0001831096false00018310962024-08-292024-08-290001831096us-gaap:CommonStockMember2024-08-292024-08-290001831096geg:Seven25NotesDue2027Member2024-08-292024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2024

Great Elm Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-39832 |

85-3622015 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

3801 PGA Boulevard, Suite 603 Palm Beach Gardens, FL |

|

33410 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 375-3006

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, par value $0.001 per share |

GEG |

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

7.25% Notes due 2027 |

GEGGL |

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 29, 2024, Great Elm Group, Inc. issued the press release furnished as Exhibit 99.1 to this report.

The foregoing information (including the Exhibit 99.1 hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

GREAT ELM GROUP, INC. |

|

|

|

Date: August 29, 2024 |

|

/s/ Keri A. Davis |

|

|

By: Keri A. Davis |

|

|

Title: Chief Financial Officer |

Exhibit 99.1

Great Elm Group Reports FISCAL 2024 FOURTH QUARTER

AND FULL YEAR financial resulTs

Company to Host Conference Call at 8:30 a.m. ET on August 30, 2024

PALM BEACH GARDENS, Florida, August 29, 2024 – Great Elm Group, Inc. (“we,” “our,” “GEG,” “Great Elm,” or “the Company”), (NASDAQ: GEG), an alternative asset manager, today announced financial results for its fiscal fourth quarter and year ended June 30, 2024.

Fiscal Fourth Quarter 2024 and Recent Highlights

•Great Elm Capital Corp. (“GECC”) raised $34 million of additional debt and equity capital since April 2024.

•Fee-paying assets under management (“FPAUM”) and assets under management (“AUM”) both increased 6% in the quarter.

•Pro forma FPAUM1 and AUM1, inclusive of net proceeds from GECC’s July capital raise, totaled approximately $546 million and $749 million, respectively.

oRepresents pro forma FPAUM1 and AUM1 growth of 11% and 9%, respectively, from March 31, 2024.

•Total revenue for the fourth quarter approximately tripled to $8.9 million, compared to $3.0 million for the prior-year period.

oMonomoy BTS closed the sale of its first build-to-suit property in June, generating over $6 million in revenue and over $1 million in profit.

•Net loss from continuing operations was ($0.6) million for the fourth quarter, compared to ($5.3) million in the prior year period.

oNet loss for the quarter included ($1.1) million in unrealized loss on GEG’s investment in Prosper Peak Holdings, LLC (“PPH”).

•Adjusted EBITDA for the fourth quarter was $1.2 million, compared to $0.4 million in the prior-year period.

•As of June 30, 2024, GEG had approximately $58 million of cash and marketable securities on its balance sheet to support growth initiatives across its alternative asset management platform.

•GEG repurchased 1.2 million shares for $2.1 million during the quarter through its share repurchase program.

•GEG repurchased $4.2 million principal of its 5% convertible notes due 2030 for $2.1 million, or approximately 47% of face value, resulting in a realized gain of $2.3 million.

Full Fiscal Year 2024 Highlights

•GECC raised over $92 million of new capital through July 2024, positioning GEG to further grow management and incentive fee revenue.

oGreat Elm supported GECC’s June and February equity raises of $12 million and $24 million, respectively, by investing a total of $9 million across two separate SPVs that purchased GECC common shares.

•FPAUM and AUM increased 17% and 14%, respectively, from June 30, 2023.

•Pro forma FPAUM1 and AUM1, inclusive of net proceeds from GECC’s July 2024 capital raise, increased 22% and 17%, respectively, from June 30, 2023.

•Great Elm collected incentive fees totaling approximately $2.7 million for the fiscal year ended June 30, 2024.

•Total revenue for the fiscal year more than doubled to $17.8 million, compared to $8.7 million for fiscal 2023, as a result of the significant build-to-suit property sale and growth in management and incentive fee revenue from credit and real estate businesses.

•Net loss for the fiscal year from continuing operations was ($0.9) million, compared to net income from continuing operations of $14.5 million in the prior year.

oFiscal year 2024 net loss included ($3.8) million in unrealized losses on GEG’s investments in Great Elm Strategic Partnership I, LLC (“GESP”) and PPH.

oFiscal year 2023 net income was primarily driven by gain on sale of Forest Investments, Inc.

