SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED

IN PROXY STATEMENT

SCHEDULE 14A

INFORMATION

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act

of 1934 (Amendment No. __)

| Filed by the Registrant x |

Filed by a Party other than the Registrant ¨ |

| |

|

|

| Check the appropriate box: |

|

|

| ¨ Preliminary Proxy Statement |

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x Definitive Proxy Statement |

|

|

| ¨ Definitive Additional Materials |

|

|

| ¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule

14a-12 |

Glen

Burnie Bancorp

(Name of Registrant as Specified

in Its Charter)

N/A

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ¨ | Fee

paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a6(i)(1) and 0-11 |

April 4, 2022

Dear Fellow Stockholder:

You are cordially invited

to attend the 2022 Annual Meeting of Stockholders of Glen Burnie Bancorp (the “Company”). We are very pleased that once again

this year’s Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted solely online via live

webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions

prior to and during the meeting by visiting: https://meetnow.global/MH9XQW7. There is no password required to join the meeting. The

meeting will be held from The Bank of Glen Burnie, 101 Crain Highway, SE, Glen Burnie, Maryland, on Thursday, May 12, 2022, at 2:00

p.m., Eastern Time, but there is no physical location for the Annual Meeting.

The accompanying notice and

proxy statement describe the formal business to be transacted at the meeting which includes electing three directors; ratifying the Board

of Directors’ acceptance of the auditors selected by the Audit Committee for the 2022 fiscal year; voting on a non-binding resolution

approving the compensation of executive officers named in the accompanying proxy statement (commonly referred to as “say on pay”);

voting on the desired frequency of stockholder “say on pay” votes; and transacting such other business as may properly come

before the Annual Meeting or any adjournments thereof.

Accompanying this proxy statement

are a proxy card and an Annual Report to Stockholders for the 2021 fiscal year. During the meeting, we will report on the operations

of the Company’s wholly owned subsidiary, The Bank of Glen Burnie. Directors and officers of the Company as well as representatives

of UHY LLP, our independent auditors, will be present to respond to any questions the stockholders may have.

ON

BEHALF OF THE BOARD OF DIRECTORS, WE URGE YOU TO SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD AS SOON AS POSSIBLE EVEN IF YOU CURRENTLY

PLAN TO ATTEND THE ANNUAL MEETING. YOU CAN ALSO VOTE ONLINE AT WWW.INVESTORVOTE.COM/GLBZ.

YOU WILL NEED YOUR CONTROL NUMBER TO VOTE ONLINE (ON PROXY CARD). This will not prevent you from voting in person but will assure that

your vote is counted if you are unable to attend the meeting. Your vote is important, regardless of the number of shares you own. If

you plan to attend the meeting, please check the box on the enclosed form of proxy.

| |

Sincerely, | |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

Chairman | |

President and Chief |

| |

| |

Executive Officer |

GLEN BURNIE BANCORP

101 Crain Highway, S.E.

Glen

Burnie, Maryland 21061

(410) 766-3300

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 12, 2022

NOTICE IS HEREBY GIVEN that

the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Glen Burnie Bancorp (the “Company”) will be

held at The Bank of Glen Burnie, 101 Crain Highway, SE, Glen Burnie, Maryland, and virtually via the Internet at https://meetnow.global/MH9XQW7,

for shareholders, on Thursday, May 12, 2022, at 2:00 p.m., Eastern Time. There is no password required to join the meeting.

A proxy statement and proxy

card for the Annual Meeting accompany this notice.

The Annual Meeting has been

called for the following purposes:

| 1. | To

elect three directors; |

| 2. | To

ratify the acceptance by the Board of Directors of the selection of the Audit Committee of

an outside auditing firm for the 2022 fiscal year; |

| 3. | To

vote on a non-binding resolution approving the compensation of the executive officers named

in the proxy statement; |

| 4. | To

vote on a non-binding advisory vote on the frequency of stockholder votes on executive compensation;

and |

| 5. | To

transact such other business as may properly come before the Annual Meeting or any adjournments

thereof. |

Any action may be taken on

any one of the foregoing proposals at the Annual Meeting on the date specified above or on any date or dates to which, by original or

later adjournment, the Annual Meeting may be adjourned. Stockholders of record at the close of business on March 24, 2022, are the only

stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

You are requested to complete

and sign the accompanying proxy card, which is solicited by the Board of Directors and to mail it promptly in the accompanying envelope.

The proxy card will not be used if you attend and vote at the Annual Meeting in person.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

| |

SECRETARY |

Glen

Burnie, Maryland

April 4, 2022

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL

SAVE YOUR COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO ENSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR

YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. YOU CAN ALSO VOTE ONLINE AT WWW.INVESTORVOTE.COM/GLBZ. YOU

WILL NEED YOUR CONTROL NUMBER TO VOTE ONLINE (ON PROXY CARD). EVEN IF YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE,

SIGN, DATE AND RETURN TO US A PROXY CARD. IF YOU ATTEND THE MEETING IN PERSON, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON AT THE MEETING.

Important

Notice Regarding the Availability of Proxy Materials

for

the Shareholder Meeting to Be Held on May 12, 2022

The

Notice of Annual Meeting of Stockholders, Proxy Statement, Form of Proxy, and 2021 Annual Report are available at www.edocumentview.com/GLBZ

PROXY STATEMENT

OF

GLEN BURNIE BANCORP

101 Crain Highway, S.E.

Glen

Burnie, Maryland 21061

ANNUAL MEETING OF STOCKHOLDERS

May 12, 2022

GENERAL

This

proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”

or “Board”) of Glen Burnie Bancorp (the “Company”) to be used at the 2022 Annual Meeting of Stockholders of the

Company and any adjournments or postponements thereof (hereinafter called the “Annual Meeting”) which will be held at The

Bank of Glen Burnie, 101 Crain Highway, SE, Glen Burnie, Maryland, and virtually via the Internet at https://meetnow.global/MH9XQW7,

for shareholders, on Thursday, May 12, 2022 at 2:00 p.m., Eastern Time. There is no password required to join the meeting.

The accompanying Notice of

Annual Meeting and form of proxy and this Proxy Statement are being first mailed to stockholders on or about April 4, 2022.

VOTING

AND REVOCABILITY OF PROXIES

Proxies

solicited by the Board of Directors of the Company will be voted in accordance with the directions given therein. Where no

instructions are given, signed proxies will be voted for the nominees named below, for the proposal to authorize the Board

of Directors to accept the selection of the Audit Committee of an outside auditing firm for the 2022 fiscal year, for the approval

of the compensation of the named executive officers, and for a submission of approval of executive compensation to stockholders

every three years. The proxy confers discretionary authority on the persons named therein to vote with respect to the election of

any person as a director where the nominee is unable to serve or for good cause will not serve, and with respect to matters incident

to the conduct of the Annual Meeting. If any other business is presented at the Annual Meeting, proxies will be voted by those named

therein in accordance with the determination of a majority of the Board of Directors. Proxies marked as abstentions will not be counted

as votes cast. In addition, shares held in street name which have been designated by brokers on proxy cards as not voted will not be

counted as votes cast. Proxies marked as abstentions or as broker no votes, however, will be treated as shares present for purposes of

determining whether a quorum is present.

Stockholders who execute

proxies retain the right to revoke them at any time prior to being voted. Unless so revoked, the shares represented by properly executed

proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies may be revoked by written notice to Michelle Stambaugh,

the Secretary of the Company, at the address above or by the filing of a later dated proxy prior to a vote being taken on a particular

proposal at the Annual Meeting. A proxy will not be voted if a stockholder attends the Annual Meeting and votes in person. The presence

of a stockholder at the Annual Meeting will not revoke such stockholder’s proxy.

