Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-268858

To

the prospectus dated December 31, 2022

PROSPECTUS

SUPPLEMENT NO. 1

This

prospectus supplement amends and supplements the prospectus dated August 30, 2022, as supplemented or amended from time to time (the

“Prospectus”), which forms a part of our Registration Statement on Form S-3 (No. 333-268858). This prospectus supplement

is being filed to update and supplement the information in the Prospectus with the information set forth below under “Amendment

to Existing Warrants.”

The

Prospectus and this prospectus supplement relate to the issuance by us and the resale by the selling security holders named in the Prospectus

(the “Selling Securityholders”) of up to an aggregate of 460,175 shares of our common stock, par value $0.0001 per

share (“common stock”), which consists of (i) up to 416,667 shares of common stock that are issuable to certain of

the Selling Securityholders (A) that are party to the Securities Purchase Agreement, dated June 30, 2022 (the “Securities Purchase

Agreement”) upon the conversion of $3,905,264 aggregate principal amount of our secured convertible 6% original issue discount

promissory notes (the “Investor Notes”), plus accrued and unpaid interest thereon, based upon a conversion price of

$24.072 per share and (B) that are party to a share purchase agreement, dated December 29, 2020 (the “GEM Agreement”)

as payment in shares of a $400,000 commitment fee (the “Commitment Fee”) owed under to the GEM Agreement; (ii) up

to 4,608 shares of common stock that are issuable upon the exercise of warrants (the “GEM Warrants”) that we issued

pursuant to the GEM Agreement and (iii) up to 38,900 shares of common stock that are issuable to the Selling Securityholders that are

party to the Securities Purchase Agreement upon the exercise of warrants to purchase shares of our common stock that we issued to these

Selling Stockholders in the private placement that closed in connection with the Securities Purchase Agreement (the “Investor

Warrants”).

On

October 28, 2022, we effected a one-for-twenty reverse split of our common stock (the “2022 Reverse Split”). On March

31, 2023, we effected a one-for-twelve reverse split of our common stock (the “2023 Reverse Split” and together with

the 2022 Reverse Split the “Reverse Splits”). All share and per share information in this prospectus supplement has

been restated retroactively, giving effect to the Reverse Splits for all periods presented.

Our

registration of the securities covered by the Prospectus and this prospectus supplement does not mean that either we or the Selling Securityholders

will issue, offer or sell, as applicable, any of the securities hereby registered. The Selling Securityholders may offer, sell, or distribute

all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated

prices. We will not receive any of the proceeds from such sales of our common stock or warrants by the Selling Securityholders pursuant

to the Prospectus and this prospectus supplement, except with respect to amounts received by us upon exercise of the Warrants to the

extent such Warrants are exercised for cash. We will bear all costs, expenses and fees in connection with the registration of these securities,

including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions

and discounts, if any, attributable to their sale of shares of our common stock. Most of the Selling Securityholders are subject to lock-up

arrangements. See “Plan of Distribution” beginning on page 11 of the Prospectus.

You

should read the Prospectus, this prospectus supplement and any additional prospectus supplement or amendment carefully before you invest

in our securities.

Our

common stock is listed on the Nasdaq under the symbol “ENSC” and our Public Warrants are traded on the OTC Pink Open Market

under the symbol “ENSCW.” On May 11, 2023, the closing sale price of our common stock as reported on Nasdaq was $3.20 and

the last sale price on that date for our Public Warrants as reported on the OTC Pink Open Market was $0.0161.

This

prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered

or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should

be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

We

are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, have

elected to comply with certain reduced disclosure and regulatory requirements.

Our

business and investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 4 of

the Prospectus and in the other documents that are incorporated by reference in the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is May 12, 2023.

AMENDMENT

TO EXISTING WARRANTS

On

May 10, 2023, Ensysce Biosciences, Inc. (the “Company” or “we”), announced the pricing

of a public offering of an aggregate of 1,800,876 shares (the “Shares”) of the Common Stock of the Company,

par value $0.0001 per share (the “Common Stock”, including pre-funded warrants in lieu thereof), Series A-1

warrants to purchase up to 1,800,876 shares of common stock and Series A-2 warrants to purchase up to 1,800,876 shares of common stock,

at a combined public offering price of $3.887 per share (or pre-funded warrant in lieu thereof) and accompanying warrants. The Series

A-1 warrants have an exercise price of $3.637 per share, are exercisable immediately upon issuance and expire five years from the date

of issuance, and the Series A-2 warrants have an exercise price of $3.637 per share, are exercisable immediately upon issuance and expire

eighteen months from the date of issuance.

In

connection with the offering, the Company also agreed to amend certain existing warrants to purchase up to an aggregate of 210,085 shares

of the Company’s common stock that were previously issued in September 2021 through December 2022 to purchasers in the offering

at exercise prices ranging from $16.80 to $187.20 per share, such that effective upon the closing of the offering the amended warrants

will have a reduced exercise price of $3.637 per share, at an additional offering price of $0.125 per amended warrant. As a result, the

exercise price of the Investor Warrants held by the Selling Securityholders was reduced to $3.637 per share.

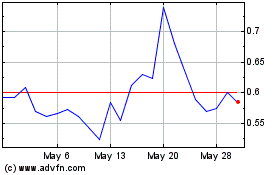

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Feb 2024 to Feb 2025