•Adjusted EBITDA of $4.8 million for the fiscal year ended June 30, 2024, compared to $1.0 million in fiscal 2023.

•Great Elm launched Great Elm Credit Income Fund LLC, a private credit fund, in November 2023.

•Great Elm launched Monomoy BTS Construction Management, LLC, a consulting business providing owner representative services to key clients.

Management Commentary

Jason Reese, Chief Executive Officer of the Company, stated, “We made considerable progress throughout fiscal 2024 in all facets of our business. GECC raised over $90 million of new capital from February to July 2024, due in large part to the innovative joint venture structure we established with experienced, institutional partners. We significantly boosted our fee revenue with growth in incentive fee revenue from GECC as well as increased management fees from our credit and real estate businesses. At Monomoy, our real estate business had outsized performance, driven by the successful sale of our first property and growing pipeline in our Build-to-Suit business. Finally, we launched complementary products and businesses, including a private credit fund and a new construction management consulting business.

Overall, we made great strides during fiscal 2024. Looking ahead to fiscal 2025, we remain focused on further growing our core credit and real estate businesses, sourcing unique investment opportunities, and utilizing our strong balance sheet to expand our platform and create value for our shareholders.”

Capital Raises to Scale Credit Platform

GECC issued $56.5 million of 8.50% notes due 2029 (“GECCI”). In April 2024, GECC completed an underwritten public offering of $34.5 million of GECCI notes. In July 2024, it issued an additional $22 million in a registered direct offering to an institutional investor.

In June 2024, GECC raised $12 million of equity capital at net asset value from PPH, an SPV that purchased GECC common stock at net asset value. This investment was supported by a $3 million investment by GEG into PPH, with other institutional investors contributing $9 million.

In February 2024, GECC raised $24 million of equity capital from GESP that acquired GECC common stock at net asset value. GEG supported the capital raise by making a $6 million investment into the SPV alongside a large institutional investor that invested $18 million.

Discussion of Financial Results for the Fiscal Fourth Quarter Ended June 30, 2024

GEG reported total revenue of $8.9 million, approximately triple that of $3.0 million in the prior-year period. The increase in revenue was primarily driven by Monomoy BTS’s first build-to-suit property sale.

GEG recorded net loss from continuing operations of ($0.6) million, compared to ($5.3) million in the prior-year period. Included in net loss was ($1.1) million unrealized loss on our investment in PPH during the quarter.

GEG recorded Adjusted EBITDA of $1.2 million, compared to $0.4 million in the prior-year period.

Discussion of Financial Results for the Fiscal Year Ended June 30, 2024

Total revenue for the fiscal year ended June 30, 2024 increased 106% to $17.8 million from $8.7 million in the prior fiscal year, primarily driven by the first build-to-suit property sale and increased incentive fees collected from GECC.

For the fiscal year ended June 30, 2024, the Company reported a net loss from continuing operations of ($0.9) million, compared to net income from continuing operations of $14.5 million for fiscal 2023, which was driven by significant gains from the sale of Forest Investments, Inc. Included in net loss for fiscal 2024 was ($3.8) million of unrealized losses on GEG’s investments in GESP and PPH.

Adjusted EBITDA for the fiscal year ended June 30, 2024 was $4.8 million, compared to $1.0 million in the prior fiscal year.

Stock Repurchase Program and Convertible Notes Extinguishment

In the fiscal second quarter, GEG’s Board of Directors approved a stock repurchase program under which GEG is authorized to repurchase up to $10 million in the aggregate of its outstanding common stock in the open market. To date, the Company has repurchased approximately 1.3 million shares for $2.4 million.

In addition, in June 2024, the Company repurchased $4.2 million in principal of 5% convertible notes due February 26, 2030 for $2.1 million, or approximately 47% of face value, resulting in a realized gain of $2.3 million.

Fiscal 2024 Fourth Quarter and Full Year Conference Call & Webcast Information

When: Friday, August 30, 2024, 8:30 a.m. Eastern Time (ET)

Call: All interested parties are invited to participate in the conference call by dialing +1 (877) 407-0752; international callers should dial +1 (201) 389-0912. Participants should enter the Conference ID 13746832 if asked.

Webcast: The conference call will be webcast simultaneously and can be accessed here. A copy of the slide presentation accompanying the conference call, can be found here.

About Great Elm Group, Inc.

