0001753162FALSE00017531622024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 7, 2024

_______________________________________________

FATHOM HOLDINGS INC.

(Exact name of registrant as specified in its charter)

_______________________________________________

| | | | | | | | |

| North Carolina | |

| (State or other jurisdiction of incorporation) | |

| | |

| 001-39412 | | 82-1518164 |

| (Commission File Number) | | (IRS Employer Identification No.) |

2000 Regency Parkway Drive, Suite 300, Cary, North Carolina 27518

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code 888-455-6040

_______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each Class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, No Par Value | FTHM | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Fathom Holdings Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein in its entirety by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit

No. | | Exhibit Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| FATHOM HOLDINGS INC. |

| |

| Date: November 7, 2024 | /s/ Marco Fregenal |

| Marco Fregenal |

| President and Chief Executive Officer |

Exhibit 99.1

Fathom Holdings Reports Third Quarter 2024 Results

– Fathom’s Real Estate Agent Network Grew 9% to ~12,383 Agent Licenses; Aiming to Return to 25% Agent Growth in Coming Quarters

CARY, NC, November 7, 2024 – Fathom Holdings Inc. (Nasdaq: FTHM) (“Fathom” or the “Company”), a national, technology-driven, end-to-end real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings for brokerages and agents, today reported financial results for the third quarter and the first nine months of 2024.

“We’re pleased to report a quarter marked by continued progress and strategic advancements, even as the housing market continues to face challenges,” said Fathom CEO Marco Fregenal. “Our team’s adaptability has enabled us to achieve key milestones, including our acquisition of My Home Group, which significantly expands our national footprint and strengthens our position in the growing Arizona housing market. This acquisition integrates a talented group of leaders, employees, and agents into the Fathom family and accelerates our growth strategy. By delivering competitive offerings such as the Fathom Max and Fathom Share commission plans, we are enhancing value for agents and supporting our integrated mortgage, title, and real estate services. Our agent-focused model equips us to capture opportunities in a shifting market, and we are encouraged by the momentum we’ve built this quarter.

We remain committed to advancing our strategic priorities, returning our company to 25% annual agent growth, and optimizing profitability and cash flow. Our recent initiatives, including targeted investments in agent recruitment and the launch of new commission plans, are already fostering growth and positioning us for sustained success. My Home Group’s alignment with Fathom’s values and objectives strengthens our capabilities in key growth regions. We are confident in our ability to execute these objectives, building a premier destination for agents and clients alike. Together, we are not only adapting to market changes but actively shaping the future of real estate.”

Third Quarter 2024 Financial Results

Fathom’s real estate agent network grew 9% to approximately 12,383 agent licenses as of September 30, 2024 from approximately 11,333 agent licenses at September 30, 2023.

Fathom completed 9,331 transactions in the third quarter of 2024, a decrease of approximately 9% compared to the third quarter of 2023. Real estate transactions decreased due to the continuation of higher home prices and uncertainty surrounding mortgage interest rates. Fathom is resolved to address this decline and return to meaningful growth by continuing its strategic recruiting efforts, powered by its recently announced new revenue share models and its service commitment to its agents.

Total revenue for the third quarter of 2024 decreased 10% to $83.7 million, compared to $93.5 million in the third quarter of 2023. The decrease in total revenue was due to an 11% decrease in brokerage revenue resulting primarily from fewer transactions partially offset by an approximately $0.4 million positive impact from the newly implemented high-value property fee and the absence of revenue from our insurance business, which we sold on May 3, 2024. Offsetting the decline in total revenue was a 44% increase in revenue from our ancillary businesses, primarily driven by improved performance from Fathom’s mortgage and title businesses.

Segment revenue for the 2024 third quarter, compared to the 2023 third quarter, was as follows:

| | | | | | | | | | | |

| Three months ended

September 30, |

| ($ in millions) | 2024 | | 2023 |

| UNAUDITED |

| Real Estate Brokerage | $ | 78.6 | | | $ | 88.2 | |

| Mortgage | 2.9 | | | 1.9 | |

| Technology | 1.1 | | | 0.8 | |

| Corporate and other services (a) | 1.1 | | | 2.5 | |

| Total revenue | $ | 83.7 | | | $ | 93.5 | |

(a)Transactions between segments are eliminated in consolidation. Such amounts are eliminated through the Corporate and other services line.

