0000038725false00000387252024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

FRANKLIN ELECTRIC CO., INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Indiana | | 0-362 | | 35-0827455 |

| (State of incorporation) | | (Commission File Number) | | (IRS employer identification no.) |

| | | | | | | | |

| 9255 Coverdale Road | |

| Fort Wayne, | Indiana | 46809 |

| (Address of principal executive offices) | (Zip code) |

(260) 824-2900

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Common Stock, $0.10 par value | | FELE | | NASDAQ Global Select Market |

| (Title of each class) | | (Trading symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

First Amendment to Amended and Restated Note Purchase and Private Shelf Agreement - NYL Shelf Agreement

On May 15, 2024, Franklin Electric Co., Inc. ("Franklin Electric") entered into the First Amendment to the Amended and Restated Note Purchase and Private Shelf Agreement among Franklin Electric, Franklin Electric B.V., a Netherlands private company with limited liability (“Dutch Subsidiary Issuer”, and together with Franklin Electric, collectively, the “Companies” and each a "Company"), NYL Investors LLC (“NYL Investors”), and each of the undersigned holders of the Notes that are signatories hereto (the "Amendment to the NYL Shelf Agreement").

Under the Amendment to the NYL Shelf Agreement, among other changes, the total available facility amount from lenders increased to $250,000,000 from $200,000,000, increased the maturity date on fixed rate notes to mature no more than 20 years after the date of original issuance and to have an average life of no more than 15 years after the date of original issuance, which was previously 15 years and 12 years, and extended the issuance and sold date of notes to May 15, 2027. The issuance fee decreased to 0.025% from 0.10% of the aggregate principal amount.

The Amendment to the NYL Shelf Agreement is subject to a number of conditions, and the description of the Amendment to the NYL Shelf Agreement herein is qualified in its entirety and is incorporated herein by reference to Exhibit 10.1.

First Amendment to Fourth Amended and Restated Note Purchase and Private Shelf Agreement - Pru Shelf Agreement

On May 15, 2024, Franklin Electric entered into the First Amendment to the Fourth Amended and Restated Note Purchase and Private Shelf Agreement among Franklin Electric, Dutch Subsidiary Issuer, PGIM, Inc. (“Prudential”), and the other holders of Notes that are signatories hereto (the "Amendment to the Pru Shelf Agreement ") .

Under the Amendment to the Pru Shelf Agreement, among other changes, the total available facility amount from lenders increased to $250,000,000 from $150,000,000, increased the maturity date on fixed rate notes to mature no more than 20 years after the date of original issuance and to have an average life of no more than 15 years after the date of original issuance, which was previously 15 years and 12 years, and extended the issuance and sold date of notes to May 15, 2027. The issuance fee increased to 0.025% from 0.0% of the aggregate principal amount.

The Amendment is subject to a number of conditions, and the description of the Amendment herein is qualified in its entirety and is incorporated herein by reference to Exhibit 10.2.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure in response to Item 1.01 of this Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 10.2 | | |

| 101 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FRANKLIN ELECTRIC CO., INC.

(Registrant)

| | | | | | | | | | | |

Date: May 16, 2024 | | By | /s/ Jeffery L. Taylor |

| | | Jeffery L. Taylor |

| | | Vice President, Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |

EXHIBIT 10.1

FIRST AMENDMENT TO AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT

THIS FIRST AMENDMENT TO AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT (this "Amendment"), is made and entered into as of May 15, 2024 by and among Franklin Electric Co., Inc., an Indiana corporation ("Franklin Electric"), Franklin Electric B.V., a Netherlands private company with limited liability (the “Dutch Subsidiary Issuer”, and together with Franklin Electric, collectively, the “Companies” and each a “Company”), NYL Investors LLC, a Delaware limited liability company ("NYL Investors") and each of the undersigned holders of Notes (as defined in the Note Agreement defined below) that are signatories hereto (together with their successors and assigns, the "Noteholders").

