0001844450false--09-30FY202400018444502023-10-012024-09-3000018444502024-09-300001844450dei:BusinessContactMember2023-10-012024-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

or |

☒ | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended September 30, 2024 | Commission File Number 001-41726 |

Electrovaya Inc. |

(Exact name of Registrant as specified in its charter) |

N/A

(Translation of Registrant’s name into English (if applicable))

Ontario, Canada | | 3692 | | N/A |

(Province or other jurisdiction of | | (Primary Standard Industrial Classification | | (I.R.S. Employer |

incorporation or organization) | | Code Number) | | Identification Number) |

6688 Kitimat Road

Mississauga, Ontario L5N 1P8

(905) 855-4627

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

1-800-221-0102

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Shares, no par value | | ELVA | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual information form | ☒ Audited annual financial statements |

Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 34,137,665 outstanding as of September 30, 2024.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☒ Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, filed as Exhibits 99.1, 99.2, and 99.3 to this annual report (“Annual Report”) on Form 40-F of Electrovaya Inc. (the “Registrant” or the “Company”), are hereby incorporated by reference into this Annual Report:

(a) Annual Information Form for the fiscal year ended September 30, 2024;

(b) Audited Consolidated Financial Statements as at September 30, 2024 and 2023, and for the two years in the period ended September 30, 2024 and the related notes and the Management’s Annual Report on Internal Control over Financial Reporting with respect thereto; and

(c) Management’s Discussion and Analysis for the fiscal year ended September 30, 2024.

EXPLANATORY NOTE

Electrovaya Inc. is a “foreign private issuer” as defined in Rule 3b-4 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is a Canadian issuer eligible to file its Annual Report pursuant to Section 13 of the Exchange Act on Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities and Exchange Commission (the “SEC”). The Company’s common shares are listed in the United States on the Nasdaq Capital Market (“NASDAQ”) under the trading symbol “ELVA” and in Canada on the Toronto Stock Exchange (“TSX” or the “Exchange”) under the trading symbol “ELVA”.

In this Annual Report, references to “we,” “our,” “us,” the “Registrant,” the “Company,” or “Electrovaya,” mean Electrovaya Inc. unless the context suggests otherwise.

FORWARD LOOKING STATEMENTS

The Exhibits incorporated by reference into this Annual Report of the Registrant contain forward-looking statements including statements that relate to, among other things, revenue, purchase orders, revenue guidance of more than $60 million in the financial year 2025 (“FY 2025”), order growth and customer demand in FY 2025, mass production schedules, funding from EXIM and the Company’s ability to finalize the loan facility from Export-Import Bank of the United States (“EXIM”) bank on a timely basis, the anticipated operational start schedule for the Company’s Jamestown facility, future business opportunities, use of proceeds, ability to deliver to customer requirements and revenue growth forecasts for the fiscal year ending September 30, 2025. Forward-looking statements can generally, but not always, be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective” and “continue” (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate are necessarily applied in making forward looking statements and such statements are subject to risks and uncertainties, therefore actual results may differ materially from those expressed or implied in such statements and undue reliance should not be placed on such statements. Material assumptions made in disclosing the forward-looking statements included in the news release include, but are not limited to assumptions that the Company’s customers will deploy its products in accordance with communicated timing and volumes, that the Company’s customers will complete new distribution centers in accordance with communicated expectations, intentions and plans, the sum of anticipated new orders in FY 2025 based on customers’ historical patterns and additional demand communicated to the Company and its partners but not yet provided as a purchase order with the Company’s current firm purchase order backlog totaling approximately $80 million, a discount of approximately 25% used in the revenue modeling applied to the overall expected order pipeline to account for potential delays in customer orders, expected decreases in input and material costs combined with stable selling prices in FY 2025, and a stable political climate with respect to exports from Canada to the United States, the start up time for manufacturing in Jamestown NY of H1 CY 2026, the ability to leverage IRA45X credits, the ability to receive incentives from the state of New York, the ability to improve margins from domestic manufacturing, and the ability to attract additional customers through domestic manufacturing. Factors that could cause actual results to differ materially from expectations include but are not limited to customers not placing orders roughly in accordance with historical ordering patterns and communicated intentions resulting in annual revenue in FY 2025 in a total amount of at least $60 million, the imposition of a new tariff regime on Canadian exports by the United States, macroeconomic effects on the Company and its business and on the lithium battery industry generally, the Company’s liquidity and cash availability in excess of its operational requirements, and the ability to generate and sustain sales orders. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company’s Annual Information Form for the year ended September 30, 2024 under “Risk Factors”, in the Company’s base shelf prospectus dated September 17, 2024, and in the Company’s most recent annual and interim Management’s Discussion and Analysis, incorporated by reference herein as Exhibit 99.3, under “Qualitative And Quantitative Disclosures about Risk and Uncertainties” as well as in other public disclosure documents filed with Canadian and American securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The revenue for the periods described herein constitute future-oriented financial information and financial outlooks (collectively, “FOFI”), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under “Forward-Looking Statements”. Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company’s control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management’s current expectations and plans relating to the Company’s future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company’s financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

Readers are cautioned that the above list of cautionary statements is not exhaustive.

