false

0001716947

0001716947

2023-11-29

2023-11-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 29, 2023 (November 28, 2023)

Ensysce

Biosciences, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38306 |

|

82-2755287 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

7946

Ivanhoe Avenue, Suite 201

La

Jolla, California |

|

92037 |

| (Address of principal

executive offices) |

|

(Zip Code) |

(858)

263-4196

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

ENSC |

|

The

Nasdaq Stock Market LLC |

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

As

previously reported on a Current Report on Form 8-K filed October 24, 2023, on October 23, 2023, Ensysce Biosciences, Inc. (“Ensysce”

or the “Company”) entered into a Securities Purchase Agreement (the “SPA”) for an aggregate financing of $1.7

million with investors. At the first closing under the SPA, which occurred on October 25, 2023, the Company issued to the investors (i)

senior secured convertible promissory notes in the aggregate principal amount of $612,000 for an aggregate purchase price of $566,667

(collectively, the “Notes”) and (ii) warrants (collectively, the “Warrants”) to purchase 1,255,697 shares of

the Company’s common stock, par value $0.0001 per share (the “Common Stock”) in the aggregate. At a second closing

under the SPA, which occurred on November 28, 2023 with funding occurring on November 29, 2023, the Company issued to the investors

referenced above, (i) Notes in the aggregate principal amount of $1,224,000 for an aggregate purchase price of $1,133,333 and (i) Warrants

to purchase 2,511,394 shares of the Common Stock in the aggregate.

The

Notes, subject to an original issue discount of eight percent (8%), have a term of six months from their respective date of issuance

and accrue interest at the rate of 6.0% per annum. The Notes are convertible into the Common Stock, at a per share conversion price equal

to $1.5675. Beginning ninety days following issuance of the respective Notes, the Company is obligated to redeem monthly one third (1/3rd)

of the original principal amount under the applicable Note, plus accrued but unpaid interest, liquidated damages and any other amounts

then owing to the holder of such Note. The Company is required to pay the redemption amount in cash with a premium of ten percent or,

at the election of the purchaser at any time, some or all of the principal amount and interest may be paid by conversion of shares under

the Note into Common Stock based on a conversion price equal to $1.5675.

The

Warrants have an exercise price of $1.5675, the same as the conversion price, and are exercisable for five years following issuance,

issuance occurring on each of the first and second closing dates under the SPA.

The

Company has registered with the Securities and Exchange Commission (the “SEC”) the resale of the shares of Common Stock issuable

upon conversion of the Notes as well as the shares of Common Stock issuable upon the exercise of the Warrants.

The

Notes contain certain covenants, and events of default and triggering events, respectively, which would require repayment of the obligations

outstanding pursuant to such instruments. The obligations of the Company pursuant to the Notes are (i) secured by all assets of the Company

and all subsidiaries of the Company pursuant to the Security Agreement and Patent Security Agreement, each dated October 25, 2023, by

and among the Company, the subsidiaries of the Company and the holders of the Notes and (ii) guaranteed jointly and severally by the

subsidiaries of the Company pursuant to the Subsidiary Guarantee, dated October 25, 2023, by and among the Company, the subsidiaries

of the Company and the purchasers signatory to the SPA.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

information provided under Item 1.01 in this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

3.02. Unregistered Sales of Equity Securities

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. The Notes and the Warrants

were issued without registration under the Securities Act of 1933, as amended (the “Securities Act”), based on the exemption

from registration afforded by Section 4(a)(2) of the Securities Act.

Item

7.01. Regulation FD Disclosure.

On

November 28, 2023, we issued a press release announcing the financing transaction described in this Current Report on Form 8-K. A copy

of the press release is furnished herewith as Exhibit 99.1.

