false000152195100015219512025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported): January 30, 2025 |

First Business Financial Services, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Wisconsin |

001-34095 |

39-1576570 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

401 Charmany Drive |

|

Madison, Wisconsin |

|

53719 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

Registrant’s Telephone Number, Including Area Code: 608 238-8008 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

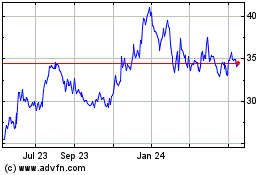

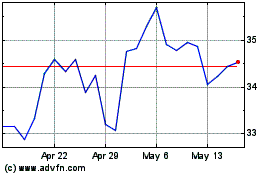

FBIZ |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2025, First Business Financial Services, Inc. (the “Company”) announced its earnings for the quarter ended December 31, 2024. A copy of the Company’s press release containing this information is being “furnished” as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 30, 2025, the Company posted an investor presentation to its website www.firstbusiness.bank under the “Investor Relations” tab. The information included in the presentation provides an overview of the Company’s recent operating performance, financial condition, and business strategy. The Company intends to use this presentation in connection with its fourth quarter 2024 earnings call to be held at 1:00 p.m. Central time on January 31, 2025, and from time to time when the Company's executives interact with shareholders, analysts, and other third parties. A copy of the registrant’s presentation is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto is being “furnished” and will not, except to the extent required by applicable law or regulation, be deemed “filed” by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor will any of such information or exhibits be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is being “furnished” as part of this Current Report on Form 8-K:

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 30, 2025 |

|

|

|

FIRST BUSINESS FINANCIAL SERVICES, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Brian D. Spielmann |

|

|

|

|

Name: |

|

Brian D. Spielmann |

|

|

|

|

Title: |

|

Chief Financial Officer |

FIRST BUSINESS BANK REPORTS RECORD FOURTH QUARTER 2024 NET INCOME OF $14.2 MILLION

-- Record operating revenue, strong net interest margin, and positive operating leverage drive record pre-tax, pre-provision earnings --

MADISON, Wis., January 30, 2025 (BUSINESS WIRE) -- First Business Financial Services, Inc. (the “Company”, the “Bank”, or “First Business Bank”) (Nasdaq:FBIZ) reported quarterly net income available to common shareholders of $14.2 million, or earnings per share ("EPS") of $1.71. This compares to net income available to common shareholders of $10.3 million, or $1.24 per share, in the third quarter of 2024 and $9.6 million, or $1.15 per share, in the fourth quarter of 2023. EPS for the fourth quarter of 2024 included tax and Small Business Administration ("SBA") recourse reserve benefits totaling $0.28 per share.

“First Business Bank’s excellent execution throughout 2024 culminated in outstanding fourth quarter performance,” said Corey Chambas, Chief Executive Officer. “Our success is attributable to our deep client relationships and exceptional team, who produced near 10% loan growth once again. At the same time, we are very pleased with the 13% expansion of fee income in the fourth quarter, which helped drive an improved efficiency ratio. Excluding the tax and recourse benefits in the quarter, our earnings per share amounted to $1.43, marking growth of 15% and 24% from the linked and prior year quarters and supporting our key focus on meaningful tangible book value expansion. We remain confident in our ability to execute our strategic plan and achieve 10% balance sheet and top line revenue growth in 2025.”

Quarterly Highlights

•Consistent Loan Growth. Loans increased $63.6 million, or 8.3% annualized, from the third quarter of 2024, and $263.8 million, or 9.3%, from the fourth quarter of 2023, reflecting growth throughout the Company.

•Strong Net Interest Margin. The Company's long-held match-funding strategy and pricing discipline produced a net interest margin of 3.77%, compared to 3.64% for the linked quarter. Net interest income grew 6.9% from the linked quarter and 12.2% from the prior year quarter.

•Record Operating Revenue. Operating revenue increased to $41.2 million, up 8.1% and 12.3% from the linked and prior year quarters, respectively, driven by loan growth, strong net interest margin, and fee income expansion.

•Continued Private Wealth Management Expansion. Private Wealth assets under management and administration grew to a record $3.419 billion, generating Private Wealth fee income of $3.4 million. Private Wealth fees increased by 16.8% from the prior year quarter and comprised 43% of total non-interest income.

•Record Pre-Tax, Pre-Provision ("PTPP") Income. PTPP income grew to $17.7 million, up 14.8% and 16.1% from the linked and prior year quarters, respectively. This performance reflects continued growth across the Company’s balance sheet coupled with operational efficiency.

•Tangible Book Value Growth. The Company’s strong earnings and sound balance sheet management continued to drive growth in tangible book value per share, producing a 23.0% annualized increase compared to the linked quarter and a 15.0% increase compared to the prior year quarter.

•Reported Earnings Elevated by Tax Benefit and Recourse Reserve. EPS of $1.71 included income tax and SBA recourse reserve benefits totaling $0.28 per share. Excluding these items, EPS increased 15.3% and 24.3% from the linked and prior year quarters.

