UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of June 2024

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

c/o

Meitar Law Offices Abba Hillel Silver Rd.,

Ramat

Gan, 5250608

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Galmed

Pharmaceuticals Ltd. (the “Company”) announces that it will hold an Annual General Meeting of Shareholders on Wednesday,

July 10, 2024 at 16:00 p.m. (Israel time) at the offices of Meitar | Law Offices, legal counsel to the Company at 16 Abba Hillel Silver

Rd., Ramat Gan, 5250608, Israel. A copy of the Notice of the Annual General Meeting of Shareholders and Proxy Statement and the Proxy

Card are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

This

Form 6-K is incorporated by reference into the Company’s Registration Statements on Form S-8 (Registration No. 333-206292

and 333-227441) and the Company’s Registration Statement on Form F-3 (Registration No. 333-254766).

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed

Pharmaceuticals Ltd. |

| |

|

|

| Date:

June 5, 2024 |

By: |

/s/

Allen Baharaff |

| |

|

Allen

Baharaff |

| |

|

President

and Chief Executive Officer |

Exhibit

99.1

GALMED

PHARMACEUTICALS LTD.

June

5, 2024

c/o

Meitar Law Offices 16 Abba Hillel

Silver

Rd., Ramat Gan, 5250608

Dear

Shareholder:

You

are cordially invited to attend the Annual General Meeting of Shareholders of Galmed Pharmaceuticals Ltd. (the “Company”)

to be held at 16:00 p.m., Israel time, on July 10, 2024, at the registered offices of Meitar | Law Offices, legal counsel to the Company,

at 16 Abba Hillel Silver Rd., Ramat Gan, 5250608, Israel (the “Meeting”).

You

will be asked at this Meeting to take action on the matters set forth in the attached Notice of the Annual General Meeting of Shareholders.

The Company’s board of directors is recommending that you vote “FOR” all of the Proposals on the agenda, each as specified

in the enclosed Proxy Statement.

We

look forward to personally greeting those shareholders who are able to be present at the Meeting. If you do plan to attend, we ask that

you bring with you some form of personal identification and verification of your status as a shareholder as of the close of trading on

Monday, June 3, 2024, the record date for the Meeting. However, whether or not you will be with us at the Meeting, it is important that

your shares be represented. Accordingly, you are requested to complete, date, sign and mail the enclosed proxy in the envelope provided

at your earliest convenience and in any event so as to be received by the Company in a timely manner as set forth in the enclosed Proxy

Statement.

Thank

you for your cooperation.

| |

Very

truly yours, |

| |

|

| |

/s/

Allen Baharaff |

| |

President

and Chief Executive Officer |

GALMED

PHARMACEUTICALS LTD.

16

Abba Hillel Silver Rd.,

Ramat

Gan, 5250608, Israel

PROXY

STATEMENT

NOTICE

OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To

be held on July 10, 2024

This

Proxy Statement is furnished to the holders of ordinary shares, par value of 0.15 New Israeli

Shekel per share (the “Ordinary Shares” or “Shares”) of

Galmed Pharmaceuticals Ltd. (the “Company”, “Galmed”,

“us” or “our”) for use at the Annual General Meeting of Shareholders (the “Meeting”)

to be held at the offices of Meitar | Law Offices, the Company’s legal counsel, at 16 Abba Hillel Silver Rd., Ramat Gan, 5250608,

Israel (“Meitar’s Offices”) on July 10, 2024, at 16:00 p.m. (Israel time), and at each postponement or adjournment

thereof.

The

agenda for the Meeting includes the following matters:

| |

1. |

To

approve the re-election of each of (a) Prof. Carol L. Brosgart and (b) Mr. Shmuel Nir as a Class I director, to serve as a member

of the board of directors (the “Board”) until the annual general meeting to be held in 2027 and until his or her

respective successor is duly elected and qualified; |

| |

2. |

To

approve a reverse share split of the Company’s Ordinary Shares in the range of up to 15:1, to be effected at the discretion

of, and at such ratio and in such date as shall be determined by, the Board, within 12 months of the Meeting; and to amend the Company’s

amended and restated articles of association (the “Articles”) accordingly; |

| |

3. |

To

ratify and approve a framework of terms and conditions for the extension, renewal and entering into an insurance policy for directors’

and officers’ liability, subject to, and in accordance with, the provisions of the Companies Law 5759-1999 (the “Companies

Law”); and |

| |

4. |

To

reappoint Brightman Almagor Zohar & Co., a member firm of Deloitte Touche Tohmatsu Limited, as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2024 until the 2025 annual general meeting of shareholders

(together, the “Proposals”). |

In

addition, shareholders at the Meeting will have an opportunity to review and ask questions regarding the financial statements of the

Company for the fiscal year ended December 31, 2023.

The

Company is not currently aware of any other matters to be presented at the Meeting. If other matters properly come before the Meeting,

it is the intention of the persons designated as proxies to vote in accordance with their judgment on such matters.

Record

Date; Entitlement to Vote

The

record date for determining shareholders entitled to notice of, and to vote at, the Meeting has been established as of the close of trading

on the Nasdaq Capital Market on Monday, June 3, 2024 (the “Record Date”).

As

of June 3, 2024, the Company had outstanding 6,358,747 Ordinary Shares, each of which is entitled to one vote upon the matters to be

presented at the Meeting.

