Record Revenues of $87.4 million and GAAP

Net Income of $4.3 million

Grid Dynamics Holdings, Inc. (Nasdaq: GDYN) (“Grid Dynamics” or

the “Company”), a leader in enterprise-level digital

transformation, today announced results for the third quarter ended

September 30, 2024.

We are very pleased to report third quarter 2024 revenues of

$87.4 million that was higher than our outlook range of $84.0

million to $86.0 million that we provided in August 2024. Our

Retail and Technology, Media and Telecom (“TMT”) verticals were the

two largest verticals during the third quarter of 2024 with 34.1%

and 27.7% of our revenues, respectively. Our Finance vertical,

representing 16.2% of our third quarter revenues, grew 12.7% on a

sequential basis and 94.0% on a year-over-year basis. Strength in

the Financial vertical came from our finance technology and

insurance customers. Our CPG and Manufacturing vertical,

representing 11.2% of our third quarter revenues, remained flat on

a sequential basis.

“The third quarter was another milestone in the Company’s

history. We reported record revenues and profitability, scaled

partnership influenced revenues, and set a new record with the

highest number of billable engineers. Customers, both existing and

new, are contributing to our strong results, which is a testament

to our technology differentiation and delivery excellence. The

strong demand we witnessed in the third quarter was built on steady

improvements in the first half of the year.

I am thrilled to welcome JUXT and Mobile Computing to Grid

Dynamics. Each company brings in a unique set of capabilities.

UK-based JUXT elevates our industry expertise in banking and

financial services, and Argentina-based Mobile Computing enhances

our engineering capabilities and adds premier clients in Latin

America.

Our AI initiatives continue to gain significant traction across

our customer base. Our pipeline of AI opportunities has grown to

more than 100, representing a 50% increase from last quarter. This

growth reflects the increasing enterprise readiness to move beyond

experimentation to implementation of AI solutions at scale.

We approach the end of 2024 with strong business momentum and

confident of the foundations of the Company as we enter 2025,” said

Leonard Livschitz, CEO.

Third Quarter of 2024 Financial

Highlights

- Total revenues were $87.4 million, an increase of 5.3% on a

sequential basis and 12.9% on a year-over-year basis.

- GAAP gross profit was $32.7 million, or 37.4% of revenues, in

the third quarter of 2024, compared to $28.2 million, or 36.4% of

revenues, in the third quarter of 2023. Non-GAAP gross profit was

$33.3 million, or 38.0% of revenues, in the third quarter of 2024,

compared to $28.7 million, or 37.0% of revenues, in the third

quarter of 2023.

- GAAP net income attributable to common stockholders was $4.3

million, or $0.05 per share, based on 78.8 million diluted

weighted-average common shares outstanding in the third quarter of

2024, compared to $0.7 million, or $0.01 per share, based on 77.3

million diluted weighted-average common shares outstanding in the

third quarter of 2023. Non-GAAP net income was $8.1 million, or

$0.10 per diluted share, based on 78.8 million diluted

weighted-average common shares outstanding in the third quarter of

2024, compared to $5.9 million, or $0.08 per diluted share, based

on 77.3 million diluted weighted-average common shares outstanding

in the third quarter of 2023.

- Non-GAAP EBITDA (earnings before interest, taxes, depreciation,

amortization, other income and expenses, fair value adjustments,

stock-based compensation, transaction and transformation-related

costs, restructuring costs as well as geographic reorganization

expenses), a non-GAAP metric, was $14.8 million in the third

quarter of 2024 compared to $10.7 million in the third quarter of

2023.

See “Non-GAAP Financial Measures” and “Reconciliation of

Non-GAAP Information” below for a discussion of our non-GAAP

measures.

Cash Flow and Other

Metrics

- Cash provided by operating activities was $23.1 million for the

nine months ended September 30, 2024, compared to $33.5 million for

the nine months ended September 30, 2023.

