industrial

Complex, 4 Wang Kwong Road, Kowloon Bay, Kowloon, HONG KONG, on Tuesday, February 6, 2024 at 10:00 a.m. local time for the following purposes:

| 1. | To elect five members of the Board of Directors to service for the ensuing year; |

| 2. | To ratify the selection of BDO China Shu Lun Pan Certified Public Accountants LLP as the independent registered

public accountants of the Company for the year ending March 31, 2024; and |

| 3. | To consider and act upon such other business as may properly come before the annual meeting or any adjournments

thereof. |

Only holders of no par value

shares (the “common shares”), of record at the close of business on December 13, 2023 (the “Record Date”) will

be entitled to vote at the annual meeting. Regardless of your plans to attend or not attend the annual meeting, please complete the enclosed

proxy card and sign, date and return it promptly in the enclosed postage paid envelope. Sending in your proxy will not prevent you from

voting in person at the annual meeting.

| |

By order of the Board of Directors |

| |

|

| |

Yiu Sing Poon |

| |

Secretary |

| |

|

Dated: December 21, 2023

Macao, SAR, PRC

This page intentionally left blank.

10B, Edificio Associacao Industrial De Macau

No. 32-36 Rua do Comandante Mata e Oliveira

Macao, SAR, PRC

Annual meeting at 10:00 a.m. local time on Tuesday,

February 6, 2024

Your proxy is solicited on

behalf of the Board of Directors of Deswell Industries, Inc. (“Deswell” or the “Company”) for use at the Annual

Meeting of Shareholders to be held at RM 516-517 Hong Leong Industrial Complex, 4 Wang Kwong Road, Kowloon Bay, Kowloon, HONG KONG, on

Tuesday, February 6, 2024, at 10:00 a.m. local time. If a proxy in the accompanying form is duly executed and returned, the shares represented

by the proxy will be voted as directed. If executed and returned but no direction is given, the shares will be voted FOR the election

of each of the five (5) nominees for directors named in this proxy statement and FOR the approval of BDO China Shu Lun Pan Certified Public

Accountants LLP as the Company’s independent registered public accountants for the year ending March 31, 2024. A proxy given by

a shareholder may be revoked at any time before it is exercised by notifying the Secretary of the Company in writing of such revocation,

by giving another proxy bearing a later date or by voting in person at the annual meeting.

The cost of this solicitation

of proxies will be borne by the Company. The Company will reimburse banks, brokerage firms, other custodians, nominees and fiduciaries

for reasonable expenses incurred in sending proxy materials to beneficial owners of common shares of the Company.

This proxy statement is being

mailed on or about December 22, 2023 to all holders of common shares of record at the close of business on December 13, 2023.

The Company’s Annual Report

on Form 20-F for the year ended March 31, 2023, including its complete audited financial statements, as filed with the United States Securities

and Exchange Commission (the “SEC”) is available without charge from the Company by written request addressed to the attention

of Mr. Herman Wong as follows:

|

Email: |

Fax: |

Mail: |

| admin@jetcrown.com.mo |

853-2832-3265 |

Deswell Industries, Inc.

10B, Edificio Associacao Industrial De Macau

No. 32-36 Rua do Comandante Mata e Oliveira

Macao, SAR, PRC |

The Company’s Annual Report

on Form 20-F for its fiscal year ended March 31, 2023 has been posted on, and is available from, Deswell’s website at https://www.deswell.com/sec-filings

by selecting “Form 20-F.” The Company’s Annual Report on Form 20-F and other documents filed or submitted to the SEC are also

available from the SEC’s website at https://www.sec.gov.

In addition, proxy materials for Deswell’s

2023 Annual Meeting may be accessed and downloaded from the website maintained by Computershare at https://www.edocumentview.com/DSWL.

Further inquiries may be obtained by contacting via mail, telephone or email either the Company’s:

Investor Relations Representative:

IMS Investor Relations

51 Locust Avenue, Ste. 300

New Canaan, CT 06840

Phone 203.972.9200

E-mail: jnesbett@imsinvestorrelations.com

or

Transfer Agent and Registrar:

Courier Services:

Computershare

150 Royal Street

Canton, MA 02021

First Class:

Computershare

P.O. BOX 43101

Providence, RI 02904

Registered/Certified Mail:

Computershare

150 Royal Street

Canton, MA 02021

| Shareholder Services Number: |

1-800-962-4284 |

| Shareholder Website: |

www.computershare.com/investor |

| Shareholder Online Inquiries: |

https://www-us.computershare.com/Investor/Contact |

QUESTIONS AND ANSWERS RELATING TO THE 2023

ANNUAL MEETING

Why did I receive these materials?

