Everbridge Shareholders to Receive $35.00 Per

Share in Cash, an Increase of $6.40 Per Share Over Previously

Announced Transaction

Represents 62% Premium to Everbridge 90-Day

Volume-Weighted Average Share Price, as of February 2, 2024, the

Last Trading Day Prior to the Announcement of the Original

Transaction

Everbridge, Inc. (Nasdaq: EVBG) (“Everbridge”), a global leader

in critical event management and national public warning solutions,

and Thoma Bravo, a leading software investment firm, today

announced that they have amended and restated the previously

announced merger agreement, dated February 4, 2024. Under the terms

of the amended and restated agreement, Thoma Bravo has increased

the price at which it has agreed to acquire all outstanding shares

of Everbridge to $35.00 per share in cash, or $6.40 per share

higher the original transaction price.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240301229252/en/

Everbridge Enters into Amended Merger

Agreement with Thoma Bravo

The per share purchase price consideration values Everbridge at

approximately $1.8 billion and represents an approximately 62%

premium to the Everbridge 90-day volume-weighted average share

price as of February 2, 2024, the last trading day prior to the

announcement of the original merger agreement.

“We’re pleased to have negotiated an even higher price for our

shareholders,” said David Henshall, Chairman and Lead Independent

Director of the Everbridge Board of Directors. “The interest we

received as part of the go-shop process is a testament to the

exceptional company we’ve built, the significant value of our

products for organizations all over the world, and Everbridge’s

long-term growth potential.”

Transaction Terms

The original merger agreement with Thoma Bravo, dated February

4, 2024, included a “go-shop” period, which permitted the

Everbridge Board and its advisors to actively initiate and solicit

alternative acquisition proposals from certain third parties, as

described in the original merger agreement with Thoma Bravo. In

connection with the Company’s “go-shop” activities, a third party

proposed to acquire all outstanding shares of Everbridge at a

higher price than the original transaction price. After acquisition

proposals from such third party that the Everbridge Board of

Directors determined to be superior proposals, Everbridge and Thoma

Bravo entered into the amended and restated merger agreement

providing for the price of $35.00 per share, which is higher than

the prices offered by such third party in its proposals.

The transaction, which was approved by the Everbridge Board of

Directors, is expected to close in the second calendar quarter of

2024, subject to customary closing conditions, including approval

by Everbridge shareholders and the receipt of required regulatory

approvals. The transaction is not subject to a financing

condition.

Upon completion of the transaction, Everbridge common stock will

no longer be listed on any public stock exchange. The Company will

continue to operate under the Everbridge name and brand.

Advisors

Qatalyst Partners is serving as financial advisor and Cooley LLP

is serving as legal counsel to Everbridge. Kirkland & Ellis LLP

is serving as legal counsel to Thoma Bravo.

About Everbridge

Everbridge (Nasdaq: EVBG) empowers enterprises and government

organizations to anticipate, mitigate, respond to, and recover

stronger from critical events. In today’s unpredictable world,

resilient organizations minimize impact to people and operations,

absorb stress, and return to productivity faster when deploying

critical event management (CEM) technology. Everbridge digitizes

organizational resilience by combining intelligent automation with

the industry’s most comprehensive risk data to Keep People Safe and

Organizations Running™. For more information, visit

https://www.everbridge.com/, read the company blog, and follow on

LinkedIn. Everbridge… Empowering Resilience.

About Thoma Bravo

Thoma Bravo is one of the largest software investors in the

world, with approximately US$134 billion in assets under management

as of September 30, 2023. Through its private equity, growth equity

and credit strategies, the firm invests in growth-oriented,

innovative companies operating in the software and technology

sectors. Leveraging Thoma Bravo's deep sector knowledge and

strategic and operational expertise, the firm collaborates with its

portfolio companies to implement operating best practices and drive

growth initiatives. Over the past 20 years, the firm has acquired

or invested in more than 455 companies representing over US$255

billion in enterprise value (including control and non-control

investments). The firm has offices in Chicago, London, Miami, New

York and San Francisco. For more information, visit Thoma Bravo's

website at www.thomabravo.com.

Additional Information and Where to Find It

In connection with the proposed merger, Everbridge, Inc.

(“Everbridge”) intends to file relevant materials with the

Securities and Exchange Commission (the “SEC”), including a

preliminary and definitive proxy statement on Schedule 14A.

