false

0001819411

0001819411

2024-12-23

2024-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 23, 2024

| |

|

|

| GAIN

THERAPEUTICS, INC. |

| (Exact name of registrant as specified in its

charter) |

| Delaware |

|

001-40237 |

|

85-1726310 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

4800

Montgomery Lane, Suite 220

Bethesda,

Maryland 20814

(Address of principal executive offices) (Zip

Code)

(301)

500-1556

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 |

GANX |

The

Nasdaq Stock

Market LLC |

Item 7.01. Regulation FD Disclosure.

On December 23, 2024,

Gain Therapeutics, Inc. (the “Company”) issued a press release announcing it has received approval in Australia to initiate

a Phase 1b clinical trial. A copy of the press release is furnished hereto as Exhibit 99.1.

The information in

this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the SEC

and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be

incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set

forth by a specific reference in such filing.

Item 8.01 Other Information

On December 23, 2024, the Company issued a press release announcing

that it has received approval in Australia to initiate a Phase 1b clinical trial. The Company will be working with local Parkinson’s

disease (“PD”) advocacy groups to support enrollment, and expects enrollment to complete in the spring of 2025 with data from

the study expected mid-2025. GT-02287 is the Company’s lead allosteric small molecule in clinical development for the treatment

of PD with or without a GBA1 mutation.

The primary goal of the

Phase 1b trial is to assess the safety and tolerability of GT-02287 in people with PD. The Phase 1b trial will follow the Company’s Phase 1 study in healthy volunteers completed during the third quarter of 2024, in which GT-02287 demonstrated a favorable

safety and tolerability profile as well as plasma and CNS exposures in the projected therapeutic range. The Phase 1 study also showed

significant target engagement of GT-02287 demonstrated by a statistically significant increase in glucocerebrosidase (GCase) activity

that was more than 50%.

The Phase 1b clinical

trial of GT-02287 will be conducted at seven sites covering the major metropolitan areas in Australia, all of which have experience with

PD trials.

The Phase 1b open-label

trial will assess the safety and tolerability of 13.5 mg/kg/day of GT-02287 for three months in patients with GBA1-PD or idiopathic PD.

Secondary endpoints include pharmacokinetics, GCase modulation, levels of GCase substrates, and other biomarkers in plasma and cerebrospinal fluid. Data

from the Phase 1b trial is anticipated mid-2025.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Exhibit is being furnished as part of this Current Report on Form

8-K

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GAIN THERAPEUTICS, INC. |

| |

|

| Dated: December 23, 2024 |

By: |

/s/

Gene Mack |

| |

Name: Gene Mack |

| |

Title: Chief Financial Officer and Interim Chief Executive Officer |

Exhibit 99.1

Gain Therapeutics

Initiates Phase 1b Clinical Trial of Lead Candidate GT-02287 in People with GBA1 and Idiopathic Parkinson’s Disease

The Company

has received approval to begin enrollment of the Phase 1b clinical trial in Australia

Phase 1b clinical

trial will assess safety and tolerability along with biomarkers during three months of dosing with GT-02287 in people diagnosed with Parkinson’s

disease

Phase 1b clinical

trial follows successful Phase 1 study in which GT-02287 was safe and well tolerated while demonstrating GCase target engagement

BETHESDA,

Md., December 23, 2024 -- Gain Therapeutics, Inc. (Nasdaq: GANX) (“Gain”, or the

“Company”), a clinical-stage biotechnology company leading the discovery and development of the next generation of allosteric

small molecule therapies, today announced it has received approval in Australia to initiate a Phase 1b trial. Gain will be working with

local Parkinson’s disease (PD) advocacy groups to support enrollment and expects enrollment to complete in the spring of 2025 with

data from the study expected mid-2025. GT-02287 is the Company’s lead allosteric small molecule in clinical development for the

treatment of PD with or without a GBA1 mutation. The primary goal of the Phase 1b trial is to assess the safety and tolerability of GT-02287

in people with PD.

The

Phase 1b trial follows the successful Phase 1 study in healthy volunteers completed during Q3 2024, in which GT-02287

demonstrated a favorable safety and tolerability profile as well as plasma and CNS exposures in the projected therapeutic range. Importantly,

the Phase 1 study also showed significant target engagement of GT-02287 demonstrated by a statistically significant increase in glucocerebrosidase

(GCase) activity that was >50%.

“It

is a fitting end to what has been a transformative year for Gain Therapeutics with the initiation of our Phase 1b clinical trial for

GT-02287 in Australia. During 2024, Gain Therapeutics made the significant transition from preclinical to clinical stage development

with successful completion of the healthy volunteer studies. We believe GT-02287 has the

potential to slow or stop the progression of Parkinson’s disease and look forward to further evaluating the safety and

tolerability of GT-02287; while also observing its impact on key biomarkers of Parkinson’s disease after three months of

administration in the Phase 1b trial. Gain Therapeutics welcomes the New Year and we are excited to take another critical step

towards advancing GT-02287 into Phase 2 trial preparation in 2025 following results of the Phase 1b trial, expected mid-year

2025,” said Gene Mack, CFO and Interim CEO of Gain Therapeutics.

Jonas Hannestad, M.D., Ph.D., Chief

Medical Officer of Gain, continued, “The Phase 1b clinical trial of GT-02287 will be conducted at seven sites covering the major

metropolitan areas in Australia, all of which have experience with Parkinson’s disease trials. Historically, a limited number of

clinical trials in Parkinson’s disease have included Australian sites, and we have heard from both investigators and potential

participants that they are eager to have the opportunity to partake in this study.”

