0001020710false00010207102025-03-072025-03-07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): March 6, 2025

Commission file number 0-21513

DXP Enterprises, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Texas | 76-0509661 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

5301 Hollister, Houston, Texas 77040 (713) 996-4700 | | | | | |

| (Address of principal executive offices) | (Registrant’s telephone number, including area code) |

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on which Registered |

| Common Stock par value $0.01 | DXPE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ⃞

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The following information is furnished pursuant to Regulation FD.

On March 6, 2025, DXP Enterprises, Inc., issued a press release announcing financial results for the fourth quarter ended December 31, 2024. A copy of the release is furnished herewith as Exhibit 99.1, and incorporated herein by reference. Such exhibit (i) is furnished pursuant to Item 2.02 of Form 8-K, (ii) is not to be considered "filed" under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and (iii) shall not be incorporated by reference into any previous or future filings made by or to be made by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

99.1 Press Release dated March 6, 2025 announcing the earnings results for the fourth quarter ended December 31, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DXP ENTERPRISES, INC. | |

| (Registrant) | |

| | |

| By: | /s/ Kent Yee | |

| Kent Yee | |

| Senior Vice President/Finance and Chief Financial Officer |

| | |

| By: | /s/ David Molero Santos | |

| David Molero Santos | |

| Vice President/Finance and Chief Accounting Officer |

| | |

| Dated: | March 7, 2025 | |

| | |

INDEX TO EXHIBITS

Introductory Note: The following exhibit is furnished pursuant to Item 2.02 of Form 8-K and is not to be considered “filed” under the Exchange Act and shall not be incorporated by reference into any of the Company’s previous or future filings under the Securities Act or the Exchange Act. | | | | | |

| Exhibit No. | Description |

| 99.1 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

DXP ENTERPRISES REPORTS FOURTH QUARTER AND FISCAL 2024 RESULTS

•Fiscal 2024 sales of $1.8 billion, up 7.4 percent from fiscal 2023

•Full year GAAP diluted EPS of $4.22

•$191.3 million in adjusted earnings before interest, taxes, depreciation, amortization and other non-cash charges ("Adjusted EBITDA")

•Net income of $70.5 million versus $68.8 million in fiscal 2023

•Refinanced our Senior Secured Term Loan B raising $649.5 million and reduced borrowing costs by 100 basis points

•Repurchased 0.6 million shares for $28.8 million in fiscal 2024

•$148.4 million in cash and restricted cash

•Remediated all previously existing material weaknesses

•Completed seven acquisitions during the fiscal year

Houston, TX – March 6, 2025 – DXP Enterprises, Inc. (NASDAQ: DXPE) today announced financial results for the fourth quarter and fiscal year ended December 31, 2024. The following are results for the three and twelve months ended December 31, 2024, compared to the three and twelve months ended December 31, 2023. A reconciliation of the non-GAAP financial measures can be found in the back of this press release.

Fourth Quarter 2024 financial highlights:

•Sales were $470.9 million for the fourth quarter of 2024, compared to $407.0 million for the fourth quarter of 2023.

•Diluted earnings per share for the fourth quarter of 2024 was $1.29 based upon 16.5 million diluted shares, compared to $0.94 per share in the fourth quarter of 2023 based on 17.0 million diluted shares. Adjusted diluted earnings per shares was $1.38 per share compared to $1.12 per share for the fourth quarter of 2023.

•Adjusted earnings before interest, taxes, depreciation and amortization and other non-cash charges ("Adjusted EBITDA") for the fourth quarter of 2024 was $50.3 million compared to $41.9 million for the fourth quarter of 2023. Adjusted EBITDA as a percentage of sales was 10.7 percent and 10.3 percent, respectively.

•Free cash flow (cash flow from operating activities less capital expenditures) for the fourth quarter was $22.7 million or 46.4 percent of EBITDA.

Fiscal Year 2024 financial highlights:

•Sales increased 7.4 percent to $1.8 billion, compared to $1.7 billion for fiscal 2023.

