false

0000109657

0000109657

2024-06-03

2024-06-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report:

(Date

of earliest event reported)

June

3, 2024

GT

Biopharma, Inc.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other Jurisdiction of Incorporation)

1-40023

|

|

94-1620407

|

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

8000

Marina Blvd., Suite 100

Brisbane,

CA 94005

(Address

of Principal Executive Offices and zip code)

(800)

304-9888

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each Exchange on which registered |

| Common

stock, $0.001 par value |

|

GTBP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

June 3, 2024, Manu Ohri’s employment as Chief Financial Officer at GT Biopharma, Inc. (the “Company”) was terminated.

In

connection with Mr. Ohri’s termination, on June 3, 2024, the Company has appointed Alan L. Urban as the Company’s

Chief Financial Officer. Mr. Urban, age 55, has previously served as a member of the Board of Directors of the Company from June 2022

to May 2023; as Chief Financial Officer for SRAX, Inc. (OTC: SRAX), a financial technology company, from March 2023 to July 2023; as

Chief Financial Officer for Creek Road Miners, Inc. (formerly OTC: CRKR), a cryptocurrency mining company, from November 2021 to March

2023; and as Chief Financial Officer and Secretary for Research Solutions, Inc. (NASDAQ: RSSS), a SaaS and content provider in the scientific,

technical and medical information space, from October 2011 to October 2021. Earlier in his career, Mr. Urban served as Chief Financial

Officer and Senior Vice President of Finance and Accounting for ReachLocal, Inc. (NASDAQ: RLOC), an internet marketing company;

and as Vice President of Finance and Treasurer for Infotrieve, Inc., a content provider in the scientific, technical and medical information

space. He has been a Certified Public Accountant (currently inactive) since 1998. Mr. Urban received a B.S. in Business, with a concentration

in Accounting Theory and Practice, from California State University, Northridge.

On June 7, 2024, the Company entered into an Employment Agreement with

Mr. Urban (the “Employment Agreement”). The Employment Agreement is effective from June 3, 2024 (the “Effective Date”)

and shall continue for a period of one year. The Employment Agreement shall automatically renew for successive one year periods unless

and until either party provides sixty (60) days’ advance written notice prior to applicable renewal term. Pursuant to the Employment Agreement,

Mr. Urban will receive an annual base salary of $375,000 and is eligible to earn an annual discretionary bonus of up to 40% of his annual

base salary each calendar year during the term, subject to the achievement of applicable Company and individual performance goals, as

determined in the Company’s sole discretion. Mr. Urban is eligible to receive a stock award of the Registrant’s Common Stock

following the three months after the Effective Date. The Employment Agreement further provides that Mr. Urban will be eligible to receive

any benefit and participate in any benefit plan generally available to employees of the Company.

The Company may terminate the Employment Agreement without Cause (as such

term is defined in the Employment Agreement) at any time and Mr. Urban may terminate his employment for Good Reason (as such term is defined

in the Employment Agreement) at any time. Upon a termination of Mr. Urban’s employment by the Company without Cause or by Mr. Urban

for Good Reason, Mr. Urban will be entitled to receive (i) for a termination or resignation that occurs during the first six months following

the Effective Date, a cash severance equal to two (2) months of Mr. Urban’s then current Annual Base Salary (as such term is defined

in the Employment Agreement) or (ii) for a termination or resignation that occurs any time thereafter, a cash severance equal to five

(5) months of Mr. Urban’s then current Annual Base Salary, in either case less deductions and withholding required by law, payable

in a lump sum within seventy (70) days of the termination of employment (or such shorter period as may allow the severance payment to

be exempt from Code Section 409A). Upon a termination of Mr. Urban’s employment by the Company for Cause or by Mr. Urban without

Good Reason, Mr. Urban will be entitled to the Accrued Amounts (as such term is defined in the Employment Agreement).

The Employment Agreement also contains certain non-disclosure covenants

that apply during his employment and thereafter.