Quarterly Financial Results

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

As of and for the Three Months Ended |

|

As of and for the Year Ended |

(Dollars in thousands, except per share amounts) |

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

Net interest income |

|

$33,148 |

|

$31,007 |

|

$29,540 |

|

$124,206 |

|

$112,588 |

Adjusted non-interest income (1) |

|

8,005 |

|

7,064 |

|

7,094 |

|

29,259 |

|

31,353 |

Operating revenue (1) |

|

41,153 |

|

38,071 |

|

36,634 |

|

153,465 |

|

143,941 |

Operating expense (1) |

|

23,434 |

|

22,630 |

|

21,374 |

|

93,016 |

|

87,787 |

Pre-tax, pre-provision adjusted earnings (1) |

|

17,719 |

|

15,441 |

|

15,260 |

|

60,449 |

|

56,154 |

Less: |

|

|

|

|

|

|

|

|

|

|

Provision for credit losses |

|

2,701 |

|

2,087 |

|

2,573 |

|

8,827 |

|

8,182 |

Net loss on repossessed assets |

|

5 |

|

11 |

|

4 |

|

168 |

|

13 |

SBA recourse (benefit) provision |

|

(687) |

|

466 |

|

210 |

|

(104) |

|

775 |

Impairment of tax credit investments |

|

400 |

|

— |

|

— |

|

400 |

|

— |

Add: |

|

|

|

|

|

|

|

|

|

|

Net loss on sale of securities |

|

— |

|

— |

|

— |

|

(8) |

|

(45) |

Income before income tax expense |

|

15,300 |

|

12,877 |

|

12,473 |

|

51,150 |

|

47,139 |

Income tax expense |

|

885 |

|

2,351 |

|

2,703 |

|

6,905 |

|

10,112 |

Net income |

|

$14,415 |

|

$10,526 |

|

$9,770 |

|

$44,245 |

|

$37,027 |

Preferred stock dividends |

|

219 |

|

218 |

|

219 |

|

875 |

|

875 |

Net income available to common shareholders |

|

$14,196 |

|

$10,308 |

|

$9,551 |

|

$43,370 |

|

$36,152 |

Earnings per share, diluted |

|

$1.71 |

|

$1.24 |

|

$1.15 |

|

$5.20 |

|

$4.33 |

Book value per share |

|

$38.17 |

|

$36.17 |

|

$33.39 |

|

$38.17 |

|

$33.39 |

Tangible book value per share (1) |

|

$36.74 |

|

$34.74 |

|

$31.94 |

|

$36.74 |

|

$31.94 |

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (2) |

|

3.77% |

|

3.64% |

|

3.69% |

|

3.66% |

|

3.78% |

Adjusted net interest margin (1)(2) |

|

3.48% |

|

3.51% |

|

3.50% |

|

3.47% |

|

3.62% |

Fee income ratio (non-interest income / total revenue) |

|

19.45% |

|

18.55% |

|

19.36% |

|

19.06% |

|

21.76% |

Efficiency ratio (1) |

|

56.94% |

|

59.50% |

|

58.34% |

|

60.61% |

|

60.99% |

Return on average assets (2) |

|

1.52% |

|

1.13% |

|

1.11% |

|

1.20% |

|

1.13% |

Return on average tangible common equity (2) |

|

19.21% |

|

14.40% |

|

14.64% |

|

15.35% |

|

14.45% |

|

|

|

|

|

|

|

|

|

|

|

Period-end loans and leases receivable |

|

$3,113,128 |

|

$3,050,079 |

|

$2,850,261 |

|

$3,113,128 |

|

$2,850,261 |

Average loans and leases receivable |

|

$3,103,703 |

|

$3,031,880 |

|

$2,810,793 |

|

$2,996,881 |

|

$2,647,851 |

Period-end core deposits |

|

$2,396,429 |

|

$2,382,730 |

|

$2,339,071 |

|

$2,396,429 |

|

$2,339,071 |

Average core deposits |

|

$2,416,919 |

|

$2,375,002 |

|

$2,247,639 |

|

$2,378,465 |

|

$2,098,153 |

Allowance for credit losses, including unfunded commitment reserves |

|

$37,268 |

|

$35,509 |

|

$32,997 |

|

$37,268 |

|

$32,997 |

Non-performing assets |

|

$28,418 |

|

$19,420 |

|

$20,844 |

|

$28,418 |

|

$20,844 |

Allowance for credit losses as a percent of total gross loans and leases |

|

1.20% |

|

1.16% |

|

1.16% |

|

1.20% |

|

1.16% |

Non-performing assets as a percent of total assets |

|

0.74% |

|

0.52% |

|

0.59% |

|

0.74% |

|

0.59% |

1.This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate financial performance, provide greater understanding of ongoing operations, and enhance comparability of results with prior periods. See the section titled Non-GAAP Reconciliations at the end of this release for a reconciliation of GAAP financial measures to non-GAAP financial measures.

2.Calculation is annualized.

Fourth Quarter 2024 Compared to Third Quarter 2024

Net interest income increased $2.1 million, or 6.9%, to $33.1 million.

•The increase in net interest income was driven by higher average loans and leases receivable and fees in lieu of interest, partially offset by a decrease in adjusted net interest margin. Average loans and leases receivable grew by $71.8 million, or 9.5% annualized, to $3.104 billion. Fees in lieu of interest, which vary from quarter to quarter based on client-driven activity, totaled $2.4 million, compared to $1.0 million in the prior quarter. Excluding fees in lieu of interest, net interest income increased $784,000, or 2.6%.

•The yield on average interest-earning assets decreased 13 basis points to 6.84% from 6.97%. Excluding fees in lieu of interest, the yield on average interest-earning assets decreased 29 basis points to 6.57% from 6.85%. The adjusted interest-earning asset beta compared to the prior quarter was 46.8%. The change in yield of the respective interest-earning asset or the rate paid on interest-bearing liability compared to the change in the effective daily fed funds rate is commonly referred to as beta.

•The rate paid for average interest-bearing core deposits decreased 45 basis points to 3.65% from 4.10%. The rate paid for average total bank funding decreased 26 basis points to 3.18% from 3.44%. Total bank funding is defined as total deposits plus Federal Home Loan Bank (“FHLB”) advances. The total core deposit beta compared to the prior quarter was 58.1%. The total bank funding beta compared to the prior quarter was 41.9%.

•Net interest margin was 3.77% compared to 3.64% for the linked quarter. Adjusted net interest margin1 was 3.48%, down 2 basis points compared to 3.50% in the linked quarter. The decrease in adjusted net interest margin was driven by a decrease in the yield on interest-earning assets partially offset by a decrease in rate paid on total bank funding.

•The Company maintains a long-term target for net interest margin in the range of 3.60% - 3.65%. Performance in future quarters will vary due to factors such as the level of fees in lieu of interest and the timing, pace and scale of future interest rate changes.

The Bank reported a provision expense of $2.7 million, compared to $2.1 million in the third quarter of 2024. The increase was driven by new specific reserves and charge-offs in the Commercial and Industrial ("C&I") loan portfolio, partially offset by decreases in general reserves primarily related to the annual review of model assumptions for both qualitative and quantitative factors.

Non-interest income increased $941,000, or 13.3%, to $8.0 million.

•Private Wealth fee income increased $162,000, or 5.0% to $3.4 million. Private Wealth assets under management and administration measured $3.419 billion on December 31, 2024, up $20.8 million, or 2.4% annualized from the prior quarter. Fee income is based on overall asset levels and may vary based on seasonal activity and the timing of fluctuations in market values.

•Gains on sale of SBA loans increased $478,000, or 103.9%, to $938,000. Gain on sale of SBA loans varies period to period based on the amount of closed and fully funded loans. While quarterly gains may vary, management expects the SBA loan sales to continue growing year-over-year.

•Commercial loan swap fee income of $588,000 increased by $128,000, or 27.8%. Swap fee income varies from period to period based on loan activity and the interest rate environment.

1.Adjusted net interest margin is a non-GAAP measure representing net interest income excluding fees in lieu of interest and other recurring, but volatile, components of net interest margin divided by average interest-earning assets less other recurring, but volatile, components of average interest-earning assets.

•Loan fee income increased $102,000 or 12.6% to $914,000.

Non-interest expense increased $45,000, or 0.2%, to $23.2 million, while operating expense increased $804,000, or 3.6%, to $23.4 million.

•Compensation expense was $15.5 million, reflecting an increase of $337,000, or 2.2%, from the linked quarter primarily due to an increase in individual incentive and share-based compensation accruals. This was partially offset by a $261,000 decrease in annual cash bonus accrual. Average full-time equivalents (“FTEs”) for the fourth quarter of 2024 were 349, down from 355 in the linked quarter. The decrease in average FTEs is associated with temporary vacancies of existing positions that we expect to fill in 2025.

•Data processing expense was $1.6 million, increasing $602,000, or 57.6%, from the linked quarter primarily due to a one-time expense as result of a change in credit card vendors.

•Other non-interest expense was $517,000, decreasing $784,000, or 60.3%, from the linked quarter primarily due to an SBA recourse provision benefit of $687,000, or $0.07 after tax per share. This benefit, considered a change in estimate, is the result of a review of assumptions which identified that actual losses over the past three years were significantly below estimated losses. Management will evaluate the need for a recourse provision on a loan-by-loan basis.