- Cash and cash equivalents totaled $231.3 million as of

September 30, 2024, compared to $257.2 million as of December 31,

2023.

- Total headcount was 4,298 as of September 30, 2024, compared

with 3,823 employees as of September 30, 2023.

Financial Outlook

- The Company expects revenue in the fourth quarter of 2024 to be

in the range of $95.0 million to $97.0 million.

- Non-GAAP EBITDA in the fourth quarter of 2024 is expected to be

between $13.5 million and $15.5 million.

- For the fourth quarter of 2024, we expect our basic share count

to be in the 77.0 - 78.0 million range and diluted share count to

be in the 80.0 - 81.0 million range.

Grid Dynamics is not able, at this time, to provide GAAP targets

for net income/(loss) for the fourth quarter of 2024 because of the

difficulty of estimating certain items excluded from Non-GAAP

EBITDA that cannot be reasonably predicted, such as interest

income, taxes, other income/(expenses), fair-value adjustments,

geographic reorganization expenses, restructuring expenses,

transaction-related costs and charges related to stock-based

compensation expense. The effect of these excluded items may be

significant.

Conference Call and

Webcast

Grid Dynamics will host a video conference call at 4:30 p.m. ET

on Thursday, October 31, 2024 to discuss its third quarter

financial results. Investors and other interested parties can

access the call in the following ways: A webcast of the video

conference call can be accessed on the Investor Relations section

of the Company’s website at https://ir.griddynamics.com/.

A replay will also be available after the call at

https://ir.griddynamics.com/ with the passcode $Q3@2024.

About Grid Dynamics

Grid Dynamics (Nasdaq: GDYN) is a digital-native technology

services provider that accelerates growth and bolsters competitive

advantage for Fortune 1000 companies. Grid Dynamics provides a

range of digital transformation consulting and implementation

services that includes artificial intelligence, big data,

analytics, search, cloud and DevOps. Grid Dynamics achieves high

speed-to-market, quality, and efficiency by using technology

accelerators, an agile delivery culture, and its pool of global

engineering talent. Founded in 2006, Grid Dynamics is headquartered

in Silicon Valley with offices across the globe, including the

U.S., Europe, the U.K., India, Mexico, Jamaica and Argentina.

To learn more about Grid Dynamics, please visit

www.griddynamics.com. Follow us on LinkedIn.

Non-GAAP Financial

Measures

To supplement the financial measures presented in Grid Dynamics

press release in accordance with generally accepted accounting

principles in the United States (“GAAP”), the Company also presents

Non-GAAP measures of financial performance.

A “non-GAAP financial measure” refers to a numerical measure of

Grid Dynamics historical or future financial performance or

financial position that is included in (or excluded from) the most

directly comparable measure calculated and presented in accordance

with GAAP. Grid Dynamics provides certain non-GAAP measures as

additional information relating to its operating results as a

complement to results provided in accordance with GAAP. The

non-GAAP financial information presented herein should be

considered in conjunction with, and not as a substitute for or

superior to, the financial information presented in accordance with

GAAP and should not be considered a measure of liquidity and

profitability.

Grid Dynamics has included these non-GAAP financial measures

because they are financial measures used by Grid Dynamics’

management to evaluate Grid Dynamics’ core operating performance

and trends, to make strategic decisions regarding the allocation of

capital and new investments and are among the factors analyzed in

making performance-based compensation decisions for key

personnel.

Grid Dynamics believes the use of non-GAAP financial measures,

as a supplement to GAAP measures, is useful to investors in that

they eliminate items that are either not part of core operations or

do not require a cash outlay, such as stock-based compensation

expense. Grid Dynamics believes these non-GAAP measures provide

investors and other users of its financial information consistency

and comparability with its past financial performance and

facilitate period to period comparisons of operations. Grid

Dynamics believes these non-GAAP measures are useful in evaluating

its operating performance compared to that of other companies in

its industry, as they generally eliminate the effects of certain

items that may vary for different companies for reasons unrelated

to overall operating performance.

