false000143735200014373522024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 09, 2024 |

Everbridge, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37874 |

26-2919312 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

25 Corporate Drive Suite 400 |

|

Burlington, Massachusetts |

|

01803 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (818) 230-9700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

EVBG |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Everbridge, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. The Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information included in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Everbridge, Inc. |

|

|

|

Dated: May 9, 2024 |

By: |

/s/ Noah F. Webster |

|

|

Noah F. Webster |

|

|

Chief Legal and Compliance Officer |

Exhibit 99.1

Everbridge Announces First Quarter 2024 Financial Results

BURLINGTON, Mass – May 9, 2024 – Everbridge, Inc. (Nasdaq: EVBG), the global leader in critical event management (CEM) and national public warning solutions, today announced its financial results for the first quarter ended March 31, 2024. Revenue for the first quarter was up 3% year-over-year to $111.4 million, and GAAP net loss was $(20.1) million, compared to $(14.6) million for the first quarter of 2023.

First Quarter 2024 Financial Highlights

•Total revenue was $111.4 million, an increase of 3% compared to $108.3 million for the first quarter of 2023. Revenue from subscription services was $105.3 million, an increase of 7% compared to $98.8 million for the first quarter of 2023. Revenue from professional services, software licenses and other was $6.1 million, a decrease of 36% compared to $9.5 million for the first quarter of 2023.

•GAAP operating loss was $(14.9) million, compared to $(15.4) million for the first quarter of 2023.

•Non-GAAP operating income was $8.2 million, compared to $10.1 million for the first quarter of 2023.

•GAAP net loss was $(20.1) million, compared to $(14.6) million for the first quarter of 2023. GAAP diluted net loss per share was $(0.49) based on 41.3 million diluted weighted average common shares outstanding, compared to $(0.36) for the first quarter of 2023, based on 40.3 million diluted weighted average common shares outstanding.

•Non-GAAP net income was $8.0 million, compared to $10.8 million for the first quarter of 2023. Non-GAAP diluted net income per share was $0.18, based on 43.8 million diluted weighted average common shares outstanding, compared to $0.25 for the first quarter of 2023, based on 43.8 million diluted weighted average common shares outstanding.

•Adjusted EBITDA was $13.7 million, compared to $15.9 million for the first quarter of 2023.

•Cash flow from operations was an inflow of $2.1 million, compared to $20.6 million for the first quarter of 2023.

•Adjusted for one-time cash payments related to our 2022 Strategic Realignment program, adjusted free cash flow was an inflow of $1.9 million, compared to $20.0 million for the first quarter of 2023.

•Annualized Recurring Revenue (ARR) was $416 million, and 26 CEM customers were added during the quarter.

•Deal metrics: 37 deals over $100,000; 6 deals over $500,000.

About Everbridge

Everbridge (Nasdaq: EVBG) empowers enterprises and government organizations to anticipate, mitigate, respond to, and recover stronger from critical events. In today’s unpredictable world, resilient organizations minimize impact to people and operations, absorb stress, and return to productivity faster when deploying critical event management (CEM) technology. Everbridge digitizes organizational resilience by combining intelligent automation with the industry’s most comprehensive risk data to Keep People Safe and Organizations Running™. For more information, visit https://www.everbridge.com/, read the company blog, and follow on LinkedIn. Everbridge… Empowering Resilience.

Key Performance Metric

Annualized Recurring Revenue (ARR) is defined as the expected recurring revenue in the next twelve months from active customer contracts, assuming no increases or reductions in the subscriptions from that cohort of customers. Investors should not place undue reliance on ARR as an indicator of future or expected results. Our presentation of this metric may differ from similarly titled metrics presented by other companies and therefore comparability may be limited.

Non-GAAP Financial Measures

This press release contains the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income/(loss), non-GAAP net income/(loss), non-GAAP net income/(loss) per share, EBITDA, adjusted EBITDA, free cash flow, adjusted free cash flow and adjusted EBITDA margin.

