Acceleration of Initiatives to Address Market

Trends

Board of Directors Appointments Strengthen

Leadership and Governance

Management to Host Conference Call Today at

4:30 p.m. Eastern Time

Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of

advanced lithium-ion energy storage solutions for electrification

of commercial and industrial equipment, has reported its financial

and operational results for the fiscal third quarter ended March

31, 2024.

Key Financial FY 2024 Third Quarter and Subsequent

Operational Highlights and Business

($ millions)

Q3 Comparison

Q3 2024

Q3 2023

$ Change YoY

% Change YoY

Revenue

$

14.5

$

15.1

$

-0.6

-4

%

Gross Profit

$

4.4

$

4.7

$

-0.3

-7

%

Gross Margin

30

%

31

%

—

-100

BPS

Adjusted EBITDA

$

-1.4

$

-0.7

$

-0.7

-104

%

CEO Commentary

“The third fiscal quarter of 2024 saw continued lumpiness from

timing of deliveries of customer new forklift orders and interest

rate variability,” said Flux Power CEO Ron Dutt. “An Institute for

Supply Management survey this month showed manufacturing grew for

the first time in 1-1/2 years in March, and although we remain

confident in a recovery, we are highly focused on additional

selling strategies to support our historical sales trajectory.

“Gross margin initiatives have dramatically improved margins

over the last two years, and we expect continued improvement. Gross

profit was down slightly during the third quarter to $4.4 million,

and gross margin held steady at 30%, compared to the year ago

period. With strategic supply chain and profitability improvement

initiatives, lower costs and higher volume purchasing, we are

targeting gross margin improvement to continue, with a longer-term

goal exceeding 40%.

“As of May 6, 2024, our open order backlog was $18.5 million.

Our backlog reflects longer lead times of incoming purchase orders

from major OEMs to align with their schedule of new forklift

deliveries and extended delivery times for certain model lines of

airlines for new Ground Support Equipment (“GSE”). These extended

lead times have resulted in some shipment deferrals and delays in

receiving anticipated orders. Beyond our backlog of open orders,

the future continues to look bright with over $100 million in high

probability orders.

- Some delays of customer orders stretch beyond current

fiscal year ending June 30, 2024

- Delays linked to forklift deferrals from higher interest rates

and economic uncertainty

- No known lost customers nor lost orders to competition

- Delays rather than pullback from Lithium adoption by

customers

- Actions supporting targeted sales trajectory

- New product launches of heavy-duty models addressing customer

demand

- Adding salespeople to support customer demand

- Increasing marketing resources and initiatives

- Launching this quarter new Private Label program for another

top Forklift OEM

- Actions supporting increasing our gross margins

- Selected cost reductions company wide

- Selected pricing increases reflecting our “total value add” to

products/customers

- Continued progress to expand technology and partnerships

- Exploring fast charging technology with partner on selected

product applications

- Telemetry features for customer asset management including

nationwide installation

- Development of machine learning and AI features for product

support of large fleets

- Automation of modularizing battery cells to launch this

summer

- Key Appointments:

- Appointed Kevin Royal, a seasoned finance and accounting

executive, as Chief Financial Officer.

- Appointed Mark Leposky, a senior-level executive and

entrepreneur, to its Board of Directors as an independent

director.

The backlog status is a point in time measure but in total

reflects underlying pacing of orders:

Fiscal Quarter Ended

Beginning Backlog

New Orders

Shipments

Ending Backlog

December 31, 2022

$

26,858,000

$

20,652,000

$

17,158,000

$

30,352,000

March 31, 2023

$

30,352,000

$

9,751,000

$

15,087,000

$

25,016,000

June 30, 2023

$

25,016,000

$

19,780,000

$

16,252,000

$

28,544,000

September 30, 2023

$

28,544,000

$

8,102,000

$

14,797,000

$

21,849,000

December 31, 2023

$

21,849,000

$

26,552,000

$

18,344,000

$

30,057,000

March 31, 2024

$

30,057,000

$

4,030,000

$

14,457,000

$

19,630,000

CEO Commentary Continued

“Looking ahead, we are highly focused on expanding sales and

marketing initiatives to secure new customer relationships and

support continued migration to lithium of current customers. We are

excited to add our second tier one OEM Private Label program to

supplement our strong OEM relationships and approvals. We are also

working with our distribution network to expand customer

acquisition with direct-to-customer initiatives. We are also

leveraging our position with growth-oriented projects and

developing partnerships with vendors, technology partners, and

opportunities to further drive growth.

