false

0001817004

0001817004

2024-08-14

2024-08-14

0001817004

dei:FormerAddressMember

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305

-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Promissory

Note dated August 14, 2024:

On

August 14, 2024, EzFill Holdings, Inc. (the “Company”) and NextNRG Holding Corp. (formerly Next Charging, LLC) (“Next”)

entered into a promissory note (the “August 14 Note”) for the sum of $165,000 (the “Loan”) to be used for the

Company’s working capital needs. The August 14 Note has an original issue discount (“OID”) equal to $15,000, which

is 10% of the aggregate original principal amount of the Loan. The unpaid principal balance of the August 14 Note has a fixed rate of

interest of 8% per annum for the first nine months, afterward, the August 14 Note will begin to accrue interest on the entire balance

at 18% per annum.

Unless

the August 14 Note is otherwise accelerated, or extended in accordance with the terms and conditions therein, the balance of the August

14 Note, along with accrued interest, will be due on October 14, 2024 (the “Maturity Date”). The Maturity Date will automatically

be extended for 2 month periods, unless Next sends 10 days written notice, prior to the end of any 2 month period, that it does not wish

to extend the August 14 Note, at which point the end of the then current 2 month period shall be the Maturity Date.

If

the Company defaults on the August 14 Note, the unpaid principal and interest sums, along with all other amounts payable, multiplied

by 150% will be immediately due. Next will have the right to convert all or any part of the outstanding and unpaid principal, interest,

penalties, and all other amounts under the August 14 Note into fully paid and non-assessable shares of the Company’s common stock.

The conversion price shall equal the greater of the average VWAP over the five (5) Trading Day period prior to the conversion date; or

$0.70 (the “Floor Price”). Notwithstanding the foregoing, the conversion price shall not exceed the closing price of the

Company’s Common Stock on the Nasdaq Capital Market on the date of the August 14 Note.

The

Company has agreed to issue 53,500 shares of its common stock to Next (the “Commitment Fee Shares”). The Commitment Fee Shares,

when issued, shall be deemed to be validly issued, fully paid, and non-assessable shares of the Company’s Common Stock. The Commitment

Fee Shares were deemed fully earned as of August 14, 2024.

The

Company and Next have agreed that the total cumulative number of common stock issued to Next under this Note, together with all other

transaction documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”), except that such

limitation will not apply following shareholder approval. If the Company is unable to obtain shareholder approval to issue common stock

to Next in excess of the Nasdaq 19.99% Cap, then any remaining outstanding balance of this August 14 Note must be repaid in cash at the

request of Next.

The

August 14 Note contains a protection for Next in the event the Company effectuates a split of its common stock. In the event of a stock

split, if the August 14 Note is issued and outstanding and has not been converted, then the number of shares and the price for any conversion

under the August 14 Note will be adjusted by the same ratios or multipliers of, any such subdivision, split, reverse split.

Michael

Farkas is the chief executive officer and the controlling shareholder of Next (the “CEO”). The CEO is also the beneficial

owner of approximately 27% of the Company’s issued and outstanding common stock. As previously reported on a Current Report on

Form 8-K that was filed with the Securities and Exchange Commission on August 16, 2023 and on November 8, 2023, the Company, the members

of Next (a limited liability company at the time of such filings) and the CEO (the managing member of Next at the time), as an individual

and also as the representative of the members of Next, entered into an Exchange Agreement (the “Exchange Agreement”), pursuant

to which the Company agreed to acquire from such members of Next 100% of the membership interests of Next in exchange for the issuance

by the Company to the members of Next of shares of common stock, par value $0.0001 per share, of the Company. Additionally and as previously

reported on a Current Report on Form 8-K that was filed with the Securities and Exchange Commission on June 14, 2024, a second amended

and restated exchange agreement to the Exchange Agreement was entered into between the Company, the shareholders of Next and the CEO

to reflect the conversion of Next Charging, LLC to NextNRG Holding Corp., a corporation organized in the State of Nevada (the “Second