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

The

securities entitled to vote at the Annual Meeting consist of the Company’s common stock, par value $1.00 per share (the “Common

Stock”). Stockholders of record as of the close of business on March 24, 2022 (the “Record Date”) are entitled to one

vote for each share then held. At the Record Date, the Company had 2,856,257 shares of Common Stock issued and outstanding. The presence,

in person or by proxy, of at least a majority of the total number of shares of Common Stock outstanding and entitled to vote will be

necessary to constitute a quorum at the Annual Meeting. Persons and groups beneficially owning in excess of 5% of the Common Stock are

required to file certain reports with respect to such ownership pursuant to the Securities Exchange Act of 1934 (the “Exchange

Act”). The following table sets forth, as of the Record Date, certain information as to the Common Stock beneficially owned

by all persons who were known to the Company to beneficially own more than 5% of the Common Stock outstanding at the Record Date.

Name

and Address of

Beneficial Owner | |

Amount

and Nature of

Beneficial Ownership1 | | |

Percent

of Shares of

Common Stock Outstanding | |

John E. Demyan

101 Crain Highway, S.E.

Glen Burnie, Maryland 21061 | |

| 285,216 | 2 | |

| 9.99 | % |

| | |

| | | |

| | |

The Edward E. Haddock, Jr Family Trust 3300

University Boulevard, Suite 218 Winter

Park, Florida 32792 | |

| 232,984 | | |

| 8.16 | % |

| 1 | Rounded to nearest whole share. For purposes of this table,

a person is deemed to be the beneficial owner of any shares of Common Stock if he or she has or shares voting or investment power with

respect to such Common Stock or has a right to acquire beneficial ownership at any time within 60 days from the Record Date. As used

herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power

to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct, and the named individuals or group exercise

sole voting and investment power over the shares of the Common Stock. |

| 2 | Includes 284,216 shares held by Mr. Demyan individually and

1,000 shares held by Mrs. Demyan. |

PROPOSAL

I -- ELECTION OF DIRECTORS

The Board of Directors currently

consists of 10 directors. Under the Company’s Articles of Incorporation, directors are divided into three classes and elected for

terms of three years each and until their successors are elected and qualified. The Board has nominated Thomas Clocker, Joan M. Rumenap

and Julie Mussog for election as directors to serve for terms of three years each and until their successors are elected and qualified.

Under Maryland law, directors are elected by a plurality of all votes cast at a meeting at which a quorum is present.

Unless contrary instruction

is given, the persons named in the proxies solicited by the Board of Directors will vote each such proxy for the election of the named

nominees. If any of the nominees is unable to serve, the shares represented by all properly executed proxies which have not been revoked

will be voted for the election of such substitute as the Board may recommend or the Board may reduce the size of the Board to eliminate

the vacancy. At this time, the Board does not anticipate that any nominee will be unable to serve.

The following table sets

forth, for each nominee and each continuing director, his or her name, age as of the Record Date, the year he or she first became a director

of the Company, the expiration of his or her current term, and whether such individual has been determined by the Board to be “independent”

as defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules. Each nominee and continuing director are also a member of the Board of

Directors of The Bank of Glen Burnie (the “Bank”) and GBB Properties Property Holdings, LLC, and GBB Properties, Inc. (“GBB

Properties”). There are no known arrangements or understandings between any director or nominee for director of the Company and

any other person pursuant to which such director or nominee has been selected as a director or nominee.

| | |

| | |

Director | | |

Current Term | | |

| |

| Name | |

Age | | |

Since | | |

to Expire | | |

Independent | |

| Board Nominees for Term to Expire in 2025 | |

| | | |

| | | |

| | | |

| | |

| Thomas Clocker | |

| 87 | | |

| 1995 | | |

| 2022 | | |

| Yes | |

| Joan M. Rumenap | |

| 63 | | |

| 2018 | | |

| 2022 | | |

| Yes | |

| Julie Mussog | |

| 47 | | |

| 2019 | | |

| 2022 | | |

| Yes | |

| | |

| | | |

| | | |

| | | |

| | |

| Directors Continuing in Office | |

| | | |

| | | |

| | | |

| | |

| John E. Demyan | |

| 74 | | |

| 1995 | | |

| 2023 | | |

| No | |

| Charles Lynch, Jr. | |

| 68 | | |

| 2003 | | |

| 2023 | | |

| Yes | |

| Frederick W. Kuethe, III | |

| 62 | | |

| 1992 | | |

| 2023 | | |

| Yes | |

| Mary Louise Wilcox | |

| 74 | | |

| 1997 | | |

| 2023 | | |

| Yes | |

| Andrew Cooch | |

| 66 | | |

| 2014 | | |

| 2024 | | |

| Yes | |

| Stanford D. Hess | |

| 79 | | |

| 2018 | | |

| 2024 | | |

| Yes | |

| John D. Long | |

| 66 | | |

| 2016 | | |

| 2024 | | |

| No | |

Presented below is certain

information concerning the nominees and directors continuing in office. Unless otherwise stated, all directors and nominees have held

the positions indicated for at least the past five years.

John

E. Demyan has been Chair of the Board of the Company, the Bank, GBB Properties and GBB Property Holdings, LLC since 1995.

He previously served as a director of the Company and the Bank from 1990 through 1994. He completed the Maryland Banking School in 1994.

Mr. Demyan is the owner and manager of commercial and residential properties in northern Anne Arundel County, Maryland. He is a lifetime

member of the 100 Club. Mr. Demyan is well qualified to serve as a member of the Company’s Board due to his familiarity with the

Bank’s business and industry, knowledge of the Bank’s market and involvement in the communities served by the Bank.

Charles

Lynch, Jr. is the retired President of The General Ship Repair Corporation in Baltimore, Maryland and has over 40 years of

experience in marine engineering and ship repair. He holds a Bachelor of Science degree in Industrial Engineering, with a minor in Ocean

Engineering, from the University of Miami and serves on the Baltimore Maritime Museum’s Board of Directors. Mr. Lynch is well qualified

to serve as a member of the Company’s Board due to his extensive business experience and knowledge of the Company’s market

and involvement in the communities served by the Bank.

Frederick

W. Kuethe, III has been a Vice President of the Company since 1995 and a director of the Bank since 1988. Mr. Kuethe has worked

in software design and systems integration at Northrop Grumman Corp. since 1981. He is a graduate of the Maryland Banking School. Mr.

Kuethe is well qualified to serve as a member of the Company’s Board due to his familiarity with the Bank’s business and

industry and knowledge of the Bank’s market.

Mary

Louise Wilcox is a retired teacher from the Anne Arundel County Public School system where she had last been teaching at Belle

Grove Elementary School in Brooklyn Park, Maryland. Currently, Mrs. Wilcox is a member of a family-owned LLC which manages commercial

property in northern Anne Arundel County. She is actively involved in her church where she has served on multiple committees, including

the Vestry, the Finance, and the Endowment committees. Also active in her community, Mrs. Wilcox served on the Glen Burnie Improvement

Association’s Carnival Banking Committee for over 50 years, as well as participating in other Carnival committees in the past.

Ms. Wilcox is well qualified to serve as a member of the Company’s Board due to her knowledge of the Company’s market and

involvement in the communities served by the Bank.

