Flexsteel Industries, Inc. (NASDAQ: FLXS) (“Flexsteel” or the

“Company”), one of the largest manufacturers, importers, and

marketers of residential furniture products in the United States,

today reported second quarter fiscal 2025 results.

Key Results for the Second Quarter Ended December 31,

2024

- Net sales for the quarter of $108.5 million compared to $100.1

million in the prior year quarter, an increase of 8.4% and fifth

consecutive quarter of year-over-year sales growth.

- Pre-tax gain of $5.0 million from sale of former manufacturing

facility in Dublin, GA.

- GAAP operating income of $11.7 million or 10.7% of net sales

compared to $4.6 million or 4.6% of net sales in the prior year

quarter.

- Adjusted operating income of $6.7 million or 6.1% of net sales

for the second quarter compared to $4.6 million or 4.6% of net

sales in the prior year quarter.

- GAAP net income per diluted share of $1.62 for the current

quarter compared to $0.57 in the prior year quarter.

- Adjusted net income per diluted share of $0.95 for the quarter

compared to $0.57 in the prior year quarter.

- Generated $6.7 million of cash from operations in the quarter

and paid off all outstanding borrowings on line of credit.

GAAP to non-GAAP reconciliations follow the financial statements

in this press release

Management Commentary

“We are competing well and gaining share in a challenging

business environment,” said Derek Schmidt, President & Chief

Executive Officer of Flexsteel Industries, Inc. “We continued our

strong momentum from the first quarter, delivering sales growth of

8.4 percent compared to the prior year quarter, which represents

our fifth consecutive quarter of mid-single to low-double digit

year-over-year growth. I’m especially encouraged because our growth

was broad-based. We solidly grew in our core markets while

simultaneously delivering growth in all our new and expanded market

initiatives. Additionally, we continue to expand our operating

margin and deliver strong positive free cash flow which has allowed

us to pay off our remaining bank debt and begin accumulating

cash.”

Mr. Schmidt continues, “While overall industry demand remains

soft, many of our retailer partners were encouraged by improved

traffic trends and sales close rates during the recent holiday

season, which provides optimism that demand declines may have

bottomed and the industry could be positioned to start growing

again, albeit modestly, in calendar 2025. As we’ve demonstrated

over the past 15 months, we can deliver attractive profitable

growth and gain share even in challenging industry conditions.

Given our confidence in continuing our strong execution, we are

increasing the midpoint of our sales guidance range for fiscal year

2025.”

Mr. Schmidt concludes, “In addition to our improved sales

outlook, we were also anticipating continued improvement in our

operating margin and free cash flow for the remainder of the fiscal

year, but the executive orders announced this weekend to implement

25% tariffs on Mexico and Canada introduced significant uncertainty

and could materially change our business outlook given our sizable

operations in Mexico. The current situation is dynamic, and the

magnitude of the profit and free cash flow impact on our business

is dependent on the ultimate amount and duration of tariffs as well

as changes in foreign exchange rates. We are actively working on

multiple plans, both short-term and mid-term, to minimize tariff

risks, and remain confident in our ability to reconfigure and

optimize our supply chain longer-term if required due to structural

changes in global trade policies. We are providing our outlook for

operating margins and free cash flow excluding the potential impact

of tariffs, but as we gain better clarity on the situation, and if

there is a material change in our outlook, we will update our

guidance. Despite near-term uncertainty from tariffs, we remain

intensely focused on maintaining our growth momentum, gaining

share, and increasing our competitiveness to drive long-term,

profitable growth. In summary, we are operating from a point of

financial strength, will continue investing for future growth and

remain agile to adapt to potential changes in the external

environment while continuing to deliver exceptional value for our

customers.”

Operating Results for the Second Quarter Ended December 31,

2024

Net sales were $108.5 million for the second quarter compared to

net sales of $100.1 million in the prior year quarter, an increase

of $8.4 million, or 8.4%. The increase was driven by higher sales

in home furnishings products sold through retail stores of $9.2

million, or 10.3%, led by unit volume increases and to a lesser

extent, ocean freight surcharges. Sales of products sold through

e-commerce channels decreased by ($0.8) million, or (7.1%),

compared to the second quarter of the prior year. Lower sales in

the e-commerce channel were driven by softer consumer demand.