Our brokerage business gross profit percentage improved to 5.7% from 5.1% for the third quarter of 2024 compared to the third quarter of 2023. Excluding our insurance business, the gross profit percentage in our ancillary businesses increased to 56% from 46% in the third quarter of 2023. Our overall gross profit percentage, excluding our insurance business, improved to 9% in the third quarter of 2024, up from 7% in the third quarter of 2023.

GAAP net loss for the third quarter of 2024 totaled $8.1 million, or $0.40 per share, compared with a loss of $5.5 million, or $0.34 per share, for the third quarter of 2023. The increase in net loss was primarily due to recognizing the $3.0 million NAR settlement contingency and related legal fee expense.

Adjusted EBITDA*, a non-GAAP measure, for the third quarter of 2024 totaled a loss of $1.4 million, compared to a loss of $0.3 million in the third quarter of 2023. The decline in Adjusted EBITDA is primarily due to a decrease in brokerage revenue and increased costs in growing our ancillary businesses.

*Fathom provides Adjusted EBITDA, a non-GAAP financial measure, because it offers additional information for monitoring the Company's cash flow performance. A table providing a reconciliation of Adjusted EBITDA to its most comparable GAAP measure, as well as an explanation of, and important disclosures about, this non-GAAP measure, is included in the tables at the end of this press release.

Q3 2024 and Recent Highlights

•On November 1, 2024, the Company acquired My Home Group ("MHG"), a real estate agency group with over 2,200 agents. This acquisition increases the Company's real estate brokerage and ancillary business presence in Arizona and Washington.

•In September 2024, the Company issued senior secured convertible promissory notes in aggregate principal amount of $5.0 million to an existing shareholder, who owns more than 5% of Fathom's common stock, and the chairman of the Company's Board of Directors.

•In September 2024, Fathom Realty, a wholly owned subsidiary of the Company reached a nationwide settlement related to claims asserted in Burnett v. The National Association of Realtors., et al. As part of the settlement Fathom Realty will pay $500,000 into a settlement fund within five days after the settlement is formally approved by the court, $500,000 on or before October 1, 2025, and $1.95 million on or before October 1, 2026. The Company has included $1.0 million in accrued and other current liabilities and $1.95 million in other long-term liabilities on its balance sheet as of September 30, 2024. The total amount of $2.95 million is included in operating expense in the Company’s condensed consolidated statements of operations for the three and nine months ended September 30, 2024.

•In August 2024, the Company introduced two innovative agent commission plans, Fathom Max and Fathom Share, complementing its existing plan and showcasing Fathom Realty's reimagined revenue share program. The strategic initiative is designed to enhance agent recruitment and retention, drive accelerated and sustainable growth, and boost long-term profitability for the Company, while reinforcing Fathom's commitment to providing flexible, attractive options for real estate professionals.

Financial Outlook

In light of the recent introduction of two new revenue share models and their yet-to-be-determined impact on future revenues and Adjusted EBITDA, the Company has elected to withhold guidance for the fourth quarter ending December 31, 2024. Management plans to reassess and potentially reinstate guidance expectations in the first quarter of 2025, allowing time to evaluate the performance of these new models.

Conference Call

Fathom management will hold a conference call today (November 7, 2024) at 5:00 p.m. Eastern time (2:00 p.m. Pacific time) to discuss these financial results.

Toll Free: 888-999-3182

International: +1-848-280-6330

Passcode: Fathom Holdings, Inc.

Please call the conference telephone number five minutes prior to the start time. An operator will register your name and organization.

A live audio webcast of the conference call will be available in listen-only mode simultaneously and available via the investor relations section of the Company’s website at www.FathomInc.com.

A telephone replay of the call will be available through November 21, 2024.

