A Record Quarter for the Company with $581

Million in Revenue Reported

Freedom Holding Corp. (the “Company”) (NASDAQ: FRHC), a

multinational diversified financial services holding company with a

presence through its subsidiaries in 22 countries, today announced

the financial results for their second quarter and first six months

of fiscal 2025. Highlights include the following:

- $581 million in revenue for the quarter

- Net income of $115 million, or $1.89 earnings per share,

diluted, and $1.93 earnings per share, basic

- Operating expenses of $452 million

- $8.8 billion in assets at the end of the quarter

- Insurance underwriting segment lead revenue growth with a 121%

Y.O.Y. increase

- Expansion to 189 offices worldwide with over 7,100 full-time

employees

Second Quarter Financial Highlights:

The Company recognized revenue of approximately $581 million for

the second quarter of fiscal 2025, compared to $436 million in the

second quarter of fiscal 2024, a 33% increase. The Company's

operating expense was approximately $452 million in the second

quarter of fiscal 2025 as compared to $301 million for the same

period last year, an increase of approximately 50%.

Net income was approximately $114.5 million for the second

quarter of fiscal 2025 as compared to $115.5 million for the

similar period in the previous fiscal year, providing for basic and

diluted earnings per share of $1.93 and $1.89, respectively. This

compares to $1.97 and $1.95 per share, respectively, for the same

period last year. Weighted average common shares outstanding used

to compute diluted earnings per share for the three-month periods

ended September 30, 2024, and 2023 were 60.5 million and 59.3

million, respectively.

6 Months Year to Date Financial Highlights:

For the six months ending September 30, 2024, the Company's

revenue totaled approximately $1.0 billion compared to

approximately $752 million for the prior year period, an increase

of 37%. The Company's operating expense was $862 million for the

period as compared to $533 million in the prior year period, an

increase of 62%.

Net income was approximately $149 million for the first six

months of fiscal 2025, compared to $183 million for the same period

in fiscal 2024, providing for basic and diluted earnings per share

of $2.51 and $2.46, respectively. This compares to $3.13 and $3.09

per share, respectively, for the same period of the last fiscal

year. Weighted average common shares outstanding used to compute

diluted earnings per share for the six-month periods ended

September 30, 2024, and 2023 were 60.4 million and 59.3 million,

respectively.

Balance Sheet Highlights:

Total assets were $8.8 billion on September 30, 2024, as

compared to $8.3 billion on March 31, 2024, fiscal year-end. Net

working capital increased to $758 million on September 30, 2024, up

from $675 million on March 31, 2024.

"We experienced an expansion of retail client activity

across all key business segments …”

Commenting on the results of the quarter, Timur Turlov, the

Company's founder and chief executive officer, stated, "Overall we

are pleased with the company’s financial performance during the

reporting period. It was a record revenue quarter for Freedom where

we achieved a 33% increase in revenues as compared to the same

quarter last year, and a 29% increase over our first quarter of

fiscal 2025. Insurance underwriting was the primary revenue growth

driver for the period, which was in line with our expectations as

we continued to penetrate the Kazakhstan and other central Asian

markets with innovative products and services, and continued the

roll out of our Freedom SuperApp. We experienced an expansion of

retail client activity across all key business segments and

continued to garner market share in each area of operations. This

was highlighted by a 33% and 58% customer-base increase in our

banking and insurance segments, respectively,” Turlov added.

“Of the $115 million in net income for the quarter, our

brokerage and banking segments were the top contributors, coming in

at $86 million and $46 million respectively, partially offset by a

loss of $32 million in our Other business segment, which was also

in keeping with our expectations as we continue to invest in these

wholly owned subsidiaries” Turlov stated, and “the significant

increase in our insurance customer base during the quarter,

accounted for $15 million of this net income. New insurance

products and services such as pension annuity and accident

insurance, coupled with an overall expansion of our insurance

operations, were significant contributors to the financial results

during the reporting period,” Turlov continued. “Our insurance

customer base increased by 58% as compared to your fiscal 2024

year-end indicating to us that we continue to be on the right path

of service offerings and value-add products for our clients.” said

the CEO.