Non-GAAP operating income excludes amortization of acquired intangible assets, stock-based compensation and costs related to the 2022 Strategic Realignment. Non-GAAP net income excludes amortization of acquired intangible assets, stock-based compensation, costs related to the 2022 Strategic Realignment, accretion of interest on convertible senior notes and the tax impact of such adjustments. EBITDA represents net loss before interest income and interest expense, income tax expense and benefit and depreciation and amortization expense. Adjusted EBITDA represents EBITDA as further adjusted for stock-based compensation expense and costs related to the 2022 Strategic Realignment. Free cash flow represents cash provided by operating activities minus cash used for capital expenditures and capitalized software development costs. Adjusted free cash flow represents free cash flow as further adjusted for cash payments for the 2022 Strategic Realignment.

We believe that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Everbridge's financial condition and results of operations. We use these non-GAAP measures for financial, operational and budgetary decision-making purposes, to understand and evaluate our core operating performance and trends, and to generate future operating plans. We believe that these non-GAAP financial measures provide useful information regarding past financial performance and future prospects, and permit us to more thoroughly analyze key financial metrics used to make operational decisions. We believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial measures with other software companies, many of which present similar non-GAAP financial measures to investors.

We do not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company's financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. We urge investors to review the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures, which are included in this press release, and not to rely on any single financial measure to evaluate our business.

Cautionary Language Concerning Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made as of the date of this press release and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: our proposed acquisition by entities affiliated with Thoma Bravo, L.P. (“Thoma Bravo”); our expectation regarding the timing and completion of the proposed acquisition by entities affiliated with Thoma Bravo; the effect of recent changes in our senior management team on our business; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures, including our ability to remediate the material weakness in internal control over financial reporting in the anticipated timeframe, if at all; the ability of our products and services to perform as intended and meet our customers’ expectations; our ability to successfully integrate businesses and assets that we may acquire; our ability to attract new customers and retain and increase sales to existing customers; our ability to increase sales of our Mass Notification application and/or ability to increase sales of our other applications; developments in the market for targeted and contextually relevant critical communications or the associated regulatory environment; our estimates of market opportunity and forecasts of market growth may prove to be inaccurate; we have not been profitable on a consistent basis historically and may not achieve or maintain profitability in the future; the lengthy and unpredictable sales cycles for new customers; nature of our business exposes us to inherent liability risks; our ability to attract, integrate and retain qualified personnel; our ability to maintain successful relationships with our channel partners and technology partners; our ability to manage our growth effectively; our ability to respond to competitive pressures; potential liability related to privacy and security of personally identifiable information; our ability to protect our intellectual property rights, and the other risks detailed in our risk factors discussed in filings with the U.S. Securities and Exchange Commission (SEC), including but not limited to, our Annual Report on Form 10-K for the year ended December 31, 2023, which we filed with the SEC on February 27, 2024 and other subsequent filings with the SEC. The forward-looking statements included in this press release represent our views as of the date of this press release. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

All Everbridge products are trademarks of Everbridge, Inc. in the USA and other countries. All other product or company names mentioned are the property of their respective owners.