Gross margin for the quarter ended December 31, 2024, was 21.0%,

compared to 21.9% for the prior-year quarter, a decrease of 90

basis points (“bps”). The 90-bps decrease was primarily due to

margin dilution from higher ocean freight costs.

Selling, general and administrative (SG&A) expenses

decreased to 14.9% of net sales in the second quarter of fiscal

2025 compared with 17.3% of net sales in the prior year quarter.

The 240-bps decrease was due to leverage on higher sales and

structural cost savings, partially offset by investments in growth

initiatives for the quarter ended December 31, 2024.

During the quarter, the Company completed the sale of its

Dublin, Georgia facility which had been previously recorded as held

for sale. The Company recorded a pre-tax gain of $5.0 million

related to the sale.

Operating income for the quarter ended December 31, 2024, was

$11.7 million compared to $4.6 million in the prior-year quarter.

Adjusted operating income for the quarter ended December 31, 2024,

was $6.7 million compared to $4.6 million in the prior year

quarter.

Income tax expense was $2.6 million, or an effective rate of

22.4%, during the second quarter compared to tax expense of $1.0

million, or an effective rate of 25.5%, in the prior year

quarter.

Net income was $9.1 million, or $1.62 per diluted share, for the

quarter ended December 31, 2024, compared to net income of $3.1

million, or $0.57 per diluted share, in the prior year quarter.

Adjusted net income for the quarter ended December 31, 2024, was

$5.3 million or $0.95 per diluted share compared to adjusted net

income of $3.1 million or $0.57 per diluted share in the prior year

quarter.

Liquidity

The Company ended the quarter with a cash balance of $11.8

million and working capital (current assets less current

liabilities) of $98.2 million, and availability of approximately

$60.8 million under its secured line of credit.

Capital expenditures for the six months ended December 31, 2024,

were $1.3 million.

Financial Outlook

For fiscal year 2025, the Company is increasing the previously

disclosed range of expected sales growth from 3.5% to 6.5%, to 5.5%

to 8.0%. Excluding the impact of potential tariffs, the range of

operating margin is forecasted to increase from 5.8% to 6.5%, to

7.3% to 7.7%, and the expected adjusted operating margin is 6.2% to

6.6%. The impact of tariffs, as well as other potential U.S. policy

changes, could materially change our business forecast. Besides

tariffs, the most significant drivers of variability in the

financial outlook are consumer demand, competitive pricing

conditions, and ocean freight rates, all of which will be shaped by

macro-economic factors.

Third Quarter Fiscal

2025

Fiscal Year

2025

Sales

$110 - 115 million

$435 - 445 million

Sales Growth (vs. Prior Year)

3% to 7%

5.5% to 8%

GAAP Operating Margin

6.0% to 7.0%

7.3% to 7.7%

Adjusted Operating Margin

6.0% to 7.0%

6.2% to 6.6%

Free Cash Flow(1)

$4 to $7 million

$25 to 30 million

Line of Credit Borrowings

$0

$0

(1) Free cash flow is calculated as net

cash provided by operations, less capital expenditure plus proceeds

from sale of property, plant & equipment.

Conference Call and Webcast

The Company will host a conference call and audio webcast with

analysts and investors on Tuesday, February 4, 2025, at 8:00 a.m.

Central Time to discuss the results and answer questions.

- Live conference call: 833-816-1123 (domestic) or 412-317-0710

(international)

- Conference call replay available through February 11, 2025:

877-344-7529 (domestic) or 412-317-0088 (international)

- Replay access code: 8540664

- Live and archived webcast: ir.flexsteel.com

To pre-register for the earnings conference call and avoid the

need to wait for a live operator, investors can visit

https://dpregister.com/sreg/10196122/fe549b0332 and enter

their contact information. Investors will then be issued a

personalized phone number and pin to dial into the live conference

call.

About Flexsteel

Flexsteel Industries, Inc., and Subsidiaries (the “Company”) is

one of the largest manufacturers, importers, and marketers of

residential furniture products in the United States. Product

offerings include a wide variety of furniture such as sofas,

loveseats, chairs, reclining rocking chairs, swivel rockers, sofa

beds, convertible bedding units, occasional tables, desks, dining

tables and chairs, kitchen storage, bedroom furniture, and outdoor

furniture. A featured component in most of the upholstered

furniture is a unique steel drop-in seat spring from which the name

“Flexsteel” is derived. The Company distributes its products

throughout the United States through its e-commerce channel and

direct sales force.