Amended and Restated Exchange Agreement”). Additionally and as previously reported on a Current Report on Form 8-K that was filed

with the Securities and Exchange Commission on July 22, 2024, the first amendment to the second amended and restated exchange agreement

was entered into between the Company and the CEO as the representative of the shareholders of Next. The first amendment provides that,

in the event that the Company at any time prior to the Closing undertakes any forward split of the Common Stock, or any reverse split

of the Common Stock, any references to numbers of shares of Common Stock as set forth in the Second Amended and Restated Exchange Agreement

shall be deemed automatically updated and amended at such time to equitably account therefor. Further, in the event the Company undertakes

any forward split of the Common Stock or any reverse split of the Common Stock following the Closing, any references to any of numbers

of Exchange Shares as set forth in the Second Amended and Restated Exchange Agreement shall be deemed similarly automatically adjusted

to the extent still applicable, including, without limitation to the numbers of Exchange Shares vesting or being forfeited pursuant to

the terms and conditions of the Second Amended and Restated Exchange Agreement. Upon occurrence of the Closing, Next will become a wholly-owned

subsidiary of the Company. As of the date of this Current Report on Form 8-K, the Closing has not occurred.

The

information set forth above is qualified in its entirety by reference to the August 14 Note, which is incorporated herein by reference

and attached hereto as Exhibit 10.1.

Item

2.02 Results of Operations and Financial Condition

On

August 15, 2024, EzFill Holdings, Inc. (the “Company”), issued a press release announcing its financial results for the quarter

ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

This

information is being furnished in this report and shall not be deemed to be “filed” for any purpose, including for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

August 15, 2024

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name: |

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

PROMISSORY

NOTE

FOR

VALUE RECEIVED, EZFILL HOLDINGS, INC., a Delaware corporation having an address of 67 NW 183rd St., Aventura, Florida

33169 (the “Borrower”), hereby promises to pay to the order of, the NextNRG Holding Corp. a Nevada corporation having

an address of 407 Lincoln Road, Ste 9F, Miami Beach, Fl. 33139 (the “Lender”), at Lender’s offices, or such

other place as Lender shall designate in writing from time to time, the principal sum of $165,000.00 (the “Loan”),

in US Dollars, together with interest thereon as hereinafter provided.

1.

ORIGINAL ISSUE DISCOUNT. The Borrower agrees that the funding of the Loan shall be made by the Lender with original issue

discount in an amount equal to 10% of the aggregate original principal amount of the Loan (i.e. $15,000).

2.

INTEREST RATE. The unpaid principal balance of this Promissory Note (the “Note”) from day to day outstanding

shall bear a fixed rate of interest equal to 8% per annum for the first nine months and after the first nine months will begin to accrue

interest on the entire balance at 18% per annum.

3.

PAYMENT OF PRINCIPAL AND INTEREST. Unless this Note is otherwise accelerated, or extended in accordance with the terms

and conditions hereof, the entire outstanding principal balance of this Note plus all accrued interest shall be due and payable in full

on October 14, 2024 (the “Maturity Date”). The Maturity Date shall automatically be extended for 2 month periods,

unless Lender sends 10 days written notice, prior to end of any two month period, that it does not wish to extend the note at which point

the end of the then current two month period shall be the Maturity Date.

4.

APPLICATION OF PAYMENTS. Except as otherwise specified herein, each payment or prepayment, if any, made under this Note

shall be applied to pay late charges, accrued and unpaid interest, principal, and any other fees, costs and expenses which Borrower is

obligated to pay under this Note.

5.

TENDER OF PAYMENT. Payment on this Note is payable on or before 5:00 p.m. on the due date thereof, at the office of Lender

specified above and shall be credited on the date the funds become available, in Lender’s account, in lawful money of the United

States.

6.

REPRESENTATIONS AND WARRANTIES. Borrower represents and warrants to Lender as follows:

6.2.

Execution of Loan Documents. This Note has been duly executed and delivered by Borrower. Execution, delivery and performance

of this Note will not: (i) violate any contracts previously entered into by Borrower, provision of law, order of any court, agency or

other instrumentality of government, or any provision of any indenture, agreement or other instrument to which he is a party or by which

he is bound; (ii) result in the creation or imposition of any lien, charge or encumbrance of any nature; and (iii) require any authorization,

consent, approval, license, exemption of, or filing or registration with, any court or governmental authority.

6.3.

Obligations of Borrower. This Note is a legal, valid and binding obligation of Borrower, enforceable against him in accordance

with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization or other laws or equitable principles relating

to or affecting the enforcement of creditors’ rights generally.

6.4.

