false

0001958777

0001958777

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 19, 2024

FibroBiologics,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41934 |

|

86-3329066 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

455

E. Medical Center Blvd.

Suite

300

Houston,

Texas 77598

(Address

of principal executive offices and Zip Code)

(281)

671-5150

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.00001 per share |

|

FBLG |

|

Nasdaq

Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry Into a Material Definitive Agreement.

As

previously disclosed, FibroBiologics, Inc., (the “Company”) entered into a share purchase agreement, dated November 12, 2021

(the “GEM SPA”), with GEM Global Yield LLC SCS (“GEM Global”) and GEM Yield Bahamas Limited (“GYBL”,

and together with GEM Global, “GEM”). Pursuant to the GEM SPA, on February 14, 2024 the Company issued a warrant to purchase

1,299,783 shares of the Company’s common stock, par value $0.00001 per share (the “Common Stock”) to GYBL (the “Warrant”).

Under the GEM SPA, the Company is obligated to pay a commitment fee of $2.0 million on the earlier of January 31, 2025 or termination

of the SPA.

On

December 19, 2024, the Company and GEM entered into a Side Letter (the “Agreement”) providing for, among other things:

| (i) | a

draw down notice under the GEM SPA for 1,152,074 shares of Common Stock (the “Closing

Shares”) to be issued to GEM at a fixed purchase price of $2.17 per share (the “Notice”); |

| (ii) | a

closing notice pursuant to which GEM accepts the Notice for the full amount of the Closing

Shares at an aggregate Purchase Price of $2.5 million (the “Final Payment”); |

| (iii) | in

satisfaction of the Final Payment, GEM’s (a) waiver of the remaining balance of the

Commitment Fee owed to GEM under the GEM SPA for an aggregate amount of $1.5 million, and

the Company’s acceptance of GEM’s waiver of the remaining balance of the Commitment

Fee for an aggregate amount of $1.5 million; and (b) termination of the Warrant in full,

effective on December 19, 2024; and |

| (iv) | the

termination of the GEM SPA, effective December 20, 2024. |

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text

of the Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item

1.02 Termination of a Material Definitive Agreement.

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

On

December 19, 2024, the Company sold 1,152,074 shares of Common Stock to GEM pursuant to the Notice. The Shares were sold at a price of

$2.17 per share for an aggregate purchase price of $2.5 million. The sale of the Shares was exempt from registration pursuant to Section

4(a)(2) of the Securities Act, including Regulation D and Rule 506 promulgated thereunder, as a transaction by an issuer not involving

a public offering.

The

information set forth in Item 1.02 of this Current Report on Form 8-K is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

*

Portions of this exhibit have been redacted in compliance with Regulation S-K Item 601(b)(10)(iv).

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

December 20, 2024 |

FibroBiologics,

Inc. |

| |

|

|

| |

By: |

/s/

Pete O’Heeron |

| |

Name: |

Pete

O’Heeron |

| |

Title: |

Chief

Executive Officer |

Exhibit 10.1

[***]

= CERTAIN INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY BRACKETS, HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL, (II)

IS THE TYPE THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL, AND (III) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

SIDE

LETER

THIS

SIDE LETTER (the “Agreement”), dated as of December 19, 2024 (the “Effective Date”), is entered

into by and among FIBROBIOLOGICS, INC. (successor to FIBROBIOLOGICS LLC), a Delaware corporation (the “Company”),

GEM GLOBAL YIELD LLC SCS, a “société en commandite simple” formed under the laws of Luxembourg (“GEM

Global”), and GEM YIELD BAHAMAS LIMITED, a limited company formed under the laws of the Commonwealth of the Bahamas (“GYBL”,

and together with GEM Global, “GEM”).

Reference

is made to the Share Purchase Agreement dated as of November 12, 2021, (the “SPA”) by and among the Company and GEM

and the Warrant to Purchase Common Shares issued on February 15, 2024 to GYBL pursuant to the SPA (the “Warrant”).

Capitalized terms used and not otherwise defined herein shall have the meanings given such terms in the SPA.

For

good and valuable consideration, the sufficiency of which is hereby confirmed, each of the Parties, severally, and not jointly, acknowledges

and agrees that:

| a. | This

Agreement constitutes a Draw Down Notice (the “Final Notice”) under the

SPA for a Draw Down Amount Requested of 1,152,074 shares of Common Shares (the “Closing

Shares”) to be issued to GEM at a fixed Purchase Price of $2.17 per share, without

the need for a Pricing Period or a Threshold Price. The Settlement Date applicable to the

Final Notice is the Effective Date. |

| b. | This

Agreement concurrently constitutes a Closing Notice pursuant to which GEM accepts the Final

Notice for the full amount of the Commitment Shares at an aggregate Purchase Price of $2,500,000.58