“Staying ahead of the game…”

Commenting further, Turlov stated, “A key differentiator for

Freedom Holding Corp. is in our ability to look ahead and identify

low-competition, high-margin niches that others are unaware of, a

task which is often easier said than done. Staying ahead of the

game requires us to leverage the foundation of our digital

ecosystem: an ecosystem that we have been building and improving

over the course of the past 5 years. Millions of dollars and

thousands of hours have been dedicated to this endeavor and the

fruit of these investments and labors can be seen in the continued

delivery of our positive financial results. One can’t overestimate

the power of the Freedom SuperApp, which allows us to accumulate

massive amounts of data about our consumers’ behavior and their

preferences. This kind of Big Data is a significant competitive

advantage as the more we know about our clients, the more rapidly

we can create products and services that meet their specific needs.

Trending data gives us foresight and we have been nimble and

efficient enough to take advantage of this. Freedom Holding Corp.

currently controls the largest ecosystem of financial services in

Kazakhstan, including a bank, two brokerage companies, an insurance

business and a payment service. All of these services can be

accessed through the Freedom SuperApp. I expect that over the

course of the next few years, we will be unmatched by our

competitors in this regard,” the CEO concluded.

Additional second quarter fiscal 2025 highlights:

Insurance underwriting income for the quarter was $160.3

million, an increase of $102.4 million or 177%, compared to the

three months ended September 30, 2023, and there was a net gain on

trading securities of $68.3 million during the quarter as compared

to a net gain on trading securities of $50.8 million for the three

months ended September 30, 2023.

Fee and commission income for the three months ended September

30, 2024 was $121.1 million, an increase of $9.3 million, or 8%,

compared to the three months ended September 30, 2023, and there

was a net gain on derivatives for the three months ended September

30, 2024 in the amount of $6.3 million, an increase of $4.9

million, or 358%, compared to the three months ended September 30,

2023.

The Company reported approximately 555,000 total retail

brokerage customers as of September 30, 2024, as compared to

approximately 530,000 as of March 31, 2024. Banking customer count

totaled approximately 1,202,000 at the Company’s subsidiary,

Freedom Bank KZ, as of September 30, 2024, as compared to

approximately 904,000 as of March 31, 2024.

About Freedom Holding Corp.

Freedom Holding Corp., a Nevada corporation, is a diversified

financial services holding company conducting retail securities

brokerage, investment research, investment counseling, securities

trading, investment banking and underwriting services, mortgages,

insurance, and consumer banking through its subsidiaries, operating

under the name Freedom Finance in Europe and Central Asia, and

Freedom Capital Markets in the United States. Through its

subsidiaries, Freedom Holding Corp. employs more than 7,600 people

and is a professional participant in the Kazakhstan Stock Exchange,

the Astana International Exchange, the Republican Stock Exchange of

Tashkent, and the Uzbek Republican Currency Exchange and is a

member of the New York Stock Exchange and the Nasdaq Stock

Exchange.

Freedom Holding Corp.'s common shares are registered with the

United States Securities and Exchange Commission and are traded

under the symbol FRHC on the Nasdaq Capital Market, operated by

Nasdaq, Inc. The Company has its main market of operations in

Kazakhstan and has operations through its subsidiaries in 22

countries.

To learn more about Freedom Holding Corp., visit

www.freedomholdingcorp.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains "forward-looking" statements, including

with respect to Freedom Holding Corp.'s (the "Company") potential

for future growth and success. All forward-looking statements are

subject to uncertainty and changes in circumstances. In some cases,

forward-looking statements can be identified by terminology such as

"expect," "new," "plan," "seek," and "will," or the negative of

such terms or other comparable terminology used in connection with

any discussion of future plans, actions, and events.