Income tax expense decreased $1.5 million, or 62.4%, to $885,000. The effective tax rate was 5.8% for the three months ended December 31, 2024, compared to 18.3% for the linked quarter. The decrease is primarily due to a $1.7 million, or $0.21 after tax per share, partial release of a state deferred tax asset valuation allowance due to changes in projected taxable income based on revised state taxation guidance and 2023 state tax return actual results. The Company expects to report an effective tax rate between 16% and 18% for 2025.

Total period-end loans and leases receivable increased $63.6 million, or 8.3% annualized, to $3.114 billion. The average rate earned on average loans and leases receivable was 7.21%, down 11 basis points from 7.32% in the prior quarter. Excluding fees in lieu of interest, the average rate earned on average loans and leases receivable was 6.91%, down 29 basis points from 7.19% in the prior quarter. This decrease in yield was primarily due to the decrease in short-term market rates.

•Commercial Real Estate (“CRE”) loans increased by $87.8 million, or 19.2% annualized, to $1.917 billion. The increase was primarily due to an increase in CRE non-owner occupied and multi-family loans in the Wisconsin markets as construction projects funded.

•C&I loans decreased $22.6 million, or 7.69% annualized, to $1.152 billion. The decrease was primarily due to asset-based lending and accounts receivable financing payoffs, partially offset by an increase in floorplan line balances.

Total period-end core deposits increased $13.7 million, or 2.3% annualized, to $2.396 billion, compared to $2.383 billion. The average rate paid was 2.98%, down 36 basis points from 3.34% in the prior quarter.

•New non-maturity deposit balances of $56.5 million were added at a weighted average rate of 2.92%. Certificate of deposit maturities of $119.8 million at a weighted average rate of 4.62% were replaced by new and renewed certificates of deposit of $98.5 million at a weighted average rate of 3.92%.

Period-end wholesale funding, including FHLB advances and brokered deposits, increased $94.4 million, or 10.7%, to $976.1 million. Consistent with the Bank’s long-held philosophy to minimize exposure to interest rate risk, management will continue to utilize the most efficient and cost-effective source of wholesale funds to match-fund fixed-rate loans as necessary.

•Wholesale deposits increased $123.5 million, or 21.0%, to $710.7 million, compared to $587.2 million. The average rate paid on wholesale deposits decreased one basis point to 4.11% and the weighted average original maturity decreased to 3.9 years from 4.6 years.

•FHLB advances decreased $29.1 million, or 9.9%, to $265.4 million, compared to $294.5 million. The average rate paid on FHLB advances decreased 5 basis points to 2.91% and the weighted average original maturity increased to 5.4 years from 4.6 years.

Non-performing assets increased $9.0 million to $28.4 million, or 0.74% of total assets, increasing as a percentage of total assets from 0.52% in the prior quarter. The increase is primarily driven by a conventional C&I loan that management identified as non-performing and recognized a specific reserve. We continue to expect full repayment of the previously disclosed Asset-Based Lending ("ABL") loan that defaulted during the second quarter of 2023. The liquidation process under Chapter 7 bankruptcy has delayed final resolution. Through the Bank's collection efforts, the current balance of this loan is $6.2 million, down from $8.8 million in the prior- year quarter. Excluding this ABL loan, non-performing assets totaled $22.2 million, or 0.58% of total assets in the current quarter and $13.0 million, or 0.35% of total assets in the linked quarter.

The allowance for credit losses, including the unfunded credit commitments reserve, increased $1.8 million, or 5.0%, as increases in new specific reserves and loan growth were partially offset by net charge-offs and changes in quantitative and qualitative factors. The allowance for credit losses, including unfunded credit commitment reserves, as a percent of total gross loans and leases was 1.20% compared to 1.16% in the prior quarter.

Fourth Quarter 2024 Compared to Fourth Quarter 2023

Net interest income increased $3.6 million, or 12.2%, to $33.1 million.

•The increase in net interest income primarily reflects an increase in average gross loans and leases and an increase in fees in lieu of interest. Fees in lieu of interest increased to $2.4 million from $1.1 million. Excluding fees in lieu of interest, net interest income increased $2.4 million, or 8.3%.

•The yield on average interest-earning assets decreased one basis point to 6.84% from 6.85%. Excluding fees in lieu of interest, the yield on average interest-earning assets measured 6.57% compared to 6.71%. This decrease in yield was primarily due to the decrease in short-term market rates partially offset by the reinvestment of cash flows from the securities and fixed-rate loan portfolios.

•The rate paid for average interest-bearing core deposits decreased 34 basis points to 3.65% from 3.99%. The rate paid for average total bank funding decreased 9 basis points to 3.18% from 3.27%.

•Net interest margin increased 8 basis points to 3.77% from 3.69%. adjusted net interest margin decreased 2 basis points to 3.48% from 3.50%.

The Company reported a credit loss provision expense of $2.7 million, compared to $2.6 million in the fourth quarter of 2023. See the provision breakdown table below for more detail on the components of provision expense.

Non-interest income increased $911,000, or 12.8%, to $8.0 million.

•Private Wealth fee income increased $493,000, or 16.8%, to $3.4 million. Private Wealth assets under management and administration measured $3.419 billion at December 31, 2024, up $297.2 million, or 9.5%.

•Gain on sale of SBA loans increased $654,000 to $938,000. Gain on sale of SBA loans varies period to period based on the number of closed commitments. Management expects the SBA loan sales pipeline to remain strong as production increases and previously closed commitments fully fund and become eligible for sale.

•Commercial loan swap fee income increased by $150,000, or 34.2%, to $588,000. Swap fee income varies from period to period based on loan activity and the interest rate environment.

•Service charges on deposits increased $112,000, or 13.2%, to $960,000, primarily driven by new core deposit relationships.

•Other fee income decreased $543,000, or 31.5%, to $1.2 million. The decrease was primarily due to lower returns on the Company’s investments in Small Business Investment Company ("SBIC") funds in the fourth quarter. Income from SBIC funds was $251,000 in the fourth quarter, compared to $860,000 in the prior year quarter. Income from SBIC funds varies from period to period based on changes in the realized and unrealized fair value of underlying investments.

Non-interest expense increased $1.6 million, or 7.2%, to $23.2 million. Operating expense increased $2.1 million, or 9.6%, to $23.4 million.

•Compensation expense increased $1.1 million, or 7.5%, to $15.5 million. The increase in compensation expense was primarily due to an increase in average FTEs and annual merit increases and promotions. Average FTEs increased 2% to 349 in the fourth quarter of 2024, compared to 343 in the fourth quarter of 2023.

•Data processing expense increased $711,000 or 76.1%, to $1.6 million, primarily due to a one-time expense resulting from a change in credit card vendors as well as an increase in core processing costs commensurate with loan and deposit account growth.

•Computer software expense increased $268,000, or 20.3%, to $1.6 million, primarily due to our commitment to innovative technology to support growth initiatives, enhance productivity, and improve the client experience.

•Marketing expense increased $204,000, or 28.2%, to $928,000, primarily due to increased business development efforts and advertising projects to support Company growth goals.

•FDIC Insurance increased $143,000, or 24.4%, to $728,000 primarily due to an increase in total assets and an increase in use of brokered deposits.