Following the filing of the definitive proxy statement (the “proxy

statement”) with the SEC, Everbridge will mail the proxy statement

and a proxy card to each stockholder entitled to vote at the

special meeting relating to the proposed merger. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION, STOCKHOLDERS OF EVERBRIDGE ARE URGED

TO CAREFULLY READ THE PROXY STATEMENT IN ITS ENTIRETY (INCLUDING

ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ANY OTHER DOCUMENTS

RELATING TO THE PROPOSED MERGER THAT WILL BE FILED WITH THE SEC OR

INCORPORATED BY REFERENCE THEREIN WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

MERGER. Investors and stockholders will be able to obtain copies of

the proxy statement (when available) and other documents filed by

Everbridge with the SEC, without charge, through the website

maintained by the SEC at https://www.sec.gov. Copies of the

documents filed with the SEC by Everbridge will be available free

of charge under the SEC Filings heading of the Investor Relations

section of Everbridge’s website ir.everbridge.com.

Participants in the Solicitation

Everbridge and its directors and certain of its executive

officers, consisting of David Benjamin, Richard D’Amore, Alison

Dean, Rohit Ghai, David Henshall, Kent Mathy, Simon Paris, Sharon

Rowlands, who are the non‑employee members of the Board of

Directors of Everbridge (the “Board”), and David Wagner, Chief

Executive Officer, President and a member of the Board of Directors

of Everbridge, and David Rockvam, Executive Vice President, Chief

Financial Officer and Treasurer, may be deemed to be participants

in the solicitation of proxies in respect of the proposed merger.

Information about its directors and certain of its executive

officers, including a description of their direct or indirect

interests, by security holdings or otherwise, can be found under

the captions “Security Ownership of Certain Beneficial Owners and

Management,” “Executive Compensation,” and “Director Compensation”

contained in the proxy statement for the Everbridge 2023 Annual

Meeting of Stockholders filed with the SEC on April 13, 2023 (the

“2023 Proxy Statement”) and under Item 5.02 in the current reports

on Form 8‑K filed with the SEC on December 20, 2022 and February 5,

2024. To the extent that Everbridge’s directors and executive

officers and their respective affiliates have acquired or disposed

of security holdings since the applicable “as of” date disclosed in

the 2023 Proxy Statement, such transactions have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Since the “as of” date in the 2023 Proxy Statement, (a)

each of Mr. Benjamin and Mr. Ghai received a grant of 5,747

restricted stock units of Everbridge (“RSUs”) that vested on

December 31, 2023 and a grant of 8,068 RSUs that will vest on May

25, 2024 provided that each such director continues to serve on the

Board at such date, in addition to any customary non‑equity annual

compensation paid to non‑employee directors, which consists of an

annual cash retainer of $40,000, plus an additional cash retainer

per year for committee membership, (b) Mr. D’Amore had 4,176 RSUs

that vested on May 31, 2023, acquired 11,000 shares of common stock

of Everbridge (“Common Stock”), and received a grant of 8,068 RSUs

that will vest on May 25, 2024 provided that he continues to serve

on the Board at such date, (c) each of Ms. Dean, Mr. Mathy and Ms.

Rowlands had 4,176 RSUs that vested on May 31, 2023 and received a

grant of 8,068 RSUs that will vest on May 25, 2024 provided that

each such director continues to serve on the Board at such date,

(d) Mr. Henshall had 8,331 RSUs that vested on January 31, 2023,

had 8,330 RSUs that vested on January 31, 2024, acquired 20,000

shares of Common Stock on May 30, 2023, and received a grant of

8,068 RSUs that will vest on May 25, 2024 provided that he

continues to serve on the Board at such date, (e) Mr. Paris had

1,700 RSUs that vested on February 28, 2023, had 4,176 RSUs that

vested on May 31, 2023, acquired 3,000 shares of Common Stock, and

received a grant of 8,068 RSUs that will vest on May 25, 2024

provided that he continues to serve on the Board at such date, (f)