No assurance can be given that these expectations will prove to be correct and such forward-looking statements in the Exhibits incorporated by reference into this Annual Report should not be unduly relied upon. The Registrant’s forward-looking statements contained in the Exhibits incorporated by reference into this Annual Report are made as of the respective dates set forth in such Exhibits. Such forward-looking statements are based on the beliefs, expectations, and opinions of management on the date the statements are made. In preparing this Annual Report, the Registrant has not updated such forward-looking statements to reflect any change in circumstances or in management’s beliefs, expectations or opinions that may have occurred prior to the date hereof. Nor does the Registrant assume any obligation to update such forward-looking statements in the future as stated above. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

NOTICE TO UNITED STATES READERS - DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under the MJDS, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant has historically prepared its consolidated financial statements, which are incorporated by reference hereto, in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and auditor independence standards. Financial statements prepared in IFRS may differ from financial statements prepared in United States GAAP (“U.S. GAAP”) and from practices prescribed by the SEC. Therefore, the Registrant’s financial statements filed with this Annual Report may not be comparable to financial statements of United States companies prepared in accordance with U.S. GAAP.

Unless otherwise indicated, all dollar amounts in this Annual Report are in United States dollars.

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report:

A. Annual Information Form

The Registrant’s Annual Information Form for the fiscal year ended September 30, 2024 is attached as Exhibit 99.1 to this Annual Report, and is incorporated by reference herein.

B. Audited Annual Financial Statements

The Registrant’s consolidated audited annual financial statements, including the reports of the independent registered public accounting firm with respect thereto, are attached as Exhibit 99.2 to this Annual Report and is incorporated by reference herein.

C. Management’s Discussion and Analysis

The Registrant’s management’s discussion and analysis of financial condition and results of operations for the twelve-month period ended September 30, 2024 is attached as Exhibit 99.3 to this Annual Report and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding or disposing of securities of the Registrant may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

DISCLOSURE CONTROLS AND PROCEDURES

The information provided in the sections entitled “Disclosure Controls” and “Internal Control Over Financial Reporting” in the 2024 Management’s Discussion and Analysis filed as Exhibit 99.3 to this Annual Report is incorporated by reference herein.

MANAGEMENT’S REPORT ON

INTERNAL CONTROL OVER FINANCIAL REPORTING

The information provided in the sections entitled “Disclosure Controls” and “Internal Control Over Financial Reporting” in the 2024 Management’s Discussion and Analysis filed as Exhibit 99.3 to this Annual Report is incorporated by reference herein.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

This Annual Report does not include an attestation report of the Registrant’s registered public accounting firm due to a transition period established by rules of the SEC for newly public companies. Under Section 3 of the Exchange Act, as a result of enactment of the Jumpstart Our Business Startups Act (the “JOBS Act”), “emerging growth companies” are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which generally requires that a public company’s registered public accounting firm provide an attestation report relating to management’s assessment of internal control over financial reporting. The Registrant qualifies as an “emerging growth company” and therefore has not included in, or incorporated by reference into, this Annual Report such an attestation report as of the end of the period covered by this Annual Report.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There have been no changes in the Registrant’s internal control over financial reporting during the fiscal year ended September 30, 2024, that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

None.

CODE OF ETHICS

The Registrant has adopted a written “code of ethics” (as defined by the rules and regulations of the SEC), entitled “Code of Conduct” (the “Code”) that applies to all members of the board of directors, officers, employees, representatives and other associates of the Company and its subsidiaries worldwide. Adherence to this code is a condition of employment with or providing services to the Company.

The Code may be obtained upon request from Electrovaya Inc.’s head office at 6688 Kitimat Rd, Mississauga, Ontario, L5N 1P8, Canada or by viewing the Registrant’s web site at https://electrovaya.com/financial-summary/.

All amendments to the Code, and all waivers of the Code with respect to any director, executive officer or principal financial and accounting officers, will be posted on the Registrant’s web site within five business days following the date of the amendment or waiver and any amendment will be provided in print to any shareholder upon request.