•Other expense decreased $835,000, or 61.8%, to $517,000 primarily due to an SBA recourse provision benefit.

Total period-end loans and leases receivable increased $263.8 million, or 9.3%, to $3.114 billion.

•CRE loans increased $217.3 million, or 12.8%, to $1.917 billion, primarily due to increases in all loan categories in the Wisconsin market.

•C&I loans increased $45.9 million, or 4.1%, to $1.152 billion, primarily due to growth in Equipment Finance and Floorplan Financing.

Total period-end core deposits grew $57.4 million, or 2.5%, to $2.396 billion, and the average rate paid decreased 22 basis points to 2.98%. The decrease in average rate paid on core deposits was primarily due to a decrease in short-term market rates. Total average core deposits grew $169.3 million, or 7.5%, to $2.417 billion.

Period-end wholesale funding increased $263.9 million, or 32.0%, to $976.1 million.

•Wholesale deposits increased $253.0 million, or 55.3%, to $710.7 million, as the Bank utilized more wholesale deposits in lieu of FHLB advances to maintain excess liquidity and to match-fund fixed-rate assets. The average rate paid on wholesale deposits decreased 4 basis points to 4.11% and the weighted average original maturity decreased to 3.9 years from 4.0 years. Consistent with our balance sheet strategy to use the most efficient and cost-effective source of wholesale funding, the Company has entered into derivative contracts which hedge a portion of the wholesale deposits to reduce the fixed rate funding costs.

•FHLB advances decreased $16.2 million, or 5.7%, to $265.4 million. The average rate paid on FHLB advances increased 46 basis points to 2.91% and the weighted average original maturity increased to 5.4 years from 5.2 years.

Non-performing assets increased to $28.4 million, or 0.74% of total assets, compared to $20.8 million, or 0.59% of total assets, driven by a conventional C&I loan and new past-due Equipment Finance loans within the C&I portfolio. Excluding the ABL loan described above for which we expect full repayment, non-performing assets totaled $22.2 million, or 0.58% of total assets and $12.0 million, or 0.34% of total assets in the prior year quarter.

The allowance for credit losses, including unfunded commitment reserves, increased $4.3 million to $37.3 million, compared to $33.0 million primarily due to an increase in specific reserves and loan growth, partially offset by net charge-offs and changes in general reserve. The allowance for credit losses as a percent of total gross loans and leases was 1.20%, compared 1.16% in the prior year.

Investor Presentation and Conference Call

On January 30, 2025, the Company posted an investor presentation to its website firstbusiness.bank under the “Investor Relations” tab which will also be furnished to the U.S. Securities and Exchange Commission on January 30, 2025. The information included in the presentation provides an overview of the Company’s recent operating performance, financial condition, and business strategy. The Company intends to use this presentation in connection with its fourth quarter 2024 earnings call to be held at 1:00 p.m. Central time on January 31, 2025, and from time to time when the Company's executives interact with shareholders, analysts, and other third parties. The conference call can be accessed at 800-549-8228 (289-819-1520 if outside the United States and Canada), using the conference call access code: FBIZ. Investors may also listen live via webcast at: https://events.q4inc.com/attendee/585942928. A replay of the call will be available through Friday, February 7, 2025, by calling 888-660-6264 or 289-819-1325 for international participants. The webcast archive of the conference call will be available on the Company’s website, ir.firstbusiness.bank.

About First Business Bank

First Business Bank® specializes in Business Banking, including Commercial Banking and Specialty Finance, Private Wealth, and Bank Consulting services, and through its refined focus delivers unmatched expertise, accessibility, and responsiveness. Specialty Finance solutions are delivered through First Business Bank’s wholly owned subsidiary First Business Specialty Finance, LLC®. First Business Bank is a wholly owned subsidiary of First Business Financial Services, Inc®. (Nasdaq: FBIZ). For additional information, visit firstbusiness.bank.

This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect First Business Bank’s current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results, or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties, and other factors that may cause actual results to differ materially from the views, beliefs, and projections expressed in such statements. Such statements are subject to risks and uncertainties, including among other things:

•Adverse changes in the economy or business conditions, either nationally or in our markets including, without limitation, inflation, economic downturn, labor shortages, wage pressures, and the adverse effects of public health events on the global, national, and local economy.

•Competitive pressures among depository and other financial institutions nationally and in the Company’s markets.

•Increases in defaults by borrowers and other delinquencies.

•Management’s ability to manage growth effectively, including the successful expansion of our client service, administrative infrastructure, and internal management systems.

•Fluctuations in interest rates and market prices.

•Changes in legislative or regulatory requirements applicable to the Company and its subsidiaries.

•Changes in tax requirements, including tax rate changes, new tax laws, and revised tax law interpretations.

•Fraud, including client and system failure or breaches of our network security, including the Company’s internet banking activities.

•Failure to comply with the applicable SBA regulations in order to maintain the eligibility of the guaranteed portion of SBA loans.

•Ongoing volatility in the banking sector may result in new legislation, regulations or policy changes that could subject the Company and the Bank to increased government regulation and supervision.

•The proportion of the Company’s deposit account balances that exceed FDIC insurance limits may expose the Bank to enhanced liquidity risk.

•The Company may be subject to increases in FDIC insurance assessments.

For further information about the factors that could affect the Company’s future results, please see the Company’s annual report on Form 10-K for the year ended December 31, 2023, and other filings with the Securities and Exchange Commission.