Quorum

Two

or more shareholders, present in person, by proxy or by proxy card, and holding shares conferring in the aggregate more than 33.33% of

the voting power of the Company on the Record Date, shall constitute a quorum at the Meeting. Should no quorum be present within half

an hour from the time set for the Meeting, the Meeting shall be adjourned to July 17, 2024, at the same time and place. No further notice

will be given or publicized with respect to such adjourned meeting. If at such adjourned meeting a quorum is not present within half

an hour from the time stated for such meeting, any two shareholders present in person, by proxy or by proxy card, shall constitute a

quorum, even if they represent in the aggregate shares conferring 33.33% or less of the voting power of the Company on the Record Date.

Joint

holders of shares should take note that, pursuant to Section 64 of the Articles, the vote of the senior holder who tenders a vote, in

person, by proxy or by proxy card, will be accepted to the exclusion of the vote(s) of the other joint holder(s), and for this purpose

seniority will be determined by the order in which the names appear in the Company’s shareholder register.

Required

Vote and Voting Procedures

The

affirmative vote of holders of a majority of the Ordinary Shares participating and voting at the Meeting, in person, by proxy or by proxy

card is required to adopt each of the Proposals to be presented at the Meeting.

In

addition, the approval of Proposal 3 is also subject to satisfaction of one of the following additional voting requirements:

| |

● the majority voted in favor of the proposal must include a majority of the shares held by non-controlling shareholders who do not have a conflict of interest (referred to under the Companies Law as a personal interest) in the approval of this proposal, excluding abstentions and broker non-votes; or |

| |

|

|

| |

● the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the proposal must not exceed two percent (2%) of the aggregate voting rights in the Company (the “Special Majority”). |

Under

the Companies Law, a “controlling shareholder” is any shareholder that has the ability to direct a company’s

activities (other than by means of being a director or other office holder of the company). For purposes of the above special voting

requirements, to the best of our knowledge, there are no shareholders who would be deemed “controlling shareholders” of our

Company.

A

“personal interest” of a shareholder under the Companies Law: (i) includes an interest of such shareholder or any

member of the shareholder’s immediate family (i.e., spouse, sibling, parent, parent’s parent, descendent, the spouse’s

descendent, sibling or parent, and the spouse of any of those) or an interest of an entity with respect to which the shareholder (or

such a family member thereof) serves as a director or the chief executive officer, owns at least 5% of the shares or its voting rights

or has the right to appoint a director or the chief executive officer; and (ii) excludes an interest arising solely from the ownership

of shares of the Company.

A

controlling shareholder and a shareholder that possesses a personal interest are qualified to participate in the vote on Proposal 3 and

will be counted towards or against the ordinary majority required for approval of the proposal; however, the vote of any such shareholder

will not be counted towards or against the Special Majority requirement described in the first bullet point above or towards the 2% threshold

described in the second bullet point above.

A

shareholder must inform our Company before the vote (or, if voting by proxy or voting instruction form, indicate on the proxy card or

voting instruction form, or by contacting the Company as detailed below) whether such shareholder is (i) a controlling shareholder or

(ii) possesses a “personal interest” under the Companies Law (i.e., a conflict of interest) concerning the approval of Proposal

3, absent any such indication to the contrary, it will be presumed that the shareholder is not a controlling shareholder nor possesses

a “personal interest” under the Companies Law with respect to Proposal 3.

Contacting

the Company can be made via registered mail to Meitar’s Offices, Attention: Elad Ziv Adv. (for Yohai Stenzler, CPA, Chief Accounting

Officer), or via email to yohai@galmedpharma.com. A shareholder may also indicate on the above when attending the meeting in person.

To

be counted, a duly executed proxy or proxy card must be received by the Company prior to the Meeting. An instrument appointing a proxy

or a proxy card shall be in writing in a form approved by the Board and shall be delivered to Meitar’s Offices, Attention: Elad

Ziv Adv (for Yohai Stenzler, CPA, Chief Accounting Officer), or delivered to Broadridge Financial Solutions, Inc. (“Broadridge”),

at 51 Mercedes Way, Edgewood, NY 11717, in an enclosed envelope no later than 11:59 p.m. EDT on July 9, 2024, or no later than 11:59

p.m. EDT on July 16, 2024, if the Meeting was adjourned, or presented to the chairperson of the Meeting at the Meeting. Shares represented

by proxies and proxy cards received after the times specified above will not be counted as present at the Meeting and thus will not be

voted.

Shareholders

may revoke the authority granted by their execution of a proxy or a proxy card at any time before the effective exercise thereof by voting

in person at the Meeting or by either written notice of such revocation or later-dated proxy or proxy card, in each case delivered either

to the Company or Broadridge at the addresses stated above not less than four (4) hours before the time scheduled for the Meeting or

adjourned meeting or presented to the chairperson of the Meeting at the Meeting.

Ordinary

Shares represented by executed and unrevoked proxies will be voted in the manner instructed by the executing shareholder, or if no specific

instructions are given, will be voted FOR the Proposals set forth in the Notice of Annual General Meeting of Shareholders.

If

you are a record holder of shares, to vote via the internet or via telephone, please follow the instructions indicated on the proxy card.

Meeting

Agenda

In

accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company holding at least five percent

(5%) of the outstanding voting rights of the Company may submit to the Company a proposed additional agenda item for the Meeting, to

Meitar’s Offices, Attention: Elad Ziv Adv. (for Yohai Stenzler, CPA, Chief Accounting Officer), or by facsimile to +972-3-6938447,

no later than Wednesday, June 12, 2024 at 23:59 pm Israel time. To the extent that there are any additional agenda items that the Board

determines to add as a result of any such submission, the Company will publish an updated agenda and proxy card with respect to the Meeting,

no later than Thursday, June 19, 2024, which will be furnished to the U.S. Securities and Exchange Commission (the “SEC”)

on Form 6-K, and will be made available to the public on the SEC’s website at http://www.sec.gov.