Andrew

Cooch is a partner in the Law Office of Cooch & Bowers, P.A. and Owner/Director of Progressive Title Corporation.

He also serves on the Board of Directors for Richcroft, Inc. and Bello Machre, Inc., both of which are Maryland based non-profits serving

the developmentally disabled. Mr. Cooch was previously Vice President of Maryland Land Title Association and was previously on

the Board of Maryland Affordable Housing Trust. Mr. Cooch received a Juris Doctorate in 1981 from the University of Baltimore,

School of Law. Mr. Cooch is well qualified to serve as a member of the Company’s Board due to his business experience, knowledge

of the Bank’s market and involvement in the communities served by the Bank.

John

D. Long became President and Chief Executive Officer (the “CEO”) of the Company and the Bank on April 1, 2016,

when he also became a director. Prior to that date, he was Executive Vice President of the Company and the Bank since February 8, 2016.

From October 2014 until February 2016, Mr. Long was an independent consultant advising commercial banks. Mr. Long served as Senior Group

Manager at PNC Bank, N.A. from 2009 through 2014 and from 2000 until 2009 he served as Senior Vice President at Mercantile Mortgage Corporation.

Mr. Long received a Bachelor of Science degree in Accounting and Business Administration from Washington and Lee University in 1978 and

became a Maryland Certified Public Accountant in 1983. Mr. Long is well qualified to serve as a member of the Company’s Board due

to his more than 40 years of experience in the banking industry.

Stanford

D. Hess has been a member of the Baltimore law firm, Neuberger, Quinn, Gielen, Rubin & Gibber, P.A., since 1995, focusing

on business planning and transactions as well as commercial real estate. Mr. Hess has also served as Executive Vice President and

legal counsel for Antwerpen Automotive Group since 2000. Throughout his career, Mr. Hess has served a variety of clients including

business and real estate transactions, automotive dealers, general contractors, and banking institutions throughout the Baltimore and

Mid-Atlantic region. His banking experience includes serving as chairperson of the State Commission to Study the Regulatory Structure

of Banking, Savings and Loan and Small Loan Industries. He also served as a member of the Governor’s Advisory Panel to Study

the Movement Towards Electronic Funds Transfer. While serving as an Assistant Attorney General, Mr. Hess represented, among other

agencies, the State Bank Commissioner, Administrator of Loan Laws, the Division of Savings and Loan Administration, and the Bank Board.

Mr. Hess is well qualified to serve as a member of the Company’s Board due to his extensive and relevant business experience.

Thomas

Clocker is a retired businessman and the former owner/operator of Angel’s Food Market in Pasadena, Maryland. He served

on the Mid-Atlantic Food Association’s board of directors for nine years and is a founding member of the Pasadena Business Association.

Mr. Clocker is actively involved in the community as a supporter of local schools, athletic associations and scouting groups. Mr. Clocker

is well qualified to serve as a member of the Company’s Board due to his business experience, knowledge of the Bank’s market

and involvement in the communities served by the Bank.

Joan

M. Rumenap holds a Master of Business Administration degree from the University of Baltimore. Since September 2016, Ms. Rumenap

has been a Special Projects Manager with Accessible Resources for Independence, which provides support and services to people with disabilities

in Anne Arundel and Howard counties, and since July 2014 she has also served part-time as a personal advocate with By Their Side, an

organization which works with Marylanders with intellectual/developmental disabilities and their families to assure that their needs

are addressed. From August 2014 until September 2016, Ms. Rumenap served as grants officer for Ancient and Accepted Scottish Rite in

Baltimore City. From September 2002 through March 2014, she was Director of Special Projects for Abilities Network, which assists individuals

with disabilities in Maryland to achieve their personal goals and reach their maximum potential. Ms. Rumenap also serves on various committees

and community organizations and was recognized by The Glen Burnie Rotary Club in 2017 as a Service Above Self Community Service Award

recipient. Ms. Rumenap is well qualified to serve as a member of the Company’s Board due to her extensive knowledge of the Bank’s

market and involvement in the communities served by the Bank.

Julie

Mussog is a Certified Public Accountant and since October 2019 has served as Chief Financial Officer of Metropolitan Washington

Council of Governments. Founded in 1957, COG is an independent, nonprofit association, with a membership of 300 elected officials from

24 local governments, the Maryland and Virginia state legislatures, and U.S. Congress. From February 2019 until October 2019, Ms. Mussog

served as Senior Vice President of MuniCap, Inc., a public finance consulting firm based in Columbia, Maryland. From November 2016 until

February 2019, Ms. Mussog served as President and Chief Executive Office of the Anne Arundel Economic Development Corporation, and from

2013 until November 2016, she was Controller for Anne Arundel County. Ms. Mussog holds a Bachelor of Business Administration and a Master

of Business of Administration from the University of Michigan’s Ross School of Business. She is active in numerous civic and community

organizations, including Junior League of Annapolis, the Anne Arundel Community College Foundation, and the Baltimore Washington Medical

Center. Ms. Mussog is well qualified to serve as a member of the Company’s Board due to her extensive financial management experience

and familiarity with the communities served by the Bank.

CORPORATE

GOVERNANCE

The Board of Directors periodically

reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports

results with accuracy and transparency, and maintains full compliance with the laws, rules and regulations which govern the Company’s

operations.

Meetings and Committees of the Board of Directors

Board

of Directors. The Board of Directors holds regular monthly meetings and special meetings as needed. During the year ended

December 31, 2021, the Board met 12 times. No incumbent director attended fewer than 75% of the total number of meetings of the Board

of Directors held during 2021 and the total number of meetings held by all committees on which the director served during such year.

Board members are expected to attend the Annual Meeting of Stockholders, and all incumbent directors serving at that time attended the

2021 Annual Meeting of Stockholders.

The Board has numerous committees,

each of which meets at scheduled times, including the following committees:

Audit

Committee. The Bank’s Audit Committee acts as the audit committee for the Company and for 2021 through the date of the Annual

Meeting consists of Directors Julie Mussog, Thomas Clocker, Frederick W. Kuethe III and Andrew Cooch. During the year ended December

31, 2021, the Audit Committee met 15 times.

The

Audit Committee monitors internal accounting controls, meets with the Bank’s Internal Auditor to review internal audit findings,

recommends independent auditors for appointment by the Board, and meets with the Company’s independent auditors regarding these

internal controls to assure full disclosure of the Company’s financial condition. Each member of the Audit Committee is independent,

as defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules and under the criteria for independence set forth in Rule 10A-3(b)(1)

promulgated by the Securities and Exchange Commission (SEC) under the Exchange Act, and otherwise meets the criteria for Audit Committee

membership set forth in applicable NASDAQ rules. In addition, each member of the Audit Committee can read and understand fundamental

financial statements, including a company’s balance sheet, income statement, and cash flow statement. The Board of Directors has

examined the SEC’s definition of “audit committee financial expert” and determined that Julie Mussog satisfies this

definition. Accordingly, Mrs. Mussog has been designated by the Board of Directors as the Company’s audit committee financial expert.

The

Board of Directors of the Company has adopted a written charter for the Audit Committee and is available on the Bank’s website,

www.thebankofglenburnie.com.

Employee

Compensation and Benefits Committee. The Bank’s Employee Compensation and Benefits Committee (the “Compensation Committee”)

acts as the compensation committee for the Company, and for 2021 through the date of the Annual Meeting is composed of Directors Thomas

Clocker, Julie Mussog, Fredrick W. Kuethe, III., Mary Louise Wilcox, Charles F. Lynch, Jr., Andrew Cooch, Joan Rumenap and Stanford Hess.