(the “Final Payment”). |

| c. | In

satisfaction of the Final Payment: |

| i. | GEM

hereby waives the remaining balance of the Commitment Fee as of the Effective Date owed to

GEM under Section 5.12 of the SPA for an aggregate amount of $1.5 million, and Company accepts

GEM’s waiver of the remaining balance of the Commitment Fee as of the Effective Date

owed to GEM under Section 5.12 of the SPA for an aggregate amount of $1.5 million; and |

| ii. | GEM

hereby agrees and acknowledges that, as of the Effective Date, the Warrant is terminated

in full and rendered null and void, and all past, current, or future obligations of the Parties

under the Warrant are extinguished. |

| d. | GEM

will return any original of the Warrant it possesses for cancellation by the Company within

ten business days of the Effective Date. GEM acknowledges and agrees that as of the Effective

Date, it has no surviving right, title or interest in or to the Warrant, any shares purchasable

thereunder or any other option, warrant, right or interest to acquire any securities of the

Company. GEM represents and warrants that (a) it has not exercised or purported to exercise

the Warrant in whole or in part to purchase any shares of the Company’s common stock,

and (b) it is the sole owner and holder of the Warrant, and has not assigned, transferred,

sold, pledged, conveyed or otherwise disposed of (or attempted any of the foregoing with

respect to) the Warrant or any shares purchasable thereunder. |

| e. | On

the date Company transfers the Closing Shares to GEM, all rights, duties or obligations of

the Company and GEM under the SPA have been satisfied, the SPA is terminated with immediate

effect, and none of the Parties will have any further rights, duties or obligations thereunder

or hereunder. |

| f. | The

Company may file a post-effective amendment to its registration statement on Form S-1 (File

No. 333-280303) registering the resale of shares issued to GEM under the SPA (the “GEM

SPA S-1”) to reduce the number of shares registered to only those actually issued

pursuant to the SPA, including the Closing Shares, prior to its termination. |

| g. | The

Company may file a post-effective amendment to its registration statement on Form S-1 (File

No. 333-277019) registering the resale of certain shares issued to GEM under the SPA and

issuable to GEM under the Warrant in order to withdraw such registration. |

| j. | GEM

consents to the Final Notice and the delivery of Closing Shares notwithstanding any volume,

beneficial ownership or other limitations set forth in the SPA and Warrant and GEM agrees

it is responsible for any Exchange Act filings GEM becomes obligated to make as a result

of this Agreement, the Final Notice, or the purchase and delivery of the Closing Shares. |

| k. | GEM

will notify Company once it has sold its Registrable Securities to allow Company to withdraw

the GEM SPA S-1. |

THIS

AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK, WITHOUT REGARD TO PRINCIPLES OF CONFLICTS

OF LAWS THEREOF TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISIDICTION WOULD BE REQUIRED THEREBY.

EACH

OF THE PARTIES HERETO IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY

LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

This

Agreement may not be modified, amended, or supplemented, and no provision of this Agreement may be waived, without the prior written

consent of each of the Parties.

This

Agreement may be signed in counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto

were upon the same instrument. Counterparts may be delivered via electronic mail (including in “.pdf” format or any electronic

signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act

or other applicable law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have

been duly and validly delivered and be valid and effective for all purposes.

[Signature

page follows]

IN

WITNESS WHEREOF, the undersigned Parties have executed this Agreement as of the date first written above.

| |

FIBROBIOLOGICS,

INC. |

| |

|

| |

By: |

/s/

Robert Hoffman |

| |

Name: |

Robert

Hoffman |

| |

Title: |

Chief

Financial Officer |

| |

GEM

GLOBAL YIELD LLC SCS |

| |

|

| |

By: |

/s/

Chris Brown |

| |

Name: |

Chris

Brown |

| |

Title: |

Manager |

| |

GEM

YIELD BAHAMAS LIMITED |

| |

|

| |

By: |

/s/

Chris Brown |

| |

Name: |

Chris

Brown |

| |

Title: |

Manager |

v3.24.4

Cover

|

Dec. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2024

|

| Entity File Number |

001-41934

|

| Entity Registrant Name |

FibroBiologics,

Inc.

|

| Entity Central Index Key |

0001958777

|

| Entity Tax Identification Number |

86-3329066

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

455

E. Medical Center Blvd.

|

| Entity Address, Address Line Two |

Suite

300

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77598

|

| City Area Code |

(281)

|

| Local Phone Number |

671-5150

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.00001 per share

|

| Trading Symbol |

FBLG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

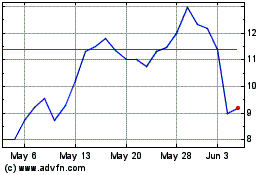

FibroBiologics (NASDAQ:FBLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

FibroBiologics (NASDAQ:FBLG)

Historical Stock Chart

From Dec 2023 to Dec 2024