|

|

|

CONTACT: |

|

First Business Financial Services, Inc. |

|

|

Brian D. Spielmann |

|

|

Chief Financial Officer |

|

|

608-232-5977 |

|

|

bspielmann@firstbusiness.bank |

SELECTED FINANCIAL CONDITION DATA

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

As of |

(in thousands) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

Assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$157,702 |

|

$131,972 |

|

$81,080 |

|

$72,040 |

|

$139,510 |

Securities available-for-sale, at fair value |

|

341,392 |

|

313,336 |

|

308,852 |

|

314,114 |

|

297,006 |

Securities held-to-maturity, at amortized cost |

|

6,741 |

|

6,907 |

|

7,082 |

|

8,131 |

|

8,503 |

Loans held for sale |

|

13,498 |

|

8,173 |

|

6,507 |

|

4,855 |

|

4,589 |

Loans and leases receivable |

|

3,113,128 |

|

3,050,079 |

|

2,985,414 |

|

2,910,864 |

|

2,850,261 |

Allowance for credit losses |

|

(35,785) |

|

(33,688) |

|

(33,088) |

|

(32,799) |

|

(31,275) |

Loans and leases receivable, net |

|

3,077,343 |

|

3,016,391 |

|

2,952,326 |

|

2,878,065 |

|

2,818,986 |

Premises and equipment, net |

|

5,227 |

|

5,478 |

|

6,381 |

|

6,268 |

|

6,190 |

Repossessed assets |

|

51 |

|

56 |

|

54 |

|

317 |

|

247 |

Right-of-use assets |

|

5,702 |

|

5,789 |

|

6,041 |

|

6,297 |

|

6,559 |

Bank-owned life insurance |

|

57,210 |

|

56,767 |

|

56,351 |

|

55,948 |

|

55,536 |

Federal Home Loan Bank stock, at cost |

|

11,616 |

|

12,775 |

|

11,901 |

|

13,326 |

|

12,042 |

Goodwill and other intangible assets |

|

11,912 |

|

11,834 |

|

11,841 |

|

11,950 |

|

12,023 |

Derivatives |

|

65,762 |

|

42,539 |

|

70,773 |

|

69,703 |

|

55,597 |

Accrued interest receivable and other assets |

|

99,059 |

|

103,707 |

|

97,872 |

|

90,344 |

|

91,058 |

Total assets |

|

$3,853,215 |

|

$3,715,724 |

|

$3,617,061 |

|

$3,531,358 |

|

$3,507,846 |

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

Core deposits |

|

$2,396,429 |

|

$2,382,730 |

|

$2,309,635 |

|

$2,297,843 |

|

$2,339,071 |

Wholesale deposits |

|

710,711 |

|

587,217 |

|

575,548 |

|

457,563 |

|

457,708 |

Total deposits |

|

3,107,140 |

|

2,969,947 |

|

2,885,183 |

|

2,755,406 |

|

2,796,779 |

Federal Home Loan Bank advances and

other borrowings |

|

320,049 |

|

349,109 |

|

327,855 |

|

381,718 |

|

330,916 |

Lease liabilities |

|

7,926 |

|

8,054 |

|

8,361 |

|

8,664 |

|

8,954 |

Derivatives |

|

57,068 |

|

45,399 |

|

61,821 |

|

61,133 |

|

51,949 |

Accrued interest payable and other liabilities |

|

32,443 |

|

31,233 |

|

28,671 |

|

26,649 |

|

29,660 |

Total liabilities |

|

3,524,626 |

|

3,403,742 |

|

3,311,891 |

|

3,233,570 |

|

3,218,258 |

Total stockholders’ equity |

|

328,589 |

|

311,982 |

|

305,170 |

|

297,788 |

|

289,588 |

Total liabilities and stockholders’ equity |

|

$3,853,215 |

|

$3,715,724 |

|

$3,617,061 |

|

$3,531,358 |

|

$3,507,846 |

STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

As of and for the Three Months Ended |

|

As of and for the Year Ended |

(Dollars in thousands, except per share amounts) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

Total interest income |

|

$60,110 |

|

$59,327 |

|

$57,910 |

|

$55,783 |

|

$54,762 |

|

$233,130 |

|

$194,928 |

Total interest expense |

|

26,962 |

|

28,320 |

|

27,370 |

|

26,272 |

|

25,222 |

|

108,924 |

|

82,340 |

Net interest income |

|

33,148 |

|

31,007 |

|

30,540 |

|

29,511 |

|

29,540 |

|

124,206 |

|

112,588 |

Provision for credit losses |

|

2,701 |

|

2,087 |

|

1,713 |

|

2,326 |

|

2,573 |

|

8,827 |

|

8,182 |

Net interest income after provision for credit losses |

|

30,447 |

|

28,920 |

|

28,827 |

|

27,185 |

|

26,967 |

|

115,379 |

|

104,406 |

Private wealth management service fees |

|

3,426 |

|

3,264 |

|

3,461 |

|

3,111 |

|

2,933 |

|

13,262 |

|

11,425 |

Gain on sale of SBA loans |

|

938 |

|

460 |

|

349 |

|

195 |

|

284 |

|

1,942 |

|

2,055 |

Service charges on deposits |

|

960 |

|

920 |

|

951 |

|

940 |

|

848 |

|

3,771 |

|

3,131 |

Loan fees |

|

914 |

|

812 |

|

826 |

|

847 |

|

869 |

|

3,399 |

|

3,363 |

Loss on sale of securities |

|

— |

|

— |

|

— |

|

(8) |

|

— |

|

(8) |

|

(45) |

Swap fees |

|

588 |

|

460 |

|

157 |

|

198 |

|

438 |

|

1,403 |

|

2,964 |

Other non-interest income |

|

1,179 |

|

1,148 |

|

1,681 |

|

1,474 |

|

1,722 |

|

5,482 |

|

8,415 |

Total non-interest income |

|

8,005 |

|

7,064 |

|

7,425 |

|

6,757 |

|

7,094 |

|

29,251 |

|

31,308 |

Compensation |

|

15,535 |

|

15,198 |

|

16,215 |

|

16,157 |

|

14,450 |

|

63,105 |

|

61,059 |

Occupancy |

|

588 |

|

585 |

|

593 |

|

607 |

|

571 |

|

2,373 |

|

2,381 |

Professional fees |

|

1,323 |

|

1,305 |

|

1,472 |

|

1,571 |

|

1,313 |

|

5,671 |

|

5,325 |

Data processing |

|

1,647 |

|

1,045 |

|

1,182 |

|

1,018 |

|

936 |

|

4,892 |

|

3,826 |

Marketing |

|

928 |

|

922 |

|

850 |

|

818 |

|

724 |

|

3,518 |

|

2,889 |

Equipment |

|

301 |

|

333 |

|

335 |

|

345 |

|

340 |

|

1,314 |

|

1,340 |

Computer software |

|

1,585 |

|

1,608 |

|

1,555 |

|

1,418 |

|

1,317 |

|

6,166 |

|

4,985 |

FDIC insurance |

|

728 |

|

810 |

|

612 |

|

610 |

|

585 |

|

2,760 |

|

2,238 |

Other non-interest expense |

|

517 |

|

1,301 |

|

1,065 |

|

798 |

|

1,352 |

|

3,681 |

|

4,532 |

Total non-interest expense |

|

23,152 |

|

23,107 |

|

23,879 |

|

23,342 |

|

21,588 |

|

93,480 |

|

88,575 |

Income before income tax expense |

|

15,300 |

|

12,877 |

|

12,373 |

|

10,600 |

|

12,473 |

|

51,150 |

|

47,139 |

Income tax expense |

|

885 |

|

2,351 |

|

1,917 |

|

1,752 |

|

2,703 |

|

6,905 |

|

10,112 |

Net income |

|

$14,415 |

|

$10,526 |

|

$10,456 |

|

$8,848 |

|

$9,770 |

|

$44,245 |

|

$37,027 |

Preferred stock dividends |

|

219 |

|

218 |

|

219 |

|

219 |

|

219 |

|

875 |

|

875 |

Net income available to common shareholders |

|

$14,196 |

|

$10,308 |

|

$10,237 |

|

$8,629 |

|

$9,551 |

|

$43,370 |

|

$36,152 |

Per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings |

|

$1.71 |

|

$1.24 |

|

$1.23 |

|

$1.04 |

|

$1.15 |

|

$5.20 |

|

$4.33 |

Diluted earnings |

|

1.71 |

|

1.24 |

|

1.23 |

|

1.04 |

|

1.15 |

|

5.20 |

|

4.33 |

Dividends declared |

|

0.2500 |

|

0.2500 |

|

0.2500 |

|

0.2500 |

|

0.2275 |

|

1.0000 |

|

0.9100 |

Book value |

|

38.17 |

|

36.17 |

|

35.35 |

|

34.41 |

|

33.39 |

|

38.17 |

|

33.39 |

Tangible book value |

|

36.74 |

|

34.74 |

|

33.92 |

|

32.97 |

|

31.94 |

|

36.74 |

|

31.94 |

Weighted-average common shares

outstanding(1) |

|

8,107,308 |

|

8,111,215 |

|

8,113,246 |

|

8,125,319 |

|

8,110,462 |

|

8,148,259 |

|

8,131,251 |

Weighted-average diluted common shares

outstanding(1) |

|

8,107,308 |

|

8,111,215 |

|

8,113,246 |

|

8,125,319 |

|

8,110,462 |

|

8,148,259 |

|

8,131,251 |

(1)Excluding participating securities.