The

information under this Item 8.01, including Exhibit 99.1, is deemed “furnished” and not “filed” under Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that

section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Cautionary

Statements

This

filing includes “forward-looking statements.” All statements other than statements of historical facts included or incorporated

herein may constitute forward-looking statements. Actual results could vary significantly from those expressed or implied in such statements

and are subject to a number of risks and uncertainties. Although the Company believes that the expectations reflected in the forward-looking

statements are reasonable, the Company can give no assurance that such expectations will prove to be correct. The forward-looking statements

involve risks and uncertainties that affect the Company’s operations, financial performance, and other factors as discussed in

the Company’s filings with the SEC. Among the factors that could cause results to differ materially are those risks discussed in

the periodic reports the Company files with the SEC. You are urged to carefully review and consider the cautionary statements and other

disclosures made in those filings, specifically those under the heading “Risk Factors.” The Company does not undertake any

duty to update any forward-looking statement except as required by law.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

| Exhibit

No. |

|

Description |

| 4.6(a) |

|

Form of Senior Secured Convertible Promissory Note to be issued by the Company pursuant to and in accordance with the Securities Purchase Agreement (incorporated by reference to Exhibit 4.6 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 4.6(b) |

|

Form of First Amendment to the Senior Secured Convertible Note) |

| 4.7 |

|

Form of Common Stock Purchase Warrant to be issued by the Company pursuant to and in accordance with the Securities Purchase Agreement (incorporated by reference to Exhibit 4.16 filed with the registrant’s Registration Statement on Form S-1 (File No. 333-275456) on November 17, 2023) |

| 10.1† |

|

Securities Purchase Agreement, dated October 23, 2023, by and among the Company and the purchasers signatory thereto (incorporated by reference to Exhibit 10.1 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 10.2 |

|

Form of Registration Rights Agreement to be entered into by and among the Company and the parties signatory thereto (incorporated by reference to Exhibit 10.2 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 10.3 |

|

Form of Subsidiary Guarantee to be entered into by and among the Company and the purchasers signatory thereto (incorporated by reference to Exhibit 10.3 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 10.4† |

|

Form of Security Agreement to be entered into by and among the Company, EBI OpCo, Inc., EBI, Inc. and the other parties signatory thereto (incorporated by reference to Exhibit 10.4 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 10.5† |

|

Form of Patent Security Agreement, to be entered into by and among the Company, EBI OpCo, Inc., EBI, Inc. and the other parties signatory thereto (incorporated by reference to Exhibit 10.5 filed with the registrant’s Current Report on Form 8-K (File No. 001-38306) on October 24, 2023) |

| 99.1 |

|

Press Release, dated November 28, 2023 |

| 104 |

|

Cover Page Interactive

Data File (embedded within the Inline XBRL document) |

†

Schedules, exhibits and similar supporting attachments

to this exhibit are omitted pursuant to Item 601(b)(2) of Regulation S-K. We agree to furnish a supplemental copy of any omitted schedule

or similar attachment to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

November 28, 2023

| |

Ensysce

Biosciences, Inc. |

| |

|

|

| |

By: |

/s/

Lynn Kirkpatrick |

| |

Name: |

Dr. Lynn Kirkpatrick |

| |

Title: |

President and Chief Executive

Officer |

Exhibit

4.6(b)

FIRST

AMENDMENT TO

SENIOR SECURED CONVERTIBLE NOTE

This

First Amendment to Senior Secured Convertible Note (this “Amendment”) dated as of November 28, 2023 (the “Effective

Date”) is entered into by and between Ensysce Biosciences, Inc., a Delaware corporation (the “Company”),

and __________ (the “Purchaser”).

RECITALS

A. The

Purchaser and the Company entered into that certain Securities Purchase Agreement dated as of October 23, 2023 (the “Original

Agreement”), pursuant to which the Company agreed to sell and issue to each Purchaser, a senior secured convertible note (each,

a “Original Note” and collectively, the “Original Notes”), convertible into shares of the Company’s

common stock, par value $0.0001 per share (the “Common Stock”), in an aggregate principal amount of up to $1,700,000.

B.

Pursuant to the Original Agreement, the Company issued to the Purchaser the Original Note in an original principal amount of $______

on October 25, 2023 but incorrectly dated the Original Note as of October 24, 2023.

C.

The Purchaser and the Company desire to correct and amend the Original Note pursuant to and in accordance with the terms set forth

herein.

D. Capitalized

terms not otherwise defined herein shall have the meanings set forth in the Original Note and Original Agreement.

AGREEMENT

NOW

THEREFORE, in consideration of the foregoing, and the covenants and agreements herein contained, and for other good and valuable consideration,

the mutual receipt and legal sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby

agree as follows:

1.

