UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of May 2024

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

16

Tiomkin St.

Tel

Aviv 6578317, Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form

20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K contains the quarterly report of Galmed Pharmaceuticals Ltd. (the “Company”), which includes the Company’s

unaudited condensed consolidated financial statements for the three months ended March 31, 2024, together with related information

and certain other information. The Company is not subject to the requirements to file quarterly or certain other reports under Section

13 or 15(d) of the Securities Exchange Act of 1934, as amended. The Company does not undertake to file or cause to be filed any such

reports in the future, except to the extent required by law.

This

Form 6-K is incorporated by reference into the Company’s Registration Statement on Form S-8 (Registration No. 333-206292

and 333-227441) and the Company’s Registration Statement on Form F-3 (Registration No. 333-254766).

Financial

Statements

GALMED

PHARMACEUTICALS LTD.

Condensed

consolidated Balance Sheets (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

As of | | |

As of | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,463 | | |

$ | 2,861 | |

| Short-term deposit | |

| 2,633 | | |

| 2,253 | |

| Restricted Cash | |

| 117 | | |

| 117 | |

| Marketable debt securities | |

| 6,715 | | |

| 7,528 | |

| Other receivables | |

| 254 | | |

| 480 | |

| Total current assets | |

| 11,182 | | |

| 13,239 | |

| | |

| | | |

| | |

| Right of use assets | |

| - | | |

| 42 | |

| Property and equipment, net | |

| 74 | | |

| 83 | |

| Investment in associate at fair value | |

| 3,265 | | |

| 3,265 | |

| Total non-current assets | |

| 3,339 | | |

| 3,390 | |

| | |

| | | |

| | |

| Total assets | |

$ | 14,521 | | |

$ | 16,629 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade payables | |

$ | 1,383 | | |

$ | 1,879 | |

| Other payables | |

| 382 | | |

| 871 | |

| Total current liabilities | |

| 1,765 | | |

| 2,750 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Ordinary shares par value NIS 0.15 per share; Authorized 20,000,000; Issued and | |

| | | |

| | |

| outstanding: 6,009,654 shares as of March 31, 2024 and 5,045,324 shares as of December 31, 2023 | |

| 249 | | |

| 209 | |

| Additional paid-in capital | |

| 207,189 | | |

| 207,076 | |

| Accumulated other comprehensive loss | |

| (455 | ) | |

| (454 | ) |

| Accumulated deficit | |

| (194,227 | ) | |

| (192,952 | ) |

| Total stockholders’ equity | |

| 12,756 | | |

| 13,879 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 14,521 | | |

$ | 16,629 | |

The

accompanying notes are an integral part of the interim Condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Condensed Consolidated Statements of Operations (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Research and development expenses | |

$ | 635 | | |

$ | 1,083 | |

| | |

| | | |

| | |

| General and administrative expenses | |

| 766 | | |

| 919 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 1,401 | | |

| 2,002 | |

| | |

| | | |

| | |

| Financial income, net | |

| (126 | ) | |

| (172 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | 1,275 | | |

$ | 1,830 | |

| | |

| | | |

| | |

| Basic and diluted net loss per share | |

$ | 0.23 | | |

$ | 1.08 | (*) |

| | |

| | | |

| | |

| Weighted-average number of shares outstanding used in computing basic and diluted net loss per

share | |

| 5,460,659 | | |

| 1,692,342 | (*) |

The

accompanying notes are an integral part of the interim Condensed consolidated financial statements.

(*)

Retroactively adjusted (See Note 4.1)

GALMED

PHARMACEUTICALS LTD.

Condensed

Consolidated Statements of Comprehensive Loss (Unaudited)

U.S.

Dollars in thousands

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Net loss | |

$ | 1,275 | | |

$ | 1,830 | |

| Other comprehensive loss: | |

| | | |

| | |

| Net unrealized loss (profit) on available for sale securities | |

| 1 | | |

| (100 | ) |

| Comprehensive loss | |

$ | 1,276 | | |

$ | 1,730 | |

The

accompanying notes are an integral part of the interim Condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Condensed

consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

| | |

Additional | | |

other | | |

| | |

| |

| | |

Ordinary shares | | |

paid-in | | |

Comprehensive | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

capital | | |

loss | | |

Deficit | | |

Total | |

| Balance - December 31, 2023 | |

| 5,045,324 | | |

$ | 209 | | |

$ | 207,076 | | |

$ | (454 | ) | |

$ | (192,952 | ) | |

$ | 13,879 | |

| Exercise of pre-funded warrants | |

| 964,330 | | |

| 40 | | |

| (40 | ) | |

| - | | |

| - | | |

| - | |

| Stock-based compensation | |

| - | | |

| - | | |

| 153 | | |

| - | | |

| - | | |

| 153 | |

| Unrealized loss from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| (1 | ) | |

| - | | |

| (1 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,275 | ) | |

| (1,275 | ) |

| Balance - March 31, 2024 | |

| 6,009,654 | | |

$ | 249 | | |

$ | 207,189 | | |

$ | (455 | ) | |

$ | (194,227 | ) | |

$ | 12,756 | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

| | |

Additional | | |

other | | |

| | |

| |

| | |

Ordinary shares (*) | | |

paid-in | | |

Comprehensive | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

capital | | |

loss | | |

Deficit | | |

Total | |

| Balance - December 31, 2022 | |

| 1,692,342 | | |

$ | 70 | | |

$ | 200,138 | | |

$ | (745 | ) | |

$ | (186,040 | ) | |

$ | 13,423 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 297 | | |

| - | | |

| - | | |

| 297 | |

| Unrealized gain from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| 100 | | |

| - | | |

| 100 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,830 | ) | |

| (1,830 | ) |

| Balance - March 31, 2023 | |

| 1,692,342 | | |

$ | 70 | | |

$ | 200,435 | | |

$ | (645 | ) | |

$ | (187,870 | ) | |

$ | 11,990 | |

(*)

Retroactively adjusted (See Note 4.1)

The

accompanying notes are an integral part of the interim Condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Condensed consolidated Statements

of Cash Flows (Unaudited)

U.S.