Litigation. There is no action, suit or proceeding at law or in equity or by or before any governmental authority, agency

or other instrumentality now pending or, to the knowledge of Borrower, threatened against or affecting Borrower or any of its properties

or rights which, if adversely determined, would materially impair or affect: (i) Borrower’s right to carry on its business substantially

as now conducted (and as now contemplated); (ii) its financial condition; or (iii) its capacity to consummate and perform its obligations

under this Note.

6.5.

No Defaults. Borrower is not in default in the performance, observance or fulfillment of any of the obligations, covenants

or conditions contained herein or in any material agreement or instrument to which he is a party or by which he is bound.

6.6.

No Untrue Statements. No document, certificate or statement furnished to Lender by or on behalf of Borrower contains any

untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein and

therein not misleading. Borrower acknowledges that all such statements, representations and warranties shall be deemed to have been relied

upon by Lender as an inducement to make the Loan to Borrower.

6.7.

Documentary and Intangible Taxes. Borrower shall be liable for all documentary stamp and intangible taxes assessed at the

closing of the Loan or from time to time during the life of the Loan.

6.8.

The loan funds shall be used solely for Borrower’s working capital needs.

7.

EVENTS OF DEFAULT. Each of the following shall constitute an event of default hereunder (an “Event of Default”):

(a) the failure of Borrower to pay any amount of principal or interest hereunder with three (3) business days from when it becomes due

and payable; (b) Borrower becoming insolvent or declaring bankruptcy; (c) the discovery that any of the Borrower representations were

untrue; or (d) the occurrence of any other default in any material term, covenant or condition hereunder, and the continuance of such

breach for a period of ten (10) days after written notice thereof shall have been given to Borrower. Borrower shall promptly notify Lender

of the occurrence of any default, Event of Default, adverse litigation or material adverse change in its financial condition.

If

an Event of Default occurs all sums of Principal and Interest and all other amounts payable hereunder multiplied by 150% the then remaining

unpaid hereon shall be immediately due and payable.

8.

CONVERSION. The Lender shall have the right to convert all or any part of the outstanding and unpaid principal, interest,

penalties, and all other amounts under this Note into fully paid and non-assessable shares of Common Stock.

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the five (5) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender. Notwithstanding anything to the contrary set forth herein, the Conversion Price shall not exceed the

closing price of EzFill’s common stock on the Nasdaq on the date of this Note.

9.

COMMITMENT SHARES. It is agreed that the Company shall issue 53,500 shares of Common Stock to Lender (the “Commitment

Fee Shares”). The Commitment Fee Shares, when issued, shall be deemed to be validly issued, fully paid, and non-assessable shares

of the Company’s Common Stock. The Commitment Fee Shares shall be deemed fully earned as of the date hereof.

10.

REMEDIES. If an Event of Default exists, Lender may exercise any right, power or remedy permitted by law or as set forth

herein, including, without limitation, the right to declare the entire unpaid principal amount hereof and all interest accrued hereon,

to be, and such principal, interest and other sums shall thereupon become, immediately due and payable.

11.

MISCELLANEOUS.

11.2.

Disclosure of Financial Information. Lender is hereby authorized to disclose any financial or other information about Borrower

to any regulatory body or agency having jurisdiction over Lender and to any present, future or prospective participant or successor in

interest in any loan or other financial accommodation made by Lender to Borrower, so long as there is a mandatory requirement to provide

such disclosure. The information provided may include, without limitation, amounts, terms, balances, payment history, return item history

and any financial or other information about Borrower.

11.3.

Integration. This Note constitutes the sole agreement of the parties with respect to the transaction contemplated hereby

and supersede all oral negotiations and prior writings with respect thereto.

11.4.

Borrower’s Obligations Absolute. The obligations of Borrower under this Note shall be absolute and unconditional

and shall remain in full force and effect without regard to, and shall not be released, suspended, discharged, terminated or otherwise

affected by, any circumstance or occurrence whatsoever, including, without limitation:

11.4.1.

any renewal, extension, amendment or modification of, or addition or supplement to or deletion from, this Note, or any other instrument

or agreement referred to therein, or any assignment or transfer of any thereof;

11.4.2.

any waiver, consent, extension, indulgence or other action or inaction under or in respect of any such agreement or instrument or this

Note;

11.4.3.

any furnishing of any additional security to the Borrower or its assignee or any acceptance thereof or any release of any security by

the Lender or its assignee; or

11.4.4.

any limitation on any party’s liability or obligations under any such instrument or agreement or any invalidity or unenforceability,

in whole or in part, of any such instrument or agreement or any term thereof.