The foregoing summary of the Employment Agreement is qualified in its entirety

by reference to the full text of the agreement, which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits

*Registrant

has omitted schedules and exhibits pursuant to Item 601(b)(2) of Regulation S-K. The Registrant agrees to furnish supplementally a copy

of the omitted schedules and exhibits to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GT

BIOPHARMA, INC. |

| |

|

|

| Date:

June 7, 2024 |

By: |

/s/

Alan Urban |

| |

|

Alan

Urban |

| |

|

Chief

Financial Officer |

Exhibit

10.1

EMPLOYMENT

AGREEMENT

This

EMPLOYMENT AGREEMENT (“Agreement”) is made and entered into as of June 7th, 2024, by and between GT Biopharma, Inc.

(the “Company”), and Alan Urban (“Employee”). This Agreement may sometimes refer to the Company

or Employee singularly as a “Party” or collectively as the “Parties.”

Article

I.

EMPLOYMENT and duties

1.1

Commencement of Employment. The Company agrees to employ Employee, and Employee hereby accepts employment with the Company, upon

the terms and conditions set forth in this Agreement, commencing on June 3rd, 2024 (the “Effective Date”).

1.2

Term. The Employee’s employment with the Company under this Agreement will commence on the Effective Date and shall continue

for a period of one (1) year (the “Initial Term”) unless either Party terminates the Employee’s employment in accordance

with Sections 1.3, 1.4 or 1.5 below; provided that on the one (1) year anniversary of the Effective Date and each annual anniversary

thereafter (such date and each annual anniversary thereof, a “Renewal Date”), the Agreement shall be deemed to be automatically

extended, upon the same terms and conditions, for successive periods of one (1) year (each a “Renewal Term” and, together

with the Initial Term, the “Term”), unless either Party provides written notice of its intention not to extend the term of

the Agreement at least sixty (60) days prior to the applicable Renewal Date. In addition, following the Initial Term, either party may

terminate this Agreement in accordance with Sections 1.3, 1.4 or 1.5 below.

1.3

Termination by Employee for Good Reason. The Employee may terminate this Agreement and Employee’s employment at any time

for Good Reason. For purposes of this Agreement, “Good Reason” means Employee voluntarily terminates Employee’s employment

with the Company after the occurrence of one or more of the following circumstances, without Employee’s advance written consent:

(i) a material reduction in Employee’s Annual Base Salary or (ii) any material diminution in the level of Employee’s job

title. Any event described above shall constitute Good Reason only if Employee provides the Company with written notice of the basis

for a Good Reason termination (and specifying in reasonable detail the actions or inactions giving rise thereto) within sixty (60) days

of the initial actions or inactions of the Company giving rise to such Good Reason. The notice must specify an effective date of termination

that is not less than thirty (30) days, nor more than forty-five (45) days, after the date of the written notice, and Employee agrees

that should the Company remedy the basis as reasonably determined by Employee for such resignation prior to the effective date of termination

specified in Employee’s written notice, then Employee’s resignation will not be considered a resignation for Good Reason.

1.4

Termination by the Company for Cause. The Company may terminate this Agreement and the Employee’s employment immediately

and at any time for Cause. For purposes of this Agreement, “Cause” shall mean (i) poor performance, gross negligence or willful

misconduct with respect to the performance of Employee’s duties for the Company, which, for clarity, shall include all duties expected

to be performed by a competent and diligent Chief Financial Officer of a publicly listed company including but not limited to the preparation

and submission of all filings and financial and accounting information on a timely basis; (ii) Employee’s breach or violation,

in any material respect, of any agreement between Employee and the Company, or any policy of the Company, including but not limited to

the Company’s Confidential Information and Invention Assignment Agreement; (iii) Employee’s commission of a material act

of dishonesty or breach of trust with regard to the Company; or (iv) Employee’s performance of any act or omission with respect

to which, if Employee were prosecuted, would constitute a felony or a misdemeanor involving a crime of dishonesty, fraud or moral turpitude.