There are significant limitations associated with the use of

non-GAAP financial measures. Further, these measures may differ

from the non-GAAP information, even where similarly titled, used by

other companies and therefore should not be used to compare our

performance to that of other companies. Grid Dynamics compensates

for these limitations by providing investors and other users of its

financial information a reconciliation of non-GAAP measures to the

related GAAP financial measures. Grid Dynamics encourages investors

and others to review its financial information in its entirety, not

to rely on any single financial measure, and to view its non-GAAP

measures in conjunction with GAAP financial measures. Please see

the reconciliation of non-GAAP financial measures to the most

directly comparable GAAP measures attached to this release.

Forward-Looking

Statements

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 that are not

historical facts, and involve risks and uncertainties that could

cause actual results of Grid Dynamics to differ materially from

those expected and projected. These forward-looking statements can

be identified by the use of forward-looking terminology, including

the words “believes,” “estimates,” “anticipates,” “expects,”

“intends,” “plans,” “may,” “will,” “potential,” “projects,”

“predicts,” “continue,” or “should,” or, in each case, their

negative or other variations or comparable terminology. These

forward-looking statements include, without limitation, the

quotations of management, the section titled “Financial Outlook,”

and statements concerning Grid Dynamics’s expectations with respect

to future performance, particularly in light of the macroeconomic

environment and the Russian invasion of Ukraine, as well as its

GigaCube strategy.

These forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside Grid Dynamics’s control and are difficult to predict.

Factors that may cause such differences include, but are not

limited to: (i) Grid Dynamics has a relatively short operating

history and operates in a rapidly evolving industry, which makes it

difficult to evaluate future prospects and may increase the risk

that it will not continue to be successful and may adversely impact

our stock price; (ii) Grid Dynamics may be unable to effectively

manage its growth or achieve anticipated growth, particularly as it

expands into new geographies, which could place significant strain

on Grid Dynamics’ management personnel, systems and resources;

(iii) Grid Dynamics’ revenues are highly dependent on a limited

number of clients and industries that are affected by seasonal

trends, and any decrease in demand for outsourced services in these

industries may reduce Grid Dynamics’ revenues and adversely affect

Grid Dynamics’ business, financial condition and results of

operations; (iv) macroeconomic conditions, inflationary pressures,

and the geopolitical climate, including the Russian invasion of

Ukraine, have and may continue to materially adversely affect our

stock price, business operations, overall financial performance and

growth prospects; (v) Grid Dynamics’ revenues are highly dependent

on clients primarily located in the United States, and any economic

downturn in the United States or in other parts of the world,

including Europe or disruptions in the credit markets may have a

material adverse effect on Grid Dynamics’ business, financial

condition and results of operations; (vi) Grid Dynamics faces

intense and increasing competition; (vii) Grid Dynamics’ failure to

successfully attract, hire, develop, motivate and retain highly

skilled personnel could materially adversely affect Grid Dynamics’

business, financial condition and results of operations; (viii)

failure to adapt to rapidly changing technologies, methodologies

and evolving industry standards may have a material adverse effect

on Grid Dynamics’ business, financial condition and results of

operations; (ix) failure to successfully deliver contracted

services or causing disruptions to clients’ businesses may have a

material adverse effect on Grid Dynamics’ reputation, business,

financial condition and results of operations; (x) risks and costs

related to acquiring and integrating other companies; and (xi)

other risks and uncertainties indicated in Grid Dynamics filings

with the SEC.

Grid Dynamics cautions that the foregoing list of factors is not

exclusive. Grid Dynamics cautions readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. Grid Dynamics does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based. Further

information about factors that could materially affect Grid

Dynamics, including its results of operations and financial

condition, is set forth under the “Risk Factors” section of the

Company’s quarterly report on Form 10-Q filed October 31, 2024 and

in other periodic filings Grid Dynamics makes with the SEC.