• Diluted earnings per share for 2024 was $4.22 based upon 16.7 million diluted shares, compared to $3.89 per share in 2023, based on 17.7 million basic shares. Adjusted diluted earnings per share was $4.51 per share compared to $4.09 per share in 2023.

• Net income for the year increased $1.7 million to $70.5 million, compared to $68.8 million for fiscal 2023.

• Adjusted EBITDA for 2024 was $191.3 million compared to $174.3 million for 2023. Adjusted EBITDA as a percentage of sales was 10.6 percent and 10.4 percent, respectively.

• Free cash flow for fiscal 2024 was $77.1 million or 42.3 percent of EBITDA compared to $94.0 million in fiscal 2023.

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

Business segment financial highlights:

•Service Centers’ revenue for the fiscal year was $1.2 billion, an increase of 1.9 percent year-over-year with a 14.3 percent operating income margin.

•Innovative Pumping Solutions’ revenue for the fiscal year was $323.0 million, an increase of 47.7 percent year over year with an 16.6 percent operating income margin.

•Supply Chain Services’ revenue for the fiscal year was $256.4 million, a decrease of 1.5 percent year-over-year with a 8.5 percent operating margin.

David R. Little, Chairman and Chief Executive Officer commented, "Fiscal 2024 was another great year for DXP. DXPeople drove fourth quarter results, with strong performance or year-over-year growth across all business segments. Broad based business strength across the business helped us deliver 7.4 percent revenue growth on a year-over-year basis. This growth has fueled good momentum going into 2025. DXP’s Innovative Pumping Solutions sales were up 47.7 percent to $323.0 million, followed by Service Centers sales growing 1.9 percent to $1.2 billion and Supply Chain Services sales declining 1.5 percent to $256.4 million. Congratulations to all of our DXPeople for their hard work and efforts to serve our customers."

Mr. Little continued, "The sales momentum from the fourth quarter accompanied by our backlogs continues to position us for success as we move into 2025. Additionally, we strengthened our balance sheet in the fourth quarter, similar to this time last year, raising a new Term Loan B which put an incremental $105 million in cash on the balance sheet. DXP’s balanced end markets, and our ability to continue to execute on acquisitions have set the stage for 2025. We see positive dynamics in our traditional end markets like oil & gas, as well as positive outlooks for end markets like water & wastewater. As a result of our strategies and our focus on managing our businesses for both the near- and long-term, we are differentiating ourselves from competitors, leveraging a broad set of assets to drive attractive returns and further advance our goals. DXP’s strategy to grow our core rotating equipment business and capabilities and expand into other highly engineered or value-added solutions for our customers, continues to deliver strong results. Over the last three years, DXP has generated an average annual return on equity of 16.5 percent and has returned approximately $118.7 million to its shareholders through share repurchases. We are confident our growth strategy, coupled with a continued focus on improving margins and maintaining operational discipline, and our evolving capital allocation model will drive shareholder value."

Kent Yee, Chief Financial Officer commented, "DXP completed an outstanding fiscal 2024, with strong underlying sales growth, operating leverage, earnings per share and free cash flow generation. The DXP team delivered a strong finish to Fiscal 2024, which represents the most profitable year in our Company’s history. Fiscal 2024 financial performance continues to reflect the execution of our end market diversification efforts, our plans to grow both organically and through acquisitions, and continuous improvement in our operations and efficiency. Total sales and adjusted EBITDA grew 7.4 percent and 9.8 percent, respectively. Our fiscal 2024 diluted earnings per share was $4.22. We are pleased with the fourth quarter, and year-end results. Once again, we positioned our balance sheet in the fourth quarter to support our growth plans in 2025. DXP ended the year with $148.4 million in cash on the balance sheet and net debt of $500.6 million. DXP’s secured leverage ratio or net debt to EBITDA was 2.4:1.0 with a covenant EBITDA of $206.2 million for fiscal 2024. We remain optimistic that DXP’s best days are ahead of us. With our strong balance sheet and broad product offering and solution, we believe DXP is unparalleled with respect to its ability to leverage these market drivers for continued growth. We expect to drive both organic and acquisition driven growth while driving shareholder and stakeholder value."

