false

0001083743

0001083743

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2024

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31543 |

|

92-3550089 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 2685

S. Melrose Drive, Vista, California |

|

92081 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

FLUX |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

November 20, 2024, Flux Power Holdings, Inc., a Nevada corporation (the “Company”) received a notice (the “Notice”)

from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market (“Nasdaq”) stating that because

the Company had not yet filed its Form 10-Q for the period ended September 30, 2024 (the “Form 10-Q”) and because the Company

remains delinquent in filing its Form 10-K for the fiscal year ended June 30, 2024 (the “Form 10-K” and together with the

Form 10-Q, the “Delinquent Reports”), the Company does not comply with Nasdaq Listing Rule 5250(c)(1) (the “Listing

Rule”), which requires Nasdaq-listed companies to timely file all required periodic financial reports with the Securities and Exchange

Commission.

The

Notice states that the Company has until December 16, 2024, to submit a plan to regain compliance with the Listing Rule (the “Plan”).

If Nasdaq accepts the Company’s Plan to regain compliance, then Nasdaq may grant the Company up to 180 calendar days from the Form

10-K filing due date, or until April 14, 2025, to file the Delinquent Reports to regain compliance. If NASDAQ does not accept the Company’s

Plan, then the Company will have the opportunity to appeal that decision to a NASDAQ Hearings Panel. The Notice has no immediate effect

on the listing of the Company’s common stock on NASDAQ.

The

Company is working diligently to complete its Delinquent Reports and plans to file its Delinquent Reports as promptly as practicable

to regain compliance with the Listing Rule.

Item

7.01 Regulation FD Disclosure.

The

information contained in Item 3.01 of this Current Report on Form 8-K is incorporated herein by reference.

On

November 25, 2024,

the Company issued a press release in accordance with Nasdaq Listing Rule 5810(b) announcing that the Company had received the Notice.

A copy of the press release is attached hereto as Exhibit 99.1.

The

information in Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

Forward-Looking

Statement Disclaimer

This

Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words

and phrases such as “anticipated,” “forward,” “will,” “would,” “could,” “may,”

“intend,” “remain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “estimate,” “and similar expressions are intended to

identify forward-looking statements. These statements include, but are not limited to, the expected filing date of its Delinquent Reports

and ability to regain compliance under the Nasdaq listing rule. All of such statements are subject to certain risks and uncertainties,

many of which are difficult to predict and generally beyond the Company’s control, that could cause actual results to differ materially

from those expressed in, or implied or projected by, the forward-looking information and statements. Such risks and uncertainties include,

but are not limited to, the completion of the review and preparation of the Company’s financial statements and internal control

over financial reporting and disclosure controls and procedures and the timing thereof; the discovery of additional information; delays

in the Company’s financial reporting, including as a result of unanticipated factors; the Company’s ability to obtain necessary

waivers or amendments to the Loan Agreement in the future; the risk that the Company may become subject to future litigation; the Company’s

ability to remediate material weaknesses in its internal control over financial reporting; risks inherent in estimates or judgments relating

to the Company’s critical accounting policies, or any of the Company’s estimates or projections, which may prove to be inaccurate;

unanticipated factors in addition to the foregoing that may impact the Company’s financial and business projections and guidance

and may cause the Company’s actual results and outcomes to materially differ from its estimates, projections and guidance; and

those risks and uncertainties identified in the “Risk Factors” sections of the Company’s Annual Report on Form 10-K

for the year ended June 30, 2023, and its other subsequent filings with the SEC. Readers are cautioned not to place undue reliance on

these forward-looking statements. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date

on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect

events that occur or circumstances that exist after the date on which they were made.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Flux

Power Holdings, Inc. |

| |

a

Nevada corporation |

| |

|

|

| |

By:

|

/s/

Ronald F. Dutt |

| |

|

Ronald

F. Dutt, |

| |

|

Chief

Executive Officer |

| |

|

|

| Dated:

November 25, 2024 |

|

|

Exhibit

99.1

Flux

Power Receives Non-Compliance Letter from Nasdaq

VISTA,

Calif. – November 25, 2024 – Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of advanced lithium-ion energy

storage solutions for electrification of commercial and industrial equipment, today announced that on November 20, 2024, it received

a letter from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that

it was not in compliance with requirements of Nasdaq Listing Rule 5250(c)(1) as a result of not having filed its Quarterly Report on

Form 10-Q for the period ended September 30, 2024 (“Form 10-Q”) and its Annual Report on Form 10-K for fiscal year ended

June 30, 2024 (“Form 10-K”), with the Securities and Exchange Commission (“SEC”).