Consolidated Balance Sheets

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

121,432 |

|

|

$ |

122,440 |

|

Restricted cash |

|

2,097 |

|

|

|

2,120 |

|

Accounts receivable, net |

|

101,720 |

|

|

|

119,389 |

|

Prepaid expenses |

|

13,826 |

|

|

|

12,880 |

|

Deferred costs and other current assets |

|

31,365 |

|

|

|

36,604 |

|

Total current assets |

|

270,440 |

|

|

|

293,433 |

|

Property and equipment, net |

|

7,369 |

|

|

|

8,305 |

|

Capitalized software development costs, net |

|

31,334 |

|

|

|

31,630 |

|

Goodwill |

|

512,545 |

|

|

|

517,184 |

|

Intangible assets, net |

|

120,809 |

|

|

|

130,264 |

|

Restricted cash |

|

790 |

|

|

|

811 |

|

Prepaid expenses |

|

1,053 |

|

|

|

902 |

|

Deferred costs and other assets |

|

44,123 |

|

|

|

43,356 |

|

Total assets |

$ |

988,463 |

|

|

$ |

1,025,885 |

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

8,113 |

|

|

$ |

15,013 |

|

Accrued payroll and employee related liabilities |

|

30,987 |

|

|

|

32,824 |

|

Accrued expenses |

|

18,003 |

|

|

|

36,346 |

|

Deferred revenue |

|

248,511 |

|

|

|

242,789 |

|

Convertible senior notes, current |

|

63,201 |

|

|

|

63,110 |

|

Other current liabilities |

|

7,687 |

|

|

|

8,918 |

|

Total current liabilities |

|

376,502 |

|

|

|

399,000 |

|

Long-term liabilities: |

|

|

|

|

|

Deferred revenue, noncurrent |

|

5,627 |

|

|

|

6,429 |

|

Convertible senior notes, noncurrent |

|

296,989 |

|

|

|

296,561 |

|

Deferred tax liabilities |

|

4,882 |

|

|

|

4,318 |

|

Other long-term liabilities |

|

16,307 |

|

|

|

17,268 |

|

Total liabilities |

|

700,307 |

|

|

|

723,576 |

|

Stockholders' equity: |

|

|

|

|

|

Common stock |

|

42 |

|

|

|

41 |

|

Additional paid-in capital |

|

783,732 |

|

|

|

771,779 |

|

Accumulated deficit |

|

(469,497 |

) |

|

|

(449,429 |

) |

Accumulated other comprehensive loss |

|

(26,121 |

) |

|

|

(20,082 |

) |

Total stockholders' equity |

|

288,156 |

|

|

|

302,309 |

|

Total liabilities and stockholders' equity |

$ |

988,463 |

|

|

$ |

1,025,885 |

|

Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Revenue |

$ |

111,429 |

|

|

$ |

108,268 |

|

Cost of revenue |

|

32,444 |

|

|

|

31,981 |

|

Gross profit |

|

78,985 |

|

|

|

76,287 |

|

Gross margin |

|

70.88 |

% |

|

|

70.46 |

% |

Operating expenses: |

|

|

|

|

|

Sales and marketing |

|

37,118 |

|

|

|

42,188 |

|

Research and development |

|

22,848 |

|

|

|

25,004 |

|

General and administrative |

|

31,541 |

|

|

|

24,466 |

|

Restructuring |

|

2,344 |

|

|

|

21 |

|

Total operating expenses |

|

93,851 |

|

|

|

91,679 |

|

Operating loss |

|

(14,866 |

) |

|

|

(15,392 |

) |

Other income, net |

|

|

|

|

|

Interest and investment income |

|

1,084 |

|

|

|

1,737 |

|

Interest expense |

|

(539 |

) |

|

|

(769 |

) |

Other income (expense), net |

|

(396 |

) |

|

|

618 |

|

Total other income, net |

|

149 |

|

|

|

1,586 |

|

Loss before income taxes |

|

(14,717 |

) |

|

|

(13,806 |

) |

Provision for income taxes |

|

(5,351 |

) |

|

|

(842 |

) |

Net loss |

$ |

(20,068 |

) |

|

$ |

(14,648 |

) |

Net loss per share attributable to common stockholders: |

|

|

|

|

|

Basic |

$ |

(0.49 |

) |

|

$ |

(0.36 |

) |

Diluted |

$ |

(0.49 |

) |

|

$ |

(0.36 |

) |

Weighted-average common shares outstanding: |

|

|

|

|

|

Basic |

|

41,330,475 |

|

|

|

40,274,069 |

|

Diluted |

|

41,330,475 |

|

|

|

40,274,069 |

|

Other comprehensive income (loss): |

|

|

|

|

|

Foreign currency translation adjustment |

|

(6,039 |

) |

|

|

2,426 |

|

Total comprehensive loss |

$ |

(26,107 |

) |

|

$ |

(12,222 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense included in the above: |