Dollars in thousands

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flow from operating activities | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (1,275 | ) | |

$ | (1,830 | ) |

| | |

| | | |

| | |

| Adjustments required to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 9 | | |

| 8 | |

| Stock-based compensation expense | |

| 153 | | |

| 297 | |

| Amortization of premium on marketable debt securities | |

| 6 | | |

| 10 | |

| Amortization of discount on long-term asset | |

| - | | |

| (176 | ) |

| Interest income from short-term deposits | |

| (5 | ) | |

| (4 | ) |

| Loss (gain) from realization of marketable debt securities | |

| (1 | ) | |

| 32 | |

| Finance expenses | |

| 1 | | |

| 4 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Decrease in other accounts receivable | |

| 226 | | |

| 257 | |

| Decrease in trade payables | |

| (496 | ) | |

| (294 | ) |

| Increase (decrease) in other accounts payable | |

| (448 | ) | |

| 1 | |

| Net cash used in operating activities | |

| (1,830 | ) | |

| (1,695 | ) |

| | |

| | | |

| | |

| Cash flow from investing activities | |

| | | |

| | |

| Purchase of available for sale securities | |

| (898 | ) | |

| (393 | ) |

| Investment in short term deposits | |

| (375 | ) | |

| (750 | ) |

| Consideration from sale of available for sale securities | |

| 1,705 | | |

| 2,494 | |

| Net cash provided by investing activities | |

| 432 | | |

| 1,351 | |

| | |

| | | |

| | |

| Decrease in cash and cash equivalents and restricted cash | |

| (1,398 | ) | |

| (344 | ) |

| Cash and cash equivalents and restricted cash at the beginning of the period | |

| 2,978 | | |

| 2,130 | |

| Cash and cash equivalents and restricted cash at the end of the period | |

$ | 1,580 | | |

$ | 1,786 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash received from interest | |

$ | 112 | | |

$ | 64 | |

The

accompanying notes are an integral part of the interim Condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Notes

to Condensed consolidated Financial Statements

Note

1 - Basis of presentation

Galmed

Pharmaceuticals Ltd. (the “Company”) was incorporated in Israel on July 31, 2013 and commenced operations on February 2,

2014.

The

Company holds three wholly-owned subsidiaries, Galmed International Ltd., which is incorporated in Malta, and Galmed Research and Development

Ltd. (“GRD”) and Galtopa Therapeutics Ltd., both of which are incorporated in Israel. In July 2023, GRD established a new

wholly-owned subsidiary incorporated under the laws of England and Wales called Galmed Therapeutics UK Limited.

The

Company is a biopharmaceutical company focused on the development of Aramchol. The Company has focused almost exclusively on developing

Aramchol for the treatment of liver disease and is currently developing Aramchol for Primary Sclerosing Cholangitis, or PSC, and exploring

the feasibility of developing Aramchol for other fibro-inflammatory indications outside of liver disease. The Company is also collaborating

with the Hebrew University in the development of Amilo-5MER. The Company has an operating history limited to pre-clinical and clinical

drug development.

The

Company funded its research and development programs and operations to date primarily through proceeds from private placements and public

offerings. The Company currently has no products approved for marketing and has not generated any revenue from product sales to date.

As of March 31, 2024, the Company had cash and cash equivalents of $1.5 million, restricted cash of $0.1 million, short-term deposits

of $2.6 million and marketable debt securities of $6.7 million.

The

Company has incurred operating losses in each year since inception. The Company’s loss attributable to holders of its ordinary

shares for the three months ended March 31, 2024 and 2023 was approximately $1.3 million and $1.8 million, respectively. As of March

31, 2024, the Company had an accumulated deficit of $194.2 million. Substantially all of its operating losses resulted from costs incurred

in connection with the Company’s development program and from general and administrative costs associated with its operations.

The

Company will need to raise substantial, additional capital to fund its operations and to develop Aramchol and Amilo-5MER for, and beyond

its current development stage and any future commercialization, as well as any additional indications.

Based

on the Company’s current operating plan, the Company’s management currently estimates that its cash position will support

its current operations as currently conducted for more than 12 months from the date of issuance of these financial statements.

These

unaudited interim condensed consolidated financial statements have been prepared as of March 31, 2024 and for the three months

period then ended. Accordingly, certain information and footnote disclosures normally included in annual financial statements prepared

in accordance with U.S. GAAP have been omitted. These unaudited interim condensed consolidated financial statements should be

read in conjunction with the audited financial statements and the accompanying notes of the Company for the year ended December 31, 2023

that are included in the Company’s Annual Report on Form 20-F, filed with the Securities and Exchange Commission on April 4, 2024

(the “Annual Report on Form 20-F”). The results of operations presented are not necessarily indicative of the results to

be expected for the year ending December 31, 2024.

Note

2 - Summary of significant accounting policies

The

significant accounting policies that have been applied in the preparation of the unaudited condensed consolidated interim financial

statements are identical to those that were applied in preparation of the Company’s most recent annual financial statements in

connection with its Annual Report on Form 20-F.