Correction. The Original Issue Date set forth on the face of the Original Note is hereby changed from October 24, 2023 to October

25, 2023 and the four references in the Original Note and ANNEX A thereto are hereby changed from April 24, 2024 to April 25, 2024.

2.

Amendment. The definition of the Monthly

Redemption Date in Section 1 of the Original Note is hereby deleted in its entirety and replaced by the following:

“Monthly

Redemption Date” means (i) with respect to the first (1st) Monthly Redemption, January 25, 2024, and (ii) with respect

to all Monthly Redemptions subsequent to the first Monthly Redemption, February 25, 2024 and March 25, 2024, and terminating

upon the full redemption of this Note.

3.

Miscellaneous.

(a) Waivers

and Amendments. Any provision of this Amendment may be amended, waived or modified only upon the written consent of the Company and

the Purchaser.

(b) Entire

Agreement. This Amendment together with the Original Note constitutes the entire agreement of the Company and the Purchaser with

respect to the subject matter hereof and supersedes all prior agreements and undertakings, both written and oral, between the Company

and Purchaser with respect to the subject matter hereof. Except as amended by this Amendment, the Original Note shall continue in full

force and effect.

(c) Counterparts.

This Amendment may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will

constitute one and the same agreement. Facsimile copies of signed signature pages will be deemed binding originals.

[Remainder

of page intentionally left blank; signature page follows.]

IN

WITNESS WHEREOF, the parties have caused this Amendment to be duly executed and delivered by their proper and duly authorized officers

as of the date and year first written above.

| |

COMPANY: |

| |

|

|

| |

ENSYSCE

BIOSCIENCES, INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Lynn

Kirkpatrick |

| |

Title:

|

CEO |

Signature

Page to First Amendment to Original Note

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed and delivered by their proper and duly authorized officers

as of the date and year first written above.

Signature

Page to First Amendment to Original Note

Exhibit

99.1

Ensysce

Biosciences Announces Completion of $1.7 Million Convertible Note Financing

~

Additional Funding from Investors Validates Company’s Mission ~

SAN

DIEGO, CA, November 28, 2023 — Ensysce Biosciences, Inc. (“Ensysce” or the “Company”) (NASDAQ: ENSC),

a clinical-stage company applying transformative chemistry to improve prescription drug safety, announced today that it has completed

its previously announced private placement under a securities purchase agreement (the “SPA”) with investors (“Investors”)

for senior secured convertible notes (the “Notes”) and warrants exercisable for Ensysce common stock (the “Warrants”)

for an aggregate investment of $1.7 million. The second funding by the Investors of $1,333,333.33, prior to fees and offering expenses,

was dated as of November 28, 2023, with funds received in full on November 29, 2023.

Dr.

Lynn Kirkpatrick, CEO of Ensysce commented, “The completion of this financing is another validation of our highly unique

TAAP and MPAR® technologies. The funding will support the completion of a time of onset study and regulatory milestones for PF614,

our lead product. We are very pleased that we were able to secure this additional funding that will complement the Federal Government Grant awards we receive that are progressing our MPAR and Opioid Use

Disorder program. The funds from this second closing will continue

our clinical progress with PF614 and support

our mission to deliver superior pain relief options while also providing abuse and overdose protection for opioid products.”

As

previously reported, the Notes, with total gross proceeds of $1.7 million before fees and expenses, are convertible into shares of Ensysce

common stock (“Common Stock”) at a conversion price of $1.5675, the base price set at the time of execution of the SPA. The

Notes have a maturity date of 6 months from the applicable closing date, will be issued with an original discount of 8% and will bear

interest from date of issuance at 6% per annum. Monthly principal payments and interest in cash, or at the election of the purchaser

in whole or in part which may occur at any time, in common stock will begin approximately 90 days after each respective closing. The

Warrants issued at the initial closing provided for the right to purchase up to 1,255,697 shares of common stock at an exercise price

of $1.5675, the same as the conversion price, and are exercisable for five years following the date of issuance. The Warrants issued

at the second closing provided for the right to purchase up to 2,511,394 shares of common stock at the same exercise price, exercisable

for five years following the date of issuance. An initial $566,667 of funding was secured upon the initial closing and $1,133,333 of

additional funding was secured at the second closing.

