Avenue Therapeutics Reports Third Quarter 2024 Financial Results and Recent Corporate Highlights

15 November 2024 - 8:05AM

Avenue Therapeutics, Inc. (Nasdaq: ATXI) (“Avenue” or the

“Company”), a specialty pharmaceutical company focused on the

development and commercialization of therapies for the treatment of

neurologic diseases, today reported financial results and recent

corporate highlights for the third quarter ended September 30,

2024.

“We have generated considerable momentum this

past quarter in advancing our pipeline of innovative treatments for

neurologic diseases,” said Alexandra MacLean, M.D., Chief Executive

Officer of Avenue. “AJ201 is a potential best-in-class asset that

would bring a disease-modifying therapeutic option to patients with

significant unmet medical need in Kennedy’s Disease. Since dosing

the last patient in the study in May, we continue to work

diligently to move the study forward. We are looking forward to

sharing topline clinical data in the coming months and building

upon our progress of delivering impactful therapies to patients

suffering from neurologic diseases.”

Recent Corporate

Highlights:

AJ201 (Nrf1 and Nrf2 activator,

androgen receptor degradation enhancer for SBMA)

- In May 2024, Avenue announced the

last patient visit was complete in the Phase 1b/2a clinical trial

of AJ201 for the treatment of spinal and bulbar muscular atrophy

(SBMA), marking the final clinical milestone ahead of the

anticipated topline data announcement around year-end 2024. The

12-week, multicenter, randomized, double-blind Phase 1b/2a clinical

trial of AJ201 enrolled 25 patients randomly assigned to AJ201 (600

mg/day) or placebo. The primary endpoint of the study is to assess

safety and tolerability of AJ201 in subjects with clinically and

genetically defined SBMA. Secondary endpoints include

pharmacokinetic and pharmacodynamic data measuring change from

baseline in mutant AR protein levels in skeletal muscle and changes

from baseline in expression of Nrf2-activated genes in skeletal

muscle. Exploratory objectives of the study include changes in the

fat and muscle composition as seen on MRI scans. These endpoints

are believed to be biomarkers indicating likelihood for longer term

clinical improvement. Further details about this study can be found

at ClinicalTrials.gov (Identifier: NCT05517603).

BAER-101 (GABAA α2/3

positive allosteric modulator)

- Subject to the receipt of

additional financing, Avenue plans to initiate a Phase 2a clinical

trial of BAER-101 in patients with focal epilepsy and other seizure

disorders. Preclinical mouse models have demonstrated BAER-101 as a

therapeutic option with the ability to fully suppress seizure

activity, with the effect being fast in onset and stable throughout

the duration of testing.

IV Tramadol

- Avenue has reached final agreement

with the U.S. Food and Drug Administration (“FDA”) on the safety

study protocol and statistical analysis approach for the Phase 3

study of intravenous (“IV”) tramadol, which is being developed for

the treatment of acute post-operative pain in a medically

supervised setting. The proposed study will randomize approximately

300 post bunionectomy patients to IV tramadol or IV morphine for

pain relief administered during a 48-hour post-operative period.

Patients will have access to IV hydromorphone, a Schedule II

opioid, for rescue of breakthrough pain. Avenue aims to initiate

the Phase 3 safety study pending additional financing or a

partnership. The Company believes that the study can be completed

and submitted to the FDA within 12 months of the study’s

initiation.

Financial Results:

- Cash

Position: As of September 30, 2024, cash and cash

equivalents totaled $2.6 million, compared to $4.9 million at June

30, 2024 and $1.8 million at December 31, 2023, a decrease of $2.3

million compared to the prior quarter and an increase of $0.8

million year-to-date.

- R&D

Expenses: Research and development expenses for the

third quarter of 2024 were $2.3 million, compared to $0.9 million

for the third quarter of 2023.

- G&A

Expenses: General and administrative expenses for the

third quarter of 2024 were $0.8 million, compared to $1.2 million

for the third quarter of 2023.

- Net Loss: Net

loss attributable to common stockholders for the third quarter of

2024 was $(3.1) million, or $(1.92) per share, compared to net

income of $0.5 million, or $4.86 per share, for the third quarter

of 2023.