WITNESSETH:

WHEREAS, the Companies and the Noteholders are parties to that certain Amended and Restated Note Purchase and Private Shelf Agreement, dated as of July 30, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the "Note Agreement"; capitalized terms used herein and not otherwise defined shall have the meanings assigned to such terms in the Note Agreement), pursuant to which the Noteholders have purchased Notes from the Companies; and

WHEREAS, the Companies have requested that the Noteholders amend certain provisions of the Note Agreement, and subject to the terms and conditions hereof, the Noteholders are willing to do so;

NOW, THEREFORE, for good and valuable consideration, the sufficiency and receipt of all of which are acknowledged, the Companies and the Noteholders agree as follows:

1. Amendments.

(a) The cover page of the Note Agreement is hereby amended by replacing the reference to “AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT $200,000,000 Master Note Agreement $75,000,000 4.04% Senior Note, Series B, Due September 26, 2025” with the following:

AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT

$250,000,000 Master Note Agreement

$75,000,000 4.04% Senior Note, Series B, Due September 26, 2025

(b) All references to the term “Dutch Issuer Subsidiary” in the Note Agreement are hereby amended by replacing such references with the term “Dutch Subsidiary Issuer”.

(c) The first sentence of Section 1.3 of the Note Agreement is hereby amended in its entirety with the following:

Each Issuer may, from time to time and in accordance with the terms of this Agreement, authorize the issue of additional senior promissory notes (the “Shelf Notes”) in an aggregate outstanding principal amount not to exceed the Available Facility Amount at any time, each to be dated the date of its issue, bearing interest on the unpaid balance from the date of original issuance at the rate per annum and in the Available Currency as provided by the terms of this Agreement and (x) in the case of Fixed Rate Notes, to mature no more than 20 years after the date of original issuance and to have an average life of no more than 15 years after the date of original issuance and (y) in the case of Floating Rate Notes, to mature no more than 10 years after the date of original issuance and to have an average life of no more than 10 years after the date of original issuance.

(d) Section 2.3 of the Note Agreement is hereby amended by replacing clause (a) of such Section in its entirety with the following:

(a) May 15, 2027 (or if such date is not a Business Day, the Business Day next preceding that date);

(e) Section 2.5 of the Note Agreement is hereby amended by replacing clause (c) of such Section in its entirety with the following:

(c) specify the principal amounts, final maturities (which are no more than (x) 20 years from the date of issuance, in the case of Fixed Rate Notes and (y) 10 years from the date of issuance, in the case of Floating Rate Notes), average life (which is no more than (x) 15 years from the date of issuance, in the case of Fixed Rate Notes and (y) 10 years from the date of issuance, in the case of Floating Rate Notes) and principal prepayment dates (if any) of the Shelf Notes covered by the Request for Purchase;

(f) Section 3.2 of the Note Agreement is hereby amended by replacing such Section in its entirety with the following:

Issuance Fee. The applicable Issuer will pay to each Purchaser in immediately available funds a fee (herein called the “Issuance Fee”) on each Closing Date in an amount equal to 0.025% of the aggregate principal amount of the Notes sold to such Purchaser payable in Dollars.

(g) Schedule A is hereby amended by replacing the defined term “Available Facility Amount” in its entirety with the following:

“Available Facility Amount” means, at any point in time, (a) $250,000,000, minus (b) the aggregate principal Dollar Amount of Notes (including the Series B Notes) purchased and sold pursuant to this Agreement prior to that time, minus (c) the aggregate principal Dollar Amount of Accepted Notes that have not been purchased and sold hereunder

prior to that time and for which the closing has not been cancelled, plus (d) the aggregate principal Dollar Amount of Notes purchased, sold, and repaid or prepaid pursuant to this Agreement prior to that time.

(h) Exhibit B of the Note Agreement is hereby amended in its entirety to read as Exhibit B attached hereto.