AUDIT COMMITTEE

Our Board of Directors has established the Audit Committee in accordance with section 3(a)(58)(A) of the Exchange Act and Rule 5605(c) of the NASDAQ Marketplace Rules for the purpose of overseeing our accounting and financial reporting processes and the audits of our annual financial statements.

The Audit Committee is comprised of Dr. James K. Jacobs (Chair), Steven Berkenfeld, and Kartick Kumar. Dr. Carolyn M. Hansson stepped down from the audit committee in March 2024. Our Board of Directors has determined that the Audit Committee meets the composition requirements set forth by Section 5605(c)(2) of the NASDAQ Marketplace Rules and are independent members of the Audit Committee as determined under Rule 10A-3 of the Exchange Act and Rule 5605(a)(2) of the NASDAQ Marketplace Rules.

All three members of the Audit Committee are financially literate, meaning they are able to read and understand the Registrant’s financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised by the Registrant’s financial statements.

Our Board of Directors has determined that Steven Berkenfeld qualifies as an “audit committee financial expert” (as defined in paragraph (8)(b) of General Instruction B to Form 40-F).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The required disclosure is included under the heading “Audit Committee” in the Company’s Annual Information Form for the fiscal year ended September 30, 2024, filed as Exhibit 99.1 to this Annual Report.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Registrant’s external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Registrant’s external auditors, in accordance with applicable law.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant currently has no off-balance sheet arrangements.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table lists, as of September 30, 2024, information with respect to the Registrant’s known contractual obligations (in thousands):

| | Payments due by period | |

| | | | | Less than | | | | | | | | | More than | |

Contractual Obligations | | Total | | | 1 year | | | 1-3 years | | | 3-5 years | | | 5 years | |

Long-Term Debt Obligations | | $ | 16,283 | | | $ | 16,283 | | | $ | - | | | $ | - | | | $ | - | |

Capital Finance Lease Obligations | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Operating Lease Obligations | | $ | 3,072 | | | $ | 760 | | | $ | 1,153 | | | $ | 1,159 | | | $ | - | |

Purchase Obligations | | $ | 9,460 | | | $ | 9,460 | | | $ | - | | | $ | - | | | $ | - | |

Other Long-Term Liabilities Reflected on Balance Sheet | | $ | 3,584 | | | $ | 2,360 | | | $ | 396 | | | $ | 350 | | | $ | 478 | |

Total | | $ | 32,399 | | | $ | 28,863 | | | $ | 1,549 | | | $ | 1,509 | | | $ | 478 | |

NASDAQ CORPORATE GOVERNANCE

The Registrant is a foreign private issuer and its common shares are listed on the NASDAQ.

NASDAQ Rule 5615(a)(3) permits a foreign private issuer to follow its home country practice in lieu of the requirements of the Rule 5600 Series, the requirement to distribute annual and interim reports set forth in Rule 5250(d), and the Direct Registration Program requirement set forth in Rules 5210(c) and 5255; provided, however, that such a company shall comply with the Notification of Material Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640), have an audit committee that satisfies Rule 5605(c)(3), and ensure that such audit committee’s members meet the independence requirement in Rule 5605(c)(2)(A)(ii).

The Registrant has reviewed the NASDAQ corporate governance requirements and confirms that except as described below, the Registrant is in compliance with the NASDAQ corporate governance standards in all significant respects:

The Registrant does not follow Rule 5605(b)(2), which requires the company to have regularly scheduled meetings at which only independent directors present (“executive sessions”). In lieu of following Rule 5605(b)(2), the Registrant follows Canadian securities laws and the rules of the TSX.

The Registrant has a formal Audit Committee charter but does not follow Rule 5605(c)(1), which requires a company’s Audit Committee charter to include the items enumerated in Rule 5605(c)(1) and have the Audit Committee review and reassess the Charter on an annual basis. In lieu of following Rule 5605(c)(1), the Registrant follows applicable Canadian securities laws and the rules of the TSX with respect to audit committee charters.

The Registrant does not follow Rule 5605(d)(1), which requires companies to adopt a formal written compensation committee charter and have a compensation committee review and reassess the adequacy of the charter on an annual basis. In lieu of following Rule 5605(d)(1), the Registrant follows applicable Canadian securities laws and the rules of the TSX.

The Registrant does not follow Rule 5620(c), under which the Nasdaq minimum quorum requirement for a shareholder meeting is 33-1/3% of the outstanding shares of common stock. A quorum for a meeting of shareholders of the Registrant is two shareholders or proxyholders that hold or represent, as applicable, not less than 25% of the issued and outstanding shares entitled to be voted at the meeting. In lieu of following Rule 5620(c) (shareholder quorum), the Registrant follows applicable Ontario and Canadian corporate and securities laws and the rules of the TSX.