Our shareholders as of the

close of business on December 13, 2023, which we refer to as the “Record Date,” are entitled to vote at our annual meeting

of shareholders, which will be held this year on February 6, 2024. As a shareholder, you are invited to attend the annual meeting and

are requested to vote on the items of business (the “Proposals”) described in this proxy statement. We are required to distribute

these proxy materials to all shareholders as of the Record Date. This proxy statement provides notice of the annual meeting of shareholders

and includes information about the Proposals. The accompanying proxy card enables shareholders to vote on the matters without having to

attend the annual meeting in person.

What is a proxy?

A proxy is your legal designation

of another person (the “proxy”) to vote on your behalf. By completing and returning the enclosed proxy card, you are giving

the Company’s Chairman of the Board and/or Chief Executive Officer and/or Chief Financial Officer the authority to vote your shares

in the manner you indicate on your proxy card.

Why did I receive more than one set of voting materials?

You may receive more

than one set of voting materials, including multiple copies of this proxy statement, multiple proxy cards or multiple voting

instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting

instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are

registered in more than one name, you will receive more than one proxy card. If you hold some of your shares in a brokerage account

and other shares in your own name, you will receive a voting instruction card from your broker for the shares the broker holds for

you and a proxy card for the shares you hold in your own name. You will receive multiple proxy cards if you hold your shares in

different ways (e.g., joint tenancy, trusts, and custodial accounts) or in multiple accounts.

If your shares are held by

a broker, bank, trustee or other nominee (i.e., in “street name”), you will receive your proxy card or other voting information

from your broker, bank, trustee or other nominee, and you should return your proxy card or cards to your broker, bank, trustee or other

nominee.

Please complete, sign, date and return each

proxy card and/or voting instruction card that you receive.

What is the difference between a “shareholder of record”

and a “street name” holder?

These terms describe how your

shares are held. If your shares are registered directly in your name with Computershare Investor Services (“Computershare”),

the Company’s transfer agent, you are a “shareholder of record.” If your shares are held in the name of a brokerage,

bank, trust or other nominee as a custodian, you are a “street name” holder.

How many shares must be present or represented to conduct business

at the annual meeting?

The presence at the annual

meeting, in person or by proxy, of the holders of not less than thirty-three and one-third percent (33⅓%) of the aggregate number

of the Company’s common shares outstanding on the Record Date will constitute a quorum, permitting the conduct of business at the

annual meeting. Based on 15,935,239 shares, which is the number of our common shares outstanding on December 13, 2023, the presence of

holders representing at least 5,311,747 of our common shares will be required to establish a quorum for the annual meeting.

Proxies received but marked

as abstentions, votes withheld and broker non-votes will be included in the calculation of the number of votes considered present at the

annual meeting for purposes of establishing the presence of a quorum.

Who is entitled to vote at the annual meeting?

Only shareholders of record

at the close of business on the Record Date are entitled to receive notice of, and to participate in, the annual meeting. If you were

a shareholder of record on the Record Date, you will be entitled to vote all of the shares that you held on that date at the annual meeting,

or any postponements or adjournments of the annual meeting.

If you are not a shareholder

of record because the shares you own are held in “street name” by a bank or brokerage firm, your bank or brokerage firm is

required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your

bank or brokerage firm provides you.

Who can attend the annual meeting?

All shareholders as of the

close of business on December 13, 2023 may attend the annual meeting. However, seating is limited and will be on a first arrival basis.

To attend the annual meeting,

please follow these instructions:

| · | If you are a shareholder of record, bring proof of ownership of Deswell shares and a form of identification;

or |

| · | If a broker or other nominee holds your shares, bring proof of ownership of Deswell shares through such

broker or nominee and a form of identification. |

Under our Articles of Association,

the Chairman of the Board of Directors serves as Chairman of our meetings of shareholders unless he is not present at the meeting, in

which case our Chief Executive Officer serves as Chairman of the shareholders meeting. The “Articles of Association” of a

business company like Deswell organized under the laws of the British Virgin Islands are comparable to a U.S. company’s bylaws.