2. Conditions to Effectiveness of this Amendment. Notwithstanding any other provision of this Amendment and without affecting in any manner the rights of the holders of the Notes hereunder, it is understood and agreed that this Amendment shall not become effective, and the Companies shall have no rights under this Amendment, until the Noteholders shall have received (i) a structuring fee in the amount of $25,000.00, (ii) to the extent the Companies have received an invoice on or prior to the date hereof, reimbursement or payment of the costs and expenses of the Noteholders incurred in connection with this Amendment or the Note Agreement (including reasonable fees, charges and disbursements of King & Spalding LLP, counsel to the Noteholders), (iii) executed counterparts to this Amendment from the Companies and the Required Holders and (iv) executed counterparts to the Consent and Acknowledgement of the parties to the Subsidiary Guaranty, in the form of Exhibit A attached hereto.

3. Representations, Covenants, and Warranties. To induce the Noteholders to enter into this Amendment, each Company hereby represents, covenants and warrants to the Noteholders that:

(a) Franklin Electric is a corporation duly organized and existing in good standing under the laws of the State of Indiana and has the corporate power to own its property and to carry on its business as now being conducted. The Dutch Subsidiary Issuer is a corporation duly organized under the laws of the Netherlands and has the corporate power to own its property and to carry on its business as now conducted. Each Subsidiary is duly organized and existing in good standing (to the extent such concept is applicable in the relevant jurisdiction) under the laws of its jurisdiction of incorporation and has the corporate power to own its property and to carry on its business as now being conducted except in such instances where the failure could not be reasonably expected to result in a Material Adverse Effect. Each of the Companies and their Subsidiaries is qualified to do business in, and is in good standing in, every jurisdiction where such qualification is required, except where the failure to do so, individually or in the aggregate, could not reasonably be expected to result in a Material Adverse Effect;

(b) Each Company has the corporate or other organizational power and authority to execute and deliver this Amendment and to perform the provisions hereof. The execution, delivery and performance of this Amendment has been duly authorized by all requisite corporate or other organizational action, and this Amendment has been duly executed and delivered by authorized officers of the applicable Company and are valid obligations of such Company, legally binding upon and enforceable against such Company in accordance with their terms, except as such enforceability may be limited by (i) bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law); and

(c) After giving effect to this Amendment, the representations and warranties contained in the Note Agreement and the other Note Documents are true, accurate and correct in all material respects (or in all respects in the case of any representation and warranty qualified by materiality or Material Adverse Effect) on and as of the date hereof, except to the extent that any such representation and warranty specifically relates to an earlier date, in which case they shall be true, accurate and correct as of such earlier date, and no Default or Event of Default has occurred and is continuing as of the date hereof.

5. Effect of Amendment. Except as set forth expressly herein, all terms of the Note Agreement, as amended hereby, and the other Note Documents shall be and remain in full force and effect and shall constitute the legal, valid, binding and enforceable obligations of the Companies to all holders of the Notes. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the holders of the Notes under the Note Agreement, nor constitute a waiver of any provision of the Note Agreement. From and after the date hereof, all references to the Note Agreement shall mean the Note Agreement as modified by this Amendment. This Amendment shall constitute a Note Document for all purposes of the Note Agreement.

6. Governing Law. This Amendment shall be governed by, and construed in accordance with, the internal laws of the State of New York and all applicable federal laws of the United States of America.

7. No Novation. This Amendment is not intended by the parties to be, and shall not be construed to be, a novation of the Note Agreement or an accord and satisfaction in regard thereto.

8. Costs and Expenses. The Companies agree to pay on demand all costs and expenses of the Noteholders in connection with the preparation, execution and delivery of this Amendment, including, without limitation, the reasonable fees and out-of-pocket expenses of outside counsel for the Noteholders with respect thereto.

9. Counterparts. This Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, each of which shall be deemed an original and all of which, taken together, shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of this Amendment by facsimile transmission or by electronic mail in pdf form shall be as effective as delivery of a manually executed counterpart hereof.

10. Binding Nature. This Amendment shall be binding upon and inure to the benefit of the parties hereto, any other holders of Notes from time to time and their respective successors, successors-in-titles, and assigns.

11. Entire Understanding. This Amendment sets forth the entire understanding of the parties with respect to the matters set forth herein, and shall supersede any prior negotiations or agreements, whether written or oral, with respect thereto.