In all cases, Cause shall be determined in the Company’s sole discretion.

1.5

Notwithstanding the foregoing, (i) the Company may terminate the Agreement and Employee’s employment at any time without Cause

by providing Employee with one (1) month’s notice in accordance with Section 4.5 below or pay in lieu thereof and (ii) the

Employee may terminate the Agreement and Employee’s employment at any time without Good Reason by providing the Company with one

(1) month’s notice in accordance with Section 4.5. The Parties acknowledge and agree that if Employee fails to provide one

(1) month’s notice of the termination of this Agreement and Employee’s employment in accordance with the terms of this Agreement,

it would be difficult or impossible to determine with precision the amount of damages that would or might be incurred by the Company

as a result. It is therefore understood and agreed by the Parties that in such event, the Employee will be responsible for an amount

equal to one (1) month of the Employee’s then current Annual Base Salary, which would be in the nature of liquidated damages, and

not a penalty, and represent a reasonable estimate of fair compensation for the losses that may reasonably be anticipated from such breach.

Nothing contained herein will be construed as prohibiting the Company from pursuing any other remedies available to the Company for such

breach.

1.6

Position. Employee shall be employed as the Chief Financial Officer of the Company, an exempt position, and shall report to the

Executive Chairman and Interim Chief Executive Officer of the Company (currently, Michael Breen). Employee shall perform such duties,

and have such power, authority, functions, and responsibilities for the Company as are commensurate and consistent with this position,

including, but not limited to all duties expected to be performed by a competent and diligent Chief Financial Officer of a publicly listed

company, which shall include the preparation and submission of all filings and financial and accounting information on a timely basis,

operating within such established guidelines, plans or policies as may be established, modified, or approved by the Chief Executive Officer

of the Company from time to time. Employee’s principal place of employment will be the Employee’s home office located in

California, subject to any necessary business travel within and outside the United States. Employee must inform the Company in a timely

manner and receive consent before relocating out of California.

1.7

Other Business Affiliations. During Employee’s employment with the Company, Employee will devote Employee’s entire

business time, attention, skill and energy on a full-time and exclusive basis to the business of the Company, and will perform the duties

and carry out the responsibilities assigned to Employee to the best of Employee’s ability, in a diligent, trustworthy, businesslike

and efficient manner for the advancement of the best interests of the Company. During Employee’s employment with the Company, Employee

will not, without the prior written consent of the Company, assume any other employment, engage in any other business or occupation,

become an officer, employee, agent or consultant for any other company, firm or individual, or otherwise devote any time to any business

affiliation which would prevent Employee from performing, conflict with, or create an appearance of conflict with Employee’s duties

and obligations under this Agreement.

Article

II.

COMPENSATION AND BENEFITS

2.1

Annual Base Salary. As full compensation for the services rendered by Employee pursuant to this Agreement, Employee shall be paid

a gross annual base salary of $375,000 (“Annual Base Salary”), less deductions and withholding required by law or

approved by Employee, paid in accordance with the Company’s normal and customary payroll practices.

2.2

Reimbursable Expenses. Employee shall be entitled to reimbursement for all reasonable and necessary out-of-pocket business expenses

incurred by Employee in connection with the performance of Employee’s duties hereunder in accordance with the Company’s expense

reimbursement policies and procedures. Any reimbursements by the Company to Employee of any eligible expenses under this Agreement, other

than reimbursements that would otherwise be exempt from income or the application of Internal Revenue Code (the “Code”) Section

409A, (“Reimbursements”) will be made promptly and, in any event, on or before the last day of Employee’s taxable year

following Employee’s taxable year in which the expense was incurred. The amount of any Reimbursements, and the value of any in-kind

benefits to be provided to Employee under this Agreement, other than in-kind benefits that would otherwise be exempt from income or the

application of Code Section 409A, during any of Employee’s taxable years will not affect the expenses eligible for reimbursement,

or in-kind benefits to be provided, in any other of their taxable years. The right to Reimbursements, or in-kind benefits, will not be

subject to liquidation or exchange for another benefit.