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 51486

About Fathom Holdings Inc.

Fathom Holdings Inc. is a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings to brokerages and agents by leveraging its proprietary cloud-based software, intelliAgent. The Company's brands include Fathom Realty, Encompass Lending, intelliAgent, LiveBy, Real Results, Verus Title, and Cornerstone. For more information, visit www.FathomInc.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements" that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including: risks associated with general economic conditions, including rising interest rates; its ability to generate positive operational cash flow; risks associated with the Company's ability to continue achieving significant growth; its ability to continue its growth trajectory while achieving profitability over time; risks related to ongoing and future litigation; and other risks as set forth in the Risk Factors section of the Company's most recent Form 10-K as filed with the SEC and supplemented from time to time in other Company filings made with the SEC. Copies of Fathom's Form 10-K and other SEC filings are available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Contact:

Matt Glover and Clay Liolios

Gateway Group, Inc.

949-574-3860

FTHM@gateway-grp.com

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | |

|

Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | |

| Revenue | | | | | | | |

| Gross commission income | $ | 78,563 | | | $ | 88,247 | | | $ | 227,073 | | | $ | 256,050 | |

| Other service revenue | 5,170 | | | 5,277 | | | 16,370 | | | 15,104 | |

| Total revenue | 83,733 | | | 93,524 | | | 243,443 | | | 271,154 | |

| Operating expenses | | | | | | | |

| Commission and other agent-related costs | 74,187 | | | 83,770 | | | 213,399 | | | 241,834 | |

| Operations and support | 2,293 | | | 1,886 | | | 7,079 | | | 5,404 | |

| Technology and development | 2,044 | | | 1,760 | | | 5,900 | | | 4,674 | |

| General and administrative | 8,660 | | | 9,793 | | | 27,166 | | | 29,552 | |

| Litigation contingency | 3,099 | | | — | | | 3,437 | | | — | |

| Marketing | 767 | | | 796 | | | 2,126 | | | 2,439 | |

| Depreciation and amortization | 444 | | | 891 | | | 1,718 | | | 2,406 | |

| Total operating expenses | 91,494 | | | 98,896 | | | 260,825 | | | 286,309 | |

| Gain on sale of business | — | | | — | | | (2,958) | | | — | |

| Loss from operations | (7,761) | | | (5,372) | | | (14,424) | | | (15,155) | |

| Other expense (income), net | | | | | | | |

| Interest expense, net | 104 | | | 88 | | | 318 | | | 151 | |

| Other nonoperating expense | 238 | | | 18 | | | 572 | | | 181 | |

| Other expense, net | 342 | | | 106 | | | 890 | | | 332 | |

| Loss before income taxes | (8,104) | | | (5,478) | | | (15,314) | | | (15,487) | |

| Income tax expense | 17 | | | 18 | | | 28 | | | 55 | |

| Net loss | $ | (8,121) | | | $ | (5,496) | | | $ | (15,342) | | | $ | (15,542) | |

| Net loss per share: | | | | | | | |

| Basic | $ | (0.40) | | | $ | (0.34) | | | $ | (0.78) | | | $ | (0.97) | |

| Diluted | $ | (0.40) | | | $ | (0.34) | | | $ | (0.78) | | | $ | (0.97) | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 20,429,791 | | 16,074,225 | | | 19,792,773 | | 16,036,656 | |

| Diluted | 20,429,791 | | 16,074,225 | | | 19,792,773 | | 16,036,656 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| (UNAUDITED) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 13,104 | | | $ | 7,399 | |

| Restricted cash | 322 | | | 141 | |

| Accounts receivable | 3,210 | | | 3,352 | |

| Other receivable - current | 4,000 | | | — | |

| Mortgage loans held for sale, at fair value | 9,033 | | | 8,602 | |

| Prepaid and other current assets | 5,336 | | | 3,700 | |

| Total current assets | 35,005 | | | 23,194 | |

| Property and equipment, net | 1,945 | | | 2,340 | |

| Lease right of use assets | 4,017 | | | 4,150 | |

| Intangible assets, net | 17,537 | | | 23,909 | |

| Goodwill | 19,344 | | | 25,607 | |

| Other receivable - long-term | 3,000 | | | — | |

| Other assets | 81 | | | 58 | |

| Total assets | $ | 80,929 | | | $ | 79,258 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,932 | | | $ | 3,396 | |