As Mr. Chin Pang Li, our Chairman, is not expected to be in attendance at our 2023 Annual Meeting, Mr. Edward So Kin Chung, Deswell’s

Chief Executive Officer, will serve as Chairman at our 2023 Annual Meeting.

How can I vote my shares in person at the annual meeting?

Shares held in your name as

the shareholder of record may be voted by you in person at the annual meeting. Shares held by you beneficially in “street name”

through a broker, bank or other nominee may be voted by you in person at the annual meeting only if you obtain a legal proxy from the

broker, bank or other nominee that holds your shares giving you the right to vote the shares.

How can I vote my shares without attending the annual meeting?

Whether you hold shares directly

as the shareholder of record or beneficially in “street name,” you may direct how your shares are voted without attending

the annual meeting. If you are a shareholder of record (that is, if your shares are registered directly in your name with our transfer

agent), you must complete and properly sign and date the accompanying proxy card and return it and it will be voted as you direct. A pre-addressed

envelope is included for your use and is postage paid if mailed in the United States. If you are a shareholder of record and attend the

annual meeting, you may deliver your completed proxy card in person. If you hold shares beneficially in “street name,” you

may vote by submitting voting instructions to your broker, bank or other nominee.

Can I vote by telephone or electronically?

If you are a shareholder of

record, you may vote by telephone, or electronically through the Internet, by following the instructions included in your proxy card.

If your shares are held in “street name,” please check your proxy card or voting instructions received from your broker, bank

or other nominee or contact your broker, bank or other nominee to determine whether you will be able to vote by telephone or electronically

and the deadline for such voting.

Can I change my vote after I return my proxy card?

Yes. If you

are a shareholder of record, you may revoke or change your vote at any time before the proxy is exercised by delivering to our Secretary

at the address shown at the beginning of this proxy statement a notice of revocation, or by signing a proxy card bearing a later date

or by attending the annual meeting and voting in person.

For shares you hold beneficially

in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other nominee or,

if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares, by attending the

annual meeting and voting in person. In either case, the powers of the proxy holders will be suspended if you attend the annual meeting

in person and so request, although attendance at the annual meeting will not by itself revoke a previously granted proxy.

How many votes do I have?

You will be entitled to one

vote for each common share of Deswell that you own as of the Record Date. As of the Record Date, we had 15,935,239 shares outstanding

and eligible to vote.

Who counts the votes?

Votes will be counted and

certified by Herman Wong, our Chief Financial Officer. If you are a shareholder of record, your signed proxy card is returned directly

to Computershare for tabulation. If you hold your shares in “street name” through a broker, bank or other nominee, your broker,

bank or other nominee will return one proxy card to Computershare on behalf of its clients. Computershare will then report its tabulations

of votes to our Inspector of Election, who will add them to the results of voting by shareholders attending the annual meeting in person.

What are the Board of Director’s recommendations on the Proposals

to be considered at the annual meeting?

The Board of Directors’

recommendations are set forth together with the description of each item in this proxy statement. In summary, the Board of Directors recommends

FOR the election of directors named in this proxy statement and FOR the ratification of the selection of BDO China Shu Lun Pan Certified

Public Accountants LLP as Deswell’s independent registered public accountants for the year ending March 31, 2024.

Will shareholders be asked to vote on any other matters?

To the knowledge of the Company

and its management, shareholders will vote only on the matters described in this proxy statement. However, if any other matters properly

come before the annual meeting, the persons named as proxies for shareholders will vote on those matters in the manner they consider appropriate.

What vote is required to approve each Proposal?

If a quorum is present at

the annual meeting:

| · | Election of Directors (Proposal 1). |

The affirmative vote of a

majority of the votes cast in person or represented by proxy at the annual meeting is required for the election of each of the directors

(Proposal 1). A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be

voted with respect to the director or directors indicated, although the votes represented by the proxy will be considered present at the

annual meeting for purposes of determining whether there is a quorum.

| · | Ratification of selection of BDO China Shu Lun Pan Certified Public Accountants LLP as Deswell’s

independent registered public accountants for the fiscal year ending March 31, 2024 (Proposal 2). |

The affirmative vote of a

majority of the votes cast in person or represented by proxy on Proposal 2 is required for approval. Abstentions on this Proposal will

not be treated as votes cast, but the votes represented by the proxy will be considered present at the annual meeting for purposes of

determining whether there is a quorum.