Forward-Looking Statements

Statements, including those in this release, which are not

historical or current facts, are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. There are certain important factors

that could cause our results to differ materially from those

anticipated by some of the statements made herein. Investors are

cautioned that all forward-looking statements involve risk and

uncertainty. Some of the factors that could affect results are the

cyclical nature of the furniture industry, supply chain

disruptions, litigation, restructurings, the effectiveness of new

product introductions and distribution channels, the product mix of

sales, pricing pressures, the cost of raw materials and fuel,

changes in foreign currency values, retention and recruitment of

key employees, actions by governments including laws, regulations,

taxes and tariffs, the amount of sales generated and the profit

margins thereon, competition (both U.S. and foreign), credit

exposure with customers, participation in multi-employer pension

plans, disruptions or security breaches to business information

systems, the impact of any future pandemic, and general economic

conditions. For further information regarding these risks and

uncertainties, see the “Risk Factors” section in Item 1A of our

most recent Annual Report on Form 10-K.

For more information, visit our website at

http://www.flexsteel.com.

FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(in thousands)

December 31,

June 30,

2024

2024

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

11,789

$

4,761

Trade receivables, net

36,310

44,238

Inventories

91,042

96,577

Other

9,910

8,098

Assets held for sale

—

1,707

Total current assets

149,051

155,381

NONCURRENT ASSETS:

Property, plant and equipment, net

36,414

36,709

Operating lease right-of-use assets

61,587

61,439

Other assets

24,495

20,933

TOTAL ASSETS

$

271,547

$

274,462

LIABILITIES AND SHAREHOLDERS'

EQUITY

CURRENT LIABILITIES:

Accounts payable - trade

$

20,712

$

25,830

Accrued liabilities

30,156

34,576

Total current liabilities

50,868

60,406

LONG-TERM LIABILITIES

Line of credit

—

4,822

Other liabilities

58,759

58,867

Total liabilities

109,627

124,095

SHAREHOLDERS' EQUITY

161,920

150,367

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

$

271,547

$

274,462

FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME (UNAUDITED)

(in thousands, except per share

data)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net sales

$

108,483

$

100,108

$

212,490

$

194,711

Cost of goods sold

85,678

78,158

167,318

154,351

Gross profit

22,805

21,950

45,172

40,360

Selling, general and administrative

expenses

16,142

17,366

32,462

33,858

(Gain) on disposal of assets held for

sale

(4,991

)

—

(4,991

)

—

Operating income

11,654

4,584

17,701

6,502

Interest expense

19

489

70

1,059

Interest (income)

(31

)

—

(31

)

—

Income before income taxes

11,666

4,095

17,662

5,443

Income tax provision

2,612

1,044

4,468

1,640

Net income and comprehensive income

$

9,054

$

3,051

$

13,194

$

3,803

Weighted average number of common shares

outstanding:

Basic

5,247

5,184

5,225

5,183

Diluted

5,582

5,324

5,554

5,360

Earnings per share of common stock:

Basic

$

1.73

$

0.59

$

2.53

$

0.73

Diluted

$

1.62

$

0.57

$

2.38

$

0.71

FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (UNAUDITED)

(in thousands)

Six Months Ended

December 31,

2024

2023

OPERATING ACTIVITIES:

Net income

$

13,194

$

3,803

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation

1,853

1,899

Deferred income taxes

1

84

Stock-based compensation expense

2,101

1,845

Change in provision for losses on accounts

receivable

4

(140

)

(Gain)/loss on disposition of property,

plant and equipment

(4,987

)

34

Changes in operating assets and

liabilities

(3,075

)

9,641

Net cash provided by operating

activities

9,091

17,166

INVESTING ACTIVITIES:

Proceeds from sales of investments

1,155

—

Proceeds from sales of property, plant and

equipment

6,704

—

Capital expenditures

(1,334

)

(3,058

)

Net cash provided by (used in) investing

activities

6,525

(3,058

)

FINANCING ACTIVITIES:

Dividends paid

(1,760

)