Note

3 – Investment in Associate at Fair Value

On

May 4, 2023, the Company entered into a definitive agreement (the “Agreement”) for a $1.5 million equity investment in OnKai,

a US-based technology company developing an AI-based platform to advance healthcare for underserved populations across the United States

by facilitating alignment between healthcare stakeholders.

Previously,

on November, 2022 the Company invested $1.5 million in OnKai through a Simple Agreement for Future Equity which converted at a 15% discount

into series seed preferred shares upon closing of the Investment Round (as defined below).

The

Company’s investment in OnKai was part of an approximately $6.0million investment round (the “Investment Round”) with

other investors that was led by the Company of which SAFE notes of approximately $3.8 million were converted into preferred shares. On

June 19, 2023, the Investment Round closed. Following the closing of the Investment Round, the Company holds 1,223,535 preferred shares

which comprises approximately 24% of the outstanding share capital of OnKai on an as-converted basis as of March 31, 2024 and the Company’s

Chief Executive Officer and director, Allen Baharaff serves as a board member of OnKai.

Under

the terms of the Agreement, during the three-year period following the closing of the Investment Round the Company will have the

right to merge with OnKai subject to the approval of the boards of directors of each of the Company and OnKai. The Company was

granted certain customary pre-emptive rights as well as registration rights, first refusal rights, co-sale rights and broad based

weighted average anti-dilution rights, a board seat, and certain customary protective provisions.

In

connection with the Agreement, the Company’s wholly-owned subsidiary GRD entered into a services agreement with OnKai (the “Services

Agreement”). The Services Agreement provides that GRD will on a non-exclusive basis (i) provide support services to OnKai relating

to finance, business development, strategic planning, execution and others; and (ii) lend its experience to OnKai in building a strategy

and for the development of treatments for the underserved and that OnKai shall on a non-exclusive basis (i) take part in plan preparation

to serve GRD’s vision of developing drugs for the underserved population and (ii) when relevant, design a process on the clinical

trial dashboard that could potentially serve GDR’s future trial.

Note

4 - Stockholders’ Equity

1.

On May 15, 2023, the Company effected a reverse share split of the Company’s ordinary shares at the ratio of 1-for-15, such that

each fifteen (15) ordinary shares, par value NIS 0.01 per share, shall be consolidated into one (1) ordinary share, par value NIS 0.15.

As a result, all share and per share amounts were adjusted retroactively for all periods presented in these financial statements.

2.

On July 18, 2023, the Company sold to investors in a public offering (i) 380,000 ordinary shares, (ii) 5,220,000 pre-funded warrants

to purchase 5,220,000 ordinary shares (the “Pre-Funded Warrants”), and (iii) 5,600,000 warrants to purchase 5,600,000 ordinary

shares (the “Investor Warrants”), at a purchase price of $1.25 per share and accompanying Investor Warrant and $1.249

per Pre-Funded Warrant and accompanying Investor Warrant.

The

Pre-Funded Warrants are immediately exercisable at an exercise price of $0.001 per ordinary share and will not expire until exercised

in full. The Investor Warrants have an exercise price of $1.25 per ordinary share, are immediately exercisable, and may be exercised

until July 18, 2028. The net proceeds to the Company were approximately $6.2 million.

As

of March 31, 2024, a total of 3,940,000 Pre-Funded Warrants were exercised into 3,937,312 ordinary shares.

Note

5 – Subsequent events

Subsequent

to the balance sheet date, a total of 350,000 Pre-Funded Warrants were exercised into 349,093 ordinary shares.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

All

references to “we,” “us,” “our,” “the Company” and “our Company”, in this

Form 6-K are to Galmed Pharmaceuticals Ltd. and its subsidiaries, unless the context otherwise requires. All references to “shares”

or “ordinary shares” are to our ordinary shares, NIS 0.01 nominal par value per share. All references to “Israel”

are to the State of Israel. “U.S. GAAP” means the generally accepted accounting principles of the United States. Unless otherwise

stated, all of our financial information presented in this Form 6-K has been prepared in accordance with U.S. GAAP. Any discrepancies

in any table between totals and sums of the amounts and percentages listed are due to rounding. Unless otherwise indicated, or the context

otherwise requires, references in this Form 6-K to financial and operational data for a particular year refer to the fiscal year of our

company ended December 31 of that year.

Our

reporting currency and financial currency is the U.S. dollar. In this Form 6-K, “NIS” means New Israeli Shekel, and “$,”

“US$” and “U.S. dollars” mean United States dollars.

Cautionary

Note Regarding Forward-Looking Statements

This

Form 6-K contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product

development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we

or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified

by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,”

“should,” “anticipate,” “could,” “might,” “seek,” “target,” “will,”

“project,” “forecast,” “continue” or their negatives or variations of these words or other comparable

words or by the fact that these statements do not relate strictly to historical matters. These forward-looking statements may be included

in, among other things, various filings made by us with the SEC, press releases or oral statements made by or with the approval of one

of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results

as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently

subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied

by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities

and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below:

| |

● |

our

ability to pursue, evaluate and complete any strategic alternative that yields value for our shareholders; |

| |

|

|

| |

● |

the timing and cost of our planned PSC clinical trial and our pivotal Phase 3 ARMOR trial, or the ARMOR Study, if re-initiated, for our product candidates, Aramchol and Amilo-5MER, or for any other pre-clinical or clinical trials; |

| |

|

|

| |

● |

completion

and receiving favorable results of our planned PSC clinical trial and the ARMOR Study (if re-initiated) for Aramchol or any other

pre-clinical or clinical trial; |

| |

● |

regulatory

action with respect to Aramchol or any other product candidate by the U.S. Food and Drug Administration, or the FDA, or the European