COMPENSATION

OF EXECUTIVE OFFICERS AND DIRECTORS

For

information regarding compensation granted to our four most highly compensated Office Holders (as defined in the Companies Law) during

or with respect to the year ended December 31, 2023, please see Item 6B. of our annual report on Form 20-F filed with the SEC on April

4, 2024, and accessible through the Company’s website at http://galmedpharma.com/ or through the SEC’s website www.sec.gov.

PROPOSAL

1

RE-ELECTION

OF EACH OF (A) PROF. CAROL L. BROSGART AND (B) MR. SHMUEL NIR AS A CLASS I DIRECTOR, TO SERVE AS A MEMBER OF THE BOARD UNTIL THE ANNUAL

GENERAL MEETING TO BE HELD IN 2027 AND UNTIL HIS OR HER RESPECTIVE SUCCESSOR IS DULY ELECTED AND QUALIFIED

Under

our Articles, the Board consists of three classes of directors who are appointed for fixed terms of office in accordance with the Companies

Law and our Articles. Directors so elected cannot be removed from office by the shareholders until the expiration of the term of office

of their class. The directors do not receive any benefits upon the expiration of their term of office.

The

three classes of directors are Class I directors, Class II directors and Class III directors. The term of the Class I directors will

expire at the close of the Meeting; the term of the Class II directors will expire at the close of the annual general meeting of shareholders

to be held in 2025; and the term of the Class III directors will expire at the close of the annual general meeting of shareholders to

be held in 2026.

Prof.

Carol Brosgart and Mr. Shmuel Nir serve as our Class I Directors until the close of the Meeting; Mr. Allen Baharaff serves as our Class

II Director until the close of the annual general meeting of shareholders to be held in 2025; and Prof. David Sidransky and Mr. Amir

Poshinski serve as our Class III Directors until the close of the annual general meeting to be held in 2026. On May 28, 2024, our Board

resolved to recommend to the shareholders to re-elect each of Prof. Carol Brosgart and Mr. Shmuel Nir as a Class I director. Accordingly,

it is proposed to approve the re-election of Prof. Carol Brosgart and the re-election of Mr. Shmuel Nir as Class I directors until the

close of the annual general meeting to be held in 2027 and until their respective successors are duly elected and qualified.

Our

Articles provide that the minimum number of members of the Board is three (3) and the maximum number is eleven (11). The Board presently

comprises of five (5) members.

Under

the Companies Law, a nominee for service as a director in a public company may not be elected without submitting a declaration to the

Company, prior to election, specifying that he or she has the requisite qualifications to serve as a director, independent director or

external director, as applicable, and the ability to devote the appropriate time to performing his or her duties as such. A director

who ceases to meet the statutory requirements must notify the Company to that effect immediately and his or her service as a director

will expire upon submission of such notice.

Director

Compensation

If

re-elected, and in accordance with the approval of our remuneration committee and the Board, Prof. Brosgart will be entitled to receive

an annual fee in the amount of $40,000 plus VAT which is the fee paid to our directors, and Mr. Nir will be entitled to receive an annual

fee in the amount of $50,000 plus VAT (which is the fee paid to our expert external directors), payable on a quarterly basis at the end

of each quarter.

If

re-elected, each of Prof. Brosgart and Mr. Nir will also be entitled to the same directors’ and officers’ liability insurance

coverage and indemnification and exculpation arrangements available to all officers and directors of the Company.

Election

of Director

Below

is the biographical information for Prof. Brosgart and Mr. Nir:

Prof.

Carol Brosgart, M.D., joined our Board on June 7, 2017. Dr. Brosgart served as a member of Tobira Therapeutics’s Board of Directors

from 2009 until it was acquired by Allergan in 2016 and on the Board of Juvaris, a vaccine company. Since January 2018, she serves on

the Board of Directors of Abivax, a biotechnology company, headquartered in Paris, working on HIV Cure and inflammatory diseases. Dr.

Brosgart serves as a consultant to Dynavax, Allergan and a number of biotechnology companies in the areas of liver diseases and infectious

diseases and on the Board of Enochian, focusing on HIV Cure. Dr. Brosgart currently serves on the Steering Committee of the National

Viral Hepatitis Roundtable, the Executive Committee of the Forum for Collaborative Research, the Steering Committee of the HBV Cure Group

at the Forum, and is on the Board of Directors of the Hepatitis B Foundation and the Northern California American Liver Foundation and

the Board of Berkeley Community Scholars. She is active in the public policy arena for AASLD and IDSA/HIVMA. Dr. Brosgart served as Senior

Advisor on Science and Policy to the Division of Viral Hepatitis at the CDC and to the Viral Hepatitis Action Coalition at the CDC Foundation

from 2011 to 2013. Dr. Brosgart has also served as a member of the clinical faculty of the School of Medicine at the University of California,

San Francisco for the past four decades, where she is a Clinical Professor of Medicine, Biostatistics and Epidemiology in the Division

of Global Health and Infectious Diseases. In 2011, Dr. Brosgart served as Chief Medical Officer at biotechnology company Alios BioPharma,

Inc. Prior to Alios, Dr. Brosgart served as Senior Vice President and Chief Medical Officer of Children’s Hospital & Research

Center in Oakland, California, from 2009 until February 2011. Previously, she served for eleven years, from 1998 until 2009, at the biopharmaceutical

company Gilead Sciences, Inc., where she held a number of senior management roles, most recently as Vice President, Public Health and

Policy and earlier as Vice President, Clinical Research and Vice President, Medical Affairs. Prior to Gilead, Dr. Brosgart was the Medical

Director of the East Bay AIDS Center in Berkeley, California (1987-1998) and the Medical Director of the Central Health Center for the

Alameda County Public Health Department (1978-1987). Dr. Brosgart received a B.S. in Community Medicine from the University of California,

Berkeley and received an M.D. from the University of California, San Francisco. Her residency training was in pediatrics, public health

and preventive medicine at UCSF and UC Berkeley School of Public Health. She has published extensively in the areas of HIV, HBV, CMV,

and liver disease.