Non-GAAP Financial Measures

DXP supplements reporting of net income with non-GAAP measurements, including EBITDA, adjusted EBITDA, free cash flow, Adjusted Net Income attributable to DXP Enterprises, Inc., and net debt. This supplemental information should not be considered in isolation or as a substitute for the unaudited GAAP measurements. Additional information regarding EBITDA, free cash flow and Adjusted Net Income attributable to DXP Enterprises, Inc. referred to in this press release are included below under "Unaudited Reconciliation of Non-GAAP Financial Information."

The Company believes EBITDA provides additional information about: (i) operating performance, because it assists in comparing the operating performance of the business, as it removes the impact of non-cash depreciation and amortization expense as well as items not directly resulting from core operations such as interest expense and income taxes and (ii) the performance and the effectiveness of operational strategies. Additionally, EBITDA performance is a component of a measure of the Company’s financial covenants under its credit facility. Furthermore, some investors use EBITDA as a supplemental measure to evaluate the overall operating performance of companies in the industry. Management believes that some investors’ understanding of performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing ongoing results of operations. By providing this non-GAAP financial measure, together with a reconciliation from net income, the Company believes it is enhancing investors’ understanding of the business and results of operations, as well as assisting investors in evaluating how well the Company is executing strategic initiatives.

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service distributor that adds value and total cost savings solutions to industrial customers throughout the United States, Canada, Mexico and the U.A.E. DXP provides innovative pumping solutions, supply chain services and maintenance, repair, operating and production ("MROP") services that emphasize and utilize DXP’s vast product knowledge and technical expertise in rotating equipment, bearings, power transmission, metal working, industrial supplies and safety products and services. DXP's breadth of MROP products and service solutions allows DXP to be flexible and customer-driven, creating competitive advantages for our customers. DXP’s business segments include Service Centers, Innovative Pumping Solutions and Supply Chain Services. For more information, go to www.dxpe.com.

The Private Securities Litigation Reform Act of 1995 provides a “safe-harbor” for forward-looking statements. Certain information included in this press release (as well as information included in oral statements or other written statements made by or to be made by the Company) contains statements that are forward-looking. These forward-looking statements include without limitation those about the Company’s expectations regarding the impact of the COVID-19 pandemic and the impact of low commodity prices of oil and gas; the Company’s business, the Company’s future profitability, cash flow, liquidity, and growth. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future; and accordingly, such results may differ from those expressed in any forward-looking statement made by or on behalf of the Company. These risks and uncertainties include, but are not limited to; decreases in oil and natural gas prices; decreases in oil and natural gas industry expenditure levels, which may result from decreased oil and natural gas prices or other factors; ability to obtain needed capital, dependence on existing management, leverage and debt service, domestic or global economic conditions, economic risks related to the impact of COVID-19, ability to manage changes and the continued health or availability of management personnel and changes in customer preferences and attitudes. In some cases, you can identify forward-looking statements by terminology such as, but not limited to, “may,” “will,” “should,” “intend,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “goal,” or “continue” or the negative of such terms or other comparable terminology. For more information, review the Company’s filings with the Securities and Exchange Commission. More information on these risks and other potential factors that could affect the Company’s business and financial results is included in the Company’s filings with the SEC, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

DXP ENTERPRISES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

($ thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| | | | | | | | | |

| Sales | $ | 470,914 | | | $ | 407,044 | | | $ | 1,802,040 | | | $ | 1,678,600 | | | |

| Cost of sales | 322,422 | | | 284,208 | | | 1,245,763 | | | 1,173,309 | | | |

| Gross profit | 148,492 | | | 122,836 | | | 556,277 | | | 505,291 | | | |

| Selling, general and administrative expenses | 109,201 | | | 92,849 | | | 410,895 | | | 366,569 | | | |

| | | | | | | | | |

| Income from operations | 39,291 | | | 29,987 | | | 145,382 | | | 138,722 | | | |