How are votes counted?

In the election of directors

(Proposal 1), you may vote “FOR” all or some of the nominees or your vote may be marked “WITHHOLD” with respect

to one or more of the nominees. You may not cumulate your votes for the election of directors.

For Proposal 2, you may vote

“FOR,” “AGAINST” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention will not be treated

as a vote cast, but the votes represented by the proxy will be considered present for purposes of determining whether there is a quorum.

If you hold your shares in

“street name” through a broker, bank or other nominee rather than directly in your own name, then your broker, bank or other

nominee is considered the shareholder of record, and you are considered the beneficial owner of your shares. We have supplied copies of

our proxy statement to the broker, bank or other nominee holding your shares of record, and they have the responsibility to send it to

you. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares at the annual

meeting. The broker, bank or other nominee that is the shareholder of record for your shares is obligated to provide you with a voting

instruction card for you to use for this purpose. If you hold your shares in a brokerage account but you fail to return your voting instruction

card to your broker, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker

is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Broker non-votes

are counted in determining whether a quorum is present. However, in tabulating the voting results for any particular proposal, shares

that constitute broker non-votes are not considered present and entitled to vote on that proposal.

If a quorum is present at

the annual meeting, the election of each of the directors requires the affirmative vote of a majority of the votes cast in person or represented

by proxy at the annual meeting (Proposal 1).

Similarly, if a quorum is

present at the annual meeting, the ratification of the appointment of our independent auditors (Proposal 2) requires the affirmative vote

of a majority of the votes cast in person or represented by proxy at the annual meeting.

Because of certain rules of

the New York Stock Exchange, and their interpretation, which govern when brokers may or may not vote their brokerage clients’ voting

securities in the absence of instructions from the beneficial owners, brokers may not vote on Proposal 1 without receiving instructions

from the beneficial owners. If brokers neither receive instructions from the beneficial owners nor vote on any of the Proposals, but nevertheless

return signed proxies without voting, a broker non-vote on Proposal 1 would occur. That broker non-vote would count for purposes of determining

the presence of a quorum at the annual meeting, but would not be voted on Proposal 1.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company’s directors

are elected annually to serve until the next annual general meeting of shareholders and until their successors are qualified and elected

or until their death, resignation or removal. The number of directors presently authorized by the Company’s Articles of Association

is not less than one or more than 12. The current number has been fixed by our directors at five.

Unless otherwise directed

by shareholders, the proxy holders will vote all shares represented by proxies held by them for the election of the nominees named below.

The Company is advised that all nominees have indicated their availability and willingness to serve if elected. In the event that any

nominee becomes unavailable or unable to serve as a director of the Company prior to the voting, the proxy holder will vote for a substitute

nominee in the exercise of his best judgment.

Information Concerning Nominees

Information concerning the

nominees based on data provided by them is set forth below.

Chin

Pang Li. Mr. Li, 78, has been appointed as the Chairman of the Board of Directors since the passing of our former chairman Mr.

Richard Pui Hon Lau. Mr. Li now serves as Chairman of the meetings of the shareholders. Mr. Li has served the Company as a member of the

Board of Directors and in various executive capacities with the Company and its predecessors since their inception in 1987. He became

Chief Financial Officer in May 1995, a position which he held until March 31, 2006. As Executive Director of Manufacturing and Administration

for Plastic Operations, Mr. Li is in charge of the manufacturing and administrative operations for the Company’s plastic products.

Mr. Li received his Bachelor of Science degree from Chun Yan Institute College, Taiwan in 1967.

VIVIAN WAI-MING LAU. Ms. Lau,

44, is the daughter of the late chairman, Mr. Lau, and Ms. Lau is nominated to replace Mr. Ben Yiu-Sing Poon, the current interim director

who has served as an interim director since the passing of former chairman Mr. Lau on June 12, 2023. Prior to joining the Company, Ms.

Lau was an Executive Director at PAG Consulting where she headed the global human capital operations. Prior to PAG Consulting, Ms. Lau

had worked at Goldman Sachs for over 13 years, including serving as an Executive Director in Goldman Sachs’ Finance Division. Prior

to Goldman Sachs, Ms. Lau worked at Deloitte Touche Tohmatsu in its Assurance and Tax Advisory services for seven years, including as

a Manager. Ms. Lau was accredited by The American Institute of Certified Public Accountants in 2003 and Ms. Lau received her bachelor’s

degree in accountancy from The George Washington University in 2001.