Shmuel

Nir, a director of the Company since 2007, serves as President and Chief Executive Officer of Tushia Consulting Engineers Ltd., an

investment and management services company. From January 2001 to January 2016, Mr. Nir served as Chairman of the board of directors of

Matan Digital Printers Ltd. From March 1998 to January 2008, he served as President and Chief Executive Officer of Macpell Industries

Ltd., a leading industrial group. Between January 1991 and March 1998, Mr. Nir was an Executive Vice President of Operations at Macpell

Industries Ltd. and President and Chief Executive Officer of two of its subsidiaries, New Net Industries Ltd. and New Net Assets Ltd.

Prior to January 1991, Mr. Nir had held various positions with Intel Corporation in Jerusalem, Israel and Tefen Management Consulting.

Between 1999 and 2006, Mr. Nir served as managing partner at Spring Venture Capital Fund. Mr. Nir holds a B.Sc. in Industrial Engineering

and Management from the Technion - Israel Institute of Technology in Haifa, which was awarded in 1989.

Proposed

Resolution

It

is proposed that the following resolution be adopted at the Meeting:

“RESOLVED,

to re-elect each of Prof. Brosgart and Mr. Nir as a Class I director to serve as a member of the Board until the close of the annual

general meeting to be held in 2027, and until hir or her respective successor is duly elected and qualified, as detailed in the Proxy

Statement dated June 5, 2024.”

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

PROPOSAL

2

REVERSE

SHARE SPLIT OF THE COMPANY’S ORDINARY SHARES IN THE RANGE OF UP TO 15:1

Background

On

September 19, 2023, we received a notification from the Nasdaq Stock Market LLC (“Nasdaq”)

that we are not in compliance with the minimum bid price requirement for continued listing, as set forth in Listing Rule 5550(a)(2),

which requires listed securities to maintain a minimum bid price of $1.00 per share, and that we had 180 calendar days, until March 18,

2024 (the “Initial Period”), to regain compliance with the minimum bid price requirement. We did not regain compliance

with the minimum $1.00 bid price per share requirement during the Initial Period. Since we did not regain compliance by March 18, 2024,

we requested and received from The Nasdaq Capital Market an additional 180-day compliance period to cure the deficiency, until September

16, 2024 (the “Extension Period”). We can regain compliance if, by the end of the Extension Period, the closing bid

price of our Ordinary Shares is at least $1.00 for a minimum of ten consecutive business days. If we cannot demonstrate compliance by

the end of the Extension Period, the Nasdaq staff may notify us that our Ordinary Shares are subject to delisting. If our Ordinary Shares’

bid price does not demonstrate compliance by itself during the abovementioned timeframe, the proposed reverse share split is intended

to adjust our Ordinary Shares’ bid price. If the reverse share split is authorized by our shareholders, our Board will have the

discretion, within 12 months following the date of the Meeting, to implement the reverse share split at a ratio within the range that

was approved by the shareholders or effect no reverse share split at all.

Due

to the decrease in the share price of the Company’s Ordinary Shares, we believe that a reverse share split of our Ordinary Shares

is advisable in order to make our Ordinary Shares more attractive to a broader range of investors, including professional investors,

institutional investors and the general investing public. Our Board believes that the anticipated increased price resulting from the

reverse share split may generate additional interest and trading in our Ordinary Shares.

We

are therefore seeking approval of the shareholders to approve a reverse share split of the Company’s Ordinary Shares in the range

of up to 15:1, to be effected at the discretion of, and at such ratio and at such date as shall be determined by the Board (the “Reverse

Split”), and subject to and upon such determination, to amend the Company’s Articles accordingly. If the Reverse Split

is approved by our shareholders, then the Board will have the authority to decide whether and when to implement the Reverse Split and

to determine the exact ratio for the Reverse Split within the range. Following such determination, if any, by our Board, we will issue

a press release or file a Form 6-K with the SEC announcing the effective date of the Reverse Split and will amend our Articles accordingly

to effect such Reverse Split. The Company is required to give notice to Nasdaq at least 5 calendar days prior to the record date of a

Reverse Split.

If

the Reverse Split is implemented, the number of authorized shares including the issued and outstanding Ordinary Shares would be reduced

in accordance with the Reverse Split ratio selected by the Board and the par value per ordinary share will be increased proportionately.

Furthermore, upon completion of the Reverse Split, the number of Ordinary Shares issuable pursuant to our 2013 Incentive Share Option

Plan (the “Plan”), as well as the number of shares and exercise prices

subject to outstanding options under the Plan and the number of shares subject to outstanding RSUs under the Plan shall be appropriately

adjusted.

In

the event that the Company’s shareholders do not approve the Reverse Split and the proposed amendments to the Company’s Articles

and the Company does not otherwise regain compliance with the minimum bid price requirements in the requisite time period, the Company’s

Ordinary Shares will likely be delisted from trading on the Nasdaq Capital Market. Delisting could also negatively impact the Company’s

ability to secure additional financing. Accordingly, the Board recommends that the shareholders vote to approve the Reverse Split as

described above, on a date and at such ratio to be determined by our Board, which will be announced by the Company and to authorize the

Company to amend the Articles accordingly.