|

(in thousands) |

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Cost of revenue |

$ |

1,287 |

|

|

$ |

1,655 |

|

Sales and marketing |

|

4,067 |

|

|

|

4,747 |

|

Research and development |

|

2,639 |

|

|

|

3,726 |

|

General and administrative |

|

3,419 |

|

|

|

3,321 |

|

Total stock-based compensation |

$ |

11,412 |

|

|

$ |

13,449 |

|

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

Net loss |

$ |

(20,068 |

) |

|

$ |

(14,648 |

) |

Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

14,447 |

|

|

|

14,774 |

|

Amortization of deferred costs |

|

4,860 |

|

|

|

4,514 |

|

Deferred income taxes |

|

(35 |

) |

|

|

(501 |

) |

Accretion of interest on convertible senior notes |

|

519 |

|

|

|

715 |

|

(Gain) loss on disposal of assets |

|

1 |

|

|

|

(352 |

) |

Provision for credit losses and sales reserve |

|

441 |

|

|

|

1,635 |

|

Stock-based compensation |

|

11,412 |

|

|

|

13,449 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

17,853 |

|

|

|

11,994 |

|

Prepaid expenses |

|

(1,097 |

) |

|

|

(2,465 |

) |

Deferred costs |

|

(4,621 |

) |

|

|

(5,909 |

) |

Other assets |

|

3,000 |

|

|

|

(597 |

) |

Accounts payable |

|

(6,539 |

) |

|

|

(1,732 |

) |

Accrued payroll and employee related liabilities |

|

(1,837 |

) |

|

|

(1,652 |

) |

Accrued expenses |

|

(18,343 |

) |

|

|

(797 |

) |

Deferred revenue |

|

4,316 |

|

|

|

3,589 |

|

Other liabilities |

|

(2,167 |

) |

|

|

(1,442 |

) |

Net cash provided by operating activities |

|

2,142 |

|

|

|

20,575 |

|

Cash flows from investing activities: |

|

|

|

|

|

Capital expenditures |

|

(247 |

) |

|

|

(575 |

) |

Proceeds from landlord reimbursement |

|

2,006 |

|

|

|

— |

|

Proceeds from sale of assets |

|

13 |

|

|

|

4,289 |

|

Additions to capitalized software development costs |

|

(3,958 |

) |

|

|

(4,112 |

) |

Net cash used in investing activities |

|

(2,186 |

) |

|

|

(398 |

) |

Cash flows from financing activities: |

|

|

|

|

|

Payments associated with shares withheld to settle employee tax withholding liability |

|

(2,164 |

) |

|

|

(1,866 |

) |

Proceeds from employee stock purchase plan |

|

1,853 |

|

|

|

2,546 |

|

Proceeds from stock option exercises |

|

53 |

|

|

|

1,263 |

|

Other |

|

(18 |

) |

|

|

(19 |

) |

Net cash provided by (used in) financing activities |

|

(276 |

) |

|

|

1,924 |

|

Effect of exchange rates on cash, cash equivalents and restricted cash |

|

(732 |

) |

|

|

63 |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

(1,052 |

) |

|

|

22,164 |

|

Cash, cash equivalents and restricted cash—beginning of period |

|

125,371 |

|

|

|

201,594 |

|

Cash, cash equivalents and restricted cash—end of period |

$ |

124,319 |

|

|

$ |

223,758 |

|

Reconciliation of GAAP measures to non-GAAP measures

(unaudited)

The following table reconciles our GAAP gross profit to non-GAAP gross profit (in thousands):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Gross profit |

$ |

78,985 |

|

|

$ |

76,287 |

|

Amortization of acquired intangibles |

|

1,521 |

|

|

|

2,385 |

|

Stock-based compensation |

|

1,287 |

|

|

|

1,655 |

|

2022 Strategic Realignment |

|

65 |

|

|

|

341 |

|

Non-GAAP gross profit |

$ |

81,858 |

|

|

$ |

80,668 |

|

The following table reconciles our GAAP gross margin to non-GAAP gross margin(1):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Gross margin |

|

70.9 |

% |

|

|

70.5 |

% |

Amortization of acquired intangibles margin |

|

1.4 |

% |

|

|

2.2 |

% |

Stock-based compensation margin |

|

1.2 |

% |

|

|

1.5 |

% |

2022 Strategic Realignment margin |

|

0.1 |

% |

|

|

0.3 |

% |

Non-GAAP gross margin |

|

73.5 |

% |

|

|

74.5 |

% |

(1) Columns may not add up due to rounding.