| Accrued and other current liabilities | 4,129 | | | 2,681 | |

| Warehouse lines of credit | 8,642 | | | 8,355 | |

| Lease liability - current portion | 1,275 | | | 1,504 | |

| Long-term debt - current portion | 3,671 | | | 416 | |

| Total current liabilities | 22,649 | | | 16,352 | |

| Lease liability, net of current portion | 3,782 | | | 3,824 | |

| Long-term debt, net of current portion | 5,089 | | | 3,467 | |

| Other long-term liabilities | 2,297 | | | 381 | |

| Total liabilities | 33,817 | | | 24,024 | |

| Commitments and contingencies (Note 17) | | | |

| Stockholders’ equity: | | | |

Common stock (no par value, shares authorized, 100,000,000; shares issued and outstanding, 21,798,554 and 20,671,515 as of September 30, 2024 and December 31, 2023, respectively) | — | | | — | |

| Additional paid-in capital | 134,040 | | | 126,820 | |

| Accumulated deficit | (86,928) | | | (71,586) | |

| Total stockholders' equity | 47,112 | | | 55,234 | |

| Total liabilities and stockholders’ equity | $ | 80,929 | | | $ | 79,258 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands) | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (15,342) | | | $ | (15,542) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 4,050 | | | 4,466 | |

| Gain on sale of business | (2,958) | | | — | |

| Non-cash lease expense | 1,372 | | | 1,291 | |

| Other non-cash | — | | | 200 | |

| Deferred financing cost amortization | — | | | 46 | |

| Gain on sale of mortgages | (5,033) | | | (2,778) | |

| Stock-based compensation | 7,118 | | | 9,325 | |

| Deferred income taxes | — | | | 14 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | 51 | | | (1,050) | |

| Prepaid and other current assets | (1,704) | | | (136) | |

| Other assets | (23) | | | (7) | |

| Accounts payable | 1,708 | | | 59 | |

| Accrued and other current liabilities | 1,383 | | | (3) | |

| Operating lease liabilities | (1,510) | | | (1,412) | |

| Other long-term liabilities | 1,916 | | | — | |

| Mortgage loans held for sale originations | (192,230) | | | (111,722) | |

| Proceeds from sale and principal payments on mortgage loans held for sale | 196,832 | | | 111,043 | |

| Net cash used in operating activities | (4,371) | | | (6,206) | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of property and equipment | (46) | | | (21) | |

| Purchase of intangible assets | (2,160) | | | (1,337) | |

| Proceeds from sale of business | 7,435 | | | — | |

| Other investing activities | (130) | | | — | |

| Net cash provided by (used in) investing activities | 5,099 | | | (1,358) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Principal payments on debt | (557) | | | (566) | |

| Proceeds from note payable, net of $100 and $200 in loan costs respectively | 5,435 | | | 3,768 | |

| Borrowings from warehouse lines of credit | 191,837 | | | 108,398 | |

| Repayment on warehouse lines of credit | (191,550) | | | (105,088) | |

| Deferred acquisition consideration payments | 20 | | | (566) | |

| Payment of offering cost in connection with issuance of common stock in connection with public offering | (28) | | | — | |

| Net cash provided by financing activities | 5,157 | | | 2,178 | |

| Net increase in cash, cash equivalents, and restricted cash | 5,886 | | | (5,386) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 7,540 | | | 8,380 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 13,426 | | | $ | 2,994 | |

| | | |

| Supplemental disclosure of cash and non-cash transactions: | | | |

| Cash paid for interest | $ | 299 | | | $ | 188 | |

| Other receivables related to sale of business | $ | 7,000 | | | $ | — | |

| Income taxes paid | $ | 2 | | | $ | 50 | |

| Amounts due to seller | $ | 300 | | | $ | — | |

| Right of use assets obtained in exchange for new lease liabilities | $ | 1,572 | | | $ | 175 | |

