Great Elm Capital Corp. (“GECC”) Declares $0.05 Per Common Share Special Cash Distribution and Approves First Quarter 2025 Distribution of $0.37 Per Common Share

17 December 2024 - 8:16AM

Great Elm Capital Corp. (the “Company” or “GECC”), (NASDAQ: GECC),

a business development company, today is pleased to declare a

special cash distribution of $0.05 per common share (the “Special

Distribution”). The Special Distribution will be payable on January

15, 2025 to stockholders of record as of December 31, 2024.

In addition, the Company’s Board of Directors

has approved a quarterly cash distribution of $0.37 per share for

the first quarter of 2025 (the “First Quarter 2025 Distribution”),

equating to a 14.5% annualized yield on the Company’s closing

market price on December 16, 2024 of $10.24. The First Quarter 2025

Distribution will be payable on March 31, 2025 to stockholders of

record as of March 17, 2025.

“We are very pleased to announce the 5.7%

increase to our base quarterly distribution to $0.37 per share from

$0.35 per share,” said Matt Kaplan, GECC’s Chief Executive Officer.

“As we look into 2025, we believe our platform is well positioned

to continue generating durable long-term income and we are pleased

the Board has approved this increase to our base distribution. In

addition, we find ourselves in a position to again deliver a

special cash distribution to stockholders, attributable to our

portfolio’s strong income generation throughout the year.”

About Great Elm Capital Corp.

GECC is an externally managed business

development company that seeks to generate current income and

capital appreciation by investing in debt and income generating

equity securities, including investments in specialty finance

businesses and CLOs. For additional information, please visit

http://www.greatelmcc.com.

Cautionary Statement Regarding

Forward-Looking Statements Statements in this

communication that are not historical facts are “forward-looking”

statements within the meaning of the federal securities laws. These

statements are often, but not always, made through the use of words

or phrases such as “expect,” “anticipate,” “should,” “will,”

“estimate,” “designed,” “seek,” “continue,” “upside,” “potential”

and similar expressions. All such forward-looking statements

involve estimates and assumptions that are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from the results expressed in the statements. The

key factors that could cause actual results to differ materially

from those projected in the forward-looking statements include,

without limitation: conditions in the credit markets, our expected

financings and investments, including interest rate volatility,

inflationary pressure, the price of GECC common stock and the

performance of GECC’s portfolio and investment manager. Information

concerning these and other factors can be found in GECC’s Annual

Report on Form 10-K and other reports filed with the Securities and

Exchange Commission. GECC assumes no obligation to, and expressly

disclaims any duty to, update any forward-looking statements

contained in this communication or to conform prior statements to

actual results or revised expectations except as required by law.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

This press release does not constitute an offer

of any securities for sale.

Media & Investor Contact:Investor Relations

investorrelations@greatelmcap.com

Source: Great Elm Capital Corp.

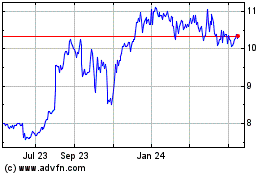

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Feb 2025 to Mar 2025

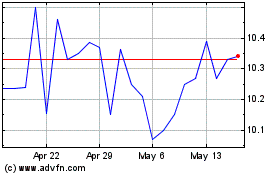

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Mar 2025