This

notification has no immediate effect on the listing of the Company’s common stock on the Nasdaq. Under the Nasdaq rules, the Company

has until December 16, 2024, to submit to Nasdaq a plan to regain compliance with the Nasdaq Listing Rule. If Nasdaq accepts the Company’s

plan, then Nasdaq may grant the Company up to 180 days from the prescribed due date for the Form 10-K to regain compliance, or April

14, 2025. If Nasdaq does not accept the Company’s plan, then the Company will have the opportunity to appeal that decision to a

Nasdaq Hearings Panel.

The

Company is working diligently to complete its Form 10-K and Form 10-Q and plans to file its Form 10-K and Form 10-Q as promptly as practicable

to regain compliance with the Listing Rule.

About

Flux Power Holdings, Inc.

Flux

Power (NASDAQ: FLUX) designs, manufactures, and sells advanced lithium-ion energy storage solutions for electrification of a range of

industrial and commercial sectors including material handling, airport ground support equipment (GSE), and stationary energy storage.

Flux Power’s lithium-ion battery packs, including the proprietary battery management system (BMS) and telemetry, provide customers

with a better performing, lower cost of ownership, and more environmentally friendly alternative, in many instances, to traditional lead

acid and propane-based solutions. Lithium-ion battery packs reduce CO2 emissions and help improve sustainability and ESG metrics for

fleets. For more information, please visit www.fluxpower.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases

such as “anticipated,” “forward,” “will,” “would,” “could,” “may,”

“intend,” “remain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “estimate,” “and similar expressions are intended to

identify forward-looking statements. These statements include, but are not limited to, the expected filing date of its Form 10-K and

Form 10-Q and ability to regain compliance under the Nasdaq listing rule. All of such statements are subject to certain risks and uncertainties,

many of which are difficult to predict and generally beyond the Company’s control, that could cause actual results to differ materially

from those expressed in, or implied or projected by, the forward-looking information and statements. Such risks and uncertainties include,

but are not limited to, the completion of the review and preparation of the Company’s financial statements and internal control

over financial reporting and disclosure controls and procedures and the timing thereof; the discovery of additional information; delays

in the Company’s financial reporting, including as a result of unanticipated factors; the Company’s ability to obtain necessary

waivers or amendments to the Loan Agreement in the future; the risk that the Company may become subject to future litigation; the Company’s

ability to remediate material weaknesses in its internal control over financial reporting; risks inherent in estimates or judgments relating

to the Company’s critical accounting policies, or any of the Company’s estimates or projections, which may prove to be inaccurate;

unanticipated factors in addition to the foregoing that may impact the Company’s financial and business projections and guidance

and may cause the Company’s actual results and outcomes to materially differ from its estimates, projections and guidance; and

those risks and uncertainties identified in the “Risk Factors” sections of the Company’s Annual Report on Form 10-K

for the year ended June 30, 2023, and its other subsequent filings with the SEC. Readers are cautioned not to place undue reliance on

these forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they

were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that

occur or circumstances that exist after the date on which they were made.

Flux,

Flux Power, and associated logos are trademarks of Flux Power Holdings, Inc. All other third-party brands, products, trademarks, or registered

marks are the property of and used to identify the products or services of their respective owners.

Follow

us at:

Blog:

Flux Power Blog

News

Flux Power News

Twitter:

@FLUXpwr

LinkedIn:

Flux Power

View

source version on businesswire.com:

Media

& Investor Relations:

media@fluxpower.com

info@fluxpower.com

External

Investor Relations:

Chris

Tyson, Executive Vice President

MZ

Group - MZ North America

949-491-8235

FLUX@mzgroup.us

www.mzgroup.us

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

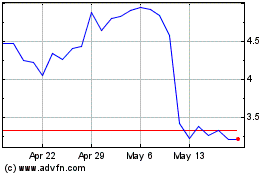

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Dec 2024 to Jan 2025

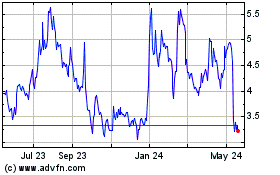

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Jan 2024 to Jan 2025