Forward-looking statements are not guarantees of future results or

performance and involve risks, assumptions, and uncertainties that

could cause actual events or results to differ materially from the

events or results described in, or anticipated by, the

forward-looking statements. Factors that could materially affect

such forward-looking statements include certain economic, business,

and regulatory risks and factors identified in the Company's

periodic and current reports filed with the U.S. Securities and

Exchange Commission. All forward-looking statements are made only

as of the date of this release and the Company assumes no

obligation to update forward-looking statements to reflect

subsequent events or circumstances. Readers should not place undue

reliance on these forward-looking statements.

Website Disclosure

Freedom Holding Corp. intends to use its website,

https://ir.freedomholdingcorp.com, as a means for disclosing

material non-public information and for complying with U.S.

Securities and Exchange Commission Regulation FD and other

disclosure obligations.

Financial Tables to

Follow

FREEDOM HOLDING CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(All amounts in thousands of

United States dollars, unless otherwise stated)

September 30, 2024

March 31, 2024

ASSETS

Cash and cash equivalents (including

$1,915 and $203 from related parties)

$

569,179

$

545,084

Restricted cash (including $6,669 and $—

with related parties)

895,651

462,637

Trading securities (including $1,231 and

$1,326 with related parties)

3,601,118

3,688,620

Available-for-sale securities, at fair

value

284,580

216,621

Margin lending, brokerage and other

receivables, net (including $162,066 and $22,039 due from related

parties)

1,623,962

1,660,275

Loans issued (including $141,290 and

$147,440 to related parties)

1,368,656

1,381,715

Fixed assets, net

142,446

83,002

Intangible assets, net

46,112

47,668

Goodwill

53,166

52,648

Right-of-use asset

37,028

36,324

Insurance contract assets

24,982

24,922

Other assets, net (including $14,914 and

$5,257 with related parties)

169,375

102,414

TOTAL ASSETS

$

8,816,255

$

8,301,930

LIABILITIES AND SHAREHOLDERS’

EQUITY

Securities repurchase agreement

obligations

$

2,584,131

$

2,756,596

Customer liabilities (including $191,607

and $44,127 to related parties)

3,329,133

2,273,830

Margin lending and trade payables

303,411

867,880

Liabilities from insurance activity

364,156

297,180

Current income tax liability

27,844

32,996

Debt securities issued

267,341

267,251

Lease liability

37,664

35,794

Liability arising from continuing

involvement

506,091

521,885

Other liabilities (including $729 and

$9,854 to related parties)

133,248

81,560

TOTAL LIABILITIES

$

7,553,019

$

7,134,972

Commitments and Contingent Liabilities

(Note 23)

—

—

SHAREHOLDERS’ EQUITY

Preferred stock - $0.001 par value;

20,000,000 shares authorized, no shares issued or outstanding

—

—

Common stock - $0.001 par value;

500,000,000 shares authorized; 60,557,801 shares issued and

outstanding as of September 30, 2024, and 60,321,813 shares issued

and outstanding as of March 31, 2024, respectively

61

60

Additional paid in capital

209,249

183,788

Retained earnings

1,147,798

998,740

Accumulated other comprehensive loss

(96,869

)

(18,938

)

TOTAL FRHC SHAREHOLDERS’ EQUITY

$

1,260,239

$

1,163,650

Non-controlling interest

2,997

3,308

TOTAL SHAREHOLDERS’ EQUITY

$

1,263,236

$

1,166,958

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

8,816,255

$

8,301,930

FREEDOM HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND STATEMENTS OF OTHER COMPREHENSIVE

INCOME (Unaudited)

(All amounts in thousands of

United States dollars, unless otherwise stated)

Three Months Ended September

30,

Six Months Ended September

30,

2024

2023

2024

2023

Revenue:

Fee and commission income (including for

the three months ended $837 and $20,022, for the six months ended

$1,703 and $35,917 from related parties)

$

121,051

$

111,703

$

236,540

$

210,406

Net gain on trading securities

68,317

50,771

16,215

82,587

Interest income (including for the three

months ended $375 and $9,731, for the six months ended $644 and

$15,084 from related parties)