11.5.

No Implied Waiver. Lender shall not be deemed to have modified or waived any of its rights or remedies hereunder unless

such modification or waiver is in writing and signed by Lender, and then only to the extent specifically set forth therein. A waiver

in one event shall not be construed as continuing or as a waiver of or bar to such right or remedy in a subsequent event. After any acceleration

of, or the entry of any judgment on, this Note, the acceptance by Lender of any payments by or on behalf of Borrower on account of the

indebtedness evidenced by this Note shall not cure or be deemed to cure any Event of Default or reinstate or be deemed to reinstate the

terms of this Note absent an express written agreement duly executed by Lender and Borrower.

11.6.

No Usurious Amounts. Notwithstanding anything herein to the contrary, it is the intent of the parties that Borrower shall

not be obligated to pay interest hereunder at a rate which is in excess of the maximum rate permitted by law (the “Maximum Rate”).

If by the terms of this Note, Borrower is at any time required to pay interest at a rate in excess of the Maximum Rate, the rate of interest

under this Note shall be deemed to be immediately reduced to the Maximum Rate and the portion of all prior interest payments in excess

of the Maximum Rate shall be applied to and shall be deemed to have been payments in reduction of the outstanding principal balance,

unless Borrower shall notify Lender, in writing, that Borrower elects to have such excess sum returned to it forthwith. Borrower agrees

that in determining whether or not any interest payable under this Note exceeds the Maximum Rate, any non-principal payment, including,

without limitation, late charges, shall be deemed to the extent permitted by law to be an expense, fee or premium rather than interest.

11.7.

Partial Invalidity. The invalidity or unenforceability of any one or more provisions of this Note shall not render any

other provision invalid or unenforceable. In lieu of any invalid or unenforceable provision, there shall be automatically added hereto

a valid and enforceable provision as similar in terms to such invalid or unenforceable provision as may be possible.

11.8.

Binding Effect. The covenants, conditions, waivers, releases and agreements contained in this Note shall bind, and the

benefits thereof shall inure to, the parties hereto and their respective heirs, executors, administrators, successors and assigns; provided,

however, that this Note cannot be assigned by Borrower without the prior written consent of Lender, and any such assignment or attempted

assignment by Borrower shall be void and of no effect with respect to Lender.

11.9.

Modifications. This Note may not be supplemented, extended, modified or terminated except by an agreement in writing signed

by the party against whom enforcement of any such waiver, change, modification or discharge is sought.

11.10.

Sales or Participations. Lender may, from time to time, sell or assign, in whole or in part, or grant participations in,

the Loan, this Note and/or the obligations evidenced thereby. The holder of any such sale, assignment or participation, if the applicable

agreement between Lender and such holder so provides, shall be: (a) entitled to all of the rights, obligations and benefits of Lender;

and (b) deemed to hold and may exercise the rights of setoff or banker’s lien with respect to any and all obligations of such holder

to Borrower, in each case as fully as though Borrower were directly indebted to such holder. Lender may in its discretion give notice

to Borrower of such sale, assignment or participation; however, the failure to give such notice shall not affect any of Lender’s

or such holder’s rights hereunder.

11.11.

Jurisdiction; etc. Borrower hereby consents that any action or proceeding against him be commenced and maintained in any

court in Miami-Dade County Florida and Borrower agrees that the courts in Miami-Dade County Florida shall have jurisdiction with respect

to the subject matter hereof and the person of Borrower. Borrower agrees not to assert any defense to any action or proceeding initiated

by Lender based upon improper venue or inconvenient forum.

11.12.

Notices. All notices from the Borrower to Lender and Lender to Borrower required or permitted by an provision of this Note

shall be in writing and sent by registered or certified mail or nationally recognized overnight delivery service and addressed to the

address set forth above.

Notice

given as hereinabove provided shall be deemed given on the date of its deposit in the United States Mail and, unless sooner actually

received, shall be deemed received by the party to whom it is address on the third (3rd) calendar day following the date on

which said notice is deposited in the mail, or if a courier system is used, on the date of delivery of the notice. The parties may add,

deleted, or alter any address to which notice is to be provided by providing written notice of such change pursuant to the terms of this

section.