Great Elm Group, Inc. (NASDAQ: GEG) is a publicly-traded, alternative asset manager focused on growing a scalable and diversified portfolio of long-duration and permanent capital vehicles across credit, real estate, specialty finance, and other alternative strategies. Great Elm Group, Inc. and its subsidiaries currently manage Great Elm Capital Corp., a publicly-traded business development company, and Monomoy Properties REIT, LLC, an industrial-focused real estate investment trust, in addition to other investments. Great Elm Group, Inc.’s website can be found at www.greatelmgroup.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements in this press release that are “forward-looking” statements, including statements regarding expected growth, profitability, acquisition opportunities and outlook involve risks and uncertainties that may individually or collectively impact the matters described herein. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and represent Great Elm’s assumptions and expectations in light of currently available information. These statements involve risks, variables and uncertainties, and Great Elm’s actual performance results may differ from those projected, and any such differences may be material. For information on certain

factors that could cause actual events or results to differ materially from Great Elm’s expectations, please see Great Elm’s filings with the Securities and Exchange Commission (“SEC”), including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Additional information relating to Great Elm’s financial position and results of operations is also contained in Great Elm’s annual and quarterly reports filed with the SEC and available for download at its website www.greatelmgroup.com or at the SEC website www.sec.gov.

Non-GAAP Financial Measures

The SEC has adopted rules to regulate the use in filings with the SEC, and in public disclosures, of financial measures that are not in accordance with US GAAP, such as adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). Adjusted EBITDA is derived from methodologies other than in accordance with US GAAP. Great Elm believes that Adjusted EBITDA is an important measure for investors to use in evaluating Great Elm’s businesses. In addition, Great Elm’s management reviews Adjusted EBITDA as they evaluate acquisition opportunities.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it either in isolation from, or as a substitute for, analyzing Great Elm’s results as reported under US GAAP. Non-GAAP financial measures reported by Great Elm may not be comparable to similarly titled amounts reported by other companies.

Included in the financial tables below is a reconciliation of Adjusted EBITDA to the most directly comparable US GAAP financial measure, net income from continuing operations.

Endnotes

1 Pro forma FPAUM assumes full investment of incremental capital.

Media & Investor Contact:

Investor Relations

geginvestorrelations@greatelmcap.com

Great Elm Group, Inc.

Condensed Consolidated Balance Sheets

Dollar amounts in thousands (except per share data)

|

|

|

|

|

|

|

|

|

ASSETS |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

48,147 |

|

|

$ |

60,165 |

|

Restricted cash |

|

|

1,571 |

|

|

|

- |

|

Receivables from managed funds |

|

|

2,259 |

|

|

|

3,308 |

|

Investments in marketable securities |

|

|

9,929 |

|

|

|

24,595 |

|

Investments, at fair value (cost $54,261 and $40,387, respectively) |

|

|

44,585 |

|

|

|

32,611 |

|

Prepaid and other current assets |

|

|

1,215 |

|

|

|

717 |

|

Real estate under development |

|

|

5,769 |

|

|

|

1,742 |

|

Assets of Consolidated Funds: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

2,371 |

|

|

|

- |

|

Investments, at fair value (cost $11,338) |

|

|

11,471 |

|

|

|

- |

|

Other assets |

|

|

253 |

|

|

|

- |

|

Total current assets |

|

|

127,570 |

|

|

|

123,138 |

|

Identifiable intangible assets, net |

|

|

11,037 |

|

|

|

12,115 |

|

Right-of-use assets |

|

|

225 |

|

|

|

497 |

|

Other assets |

|

|

1,614 |

|

|

|

143 |

|

Total assets |

|

$ |

140,446 |

|

|

$ |

135,893 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

317 |

|

|

$ |

191 |

|

Accrued expenses and other current liabilities |

|

|

7,009 |

|

|

|

5,418 |

|

Current portion of related party payables |

|

|

634 |

|

|

|

1,409 |

|

Current portion of lease liabilities |

|

|

137 |

|

|

|

359 |

|

Liabilities of Consolidated Funds: |

|

|

|

|

|

|

Payable for securities purchased |

|

|

100 |

|

|

|

- |

|

Accrued expenses and other liabilities |

|

|

162 |

|

|

|

- |

|

Total current liabilities |

|

|

8,359 |

|

|

|

7,377 |

|

Lease liabilities, net of current portion |

|

|

57 |

|

|

|

142 |

|

Long-term debt (face value $26,945) |

|

|

26,090 |

|

|

|

25,808 |

|

Related party payables, net of current portion |

|

|

- |

|

|

|

926 |

|

Convertible notes (face value $35,494 and $37,912, including $16,174 and $15,395 held by related parties, respectively) |