This Committee met 1 time during 2021. The purpose of the Compensation Committee is to evaluate and ascertain the appropriateness of

compensation levels pertaining to the officers of the Bank other than the CEO and the other executive officers of the Bank. The compensation

levels of all executive officers, other than the CEO, are recommended by the CEO for deliberation and approval of the Committee prior

to submission to the full Board. The compensation levels of the CEO and the other executive officers of the Bank are reviewed by the

full Board of Directors and must be approved by a majority of the independent directors. No executive officer is present during deliberations

or voting on his/her compensation. The Board has adopted a written charter for the Compensation Committee, which is available on the

Bank’s website, www.thebankofglenburnie.com.

During

2021, the Compensation Committee engaged the services of ChaseCompGroup as its independent advisor on matters of executive and board

compensation, reporting directly to the Compensation Committee. ChaseCompGroup provides no other remunerated services to the Company

or any of its affiliates.

Nominations.

The independent members of the Company’s Board of Directors acts as a nominating committee for the annual selection

of its nominees for election as directors, and the Board held no meetings during 2021. The Board has not adopted a charter with respect

to the nominating committee function. The Board of Directors believes that the interests of the Company’s shareholders are served

by delegating the nominations process to the board members who are independent from management. While the Board of Directors will consider

nominees recommended by stockholders, it has not actively solicited recommendations from the Company’s stockholders for nominees,

nor established any procedures for this purpose. In considering prospective nominees, the Board of Directors will consider the prospect’s

relevant financial and business experience, familiarity with and participation in the Bank’s market area, the integrity and dedication

of the prospect, prospective nominee’s independence and other factors the Board deems relevant. The Board of Directors will apply

the same criteria to nominees recommended by stockholders as those recommended by the nominating committee. Nominations by stockholders

must comply with certain informational requirements set forth in Article III, Section 1 of the Company’s Bylaws. See “Stockholder

Proposals” elsewhere in this Proxy Statement.

Director Compensation

Director’s

Fees. Currently, directors are paid a fee of $1,250 for each combined regular or special meeting of the Company and the Bank

attended, with fees paid for one excused absence. Mr. Demyan was compensated at the rate of $80,702 per annum for the additional responsibilities

of serving as the Chair of the Board of Directors. Directors (other than Mr. Demyan and Mr. Long who receive no fees for board or committee

meetings) are paid an additional $300 chair fee, an additional $350 for the Audit Committee chair and $250 for audit committee members,

or $200 member fee, as applicable, for each committee meeting.

The following table summarizes

the compensation paid to directors other than those included in the Summary Compensation Table below, for the fiscal year ended December

31, 2021:

| Name | |

Fees

Earned or Paid in Cash(1) | | |

All Other

Compensation | | |

Total | |

| (a) | |

| (b) | | |

| (g) | | |

| (h) | |

| | |

| | | |

| | | |

| | |

| Thomas Clocker | |

$ | 21,150 | | |

| -- | | |

$ | 21,150 | |

| Andrew Cooch | |

$ | 21,050 | | |

| -- | | |

$ | 21,050 | |

| Julie Mussog | |

$ | 22,750 | | |

| -- | | |

$ | 22,750 | |

| John

E. Demyan1 | |

$ | 61,027 | | |

$ | 19,675 | 1 | |

$ | 80,702 | |

| Joan M. Rumenap | |

$ | 18,600 | | |

| -- | | |

$ | 18,600 | |

| Charles Lynch, Jr. | |

$ | 18,200 | | |

| -- | | |

$ | 18,200 | |

| F. W. Kuethe, III | |

$ | 28,550 | | |

| -- | | |

$ | 28,550 | |

| Mary Louise Wilcox | |

$ | 18,400 | | |

| -- | | |

$ | 18,400 | |

| Stanford D. Hess | |

$ | 17,800 | | |

| -- | | |

$ | 17,800 | |

1Mr.

Demyan’s fees earned or paid in cash include a bonus of $11,666, and his other compensation consists of: (a) $1,987 as a 3% employer

contribution and $2,512 as an employer matching contribution to The Bank of Glen Burnie 401(K) Profit Sharing Plan; (b) $2,858 employer

match for the 401(K) contribution by the employee; (c) $39 representing the dollar value to Mr. Demyan of premiums on a term life insurance

policy for his benefit, and (d) $613 for disability insurance benefits.

Transactions with Management

Certain directors, executive

officers and significant stockholders of the Company, and members of their immediate families, were depositors, borrowers or customers

of the Bank in the ordinary course of business during 2021. Similar transactions are expected to occur in the future. All such transactions

were made in the ordinary course of business of the Bank and on substantially the same terms, including interest rates and collateral,

as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collection

or present other unfavorable terms.

The Bank’s Internal

Audit Department reviews all loan transactions with directors, officers and employees of the Bank and members of their immediate families

to verify that they are fair and reasonable, on market terms, on an arms-length basis and comply with all applicable regulations including

Federal Reserve Board Regulation O which governs such loans. The Internal Audit Department also provides the Board of Directors with

semi-annual reports of all loans outstanding to employees, officers, and directors which reports are reviewed by the entire Board at

a regularly scheduled meeting.

Code of Ethics

The Company has adopted a

Code of Business Conduct and Ethics that is designed to promote the highest standards of ethical conduct by the Company’s and the

Bank’s directors, executive officers and employees. The Code of Business Conduct and Ethics has been posted on the Bank’s

website, www.thebankofglenburnie.com.

Communications with the Board

The Board of Directors has

not established a formal process for stockholders to send communications to the Board. Due to the infrequency of stockholder communications

to the Board, the Board does not believe that a formal process is necessary. Furthermore, almost all the Company’s Board members

are residents of or work in the communities served by the Bank and where most of the Company’s stockholders reside, and therefore

are accessible to the great majority of the Company’s stockholders.

Leadership Structure and Risk Oversight

While the Board believes

that there are various structures which can provide successful leadership to the Company, we currently have separate individuals serving

in the roles of Chair of the Board and CEO in recognition of the differences between the two roles.

The CEO is responsible for

setting the strategic direction for the Company and the day-to-day leadership of the Company, while the Chair of the Board provides guidance

to the CEO and presides over meetings of the full Board. This structure is appropriate at this time to the Company’s business because

it reflects the Company and industry experience and vision brought to the Board of Directors by the Chair, and the day-to-day management

direction of the Company under the CEO.

Management is responsible

for the day-to-day management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility

for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that

the risk management processes designed and implemented by management are adequate and functioning as designed. To do this, the Chair

of the Board meets regularly with management to discuss strategy and the risks facing the Company. Senior management attends the Board

meetings and is available to address any questions or concerns raised by the Board on risk management and any other matters. The Chair

of the Board and independent members of the Board work together to provide strong, independent oversight of the Company's management

and affairs through its standing committees and, when necessary, special meetings of independent directors.

Board Diversity

Although the Company does

not have a formal policy with respect to diversity, the Board and the Governance Committee believe it is essential that the Board members

represent diverse view points and skill sets (such as gender, race, religion, sexual orientation, national origin and education as well

as professional experience). Each nominee’s/Director’s diverse knowledge of risk management and internal controls, credentials,

competencies and skills as well as the candidate’s area(s) of qualifications and expertise that would enhance the Board’s

composition and effectiveness are considered. As a bank holding company, it is important that the Directors have specific knowledge of

the communities that the Bank serves as a community bank. The Company qualifies as a Smaller Reporting Company (“SRC”) under

the guidelines of the Securities and Exchange Commission. The Company’s shares trade on the NASDAQ Global Select Market (“NASDAQ”).

