Diamondback Stockholders,

This letter is meant to be a supplement to our

earnings release and is being furnished to the Securities and

Exchange Commission (SEC) and released to our stockholders

simultaneously with our earnings release. Please see the

information regarding forward-looking statements and non-GAAP

financial information included at the end of this letter.

2024: Year in Review 2024 was

arguably the most transformational year in the Company’s history.

In February, we announced the $26 billion merger with Endeavor

Energy, creating the must own Permian Pure Play. The merger not

only made Diamondback bigger, with a combined ~722,000 net acres in

the core of the Midland Basin, but better, giving Diamondback the

ability to bring its industry leading operational structure onto a

world class asset with differentiated inventory quality and

duration. The deal closed on September 10th, and since then the

combined Diamondback team has seamlessly integrated, sharing best

practices and immediately delivering on the operational synergies

we highlighted to the market at deal announcement.

Even considering the potential challenges that

come with a large integration, our team was able to remain focused

and execute each quarter. In 2024, our daily average production was

598 MBOE/d (56% oil) with capital expenditures of $2.9 billion. We

generated $6.4 billion of net cash provided by operating activities

and $4.0 billion of Adjusted Free Cash Flow of which

$2.3 billion, or approximately 57%, was returned to

stockholders through our stable and growing base dividend, variable

dividends and buyback program. We repurchased nearly $1 billion

worth of stock in 2024 as our buyback program allowed us to

effectively buy during periods of market weakness and be an anchor

order in the secondary offering completed last September.

Operational UpdateOver the past

year, the team has seen a step change in efficiency improvements in

the field. We pushed well costs lower every quarter last year, and

today we are announcing a new Midland Basin well cost range of $555

- $605 per foot, down approximately $45 per foot (over 7%) year

over year. This is a testament to our drilling, completions and

production groups who continue to strive to be the best at what

they do, day in and day out.

On the drilling side, our use of clear fluids

combined with an improved downhole assembly has allowed us to

consistently achieve record drilling times. We drilled over 1.6

million lateral feet in the fourth quarter and are now averaging

approximately 7 days from spud to target depth on our average

Midland Basin 13,000’ lateral. We set a basin record in the fourth

quarter by drilling 20,386 total feet (vertical section, curve and

lateral) in one bit run.

Our completions teams continue to utilize

SimulFrac fleets for nearly all of our completions, which speed up

cycle times and reduce ancillary rental days. We are running four

electric SimulFrac fleets today and expect to average five

completion crews this year. Each crew can now complete

approximately 100 wells per year at an average of over 3,700

lateral feet per day, up from 80 wells and ~3,000 lateral feet per

day at this time last year. These electric fleets have enabled us

to realize meaningful value through higher uptimes and fuel cost

savings.

Since closing the Endeavor merger, we have also

started to see the benefits of some un-modeled synergies. We expect

a new standardized facility design, comprised of best practices

from Diamondback and Endeavor, to save us ~10% versus our prior

design. We are also seeing improved efficiencies and cycle times in

our drillout process, courtesy of the legacy Endeavor team. Lastly,

we are starting to see the benefit of size and scale in our

procurement process, with an estimated per well savings of 2% - 3%.

We believe we will continue to capture synergies, particularly on

the production side of our business, through shared learning as the

integration process continues.

Fourth Quarter PerformanceFor

the quarter, Diamondback produced 475.9 MBO/d (883.4 MBOE/d), above

the high end of the guidance range of 470 - 475 MBO/d (840 - 850

MBOE/d). Well performance continued to impress with strong results

in our Sale and Robertson Ranch areas and on the recently acquired

TRP acreage in Upton County. Capital expenditures were $933

million, below the low end of our guidance range of $950 million to

$1.05 billion. This beat was primarily driven by Midland Basin well

costs continuing to move lower, settling below our stated fourth

quarter $600 per lateral foot estimate.

We generated $2.3 billion of net cash provided

by operating activities and $1.4 billion of Adjusted Free Cash Flow

of which approximately $694 million, or approximately 51%, was

delivered to stockholders through our base dividend and buyback

program. We leaned into buybacks in the fourth quarter as we felt

our share price was below the intrinsic value of our business,

particularly during the volatility witnessed in December. We have

continued to buy back shares in January and February, and through

last Friday had repurchased 1,254,600 of shares at a weighted

average price of $167.42.

This quarter, we announced an 11% increase to

the base dividend, moving the dividend from $0.90 per share to

$1.00 per share per quarter ($4.00 per share annually). As we

continue to lower costs and develop our highest quality inventory,

our capital efficiency improves and lowers our corporate break even

(the dollar per barrel of oil needed for us to maintain our current

production levels and protect our dividend). Today, we are

confident we can protect the increased dividend and our base level

of activity below $40 a barrel at our current cost structure.