12. Severability. If any term or provision of this Amendment shall be deemed prohibited by or invalid under any applicable law, such provision shall be invalidated without affecting the remaining provisions of this Amendment or the Note Agreement, respectively.

[Signature Pages to Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed, under seal in the case of each Company, by its respective authorized officers as of the day and year first above written.

COMPANIES:

FRANKLIN ELECTRIC CO., INC.

By /s/ Jonathan Grandon

Name: Jonathan Grandon

Title: Secretary

FRANKLIN ELECTRIC B.V.

By /s/ Diederik Hiebendaal

Name: Diederik Hiebendaal

Title: Managing Director A

By /s/ Jonathan Grandon

Name: Jonathan Grandon

Title: Managing Director B

NYL INVESTORS LLC

By: /s/ Andrew Donner

Name: Andrew Donner

Title: Managing Director

NOTEHOLDERS

NEW YORK LIFE INSURANCE COMPANY

By: NYL Investors LLC, its Investment Manager

By: /s/ Andrew Donner

Name: Andrew Donner

Title: Managing Director

NEW YORK LIFE INSURANCE AND ANNUITY

CORPORATION

By: NYL Investors LLC, its Investment Manager

By: /s/ Andrew Donner

Name: Andrew Donner

Title: Managing Director

NEW YORK LIFE INSURANCE AND ANNUITY

CORPORATION INSTITUTIONALLY OWNED

LIFE INSURANCE SEPARATE ACCOUNT

(BOLI 30C)

By: NYL Investors LLC, its Investment Manager

By: /s/ Andrew Donner

Name: Andrew Donner

Title: Managing Director

THE BANK OF NEW YORK MELLON, A BANKING CORPORATION ORGANIZED UNDER THE LAWS OF NEW YORK, NOT IN ITS INDIVIDUAL CAPACITY BUT SOLELY AS TRUSTEE UNDER THAT CERTAIN TRUST AGREEMENT DATED AS OF JULY 1, 2015 BETWEEN NEW YORK LIFE INSURANCE COMPANY (U.S.A.), AS BENEFICIARY, JOHN HANCOCK LIFE INSURANCE COMPANY OF NEW YORK, AS BENEFICIARY, AND THE BANK OF NEW YORK MELLON, AS TRUSTEE

By: New York Life Insurance Company, its Attorney-in-Fact

By: NYL Investors LLC, its Investment Manager

By: /s/ Andrew Donner

Name: Andrew Donner

Title: Managing Director

EXHIBIT A

CONSENT AND ACKNOWLEDGEMENT

May 15, 2024

The undersigned, each a Subsidiary Guarantor under the Amended and Restated Subsidiary Guaranty Agreement, dated as of July 30, 2021 (the “Guaranty”), in favor of the Purchasers (as defined therein) and the other holders from time to time of the Notes (as defined therein), under the Amended and Restated Note Purchase and Private Shelf Agreement, dated as of July 30, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the “Note Agreement”; capitalized terms used and not otherwise defined in this Consent and Acknowledgement have the respective meanings ascribed to them in the Note Agreement), hereby acknowledges, confirms and agrees that the Guaranty is, and shall continue to be, in full force and effect and is hereby confirmed and ratified in all respects after giving effect to the First Amendment to the Amended and Restated Note Purchase and Private Shelf Agreement.

Each of the undersigned Guarantors hereby represents and warrants that the execution, delivery and performance by such Guarantor of the Guaranty and each other document or instrument to be delivered by such Guarantor pursuant to the Note Agreement have in each case been duly authorized by all necessary corporate or other organizational action and do no and will not (i) contravene the terms of the certificate of incorporation, article of incorporation, the certificate of formation, the bylaws, the limited liability company agreement or other equivalent organizational documents of such Guarantor, (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under the Note Agreement, any document evidencing any contractual obligation to which such Guarantor is a party or any order, injunction, writ or decree of any governmental authority binding on such Guarantor or its properties, or (iii) violate any applicable law binding on or affecting such Guarantor.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF, the parties hereto have caused this Consent and Acknowledgement to be duly executed and delivered by their respective proper and duly authorized officers effective as of the date first above written.