Implementation

of Reverse Split

If

our shareholders approve the Reverse Split and our Board decides to effectuate the Reverse Split, each block of up to 15 (depending on

the final Reverse Split ratio determined by the Board) Ordinary Shares issued and outstanding will be reclassified and changed into one

fully paid and non-assessable ordinary share of the Company. In addition, the number of authorized Ordinary Shares that the Company may

issue will be reclassified, and proportionately decreased in accordance with the Reverse Split ratio.

Upon

the implementation of the Reverse Split, we intend to treat shares held by shareholders through a bank, broker, custodian or other nominee

in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers, custodians or other nominees

will be instructed to effect the Reverse Split for their beneficial holders holding our Ordinary Shares in street name. However, these

banks, brokers, custodians or other nominees may have different procedures than registered shareholders for processing the Reverse Split.

Shareholders who hold our Ordinary Shares with a bank, broker, custodian or other nominee and who have any questions in this regard are

encouraged to contact their banks, brokers, custodians or other nominees.

Our

registered holders of Ordinary Shares hold their shares electronically in book-entry form with the transfer agent. These shareholders

do not have share certificates evidencing their ownership of their Ordinary Shares. They are, however, provided with a statement reflecting

the number of shares registered in their accounts. Registered holders who hold shares electronically in book-entry form with the transfer

agent will not need to take action (the exchange will be automatic) to receive whole shares of post-Reverse Split Ordinary Shares. No

fractional shares will be issued as a result of the Reverse Split. In accordance with our Articles, all fractional shares will be rounded

to the nearest whole ordinary share, such that only shareholders holding fractional consolidated shares of more than half of the number

of shares which consolidation constitutes one whole share, shall be entitled to receive one consolidated share.

Certain

Risks Associated with the Reverse Split

There

are numerous factors and contingencies that could affect our price following the proposed Reverse Split, including the status of the

market for our Ordinary Shares at the time, our reported results of operations in future periods, and general economic, market and industry

conditions. Accordingly, the market price of our Ordinary Shares may not be sustainable at the direct arithmetic result of the Reverse

Split. If the market price of our Ordinary Shares declines after the Reverse Split, our total market capitalization (the aggregate value

of all of our outstanding Ordinary Shares at the then existing market price) after the Reverse Split will be lower than before the Reverse

Split.

The

Reverse Split may result in some shareholders owning “odd lots” of less than 100 Ordinary Shares on a post-split basis. Odd

lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of

even multiples of 100 shares.

Material

U.S. Federal Income Tax Consequences

The

following is a summary of the material U.S. federal income tax consequences of the Reverse Split to U.S. Holders (as defined below) of

our Ordinary Shares. This summary does not purport to be a complete discussion of all of the possible U.S. federal income tax consequences.

Further, it does not address the impact of the Medicare surtax on certain net investment income or the alternative minimum tax, U.S.

federal estate or gift tax laws, any state, local or foreign income or other tax consequences or any tax treaties. Also, it does not

address the tax consequences to holders that are subject to special tax rules, such as (i) persons who are not U.S. Holders; (ii) banks,

insurance companies, or other financial institutions; (iii) regulated investment companies; (iv) tax-qualified retirement plans; (v)

dealers in securities and foreign currencies; (vi) persons whose functional currency is not the U.S. dollar; (vii) traders in securities

that use the mark-to-market method of accounting for U.S. federal income tax purposes; (viii) persons deemed to sell our Ordinary Shares

under the constructive sale provisions of the Code; (ix) persons that acquired our Ordinary Shares through the exercise of employee stock

options or otherwise as compensation or through a tax-qualified retirement plan; (x) persons that hold our Ordinary Shares as part of

a straddle, appreciated financial position, synthetic security, hedge, conversion transaction or other integrated investment or risk

reduction transaction; (xi) persons that own, directly, indirectly or constructively, at any time, Ordinary Shares representing 5% or

more of our voting power or value; (xii) certain former citizens or long-term residents of the United States; and (xiii) tax-exempt entities

or governmental organizations.

As

used herein, the term “U.S. Holder” means a beneficial owner of our Ordinary Shares that is (i) an individual citizen or

resident of the United States, (ii) a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) that

is created or organized (or treated as created or organized) in or under the laws of the United States, any state thereof or the District

of Columbia, (iii) an estate whose income is includible in gross income for U.S. federal income tax purposes regardless of its source,

or (iv) a trust if (x) a U.S. court can exercise primary supervision over the trust’s administration and one or more U.S. persons

are authorized to control all substantial decisions of the trust, or (y) it has a valid election in effect under applicable U.S. Treasury

regulations to be treated as a U.S. person.

The

discussion is based on the Internal Revenue Code of 1986, as amended, or the Code, U.S. Treasury regulations, administrative rulings

and judicial authority as of the date hereof, all of which are subject to change or differing interpretations, possibly with retroactive

effect. This summary also assumes that the Ordinary Shares prior to the Reverse Split, or the Old Shares, were, and the Ordinary Shares

after the Reverse Split, or the New Shares, will be, held as a “capital asset,” as defined within the meaning of Section

1221 of the Code (i.e., generally, property held for investment). The tax treatment of a U.S. Holder may vary depending upon the particular

facts and circumstances of such U.S. Holder. Each shareholder is urged to consult with such shareholder’s own tax advisor with

respect to the tax consequences of the Reverse Split.