11.13.

Governing Law. This Note shall be governed by and construed in accordance with the substantive laws of the State of Florida

without regard to conflict of laws principles.

11.14.

Waiver of Jury Trial. BORROWER AND LENDER AGREE THAT, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY SUIT, ACTION OR

PROCEEDING, WHETHER CLAIM OR COUNTERCLAIM, BROUGHT BY LENDER OR BORROWER, ON OR WITH RESPECT TO THIS NOTE OR ANY OTHER LOAN DOCUMENT

EXECUTED IN CONNECTION HEREWITH OR THE DEALINGS OF THE PARTIES WITH RESPECT HERETO OR THERETO, SHALL BE TRIED ONLY BY A COURT AND NOT

BY A JURY. LENDER AND BORROWER EACH HEREBY KNOWINGLY, VOLUNTARILY, INTENTIONALLY AND INTELLIGENTLY AND WITH THE ADVICE OF THEIR RESPECTIVE

COUNSEL, WAIVE, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO A TRIAL BY JURY IN ANY SUCH SUIT, ACTION OR PROCEEDING. FURTHER,

BORROWER WAIVES ANY RIGHT IT MAY HAVE TO CLAIM OR RECOVER, IN ANY SUCH SUIT, ACTION OR PROCEEDING, ANY SPECIAL, EXEMPLARY, PUNITIVE,

CONSEQUENTIAL OR OTHER DAMAGES OTHER THAN, OR IN ADDITION TO, ACTUAL DAMAGES. BORROWER ACKNOWLEDGES AND AGREES THAT THIS SECTION IS A

SPECIFIC AND MATERIAL ASPECT OF THIS NOTE AND THAT LENDER WOULD NOT EXTEND CREDIT TO BORROWER IF THE WAIVERS SET FORTH IN THIS SECTION

WERE NOT A PART OF THIS NOTE.

11.15.

Adjustment Due to Stock Split by Borrower. If, at any time when this Note is issued and outstanding and prior to conversion of

all of the Notes Borrower shall: (i) subdivides outstanding shares of its Common Stock into a larger number of shares, or (ii) combines

(including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the number

of shares and the price for any conversion under this Note shall be adjusted in alignment with, in accordance with, and by the same ratios

or multipliers of, any such subdivision, split, reverse split set forth in items (i) and (ii) of this subsection.

Borrower,

intending to be legally bound, has duly executed and delivered this Note as of the day and year first above written.

| BORROWER: |

|

| EzFill

Holdings, Inc. |

|

| |

|

|

| By:

|

/s/

Yehuda Levy |

|

| Name:

|

Yehuda Levy |

|

| Title:

|

CEO |

|

Exhibit 99.1

EzFill Announces

2024 Second Quarter Financial Results

--

Revenue Increased 21% Year Over Year to Approximately $7.4 Million From $6.1 Million --

--

Gross Profit Increased 14% From The Prior Year Period --

--

Gallons Delivered Approximately 1.84 Million, Up 16% From The Prior Year Period –

--

40 New Commercial Accounts Added in Quarter --

--

Loss Per Share Improves 6% from $(1.78) to $(1.67) --

MIAMI,

FL, August 15, 2024 – EzFill Holdings, Inc. (“EzFill” or the “Company”) (NASDAQ: EZFL), a pioneer and

emerging leader in the mobile fueling industry, announced today its financial results for the three-month period ended June 30, 2024

(“2Q24” or “second quarter 2024”).

2Q

24 Highlights (in US$, except gallons delivered)

| | |

Q2

2024 | |

Q2

2023 |

| Financial

Highlights | |

| |

|

| Revenue | |

| 7,398,278 | | |

| 6,130,661 | |

| Net

loss | |

| (3,361,233 | ) | |

| (2,468,811 | ) |

| Adjusted

EBITDA* | |

| (1,090,456 | ) | |

| (1,839,535 | ) |

| Operating

Highlights | |

| | | |

| | |

| Total

Gallons Delivered | |

| 1,837,580 | | |

| 1,583,320 | |

| | |

| | | |

| | |

| *

See end of this press release for reconciliation to US GAAP | |

| | | |

| | |

Commenting

on the second quarter results, Interim CEO Yehuda Levy stated, “We are proud to report a strong quarter of growth in Q2, driven

by our team’s pursuit of excellence and our strategic initiatives. Our focus on customer-centric solutions and operational efficiency

has yielded impressive results, and we are excited about the opportunities ahead. As we continue to expand our reach and enhance our

offerings, we remain committed to delivering exceptional value and driving sustainable growth. Additionally, for the second year, we

have successfully completed fueling services for the Formula 1 Crypto.com Miami Grand Prix.”