Hung-Hum

Leung. Mr. Leung, 77, has been a non-executive director of the Company and member of the Audit Committee since December 1999. Mr.

Leung has over 25 years of experience in the manufacture of electronic products. Mr. Leung was the founder of Sharp Brave Holdings Ltd.

(since 2007 known as China Properties Investment Holdings Limited), a Hong Kong public company listed on the Hong Kong Stock Exchange,

and from 1991 to 1995 served as the Chairman of Sharp Brave Holdings Ltd. Since 1995, Mr. Leung has been an independent consultant to

the electronics industry. He received his Bachelor of Science degree in Physics from the National Taiwan University in 1971.

Allen

Yau-Nam Cham. Mr. Cham, 76, has been a non-executive director of the Company and member of the Audit Committee since August 2003.

He has over 20 years of experience in the securities industry. He obtained his Bachelor of Science degree from St. Mary’s University,

Halifax, Canada, Bachelor of Engineering (Electrical) degree from Nova Scotia Technical College, Halifax, Canada and Master of Business

Administration degree from the University of British Columbia, Canada.

Wing-Ki

Hui. Mr. Hui, 79, has been a non-executive director of the Company and member of the Audit Committee since October 2004. Since

1995 he has been the Operation Director of the Electronic Products Division of Tomorrow International Holdings Limited, a company listed

on the Hong Kong Stock Exchange engaged in manufacturing of consumer electronics and printed circuit boards. Prior to serving in this

capacity, Mr. Hui was Executive Director of Sharp Brave International Holdings Limited from 1991 to 1995 and Director of Sharp Brave Electronics

Co., Ltd. from 1984 to 1995. Mr. Hui possesses over 20 years of experience in the electronic manufacturing industry, and is a graduate

of South East Electronic College in Hong Kong.

Ms. Lau is the daughter

of the late chairman Mr. Lau and Mr. Yiu-Sing Poon (who is the interim director) is the nephew of Mr. Lau. Other than the family

relationships between Ms. Lau and Mr. Yiu-Sing Poon described immediately above, no family relationship exists among any of the

named directors and nominees or the Company’s executive officers or key employees and no arrangement or understanding exists

between any director or executive officer and any other persons pursuant to which any director or executive officer was elected as a

director or appointed as an executive officer of the Company. The executive officers serve at the pleasure of the Board of Directors

of the Company.

Compensation of Directors and Executive Officers

The amount of compensation

(cash benefits) paid by the Company and its subsidiaries to all directors and to executive officers as a group for services in all service

capacities was approximately $1,627,000 during the year ended March 31, 2023. These amounts exclude amounts paid by the Company or its

subsidiaries as dividends to directors and executive officers in their capacity as shareholders of the Company for the year ended March

31, 2023. No options under the Company’s 2003 Stock Option Plan (or otherwise) were granted to directors and officers for the year

ended March 31, 2023.

Compensation Policy for Outside Directors

Our policy is to pay directors

who are not employees of the Company or any of its subsidiaries $2,000 per month for services as a director, and to reimburse directors

for all reasonable expenses incurred in connection with their services as a director and member of Board committees.

Independence of Directors

The Board has determined that

Messrs. Hung-Hum Leung, Allen Yau-Nam Cham and Wing-Ki Hui are each “independent” within the meaning of Rule 5605(a)(2) of

the NASDAQ Stock Market Rules.

Audit Committee

The Audit Committee meets

from time to time to review the financial statements and matters relating to the audit and has full access to management and the Company’s

auditors in this regard. The Audit Committee recommends the engagement or discharge of the Company’s independent accountants, consults

on the adequacy of the Company’s internal controls and accounting procedures and reviews and approves financial statements and reports.

Deswell’s audit committee consists of Messrs. Hung-Hum Leung, Allen Yau-Nam Cham and Wing-Ki Hui, each of whom is an independent

director within the meaning of that term under the NASDAQ Stock Market Rules. Mr. Allen Yau-Nam Cham currently acts as the Chairman of

the Audit Committee.

Deswell’s Board of Directors

has determined that at least one person serving on the Audit Committee is an “audit committee financial expert” as defined

under Item 16A(b) of Form 20-F promulgated by the SEC, which person is Mr. Allen Yau-Nam Cham.