About Avenue TherapeuticsAvenue

Therapeutics, Inc. (Nasdaq: ATXI) is a specialty pharmaceutical

company focused on the development and commercialization of

therapies for the treatment of neurologic diseases. It is currently

developing three assets including AJ201, a first-in-class asset for

spinal and bulbar muscular atrophy, BAER-101, an oral small

molecule selective GABAA α2, α3 receptor positive allosteric

modulator for CNS diseases, and IV tramadol, which is in Phase 3

clinical development for the management of acute postoperative pain

in adults in a medically supervised healthcare setting. Avenue is

headquartered in Miami, FL and was founded by Fortress Biotech,

Inc. (Nasdaq: FBIO). For more information, visit

www.avenuetx.com.

Forward-Looking StatementsThis

press release contains predictive or “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than statements of current or

historical fact contained in this press release, including

statements that express our intentions, plans, objectives, beliefs,

expectations, strategies, predictions or any other statements

relating to our future activities or other future events or

conditions are forward-looking statements. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “will,” “should,” “would” and

similar expressions are intended to identify forward-looking

statements. These statements are based on current expectations,

estimates and projections made by management about our business,

our industry and other conditions affecting our financial

condition, results of operations or business prospects. These

statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in, or implied by, the

forward-looking statements due to numerous risks and uncertainties.

Factors that could cause such outcomes and results to differ

include, but are not limited to, risks and uncertainties arising

from: the fact that we currently have no drug products for sale and

that our success is dependent on our product candidates receiving

regulatory approval and being successfully commercialized; the

possibility that serious adverse or unacceptable side effects are

identified during the development of our current or future product

candidates, such that we would need to abandon or limit development

of some of our product candidates; our ability to successfully

develop, partner, or commercialize any of our current or future

product candidates including AJ201, IV tramadol, and BAER-101; the

substantial doubt raised about our ability to continue as a going

concern, which may hinder our ability to obtain future financing;

the significant losses we have incurred since inception and our

expectation that we will continue to incur losses for the

foreseeable future; our need for substantial additional funding,

which may not be available to us on acceptable terms, or at all,

which unavailability could force us to delay, reduce or eliminate

our product development programs or commercialization efforts; our

reliance on third parties for several aspects of our operations;

our reliance on clinical data and results obtained by third parties

that could ultimately prove to be inaccurate, unreliable, or

unacceptable to regulatory authorities; the possibility that we may

not receive regulatory approval for any or all of our product

candidates, or that such approval may be significantly delayed due

to scientific or regulatory reasons; the fact that even if one or

more of our product candidates receives regulatory approval, they

will remain subject to substantial regulatory scrutiny; the effects

of current and future laws and regulations relating to fraud and

abuse, false claims, transparency, health information privacy and

security, and other healthcare laws and regulations; the effects of

competition for our product candidates and the potential for new

products to emerge that provide different or better therapeutic

alternatives for our targeted indications; the possibility that the

government or third-party payors fail to provide adequate coverage

and payment rates for our product candidates or any future

products; our ability to establish sales and marketing capabilities

or to enter into agreements with third parties to market and sell

our product candidates; our exposure to potential product liability

claims; related to the protection of our intellectual property and

our potential inability to maintain sufficient patent protection

for our technology and products; our ability to maintain compliance

with the obligations under our intellectual property licenses and

funding arrangements with third parties, without which licenses and

arrangements we could lose rights that are important to our

business; the fact that Fortress Biotech, Inc. controls a majority

of the voting power of our outstanding capital stock and has rights

to receive significant share grants annually; and those risks

discussed in our filings which we make with the SEC. Any

forward-looking statements speak only as of the date on which they

are made, and we undertake no obligation to publicly update or

revise any forward-looking statements to reflect events or

circumstances that may arise after the date of this press release,

except as required by applicable law. Investors should evaluate any

statements made by us in light of these important factors.

Contact: Jaclyn JaffeAvenue Therapeutics, Inc.