Drop Down AcquisitionIn

January, we announced a significant mineral and override drop down

of legacy Endeavor assets to our subsidiary, Viper Energy, Inc. in

a transaction valued at approximately $4.45 billion. Diamondback

will receive $1 billion in cash and 69.6 million units of Viper’s

operating subsidiary. The cash proceeds will be used to pay down

near-term debt and the units received will push Diamondback’s

ownership in Viper back above 50%, increasing Diamondback’s

exposure to Viper’s differentiated growth profile and robust

minerals position. We view Viper as a one-of-a-kind mineral

company, with an exciting trajectory that includes unique insight

into the Diamondback drill-bit. We believe in the long term

distribution growth potential at Viper, and our pro forma position

is worth approximately $7.5 billion assuming Friday’s stock

price.

Double Eagle AcquisitionLast

week, we announced a unique transaction with Double Eagle IV. We

agreed to purchase the northern portion of their acreage position

for approximately $4.1 billion. Consideration mix is made up of

approximately 6.9 million shares of Diamondback common stock

and $3 billion of cash.

We felt that this asset was the most attractive

remaining position in our backyard, public or private. The Double

Eagle team did an impressive job putting together undrilled units

in the highest returning parts of the Basin, and the roughly 400

core locations we expect to acquire immediately slot into our

near-term drilling profile. The acreage is also adjacent to our

existing position and we expect additional synergies from over 20

lateral length extensions and infrastructure sharing. We also

entered into a partnership to accelerate development on the

southernmost acreage we acquired from Endeavor, which is expected

to add significantly to Free Cash Flow in 2026 at no cost to

Diamondback.

Through this transaction, we continue to

high-grade our inventory base in the most productive parts of the

Midland Basin, maximize near-term Free Cash Flow generation and

extend inventory duration. While we recognize this deal was done

shortly after closing the Endeavor merger, we don’t often control

deal timing, and we prepare our organization to always “be ready”

when an opportunity arises. That said, the opportunity set is

shrinking, particularly for remaining quality private opportunities

in the Basin. As we have proven time and again, we expect to

seamlessly integrate this asset and execute flawlessly. We are

positioning Diamondback to have the best long-term capital

efficiency in the Permian Basin through a combination of inventory

quality, duration and execution cost structure.

2025 Guidance: Maximizing Capital

EfficiencyIn 2025, we have again chosen capital efficiency

and Free Cash Flow generation over volume growth for our capital

plan. This is a decision we have consistently made over the last

four years, and it has been consistently rewarded by the market and

applauded by our stockholders, who own the Company. The output of

this year's plan is the most capital efficient drilling program in

the Company’s history.

We measure our capital efficiency using oil

barrels produced divided by every dollar of capital spent. When we

announced the Endeavor transaction a year ago, we expected to be

able to produce approximately 470 - 480 MBO/d with a capital budget

of approximately $4.1 - $4.4 billion in 2025, which equated to

approximately 40.8 MBO per million dollars of capex spend. Today,

we are announcing a 2025 capital plan that generates 485 - 498

MBO/d with a capital budget of approximately $3.8 - $4.2 billion,

or approximately 44.8 MBO per million dollars of capex spend.

This ~10% improvement in capital efficiency is

the direct result of applying the lowest cost structure in the

Basin on top of our differentiated asset base. We plan to drill

approximately 460 wells and complete approximately 575 wells this

year, continuing to draw down on the DUC backlog we acquired from

Endeavor, TRP and Double Eagle. At this pace, we are confident we

can maintain this level of capital efficiency for nearly a decade,

once again highlighting Diamondback’s differentiated inventory

quality.

Balance SheetAt year-end we had

approximately $13.2 billion of gross debt and $13.0 billion of net

debt on a consolidated basis. We ended the year with ~$2.6 billion

of liquidity at Diamondback, with an undrawn credit facility. This

equated to a consolidated fourth quarter leverage ratio of

approximately 1.2x.

As we stated previously, we expect to fund the

$3 billion cash portion of the Double Eagle transaction

through a combination of cash on hand, borrowings under the

Company’s credit facility and/or proceeds from term loans and

senior notes offerings.

This increase in our total debt will be

partially offset by $1 billion of cash received from Viper upon the

anticipated closing of the drop-down acquisition in the second

quarter. In addition, we have committed to at least

$1.5 billion of near-term asset sales, which we expect to

include sales of our equity method investments, Endeavor’s water

infrastructure and non-operated assets.

We pride ourselves on our balance sheet strength

and continue to reiterate our intent to reduce net debt to $10

billion and maintain long-term leverage of $6 billion to $8

billion. We expect to achieve this de-leveraging naturally through

robust Free Cash Flow generation, dedicating approximately 50% of

Free Cash Flow to debt paydown, with acceleration from proceeds

from non-core asset sales as noted above.