Other Committees; NASDAQ Compliance

Various corporate governance

practices required of public companies with securities listed on The NASDAQ Stock Market are not required of “controlled companies”

such as Deswell. Of the corporate governance practices required under NASDAQ’s MarketPlace Rules, Deswell does not have a compensation

committee or a nominating committee consisting of independent directors; does not have a formal written charter addressing the nominations

process; does not have nominees to its board selected or recommended by a majority of its independent directors; and does not have the

compensation of its Chief Executive Officer and other executive officers determined or recommended to the board by a majority of its independent

directors. For a further discussion of how our SEC reporting and corporate governance practices differ from those applicable to US domestic

issuers and US NASDAQ-listed companies, see “Our exemptions from certain of the reporting requirements under the Exchange Act limits

the protections and information afforded to investors” beginning on page 18 in the Risk Factors section of Item 3 of our Annual

Report on Form 20-F for the year ended March 31, 2022 and under the heading “Other Committees; NASDAQ Compliance” of Item

6 beginning on page 48 of that Report.

Board Diversity Matrix

Board Diversity Matrix (As of December 21, 2023)

| Country of Principal executive Offices |

PRC |

| Foreign Private Issuer |

Yes |

| Disclosure Prohibited Under Home Country Law |

No |

| Total Number of Directors |

5 |

| Part I: Gender Identity |

Female |

Male |

|

Non-Binary |

Did Not

Disclose Gender |

| Directors |

0 |

5 |

|

0 |

0 |

| Part II: Demographic Background |

|

|

|

|

|

| Underrepresented Individual in Home Country Jurisdiction |

|

|

0 |

|

|

| LGBTQ+ |

|

|

0 |

|

|

| Did Not Disclose Demographic Background |

|

|

0 |

|

|

Under Rule 5605(f)(2) and Rule 5605(f)(6) of the

Nasdaq Listing Rules, we are required to have, or disclose why we do not have, at least one “diverse”

(as such term is defined in Rule 5605(f)(2)(B)(i) of the Nasdaq Listing Rules) director by December 31, 2023. As of March 31, 2023, we

did not have at least one diverse director because we have not yet identified a suitable candidate. The Company will continue its search

for a suitable candidate in order to increase the diversity of our board of directors.

Certain Related Party Transactions

Deswell had no transactions

of the kind specified in Item 7.B. of Form 20-F from April 1, 2016 through the Record Date.

Control of the Company

The Company is not directly

owned or controlled by another corporation or by any foreign government. Except as set forth in footnote one below, the following table

sets forth, as of June 30, 2023, the beneficial ownership of the Company's common shares by each person known by the Company to beneficially

own 5% or more of the common shares of the Company and by each member of the Board of Directors and of Senior Management of the Company

who beneficially own in excess of one percent of the Company’s common shares.

|

|

|

Shares

beneficially

Owned

(1) |

| Name of beneficial owner or identity of group |

Amount |

Percent |

| The Family of Richard Pui Hon Lau |

|

9,838,426 |

(2) |

61.7 |

| Chin Pang Li |

|

1,625,750 |

(3) |

10.1 |

| Herman Wong Chi Wah |

|

30,000 |

(4) |

* |

| Edward So Kin Chung |

|

50,000 |

(5) |

* |

| Hung-Hum Leung |

|

- |

|

- |

| Allen Yau-Nam Cham |

|

- |

|

- |

| Wing-Ki Hui |

|

- |

|

- |

| * Less than 1% |

|

|

|

|

| |

|

|

|

|

| (1) | Based on 15,935,239 shares outstanding on June 30, 2023. However, in accordance with Rule 13d-3(d)(1)

under the Securities Exchange Act of 1934, shares not outstanding but which are the subject of currently exercisable options have been

considered outstanding for the purpose of computing the percentage of outstanding shares owned by the listed person holding such options,

but are not considered outstanding for the purpose of computing the percentage of shares owned by any of the other listed persons. |

| (2) | Consists of 9,838,426 shares held of record by the family of Richard Pui Hon Lau. |

| (3) | Consists of 1,425,750 shares held of record by Mr. Li and options to purchase 200,000 shares granted to

Mr. Li under the Company’s stock option plans. Mr. Li’s options are exercisable at an exercise price of $2.09 per share, with

a term expiring on July 29, 2024. |

| (4) | Consists of 30,000 shares held of record by Mr. Wong. |

| (5) | Consists of 50,000 shares held of record by Mr. So. |

PROPOSAL 2

RATIFY SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTANTS

The Board of Directors has

selected BDO China Shu Lun Pan Certified Public Accountants LLP, which is sometimes referred to in this proxy statement as “BDO

China,” as independent registered public accountants of the Company for the year ending March 31, 2024 and further directed that

the Company submit the selection of its independent registered public accountants for ratification by shareholders at the Company’s

annual meeting.