(781) 652-4500ir@avenuetx.com

|

|

|

|

AVENUE THERAPEUTICS, INC.Unaudited

Condensed Consolidated Balance Sheets($ in

thousands, except for share and per share amounts) |

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,597 |

|

|

$ |

1,783 |

|

|

Prepaid expenses and other current assets |

|

|

28 |

|

|

|

67 |

|

| Total

assets |

|

$ |

2,625 |

|

|

$ |

1,850 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

427 |

|

|

$ |

287 |

|

|

Accounts payable and accrued expenses - related party |

|

|

517 |

|

|

|

323 |

|

|

Warrant liability |

|

|

29 |

|

|

|

586 |

|

|

Total current liabilities |

|

|

973 |

|

|

|

1,196 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

973 |

|

|

|

1,196 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

| Preferred stock

($0.0001 par value), 2,000,000 shares authorized |

|

|

|

|

|

|

|

|

|

Class A Preferred stock, 250,000 shares issued and outstanding as

of September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock ($0.0001

par value) 200,000,000 and 75,000,000 shares authorized as of

September 30, 2024 and December 31, 2023,

respectively |

|

|

|

|

|

|

|

|

|

Common shares, 1,604,158 and 341,324 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

3 |

|

| Additional paid-in

capital |

|

|

103,646 |

|

|

|

92,507 |

|

| Accumulated deficit |

|

|

(101,036 |

) |

|

|

(90,928 |

) |

| Total

stockholders’ equity attributed to the Company |

|

|

2,610 |

|

|

|

1,582 |

|

| |

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

|

(958 |

) |

|

|

(928 |

) |

| Total

stockholders’ equity |

|

|

1,652 |

|

|

|

654 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

2,625 |

|

|

$ |

1,850 |

|

|

|

|

AVENUE THERAPEUTICS, INC.Unaudited

Condensed Consolidated Statements of Operations($

in thousands, except for share and per share amounts) |

|

|

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

2,327 |

|

|

$ |

907 |

|

|

$ |

6,080 |

|

|

$ |

5,149 |

|

|

Research and development - licenses acquired |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,230 |

|

|

General and administrative |

|

|

829 |

|

|

|

1,161 |

|

|

|

3,607 |

|

|

|

3,042 |

|

| Loss from operations |

|

|

(3,156 |

) |

|

|

(2,068 |

) |

|

|

(9,687 |

) |

|

|

(12,421 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

51 |

|

|

|

9 |

|

|

|

152 |

|

|

|

104 |

|

|

Financing costs – warrant liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(332 |

) |

|

Loss on settlement of common stock warrant liabilities |

|

|

— |

|

|

|

— |

|

|

|

(759 |

) |

|

|

— |

|

|

Change in fair value of warrant liabilities |

|

|

18 |

|

|

|

2,572 |

|

|

|

157 |

|

|

|

(1,544 |

) |

| Total other income

(expense) |

|

|

69 |

|

|

|

2,581 |

|

|

|

(450 |

) |

|

|

1,316 |

|

| Net (loss) income |

|

$ |

(3,087 |

) |

|

$ |

513 |

|

|

$ |

(10,137 |

) |

|

$ |

(11,105 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

non-controlling interests |

|

|

(11 |

) |

|

|

(13 |

) |

|

|

(29 |

) |

|

|

(88 |

) |

| Net (loss) income attributable

to Avenue |

|

$ |

(3,076 |

) |

|

$ |

526 |

|

|

$ |

(10,108 |

) |

|

$ |

(11,017 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable

to common stockholders |

|

$ |

(3,076 |

) |

|

$ |

526 |

|

|

$ |

(18,918 |

) |

|

$ |

(11,017 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per common

share attributable to common stockholders, basic and diluted |

|

$ |

(1.92 |

) |

|

$ |

4.86 |

|

|

$ |

(17.27 |

) |

|

$ |

(115.55 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding, basic and diluted |

|

|

1,600,189 |

|

|

|

108,210 |

|

|

|

1,095,180 |

|

|

|

95,348 |

|

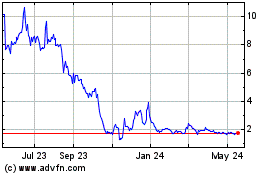

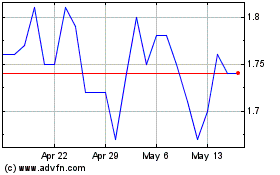

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Feb 2024 to Feb 2025