Second Quarter

2024 Financial Results

During

the second quarter of 2024, the Company reported revenue of $7.4 million, up from $6.1 million in the prior year period, a 21% increase,

primarily due to a 16% increase in gallons delivered. Total gallons delivered in the second quarter of 2024 were 1,837,580 compared to

1,583,320 in the prior year period, reflecting new customers in existing and newly developed markets. Average fuel margin per gallon

was $0.60 for the quarter, which was the same in the prior year period.

Cost

of sales was $6.8 million for the second quarter of 2024 compared to $5.6 million for the prior year period. The increase from the prior

year reflects the increase in sales as well as the hiring of additional drivers, primarily in new markets. Our gross profit improved

year over year due to higher fuel revenue as well as increased delivery fees and driver efficiency.

Operating

expenses, excluding depreciation and amortization, were $1.8 million for the second quarter of 2024, compared to $2.3 million in the

prior year period. The decrease was primarily due to decreases in payroll, stock compensation, marketing and public company expenses

as we continue to achieve efficiencies in our operations.

Depreciation

and amortization increased to $0.28 million in the second quarter of 2024 from $0.26 million in the prior year period.

Interest

expense increased to $1.9 million in the second quarter of 2024 from $0.01 million in the prior period due to increased borrowing from

related parties.

The

net loss in the second quarter of 2024 was $(3.4) million, compared to $(2.5) million in the prior year. Loss per share improved in the

quarter to $(1.67) from $(1.78) in the prior year period.

Adjusted

EBITDA loss in the second quarter of 2024 was $(1.1) million as compared to Adjusted EBITDA loss of $(1.8) million in the second quarter

of 2023, an improvement of approx. 41%. The improvement in adjusted EBITDA reflects both the improved margin and the operating cost efficiencies.

Balance

Sheet

At

June 30, 2024, the Company had a cash position of $0.3 million, compared with $0.2 million at year end 2023. The Company had $9.8 million

of long-term debt as of the quarter end.

About

EzFill

EzFill

is a leader in the fast-growing mobile fuel industry, with the largest market share in its home state of Florida. Its mission is to disrupt

the gas station fueling model by providing consumers and businesses with the convenience, safety, and touch-free benefits of on-demand

fueling services brought directly to their locations. For commercial and specialty customers, at-site delivery during downtimes enables

operators to begin their daily operations with fully fueled vehicles. For more information, visit www.ezfl.com.

With

the number of gas stations in the U.S. continuing to decline, corporate giants such as Shell, Exxon, GM, Bridgestone, Enterprise, and

Mitsubishi have recognized the increasing shift in consumer behavior and are investing in the fast growing on-demand mobile fueling industry,

in companies such as Booster and Yoshi. As the only company to provide fuel delivery in three verticals – consumer, commercial,

and specialty including marine and construction equipment, we believe EzFill is well positioned to capitalize on the growing demand for

convenient and cost-efficient mobile fueling options.

Forward

Looking Statements

This

press release contains “forward-looking statements” Forward-looking statements reflect our current view about future events.

When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate

to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained

in this press release relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They

are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying

on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the

forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect

our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other

providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability

to complete capital raising transactions; and other factors relating to our industry, our operations and results of operations. Actual

results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Factors or events that could

cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee

future results, levels of activity, performance or achievements. The Company assumes no obligation to update any forward-looking statements

in order to reflect any event or circumstance that may arise after the date of this release except as may be required under applicable

securities law.

For further

information, please contact:

Investor Contact

TraDigital IR

John McNamara

john@tradigitalir.com

Media Contact

Telx, Inc.