The

conversion price for the Notes of $1.5675 and the exercise price for the Warrants of $1.5675 meet a minimum price requirement established

by The Nasdaq Stock Market in connection with a potential issuance of 20% or more of the common stock of a public company or 20% or more

of the voting power outstanding before the potential issuance. If the Company is not able to pay the principal and interest on the Notes

when due and the Company needs to issue more shares of Common Stock or on terms different than those provided by the transaction documents,

the Company might, in certain circumstances, be required to obtain stockholder approval before doing so.

This

press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale

of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful. This news release

is being issued pursuant to and in accordance with Rule 135c under the Securities Act of 1933, as amended.

About

Ensysce Biosciences

Ensysce

Biosciences is a clinical-stage company using its proprietary technology platforms to develop safer prescription drugs. Leveraging its

Trypsin-Activated Abuse Protection (TAAP) and Multi-Pill Abuse Resistance (MPAR®) platforms, the Company is developing unique, tamper-proof

treatment options for pain that minimize the risk of both drug abuse and overdose. Ensysce’s products are anticipated to provide

safer options to treat patients suffering from severe pain and assist in preventing deaths caused by medication abuse. The platforms

are covered by an extensive worldwide intellectual property portfolio for a wide array of prescription drug compositions. For more information,

please visit www.ensysce.com.

Forward-Looking

Statements

Statements

contained in this press release that are not purely historical may be deemed to be forward-looking statements for the purposes of the

safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. Without limiting

the foregoing, the use of words such as “may,” “intends,” “can,” “might,” “will,”

“expect,” “plan,” “possible,” “believe” and other similar expressions are intended to

identify forward-looking statements. The product candidates discussed are in clinic and not approved and there can be no assurance that

the clinical programs will be successful in demonstrating safety and/or efficacy, that Ensysce will not encounter problems or delays

in clinical development, or that any product candidate will ever receive regulatory approval or be successfully commercialized. All forward-looking

statements are based on estimates and assumptions by Ensysce’s management that, although Ensysce believes to be reasonable, are

inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially

from those that Ensysce expected. In addition, Ensysce’s business is subject to additional risks and uncertainties, including among

others, the initiation and conduct of preclinical studies and clinical trials; the timing and availability of data from preclinical studies

and clinical trials; expectations for regulatory submissions and approvals; potential safety concerns related to, or efficacy of, Ensysce’s

product candidates; the availability or commercial potential of product candidates; the ability of Ensysce to fund its continued operations,

including its planned clinical trials; the dilutive effect of stock issuances from our fundraising; and Ensysce’s and its partners’

ability to perform under their license, collaboration and manufacturing arrangements. These statements are also subject to a number of

material risks and uncertainties that are described in Ensysce’s most recent quarterly report on Form 10-Q and current reports

on Form 8-K, which are available, free of charge, at the SEC’s website at www.sec.gov. Any forward-looking statement speaks only

as of the date on which it was made. Ensysce undertakes no obligation to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise, except as required under applicable law.

Ensysce

Biosciences Company Contact:

Lynn

Kirkpatrick, Ph.D.

Chief

Executive Officer

(858)

263-4196

Ensysce

Biosciences Investor Relations Contact:

Shannon

Devine

MZ

North America

Main:

203-741-8811

ENSC@mzgroup.us

Source:

Ensysce Biosciences Inc.

v3.23.3

Cover

|

Nov. 29, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 29, 2023

|

| Entity File Number |

001-38306

|

| Entity Registrant Name |

Ensysce

Biosciences, Inc.

|

| Entity Central Index Key |

0001716947

|

| Entity Tax Identification Number |

82-2755287

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7946

Ivanhoe Avenue

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

La

Jolla

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92037

|

| City Area Code |

(858)

|

| Local Phone Number |

263-4196

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

ENSC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

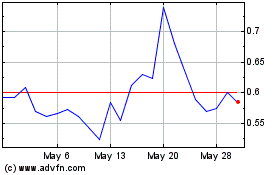

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Nov 2023 to Nov 2024