Medicines Authority, or EMA, including but not limited to acceptance of an application for marketing authorization, review and approval

of such application, and, if approved, the scope of the approved indication and labeling; |

| |

|

|

| |

● |

the

commercial launch and future sales of Aramchol and any future product candidates; |

| |

|

|

| |

● |

our

ability to comply with all applicable post-market regulatory requirements for Aramchol, Amilo-5MER or any other product candidate

in the countries in which we seek to market the product; |

| |

|

|

| |

● |

our

ability to achieve favorable pricing for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

our

expectations regarding the commercial market for non-alcoholic steato-hepatitis, or NASH, in patients or any other targeted indication; |

| |

|

|

| |

● |

third-party

payor reimbursement for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

our

estimates regarding anticipated capital requirements and our needs for additional financing; |

| |

|

|

| |

● |

market

adoption of Aramchol or any other product candidate by physicians and patients; |

| |

|

|

| |

● |

the

timing, cost or other aspects of the commercial launch of Aramchol or any other product candidate; |

| |

|

|

| |

● |

our

ability to obtain and maintain adequate protection of our intellectual property; |

| |

|

|

| |

● |

the

possibility that we may face third-party claims of intellectual property infringement; |

| |

|

|

| |

● |

our

ability to manufacture our product candidates in commercial quantities, at an adequate quality or at an acceptable cost; |

| |

● |

our

ability to establish adequate sales, marketing and distribution channels; |

| |

|

|

| |

● |

intense

competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory

and clinical, manufacturing, marketing and sales, distribution and personnel resources than we do; |

| |

|

|

| |

● |

the

development and approval of the use of Aramchol or any other product candidate for additional indications or in combination therapy; |

| |

|

|

| |

● |

our

expectations regarding licensing, acquisitions and strategic operations; |

| |

|

|

| |

● |

current

or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated

liquidity risk; |

| |

|

|

| |

● |

our

ability to maintain the listing of our ordinary shares on The Nasdaq Capital Market; and |

| |

|

|

| |

● |

security,

political and economic instability in the Middle East that could harm our business, including due to the the recent attacks by Hamas

and other terrorist organizations from the Gaza Strip and elsewhere in the region and Israel’s war against them and military hostilities

with Hezbollah on the northern border of Israel. |

We

believe these forward-looking statements are reasonable; however, these statements are only current predictions and are subject to known

and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance

or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in

our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the SEC on April 4, 2024, in greater detail under the

heading “Risk Factors” and elsewhere in the Annual Report and this Form 6-K. Given these uncertainties, you should not rely

upon forward-looking statements as predictions of future events.

All

forward-looking statements attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified

in their entirety by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking

statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In

evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

We

are a biopharmaceutical company focused on the development of Aramchol. We have focused almost exclusively on developing Aramchol for

the treatment of liver disease and are currently developing Aramchol for PSC and exploring the feasibility of developing Aramchol for

other fibro-inflammatory indications outside of liver disease. We are also collaborating with the Hebrew University in the development

of Amilo-5MER, a 5 amino acid synthetic peptide.

While

we previously announced that we were no longer evaluating our strategic alternatives following the initiation of our PSC clinical program

and our investment and collaboration with Onkai, we have reinitiated the process of evaluating our strategic options alternatives

and our structuring to best optimize our resources to enhance shareholder value and achieve our goals.

To

date, we have not generated revenue from the sale of any product, excluding the licensing revenue we recorded in connection with the

Samil Agreement, and we do not expect to generate any significant revenue other than the amortization of the upfront payments under the

license agreement with Samil and of the subsequent royalties and/or milestones that may be earned in connection with the Samil Agreement

or potential other license Agreements, unless and until we commercialize Aramchol, or license the product to additional third parties.

As of March 31, 2024, we had an accumulated deficit of approximately $193.0 million.

Our

financing activities are described below under “Liquidity and Capital Resources.” Obtaining approval of an NDA, MMA, or other

similar application is an extensive, lengthy, expensive and uncertain process, and the FDA, EMA, MHRA and other regulatory agencies may

delay, limit or deny approval of Aramchol, Amilo-5MER or any other product candidate.

Financial

Overview

To

date, we have funded our operations primarily through proceeds from private placements and public offerings. At March 31, 2024, we had

current assets of $11.2 million, which includes cash and cash equivalents of $1.5 million, short term deposit of $2.6 million, marketable

debt securities of $6.7 million, other receivables of $0.3 million and restricted cash of $0.1 million. This compares with current assets

of $13.2 million at December 31, 2023, which includes cash and cash equivalents of $2.9 million, short term deposit of $2.2 million,

marketable debt securities of $7.5 million,other receivables if $0.5 million and restricted cash of $0.1 million. Although we provide

no assurance, we believe that such existing funds will be sufficient to continue our business and operations as currently conducted for

more than 12 months from the date of issuance of this Form 6-K. However, we will continue to incur operating losses, which may be substantial

over the next several years, and we expect that we will need to obtain additional funds to further develop our research and development

programs.

Costs

and Operating Expenses

Our

current costs and operating expenses consist of two components: (i) research and development expenses; and (ii) general and administrative

expenses.

Research

and Development Expenses

Our

research and development expenses consist primarily of outsourced development expenses, salaries and related personnel expenses and fees

paid to external service providers, patent and regulatory related legal fees, costs of pre-clinical studies and clinical trials and drug

and laboratory supplies. We account for all research and development expenses as they are incurred. Subject to our strategic review,

we generally expect our research and development expense to be our primary expense in the near future as we continue to develop

Aramchol and Amilo-5MER. Increases or decreases in research and development expenditures are primarily attributable to the number and/or

duration of the pre-clinical and clinical studies that we conduct.