“We are working to expand product lines for multiple customer

segments and adjacent markets with new products and filling in gaps

in energy storage offerings. Recently we introduced our new

second-generation lithium-ion battery pack for Class II narrow

aisle forklifts and Class I 4-wheel counterbalance forklifts and

will be adding heavy duty models to most of our product line in

coming months. Our telemetry, which includes asset management

features, is in the pilot stage for a Fortune 50 company

implementation nationwide. The introduction of new products is yet

another example of our solid track record of introducing new

technologies and reliably satisfying our customers.

“Finally, I am pleased to announce our new CFO, Kevin Royal, and

our newly elected board director, Mark Leposky. They both bring

depth of experience successfully building high growth businesses.

They are both key resources to achieve our strategy of scaling our

business with top tier customers.”

Q3’24 Financial Results

Revenue for the fiscal third quarter of 2024 decreased 4%

to $14.5 million compared to $15.1 million in the fiscal third

quarter of 2023, due to lower capital spending in the market

sectors that we serve resulting in shipments of fewer units during

the quarter ended March 31, 2024, partially offset by price

increases for certain energy storage units.

Gross profit for the fiscal third quarter of 2024

decreased 7% to $4.4 million compared to a gross profit of $4.7

million in the fiscal third quarter of 2023. Gross margin decreased

to 30% in the fiscal third quarter of 2024 as compared to 31% in

the fiscal third quarter of 2023. Gross profit margin decreased

nominally by 100 basis points as a result of higher warranty

expense during the current quarter, partially offset by lower

average cost of sales per unit achieved during the quarter ended

March 31, 2024, as a result of our product cost improvement

initiatives.

Adjusted EBITDA loss was $1.4 million in the fiscal third

quarter of 2024 as compared to a loss of $0.7 million in the fiscal

third quarter of 2023, primarily attributable to the impact of

lower revenue.

Selling & Administrative expenses increased to $5.3

million in the fiscal third quarter of 2024, as compared to $4.7

million in fiscal third quarter of 2023, primarily attributable to

higher staff related expenses including certain severance expenses

and increases in stock-based compensation, recruiting expenses,

outbound shipping costs, and professional service fees, partially

offset by decreases in sales commissions, D&O insurance

expenses, travel expenses, and depreciation expense.

Research & Development expenses increased to $1.3

million in the fiscal third quarter of 2024, compared to $1.2

million in the fiscal third quarter of 2023, primarily due to

higher staff related expenses including severance expenses,

stock-based compensation, and general research and development

costs, partially offset by a decrease in equipment rental fees.

Net loss for the fiscal third quarter of 2024 was $2.6

million, compared to a loss of $1.4 million in the fiscal third

quarter of 2023, primarily attributable to decreased gross profit,

and increases in operating expenses and interest expense to support

our planned growth.

Cash was $1.3 million on March 31, 2024, as compared to

$2.4 million at June 30, 2023, reflecting changes in working

capital management. Available working capital includes: our line of

credit as of May 6, 2024, under our $16.0 million credit facility

from Gibraltar Business Capital, or Gibraltar, with a remaining

available balance of $3.2 million subject to borrowing base

limitations and satisfaction of certain financial covenants; and

$2.0 million available under the subordinated line of credit with

Cleveland Capital. Credit line with Gibraltar, subject to eligible

accounts receivables and inventory borrowing base, provides for

expansion up to $20 million. An event of default has occurred under

the loan agreement associated with certain EBITDA requirements that

were not achieved for the three month period ended April 30, 2024.