The following table reconciles our GAAP operating loss to non-GAAP operating income (in thousands):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Operating loss |

$ |

(14,866 |

) |

|

$ |

(15,392 |

) |

Amortization of acquired intangibles |

|

8,583 |

|

|

|

9,648 |

|

Stock-based compensation |

|

11,412 |

|

|

|

13,449 |

|

2022 Strategic Realignment |

|

3,083 |

|

|

|

2,405 |

|

Non-GAAP operating income |

$ |

8,212 |

|

|

$ |

10,110 |

|

The following table reconciles our GAAP net loss to non-GAAP net income:

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Net loss |

$ |

(20,068 |

) |

|

$ |

(14,648 |

) |

Amortization of acquired intangibles |

|

8,583 |

|

|

|

9,648 |

|

Stock-based compensation |

|

11,412 |

|

|

|

13,449 |

|

2022 Strategic Realignment |

|

3,083 |

|

|

|

2,404 |

|

Accretion of interest on convertible senior notes |

|

519 |

|

|

|

715 |

|

Income tax adjustments |

|

4,444 |

|

|

|

(737 |

) |

Non-GAAP net income |

$ |

7,973 |

|

|

$ |

10,831 |

|

Reconciliation of GAAP measures to non-GAAP measures (Continued)

(unaudited)

The following table reconciles our GAAP net loss per basic share to non-GAAP net income per basic share(1):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Net loss per basic share⁽ᵃ⁾ |

$ |

(0.49 |

) |

|

$ |

(0.36 |

) |

Amortization of acquired intangibles per basic share⁽ᵇ⁾ |

|

0.21 |

|

|

|

0.24 |

|

Stock-based compensation per basic share⁽ᵇ⁾ |

|

0.28 |

|

|

|

0.33 |

|

2022 Strategic Realignment per basic share⁽ᵇ⁾ |

|

0.07 |

|

|

|

0.06 |

|

Accretion of interest on convertible senior notes per basic share⁽ᵇ⁾ |

|

0.01 |

|

|

|

0.02 |

|

Income tax adjustments per basic share⁽ᵇ⁾ |

|

0.11 |

|

|

|

(0.02 |

) |

Non-GAAP net income per basic share⁽ᵇ⁾ |

$ |

0.19 |

|

|

$ |

0.27 |

|

(1) Amounts may not add up due to rounding.

The following table reconciles our GAAP net loss per diluted share to non-GAAP net income per diluted share(1):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Net loss per diluted share⁽ᵃ⁾ |

$ |

(0.49 |

) |

|

$ |

(0.36 |

) |

|

|

|

|

|

|

Amortization of acquired intangibles per diluted share⁽ᵇ⁾ |

|

0.20 |

|

|

|

0.22 |

|

Stock-based compensation per diluted share⁽ᵇ⁾ |

|

0.26 |

|

|

|

0.31 |

|

2022 Strategic Realignment per diluted share⁽ᵇ⁾ |

|

0.07 |

|

|

|

0.05 |

|

Accretion of interest on convertible senior notes per diluted share⁽ᵇ⁾ |

|

0.01 |

|

|

|

0.02 |

|

Income tax adjustments per diluted share⁽ᵇ⁾ |

|

0.10 |

|

|

|

(0.02 |

) |

Non-GAAP net income per diluted share⁽ᵇ⁾ |

$ |

0.18 |

|

|

$ |

0.25 |

|

(1) Amounts may not add up due to differences in GAAP and non-GAAP net income (loss) and diluted shares.

|

|

|

|

|

|

|

|

(a) GAAP weighted-average common shares outstanding: |

|

|

|

|

|

Basic |

|

41,330,475 |

|

|

|

40,274,069 |

|

Diluted |

|

41,330,475 |

|

|

|

40,274,069 |

|

(b) Non-GAAP weighted-average common shares outstanding: |

|

|

|

|

|

Basic |

|

41,330,475 |

|

|

|

40,274,069 |

|

Diluted |

|

43,792,612 |

|

|

|

43,767,021 |

|

GAAP diluted weighted-average shares include dilutive potential common shares related to stock-based compensation grants. Non-GAAP diluted weighted-average shares include dilutive potential common shares related to convertible notes and stock-based compensation grants.