210,324

213,063

436,328

362,412

Insurance underwriting income

160,344

57,976

289,752

102,865

Net gain/(loss) on foreign exchange

operations

6,479

(3,696

)

14,568

15,605

Net gain/(loss) on derivative

6,308

1,378

18,802

(29,227

)

Other income

8,077

4,386

19,410

7,143

TOTAL REVENUE, NET

$

580,900

$

435,581

$

1,031,615

$

751,791

Expense:

Fee and commission expense

$

90,837

$

31,614

$

170,984

$

60,298

Interest expense

124,665

139,381

270,383

234,427

Insurance claims incurred, net of

reinsurance

66,684

33,988

113,993

55,502

Payroll and bonuses

66,210

39,998

123,734

71,628

Professional services

8,245

11,951

15,513

18,576

Stock compensation expense

12,056

1,031

22,671

2,264

Advertising expense

20,049

8,639

37,250

16,739

General and administrative expense

(including for the three months ended $6,247 and $5,229, for the

six months ended $8,971 and $7,561 from related parties)

53,240

29,630

98,345

54,105

Provision for allowance for expected

credit losses

10,427

4,662

8,657

18,988

TOTAL EXPENSE

$

452,413

$

300,894

$

861,530

$

532,527

INCOME BEFORE INCOME TAX

128,487

134,687

170,085

219,264

Income tax expense

(13,999

)

(19,208

)

(21,338

)

(35,864

)

NET INCOME

$

114,488

$

115,479

$

148,747

$

183,400

Less: Net loss attributable to

non-controlling interest in subsidiary

(170

)

(368

)

(311

)

(549

)

NET INCOME ATTRIBUTABLE TO

COMMON

$

114,658

$

115,847

$

149,058

$

183,949

OTHER COMPREHENSIVE INCOME

Change in unrealized gain on investments

available-for-sale, net of tax effect

4,306

2,168

7,680

4,407

Reclassification adjustment for net

realized (gain)/loss on available-for-sale investments disposed of

in the period, net of tax effect

185

(306

)

167

(1,264

)

Foreign currency translation

adjustments

(19,967

)

(29,933

)

(85,778

)

(31,693

)

OTHER COMPREHENSIVE LOSS

(15,476

)

(28,071

)

(77,931

)

(28,550

)

COMPREHENSIVE INCOME BEFORE

NON-CONTROLLING INTERESTS

$

99,012

$

87,408

$

70,816

$

154,850

Less: Comprehensive loss attributable to

non-controlling interest in subsidiary

(170

)

(368

)

(311

)

(549

)

COMPREHENSIVE INCOME/(LOSS)

ATTRIBUTABLE TO COMMON SHAREHOLDERS

$

99,182

$

87,776

$

71,127

$

155,399

EARNINGS PER COMMON SHARE (In U.S.

dollars):

Earnings per common share - basic

1.93

1.97

2.51

3.13

Earnings per common share - diluted

1.89

1.95

2.46

3.09

Weighted average number of shares

(basic)

59,363,122

58,581,332

59,310,891

58,546,963

Weighted average number of shares

(diluted)

60,460,173

59,291,832

60,358,442

59,292,757

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108030211/en/

Natalia Kharlashina Public Relations Freedom

Holding Corp. +7 701 364 1454

prglobal@ffin.kz

Ramina Fakhrutdinova (KZ) Public Relations

Freedom Finance JSC +7 777 377 8868

pr@ffin.kz

Al Palombo (US) Global Communications Chief

Freedom US Markets +1 212-980-4400, Ext. 1013

apalombo@freedomusmkts.com

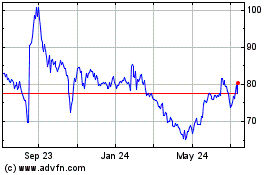

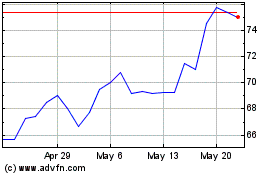

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Dec 2023 to Dec 2024