If

a partnership (or other entity or arrangement classified as a partnership for U.S. federal income tax purposes) is the beneficial owner

of our Ordinary Shares, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of

the partner and the activities of the partnership. Partnerships that hold our Ordinary Shares, and partners in such partnerships, should

consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Split.

We

have not sought and will not seek any ruling from the Internal Revenue Service, or the IRS, or an opinion from counsel, with respect

to the U.S. federal income tax consequences of the Reverse Split. Our view regarding the tax consequences of the Reverse Split is not

binding on the IRS or the courts. Moreover, there can be no assurance that the IRS or a court will agree with such statements and conclusions.

The

Reverse Split is intended to constitute a “recapitalization” for U.S. federal income tax purposes. Therefore, subject to

the discussion regarding passive foreign investment company, or PFIC, status below, no gain or loss should be recognized by a U.S. Holder

upon such U.S. Holder’s exchange (or deemed exchange) of Old Shares for New Shares pursuant to the Reverse Split. The aggregate

tax basis of the New Shares received (or deemed received) in the Reverse Split should be the same as the U.S. Holder’s aggregate

tax basis in the Old Shares exchanged (or deemed exchanged) therefor. The U.S. Holder’s holding period for the New Shares should

include the period during which the U.S. Holder held the Old Shares surrendered (or deemed surrendered) in the Reverse Split. U.S. holders

that hold Ordinary Shares acquired on different dates and at different prices should consult their tax advisors regarding identifying

the bases and holding periods of the particular Ordinary Shares they hold after the Reverse Split.

Pursuant

to Section 1291(f) of the Code, to the extent provided in U.S. Treasury regulations, if a U.S. person transfers stock in a PFIC in a

transaction that does not result in full recognition of gain, then any unrecognized gain is required to be recognized notwithstanding

any non-recognition provision in the Code. The U.S. Treasury has issued proposed regulations under Section 1291(f) of the Code, but they

have not been finalized. The IRS could take the position that Section 1291(f) of the Code is effective even in the absence of finalized

regulations, or the regulations could be finalized with retroactive effect. Accordingly, no assurances can be provided as to the potential

applicability of Section 1291(f) of the Code to the Reverse Split.

We

believe that the Company was a PFIC for the taxable year ended December 31, 2023, and may be a PFIC for the taxable year ending December

31, 2024. However, the Company’s actual PFIC status for the current taxable year or any subsequent taxable year is uncertain and

will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance with respect to the Company’s

status as a PFIC for the taxable year ending December 31, 2024, or any subsequent taxable year. If the Company is treated as a PFIC with

respect to a U.S. Holder and Section 1291(f) applies to the U.S. Holder’s exchange (or deemed exchange) of Old Shares for New Shares

pursuant to the Reverse Split, the U.S. Holder may be required to recognize any gain realized on such transfer, in which case such gain

generally would be subject to the “excess distribution” rules under Section 1291 of the Code. U.S. Holders should consult

their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Split if the Company were treated as a PFIC.

Each

shareholder should consult with his, her or its own tax advisor with respect to all of the potential tax consequences to such shareholder

of the Reverse Split, including the applicability and effect of any state, local, and non-U.S. tax laws, as well as U.S. federal tax

laws and any applicable tax treaties.

THE

U.S. CONSEQUENCES OF THE REVERSE SPLIT MAY DEPEND UPON THE PARTICULAR CIRCUMSTANCES OF EACH SHAREHOLDER. ACCORDINGLY, EACH SHAREHOLDER

IS ADVISED TO CONSULT THE SHAREHOLDER’S TAX ADVISOR WITH RESPECT TO ALL OF THE POTENTIAL TAX CONSEQUENCES TO THE SHAREHOLDER OF

THE REVERSE SPLIT.

Proposed

Resolution

It

is proposed that the following resolution be adopted at the Meeting:

“RESOLVED,

to approve a reverse share split of the Company’s Ordinary Shares in the range of up to 15:1, to be effected at the discretion

of, and at such ratio and at such date as shall be determined by the Board of Directors of the Company within twelve months of the Meeting;

and to amend the Company’s Articles of Association accordingly.”

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

PROPOSAL

3

RATIFICATION

AND APPROVAL OF A FRAMEWORK OF TERMS AND CONDITIONS FOR THE EXTENSION, RENEWAL AND ENTERING INTO AN INSURANCE POLICY FOR DIRECTORS’

AND OFFICERS’ LIABILITY

The

Companies Law and our Articles of Association provide that a company may obtain insurance for an office holder against liabilities incurred

with respect to an act or omission in his or her capacity as an office holder (subject to certain limitations and conditions which

are further described in the Companies Law and our Articles of Association). The Company previously

purchased a professional liability insurance policy with an annual premium of $0.4 million and a total coverage of $10 million with an

additional $5 million Side A Coverage (the “Previous Insurance Policy”). Following the approval of this

Resolution by the shareholders of the Company, the Company will obtain a new insurance coverage for its directors and officers, who are

appointed from time to time, which the Company expects will be on similar terms as the Previous Insurance Policy (the “Insurance

Policy”). The Company’s current amended and restated compensation policy with respect to the terms of office and employment

of the Company’s office holders, or the Compensation Policy, was adopted by the Board on May 30, 2023, and will remain in effect

for a period of three years according to the Companies Law, unless replaced prior. The Compensation Policy was approved in accordance

with the mechanism set forth in the Companies Law, which allows the Board to approve the Compensation Policy, notwithstanding the resolution

of the general meeting on May 11, 2023 (the “Overruling Mechanism”). Due to the use of the overruling mechanism, the

approval of our shareholders is required for approving a new framework for the renewal of our insurance policy as described in this Proposal.

