Form 8-A12B - Registration of securities [Section 12(b)]

23 November 2024 - 8:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE

SECURITIES EXCHANGE ACT OF 1934

EQUINIX, INC.

EQUINIX EUROPE 2 FINANCING

CORPORATION LLC

(Exact Name of Registrant as Specified in Its

Charter)

| Delaware |

|

77-0487526 |

| (State of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

One Lagoon Drive

Redwood City, California 94065

(Address of Principal Executive Offices) (Zip

Code)

Securities to be registered pursuant to Section 12(b) of

the Act:

Title of Each Class

to Be so Registered |

|

Name of Each Exchange on Which

Each Class Is to Be Registered |

| |

|

|

| 3.250% Senior Notes due 2031 |

|

The Nasdaq Stock Market LLC |

| 3.625% Senior Notes due 2034 |

|

The Nasdaq Stock Market LLC |

| |

|

|

If this form relates to the registration of a class of securities

pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), please check the following

box. x

If this form relates to the registration of a class of securities

pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), please check the following

box. ¨

If this form relates to the registration of a class of securities

concurrently with a Regulation A offering, check the following box. ¨

Securities Act registration statement or Regulation

A offering statement file number to which this form relates:

333-275203

333-275203-01

(If applicable)

Securities to be registered pursuant to Section 12(g) of

the Act:

None

(Title of Class)

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Equinix Europe 2 Financing Corporation LLC (the

“Issuer”), a Delaware limited liability company and an indirect, wholly-owned subsidiary of Equinix, Inc. (the “Guarantor”),

a Delaware corporation, together with the Guarantor, have filed with the Securities and Exchange Commission (the “Commission”)

pursuant to Rule 424(b) under the Securities Act of 1933, as amended, a prospectus supplement dated November 13, 2024

(the “Prospectus Supplement”) to a prospectus dated March 18, 2024 (the “Prospectus”) contained in the Issuer

and the Guarantor’s Post Effective Amendment No. 1 to the Registration Statement on Form S-3 (File No. 333-275203),

which Registration Statement was initially filed with the Commission on October 27, 2023, relating to the securities to be registered

hereunder.

The Issuer and the Guarantor incorporate by reference

the Prospectus and the Prospectus Supplement to the extent set forth below.

| |

Item 1. |

Description of Registrant’s Securities to Be Registered |

The information required by this item is incorporated

by reference to the information contained in the sections captioned “Description of Notes” and “Material U.S. Federal

Income Tax Considerations” in the Prospectus Supplement and “Description of Debt Securities” in the Prospectus.

Exhibit

Number |

|

Description |

| 4.1 |

|

Indenture

dated as of March 18, 2024, among Equinix Europe 2 Financing Corporation LLC, as issuer, Equinix, Inc. as guarantor, and

U.S. Bank Trust Company, National Associate as trustee (incorporated herein by reference to Exhibit 4.4 to the Post Effective

Amendment No. 1 to the Registration Statement on Form S-3 (File No. 333-275203) initially filed with the Commission

on October 27, 2023). |

| |

|

|

| 4.2 |

|

Third Supplemental Indenture, dated as of November 22, 2024, among Equinix Europe 2 Financing

Corporation LLC, as Issuer, Equinix, Inc, as guarantor, U.S. Bank Europe DAC, U.K. Branch, as paying agent, and U.S. Bank Trust

Company, National Association as registrar and trustee. |

| |

|

|

| 4.3 |

|

Fourth Supplemental Indenture, dated as of November 22, 2024, among Equinix Europe 2 Financing

Corporation LLC, as Issuer, Equinix, Inc, as guarantor, U.S. Bank Europe DAC, U.K. Branch, as paying agent, and U.S. Bank Trust

Company, National Association as registrar and trustee. |

| |

|

|

| 4.4 |

|

Form of 3.250% Senior Notes due 2031 (incorporated herein by reference to Exhibit 4.3 to

Equinix, Inc.’s Current Report on Form 8-K filed with the Commission on November 22, 2024). |

| |

|

|

| 4.5 |

|

Form of 3.625% Senior Notes due 2034 (incorporated herein by reference to Exhibit 4.5 to

Equinix, Inc.’s Current Report on Form 8-K filed with the Commission on November 22, 2024). |

SIGNATURE

Pursuant to the requirements of Section 12

of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the

undersigned, thereto duly authorized.

| |

Equinix, Inc. |

| |

|

| |

By: |

/s/ Keith D. Taylor |

| |

Name: |

Keith D. Taylor |

| |

Title: |

Chief Financial Officer |

| |

Equinix Europe 2 Financing Corporation LLC |

| |

|

| |

By: |

/s/ Keith D. Taylor |

| |

Name: |

Keith D. Taylor |

| |

Title: |

Authorized Signatory |

Date: November 22, 2024

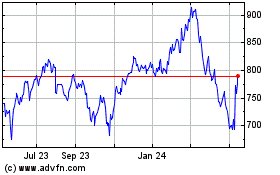

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Dec 2024 to Jan 2025

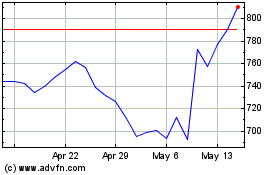

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Jan 2024 to Jan 2025