We

expect that a substantial amount of our research and development expense in the future will be incurred in support of our current and

anticipated pre-clinical and clinical development projects. Due to the inherently unpredictable nature of pre-clinical and clinical development

studies, we are unable to estimate with any certainty the costs we will incur in the continued development of Aramchol, Amilo-5MER and

any other potential product candidate. Clinical development timelines, the probability of success and development costs can differ materially

from expectations. We currently expect to continue testing Aramchol and Amilo-5MER in pre-clinical studies for toxicology, safety and

efficacy, and to conduct additional clinical trials for Aramchol and to initiate a first-in-human clinical study for Amilo-5MER.

While

we are currently focused on advancing Aramchol’s and Amilo-5MER’s development, our future research and development expenses

will depend largely on the outcome of our strategic review, the duration of the ARMOR study, the number of enrolled patients, the clinical

success of Aramchol, as well as ongoing assessments of the Aramchol’s commercial potential. As we obtain results from clinical

trials, we may elect to discontinue or delay clinical trials for our product candidate in certain indications in order to focus our resources

on more promising indications for such product candidate. Completion of clinical trials may take several years or more, but the length

of time generally varies according to the type, complexity, novelty and intended use of a product candidate.

We

expect our research and development expenses to increase in the future from current levels as we continue to advance our clinical product

development into a pivotal stage trial and, potentially, the in-licensing of additional product candidates.

The

lengthy process of completing clinical trials and seeking regulatory approval for Aramchol requires the expenditure of substantial resources.

Any failure or delay in completing clinical trials, or in obtaining regulatory approvals, could cause a delay in generating product revenue

and cause our research and development expenses to increase and, in turn, have a material adverse effect on our operations. Because of

the factors set forth above, we are not able to estimate with any certainty when we would recognize any net cash inflows from our projects.

General

and Administrative Expenses

General

and administrative expenses consist primarily of compensation for employees in executive and operational roles, including finance, accounting,

legal and other operating positions in connection with our activities. Our other significant general and administrative expenses include

non-cash stock-based compensation costs and facilities costs (including the rental expense for our offices in Tel Aviv, Israel), professional

fees for outside accounting and legal services, travel costs, investors relations, insurance premiums and depreciation.

Financial

expenses (income), Net

Our

financial income, net consists mainly of interest income from marketable debt securities and foreign currency gains. Our financial expense

consists of fees associated with banking activities and losses from realization of marketable debt securities.

Results

of Operations

The

table below provides our results of operations for the three months ended March 31, 2024 as compared to the three months ended March

31, 2023.

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | |

| | |

(In thousands, except per share data) | |

| Research and development expenses | |

| 635 | | |

| 1,083 | |

| General and administrative expenses | |

| 766 | | |

| 919 | |

| Total operating expenses | |

| 1,401 | | |

| 2,002 | |

| Financial income, net | |

| (126 | ) | |

| (172 | ) |

| Net loss | |

| 1,275 | | |

| 1,830 | |

| Other comprehensive loss (gain): | |

| 1 | | |

| (100 | ) |

| Comprehensive loss | |

| 1,276 | | |

| 1,730 | |

| Basic and diluted net loss per share | |

$ | 0.23 | | |

$ | 1.08 | |

Research

and Development Expenses

Our

research and development expenses amounted to approximately $0.6 million during the three months ended March 31, 2024, representing a

decrease of approximately $0.5 million, or 45%, compared to approximately $1.1 million for the comparable period in 2023. The decrease

during the three months ended March 31, 2024 primarily resulted from a decrease in clinical and pre-clinical studies expenses.

General

and Administrative Expenses

Our

general and administrative expenses amounted to approximately $0.8 million during the three months ended March 31, 2024, representing

a decrease of approximately $0.1 million, or 11%, compared to approximately $0.9 million for the comparable period in 2023. The decrease

in general and administrative expenses for the three months ended March 31, 2024 resulted primarily from a decrease in D&O insurance

premium costs.

Operating

Loss

As

a result of the foregoing, for the three months ended March 31, 2024, our operating loss was approximately $1.4 million, representing

a decrease of $0.6 million, or 30%, as compared to approximately $2.0 million for the comparable period in 2023.

Financial

expenses, Net

Our

financial income, net amounted to approximately $0.1 million during the three months ended March 31, 2024, compared to $0.2 million for

the comparable period in 2023.

The

financial income, net for the three months ended March 31, 2024 primarily relates to interest income from marketable debt securities

and exchange rate income.

Net

Loss

As

a result of the foregoing, for the three months ended March 31, 2024, our net loss was approximately $1.3 million, representing a decrease

of $0.5 million, or 28%, as compared to approximately $1.8 million for the comparable period in 2023.

Liquidity

and Capital Resources

To

date, we have funded our operations primarily through proceeds from private placements and public offerings and we have incurred substantial

losses since our inception. As of March 31, 2024, we had an accumulated deficit of approximately $194.2 million and positive working

capital (current assets less current liabilities) of approximately $9.4 million. We expect that operating losses will continue for the

foreseeable future.

As

of March 31, 2024, we had cash and cash equivalents of approximately $1.5 million, short term deposits of $2.6 million, restricted cash

of approximately $0.1 million and marketable debt securities of approximately $6.7 million invested in accordance with our investment

policy, totaling approximately $10.9 million, as compared to approximately $2.9 million, $2.2 million, $0.1 million and $7.5 million

as of December 31, 2023, respectively, totaling approximately $12.7 million. The decrease is mainly attributable to the $1.8 million

negative cash flow from operating activities during the three months ended March 31, 2024.