Reconciliation of GAAP measures to non-GAAP measures (Continued)

(unaudited)

The following tables reconcile our GAAP net loss to EBITDA and adjusted EBITDA, net cash provided by operating activities to free cash flow and adjusted free cash flow and net loss margin to EBITDA margin and adjusted EBITDA margin (dollars in thousands):

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Net loss |

$ |

(20,068 |

) |

|

$ |

(14,648 |

) |

Interest and investment expense, net |

|

(545 |

) |

|

|

(968 |

) |

Provision for income taxes |

|

5,351 |

|

|

|

842 |

|

Depreciation and amortization |

|

14,447 |

|

|

|

14,774 |

|

EBITDA |

|

(815 |

) |

|

|

— |

|

Stock-based compensation |

|

11,412 |

|

|

|

13,449 |

|

2022 Strategic Realignment |

|

3,083 |

|

|

|

2,404 |

|

Adjusted EBITDA |

$ |

13,680 |

|

|

$ |

15,853 |

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

2,142 |

|

|

$ |

20,575 |

|

Capital expenditures |

|

(247 |

) |

|

|

(575 |

) |

Capitalized software development costs |

|

(3,958 |

) |

|

|

(4,112 |

) |

Free cash flow |

|

(2,063 |

) |

|

|

15,888 |

|

Cash payments for 2022 Strategic Realignment |

|

3,923 |

|

|

|

4,121 |

|

Adjusted free cash flow |

$ |

1,860 |

|

|

$ |

20,009 |

|

|

|

|

|

|

|

Net loss margin |

|

(18.0 |

)% |

|

|

(13.5 |

)% |

Interest and investment expense, net margin |

|

(0.5 |

)% |

|

|

(0.9 |

)% |

Provision for income taxes margin |

|

4.8 |

% |

|

|

0.8 |

% |

Depreciation and amortization margin |

|

13.0 |

% |

|

|

13.6 |

% |

EBITDA margin |

|

(0.7 |

)% |

|

|

— |

|

Stock-based compensation margin |

|

10.2 |

% |

|

|

12.4 |

% |

2022 Strategic Realignment margin |

|

2.8 |

% |

|

|

2.2 |

% |

Adjusted EBITDA margin |

|

12.3 |

% |

|

|

14.6 |

% |

(margin % columns may not add up due to rounding) |

|

|

|

|

|

Remaining Performance Obligations as of March 31, 2024

(in millions)

|

|

|

|

|

|

|

|

|

Remaining Performance Obligations |

|

|

Remaining Performance Obligations

Next Twelve Months |

|

Subscription and other contracts |

$ |

488 |

|

|

$ |

302 |

|

Professional services contracts |

|

10 |

|

|

|

9 |

|

Everbridge Contacts:

Investors:

Nandan Amladi

Investor Relations

nandan.amladi@everbridge.com

617-665-7197

Media:

Jeff Young

Media Relations

jeff.young@everbridge.com

781-859-4116

Source: Everbridge, Inc.

v3.24.1.u1

Document And Entity Information

|

May 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

Everbridge, Inc.

|

| Entity Central Index Key |

0001437352

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37874

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-2919312

|

| Entity Address, Address Line One |

25 Corporate Drive

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Burlington

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01803

|

| City Area Code |

(818)

|

| Local Phone Number |

230-9700

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

EVBG

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

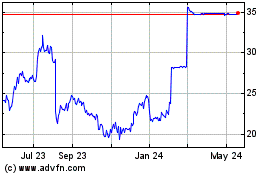

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Jan 2025 to Feb 2025

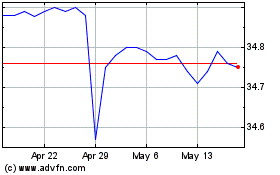

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Feb 2024 to Feb 2025