Paula Luna

Paula@Telxcomputers.com

Note Regarding

Use of Non-GAAP Financial Measures

To

supplement our condensed consolidated financial statements, which are prepared in accordance with generally accepted accounting principles

in the United States (GAAP), we use non-GAAP measures. Adjusted EBITDA is a non-GAAP financial measure which we use in our financial

performance analyses. This measure should not be considered a substitute for GAAP-basis measures, nor should it be viewed as a substitute

for operating results determined in accordance with GAAP. We believe that the presentation of Adjusted EBITDA, a non-GAAP financial measure

that excludes the impact of net interest expense, taxes, depreciation, amortization and stock compensation expense, provides useful supplemental

information that is essential to a proper understanding of our financial results. Non-GAAP measures are not formally defined by GAAP,

and other entities may use calculation methods that differ from ours for the purposes of calculating Adjusted EBITDA. As a complement

to GAAP financial measures, we believe that Adjusted EBITDA assists investors who follow the practice of some investment analysts who

adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability.

The

following is a reconciliation of net loss to the non-GAAP financial measure referred to as Adjusted EBITDA for the three months ended

June 30, 2024 and 2023:

| | |

Three

Months Ended June

30, |

| | |

2024 | |

2023 |

| Net

loss | |

$ | (3,361,233 | ) | |

$ | (2,468,811 | ) |

| Interest

expense | |

| 1,902,409 | | |

| 12,819 | |

| Depreciation

and amortization | |

| 264,368 | | |

| 277,608 | |

| Stock

compensation | |

| 104,000 | | |

| 338,849 | |

| Adjusted

EBITDA | |

$ | (1,090,456 | ) | |

$ | (1,839,535 | ) |

| | |

| | | |

| | |

| Gallons

delivered | |

| 1,837,580 | | |

| 1,583,320 | |

| Average fuel margin

per gallon | |

$ | 0.60 | | |

$ | 0.60 | |

EzFill

Holdings, Inc. and Subsidiary

Consolidated

Statements of Operations and Comprehensive Loss

(Unaudited)