Our

remuneration committee and Board approved, and recommend the shareholders to approve, to authorized the Company, from time to time and

for up to a period of three years from the date of the Meeting, to extend and/or renew the insurance policy or enter into a new insurance

policy, with the same insurers or any other insurers, in Israel or overseas, for the insurance of directors’ and officers’

liability with respect to the directors and/or officers serving the Company and its subsidiaries from time to time, provided that the

insurance complies with the limitations included in our Compensation Policy, as amended from time to time. Maintaining a D&O insurance

policy in effect is a crucial element in maintaining Company’s on-going conduct of business.

Proposed

Resolution

It

is proposed that the following resolutions be adopted at the Meeting:

“RESOLVED,

to approve and ratify the purchase of a professional liability insurance policy for our current and future directors and officers,

in compliance with the requirements of the Companies Law and the terms and limitations included in the Compensation Policy, as amended,

and the framework of terms and conditions for the renewal, extension and replacement of the directors’ and officers’ liability

insurance policy of the Company as set forth in the Proxy Statement, dated June 5, 2024.”

The

approval of the above resolution requires approval by a Special Majority.

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

PROPOSAL

4

RE-APPOINTMENT

OF Brightman Almagor Zohar & Co., a member firm of Deloitte Touche Tohmatsu Limited, as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2024 and until the 2025 annual general meeting of shareholders

At

the Meeting, Brightman Almagor Zohar & Co., independent registered public accountants in Israel and a member firm of Deloitte Touche

Tohmatsu Limited, will be nominated for re-appointment as the auditors of the Company for the fiscal year ending December 31, 2024, and

until the 2025 annual general meeting of shareholders.

Pursuant

to the provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), Israeli law and our Articles, the

appointment of our independent auditors requires the approval of the shareholders of the Company following the approvals of the Board

and the audit committee, and their compensation requires the approval of the Board, following approval and recommendation by the audit

committee. Our Board has delegated its authority to approve the compensation of independent auditors for audit and non-audit services

to our audit committee. Our audit committee and Board have reviewed, and are satisfied with, the performance of Brightman Almagor Zohar

& Co., and have approved and are recommending the shareholders to approve, their re-appointment as the Company’s independent

auditors.

One

of our audit committee’s main roles is to assist the Board in fulfilling its responsibility for oversight of the quality and integrity

of the accounting, auditing and reporting practices of the Company. The audit committee oversees the appointment, compensation, and oversight

of the public accounting firm engaged to prepare or issue an audit report on the financial statements of the Company.

Our

audit committee has adopted a pre-approval policy for the engagement of our independent auditors to perform certain audit and non-audit

services. Pursuant to this policy, which is designed to assure that such engagements do not impair the independence of our auditors,

the audit committee pre-approves annually a list of specific audit and non-audit services in the categories of audit services, audit-related

services, tax services and other services that may be performed by our independent auditors. If a type of service that is to be provided

by our auditors has not received such general pre-approval, it will require specific pre-approval by our audit committee. The policy

prohibits retention of our independent auditors to perform prohibited non-audit functions defined in applicable SEC rules.

The

following table provides information regarding fees paid by the Company to Brightman Almagor Zohar & Co. and other member firms of

Deloitte Touche Tohmatsu Limited for all services, including audit services, for the years ended December 31, 2023 and 2022:

| | |

2023 | | |

2022 | |

| | |

(US$

in thousands) | |

| Audit Fees (1) | |

| 120 | | |

| 120 | |

| Audit-Related fees (2) | |

| 40 | | |

| 20 | |

| Tax Fees (3) | |

| 0 | | |

| 27 | |

| Total | |

| 160 | | |

| 167 | |

| |

(1) |

Includes professional services rendered

in connection with the audit of our annual financial statements and the review of our interim financial statements. |

| |

(2) |

Audit related services consist of services

that were reasonably related to the performance of the audit or reviews of our financial statements and not included under “Audit

Fees” above, including, principally, providing consents for registration statement filings. |

| |

(3) |

Tax fees consist of services related to

obtaining a tax rulings. |

Proposed

Resolution

It

is proposed that the following resolution be adopted at the Meeting:

“RESOLVED,

to reappoint the Company’s auditors, Brightman Almagor Zohar & Co., an independent registered public accountant in Israel and

a member firm of Deloitte Touche Tohmatsu Limited, as auditors of the Company for the fiscal year ending December 31, 2024, and until

the 2025 annual general meeting of shareholders.”

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

PRESENTATION

OF THE 2023 FINANCIAL STATEMENTS

The

Board has approved, and is presenting to shareholders for receipt and consideration at the Meeting, the Company’s annual consolidated

financial statements for the year ended December 31, 2023, which are included in the Company’s annual report on Form 20-F filed

with the SEC on April 4, 2024, and accessible through the Company’s website at http://galmedpharma.com/ or through the SEC’s

website www.sec.gov.

OTHER

BUSINESS

Other

than as set forth above, management knows of no business to be transacted at the Meeting. If any other matters are properly presented

at the Meeting, ordinary shares represented by executed and unrevoked proxies will be voted by the persons named in the enclosed form

of proxy upon such matters in accordance with their best judgment.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Prof. David Sidransky

|

| |

Lead

Independent Director |

| Ramat

Gan, Israel |

|

| June

5, 2024 |

|

Exhibit

99.2

EACH

SHAREHOLDER IS URGED TO COMPLETE, DATE, SIGN AND PROMPTLY

RETURN

THE ENCLOSED PROXY

Annual

General Meeting of Shareholders of

GALMED

PHARMACEUTICALS LTD.