| | | | | |

| Franklin Electric International, Inc. | Driller Services, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Fueling Systems, LLC | 2M Company, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Grid Solutions, LLC | Western Hydro LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Headwater Companies, LLC | Gicon Pumps & Equipment, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Valley Farms Supply, LLC | Puronics, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Water Treatment, LLC | Milan Supply Company, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Blake Equipment, LLC | |

By: /s/ Jonathan Grandon | |

Name: Jonathan Grandon | |

Title: Secretary | |

EXHIBIT B

[FORM OF REQUEST FOR PURCHASE]

FRANKLIN ELECTRIC CO., INC.

Reference is made to the Amended and Restated Note Purchase and Private Shelf Agreement (the “Agreement”), dated as of July 30, 2021 among Franklin Electric Co., Inc., an Indiana corporation (the “Company”), on the one hand, and NYL Investors LLC (“New York Life”), the Purchasers and each New York Life Affiliate which becomes party thereto, on the other hand. Capitalized terms used and not otherwise defined herein shall have the respective meanings specified in the Agreement.

Pursuant to Section 2.5 of the Agreement, the Company hereby makes the following Request for Purchase:

1. Aggregate principal amount of

the Notes covered hereby

(the “Notes”) $[1]

2. [Fixed/Floating] Interest Rate

[For Floating Rate Notes Only: 1/3/6 month LIBOR and interest periods]

3. Individual specifications of the Notes: | | | | | | | | | | | | | | | | | |

Issuer |

Principal Amount |

Final Maturity Date[2] | Principal Prepayment Dates and Amounts[3] |

Interest Payment Period[4] | Applicable Currency[5] |

| | | | | |

4. Use or uses of proceeds of the Notes:

5. Proposed day for the closing of the purchase and sale of the Notes:

[1] Minimum principal amount of $5,000,000.

[2] Final maturity not to exceed 20 years (for Fixed Rate Notes) or 10 years (for Floating Rate Notes).

[3] Average life not to exceed 15 years (for Fixed Rate Notes) or 10 years (for Floating Rate Notes).

[4] Specify monthly, quarterly or semi-annually.

[5] Must be Dollars for Floating Rate Loans.

6. Each Issuer certifies (a) that the representations and warranties contained in Section 5 of the Agreement are true on and as of the date of this Request for Purchase except to the extent of changes caused by the transactions contemplated in the Agreement and except as the schedules to the Agreement have been modified by written supplements delivered by the Company to the Purchasers, and (b) that there exists on the date of this Request for Purchase no Default or Event of Default and, after giving effect to the issuance of Notes on the proposed Closing Date, no Default or Event of Default shall have occurred and be continuing.

Dated:

FRANKLIN ELECTRIC CO., INC.

By:

Name:

Title:

FRANKLIN ELECTRIC B.V.

By:

Name:

Title:

By:

Name:

Title:

EXHIBIT 10.2

FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT

THIS FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED NOTE PURCHASE AND PRIVATE SHELF AGREEMENT (this “Amendment”), is made and entered into as of May 15, 2024, by and among Franklin Electric Co., Inc., an Indiana corporation (“Franklin Electric”), Franklin Electric B.V., a Netherlands private company with limited liability (the “Dutch Subsidiary Issuer”, and together with Franklin Electric, collectively, the “Companies” and each a “Company”), PGIM, Inc. (“Prudential”) and the other holders of Notes (as defined in the Note Agreement defined below) that are signatories hereto (together with their successors and assigns, the “Noteholders”).