As an SRC, the Company meets the requirements of NASDAQ’s Board Diversity Rule, Listing Rule 5606, which takes effect in 2022.

SECURITIES

OWNERSHIP OF MANAGEMENT

The following table sets

forth information with respect to the beneficial ownership of the shares of Common Stock as of the Record Date by (i) each executive

officer of the Company named in the Summary Compensation Table included elsewhere in this Proxy Statement, (ii) each current director

and each nominee for election as a director and (iii) all directors and executive officers of the Company as a group.

Name | |

Amount

And Nature of Beneficial Ownership1 | | |

Percent

of Class | |

| | |

| | |

| |

| Thomas Clocker | |

| 2,680 | | |

| 0.09 | % |

| Andrew Cooch | |

| 1,150 | | |

| 0.04 | % |

| John E. Demyan | |

| 285,216 | 2 | |

| 9.99 | % |

| Jeffrey D. Harris | |

| - | | |

| - | |

| Stanford Hess | |

| 100 | | |

| 0.00 | % |

| Andrew Hines | |

| - | | |

| - | |

| Frederick W. Kuethe III | |

| 23,403 | 3 | |

| 0.82 | % |

| John D. Long | |

| 7,839 | | |

| 0.27 | % |

| Charles F. Lynch | |

| 39,661 | 4 | |

| 1.39 | % |

| Julie Mussog | |

| 100 | | |

| 0.00 | % |

| Joan Rumenap | |

| 51,628 | | |

| 1.81 | % |

| Donna Smith | |

| - | | |

| - | |

| Michelle Stambaugh | |

| 2,358 | 5 | |

| 0.08 | % |

| Mary Louise Wilcox | |

| 21,446 | | |

| 0.75 | % |

1

Rounded to nearest whole share. For the definition of “beneficial ownership,” see footnote (1) to the table in the

section entitled “Voting Securities and Principal Holders Thereof.” Unless otherwise noted, ownership is direct and the

named individual has sole voting and investment power.

2

See footnote (2) to the table in the section entitled “Voting Securities and Principal Holders Thereof”.

3

Includes 21,004 shares as to which Mr. Kuethe shares voting and investment power and 749 shares held by Mrs. Kuethe.

4

Includes 14,787 shares held for the benefit of two minor children and 2,236 shares held by Mrs. Lynch. Each disclaims beneficial

ownership to the shares owned individually by the other.

5

Includes 2,358 shares as to which Mrs. Stambaugh shares voting and investment power held with Mr. Stambaugh.

Section 16(a) Beneficial Ownership Reporting

Compliance

Pursuant to regulations promulgated

under the Exchange Act, the Company’s officers, directors and persons who own more than ten percent of the outstanding Common Stock

(“Reporting Person”) are required to file reports detailing their ownership and changes of ownership in such Common Stock,

and to furnish the Company with copies of all such reports. Based on the Company’s review of such reports which the Company received

during the last fiscal year, or written representations from Reporting Persons that no annual report of change in beneficial ownership

was required, the Company believes that during the last fiscal year, all persons subject to such reporting requirements have complied

with the reporting requirements.

EXECUTIVE

COMPENSATION

Summary Compensation Table

In this Proxy Statement,

the “named executive officers” means the following individuals: (i) each individual who served as the Company’s CEO

during 2021; (ii) the Company’s two most highly compensated executive officers in 2021, other than the CEO, who were serving as

executive officers as of December 31, 2021 whose total compensation during 2021 exceeded $100,000; and (iii) up to two additional individuals

whose total compensation during 2021 exceeded $100,000, who would have been included in the table as the highest compensated executive

officers but were not serving as executive officers as of December 31, 2021. The following table sets forth information regarding the

total compensation paid or earned by the named executive officers for the fiscal years ended December 31, 2021 and 2020:

| Name and Principal

Position | |

Year | | |

Salary | | |

Bonus | | |

All Other

Compensation | | |

Total | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(i) | | |

(j) | |

| | |

| | |

| | |

| | |

| | |

| |

| John D. Long | |

| 2021 | | |

$ | 318,240 | | |

$ | 41,826 | | |

$ | 41,748 | 1 | |

$ | 401,814 | |

| President and Chief Executive | |

| 2020 | | |

$ | 318,711 | | |

$ | 30,313 | | |

$ | 37,416 | 1 | |

$ | 386,440 | |

| Officer | |

| | | |

| | | |

| | | |

| | | |

| | |

| Andrew Hines | |

| 2021 | | |

$ | 200,719 | | |

$ | 20,000 | | |

$ | 33,335 | 2 | |

$ | 254,054 | |

| Executive Vice President and | |

| 2020 | | |

$ | 203,732 | | |

$ | 17,881 | | |

$ | 32,715 | 2 | |

$ | 254,328 | |

| Chief Lending Officer | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeffrey D. Harris | |

| 2021 | | |

$ | 189,879 | | |

$ | 14,000 | | |

$ | 20,291 | 3 | |

$ | 224,170 | |

| Senior Vice President and | |

| 2020 | | |

$ | 192,729 | | |

$ | 19,215 | | |

$ | 16,721 | 3 | |

$ | 228,665 | |

| Chief Financial Officer | |

| | | |

| | | |

| | | |

| | | |

| | |

| Donna Smith | |

| 2021 | | |

$ | 146,034 | | |

$ | 25,000 | | |

$ | 16,067 | 4 | |

$ | 187,101 | |

| Senior Vice President and | |

| 2020 | | |

$ | 148,226 | | |

$ | 15,205 | | |

$ | 13,195 | 4 | |

$ | 176,626 | |

| Director of Branch & Deposit | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operations | |

| | | |

| | | |

| | | |

| | | |

| | |

| Michelle Stambaugh | |

| 2021 | | |

$ | 139,660 | | |

$ | 25,000 | | |

$ | 15,387 | 5 | |

$ | 180,047 | |

| Senior Vice President and | |

| 2020 | | |

$ | 141,756 | | |

$ | 15,075 | | |

$ | 12,803 | 5 | |

$ | 169,634 | |

| Director of Human Resources | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) | Mr.

Long’s “All Other Compensation” for 2021 consisted of: $8,700 as a 3% employer

contribution and $9,942 as an employer matching contribution to The Bank of Glen Burnie 401(K)

Profit Sharing Plan; an employer match for the employee 401(K) contribution of $8,820; and

$13,052 health plan benefits (including health and dental), $51 term life insurance benefits,

and $1,182 disability insurance benefits. Mr. Long’s “All Other Compensation”

for 2020 consisted of: $8,550 as a 3% employer contribution and $4,102 as an employer matching

contribution to The Bank of Glen Burnie 401(K) Profit Sharing Plan; an employer match for

the employee 401(K) contribution of $9,194; and $14,294 health plan benefits (including health

and dental), $89 term life insurance benefits, and $1,186 disability insurance benefits. |

| (2) | Mr.

Hines’ “All Other Compensation” for 2021 consisted of: $6,558 as a 3% employer

contribution and $7,494 as an employer matching contribution to The Bank of Glen Burnie 401(K)

Profit Sharing Plan; an employer match for the employee 401(K) contribution of 5,327; $12,692

for health plan benefits; $78 term life insurance benefits; and $1,186 disability insurance

benefits. Mr. Hines was appointed Executive Vice President on January 12, 2017. Mr. Hines’

“All Other Compensation” for 2020 consisted of: $6,502 as a 3% employer contribution

and $3,119 as an employer matching contribution to The Bank of Glen Burnie 401(K) Profit

Sharing Plan; an employer match for the employee 401(K) contribution of $6,112; $15,707 for

health plan benefits (including health and dental); $89 term life insurance benefits; and

$1,186 disability insurance benefits. |

| (3) | Mr.