We

had negative cash flow from operating activities of approximately $1.8 million for the three months ended March 31, 2024, as compared

to negative cash flow from operating activities of approximately $1.7 million for the three months ended March 31, 2023. The negative

cash flow from operating activities for the three months ended March 31, 2024 is mainly attributable to our net loss of approximately

$1.3 million.

We

had positive cash flow from investing activities of approximately $0.4 million for the three months ended March 31, 2024, as compared

to a approximately $1.3 million for the three months ended March 31, 2023. The positive cash flow from investing activities for the three

months ended March 31, 2024 was primarily due to the net sale of available for sale securities.

We

had no cash flow from financing activities for the three months ended March 31, 2024, and for the three months ended March 31, 2023.

On

March 26, 2021, we entered into a Sales Agreement with Cantor Fitzgerald & Co. and Canaccord Genuity LLC, as sales agents, pursuant

to which we may offer and sell ordinary shares “at the market” having an aggregate offering price of up to $50.0 million

from time to time through the sales agents subject to the limits of General Instruction I.B.5 to Form F-3, also known as the baby shelf

rule.

Although

we provide no assurance, we believe that our existing funds will be sufficient to continue our business and operations as currently conducted

for more than 12 months from the date of issuance of this Report on Form 6-K. However, significant additional funding will be necessary

to fund our ARMOR Study, our Amilo-5MER program and ongoing research and development work and to advance our product candidates through

regulatory approval and into commercialization, if approved. Subject to our strategic review, we intend to obtain additional funding

through debt or equity financings, governmental grants or through entering into collaborations, strategic alliances or license agreements

to increase the funds available to support our operating and capital needs. Although we have been successful in raising capital in the

past, there is no assurance that we will be successful in obtaining additional financing on terms acceptable to us. If funds are not

available, we may be required to delay, reduce the scope of or eliminate research or development plans for, or commercialization efforts

with respect to Aramchol, Amilo-5MER and/or our other pre-clinical and clinical programs. This may raise substantial doubts about our

ability to continue as a going concern.

The

extent of our future capital requirements will depend on many other factors, including:

| |

● |

the outcome of our review

of our strategic alternatives: |

| |

|

|

| |

● |

the progress and costs

of our pre-clinical studies, clinical trials and other research and development activities; |

| |

|

|

| |

● |

the regulatory pathway

of Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

the scope, prioritization

and number of our clinical trials and other collaboration, research and development programs; |

| |

|

|

| |

● |

the amount of revenues

and contributions we receive under future licensing, development and commercialization arrangements with respect to Aramchol, Amilo-5MER

or any other product candidate; |

| |

|

|

| |

● |

the costs of the development

and expansion of our operational infrastructure; |

| |

|

|

| |

● |

the costs and timing of

obtaining regulatory approval for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

the ability of us, or our

collaborators, to achieve development milestones, marketing approval and other events or developments under our potential future

licensing agreements; |

| |

|

|

| |

● |

the costs of filing, prosecuting,

enforcing and defending patent claims and other intellectual property rights; |

| |

|

|

| |

● |

the costs and timing of

securing manufacturing arrangements for clinical or commercial production; |

| |

|

|

| |

● |

the costs of contracting

with third parties to provide sales and marketing capabilities for us; |

| |

|

|

| |

● |

the costs of acquiring

or undertaking development and commercialization efforts for any future products, product candidates or platforms; |

| |

|

|

| |

● |

the magnitude of our general

and administrative expenses; |

| |

● |

any cost that we may incur

under future in- and out-licensing arrangements relating to Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

market conditions; |

| |

|

|

| |

● |

our ability to maintain

the listing of our ordinary shares on The Nasdaq Capital Market; and |

| |

|

|

| |

● |

the impact of any resurgence

of the COVID-19 pandemic and the war between Hamas and Israel, which may exacerbate the magnitude of the factors discussed above. |

Trend

Information

We

are a development stage company, and it is not possible for us to predict with any degree of accuracy the outcome of our research, development

or commercialization efforts. As such, it is not possible for us to predict with any degree of accuracy any significant trends, uncertainties,

demands, commitments or events that are reasonably likely to have a material effect on our net loss, liquidity or capital resources,

or that would cause financial information to not necessarily be indicative of future operating results or financial condition. However,

to the extent possible, certain trends, uncertainties, demands, commitments and events are in this “Management’s Discussion

and Analysis of Financial Condition and Results of Operations”.

Controls

and Procedures

As

a “foreign private issuer”, we are only required to conduct the evaluations required by Rules 13a-15(b) and 13a-15(d) of

the Exchange Act as of the end of each fiscal year and therefore have elected not to provide disclosure regarding such evaluations at

this time.

Risks

Factors

Any

investment in our business involves a high degree of risk. Before making an investment decision, you should carefully consider the information

we include in this Report on Form 6-K, including our unaudited condensed consolidated financial statements and accompanying notes, and

the additional information in the other reports we file with the Securities and Exchange Commission along with the risks described in

our Annual Report on Form 20-F for the fiscal year ended December 31, 2023. These risks may result in material harm to our business and

our financial condition and results of operations. In this event, the market price of our ordinary shares may decline and you could lose

part or all of your investment. We have described below those risks that reflect substantive changes from, or additions to, the risks

described in our Annual Report on Form 20-F for the fiscal year ended December 31, 2023.