Schedule 1:

GRID DYNAMICS HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME/(LOSS) AND

COMPREHENSIVE

INCOME/(LOSS)

Unaudited

(In thousands, except per

share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

$

87,435

$

77,419

$

250,289

$

234,841

Cost of revenues

54,706

49,267

160,332

149,809

Gross profit

32,729

28,152

89,957

85,032

Operating expenses

Engineering, research, and development

4,446

3,402

12,945

10,878

Sales and marketing

6,817

6,132

21,395

17,729

General and administrative

19,330

18,475

58,983

60,940

Total operating expenses

30,593

28,009

93,323

89,547

Income/(loss) from operations

2,136

143

(3,366

)

(4,515

)

Other income/(expense), net

3,466

3,159

8,656

7,849

Income before income taxes

5,602

3,302

5,290

3,334

Provision for income taxes

1,320

2,626

5,773

8,001

Net income/(loss)

$

4,282

$

676

$

(483

)

$

(4,667

)

Foreign currency translation

adjustments

214

(561

)

(91

)

1,337

Comprehensive income/(loss)

$

4,496

$

115

$

(574

)

$

(3,330

)

Income/(loss) per share

Basic

$

0.06

$

0.01

$

(0.01

)

$

(0.06

)

Diluted

$

0.05

$

0.01

$

(0.01

)

$

(0.06

)

Weighted average shares

outstanding

Basic

76,697

75,464

76,485

75,026

Diluted

78,837

77,339

76,485

75,026

Schedule 2:

GRID DYNAMICS HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

Unaudited

(In thousands, except share

and per share data)

As of

September 30,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

231,261

$

257,227

Accounts receivable, net of allowance of

$1,791 and $1,363 as of September 30, 2024 and December 31, 2023,

respectively

64,320

49,824

Unbilled receivables

5,737

3,735

Prepaid income taxes

10,292

3,998

Prepaid expenses and other current

assets

11,385

9,196

Total current assets

322,995

323,980

Property and equipment, net

13,965

11,358

Operating lease right-of-use assets,

net

12,329

10,446

Intangible assets, net

42,451

26,546

Goodwill

73,875

53,868

Deferred tax assets

7,515

6,418

Other noncurrent assets

4,122

2,549

Total assets

$

477,252

$

435,165

Liabilities and equity

Current liabilities

Accounts payable

$

3,717

$

3,621

Accrued compensation and benefits

22,986

19,263

Accrued income taxes

13,191

8,828

Operating lease liabilities, current

5,179

4,235

Accrued expenses and other current

liabilities

9,161

6,276

Total current liabilities

54,234

42,223

Deferred tax liabilities

7,621

3,274

Operating lease liabilities,

noncurrent

7,649

6,761

Contingent consideration payable,

noncurrent

7,501

—

Total liabilities

$

77,005

$

52,258

Stockholders’ equity

Common stock, $0.0001 par value;

110,000,000 shares authorized; 76,742,933 and 75,887,475 issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

$

8

$

8

Additional paid-in capital

415,425

397,511

Accumulated deficit

(16,369

)

(15,886

)

Accumulated other comprehensive income

1,183

1,274

Total stockholders’ equity

400,247

382,907

Total liabilities and stockholders’

equity

$

477,252

$

435,165

Schedule 3:

GRID DYNAMICS HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS

Unaudited

(In thousands)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating

activities

Net loss

$

(483

)

$

(4,667

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

9,579

6,255

Operating lease right-of-use assets

amortization expense

3,301

2,295

Bad debt expense

1,077

674

Deferred income taxes

(1,516

)

(2,451

)

Change in fair value of contingent

consideration

—

(4,220

)

Stock based compensation

25,969

27,677

Other (income)/expenses, net

(890

)

98

Changes in assets and liabilities:

Accounts receivable

(8,649

)

3,085

Unbilled receivables

(1,027

)

(1,509

)

Prepaid income taxes

(5,866

)

(5,295

)

Prepaid expenses and other current

assets

(2,894

)

28

Accounts payable

(740

)