Harris’ “All Other Compensation” for 2021 consisted of: $6,273 as a 3%

employer contribution and $7,169 as an employer matching contribution to The Bank of Glen

Burnie 401(K) Profit Sharing Plan; an employer match for the employee 401(K) contribution

of $5,616; $51 term life insurance benefits; and $1,182 disability insurance benefits. Mr.

Harris’ “All Other Compensation” for 2020 consisted of: $6,232 as a 3%

employer contribution and $2,990 as an employer matching contribution to The Bank of Glen

Burnie 401(K) Profit Sharing Plan; an employer match for the employee 401(K) contribution

of $6,232; $81 term life insurance benefits; and $1,186 disability insurance benefits. |

| (4) | Ms.

Smith’s “All Other Compensation” for 2021 consisted of: $4,837 as a 3%

employer contribution and $5,528 as an employer matching contribution to The Bank of Glen

Burnie 401(K) Profit Sharing Plan; an employer match for the employee 401(K) contribution

of $4,280; $78 term life insurance benefits, $158 for health plan benefits, and $1,186 disability

insurance benefits. Ms. Smith’s “All Other Compensation” for 2020 consisted

of: $4,807 as a 3% employer contribution and $2,306 as an employer matching contribution

to The Bank of Glen Burnie 401(K) Profit Sharing Plan; an employer match for the employee

401(K) contribution of $4,807; $89 term life insurance benefits, and $1,186 disability insurance

benefits. |

| (5) | Ms.

Stambaugh’s “All Other Compensation” for 2021 consisted of: $4,649 as a

3% employer contribution and $5,313 as an employer matching contribution to The Bank of Glen

Burnie 401(K) Profit Sharing Plan; $78 term life insurance benefits; an employer match for

the employee 401(K) contribution of $4,002; $158 for health plan benefits, and $1,186 disability

insurance benefits. Ms. Stambaugh’s “All Other Compensation” for 2020 consisted

of: $4,621 as a 3% employer contribution and $2,217 as an employer matching contribution

to The Bank of Glen Burnie 401(K) Profit Sharing Plan; $89 term life insurance benefits;

an employer match for the employee 401(K) contribution of $4,539; $151 for health plan benefits

(including health, dental and EAP), and $1,186 disability insurance benefits. |

Change in Control Severance Plan

The Company and the Bank

maintain a Change in Control Severance Plan (the “Plan”). All employees, including the named executive officers, and Board

members of the Company, the Bank and affiliates of the Company or Bank who, on the date of a change in control, are not parties to an

employment agreement or change in control severance agreement with the applicable employer, are eligible to participate in the Plan.

A “change in control” is defined as any one of the following events: (i) the acquisition of ownership, holding or power to

vote more than 25% of the Company’s voting stock, (ii) the acquisition of the ability to control the election of a majority of

the Bank’s or the Company’s directors, (iii) the acquisition of a controlling influence over the management or policies of

the Bank or the Company by any person or by persons acting as a “group” (within the meaning of Section 13(d) of the Exchange

Act, or (iv) during any period of two consecutive years, individuals who at the beginning of such period constitute the board of directors

of the Bank or the Company (excluding individuals whose election or nomination for election as a member of the existing board was approved

by a vote of at least two-thirds of the continuing directors then in office) cease for any reason to constitute at least two-thirds thereof.

Under the terms of the Plan,

in the event the individual voluntarily terminates his/her employment within two years following a change in control, or in the event

the individual’s employment is terminated by the Bank (or its successor) for any reason, other than cause, within two years following

a change in control, the individual is entitled to receive the benefits specified in the Plan based on the individual’s position

with the employer and, in some instances, years of service on the date of the change in control. The payment will be made either in a

lump sum or in installments, at the option of the individual. Under the Plan, upon a change in control, Mr. Long and Mr. Hines would

receive an amount equal to the aggregate present value of 2.99 times their average annual taxable compensation from the Company for the

prior five complete years, Ms. Stambaugh would receive an amount equal to 130 weeks of her gross weekly salary as of the date of termination.

Mr. Harris and Ms. Smith would receive 104 weeks of their gross weekly salary as of the date of termination. In addition, Mr. Harris,

Ms. Stambaugh and Ms. Smith would receive $10,000 toward the premiums for their COBRA medical insurance coverage following the termination

of employment if they elected to receive COBRA benefits. Mr. Harris, Ms. Stambaugh and Ms. Smith’s cash payment and COBRA benefits

may not exceed 2.99 times their average annual taxable compensation from the Company for the prior five complete years.

If change in control payments

were triggered today, the named executive officers would receive the following amounts: Mr. Long, $862,148; Mr. Hines, $554,543; Mr.

Harris, $357,566; Ms. Stambaugh, $340,521, and Ms. Smith $285,059.

Employee Stock Purchase Plan

All employees, including

the named executive officers, are eligible to participate in the Company’s Employee Stock Purchase Plan at levels determined by

the Bank’s human resources department and commensurate with each employee’s salary level. The Board believes that by making

shares of the Company’s stock available to employees at a discounted price, employees become vested in the successful financial

performance of the Bank and the Company.

REPORT

OF THE AUDIT COMMITTEE

The

Audit Committee has reviewed and discussed with management the annual audited financial statements of the Company and its subsidiary.

The

Audit Committee has discussed with UHY, LLP, the independent auditors for the Company for 2021, the matters required to be discussed

by Statement on Auditing Standards No. 1301, Communications with the Audit Committee issued by the Public Company Accounting Oversight

Board (PCAOB). In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required

by Rule 3526, Communication with Audit Committees Concerning Independence, as adopted by the PCAOB and has discussed with the

independent auditors the independent auditors’ independence.

The

Audit Committee discussed and reviewed with the independent registered public accounting firm, who are responsible for expressing an

opinion on the conformity of the audited financial statements with accounting principles generally accepted in the United States, their

judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required

to be discussed with the Audit Committee by Auditing Standard 1301: Communication with Audit Committees promulgated by the PCAOB.

Based

on the foregoing review and discussions, the Audit Committee recommended to the Company’s Board of Directors that the audited financial

statements be included in the Company’s Annual Report on Form 10-K for the year 2021 for filing with the Securities and Exchange

Commission.

Audit

Committee

| |

Julie

Mussog, Chair | |

Thomas Clocker |

| |

Frederick

W. Kuethe III | |

Andrew Cooch |

PROPOSAL

II -- AUTHORIZATION FOR APPOINTMENT OF AUDITORS

Selection of Auditors

UHY LLP, Certified Public

Accountants (“UHY”) was the Company’s independent auditing firm for the 2021 fiscal year.

As the result of the sale

by TGM Group, LLC (“TGM”) of its accounting, auditing, tax, and consulting business to UHY, TGM resigned its engagement as

the Company’s independent registered public accounting firm

effective January 3, 2022, the date of the sale.