| Interest expense | 17,283 | | | 17,078 | | | 63,927 | | | 53,146 | | | |

Other income, net | (673) | | | (1,877) | | | (3,517) | | | (1,355) | | | |

| Income before income taxes | 22,681 | | | 14,786 | | | 84,972 | | | 86,931 | | | |

| Provision for income taxes | 1,318 | | | (1,220) | | | 14,483 | | | 18,119 | | | |

| Net income | 21,363 | | | 16,006 | | | 70,489 | | | 68,812 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Preferred stock dividend | 22 | | | 23 | | | 90 | | | 90 | | | |

| Net income attributable to common shareholders | $ | 21,341 | | | $ | 15,983 | | | $ | 70,399 | | | $ | 68,722 | | | |

| | | | | | | | | |

| Net income | $ | 21,363 | | | $ | 16,006 | | | $ | 70,489 | | | $ | 68,812 | | | |

| Foreign currency translation adjustments | (2,229) | | | 522 | | | (2,370) | | | 435 | | | |

| Comprehensive income | $ | 19,134 | | | $ | 16,528 | | | $ | 68,119 | | | $ | 69,247 | | | |

| | | | | | | | | |

Earnings per share: | | | | | | | | | |

| Basic | $ | 1.36 | | | $ | 0.99 | | | $ | 4.44 | | | $ | 4.07 | | | |

| Diluted | $ | 1.29 | | | $ | 0.94 | | | $ | 4.22 | | | $ | 3.89 | | | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 15,695 | | | 16,177 | | | 15,861 | | | 16,870 | | | |

| Diluted | 16,535 | | | 17,017 | | | 16,701 | | | 17,710 | | | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

DXP ENTERPRISES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

($ thousands, except share amounts) | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 148,320 | | | $ | 173,120 | |

| Restricted cash | 91 | | | 91 | |

| Accounts receivable, net of allowance of $5,172 and $5,584, respectively | 339,365 | | | 311,171 | |

| Inventories | 103,113 | | | 103,805 | |

| Costs and estimated profits in excess of billings | 50,735 | | | 42,323 | |

| Prepaid expenses and other current assets | 20,250 | | | 18,044 | |

| | | |

| Total current assets | 661,874 | | | 648,554 | |

| Property and equipment, net | 81,556 | | | 61,618 | |

| Goodwill | 452,343 | | | 343,991 | |

| Other intangible assets, net | 85,679 | | | 63,895 | |

| Operating lease right of use assets, net | 46,569 | | | 48,729 | |

| Other long-term assets | 21,473 | | | 10,649 | |

| Total assets | $ | 1,349,494 | | | $ | 1,177,436 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of debt | $ | 6,595 | | | $ | 5,500 | |

| Trade accounts payable | 103,728 | | | 96,469 | |

| Accrued wages and benefits | 41,650 | | | 36,238 | |

| | | |

| Customer advances | 13,655 | | | 12,160 | |

| Billings in excess of costs and estimated profits | 12,662 | | | 9,506 | |

| Short-term operating lease liabilities | 14,921 | | | 15,438 | |

| Other current liabilities | 50,773 | | | 48,854 | |

| Total current liabilities | 243,984 | | | 224,165 | |

| Long-term debt, net of unamortized debt issuance costs and discounts | 621,684 | | | 520,697 | |

| Long-term operating lease liabilities | 33,159 | | | 34,336 | |

| Other long-term liabilities | 27,879 | | | 17,359 | |

| | | |

| Total long-term liabilities | 682,722 | | | 572,392 | |

| Total liabilities | 926,706 | | | 796,557 | |

| | | |

| Shareholders' Equity: | | | |

| Series A preferred stock, $1.00 par value; 1,000,000 shares authorized | 1 | | | 1 | |

| Series B preferred stock, $1.00 par value; 1,000,000 shares authorized | 15 | | | 15 | |

| Common stock, $0.01 par value, 100,000,000 shares authorized; 20,402,861 issued and 15,695,088 outstanding at December 31, 2024 and 20,319,226 issued and 16,177,237 outstanding at December 31, 2023 | 204 | | | 345 | |

| Additional paid-in capital | 219,511 | | | 216,482 | |

| Retained earnings | 389,670 | | | 319,271 | |

| Accumulated other comprehensive loss | (33,610) | | | (31,240) | |

| Treasury stock, at cost 4,707,773 and 4,141,989 shares, respectively | (153,003) | | | (123,995) | |

| Total DXP Enterprises, Inc. equity | 422,788 | | | 380,879 | |

| | | |

| | | |

| Total liabilities and equity | $ | 1,349,494 | | | $ | 1,177,436 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