WITNESSETH:

WHEREAS, the Companies and the Noteholders are parties to a certain Fourth Amended and Restated Note Purchase and Private Shelf Agreement, dated as of July 30, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the “Note Agreement”; capitalized terms used herein and not otherwise defined shall have the meanings assigned to such terms in the Note Agreement), pursuant to which the Noteholders have purchased Notes from the Companies; and

WHEREAS, the Companies have requested that the Noteholders amend certain provisions of the Note Agreement, and subject to the terms and conditions hereof, the Noteholders are willing to do so;

NOW, THEREFORE, for good and valuable consideration, the sufficiency and receipt of all of which are acknowledged, the Companies and the Noteholders agree as follows:

1. Amendments.

(a) The first sentence of Paragraph 1B of the Note Agreement is hereby amended by replacing such sentence in its entirety with the following:

Each Issuer may authorize the issue of, but shall not be obligated to issue, its additional senior promissory notes (herein called the “Private Shelf Notes”; for the avoidance of doubt the Series B Notes constitute Private Shelf Notes) after the date hereof in the aggregate principal amount of up to $250,000,000 (including the equivalent in the Available Currencies), to be dated the date of issue thereof, to mature, in the case of each Private Shelf Note so issued, no less than five (5) years and no more than twenty (20) years after the date of original issuance thereof, to have an average life, in the case of each Private Shelf Note so issued, of no more than fifteen (15) years after the date of original issuance thereof, to bear interest on the unpaid balance thereof from the date thereof at the rate per annum (and to have such other particular terms) as shall be set forth in the case of each Private Shelf Note so issued in the Confirmation of Acceptance with respect to such Private Shelf Note delivered pursuant to paragraph 2A(5), and to be substantially in the form of Exhibit A attached hereto.

(b) Paragraph 2A(2) of the Note Agreement is hereby amended by replacing such Paragraph in its entirety with the following:

Issuance Period. Private Shelf Notes may be issued and sold pursuant to this Agreement until the earlier of (i) May 15, 2027 (or if such date is not a New York Business Day, the New York Business Day next preceding such date); (ii) the thirtieth day after Prudential shall have given to the Company, or the Company shall have given to Prudential, a written notice stating that it elects to terminate the issuance and sale of Private Shelf Notes pursuant to this Agreement (or if such thirtieth day is not a New York Business Day, the New York Business Day next preceding such thirtieth day), (iii) the last Private Shelf Closing Day after which there is no Available Facility Amount, (iv) the termination of the Facility under paragraph 7A of this Agreement, and (v) the acceleration of any Note under paragraph 7A of this Agreement. The period during which Private Shelf Notes may be issued and sold pursuant to this Agreement is herein called the “Issuance Period”.

(c) Paragraph 2A(8)(i) of the Note Agreement is hereby amended by replacing such Paragraph in its entirety with the following:

Issuance Fee. The applicable Issuer will pay to each Purchaser in immediately available funds a fee (herein called the “Issuance Fee”) on each Private Shelf Closing Day in an amount equal to 0.025% of the aggregate principal amount of the Notes sold to such Purchaser in Dollars.

(d) Paragraph 3A(iii) of the Note Agreement is hereby amended by replacing such Paragraph in its entirety with the following:

Payment of Fees. The Company shall have paid to Prudential and each Purchaser any fees due it pursuant to or in connection with this Agreement, including any Issuance Fee pursuant to paragraph 2A(8)(i), any Delayed Delivery Fee pursuant to paragraph 2A(8)(ii) and the fees and expenses of counsel for Prudential and the Purchasers, as applicable.

(e) Paragraph 10(B) of the Note Agreement is hereby amended by adding the following new defined term in the appropriate alphabetical order:

“Issuance Fee” shall have the meaning specified in paragraph 2A(8)(i).

2. Conditions to Effectiveness of this Amendment. Notwithstanding any other provision of this Amendment and without affecting in any manner the rights of the holders of the Notes hereunder, it is understood and agreed that this Amendment shall not become effective, and the Companies shall have no rights under this Amendment, until Prudential shall have received (i) a structuring fee in the amount of $25,000.00, (ii) to the extent the Companies have received an invoice on or prior to the date hereof, reimbursement or payment of the costs and expenses of Prudential incurred in connection with this Amendment or the Note Agreement (including reasonable fees, charges and disbursements of King & Spalding LLP, counsel to Prudential), (iii) executed counterparts to this Amendment from the Companies and the Required Holders and (iv) executed counterparts to the Consent and Acknowledgement of the parties to the Subsidiary Guaranty, in the form of Exhibit A attached hereto.