|

|

34,900 |

|

|

|

37,129 |

|

Other liabilities |

|

|

845 |

|

|

|

669 |

|

Total liabilities |

|

|

70,251 |

|

|

|

72,051 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 authorized and zero outstanding |

|

|

- |

|

|

|

- |

|

Common stock, $0.001 par value; 350,000,000 shares authorized and 31,875,285 shares issued and 30,494,448 outstanding at June 30, 2024; and 30,651,047 shares issued and 29,546,655 outstanding at June 30, 2023 |

|

|

30 |

|

|

|

30 |

|

Additional paid-in-capital |

|

|

3,315,638 |

|

|

|

3,315,378 |

|

Accumulated deficit |

|

|

(3,252,954 |

) |

|

|

(3,251,566 |

) |

Total Great Elm Group, Inc. stockholders' equity |

|

|

62,714 |

|

|

|

63,842 |

|

Non-controlling interests |

|

|

7,481 |

|

|

|

- |

|

Total stockholders' equity |

|

|

70,195 |

|

|

|

63,842 |

|

Total liabilities and stockholders' equity |

|

$ |

140,446 |

|

|

$ |

135,893 |

|

Great Elm Group, Inc.

Condensed Consolidated Statements of Operations

Amounts in thousands (except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

For the twelve months ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

$ |

8,918 |

|

|

$ |

3,026 |

|

|

$ |

17,834 |

|

|

$ |

8,663 |

|

Cost of revenues |

|

5,526 |

|

|

- |

|

|

5,526 |

|

|

- |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Investment management expenses |

|

|

2,997 |

|

|

|

3,303 |

|

|

|

11,331 |

|

|

|

10,196 |

|

Depreciation and amortization |

|

|

271 |

|

|

|

282 |

|

|

|

1,108 |

|

|

|

1,152 |

|

Selling, general and administrative |

|

|

1,916 |

|

|

|

3,039 |

|

|

|

7,654 |

|

|

|

8,480 |

|

Expenses of Consolidated Funds |

|

|

31 |

|

|

|

- |

|

|

|

53 |

|

|

|

46 |

|

Total operating costs and expenses |

|

|

5,215 |

|

|

|

6,624 |

|

|

|

20,146 |

|

|

|

19,874 |

|

Operating loss |

|

|

(1,823 |

) |

|

|

(3,598 |

) |

|

|

(7,838 |

) |

|

|

(11,211 |

) |

Dividends and interest income |

|

|

1,640 |

|

|

|

1,777 |

|

|

|

8,057 |

|

|

|

6,209 |

|

Net realized and unrealized gain (loss) on investments |

|

|

477 |

|

|

|

(2,187 |

) |

|

|

2,212 |

|

|

|

15,247 |

|

Net realized and unrealized (loss) gain on investments of Consolidated Funds |

|

|

(12 |

) |

|

|

- |

|

|

|

233 |

|

|

|

(16 |

) |

Interest and other income of Consolidated Funds |

|

|

378 |

|

|

|

- |

|

|

|

829 |

|

|

|

- |

|

Gain on sale of controlling interest in subsidiary |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,524 |

|

Interest expense |

|

|

(1,137 |

) |

|

|

(1,050 |

) |

|

|

(4,334 |

) |

|

|

(6,074 |

) |

(Loss) income before income taxes from continuing operations |

|

|

(477 |

) |

|

|

(5,058 |

) |

|

|

(841 |

) |

|

|

14,679 |

|

Income tax benefit (expense) |

|

|

(101 |

) |

|

|

(198 |

) |

|

|

(101 |

) |

|

|

(200 |

) |

Net (loss) income from continuing operations |

|

|

(578 |

) |

|

|

(5,256 |

) |

|

|

(942 |

) |

|

|

14,479 |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income from discontinued operations |