Leadership TransitionOn

Thursday last week, we announced our leadership transition plan

where I will move from CEO to Executive Chairman effective as of

the Company’s 2025 Annual Meeting. At that time, Kaes Van’t Hof

will assume the CEO role and join the Board of Directors. This is

the culmination of a thorough succession planning process and Kaes

has my full support, as well as support from the Board of Directors

in taking on his new role.

I will remain close to the Company in my new

role as Executive Chairman as well as my future role on the Board

of Directors. While this is not my final stockholder letter, I

would like to say that representing the employees of Diamondback as

CEO over the last 13 years has been an incredible privilege. I

always believed in the growth opportunity for Diamondback, even

when we were a small cap oil producer that no one had ever heard

of. The success of this Company since the IPO in 2012 has never

been about any individual, but rather the collective efforts of an

extremely talented employee base with a strong culture based on

trust and a well-defined strategy.

Closing2024 was an incredible

year for Diamondback. We are uniquely positioned to succeed for the

long term, and continue to focus, day in and day out, on making our

company better. I am so proud of our team and the work they have

put in over the past 13 years to turn Diamondback into what it is

today.

Thank you for your ongoing support and interest

in Diamondback Energy.

Travis D. SticeChairman of the Board and Chief

Executive Officer

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Forward-Looking Statements:

This letter contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended, which involve risks, uncertainties, and assumptions.

All statements, other than statements of historical fact, including

statements regarding future performance; business strategy; future

operations (including drilling plans and capital plans); estimates

and projections of revenues, losses, costs, expenses, returns, cash

flow, and financial position; reserve estimates and its ability to

replace or increase reserves; anticipated benefits or other effects

of strategic transactions (including the recently completed

Endeavor merger and other acquisitions or divestitures); the

expected amount and timing of synergies from the Endeavor merger;

and plans and objectives of management (including plans for future

cash flow from operations and for executing environmental

strategies) are forward-looking statements. When used in this

letter, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: changes

in supply and demand levels for oil, natural gas, and natural gas

liquids, and the resulting impact on the price for those

commodities; the impact of public health crises, including epidemic

or pandemic diseases and any related company or government policies

or actions; actions taken by the members of OPEC and Russia

affecting the production and pricing of oil, as well as other

domestic and global political, economic, or diplomatic

developments, including any impact of the ongoing war in Ukraine

and the Israel-Hamas war on the global energy markets and

geopolitical stability; instability in the financial markets;

concerns over a potential economic slowdown or recession;

inflationary pressures; higher interest rates and their impact on

the cost of capital; regional supply and demand factors, including

delays, curtailment delays or interruptions of production, or

governmental orders, rules or regulations that impose production

limits; federal and state legislative and regulatory initiatives

relating to hydraulic fracturing, including the effect of existing

and future laws and governmental regulations; physical and

transition risks relating to climate change; those risks described

in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with

the SEC on February 22, 2024, and those risks disclosed in its

subsequent filings on Forms 10-Q and 8-K, which can be obtained

free of charge on the SEC’s website at http://www.sec.gov and

Diamondback’s website at www.diamondbackenergy.com/investors.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this letter

or, if earlier, as of the date they were made. Diamondback does not

intend to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

Non-GAAP Financial Measures

This letter includes financial information not

prepared in conformity with generally accepted accounting

principles (GAAP), including free cash flow. The non-GAAP

information should be considered by the reader in addition to, but

not instead of, financial information prepared in accordance with

GAAP. A reconciliation of the differences between these non-GAAP

financial measures and the most directly comparable GAAP financial

measures can be found in Diamondback's quarterly results posted on

Diamondback's website at www.diamondbackenergy.com/investors/.

Furthermore, this letter includes or references certain

forward-looking, non-GAAP financial measures. Because Diamondback

provides these measures on a forward-looking basis, it cannot

reliably or reasonably predict certain of the necessary components

of the most directly comparable forward-looking GAAP financial

measures, such as future impairments and future changes in working

capital. Accordingly, Diamondback is unable to present a

quantitative reconciliation of such forward-looking, non-GAAP

financial measures to the respective most directly comparable

forward-looking GAAP financial measures. Diamondback believes that

these forward-looking, non-GAAP measures may be a useful tool for

the investment community in comparing Diamondback's forecasted

financial performance to the forecasted financial performance of

other companies in the industry.

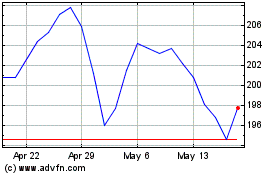

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Feb 2024 to Feb 2025