A waiver of such default was obtained and we are working with

Gibraltar to modify the financial covenants in the loan agreement

to prevent future defaults. In conjunction with additional time

required to address the covenant development, we anticipate filing

the related 10-Q on Monday, May 13, 2024. Our ability to continue

as a going concern is dependent upon our ability to meet order

projections, ship open sales orders, further improve our margins,

reduce operating costs and raise additional capital, if needed, on

a timely basis until such time as revenues and related cash flows

are sufficient to fund its operations.

Net cash used in operating activities decreased by $0.9

million to $4.3 million in the nine months ended March 31, 2024,

compared to $5.2 million in the nine months ended March 31,

2023.

Third Quarter Fiscal Year 2024 Results Conference

Call

Flux Power CEO Ron Dutt and CFO Kevin Royal will host the

conference call, followed by a question-and-answer session. The

conference call will be accompanied by a presentation, which can be

viewed during the webcast or accessed via the investor relations

section of the Company’s website here.

To access the call, please use the following information:

Date:

Thursday, May 9, 2024

Time:

4:30 p.m. Eastern Time, 1:30 p.m.

Pacific Time

Toll-free dial-in number:

1-877-407-4018

International dial-in number:

1-201-689-8471

Conference ID:

13745699

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact MZ Group at 1-949-491-8235.

The conference call will be broadcast live and available for

replay at

https://viavid.webcasts.com/starthere.jsp?ei=1664610&tp_key=290c3adc41

and via the investor relations section of the Company's website

here.

A replay of the webcast will be available after 7:30 p.m.

Eastern Time through August 9, 2024.

Toll-free replay number:

1-844-512-2921

International replay number:

1-412-317-6671

Replay ID:

13745699

Note about Non-GAAP Financial Measures

A non-GAAP financial measure is a numerical measure of a

company’s performance, financial position, or cash flows that

either excludes or includes amounts that are not normally excluded

or included in the most directly comparable measure calculated and

presented in accordance with accounting principles generally

accepted in the United States of America, or GAAP. Non-GAAP

measures are not in accordance with, nor are they a substitute for,

GAAP measures. Other companies may use different non-GAAP measures

and presentation of results.

In addition to financial results presented in accordance with

GAAP, this press release presents adjusted EBITDA, which is a

non-GAAP measure. Adjusted EBITDA is determined by taking net loss

and adding interest, taxes, depreciation, amortization, and

stock-based compensation expenses. The company believes that this

non-GAAP measure, viewed in addition to and not in lieu of net

loss, provides additional information to investors by providing a

more focused measure of operating results. This metric is an

integral part of the Company’s internal reporting to evaluate its

operations and the performance of senior management. A

reconciliation of adjusted EBITDA to net loss, the most comparable

GAAP measure, is available in the accompanying financial tables

below. The non-GAAP measure presented herein may not be comparable

to similarly titled measures presented by other companies.

US-GAAP NET INCOME (LOSS) TO

ADJUSTED EBITDA RECONCILIATION

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Net loss

$

(2,640,000

)

$

(1,445,000

)

$

(5,566,000

)

$

(5,265,000

)

Add/Subtract:

Interest, net

433,000

258,000

1,285,000

971,000

Depreciation and amortization

264,000

276,000

787,000

647,000

EBITDA

(1,943,000

)

(911,000

)

(3,494,000

)

(3,647,000

)

Add/Subtract:

Stock-based compensation

563,000

235,000

1,233,000

539,000

Adjusted EBITDA

$

(1,380,000

)

$

(676,000

)

$

(2,261,000

)

$

(3,108,000

)

About Flux Power Holdings, Inc.

Flux Power (NASDAQ: FLUX) designs, manufactures, and sells

advanced lithium-ion energy storage solutions for electrification

of a range of industrial and commercial sectors including material

handling, airport ground support equipment (GSE), and stationary

energy storage. Flux Power’s lithium-ion battery packs, including

the proprietary battery management system (BMS) and telemetry,

provide customers with a better performing, lower cost of

ownership, and more environmentally friendly alternative, in many

instances, to traditional lead acid and propane-based solutions.

Lithium-ion battery packs reduce CO2 emissions and help improve

sustainability and ESG metrics for fleets. For more information,

please visit www.fluxpower.com.

Forward-Looking Statements

This release contains projections and other "forward-looking

statements" relating to Flux Power’s business, that are often

identified using "believes," "expects" or similar expressions.