NET INTEREST INCOME ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

For the Three Months Ended |

(Dollars in thousands) |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

|

Average

Balance |

|

Interest |

|

Average

Yield/Rate(4) |

|

Average

Balance |

|

Interest |

|

Average

Yield/Rate(4) |

|

Average

Balance |

|

Interest |

|

Average

Yield/Rate(4) |

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate and

other mortgage loans(1) |

|

$1,879,136 |

|

$30,580 |

|

6.51% |

|

$1,805,020 |

|

$30,340 |

|

6.72% |

|

$1,675,926 |

|

$27,359 |

|

6.53% |

Commercial and industrial

loans(1) |

|

1,176,175 |

|

24,709 |

|

8.40 |

|

1,177,112 |

|

24,481 |

|

8.32 |

|

1,089,558 |

|

22,751 |

|

8.35 |

Consumer and other loans(1) |

|

48,392 |

|

663 |

|

5.48 |

|

49,748 |

|

685 |

|

5.51 |

|

45,309 |

|

577 |

|

5.09 |

Total loans and leases

receivable(1) |

|

3,103,703 |

|

55,952 |

|

7.21 |

|

3,031,880 |

|

55,506 |

|

7.32 |

|

2,810,793 |

|

50,687 |

|

7.21 |

Mortgage-related securities(2) |

|

290,471 |

|

2,858 |

|

3.94 |

|

269,842 |

|

2,662 |

|

3.95 |

|

221,708 |

|

2,061 |

|

3.72 |

Other investment securities(3) |

|

45,174 |

|

231 |

|

2.05 |

|

51,446 |

|

315 |

|

2.45 |

|

67,444 |

|

541 |

|

3.21 |

FHLB stock |

|

11,788 |

|

274 |

|

9.30 |

|

11,960 |

|

285 |

|

9.53 |

|

12,960 |

|

279 |

|

8.61 |

Short-term investments |

|

65,254 |

|

795 |

|

4.87 |

|

40,406 |

|

559 |

|

5.53 |

|

86,580 |

|

1,193 |

|

5.51 |

Total interest-earning assets |

|

3,516,390 |

|

60,110 |

|

6.84 |

|

3,405,534 |

|

59,327 |

|

6.97 |

|

3,199,485 |

|

54,761 |

|

6.85 |

Non-interest-earning assets |

|

230,218 |

|

|

|

|

|

231,353 |

|

|

|

|

|

255,167 |

|

|

|

|

Total assets |

|

$3,746,608 |

|

|

|

|

|

$3,636,887 |

|

|

|

|

|

$3,454,652 |

|

|

|

|

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction accounts |

|

$928,428 |

|

8,161 |

|

3.52 |

|

$864,936 |

|

8,451 |

|

3.91 |

|

$785,480 |

|

7,657 |

|

3.90 |

Money market |

|

833,501 |

|

7,571 |

|

3.63 |

|

850,590 |

|

8,780 |

|

4.13 |

|

734,903 |

|

7,145 |

|

3.89 |

Certificates of deposit |

|

210,307 |

|

2,282 |

|

4.34 |

|

219,315 |

|

2,584 |

|

4.71 |

|

278,438 |

|

3,160 |

|

4.54 |

Wholesale deposits |

|

594,578 |

|

6,106 |

|

4.11 |

|

531,472 |

|

5,475 |

|

4.12 |

|

450,880 |

|

4,682 |

|

4.15 |

Total interest-bearing

deposits |

|

2,566,814 |

|

24,120 |

|

3.76 |

|

2,466,313 |

|

25,290 |

|

4.10 |

|

2,249,701 |

|

22,644 |

|

4.03 |

FHLB advances |

|

270,476 |

|

1,969 |

|

2.91 |

|

278,103 |

|

2,059 |

|

2.96 |

|

301,773 |

|

1,851 |

|

2.45 |

Other borrowings |

|

54,672 |

|

874 |

|

6.39 |

|

50,642 |

|

971 |

|

7.67 |

|

49,394 |

|

727 |

|

5.89 |

Total interest-bearing

liabilities |

|

2,891,962 |

|

26,963 |

|

3.73 |

|

2,795,058 |

|

28,320 |

|

4.05 |

|

2,600,868 |

|

25,222 |

|

3.88 |

Non-interest-bearing demand

deposit accounts |

|

444,683 |

|

|

|

|

|

440,161 |

|

|

|

|

|

448,818 |

|

|

|

|

Other non-interest-bearing

liabilities |

|

90,555 |

|

|

|

|

|

91,520 |

|

|

|

|

|

119,833 |

|

|

|

|

Total liabilities |

|

3,427,200 |

|

|

|

|

|

3,326,739 |

|

|

|

|

|

3,169,519 |

|

|

|

|

Stockholders’ equity |

|

319,408 |

|

|

|

|

|

310,148 |

|

|

|

|

|

285,133 |

|

|

|

|

Total liabilities and

stockholders’ equity |

|

$3,746,608 |

|

|

|

|

|

$3,636,887 |

|

|

|

|

|

$3,454,652 |

|

|

|

|

Net interest income |

|

|

|

$33,147 |

|

|

|

|

|

$31,007 |

|

|

|

|

|

$29,539 |

|

|

Interest rate spread |

|

|

|

|

|

3.11% |

|

|

|

|

|

2.92% |

|

|

|

|

|

2.97% |

Net interest-earning assets |

|

$624,428 |

|

|

|

|

|

$610,476 |

|

|

|

|

|

$598,617 |

|

|

|

|

Net interest margin |

|

|

|

|

|

3.77% |

|

|

|

|

|

3.64% |

|

|

|

|

|

3.69% |

(1)The average balances of loans and leases include non-accrual loans and leases and loans held for sale. Interest income related to non-accrual loans and leases is recognized when collected. Interest income includes net loan fees collected in lieu of interest.

(2)Includes amortized cost basis of assets available for sale and held to maturity.

(3)Yields on tax-exempt municipal obligations are not presented on a tax-equivalent basis in this table.

(4)Represents annualized yields/rates.