| Reconciliation of cash and restricted cash: | | | |

| Cash and cash equivalents | $ | 13,104 | | | $ | 6,616 | |

| Restricted cash | 322 | | 146 |

| Total cash, cash equivalents, and restricted cash shown in statement of cash flows | $ | 13,426 | | | $ | 6,762 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (8,121) | | | $ | (5,496) | | | $ | (15,342) | | | $ | (15,542) | |

| Gain on sale of business | — | | | — | | | (2,958) | | | — | |

| Stock based compensation | 1,967 | | | 3,320 | | | 7,118 | | | 9,325 | |

| Depreciation and amortization | 1,251 | | | 1,599 | | | 4,050 | | | 4,466 | |

| Litigation contingency | 3,099 | | | — | | | 3,437 | | | — | |

| Other expense, net | 342 | | | 106 | | | 890 | | | 332 | |

| Other non-cash items and transaction costs | — | | | 200 | | | — | | | 200 | |

| Income tax expense | 17 | | | 18 | | | 28 | | | 55 | |

| Adjusted EBITDA | $ | (1,445) | | | $ | (253) | | | $ | (2,777) | | | $ | (1,164) | |

Note about Non-GAAP Financial Measures

To supplement Fathom's consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company uses Adjusted EBITDA, a non-GAAP financial measure, to understand and evaluate our core operating performance. This non-GAAP financial measure, which may be different than similarly titled measures used by other companies, is presented to enhance investors' overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Fathom defines the non-GAAP financial measure of Adjusted EBITDA as net income (loss), excluding other income and expense, income taxes, depreciation and amortization, share-based compensation expense, and transaction-related cost.

Fathom believes that Adjusted EBITDA provides useful information about the Company's financial performance, enhances the overall understanding of its past performance and future prospects, and allows for greater transparency with respect to a key metric used by Fathom's management for financial and operational decision-making. Fathom believes that Adjusted EBITDA helps identify underlying trends in its business that otherwise could be masked by the effect of the expenses that the Company excludes in Adjusted EBITDA. In particular, Fathom believes the exclusion of share-based compensation expense and transaction-related costs associated with the Company's acquisition activity, provides a useful supplemental measure in evaluating the performance of its operations and provides better transparency into its results of operations. Adjusted EBITDA also excludes other income and expense, net which primarily includes nonrecurring items, such as, professional fees related to investigating potential financing and acquisition opportunities, if applicable.

Fathom is presenting the non-GAAP measure of Adjusted EBITDA to assist investors in seeing its financial performance through the eyes of management, and because the Company believes this measure provides an additional tool for investors to use in comparing Fathom's core financial performance over multiple periods with other companies in its industry.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. There are several limitations related to the use of Adjusted EBITDA compared to net income (loss), the closest comparable GAAP measure. Some of these limitations are that:

•Adjusted EBITDA excludes share-based compensation expense related to restricted stock and restricted stock unit awards and stock options, which have been, and will continue to be for the foreseeable future, significant recurring expenses in Fathom's business and an important part of its compensation strategy;

•Adjusted EBITDA excludes transaction-related costs primarily consisting of professional fees and any other costs incurred directly related to acquisition activity, which is an ongoing part of Fathom's growth strategy and therefore likely to occur; and

•Adjusted EBITDA excludes certain recurring, non-cash charges such as depreciation and amortization of property and equipment and capitalized software, and acquisition related intangible asset costs, however, the assets being depreciated and amortized may have to be replaced in the future.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

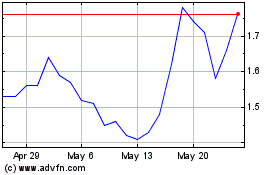

Fathom (NASDAQ:FTHM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fathom (NASDAQ:FTHM)

Historical Stock Chart

From Nov 2023 to Nov 2024