Forward-looking statements involve several estimates, assumptions,

risks, and other uncertainties that may cause actual results to be

materially different from those anticipated, believed, estimated,

expected, etc. Accordingly, statements are not guarantees of future

results. Some of the important factors that could cause Flux

Power’s actual results to differ materially from those projected in

any such forward-looking statements include, but are not limited

to: risks and uncertainties, related to Flux Power’s business,

results and financial condition; plans and expectations with

respect to access to capital and outstanding indebtedness; Flux

Power’s ability to comply with the terms of the existing credit

facilities to obtain the necessary capital from such credit

facilities; Flux Power’s ability to raise capital; Flux Power’s

ability to continue as a going concern. Flux Power’s ability to

obtain raw materials and other supplies for its products at

competitive prices and on a timely basis, particularly in light of

the potential impact of the COVID-19 pandemic on its suppliers and

supply chain; the development and success of new products,

projected sales, cancellation of purchase orders, deferral of

shipments, Flux Power’s ability to improve its gross margins, or

achieve breakeven cash flow or profitability, Flux Power’s ability

to fulfill backlog orders or realize profit from the contracts

reflected in backlog sale; Flux Power’s ability to fulfill backlog

orders due to changes in orders reflected in backlog sales, Flux

Power’s ability to obtain the necessary funds under the credit

facilities, Flux Power’s ability to timely obtain UL Listing for

its products, Flux Power’s ability to fund its operations,

distribution partnerships and business opportunities and the

uncertainties of customer acceptance and purchase of current and

new products, and changes in pricing. Actual results could differ

from those projected due to numerous factors and uncertainties.

Although Flux Power believes that the expectations, opinions,

projections, and comments reflected in these forward-looking

statements are reasonable, they can give no assurance that such

statements will prove to be correct, and that the Flux Power’s

actual results of operations, financial condition and performance

will not differ materially from the results of operations,

financial condition and performance reflected or implied by these

forward-looking statements. Undue reliance should not be placed on

the forward-looking statements and Investors should refer to the

risk factors outlined in our Form 10-K, 10-Q and other reports

filed with the SEC and available at www.sec.gov/edgar. These

forward-looking statements are made as of the date of this news

release, and Flux Power assumes no obligation to update these

statements or the reasons why actual results could differ from

those projected.

Flux, Flux Power, and associated logos are trademarks of Flux

Power Holdings, Inc. All other third-party brands, products,

trademarks, or registered marks are the property of and used to

identify the products or services of their respective owners.

Follow us at:

Blog: Flux Power Blog News Flux Power News Twitter: @FLUXpwr

LinkedIn: Flux Power

FLUX POWER HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 31, 2024

June 30, 2023

ASSETS

Current assets:

Cash

$

1,250,000

$

2,379,000

Accounts receivable

10,404,000

8,649,000

Inventories, net

20,174,000

18,996,000

Other current assets

840,000

918,000

Total current assets

32,668,000

30,942,000

Right of use assets

2,291,000

2,854,000

Property, plant and equipment, net

1,705,000

1,789,000

Other assets

118,000

120,000

Total assets

$

36,782,000

$

35,705,000

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

11,050,000

$

9,735,000

Accrued expenses

3,645,000

3,181,000

Line of credit

13,645,000

9,912,000

Deferred revenue

343,000

131,000

Customer deposits

18,000

82,000

Finance lease payable, current portion

153,000

143,000

Office lease payable, current portion

712,000

644,000

Accrued interest

136,000

2,000

Total current liabilities

29,702,000

23,830,000

Office lease payable, less current

portion

1,511,000

2,055,000

Finance lease payable, less current

portion

153,000

273,000

Total liabilities

31,366,000

26,158,000

Stockholders’ equity:

Preferred stock, $0.001 par value; 500,000

shares authorized; none issued and outstanding

-

-

Common stock, $0.001 par value; 30,000,000

shares authorized; 16,599,683 and 16,462,215 shares issued and

outstanding at March 31, 2024 and June 30, 2023, respectively

17,000

16,000

Additional paid-in-capital

99,520,000

98,086,000

Accumulated deficit

(94,121,000

)