(471

)

Accrued compensation and benefits

3,293

6,554

Operating lease liabilities

(3,352

)

(2,119

)

Accrued income taxes

4,363

5,638

Accrued expenses and other current

liabilities

965

1,965

Net cash provided by operating

activities

23,130

33,537

Cash flows from investing

activities

Purchase of property and equipment

(9,126

)

(5,593

)

Acquisition of business, net of cash

acquired

(32,144

)

(17,830

)

Other investing activities, net

(44

)

—

Net cash used in investing

activities

(41,314

)

(23,423

)

Cash flows from financing

activities

Proceeds from exercises of stock options,

net of shares withheld for taxes

867

491

Payments of tax obligations resulted from

net share settlement of vested stock awards

(8,635

)

(14,958

)

Net cash used in financing

activities

(7,768

)

(14,467

)

Effect of exchange rate changes on cash

and cash equivalents

(14

)

1,337

Net decrease in cash and cash

equivalents

(25,966

)

(3,016

)

Cash and cash equivalents, beginning of

period

257,227

256,729

Cash and cash equivalents, end of

period

$

231,261

$

253,713

Supplemental disclosure of cash flow

information:

Cash paid for income taxes

$

8,993

$

9,936

Supplemental disclosure of non-cash

activities

Acquisition fair value of contingent

consideration issued for acquisition of business

$

7,480

$

932

Schedule 4:

GRID DYNAMICS HOLDINGS,

INC.

RECONCILIATION OF NON-GAAP

INFORMATION

Unaudited

(In thousands, except per

share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

$

87,435

$

77,419

$

250,289

$

234,841

Cost of revenues

54,706

49,267

160,332

149,809

GAAP gross profit

32,729

28,152

89,957

85,032

Stock-based compensation

525

502

1,517

1,482

Non-GAAP gross profit

$

33,254

$

28,654

$

91,474

$

86,514

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income/(loss)

$

4,282

$

676

$

(483

)

$

(4,667

)

Adjusted for:

Depreciation and amortization

3,424

2,478

9,579

6,255

Provision for income taxes

1,320

2,626

5,773

8,001

Stock-based compensation

7,139

7,267

25,969

27,677

Transaction and transformation-related

costs(1)

1,571

436

2,238

1,519

Geographic reorganization(2)

316

306

1,262

1,528

Restructuring costs(3)

227

103

1,157

1,086

Other (income)/expense, net(4)

(3,466

)

(3,159

)

(8,656

)

(7,849

)

Non-GAAP EBITDA

$

14,813

$

10,733

$

36,839

$

33,550

__________________________

(1)

Transaction and

transformation-related costs include, when applicable, external

deal costs, transaction-related professional fees,

transaction-related retention bonuses, which are allocated

proportionally across cost of revenue, engineering, research and

development, sales and marketing and general and administrative

expenses as well as other transaction-related costs including

integration expenses consisting of outside professional and

consulting services.

(2)

Geographic reorganization

includes expenses connected with military actions of Russia against

Ukraine and the exit plan announced by the Company and includes

travel and relocation-related expenses of employees from the

aforementioned countries, severance payments, allowances as well as

legal and professional fees related to geographic repositioning in

various locations. These expenses are incremental to those expenses

incurred prior to the crisis, clearly separable from normal

operations, and not expected to recur once the crisis has subsided

and operations return to normal.

(3)

We implemented a restructuring

plan during the first quarter of 2023. Our restructuring costs are

comprised of severance charges and respective taxes, and are

included in General and administrative expenses in the Company’s

unaudited condensed consolidated statement of income (loss) and

comprehensive income (loss).

