Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 February 2025 - 8:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-33768

AIX INC.

27/F, Pearl River Tower

No.15 West Zhujiang Road

Tianhe District, Guangzhou 510623

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

AIX Inc. |

| |

|

| |

By: |

/s/ Wei Chen |

| |

Name: |

Wei Chen |

| |

Title: |

Chief Executive Officer |

Date: February 25, 2025

Exhibit Index

2

Exhibit 99.1

|

|

IR-412 |

AIX Announces Receipt of Minimum Bid Price Notice

from Nasdaq

GUANGZHOU, China, February 25, 2025 (GLOBE NEWSWIRE)

-- AIX Inc. (NASDAQ: AIFU) (“AIX” or the “Company”), today announced that it has received a written notification

from the staff of the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”), dated February 24, 2025,

indicating that for the last 30 consecutive business days, the closing bid price for the Company’s American depositary shares (the

“ADSs”) was below the minimum bid price of US$1.00 per share requirement set forth in Nasdaq Listing Rules 5450(a)(1). The

Nasdaq notification letter has no current effect on the listing or trading of the Company’s securities on the Nasdaq Global Market.

Pursuant to the Nasdaq Listing Rules 5810(c)(3)(A),

the Company is provided with a compliance period of 180 calendar days, or until August 25, 2025, to regain compliance under the Nasdaq

Listing Rules. If at any time during the 180-day compliance period, the closing bid price of the Company’s ADSs is US$1.00 per share

or higher for a minimum of ten consecutive business days, the Nasdaq will provide the Company written confirmation of compliance and the

matter will be closed.

In the event that the Company does not regain

compliance by August 25, 2025, subject to the determination by the staff of Nasdaq, the Company may be eligible for an additional 180-day

compliance period if it meets the continued listing requirement for market value of publicly held shares and all other initial listing

standards for the Nasdaq Capital Market, with the exception of the minimum bid price requirement. In this case, the Company will need

to provide written notice of its intention to cure the deficiency during the second compliance period, including by effecting a reverse

stock split, if necessary.

The Nasdaq notification letter will have no effect

on the Company’s business operations, and the Company will take all reasonable measures to regain compliance.

|

|

IR-412 |

About AIX Inc.

AIX, established in 1998, is a leading intelligent

technology-driven independent financial services provider in China. It provides 400 million middle-class families with insurance protection,

wealth management, and value-added services and provides independent financial advisors and various insurance/financial sales organizations

with technical support and comprehensive solutions. Through AI-driven insights and cutting-edge digital tools, AIX has successfully established

itself as a leader in intelligent transformation within the financial services industry.

Forward-looking Statements

This press release contains statements of a forward-looking

nature. These statements, including the statements relating to the Company’s future financial and operating results, are made under

the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking

statements by terminology such as “will”, “expects”, “believes”, “anticipates”, “intends”,

“estimates” and similar statements. These forward-looking statements involve known and unknown risks and uncertainties and

are based on current expectations, assumptions, estimates and projections about AIX Inc. and the industry. Potential risks and uncertainties

include, but are not limited to, those relating to its ability to attract and retain productive agents, especially entrepreneurial agents,

its ability to maintain existing and develop new business relationships with insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the Chinese insurance industry, its ability to compete effectively against

its competitors, quarterly variations in its operating results caused by factors beyond its control including macroeconomic conditions

in China. Except as otherwise indicated, all information provided in this press release speaks as of the date hereof, and AIX Inc. undertakes

no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations,

except as may be required by law. Although AIX Inc. believes that the expectations expressed in these forward-looking statements are reasonable,

it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially

from the anticipated results. Further information regarding risks and uncertainties faced by AIX Inc. is included in AIX Inc.’s

filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

For more information, please contact:

AIX Inc.

Investor Relations

Tel: +86 (20) 8388-3191

Email: ir@aifugroup.com

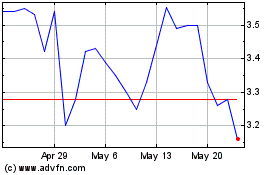

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Feb 2025 to Mar 2025

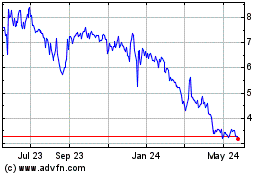

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Mar 2024 to Mar 2025