(88,555,000

)

Total stockholders’ equity

5,416,000

9,547,000

Total liabilities and stockholders’

equity

$

36,782,000

$

35,705,000

FLUX POWER HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Revenues

$

14,457,000

$

15,087,000

$

47,598,000

$

50,085,000

Cost of sales

10,067,000

10,368,000

33,229,000

37,310,000

Gross profit

4,390,000

4,719,000

14,369,000

12,775,000

Operating expenses:

Selling and administrative

5,311,000

4,724,000

14,629,000

13,510,000

Research and development

1,286,000

1,182,000

4,021,000

3,567,000

Total operating expenses

6,597,000

5,906,000

18,650,000

17,077,000

Operating loss

(2,207,000

)

(1,187,000

)

(4,281,000

)

(4,302,000

)

Other income

-

-

-

8,000

Interest income (expense), net

(433,000

)

(258,000

)

(1,285,000

)

(971,000

)

Net loss

$

(2,640,000

)

$

(1,445,000

)

$

(5,566,000

)

$

(5,265,000

)

Net loss per share - basic and diluted

$

(0.16

)

$

(0.09

)

$

(0.34

)

$

(0.33

)

Weighted average number of common shares

outstanding - basic and diluted

16,538,998

16,048,054

16,510,046

16,021,653

FLUX POWER HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended March

31,

2024

2023

Cash flows from operating activities:

Net loss

$

(5,566,000

)

$

(5,265,000

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation

787,000

647,000

Stock-based compensation

1,233,000

539,000

Fair value of warrants issued as debt

issuance cost

92,000

-

Amortization of debt issuance costs

161,000

445,000

Noncash lease expense

448,000

370,000

Allowance for inventory reserve

13,000

214,000

Changes in operating assets and

liabilities:

Accounts receivable

(1,755,000

)

(1,244,000

)

Inventories

(1,191,000

)

(4,911,000

)

Other assets

(81,000

)

11,000

Accounts payable

1,315,000

4,182,000

Accrued expenses

464,000

395,000

Accrued interest

134,000

2,000

Office lease payable

(476,000

)

(379,000

)

Deferred revenue

212,000

(163,000

)

Customer deposits

(64,000

)

(40,000

)

Net cash used in operating activities

(4,274,000

)

(5,197,000

)

Cash flows from investing activities

Purchases of equipment

(588,000

)

(753,000

)

Proceeds from sale of equipment

-

8,000

Net cash used in investing activities

(588,000

)

(745,000

)

Cash flows from financing activities:

Proceeds from issuance of common stock in

public offering, net of offering costs

-

697,000

Proceeds from stock option exercises and

employee stock purchase plan exercises

110,000

-

Proceeds from revolving line of credit

52,820,000

48,800,000

Payment of revolving line of credit

(49,087,000

)

(43,198,000

)

Payment of finance leases

(110,000

)

(52,000

)

Net cash provided by financing

activities

3,733,000

6,247,000

Net change in cash

(1,129,000

)

305,000

Cash, beginning of period

2,379,000

485,000

Cash, end of period

$

1,250,000

$

790,000

Supplemental Disclosures of Non-Cash

Investing and Financing Activities:

Initial right of use asset recognition

$

-

$

855,000

Common stock issued for vested RSUs

$

222,000

$

114,000

Supplemental cash flow

information:

Interest paid

$

1,000,000

$

524,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509461968/en/

Media & Investor Relations: media@fluxpower.com

info@fluxpower.com

External Investor Relations: Chris Tyson,

Executive Vice President MZ Group - MZ North America 949-491-8235

FLUX@mzgroup.us www.mzgroup.us

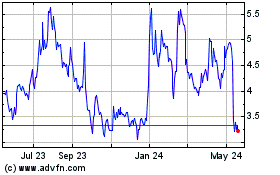

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Dec 2024 to Jan 2025

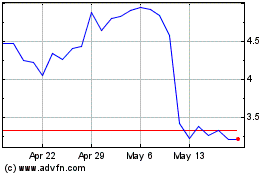

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Jan 2024 to Jan 2025