3. Representations, Covenants, and Warranties. To induce the Noteholders to enter into this Amendment, each Company hereby represents, covenants and warrants to the Noteholders that:

(a) Franklin Electric is a corporation duly organized and existing in good standing under the laws of the State of Indiana and has the corporate power to own its property and to carry on its business as now being conducted. The Dutch Subsidiary Issuer is a corporation duly organized under the laws of the Netherlands and has the corporate power to own its property and to carry on its business as now conducted. Each Subsidiary is duly organized and existing in good standing (to the extent such concept is applicable in the relevant jurisdiction) under the laws of its jurisdiction of incorporation and has the corporate power to own its property and to carry on its business as now being conducted except in such instances where the failure could not be reasonably expected to result in a material adverse effect on the business, assets, operations or condition (financial or otherwise) of the Companies and their Subsidiaries taken as a whole. Each of the Companies and its Subsidiaries is qualified to do business in, and is in good standing in, every jurisdiction where such qualification is required, except where the failure to do so, individually or in the aggregate, could not reasonably be expected to result in a material adverse effect on the business, assets, operations or condition (financial or otherwise) of the Companies and their Subsidiaries taken as a whole.

(b) Each Company has the corporate or other organizational power and authority to execute and deliver this Amendment and to perform the provisions hereof. The execution, delivery and performance of this Amendment has been duly authorized by all requisite corporate or other organizational action, and this Amendment has been duly executed and delivered by authorized officers of the applicable Company and are valid obligations of such Company, legally binding upon and enforceable against such Company in accordance with their terms, except as such enforceability may be limited by (i) bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law); and

(c) After giving effect to this Amendment, the representations and warranties contained in the Note Agreement and the other Note Documents are true, accurate and correct in all material respects (or in all respects in the case of any representation and warranty qualified by materiality or Material Adverse Effect) on and as of the date hereof, except to the extent that any such representation and warranty specifically relates to an earlier date, in which case they shall be true, accurate and correct as of such earlier date, and no Default or Event of Default has occurred and is continuing as of the date hereof.

4. Effect of Amendment. Except as set forth expressly herein, all terms of the Note Agreement, as amended hereby, and the other Note Documents shall be and remain in full force and effect and shall constitute the legal, valid, binding and enforceable obligations of the Companies to all holders of the Notes. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the holders of the Notes under the Note Agreement, nor constitute a waiver of any provision of the Note Agreement. From and after the date hereof, all references to the Note Agreement shall mean the Note Agreement as modified by this Amendment. This Amendment shall constitute a Note Document for all purposes of the Note Agreement.

5. Governing Law. This Amendment shall be governed by, and construed in accordance with, the internal laws of the State of New York and all applicable federal laws of the United States of America.

6. No Novation. This Amendment is not intended by the parties to be, and shall not be construed to be, a novation of the Note Agreement or an accord and satisfaction in regard thereto.

7. Costs and Expenses. The Companies agree to pay on demand all costs and expenses of the Noteholders in connection with the preparation, execution and delivery of this Amendment, including, without limitation, the reasonable fees and out-of-pocket expenses of outside counsel for the Noteholders with respect thereto.

8. Counterparts. This Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, each of which shall be deemed an original and all of which, taken together, shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of this Amendment by facsimile transmission or by electronic mail in pdf form shall be as effective as delivery of a manually executed counterpart hereof.

9. Binding Nature. This Amendment shall be binding upon and inure to the benefit of the parties hereto, any other holders of Notes from time to time and their respective successors, successors-in-titles, and assigns.

10. Entire Understanding. This Amendment sets forth the entire understanding of the parties with respect to the matters set forth herein, and shall supersede any prior negotiations or agreements, whether written or oral, with respect thereto.

11. Severability. If any term or provision of this Amendment shall be deemed prohibited by or invalid under any applicable law, such provision shall be invalidated without affecting the remaining provisions of this Amendment or the Note Agreement, respectively.