July

10, 2024

NOTICE

OF INTERNET AVAILABILITY OF PROXY MATERIAL:

The

notice of the meeting, proxy statement and proxy card

are

available at http://galmedpharma.investorroom.com/

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The

undersigned hereby constitutes and appoints each of Mr. Yohai Stenzler, CPA, Chief Accounting Officer, Guy Nehemya, Chief Operating Officer,

and anyone on their behalf as the true and lawful attorneys, agents and proxies of the undersigned, with full power of substitution,

to vote with respect to all ordinary shares, par value NIS 0.15 per share, of Galmed Pharmaceuticals Ltd. (the “Company”),

standing in the name of the undersigned at the close of trading on June 3, 2024, at an Annual General Meeting of Shareholders of the

Company to be held at the offices of Meitar | Law Offices, legal counsel to the Company, at 16 Hillel Silver Rd., Ramat Gan, 5250608,

Israel on Wednesday, July 10, 2024, at 16:00 p.m., Israel time, and at any and all adjournments thereof, with all the power that the

undersigned would possess if personally present and especially (but without limiting the general authorization and power hereby given)

to vote as specified on the reverse side.

The

shares represented by this proxy will be voted in the manner directed and, if no instructions to the contrary are indicated, will be

voted “FOR” the proposals on the agenda (the “Proposals”), as specified in the enclosed proxy statement

(the “Proxy Statement”). Capitalized terms used but not defined herein shall have the meanings given to them in the Proxy

Statement.

The

undersigned hereby acknowledges receipt of the Notice of Annual General Meeting of Shareholders and the Proxy Statement furnished therewith.

IF

YOU ARE A CONTROLLING SHAREHOLDER OR HAVE A PERSONAL INTERESRT IN THE APPROVAL OF PROPOSAL 3, PLEASE NOTIFY THE COMPANY’S LEGAL

COUNSEL, AT MEITAR LAW OFFICES, 16 ABBA HILLEL SILVER RD., RAMAT GAN, 5250608, ATTENTION: ELAD ZIV, ADV., (FOR YOHAI STENZLER, CPA, CHIEF

ACCOUNTING OFFICER). PLEASE SEE THE PROXY STATMENT FOR A FURTHER EXPLANATION AS TO WHO IS CONSIDERED A CONTROLLING SHAREHOLDER OR HAVE

A PERSONAL INTERESRT IN THE VOTE.

(Continued

and to be Signed on Reverse Side)

| |

VOTE

BY MAIL |

| |

|

| |

Mark,

sign and date your proxy card and return it in the envelope we have provided. |

| |

|

| |

VOTE

IN PERSON |

| |

|

| |

If

you would like to vote in person, please attend the Annual General Meeting to be held at 16 Hillel Silver Rd., Ramat Gan, 5250608,

Israel on Wednesday, July 10, 2024, at 16:00 p.m. Israel time. |

Please

Vote, Sign, Date and Return Promptly in the Enclosed Envelope.

Annual

General Meeting Proxy Card – Ordinary Shares

DETACH

PROXY CARD HERE TO VOTE BY MAIL

DETACH

PROXY CARD HERE TO VOTE BY MAIL

| |

|

For |

Against |

Abstain |

| 1.a. |

To

approve the re-election of Prof. Carol L. Brosgart as a Class I director, to serve as a member of the Board until the annual general

meeting to be held in 2027 and until her successor is duly elected and qualified. |

☐ |

☐ |

☐ |

| 1.b. |

To

approve the re-election of Mr. Shmuel Nir as a Class I director, to serve as a member of the Board until the annual general meeting

to be held in 2027 and until his successor is duly elected and qualified. |

☐ |

☐ |

☐ |

| 2. |

To

approve a reverse share split of the Company’s Ordinary Shares in the range of up to 15:1, to be effected at the discretion

of, and at such ratio and in such date as shall be determined by the Board, within 12 months of the Meeting; and to amend the Company’s

amended and restated articles of association accordingly. |

☐ |

☐ |

☐ |

| 3. |

To

ratify and approve a framework of terms and conditions for the extension, renewal and entering into an insurance policy for directors’

and officers’ liability, subject to, and in accordance with, the provisions of the Companies Law 5759-1999; and |

☐ |

☐ |

☐ |

| 3A. |

Are

you a controlling shareholder or do you have a personal interest in the approval of Proposal 3? (Please note: If you do not mark

either ‘FOR’ or ‘AGAINST’, or otherwise contact the Company, we will assume that you are not a controlling

shareholder and do not have a personal interest in the approval of Proposal 3). |

☐ |

☐ |

|

| 4. |

To

reappoint the Company’s auditors, Brightman Almagor Zohar & Co., an independent registered public accountant in Israel

and a member firm of Deloitte Touche Tohmatsu Limited, as auditors of the Company for the fiscal year ending December 31, 2024, and

until the 2025 annual general meeting of shareholders. |

☐ |

☐ |

☐ |

| Date

|

|

Signature

|

|

Signature,

if held jointly |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| To

change the address on your account, please check the box at right and indicate your new address. |

|

☐ |

Note:

This proxy must be signed exactly as the name appears hereon. When shares are held jointly, each holder should sign. When signing as

executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full

corporate name by a duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by

an authorized person.

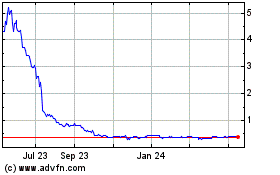

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

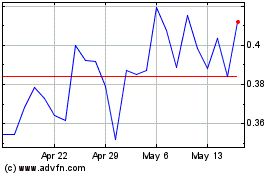

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Jan 2024 to Jan 2025