(4)

Other (income)/expense, net

consists primarily of gains and losses on foreign currency

transactions, fair value adjustments, and other miscellaneous

non-operating expenses, potential loss contingencies as well as

other income consisting primarily of interest on cash held at banks

and returns on investments in money-market funds.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income/(loss)

$

4,282

$

676

$

(483

)

$

(4,667

)

Adjusted for:

Stock-based compensation

7,139

7,267

25,969

27,677

Transaction and transformation-related

costs (1)

1,571

436

2,238

1,519

Geographic reorganization (2)

316

306

1,262

1,528

Restructuring costs(3)

227

103

1,157

1,086

Other (income)/expense, net(4)

(3,466

)

(3,159

)

(8,656

)

(7,849

)

Tax impact of non-GAAP adjustments(5)

(1,982

)

232

(2,132

)

86

Non-GAAP net income

$

8,087

$

5,861

$

19,355

$

19,380

Number of shares used in the GAAP diluted

EPS

78,837

77,339

76,485

75,026

GAAP diluted EPS

$

0.05

$

0.01

$

(0.01

)

$

(0.06

)

Number of shares used in the non-GAAP

diluted EPS

78,837

77,339

78,301

77,298

Non-GAAP diluted EPS

$

0.10

$

0.08

$

0.25

$

0.25

__________________________

(1)

Transaction and

transformation-related costs include, when applicable, external

deal costs, transaction-related professional fees,

transaction-related retention bonuses, which are allocated

proportionally across cost of revenue, engineering, research and

development, sales and marketing and general and administrative

expenses as well as other transaction-related costs including

integration expenses consisting of outside professional and

consulting services.

(2)

Geographic reorganization

includes expenses connected with military actions of Russia against

Ukraine and the exit plan announced by the Company and includes

travel and relocation-related expenses of employees from the

aforementioned countries, severance payments, allowances as well as

legal and professional fees related to geographic repositioning in

various locations. These expenses are incremental to those expenses

incurred prior to the crisis, clearly separable from normal

operations, and not expected to recur once the crisis has subsided

and operations return to normal.

(3)

We implemented a restructuring

plan during the first quarter of 2023. Our restructuring costs are

comprised of severance charges and respective taxes, and are

included in General and administrative expenses in the Company’s

unaudited condensed consolidated statement of income (loss) and

comprehensive income (loss).

(4)

Other (income)/expense, net

consists primarily of gains and losses on foreign currency

transactions, fair value adjustments, and other miscellaneous

non-operating expenses, potential loss contingencies as well as

other income consisting primarily of interest on cash held at banks

and returns on investments in money-market funds.

(5)

Reflects the estimated tax impact

of the non-GAAP adjustments presented in the table.

Schedule 5:

GRID DYNAMICS HOLDINGS,

INC.

REVENUE BY VERTICALS

Unaudited

(In thousands, except

percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands, except

percentages of revenues)

Retail

$

29,825

34.1 %

$

26,544

34.3 %

$

81,233

32.5 %

$

77,972

33.2 %

Technology, Media and Telecom

24,188

27.7 %

23,732

30.7 %

71,449

28.5 %

74,639

31.8 %

Finance

14,158

16.2 %

7,299

9.4 %

36,967

14.8 %

20,562

8.8 %

CPG/Manufacturing

9,807

11.2 %

9,668

12.5 %

29,209

11.7 %

33,186

14.1 %

Healthcare and Pharma

2,510

2.9 %

3,434

4.4 %

8,677

3.5 %

10,292

4.4 %

Other

6,947

7.9 %

6,742

8.7 %

22,754

9.0 %

18,190

7.7 %

Total

$

87,435

100.0 %

$

77,419

100.0 %

$

250,289

100.0 %

$

234,841

100.0 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031031735/en/

Grid Dynamics Investor Relations:

investorrelations@griddynamics.com

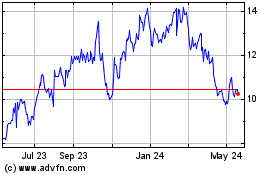

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

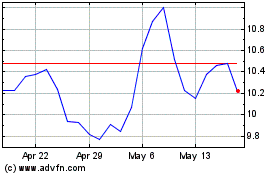

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Nov 2023 to Nov 2024