Mr. Wagner had 12,500 RSUs that vested on October 31, 2023, 3,160

of which were withheld by Everbridge to satisfy tax withholding

obligations and had 12,500 RSUs that vested on January 31, 2024,

3,431 of which were withheld by Everbridge to satisfy tax

withholding obligations and (g) on March 7, 2024, Mr. Rockvam will

receive a grant of 115,000 RSUs that will vest over four years with

25% vesting after year one and quarterly thereafter and a grant of

115,000 performance share units of Everbridge that will vest based

on performance measures determined by the Board at the time of

grant, 55,000 of which will be forfeited for no consideration upon

the consummation of the proposed merger. In the proposed merger,

outstanding equity awards held by Everbridge’s non‑employee

directors will accelerate vesting prior to the consummation of the

proposed merger, and outstanding equity awards held by Everbridge’s

executive officers will be treated in accordance with their

respective equity award agreements and as described in the 2023

Proxy Statement under the caption “Executive

Compensation—Everbridge Executive Compensation Program—Potential

Payments upon Change in Control.” Stockholders may obtain

additional information regarding the interests of such participants

by reading the proxy statement and other relevant materials

regarding the proposed merger to be filed with the SEC or

incorporated by reference therein when they become available.

Investors should read the proxy statement carefully when it becomes

available before making any voting or investment decisions.

Forward-Looking Statements

This communication includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward‑looking

statements may be identified by the use of words such as

“continue,” “guidance,” “expect,” “outlook,” “project,” “believe”

or other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding the benefits of and timeline for closing the

proposed merger. These statements are based on various assumptions,

whether or not identified in this communication, and on the current

expectations of Everbridge management and are not predictions of

actual performance. These forward‑looking statements are provided

for illustrative purposes only and are not intended to serve as,

and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and may differ from assumptions. Many actual

events and circumstances are beyond the control of Everbridge.

These forward-looking statements are subject to a number of risks

and uncertainties, including the timing, receipt and terms and

conditions of any required governmental and regulatory approvals of

the proposed transaction that could delay the consummation of the

proposed transaction or cause the parties to abandon the proposed

transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into in connection with the proposed transaction;

the possibility that Everbridge stockholders may not approve the

proposed transaction; the risk that the parties to the merger

agreement may not be able to satisfy the conditions to the proposed

transaction in a timely manner or at all; risks related to

disruption of management time from ongoing business operations due

to the proposed transaction; the risk that any announcements

relating to the proposed transaction could have adverse effects on

the market price of the Common Stock; the risk of any unexpected

costs or expenses resulting from the proposed transaction; the risk

of any litigation relating to the proposed transaction; and the

risk that the proposed transaction and its announcement could have

an adverse effect on the ability of Everbridge to retain and hire

key personnel and to maintain relationships with customers,

vendors, partners, employees, stockholders and other business

relationships and on its operating results and business generally.

Further information on factors that could cause actual results to

differ materially from the results anticipated by the

forward-looking statements is included in the Everbridge Annual

Report on Form 10‑K for the fiscal year ended December 31, 2023

filed with the SEC on February 27, 2024, Quarterly Reports on Form

10‑Q, Current Reports on Form 8‑K and other filings made by

Everbridge from time to time with the SEC. These filings, when

available, are available on the investor relations section of the

Everbridge website at https://ir.everbridge.com or on the SEC’s

website at https://www.sec.gov. If any of these risks materialize

or any of these assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking

statements. There may be additional risks that Everbridge presently

does not know of or that Everbridge currently believes are

immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. The

forward-looking statements included in this communication are made

only as of the date hereof. Everbridge assumes no obligation and

does not intend to update these forward-looking statements, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240301229252/en/

Everbridge

Investors Nandan Amladi Investor Relations

nandan.amladi@everbridge.com (617) 665-7197

Media Jeff Young Media Relations

jeff.young@everbridge.com (781) 859-4116

Thoma Bravo

Megan Frank mfrank@thomabravo.com (212) 731-4778

Liz Micci / Abigail Farr / Akash Lodh FGS Global

ThomaBravo-US@fgsglobal.com (347) 675-2883 / (646) 957-2067 / (202)

758-4263

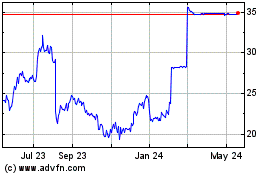

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Jan 2025 to Feb 2025

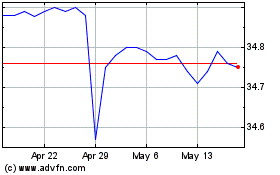

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Feb 2024 to Feb 2025