|

|

- |

|

|

|

(1 |

) |

|

|

16 |

|

|

|

13,201 |

|

Net (loss) income |

|

$ |

(578 |

) |

|

$ |

(5,257 |

) |

|

$ |

(926 |

) |

|

$ |

27,680 |

|

Less: net income (loss) attributable to non-controlling interest, continuing operations |

|

|

- |

|

|

|

- |

|

|

|

462 |

|

|

|

(1,554 |

) |

Less: net income attributable to non-controlling interest, discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,504 |

|

Net (loss) income attributable to Great Elm Group, Inc. |

|

$ |

(578 |

) |

|

$ |

(5,257 |

) |

|

$ |

(1,388 |

) |

|

$ |

27,730 |

|

Basic net (loss) income per share from: |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.02 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.55 |

|

Discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.40 |

|

Basic net (loss) income per share |

|

$ |

(0.02 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.95 |

|

Diluted net (loss) income per share from: |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.02 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.44 |

|

Discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.29 |

|

Diluted net (loss) income per share |

|

$ |

(0.02 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.73 |

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,318 |

|

|

|

29,303 |

|

|

|

29,962 |

|

|

|

28,910 |

|

Diluted |

|

|

30,318 |

|

|

|

29,303 |

|

|

|

29,962 |

|

|

|

40,980 |

|

Great Elm Group, Inc.

Reconciliation from Net Income (Loss) from Continuing Operations to Adjusted EBITDA

Dollar amounts in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

Twelve months ended June 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) from continuing operations - GAAP |

|

$ |

(578 |

) |

|

$ |

(5,256 |

) |

|

$ |

(942) |

|

|

$ |

14,479 |

|

Interest expense |

|

|

1,137 |

|

|

|

1,050 |

|

|

|

4,334 |

|

|

|

6,074 |

|

Income tax expense (benefit) |

|

|

101 |

|

|

|

198 |

|

|

|

101 |

|

|

|

200 |

|

Depreciation and amortization |

|

|

271 |

|

|

|

282 |

|

|

|

1,108 |

|

|

|

1,152 |

|

Non-cash compensation |

|

|

688 |

|

|

|

701 |

|

|

|

3,112 |

|

|

|

2,948 |

|

(Gain) loss on investments |

|

|

(465) |

|

|

|

2,187 |

|

|

|

(2,445 |

) |

|

|

9,167 |

|

Gains related to sale of Forest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(34,922 |

) |

Transaction and integration related costs(1) |

|

|

- |

|

|

|

634 |

|

|

|

- |

|

|

|

1,105 |

|

Change in contingent consideration |

|

|

20 |

|

|

|

603 |

|

|

|

(498 |

) |

|

|

783 |

|

Adjusted EBITDA(2) |

|

$ |

1,174 |

|

|

$ |

399 |

|

|

$ |

4,770 |

|

|

$ |

986 |

|

(1) Transaction and integration-related costs include costs to sell, acquire and integrate acquired businesses.

(2) Adjusted EBITDA for prior periods has been adjusted to include dividend income earned during such periods consistent with the methodology for June 30, 2024.

v3.24.2.u1

Document and Entity Information

|

Aug. 29, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 29, 2024

|

| Entity Registrant Name |

Great Elm Group, Inc.

|

| Entity Central Index Key |

0001831096

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39832

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-3622015

|

| Entity Address, Address Line One |

3801 PGA Boulevard

|

| Entity Address, Address Line Two |

Suite 603

|

| Entity Address, City or Town |

Palm Beach Gardens

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33410

|

| City Area Code |

617

|

| Local Phone Number |

375-3006

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock [Member] |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

GEG

|

| Security Exchange Name |

NASDAQ

|

| 7.25% Notes due 2027 [Member] |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

7.25% Notes due 2027

|

| Trading Symbol |

GEGGL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=geg_Seven25NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

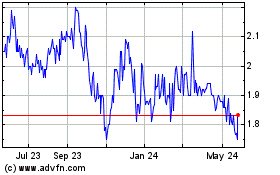

Great Elm (NASDAQ:GEG)

Historical Stock Chart

From Jan 2025 to Feb 2025

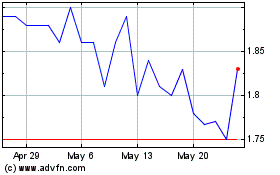

Great Elm (NASDAQ:GEG)

Historical Stock Chart

From Feb 2024 to Feb 2025