SEGMENT DATA

($ thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| Sales | 2024 | | 2023(1) | | 2024 | | 2023(1) |

| Service Centers | $ | 310,816 | | | $ | 285,423 | | | $ | 1,222,599 | | | $ | 1,199,501 | |

| Innovative Pumping Solutions | 97,609 | | | 60,291 | | | 323,026 | | | 218,731 | |

| Supply Chain Services | 62,489 | | | 61,330 | | | 256,415 | | | 260,368 | |

| Total DXP Sales | $ | 470,914 | | | $ | 407,044 | | | $ | 1,802,040 | | | $ | 1,678,600 | |

| | | | | | | |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| Operating Income | 2024 | | 2023(1) | | 2024 | | 2023(1) |

| Service Centers | $ | 44,666 | | | $ | 37,546 | | | $ | 174,995 | | | $ | 172,095 | |

| Innovative Pumping Solutions | 15,193 | | | 8,592 | | | 53,736 | | | 35,147 | |

| Supply Chain Services | 5,089 | | | 5,004 | | | 21,742 | | | 21,522 | |

| Total segment operating income | $ | 64,948 | | | $ | 51,142 | | | $ | 250,473 | | | $ | 228,764 | |

(1) Prior period segment disclosures have been recast |

RECONCILIATION OF OPERATING INCOME FOR REPORTABLE SEGMENTS

($ thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Income from operations for reportable segments | $ | 64,948 | | | $ | 51,142 | | | $ | 250,473 | | | $ | 228,764 | |

| Adjustment for: | | | | | | | |

| | | | | | | |

Amortization of intangibles(1) | 5,494 | | | 3,025 | | | 19,827 | | | 18,231 | |

Corporate expenses, net | 20,163 | | | 18,130 | | | 85,264 | | | 71,811 | |

Income from operations | $ | 39,291 | | | $ | 29,987 | | | $ | 145,382 | | | $ | 138,722 | |

| Interest expense | 17,283 | | | 17,078 | | | 63,927 | | | 53,146 | |

| Other (income) expense, net | (673) | | | (1,877) | | | (3,517) | | | (1,355) | |

| Income before income taxes | $ | 22,681 | | | $ | 14,786 | | | $ | 84,972 | | | $ | 86,931 | |

(1) Amortization of intangible assets is recorded at the corporate level. |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION

($ thousands, unaudited)

The following table is a reconciliation of EBITDA, EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin to the most comparable U.S. GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Income before income taxes | $ | 22,681 | | | $ | 14,786 | | | $ | 84,972 | | | $ | 86,931 | |

Plus: Interest expense | 17,283 | | | 17,078 | | | 63,927 | | | 53,146 | |

Plus: Depreciation and amortization | 9,020 | | | 8,637 | | | 33,405 | | | 30,105 | |

| EBITDA | $ | 48,984 | | | $ | 40,501 | | | $ | 182,304 | | | $ | 170,182 | |

| | | | | | | |

| | | | | | | |

Plus: other non-recurring items(1) | — | | | 500 | | | 4,292 | | | 1,051 | |

| Plus: stock compensation expense | 1,316 | | | 861 | | | 4,714 | | | 3,072 | |

| Adjusted EBITDA | $ | 50,300 | | | $ | 41,862 | | | $ | 191,310 | | | $ | 174,305 | |

| | | | | | | |

Operating Income Margin | 8.3 | % | | 7.4 | % | | 8.1 | % | | 8.3 | % |

EBITDA Margin | 10.4 | % | | 10.0 | % | | 10.1 | % | | 10.1 | % |

Adjusted EBITDA Margin | 10.7 | % | | 10.3 | % | | 10.6 | % | | 10.4 | % |

(1) Other non-recurring items includes unique acquisition integration costs and other non-cash, non-recurring costs not related to continuing business operations. |