| | |

For

the Three Months Ended June 30, |

| | |

2024 | |

2023 |

| | |

| |

|

| Sales

- net | |

$ | 7,398,278 | | |

$ | 6,130,661 | |

| | |

| | | |

| | |

| Costs

and expenses | |

| | | |

| | |

| Cost of sales | |

| 6,847,450 | | |

| 5,646,291 | |

| General

and administrative expenses | |

| 1,805,734 | | |

| 2,369,026 | |

| Depreciation

and amortization | |

| 264,368 | | |

| 277,608 | |

| Total

costs and expenses | |

| 8,917,552 | | |

| 8,292,925 | |

| | |

| | | |

| | |

| Loss

from operations | |

| (1,519,274 | ) | |

| (2,162,264 | ) |

| | |

| | | |

| | |

| Other

income (expense) | |

| | | |

| | |

| Interest

income | |

| - | | |

| 14,461 | |

| Other

income | |

| 60,450 | | |

| (308,189 | ) |

| Interest

expense | |

| (1,902,409 | ) | |

| (12,819 | ) |

| Total

other income (expense) - net | |

| (1,841,959 | ) | |

| (306,547 | ) |

| | |

| | | |

| | |

| Net

loss | |

$ | (3,361,233 | ) | |

$ | (2,468,811 | ) |

| | |

| | | |

| | |

| Loss

per share - basic and diluted | |

$ | (1.67 | ) | |

$ | (1.78 | ) |

| | |

| | | |

| | |

| Weighted

average number of shares - basic and diluted | |

| 2,007,608 | | |

| 1,387,796 | |

| | |

| | | |

| | |

| Comprehensive

loss: | |

| | | |

| | |

| Net

loss | |

$ | (3,361,233 | ) | |

$ | (2,468,811 | ) |

| Change

in fair value of debt securities | |

| - | | |

| - | |

| Total

comprehensive loss: | |

$ | (3,361,233 | ) | |

$ | (2,468,811 | ) |

EzFill

Holdings, Inc. and Subsidiary

Consolidated

Balance Sheets

| | |

June

30, 2024 | |

December

31, 2023 |

| | |

| (Unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current

Assets | |

| | | |

| | |

| Cash | |

$ | 306,811 | | |

$ | 226,985 | |

| Accounts

receivable - net | |

| 1,655,171 | | |

| 1,192,340 | |

| Inventory | |

| 103,490 | | |

| 134,057 | |

| Due

from related party | |

| 17,150 | | |

| - | |

| Prepaids

and other | |

| 199,848 | | |

| 220,909 | |

| Total

Current Assets | |

| 2,282,470 | | |

| 1,774,291 | |

| | |

| | | |

| | |

| Property

and equipment - net | |

| 2,780,964 | | |

| 3,310,187 | |

| | |

| | | |

| | |

| Operating

lease - right-of-use asset | |

| 180,886 | | |

| 297,394 | |

| | |

| | | |

| | |

| Operating

lease - right-of-use asset - related party | |

| 249,402 | | |

| 286,397 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Deposits | |

| 49,063 | | |

| 49,063 | |

| | |

| | | |

| | |

| Total

Assets | |

$ | 5,542,785 | | |

$ | 5,717,332 | |

| | |

| | | |

| | |

| Liabilities

and Stockholders’ Deficit | |

| | | |

| | |

| | |

| | | |

| | |

| Current

Liabilities | |

| | | |

| | |

| Accounts

payable and accrued expenses | |

$ | 1,196,301 | | |

$ | 845,275 | |

| Accounts

payable and accrued expenses - related parties | |

| 235,428 | | |

| 72,428 | |

| | |

| | | |

| | |

| Notes

payable - net | |

| 606,746 | | |

| 946,228 | |

| Notes

payable - related parties - net | |

| 7,515,713 | | |

| 4,802,115 | |

| | |

| | | |

| | |

| Operating

lease liability | |

| 202,002 | | |

| 246,880 | |

| Operating

lease liability - related party | |

| 75,147 | | |

| 72,034 | |

| | |

| | | |

| | |

| Total

Current Liabilities | |

| 9,831,337 | | |

| 6,984,960 | |

| | |

| | | |

| | |

| Long

Term Liabilities | |

| | | |

| | |

| Notes

payable - net | |

| 367,130 | | |

| 353,490 | |

| Operating

lease liability | |

| - | | |

| 69,128 | |

| Operating

lease liability - related party | |

| 177,768 | | |

| 215,960 | |

| | |

| | | |

| | |

| Total

Long Term Liabilities | |

| 544,898 | | |

| 638,578 | |

| | |

| | | |

| | |

| Total

Liabilities | |

| 10,376,235 | | |

| 7,623,538 | |

| | |

| | | |

| | |

| Commitments

and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’

Deficit | |

| | | |

| | |

| Preferred

stock - $0.0001 par value; 5,000,000 shares authorized none issued and outstanding, respectively | |

| - | | |

| - | |

| Common

stock - $0.0001 par value, 500,000,000 shares authorized 2,151,902 and 1,806,612 shares issued and outstanding, respectively | |

| 216 | | |

| 181 | |

| Common

stock issuable (242,000 and 104,000 shares, respectively) | |

| 24 | | |

| 10 | |

| Additional

paid-in capital | |

| 45,743,715 | | |

| 43,410,653 | |

| Accumulated

deficit | |

| (50,577,405 | ) | |

| (45,317,050 | ) |

| Total

Stockholders’ Deficit | |

| (4,833,450 | ) | |

| (1,906,206 | ) |

| | |

| | | |

| | |

| Total

Liabilities and Stockholders’ Deficit | |

$ | 5,542,785 | | |

$ | 5,717,332 | |

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity File Number |

001-40809

|

| Entity Registrant Name |

EZFILL

HOLDINGS, INC.

|

| Entity Central Index Key |

0001817004

|

| Entity Tax Identification Number |

84-4260623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

67

NW 183rd Street

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33169

|

| City Area Code |

305

|

| Local Phone Number |

791-1169

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

EZFL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

2999

NE 191st Street

|

| Entity Address, Address Line Two |

Ste 500

|

| Entity Address, City or Town |

Aventura

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33180

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

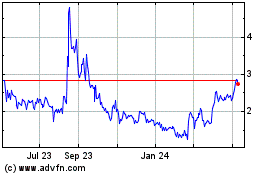

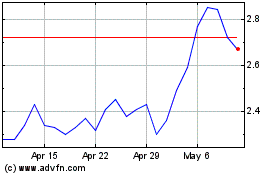

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Oct 2024 to Nov 2024

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Nov 2023 to Nov 2024