Exhibit 99.1

Grupo Financiero Galicia S.A. Announces Results of Rights Offering

BUENOS AIRES, February 7, 2025 — Grupo Financiero Galicia S.A. (Nasdaq: GGAL; Bolsas y Mercados Argentinos S.A./Mercado Abierto Electrónico S.A.: GGAL, the “Company”), one of Argentina’s largest financial services groups, announced the expiration of its subscription rights offering (the “Rights Offering”), which expired at 5:00 p.m., New York City time, on February 6, 2025.

The Rights Offering resulted in subscriptions for 645,721 American Depositary Shares (“ADSs”), representing the Company’s Class B ordinary shares, par value Ps.1.00 per share. The subscribed ADSs represent approximately 36.4% of the ADSs offered at a price of $53.87 per ADS (inclusive of the issuance fee of $0.05 per ADS), generating $34,752,704.22 in gross proceeds for the Company. The ADSs subscribed for in the Rights Offering are expected to be issued to participating ADS holders on or about February 13, 2025.

The Company expects to use the proceeds from the Rights Offering, together with the proceeds from its concurrent rights offering in Argentina, to fund, directly or indirectly, the purchase price adjustment payable in connection with the acquisition of HSBC Latin America B.V.’s banking, asset management, and insurance businesses in Argentina.

The Rights Offering was made pursuant to the Company’s existing effective shelf registration statement on Form F-3 (Reg. No. 333-283462) on file with the Securities and Exchange Commission and is more fully described in the prospectus supplement filed with the SEC on January 22, 2025, as amended.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Such forward-looking statements include, but are not limited to, those regarding the closing of the Rights Offering, the anticipated delivery of ADSs, and the use of proceeds from the Rights Offering. Forward-looking statements generally can be identified by the use of such words as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue” or other similar terminology, although not all forward-looking statements contain these identifying words. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from current expectations and beliefs, including, but not limited to, risks and uncertainties related to: the occurrence of any event, change or other circumstance that could impact the expected timing, completion or other terms of the Rights Offering; the impact of general economic, industry or political conditions in the United States or internationally, as well as the other risk factors set forth under the caption “Item 3.D. Risk Factors” in our most recent annual report on Form 20-F, and from time to time in the Company’s other filings with the SEC. The information contained in this press release is as of the date indicated above. The Company does not undertake any obligation to release publicly any revisions to forward-looking statements to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

Non-Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2025

Commission File Number: 0-30852

GRUPO FINANCIERO GALICIA S.A.

(the “Registrant”)

Galicia Financial Group S.A.

(translation of Registrant’s name into English)

Tte. Gral. Juan D. Perón 430, 25th Floor

(CP1038AAJ) Buenos Aires, Argentina

(address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ____

Indicate by check mark whether by furnishing the information contained in this form, the Registrant is also thereby furnishing the information to the Securities and Exchange Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82- ________

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

| | | | | | | | |

|

| Exhibit | | Description |

| | |

| 99.1 | | Press release – Grupo Financiero Galicia S.A. informs results of Rights Offering |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GRUPO FINANCIERO GALICIA S.A. (Registrant)

Date: February 7, 2025 By: /s/ Fabián E. Kon

Name: Fabián E. Kon

Title: Chief Executive Officer

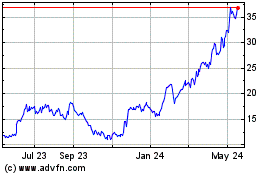

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

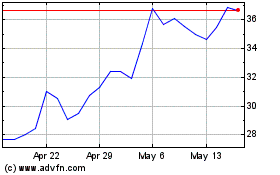

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Feb 2024 to Feb 2025