BDO China acted as Deswell’s

principal accountants for the audit of its financial statements at, and for the years ended, March 31, 2021, 2022 and 2023.

The following table presents

the aggregate fees for professional services and other services rendered to Deswell by BDO China for the years ended March 31, 2022 and

March 31, 2023.

| |

Year ended March 31, |

| |

2022 |

|

2023 |

| |

(In thousands) |

| Audit fees(1) |

$ |

217 |

|

$ |

206 |

|

| Audit-related fees(2) |

|

- |

|

|

- |

|

| Tax fees(3) |

|

- |

|

|

- |

|

| All other fees(4) |

|

- |

|

|

- |

|

| |

$ |

217 |

|

$ |

206 |

|

| (1) | Audit Fees consist of fees billed for the annual audit of our consolidated financial statements. They

also include fees billed for other audit services, which are those services that only the external auditor reasonably can provide, and

include the provision for consents relating to the review of documents filed with the SEC. |

| (2) | There were no other audit-related fees billed by the principal accountant during the last two fiscal years

for assurance and related services that were reasonably related to the performance of the audit not reported under “Audit Fees”

above. |

| (3) | There were no tax fees billed by the principal accountants during the last two fiscal years for advice

services. |

| (4) | There were no other fees billed by the principal accountants during the last two fiscal years for products

and services provided. |

The Board of Directors recommends

that the shareholders ratify the selection of BDO China as independent registered public accountants of the Company for the fiscal year

ending March 31, 2024. The affirmative vote of a majority of the shares of the Company present at the annual meeting in person or by proxy

is required to ratify the selection of BDO China as independent registered public accountants of the Company for the year ending March

31, 2024.

If the appointment of BDO

China is not ratified, the Board of Directors will evaluate the basis for the shareholders’ vote when determining whether to continue

the firm’s engagement, but may ultimately determine to continue the engagement or engage another audit firm without re-submitting

the matter to shareholders. Even if the appointment is ratified, the Board of Directors, in its discretion, may act to engage a different

independent auditing firm at any time during the year if the Board of Directors determines that such a change would be in the Company’s

and its shareholders’ best interests.

Audit Committee Pre-approval Policies and Procedures

The Audit Committee’s

policy is to pre-approve all audit and permissible non-audit related services provided by the independent auditors. These services may

include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year

and any pre-approval is detailed as to the particular service or category of services. Management will periodically report to the Audit

Committee regarding the extent of services provided and the fees for the services performed by the independent auditors in accordance

with this pre-approval policy. The Audit Committee may also pre-approve particular services on a case-by-case basis.

OTHER BUSINESS

The Board of Directors knows

of no other business to be acted upon at the annual meeting. However, if any other matter shall properly come before the annual meeting,

the proxy holder named in the proxy accompanying this statement will have discretionary authority to vote all proxies in accordance with

his best judgment.

| |

By order of the Board of Directors |

| |

|

| |

|

| |

Yiu Sing Poon |

| |

Secretary |

| |

|

Dated December 21, 2023

Macao, SAR, PRC

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

For and on behalf of

Deswell Industries, Inc.

by |

| |

|

| |

|

| |

Edward So Kin Chung, |

| |

Chief Executive Officer |

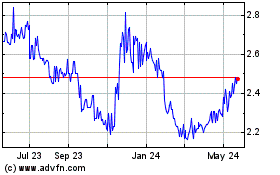

Deswell Industries (NASDAQ:DSWL)

Historical Stock Chart

From Oct 2024 to Nov 2024

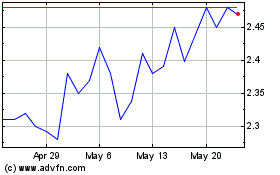

Deswell Industries (NASDAQ:DSWL)

Historical Stock Chart

From Nov 2023 to Nov 2024