(1,671

)

Treasury stock purchases

—

(1,427

)

Proceeds from line of credit

202,344

180,524

Payments on line of credit

(207,262

)

(190,899

)

Proceeds from issuance of common stock

141

—

Shares withheld for tax payments on vested

shares and options exercised

(2,051

)

(688

)

Net cash (used in) financing

activities

(8,588

)

(14,161

)

Increase (decrease) in cash and cash

equivalents

7,028

(53

)

Cash and cash equivalents at beginning of

the period

4,761

3,365

Cash and cash equivalents at end of the

period

$

11,789

$

3,312

NON-GAAP DISCLOSURE (UNAUDITED)

The Company is providing information regarding adjusted

operating income, adjusted net income, and adjusted diluted

earnings per share of common stock, which are not recognized terms

under U.S. Generally Accepted Accounting Principles (“GAAP”) and do

not purport to be alternatives to operating income, net income, or

diluted earnings per share of common stock as a measure of

operating performance. A reconciliation of adjusted operating

income, adjusted net income, and adjusted diluted earnings per

share of common stock is provided below. Management believes the

use of these non-GAAP financial measures provides investors useful

information to analyze and compare performance across periods

excluding the items which are considered by management to be

extraordinary or one-time in nature. Because not all companies use

identical calculations, these presentations may not be comparable

to other similarly titled measures of other companies.

Reconciliation of GAAP operating income to adjusted operating

income:

The following table sets forth the reconciliation of the

Company’s reported GAAP operating income to the calculation of

adjusted operating income for the three and six months ended

December 31, 2024 and 2023:

Three Months Ended

Six Months Ended

December 31,

December 31,

(in thousands)

2024

2023

2024

2023

Reported GAAP operating income

$

11,654

$

4,584

$

17,701

$

6,502

(Gain) on disposal of assets held for

sale

(4,991

)

—

(4,991

)

—

Adjusted operating income

$

6,663

4,584

$

12,710

$

6,502

GAAP operating margin

10.7

%

4.6

%

8.3

%

3.3

%

Adjusted operating margin

6.1

%

4.6

%

6.0

%

3.3

%

Reconciliation of GAAP net income to adjusted net

income:

The following table sets forth the reconciliation of the

Company’s reported GAAP net income to the calculation of adjusted

net income for the three and six months ended December 31, 2024 and

2023:

Three Months Ended

Six Months Ended

December 31,

December 31,

(in thousands)

2024

2023

2024

2023

Reported GAAP net income

$

9,054

$

3,051

$

13,194

$

3,803

(Gain) on disposal of assets held for

sale

(4,991

)

—

(4,991

)

—

Tax impact of the above adjustments(1)

1,231

—

1,231

—

Adjusted net income

$

5,294

$

3,051

$

9,434

$

3,803

(1) Effective tax rate of 24.66% was used

to calculate the three and six months ended December 31, 2024

Reconciliation of GAAP diluted earnings per share of common

stock to adjusted diluted earnings per share of common

stock:

The following table sets forth the reconciliation of the

Company’s reported GAAP diluted earnings per share to the

calculation of adjusted diluted earnings per share for the three

and six months ended December 31, 2024 and 2023:

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Reported GAAP diluted earnings per

share

$

1.62

$

0.57

$

2.38

$

0.71

(Gain) on disposal of assets held for

sale

(0.89

)

—

(0.90

)

—

Tax impact of the above adjustments(1)

0.22

—

0.22

—

Adjusted diluted earnings per share

$

0.95

$

0.57

$

1.70

$

0.71

Note: The table above may not foot due to

rounding.

(1) Effective tax rate of 24.66% was used

to calculate the three and six months ended December 31, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203366219/en/

INVESTOR CONTACT: Michael Ressler, Flexsteel Industries, Inc.

563-585-8116 investors@flexsteel.com

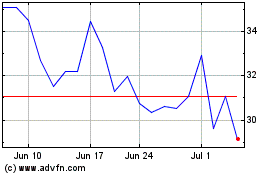

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

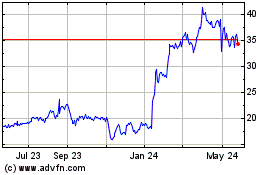

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Feb 2024 to Feb 2025