If

we fail to comply with the continued listing requirements of the Nasdaq Capital Market, our ordinary shares may be delisted and the price

of our ordinary shares and our ability to access the capital markets could be negatively impacted

Our

ordinary shares are listed on the Nasdaq Capital Market. As such, we are required to meet the continued listing requirements of the Nasdaq

Capital Market and other Nasdaq rules, including those regarding director independence and independent committee requirements, minimum

shareholders’ equity, minimum share price and certain other corporate governance requirements. In particular, we are required to

maintain a minimum bid price for our listed ordinary shares of $1.00 per share.

On

September 19, 2023, we were notified by the Nasdaq Stock Market, LLC, or Nasdaq, that we were not in compliance with the minimum bid

price requirements set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule

5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides

that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days.

The notification provided that we had 180 calendar days, or until March 18, 2024, to regain compliance with Nasdaq Listing Rule 5550(a)(2).

To regain compliance, the bid price of our ordinary shares must have a closing bid price of at least $1.00 per share for a minimum of

10 consecutive business days. Since we did not regain compliance by March 18, 2024, we requested and received from The Nasdaq Capital

Market an additional 180 calendar days or until September 16, 2024 to comply with the minimum bid price. If we fail to regain compliance

during the second compliance period, then Nasdaq will notify us of its determination to delist our ordinary shares, at which point we

will have an opportunity to appeal the delisting determination to a Hearings Panel. No assurance can be given that we will be able to

regain compliance with the Rule. If we do not meet these or other continued listing requirements, our ordinary shares could be delisted.

A delisting of our ordinary shares from Nasdaq could materially reduce the liquidity of our ordinary shares and result in a corresponding

material reduction in the price of our ordinary shares. In addition, delisting could harm our ability to raise capital through alternative

financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, employees and

fewer business development opportunities and strategic alternatives. No assurance can be given that we will be able to regain compliance

with the Rule. If we do not meet these or other continued listing requirements, our ordinary shares could be delisted. Delisting of our

ordinary shares from the Nasdaq Capital Market would cause us to pursue eligibility for trading on other markets or exchanges, or on

the pink sheets. In such case, our shareholders’ ability to trade, or obtain quotations of the market value of, our ordinary shares

would be severely limited because of lower trading volumes and transaction delays. These factors could contribute to lower prices and

larger spreads in the bid and ask prices for our securities. There can be no assurance that our ordinary shares, if delisted from the

Nasdaq Capital Market in the future, would be listed on a national securities exchange, a national quotation service, the Over-The-Counter

Markets or the pink sheets. Delisting from the Nasdaq Capital Market, or even the issuance of a notice of potential delisting, would

also result in negative publicity, make it more difficult for us to raise additional capital, adversely affect the market liquidity of

our ordinary shares, reduce security analysts’ coverage of us and diminish investor, supplier and employee confidence. Additionally,

the threat of delisting or a delisting of our ordinary shares from the Nasdaq Capital Market, could reduce the number of investors willing

to hold or acquire our ordinary shares, thereby further restricting our ability to obtain equity financing, and it could reduce our ability

to retain, attract and motivate our directors, officers and employees. In addition, as a consequence of any such delisting, our share

price could be negatively affected and our shareholders would likely find it more difficult to sell, or to obtain accurate quotations

as to the prices of, our ordinary shares.

Our

headquarters and other significant operations are located in Israel and, therefore, our results may be adversely affected by political,

economic and military instability in Israel.

Our

executive office is located in Ramat Gan, Israel. In addition, certain of our key employees, officers and directors are residents of

Israel. Accordingly, political, economic and military conditions in the Middle East may affect our business directly. Since the establishment

of the State of Israel in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries and terrorist

organizations active in the region, including Hamas (an Islamist militia and political group in the Gaza Strip) and Hezbollah (an Islamist

militia and political group in Lebanon).

In

October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian

and military targets. Hamas also launched extensive rocket attacks on Israeli population and industrial centers located along Israel’s

border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in extensive deaths, injuries and kidnapping

of civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and a military campaign against

these terrorist organizations commenced in parallel to their continued rocket and terror attacks. In addition, since the commencement

of these events, there have been continued hostilities along Israel’s northern border with Lebanon (with the Hezbollah terror organization)

and southern border (with the Houthi movement in Yemen, as described below). It is possible that hostilities with Hezbollah in Lebanon

will escalate, and that other terrorist organizations, including Palestinian military organizations in the West Bank as well as other

hostile countries will join the hostilities. In addition, Iran recently launched a direct attack on Israel involving hundreds of drones

and missiles and has threatened to continue to attack Israel and is widely believed to be developing nuclear weapons. Iran is also believed

to have a strong influence among extremist groups in the region, such as Hamas in Gaza, Hezbollah in Lebanon, the Houthi movement in

Yemen and various rebel militia groups in Syria and Iraq. Such clashes may escalate in the future into a greater regional conflict.

In

connection with the Israeli security cabinet’s declaration of war against Hamas and possible hostilities with other organizations,

several hundred thousand Israeli military reservists were drafted to perform immediate military service. Although many of such military

reservists have since been released, they may be called up for additional reserve duty, depending on developments in the war in Gaza

and along Israel’s other borders. While none of our employees in Israel have been called to active military duty, we rely on service

providers located in Israel and have entered into certain agreements with Israeli counterparties. Employees of such service providers

or contractual counterparties may be called for service in the current or future wars or other armed conflicts with Hamas as well as

the other pending or future armed conflicts in which Israel is or may become engaged, and such persons may be absent for an extended

period of time. As a result, our operations may be disrupted by such absences, which disruption may materially and adversely affect our

business and results of operations.