NET INTEREST INCOME ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31, |

|

|

2024 |

|

2023 |

|

2022 |

|

|

Average

Balance |

|

Interest |

|

Average

Yield/

Rate |

|

Average

Balance |

|

Interest |

|

Average

Yield/

Rate |

|

Average

Balance |

|

Interest |

|

Average

Yield/

Rate |

|

|

(Dollars in Thousands) |

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate and other mortgage loans(1) |

|

$1,793,041 |

|

$118,339 |

|

6.60% |

|

$1,586,967 |

|

$98,370 |

|

6.20% |

|

$1,484,239 |

|

$66,917 |

|

4.51% |

Commercial and industrial loans(1) |

|

1,153,955 |

|

95,782 |

|

8.30% |

|

1,013,866 |

|

81,963 |

|

8.08% |

|

771,056 |

|

46,575 |

|

6.04% |

Consumer and other loans(1) |

|

49,885 |

|

2,777 |

|

5.57% |

|

47,018 |

|

2,316 |

|

4.93% |

|

49,695 |

|

1,876 |

|

3.78% |

Total loans and leases receivable(1) |

|

2,996,881 |

|

216,898 |

|

7.24% |

|

2,647,851 |

|

182,649 |

|

6.90% |

|

2,304,990 |

|

115,368 |

|

5.01% |

Mortgage-related securities(2) |

|

266,098 |

|

10,405 |

|

3.91% |

|

200,383 |

|

6,433 |

|

3.21% |

|

173,495 |

|

3,486 |

|

2.01% |

Other investment securities(3) |

|

56,301 |

|

1,507 |

|

2.68% |

|

62,921 |

|

1,770 |

|

2.81% |

|

51,700 |

|

986 |

|

1.91% |

FHLB and FRB stock |

|

12,167 |

|

1,133 |

|

9.31% |

|

15,162 |

|

1,231 |

|

8.12% |

|

16,462 |

|

989 |

|

6.01% |

Short-term investments |

|

59,853 |

|

3,186 |

|

5.32% |

|

54,311 |

|

2,845 |

|

5.24% |

|

30,845 |

|

542 |

|

1.76% |

Total interest-earning assets |

|

3,391,300 |

|

233,129 |

|

6.87% |

|

2,980,628 |

|

194,928 |

|

6.54% |

|

2,577,492 |

|

121,371 |

|

4.71% |

Non-interest-earning assets |

|

234,973 |

|

|

|

|

|

231,521 |

|

|

|

|

|

175,424 |

|

|

|

|

Total assets |

|

$3,626,273 |

|

|

|

|

|

$3,212,149 |

|

|

|

|

|

$2,752,916 |

|

|

|

|

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction accounts |

|

$884,321 |

|

33,796 |

|

3.82% |

|

$689,500 |

|

23,727 |

|

3.44% |

|

$503,668 |

|

3,963 |

|

0.79% |

Money market accounts |

|

815,603 |

|

32,180 |

|

3.95% |

|

681,336 |

|

22,129 |

|

3.25% |

|

761,469 |

|

6,241 |

|

0.82% |

Certificates of deposit |

|

237,228 |

|

10,879 |

|

4.59% |

|

273,387 |

|

11,209 |

|

4.10% |

|

97,448 |

|

1,358 |

|

1.39% |

Wholesale deposits |

|

515,197 |

|

21,066 |

|

4.09% |

|

346,285 |

|

14,353 |

|

4.14% |

|

48,825 |

|

1,616 |

|

3.31% |

Total interest-bearing deposits |

|

2,452,349 |

|

97,921 |

|

3.99% |

|

1,990,508 |

|

71,418 |

|

3.59% |

|

1,411,410 |

|

13,178 |

|

0.93% |

FHLB advances |

|

282,437 |

|

7,719 |

|

2.73% |

|

351,990 |

|

8,881 |

|

2.52% |

|

414,191 |

|

7,024 |

|

1.70% |

Other borrowings |

|

51,072 |

|

3,284 |

|

6.43% |

|

38,891 |

|

2,041 |

|

5.25% |

|

43,818 |

|

2,243 |

|

5.12% |

Junior subordinated notes(4) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,429 |

|

504 |

|

20.75% |

Total interest-bearing liabilities |

|

2,785,858 |

|

108,924 |

|

3.91% |

|

2,381,389 |

|

82,340 |

|

3.46% |

|

1,871,848 |

|

22,949 |

|

1.23% |

Non-interest-bearing demand deposit accounts |

|

441,313 |

|

|

|

|

|

453,930 |

|

|

|

|

|

566,230 |

|

|

|

|

Other non-interest-bearing liabilities |

|

92,708 |

|

|

|

|

|

102,668 |

|

|

|

|

|

65,611 |

|

|

|

|

Total liabilities |

|

3,319,879 |

|

|

|

|

|

2,937,987 |

|

|

|

|

|

2,503,689 |

|

|

|

|

Stockholders’ equity |

|

306,394 |

|

|

|

|

|

274,162 |

|

|

|

|

|

249,227 |

|

|

|

|

Total liabilities and stockholders’ equity |

|

$3,626,273 |

|

|

|

|

|

$3,212,149 |

|

|

|

|

|

$2,752,916 |

|

|

|

|

Net interest income |

|

|

|

$124,205 |

|

|

|

|

|

$112,588 |

|

|

|

|

|

$98,422 |

|

|

Interest rate spread |

|

|

|

|

|

2.96% |

|

|

|

|

|

3.08% |

|

|

|

|

|

3.48% |

Net interest-earning assets |

|

$605,442 |

|

|

|

|

|

$599,239 |

|

|

|

|

|

$705,644 |

|

|

|

|

Net interest margin |

|

|

|

|

|

3.66% |

|

|

|

|

|

3.78% |

|

|

|

|

|

3.82% |

Average interest-earning assets to average interest-bearing liabilities |

|

121.73% |

|

|

|

|

|

125.16% |

|

|

|

|

|

137.70% |

|

|

|

|

Return on average assets(4) |

|

1.20% |

|

|

|

|

|

1.13% |

|

|

|

|

|

1.46% |

|

|

|

|

Return on average common equity(4) |

|

14.73% |

|

|

|

|

|

13.79% |

|

|

|

|

|

16.79% |

|

|

|

|

Average equity to average assets |

|

8.45% |

|

|

|

|

|

8.54% |

|

|

|

|

|

9.05% |

|

|

|

|

Non-interest expense to average assets(4) |

|

2.58% |

|

|

|

|

|

2.76% |

|

|

|

|

|

2.89% |

|

|

|

|

BETA ANALYSIS

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

(Unaudited) |

|

December 31, 2024 |

|

September 30, 2024 |

|

|

|

|

Average Yield/Rate (3) |

|

Average Yield/Rate (3) |

|

Increase (Decrease) |

Total loans and leases

receivable (a) |

|

7.21% |

|

7.32% |

|

(0.11)% |

Total interest-earning assets(b) |

|

6.84% |

|

6.97% |

|

(0.13)% |

Adjusted total loans and leases

receivable (1)(c) |

|

6.91% |

|

7.20% |

|

(0.29)% |

Adjusted total interest-earning

assets (1)(d) |

|

6.57% |

|

6.86% |

|

(0.29)% |

Total core deposits(e) |

|

2.98% |

|

3.34% |

|

(0.36)% |

Total bank funding(f) |

|

3.18% |

|

3.44% |

|

(0.26)% |

Net interest margin(g) |

|

3.77% |

|

3.64% |

|

0.13% |

Adjusted net interest margin(h) |

|

3.48% |

|

3.51% |

|

(0.03)% |

|

|

|

|

|

|

|

Effective fed funds rate (2)(i) |

|

4.65% |

|

5.27% |

|

(0.62)% |

|

|

|

|

|

|

|

Beta Calculations: |

|

|

|

|

|

|

Total loans and leases

receivable(a)/(i) |

|

|

|

|

|

17.6% |

Total interest-earning assets(b)/(i) |

|

|

|

|

|

21.3% |

Adjusted total loans and leases

receivable (1)(c)/(i) |

|

|

|

|

|

46.8% |

Adjusted total interest-earning

assets (1)(d)/(i) |

|

|

|

|

|

46.8% |

Total core deposits(e/i) |

|

|

|

|

|

58.1% |

Total bank funding(f)/(i) |

|

|

|

|

|

41.9% |

Net interest margin(g/i) |

|

|

|

|

|

(21.0)% |

Adjusted net interest margin(h/i) |

|

|

|

|

|

4.8% |

PROVISION FOR CREDIT LOSS COMPOSITION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