The audit reports of TGM

on the financial statements for the past two years did not contain any adverse opinion or disclaimer of opinion, and were not qualified

or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended December 31, 2020, and December 31,

2021, and the subsequent period through January 3, 2022, there were no disagreements (as defined in Item 304(a)(1)(iv) of regulation

S-K and the related instructions to Item 304 of Regulation S-K) with TGM, on any matter of accounting principles or practices, financial

statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to TGM’s satisfaction, would have caused

TGM to make reference to the subject matter of the disagreement in its reports on the consolidated financial statements for such years.

During the fiscal years ended December 31, 2020, and December 31, 2021, and the subsequent period through January 3, 2022, there were

no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

On February 10, 2022, the

Audit Committee of the Company’s Board of Directors engaged UHY as its independent registered public accounting firm for the year

ending December 31, 2021, effective immediately.

During the Company’s

fiscal years ended December 31, 2020, and December 31, 2021, and the subsequent interim period through February 10, 2022, neither the

Company nor anyone acting on its behalf has consulted with UHY regarding any of the matters or events set forth in Item 304(a)(2)(i)

and (ii) of Regulation S-K.

A representative of UHY is

expected to be present at the Annual Meeting to respond to questions from stockholders and will have the opportunity to make a statement

if he or she so desires. The Board of Directors recommends a vote FOR the proposal to ratify the Board of Directors’ authorization

to accept the selection of the Audit Committee of UHY as the Company’s outside auditing firm for the ensuing year.

Disclosure of Independent Auditor Fees

The following is a description

of the fees billed to the Company by TGM and UHY during the years ended December 31, 2020, and 2021:

Audit

Fees. Audit fees include fees paid by the Company to TGM and UHY in connection with the annual audit of the Company’s

consolidated financial statements, and review of the Company’s quarterly interim financial statements. Audit fees also include

fees for services performed by TGM or UHY that are closely related to the audit and in many cases could only be provided by our independent

auditors. Such services include consents related to SEC and other regulatory filings. The aggregate fees billed to the Company by TGM

and UHY for audit services rendered to the Company for the years ended December 31, 2020, and December 31, 2021, totaled $78,913 and

$92,276 respectively.

Audit

Related Fees. Audit related services include employee benefit plan audits. The aggregate fees billed to the Company by TGM

and UHY for employee benefit plan audit related services rendered to the Company for the years ended December 31, 2020, and December

31, 2021, totaled $13,008 and $13,000, respectively.

All

Other Fees. The aggregate fees billed to the Company by TGM and UHY for all other services rendered to the Company for matters

such as general consulting services and services in connection with annual and special meetings of stockholders for the years ended December

31, 2020, and December 31, 2021, totaled $1,860 and $2,400, respectively.

Approval of Independent Auditor Services and

Fees

The Company’s Audit

Committee reviews all fees charged by the Company’s independent auditors, and actively monitors the relationship between audit

and non-audit services provided. The Audit Committee must pre-approve all audit and non-audit services provided by the Company’s

independent auditors and fees charged.

PROPOSAL

III -- ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Regulation

14A under the Exchange Act requires that the Company seek an advisory, non-binding shareholder vote on the compensation of its named

executive officers as disclosed in this Proxy Statement, and at the Company’s 2013 Annual Meeting, the Company’s stockholders

approved a frequency of every three years for submission of vote on compensation to the stockholders. Accordingly, as required by the

Exchange Act and the rules promulgated by the SEC, the Company is providing its stockholders with the opportunity to cast an advisory,

non-binding vote on the compensation of the named executive officers, as disclosed in this proxy statement.

This

proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to endorse or

not endorse the Company’s executive pay program and policies through the following resolution:

“Resolved, that

the stockholders approve the compensation of the named executive officers, as disclosed in the compensation tables and related material

in the Proxy Statement distributed in connection with this Meeting.”

The

Compensation Committee and the Board believe that the Company’s compensation policies and procedures align with the long-term

success of the Company and the interests of the stockholders.

Because the vote on this Proposal

is advisory, it will not be binding on the Board and may not be construed as overruling a decision by the Board nor to create or imply

any additional fiduciary duty by the Board. However, the Compensation Committee and the Board will consider the outcome of the vote when

considering future executive compensation arrangements.

This matter will be decided

by the affirmative vote of a majority of the votes cast at the annual meeting. The affirmative vote of holders of a majority of all of

the votes cast at a meeting at which a quorum is present is needed to approve the proposal. Consequently, abstentions and broker non-votes

with respect to shares otherwise present at the Annual Meeting in person or by proxy will have no effect on the result of the vote although

they will be considered present for purposes of determining the presence of a quorum.

The Board of Directors recommends a vote

FOR approval of the compensation of the named executive officers.

PROPOSAL

IV -- ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION

Regulation 14A under the Exchange Act also requires

that, every six years, the Company seek an advisory, non-binding stockholder vote on whether stockholders would prefer “say-on-pay”

advisory votes of the type described in Proposal III every year, every two years, or every three years. As stated above, in 2013 the

stockholders voted for a frequency of every three years, which the Board has adopted. Stockholders are now being provided another opportunity

to cast an advisory vote on the frequency of the “say-on-pay” advisory vote. Stockholders will be afforded the next opportunity

to vote on the frequency of the “say-on-pay” advisory vote in 2025. The voting instructions allow stockholders to choose

the desired frequency.

This proposal, sometimes referred

to as a “say-on-frequency” proposal, is the stockholders’ expression of how often they would like to be consulted for

the non-binding vote on executive compensation. Stockholders will have the opportunity to vote for the following options for this proposal: one

year, two years, three years, or abstain.

As with Proposal III, your

vote is advisory, and it will not be binding on the Company. However, the Compensation Committee and the Board will consider the outcome

of the vote when considering the frequency of future shareholder advisory votes on executive compensation.

The Board and the Compensation

Committee value the input of stockholders on the Company’s compensation practices. However, they also believe that a three-year

cycle would give shareholders, management, and the Compensation Committee time to evaluate the effectiveness of executive compensation

on long-term company performance. A three-year cycle would also provide the Committee sufficient time to thoughtfully respond to stockholders’

input, and to implement any appropriate changes to our executive compensation program and to evaluate the results of such changes before

the next stockholder advisory vote. Therefore, after careful consideration, the Board and Compensation Committee believe that a three-year

review of executive officer compensation is in the best interest of the stockholders and the Company.

On this Proposal, Stockholders

are not voting to approve or disapprove the Board’s recommendation; rather Stockholders are requested to select a one-year, two-year,

or three-year frequency. The option that receives the highest number of votes cast by Stockholders will be deemed the preferred frequency

for the advisory vote on the approval of compensation for the named executive officers. Consequently, abstentions and broker non-votes

with respect to shares otherwise present at the Annual Meeting in person or by proxy will have no effect on the result of the vote.

The

Board of Directors recommends a vote FOR approval of shareholder advisory votes on executive compensation once every three

years.

OTHER

MATTERS

The Board of Directors is

not aware of any business to come before the Annual Meeting other than those matters described above in this proxy statement and matters

incident to the conduct of the Annual Meeting. However, if any other matters should properly come before the Annual Meeting, it is intended

that proxies in the accompanying form will be voted in respect thereof in accordance with the determination of a majority of the named

proxies.

MISCELLANEOUS

The cost of soliciting proxies

will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable

expenses incurred by them in sending proxy materials to the beneficial owners of Common Stock. In addition to solicitations by mail,

directors, officers and regular employees of the Company may solicit proxies personally or by telegraph or telephone without additional

compensation therefore.