The following table sets forth the reconciliation of Acquisition Sales, Organic Sales and Organic Sales per Business Day to the most comparable U.S. GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023(1) | | | | 2024 | | 2023(1) | | |

Sales by Business Segment | | | | | | | | | | | |

| Service Centers | $ | 310,816 | | | $ | 285,423 | | | | | $ | 1,222,599 | | | $ | 1,199,501 | | | |

| Innovative Pumping Solutions | 97,609 | | | 60,291 | | | | | 323,026 | | | 218,731 | | | |

| Supply Chain Services | 62,489 | | | 61,330 | | | | | 256,415 | | | 260,368 | | | |

| Total DXP Sales | $ | 470,914 | | | $ | 407,044 | | | | | $ | 1,802,040 | | | $ | 1,678,600 | | | |

| Acquisition Sales | $ | 34,787 | | | $ | 2,812 | | | | | $ | 98,500 | | | $ | 33,078 | | | |

| Organic Sales | $ | 436,127 | | | $ | 404,232 | | | | | $ | 1,703,540 | | | $ | 1,645,522 | | | |

| | | | | | | | | | | |

| Business Days | 62 | | 61 | | | | 253 | | 252 | | |

| Sales per Business Day | $ | 7,595 | | | $ | 6,673 | | | | | $ | 7,123 | | | $ | 6,661 | | | |

| Organic Sales per Business Day | $ | 7,034 | | | $ | 6,627 | | | | | $ | 6,733 | | | $ | 6,530 | | | |

(1) Prior period segment disclosures have been recast. | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO www.dxpe.com THE INDUSTRIAL DISTRIBUTION EXPERTS |

RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION CONTINUED

($ thousands, unaudited)

The following table sets forth a reconciliation of Free Cash Flow to the most comparable U.S. GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash from operating activities | $ | 32,143 | | | $ | 42,447 | | | $ | 102,211 | | | $ | 106,222 | |

| Less: purchases of property and equipment, net | (9,395) | | | (5,160) | | | (25,068) | | | (12,263) | |

| | | | | | | |

| Free Cash Flow | $ | 22,748 | | | $ | 37,287 | | | $ | 77,143 | | | $ | 93,959 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

The following table is a reconciliation of adjusted net income attributable to DXP Enterprises, Inc., a non-GAAP financial measure, to net income, calculated and reported in accordance with U.S. GAAP (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net Income | $ | 21,363 | | | $ | 16,006 | | | $ | 70,489 | | | $ | 68,812 | |

| One-time debt financing costs | 1,623 | | | 1,981 | | | 1,623 | | | 1,981 | |

Other non-cash items | — | | | 500 | | | 4,292 | | | 1,051 | |

Adjustment for taxes | (101) | | | (517) | | | (1,008) | | | (632) | |

Adjusted Net Income | $ | 22,885 | | | $ | 17,970 | | | $ | 75,396 | | | $ | 71,212 | |

| | | | | | | |

| Weighted average common shares and common equivalent shares outstanding | | | | | | | |

| | | | | | | |

| Diluted | 16,535 | | | 17,017 | | | 16,701 | | | 17,710 | |

| | | | | | | |

| Diluted Earnings per Share | $ | 1.29 | | | $ | 0.94 | | | $ | 4.22 | | | $ | 3.89 | |

| Adjusted Diluted Earnings per Share | $ | 1.38 | | | $ | 1.12 | | | $ | 4.51 | | | $ | 4.09 | |

| | | | | | | |

|

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

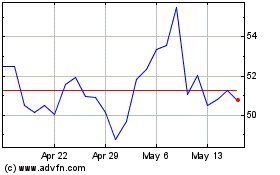

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Feb 2025 to Mar 2025

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Mar 2024 to Mar 2025