For the Three Months Ended |

|

For the Twelve Months Ended |

(Dollars in thousands) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

Change due to qualitative factor changes |

|

$(460) |

|

$(444) |

|

$496 |

|

$740 |

|

$(432) |

|

$332 |

|

$33 |

Change due to quantitative factor

changes |

|

(598) |

|

(330) |

|

150 |

|

(199) |

|

(260) |

|

(977) |

|

(1,453) |

Charge-offs |

|

1,132 |

|

1,619 |

|

1,583 |

|

921 |

|

724 |

|

5,255 |

|

1,781 |

Recoveries |

|

(190) |

|

(91) |

|

(191) |

|

(227) |

|

(114) |

|

(699) |

|

(548) |

Change in reserves on individually

evaluated loans, net |

|

2,579 |

|

757 |

|

(1,037) |

|

629 |

|

2,008 |

|

2,928 |

|

4,330 |

Change due to loan growth, net |

|

577 |

|

616 |

|

680 |

|

354 |

|

629 |

|

2,227 |

|

3,652 |

Change in unfunded commitment

reserves |

|

(339) |

|

(40) |

|

32 |

|

108 |

|

17 |

|

(239) |

|

387 |

Total provision for credit losses |

|

$2,701 |

|

$2,087 |

|

$1,713 |

|

$2,326 |

|

$2,572 |

|

$8,827 |

|

$8,182 |

PERFORMANCE RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Twelve Months Ended |

(Unaudited) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

Return on average assets (annualized) |

|

1.52% |

|

1.13% |

|

1.14% |

|

0.98% |

|

1.11% |

|

1.20% |

|

1.13% |

Return on average tangible common equity (annualized) |

|

19.21% |

|

14.40% |

|

14.73% |

|

12.79% |

|

14.64% |

|

15.35% |

|

14.45% |

Efficiency ratio |

|

56.94% |

|

59.44% |

|

62.75% |

|

63.76% |

|

58.34% |

|

60.61% |

|

60.99% |

Interest rate spread |

|

3.11% |

|

2.92% |

|

2.95% |

|

2.88% |

|

2.97% |

|

2.96% |

|

3.08% |

Net interest margin |

|

3.77% |

|

3.64% |

|

3.65% |

|

3.58% |

|

3.69% |

|

3.66% |

|

3.78% |

Average interest-earning assets to average interest-bearing liabilities |

|

121.59% |

|

121.84% |

|

121.37% |

|

122.15% |

|

123.02% |

|

121.73% |

|

125.16% |

ASSET QUALITY RATIOS

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

As of |

(Dollars in thousands) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

Non-accrual loans and leases |

|

$28,367 |

|

$19,364 |

|

$18,999 |

|

$19,829 |

|

$20,597 |

Repossessed assets |

|

51 |

|

56 |

|

54 |

|

317 |

|

247 |

Total non-performing assets |

|

$28,418 |

|

$19,420 |

|

$19,053 |

|

$20,146 |

|

$20,844 |

Non-accrual loans and leases as a

percent of total gross loans and leases |

|

0.91% |

|

0.63% |

|

0.64% |

|

0.68% |

|

0.72% |

Non-performing assets as a percent of

total gross loans and leases plus

repossessed assets |

|

0.91% |

|

0.64% |

|

0.64% |

|

0.69% |

|

0.73% |

Non-performing assets as a percent of

total assets |

|

0.74% |

|

0.52% |

|

0.53% |

|

0.57% |

|

0.59% |

Allowance for credit losses as a percent

of total gross loans and leases |

|

1.20% |

|

1.16% |

|

1.17% |

|

1.19% |

|

1.16% |

Allowance for credit losses as a percent

of non-accrual loans and leases |

|

131.38% |

|

183.38% |

|

183.96% |

|

174.64% |

|

160.21% |

NET CHARGE-OFFS (RECOVERIES)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

For the Three Months Ended |

|

For the Twelve Months Ended |

(Dollars in thousands) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

Charge-offs |

|

$1,132 |

|

$1,619 |

|

$1,583 |

|

$921 |

|

$724 |

|

$5,255 |

|

$1,781 |

Recoveries |

|

(190) |

|

(91) |

|

(191) |

|

(227) |

|

(114) |

|

(699) |

|

(548) |

Net charge-offs (recoveries) |

|

$942 |

|

$1,528 |

|

$1,392 |

|

$694 |

|

$610 |

|

$4,556 |

|

$1,233 |

Net charge-offs (recoveries) as a percent of average gross loans and leases (annualized) |

|

0.12% |

|

0.20% |

|

0.19% |

|

0.10% |

|

0.09% |

|

0.15% |

|

0.05% |

CAPITAL RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Three Months Ended |

(Unaudited) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

Total capital to risk-weighted assets |

|

12.08% |

|

11.72% |

|

11.45% |

|

11.36% |

|

11.19% |

Tier I capital to risk-weighted assets |

|

9.45% |

|

9.11% |

|

8.99% |

|

8.86% |

|

8.74% |

Common equity tier I capital to risk-

weighted assets |

|

9.10% |

|

8.76% |

|

8.64% |

|

8.51% |

|

8.38% |

Tier I capital to adjusted assets |

|

8.78% |

|

8.68% |

|

8.51% |

|

8.45% |

|

8.43% |

Tangible common equity to tangible

assets |

|

7.93% |

|

7.78% |

|

7.80% |

|

7.78% |

|

7.60% |

LOAN AND LEASE RECEIVABLE COMPOSITION

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

As of |

(in thousands) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

Commercial real estate - owner occupied |

|

$273,397 |

|

$259,532 |

|

$258,636 |

|

$263,748 |

|

$256,479 |

Commercial real estate - non-owner occupied |

|

845,298 |

|

768,195 |

|

777,704 |

|

792,858 |

|

773,494 |

Construction |

|

221,086 |

|

266,762 |

|

229,181 |

|

202,382 |

|

193,080 |

Multi-family |

|

530,853 |

|

494,954 |

|

470,176 |

|

453,321 |

|

450,529 |

1-4 family |

|

46,496 |

|

39,933 |

|

39,680 |

|

27,482 |

|

26,289 |

Total commercial real estate |

|

1,917,130 |

|

1,829,376 |

|

1,775,377 |

|

1,739,791 |

|

1,699,871 |

Commercial and industrial |

|