false000086041300008604132025-01-032025-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

------------------------------

FORM 8-K

------------------------------

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (date of earliest event reported): January 3, 2025

------------------------------

FIRST INTERSTATE BANCSYSTEM, INC.

(Exact name of registrant as specified in its charter)

------------------------------

| | | | | | | | | | | | | | |

| | | | |

| Delaware | 001-34653 | | 81-0331430 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File No.) | | (IRS Employer

Identification No.) |

| | | | |

401 North 31st Street | | | |

Billings, | MT | | | 59101 |

| (Address of principal executive offices) | | | (zip code) |

| | | | | | | | | | | | | | |

| (406) | 255-5311 | |

| (Registrant’s telephone number, including area code) |

| | | | |

| Not Applicable | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a- 12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

* * * * *

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common stock, $0.00001 par value | FIBK | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

* * * * *

Item 2.02 Results of Operations and Financial Condition.

The information in Item 2.06 of this Current Report on Form 8-K (the “Report”) is incorporated herein by reference.

Item 2.06 Material Impairments.

On January 3, 2025, management of First Interstate BancSystem, Inc. (the “Company”) and its wholly owned subsidiary First Interstate Bank (the “Bank”) determined that the Company expects to recognize a material, partial charge-off of approximately $49.3 million for the quarter ended December 31, 2024 related to a single commercial and industrial loan relationship (the “C&I Loan”), for which a $26.5 million specific reserve was held as of September 30, 2024. As of December 31, 2024, the outstanding aggregate balance of the C&I Loan was approximately $62.8 million.

As previously disclosed with respect to the C&I Loan, the Bank placed the loan relationship on non-accrual status in the first quarter of 2024. As a result of adverse developments impacting the borrower’s business, including the continued deterioration of the borrower’s financial performance in the fourth quarter of 2024, a careful review of the available collateral and other developments, and the borrower’s failure to perform under a forbearance agreement, including its failure to consummate a proposed sale of its assets prior to December 31, 2024 in accordance with a mutually agreed upon market and sale process, the Company initiated proceedings against the borrower and certain of its affiliates on January 3, 2025 seeking, among other things, the appointment of a receiver over the borrower and its assets on an emergency basis and to enforce its rights under the applicable loan documents. On January 6, 2025, a receiver was appointed by a court on an emergency basis. On January 8, 2025, the borrower, under the control of the receiver, entered into an asset purchase agreement with a third-party buyer pursuant to which the borrower has agreed to sell substantially all of its assets to the buyer. Closing of this transaction is expected to occur in January 2025, subject to various closing conditions, including court approval of the Purchase Agreement. If consummated, proceeds received by the borrower pursuant to the Purchase Agreement are expected to be applied to resolve the C&I Loan, as further described below.

The C&I Loan is secured by all of the borrower’s assets. As of the date of this Report, based on the estimated realizable value to the Company pursuant to the terms of the Purchase Agreement, the Company’s remaining exposure of $13.5 million is the Company’s best estimate of proceeds expected to be received by the Company at this time. The Company is currently unable to quantify the amount of potential recoveries in excess of what is reflected in the current charge-off estimate or if further charges will be incurred related to this lending relationship. At this time, the Company does not expect any material future cash expenditures in connection with the enforcement of the Company’s rights under the applicable loan documents and the contemplated sale of the borrower’s assets pursuant to the Purchase Agreement.

After accounting for the non-cash charge-off, the Company’s fourth quarter 2024 operating results are expected to reflect a larger than expected provision for credit losses expense due to the charge-off amount of the C&I Loan exceeding the specific reserve. The impact associated with the C&I Loan partial charge-off was positively offset, however, by the Company’s successful resolution in the fourth quarter of 2024 of a previously disclosed non-performing agricultural loan. As of September 30, 2024, the Company had an agricultural loan with a non-performing loan balance of approximately $22.2 million, which had been reported as non-performing since the fourth quarter of 2023. In the fourth quarter of 2024, the Company received the payoff of the agricultural loan and, as a result, no loss is expected to be reported in the fourth quarter of 2024. There was not a specific reserve applied to this agricultural loan as of September 30, 2024. Driven by the developments discussed above, the Company anticipates non-performing loans to decline during the fourth quarter of 2024.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this Report constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictive in nature and are identified by the use of the terms “expected,” “will,” “look forward to,” “aim,” and similar words or phrases indicating possible future expectations, events or actions. Such forward-looking statements are based on current expectations, assumptions and projections about our business and the Company, and are not guarantees of our future performance or outcomes. These statements are subject to a number of known and unknown risks, uncertainties, and other factors, many of which are beyond our ability to control or predict, which may cause actual events to be materially different from those expressed or implied herein. The Company has provided additional information about the risks facing its business in its most recent annual report on Form 10-K, and any subsequent periodic and current reports on Forms 10-Q and 8-K, filed by it with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made and are expressly qualified in their entirety by the cautionary statements set forth herein and in the filings with the Securities and Exchange Commission identified above, which you should read in their entirety before making any investment or other decision with respect to our securities. We undertake no obligation to update or revise any forward-looking statements contained in this report, whether as a result of new information, future events or otherwise, except as otherwise required by applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | |

| Exhibit Number | Exhibit Description |

| | |

| | |

| | |

| 104 | Cover Page Interactive Data File (embedded within Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 10, 2025

| | | | | | | | |

| | |

| FIRST INTERSTATE BANCSYSTEM, INC. |

| | |

| By: | /s/ JAMES A. REUTER |

| | James A. Reuter |

| | President and Chief Executive Officer |

v3.24.4

Cover

|

Jan. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 03, 2025

|

| Entity Registrant Name |

FIRST INTERSTATE BANCSYSTEM, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34653

|

| Entity Tax Identification Number |

81-0331430

|

| Entity Address, Address Line One |

401 North 31st Street

|

| Entity Address, City or Town |

Billings,

|

| Entity Address, State or Province |

MT

|

| Entity Address, Postal Zip Code |

59101

|

| City Area Code |

(406)

|

| Local Phone Number |

255-5311

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.00001 par value

|

| Trading Symbol |

FIBK

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000860413

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

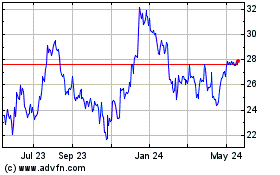

First Interstate BancSys... (NASDAQ:FIBK)

Historical Stock Chart

From Dec 2024 to Jan 2025

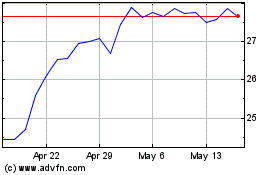

First Interstate BancSys... (NASDAQ:FIBK)

Historical Stock Chart

From Jan 2024 to Jan 2025