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed, under seal in the case of each Company, by its respective authorized officers as of the day and year first above written.

COMPANIES:

FRANKLIN ELECTRIC CO., INC.

By /s/ Jonathan Grandon

Name: Jonathan Grandon

Title: Secretary

FRANKLIN ELECTRIC B.V.

By /s/ Diederik Hiebendaal

Name: Diederik Hiebendaal

Title: Managing Director A

By /s/ Jonathan Grandon

Name: Jonathan Grandon

Title: Managing Director B

NOTEHOLDERS:

PGIM, INC.

By: /s/ David Quakenbush

Name: David Quakenbush

Title: Vice President

EXHIBIT A

CONSENT AND ACKNOWLEDGEMENT

May 15, 2024

The undersigned, each a Guarantor under the Amended and Restated Subsidiary Guaranty Agreement, dated as of July 30, 2021 (the “Guaranty”), in favor of the Purchasers (as defined therein) and the other holders from time to time of the Notes (as defined therein), under the Fourth Amended and Restated Note Purchase and Private Shelf Agreement, dated as of July 30, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the “Note Agreement”; capitalized terms used and not otherwise defined in this Consent and Acknowledgement have the respective meanings ascribed to them in the Note Agreement), hereby acknowledges, confirms and agrees that the Guaranty is, and shall continue to be, in full force and effect and is hereby confirmed and ratified in all respects after giving effect to the First Amendment to the Fourth Amended and Restated Note Purchase and Private Shelf Agreement.

Each of the undersigned Guarantors hereby represents and warrants that the execution, delivery and performance by such Guarantor of the Guaranty and each other document or instrument to be delivered by such Guarantor pursuant to the Note Agreement have in each case been duly authorized by all necessary corporate or other organizational action and do no and will not (i) contravene the terms of the certificate of incorporation, article of incorporation, the certificate of formation, the bylaws, the limited liability company agreement or other equivalent organizational documents of such Guarantor, (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under the Note Agreement, any document evidencing any contractual obligation to which such Guarantor is a party or any order, injunction, writ or decree of any governmental authority binding on such Guarantor or its properties, or (iii) violate any applicable law binding on or affecting such Guarantor.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF, the parties hereto have caused this Consent and Acknowledgement to be duly executed and delivered by their respective proper and duly authorized officers effective as of the date first above written.

| | | | | |

| Franklin Electric International, Inc. | Driller Services, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Fueling Systems, LLC | 2M Company, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Grid Solutions, LLC | Western Hydro LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Headwater Companies, LLC | Gicon Pumps & Equipment, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Valley Farms Supply, LLC | Puronics, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Franklin Water Treatment, LLC | Milan Supply Company, LLC |

By: /s/ Jonathan Grandon | By: /s/ Jonathan Grandon |

Name: Jonathan Grandon | Name: Jonathan Grandon |

Title: Secretary | Title: Secretary |

| |

| Blake Equipment, LLC | |

By: /s/ Jonathan Grandon | |

Name: Jonathan Grandon | |

Title: Secretary | |

v3.24.1.1.u2

DOCUMENT AND ENTITY INFORMATION DOCUMENT

|

May 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 15, 2024

|

| Entity Registrant Name |

FRANKLIN ELECTRIC CO., INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

0-362

|

| Entity Tax Identification Number |

35-0827455

|

| Entity Address, Address Line One |

9255 Coverdale Road

|

| Entity Address, City or Town |

Fort Wayne,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46809

|

| City Area Code |

260

|

| Local Phone Number |

824-2900

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

FELE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000038725

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

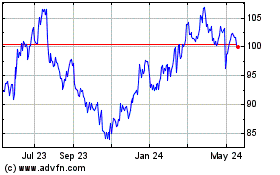

Franklin Electric (NASDAQ:FELE)

Historical Stock Chart

From May 2024 to Jun 2024

Franklin Electric (NASDAQ:FELE)

Historical Stock Chart

From Jun 2023 to Jun 2024