While

our executive offices are located in Ramat Gan, Israel, which is not near Israel’s borders where the main hostilities are currently

taking place and none of our employees have been called into military reserve duty, to help mitigate the effects of Israel’s war

with Hamas, we have taken several measures, including work-from-home measures and have a business continuity plan. Nevertheless, we experienced

disruptions to our work and have since returned to full activity together with our local vendors and consultants. However, as a result

of disruptions to our work with our local vendors and consultants following the initial outbreak

of the war, in November 2023, we determined that the commencement of our Phase 2 PSC study was to be delayed. We expect to commence

our Phase 2 PSC study in the fourth quarter of 2024, which may be subject to further delay based on disruptions that are outside of our

control or the control of our local vendors and consultants.

Further

disruptions that could severely impact our business, clinical trials, and supply chains, include:

| ● |

limitations

on employee resources that would otherwise be focused on the conduct of our business including because of military reserve duty call-ups

in the future that impact our employees and the affect the current war between Israel and Hamas on the productivity of our employees

and external partners; |

| |

|

| ● |

delays

in necessary interactions with vendors, local regulators, and other important agencies and contractors due to limitations in employee

resources; and |

| |

|

| ● |

impacts

from prolonged remote work arrangements, such as increased cybersecurity risks and strains on our business continuity plans. |

The

intensity and duration of Israel’s current war against Hamas is difficult to predict, as are such war’s economic implications

on the Company’s business and operations, on Israel’s economy in general, on the trading price of shares of our ordinary

shares and could impact our ability to raise additional capital on a timely basis or at all. These events may be intertwined with wider

macroeconomic indications of a deterioration of Israel’s economic standing that may involve a downgrade in Israel’s credit

rating by rating agencies (such as the recent downgrade by Moody’s of its credit rating of Israel from A1 to A2, as well as the

downgrade of its outlook rating from “stable” to “negative”), which may have a material adverse effect on the

Company and its ability to effectively conduct its operations. The impact of the current war between Israel and Hamas may also have the

effect of heightening many of the other risks described in this section and in the “Risk Factors” section of our 2023

Annual Report.

In

addition, some countries around the world restrict doing business with Israel and Israeli companies, and additional countries may impose

restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability in the region continue

or increase. In addition, there have been increased efforts by countries, activists and organizations to cause companies and consumers

to boycott Israeli goods and services. In addition, in January 2024 the International Court of Justice, or ICJ, issued an interim ruling

in a case filed by South Africa against Israel in December 2023, making allegations of genocide amid and in connection with the war in

Gaza, and ordered Israel, among other things, to take measures to prevent genocidal acts, prevent and punish incitement to genocide,

and take steps to provide basic services and humanitarian aid to civilians in Gaza. There are concerns that companies and businesses

will terminate, and may have already terminated, certain commercial relationships with Israeli companies following the ICJ decision.

The foregoing efforts by countries, activists and organizations, particularly if they become more widespread, as well as the ICJ rulings

and future rulings and orders of other tribunals against Israel (if handed), may materially and adversely impact our business, clinical

trials, and supply chains.

Furthermore,

following Hamas’ attack on Israel and Israel’s security cabinet declaration of war against Hamas, the Houthi movement, which

controls parts of Yemen has launched attacks on Israeli-controlled or owned ships in the Red Sea, resulting in shipping companies rerouting

their cargo ships or ceasing shipments to Israel in the case of the latter. The hostilities with Hamas, Hezbollah, the Houthi movement

and other terrorist organizations, include and may include terror, missile and drone attacks. In the event that our facilities are damaged

as a result of hostile actions, or hostilities otherwise disrupt our ongoing operations, our ability to deliver or provide products and

services in a timely manner to meet our contractual obligations towards customers and vendors could be materially and adversely affected.

Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its present trading partners could have

a material adverse effect on our business and could make it more difficult for us to raise capital. Our insurance policies do not cover

losses that may occur as a result of events associated with war and terrorism. Although the Israeli government currently covers the reinstatement

value of direct damages that are caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will

be maintained or that it will sufficiently cover our potential damages. Any losses or damages incurred by us could have a material adverse

effect on our business. Any armed conflicts or political instability in the region would likely negatively affect business conditions

and could harm our results of operations.

Finally,

political conditions within Israel may affect our operations. Israel has held five general elections between 2019 and 2022, and prior

to October 2023, the Israeli government pursued extensive changes to Israel’s judicial system, which sparked extensive political

debate and unrest. In response to such initiative, many individuals, organizations and institutions, both within and outside of Israel,

voiced concerns that the proposed changes may negatively impact the business environment in Israel including due to reluctance of foreign

investors to invest or transact business in Israel, as well as to increased currency fluctuations, downgrades in credit rating, increased

interest rates, increased volatility in security markets and other changes in macroeconomic conditions. To date, these initiatives have

been substantially put on hold. If such changes to Israel’s judicial system are again pursued by the government and approved by

the parliament, this may have an adverse effect on our business, our results of operations and our ability to raise additional funds,

if deemed necessary by our management and board of directors.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed Pharmaceuticals Ltd. |

| |

|

|

| Date:

May 30, 2024 |

By: |

/s/

Allen Baharaff |

| |

|

Allen

Baharaff |

| |

|

President

and Chief Executive Officer |

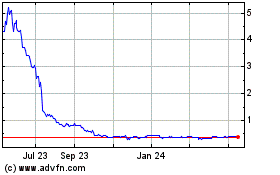

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

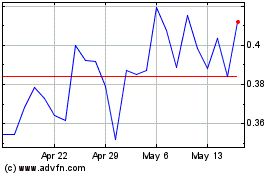

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Jan 2024 to Jan 2025