The

Phase 1b open-label trial will assess the safety and tolerability of 13.5 mg/kg/day of GT-02287 for three months in patients with GBA1-PD

or idiopathic Parkinson’s disease. Secondary endpoints include pharmacokinetics, GCase modulation, levels of GCase substrates,

and other biomarkers in plasma and cerebrospinal fluid . Data from the Phase 1b trial is anticipated mid-2025.

For more information visit:

https://clinicaltrials.gov/study/NCT06732180

About

GT-02287

Gain Therapeutics’ lead drug candidate, GT-02287, is in clinical development for

the treatment of Parkinson’s disease (PD) with or without a GBA1 mutation. The orally administered, brain-penetrant small molecule

is an allosteric protein modulator that restores the function of the lysosomal protein enzyme glucocerebrosidase (GCase) which becomes

misfolded and impaired due to mutations in the GBA1 gene, the most common genetic abnormality associated with PD, or other age-related

stress factors. In preclinical models of PD, GT-02287 restored GCase enzymatic function, reduced aggregated α-synuclein, neuroinflammation

and neuronal death, and improved motor function and cognitive performance. Additionally, GT-02287 significantly reduced plasma neurofilament

light chain (NfL) levels, an emerging biomarker for neurodegeneration.

Compelling preclinical data in models

of both GBA1-PD and idiopathic PD, demonstrating a disease-modifying effect after administration of GT-02287, suggests that GT-02287

may have the potential to slow or stop the progression of Parkinson’s disease.

Gain’s lead program in Parkinson’s

disease has been awarded funding support from The Michael J. Fox Foundation for Parkinson’s Research (MJFF) and The Silverstein

Foundation for Parkinson’s with GBA, as well as from the Eurostars-2 joint program with co-funding from the European Union Horizon

2020 research and Innosuisse – Swiss Innovation Agency.

About

Gain Therapeutics, Inc.

Gain Therapeutics, Inc. is a clinical-stage biotechnology company leading

the discovery and development of next generation allosteric therapies. Gain’s lead drug candidate, GT-02287 is currently being

evaluated for the treatment of Parkinson’s disease with or without a GBA1 mutation. Results from a Phase 1 study of GT-02287 in

healthy volunteers demonstrated favorable safety and tolerability, plasma exposure in the projected therapeutic range, CNS exposure,

and target engagement and modulation of GCase enzyme.

Gain’s unique approach enables

the discovery of novel, allosteric small molecule modulators that can restore or disrupt protein function. Deploying its highly advanced

Magellan™ platform, Gain is accelerating drug discovery and unlocking novel disease-modifying treatments for untreatable or difficult-to-treat

disorders including neurodegenerative diseases, rare genetic disorders and oncology.

Forward-Looking

Statements

This release contains “forward-looking statements” made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are typically preceded by words such

as “believes,” “expects,” “anticipates,” “intends,” “will,” “may,”

“should,” or similar expressions. These forward-looking statements reflect management’s current knowledge, assumptions,

judgment and expectations regarding future performance or events. Although management believes that the expectations reflected in such

statements are reasonable, they give no assurance that such expectations will prove to be correct or that those goals will be achieved,

and you should be aware that actual results could differ materially from those contained in the forward-looking statements. Forward-looking

statements are subject to a number of risks and uncertainties, including, but not limited to, statements regarding: the development of

the Company’s current or future product candidates including GT-02287; expectations regarding the timing of results from a Phase

1b clinical study for GT-02287; expectations regarding the timing of patient enrollment for a Phase 1b clinical study for GT-02287; and

the potential therapeutic and clinical benefits of the Company’s product candidates. For a further description of the risks and

uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating

to the Company’s business in general, please refer to the Company’s Form 10-K for the year ended December 31, 2023 and Form

10-Q for the quarter ended September 30, 2024. All forward-looking statements are expressly qualified in their entirety by this cautionary

notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this release.

We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether

as a result of new information, future events or otherwise.

Investor

Contacts:

Apaar Jammu and Chuck Padala

ajammu@gaintherapeutics.com

chuck@lifesciadvisors.com

Media

Contacts:

Russo Partners

Nic Johnson and Elio Ambrosio

nic.johnson@russopartnersllc.com

elio.ambrosio@russopartnersllc.com

(760) 846-9256

v3.24.4

Cover

|

Dec. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 23, 2024

|

| Entity File Number |

001-40237

|

| Entity Registrant Name |

GAIN

THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001819411

|

| Entity Tax Identification Number |

85-1726310

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4800

Montgomery Lane

|

| Entity Address, Address Line Two |

Suite 220

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

301

|

| Local Phone Number |

500-1556

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001

|

| Trading Symbol |

GANX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

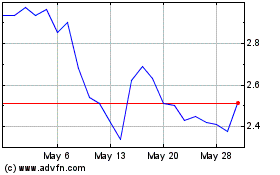

Gain Therapeutics (NASDAQ:GANX)

Historical Stock Chart

From Nov 2024 to Dec 2024

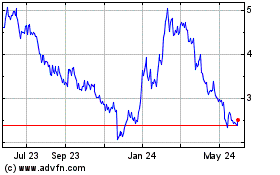

Gain Therapeutics (NASDAQ:GANX)

Historical Stock Chart

From Dec 2023 to Dec 2024