The foregoing is consistent with the laws, customs, and practices in the province of Ontario and Canada.

Further information about the Registrant’s governance practices is included on the Registrant’s website.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

The Registrant has adopted a compensation recovery policy (the “Clawback Policy”) as required by Nasdaq listing standards and pursuant to Rule 10D-1 of the Exchange Act. A copy of the Clawback Policy attached to hereto as Exhibit 97.

At no time during or after the fiscal year ended September 30, 2024, was the Registrant required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the Clawback Policy. As of September 30, 2024, there was no outstanding balance of erroneously awarded compensation to be recovered from the application of the Clawback Policy to a prior restatement.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

None.

BOARD DIVERSITY MATRIX

The table below reports self-identified diversity statistics for the Board of Directors of the Registrant as required by NASDAQ Rule 5606.

Board Diversity Matrix | | Electrovaya Inc. | |

| | | |

Country of Principal Executive Offices | | Canada | |

| | | |

Foreign Private Issuer | | Yes | |

| | | |

Disclosure Prohibited Under Home Country Law | | No | |

| | As of | | January 5, 2024 | | | | As of | | December 26, 2024 | | |

| | | | | | | | | | | | |

Total Number of Directors | | | | 6 | | | | | | 6 | | |

| | | | |

Gender Identity | | Female | | Male | | Non- Binary | | Did Not Disclose Gender | | Female | | Male | | Non- Binary | | Did Not Disclose Gender |

Directors | | 1 | | 5 | | 0 | | 0 | | 1 | | 5 | | 0 | | 0 |

Demographic Background |

Underrepresented Individual in Home Country Jurisdiction | | 4 | | 4 |

LGBTQ+ | | 0 | | 0 |

Did Not Disclose Demographic Background | | 0 | | 0 |

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Registrant’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Registrant.

ADDITIONAL INFORMATION

Additional information relating to the Registrant may be found on the SEDAR+ System for Electronic Document Analysis and Retrieval at www.sedarplus.ca and on the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system at www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ELECTROVAYA INC. | |

| | | |

| By: | /s/ Raj Das Gupta | |

| Name: | Raj Das Gupta | |

| Title: | Chief Executive Officer | |

Date: December 26, 2024

EXHIBIT INDEX

EXHIBIT | | DESCRIPTION OF EXHIBIT |

| | |

97 | | Clawback Policy |

| | |

99.1 | | The Registrant’s Annual Information Form for the fiscal year ended September 30, 2024 |

| | |

99.2 | | Audited Consolidated Financial Statements for the fiscal year ended September 30, 2024 (incorporated by reference to Exhibit 99.2 to Registrant’s Report on Form 6-K/A dated December 17, 2024) |

| | |

99.3 | | Management’s Discussion and Analysis for the year ended September 30, 2024 (incorporated by reference to Exhibit 99.1 to Registrant’s Report on Form 6-K/A dated December 17, 2024) |

| | |

99.4 | | Certification by the Chief Executive Officer of the Registrant pursuant to Rule 13a-14(a) or 15d- 14 of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

99.5 | | Certification by the Chief Financial Officer of the Registrant pursuant to Rule 13a-14(a) or 15d-14 of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

99.6 | | Certification by the Chief Executive Officer of the Registrant pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| | |

99.7 | | Certification by the Chief Financial Officer of the Registrant pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| | |

99.8 | | Consent of MNP LLP Toronto, Canada PCAOB ID: 1930 |

| | |

101 | | XBRL Document |

| | |

104 | | Cover Page Interactive Data File |

nullnullnullnullnullnullnull

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag with value true on a form if it is an annual report containing audited financial statements. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditedAnnualFinancialStatements |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a registration statement. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

| Name: |

dei_DocumentRegistrationStatement |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

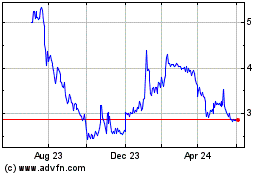

Electrovaya (NASDAQ:ELVA)

Historical Stock Chart

From Dec 2024 to Jan 2025

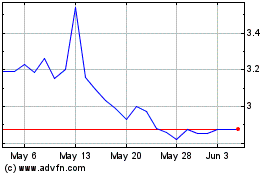

Electrovaya (NASDAQ:ELVA)

Historical Stock Chart

From Jan 2024 to Jan 2025