The Company’s 2021

Annual Report to Stockholders, including financial statements, has been mailed to all stockholders of record as of the close of business

on the Record Date with this Proxy Statement. Any stockholder who has not received a copy of such Annual Report may obtain a copy by

writing to the Secretary of the Company. Such Annual Report is not to be treated as a part of the proxy solicitation material or as having

been incorporated herein by reference. A copy of the Company’s Form 10-K for the fiscal year ended December 31, 2021 as filed

with the Securities and Exchange Commission will be furnished without charge to stockholders as of the Record Date upon written request

to Chief Financial Officer, Glen Burnie Bancorp, 101 Crain Highway, S.E., Glen Burnie, Maryland 21061.

STOCKHOLDER

PROPOSALS

Any stockholder desiring

to present a proposal at the 2023 Annual Meeting of Stockholders and wishing to have that proposal included in the proxy statement for

that meeting must submit the same in writing to the Secretary of the Company at 101 Crain Highway, S.E., Glen Burnie, Maryland 21061,

in time to be received by December 5, 2022. The persons designated by the Company to vote proxies given by stockholders in connection

with the Company’s 2023 Annual Meeting of Stockholders will not exercise any discretionary voting authority granted in such proxies

on any matter not disclosed in the Company’s 2023 proxy statement with respect to which the Company has received written notice

no later than February 18, 2023 that a stockholder (i) intends to present such matter at the 2023 Annual Meeting, and (ii) intends to

and does distribute a proxy statement and proxy card to holders of such percentage of the shares of Common Stock required to approve

the matter. If a stockholder fails to provide evidence that the necessary steps have been taken to complete a proxy solicitation on such

matter, the Company may exercise its discretionary voting authority if it discloses in its 2023 proxy statement the nature of the proposal

and how it intends to exercise its discretionary voting authority.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

| |

secretary |

Glen Burnie, Maryland

April 4, 2022

| 4. A non-binding advisory vote on the frequency of

stockholder vote on executive compensation.

2 Years 3 Years Abstain 1 Year

The Board of Directors recommends a vote for every “THREE YEARS” as the preferred

frequency for the advisory vote on the approval of executive compensation.

1UPX

Mark here to vote

FOR all nominees

01 - Thomas Clocker 02 - Julie Mussog 03 - Joan M. Rumenap

Mark here to WITHHOLD

vote from all nominees

For All EXCEPT - To withhold authority to vote for any nominee(s),

write the name(s) of such nominee(s) below.

_____________________________________________________________________

Using a black ink pen, mark your votes with an X as shown in this example.

Please do not write outside the designated areas.

03LUEE

+

+

Please sign exactly as your name appears on the envelope in which this proxy was mailed. When signing as attorney, executor, administrator, trustee or guardian, please give your full title.

If shares are held jointly, each holder should sign.

Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. Date (mm/dd/yyyy) — Please print date below.

Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below B

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q

Annual Meeting Proxy Card

Proposals — The Board of Directors recommends a vote FOR all the nominees listed and FOR Proposals 2 and 3. A

2. To authorize the Board of Directors to accept the auditors

selected by the Audit Committee for the 2022 fiscal year.

3. A non-binding resolution to approve the compensation of

named executive officers.

1. To elect as directors all nominees listed below:

For Against Abstain For Against Abstain

000004

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6

ENDORSEMENT_LINE______________ SACKPACK_____________

1234 5678 9012 345

MMMMMMMMM

MMMMMMMMMMMMMMM

538300

MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE

140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

C 1234567890 J N T

C123456789

MMMMMMMMMMMM

MMMMMMM

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

If no electronic voting,

delete QR code and control #

Δ≈

You may vote online or by phone instead of mailing this card.

Online

Go to www.investorvote.com/GLBZ

or scan the QR code — login details are

located in the shaded bar below.

Save paper, time and money!

Sign up for electronic delivery at

www.investorvote.com/GLBZ

Phone

Call toll free 1-800-652-VOTE (8683) within

the USA, US territories and Canada

Your vote matters – here’s how to vote! |

| Small steps make an impact.

Help the environment by consenting to receive electronic

delivery, sign up at www.investorvote.com/GLBZ

2022 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS.

The undersigned hereby constitutes and appoints John E. Demyan and John D. Long, or a majority of them, with full powers of substitution, as attorneys-in- fact and agents for the undersigned, to vote

all shares of Common Stock of Glen Burnie Bancorp which the undersigned is entitled to vote at the Annual Meeting of Stockholders, to be held at The Bank of Glen Burnie, 101 Crain Highway, SE,

Glen Burnie, Maryland, and virtually via the Internet at meetnow.global/MH9XQW7, for shareholders, on Thursday, May 12, 2022 at 2:00 p.m., Eastern Time (the “Annual Meeting”), and at any and all

adjournments thereof, as indicated below and as determined by a majority of the named proxies with respect to any other matters presented at the Annual Meeting.

The Board of Directors recommends a vote “FOR” the election of the nominees listed. The Board of Directors recommends a vote “FOR” the authorization to select the auditors. The Board of Directors

recommends a vote "FOR" a non-binding resolution approving the compensation of the executive officers named in the proxy statement. The Board of Directors recommends a vote for every “THREE

YEARS” as the preferred frequency for the advisory vote on the approval of executive compensation.

THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR EACH OF THE ABOVE NOMINEES AND FOR ALL PROPOSALS. IF ANY OTHER BUSINESS IS

PROPERLY PRESENTED AT THE ANNUAL MEETING, THIS PROXY WILL BE VOTED BY THOSE NAMED IN THIS PROXY IN ACCORDANCE WITH THE DETERMINATION OF A MAJORITY OF THE NAMED PROXIES. THIS

PROXY CONFERS DISCRETIONARY AUTHORITY ON THE HOLDERS THEREOF TO VOTE WITH RESPECT TO THE ELECTION OF ANY PERSON AS DIRECTOR WHERE THE NOMINEE IS UNABLE TO SERVE OR FOR GOOD

CAUSE WILL NOT SERVE AND MATTERS INCIDENT TO THE CONDUCT OF THE ANNUAL MEETING.

Should the above signed be present and elect to vote at the Annual Meeting or at any adjournment thereof and after notification to the Secretary of the Company at the Annual Meeting of the stockholder’s

decision to terminate this proxy, then the power of said attorneys and proxies shall be deemed terminated and of no further force and effect. The above signed hereby revokes any and all proxies

heretofore given with respect to the shares of Common Stock held of record by the above signed. The above signed acknowledges receipt from the Company prior to the execution of this proxy of notice

and a proxy statement and a 2021 Annual Report to stockholders for the annual meeting.

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED

BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

REVOCABLE PROXY — GLEN BURNIE BANCORP

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q

Change of Address — Please print new address below. Comments — Please print your comments below.

Non-Voting Items C

+

+

The 2022 Annual Meeting of Shareholders of Glen Burnie Bancorp will be held on

Thursday, May 12, 2022 2:00 p.m. Eastern Time, virtually via the internet at meetnow.global/MH9XQW7.

To access the virtual meeting, you must have the information that is printed in the shaded bar

located on the reverse side of this form.

IMPORTANT ANNUAL MEETING INFORMATION

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON

MAY 12, 2022

THE PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT:

www.edocumentview.com/GLBZ |

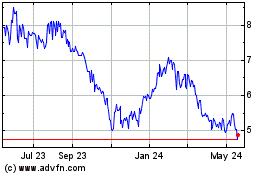

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

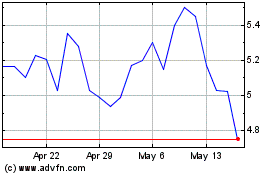

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025