2.3

Bonus. Employee is eligible to earn an annual discretionary bonus (the “Annual Bonus”) equal to forty percent

(40%) of the Annual Base Salary, less deductions and withholding required by law or approved by Employee, subject to the achievement

of Company and individual performance goals, to be established by the Company, by December 31 of the immediately preceding calendar year,

as determined in the Company’s sole discretion. For calendar year 2024, the Company will provide the applicable Company and individual

performance goals on or shortly after the Effective Date. For the avoidance of doubt, the Annual Bonus in calendar year 2024, if earned,

will be prorated based on the Effective Date. The Annual Bonus, if any, earned for a calendar year shall be paid to Employee as soon

as reasonably practicable following the determination of the attainment level of the performance conditions applicable to the Annual

Bonus, provided that such Annual Bonus will only be earned and payable if the Employee remains employed by the Company through the date

on which the Annual Bonus is paid out.

2.4

Benefits. Employee will be eligible to participate in all Company health, medical, dental, disability and insurance plans and

such other employee benefits, if any, as the Company may establish for its employees and as may be modified or terminated by the Company

from time to time in accordance with the terms of the plans.

2.5

Equity Awards. As soon as reasonably practicable after the third month following the Effective Date, the Company shall consider

Employee’s eligibility to be granted a long-term performance award over the shares of the common stock of the Company.

2.6

Vacation. Employee will be entitled to 20 days of vacation (“Vacation”) per full calendar year (prorated for partial

years), to be taken for any reason, including vacation or other personal time away from work, at times agreed upon by Employee and the

Company, subject to applicable law. Employee’s Vacation entitlement is not granted on the Effective Date, but rather will accrue

on a pro-rata basis (i.e., at a rate of 1.67 days per month) with every month of active employment after the Effective Date. Employee’s

accrued but unused Vacation will carry over from year to year. However, Employee may only accrue Vacation up to a maximum of one and

one-half times the annual accrual amount. When the maximum accrual level is reached, accrual will cease until Employee has used previously

accrued Vacation and their accrued but unused Vacation falls below the maximum accrual amount. Employee will not receive retroactive

credit for any period of time in which Employee did not accrue Vacation because Employee had reached the maximum accrual leave. On termination

of employment, the Company will pay Employee for any accrued but unused Vacation.

2.7

Paid Sick Leave. Employee will also be entitled to six (6) days each full calendar year (prorated for partial years), which will

be subject to the terms of the Company’s sick time policy in effect at any time. Employee will not carry over unused paid sick

leave from one year to the next and unused sick days will not paid out on termination of employment.

Article

III.

Remuneration upon Termination of Employment.

3.1

Remuneration upon Termination by the Company without Cause or Resignation by the Employee with Good Reason. Upon termination of

Employee’s employment with the Company for any reason, Employee will be entitled to: (a) any accrued and unpaid Annual Base Salary

through the date of termination, (b) reimbursement for any business expenses properly incurred for which Employee shall not have been

previously reimbursed, (c) any accrued but unpaid Vacation, and (d) any other amounts required by applicable law (collectively the “Accrued

Amounts”). In addition, in the event of termination by the Company without Cause or resignation by the Employee with Good Reason,

subject to the Employee complying with executing a separation and release agreement in a form satisfactory to the Company, Employee shall

receive: (i) for a termination or resignation that occurs during the first six months following the Effective Date, a cash severance

equal to two (2) months of the Employee’s then current Annual Base Salary or (ii) for a termination or resignation that occurs

any time thereafter, a cash severance equal to five (5) months of the Employee’s then current Annual Base Salary, in either case

less deductions and withholding required by law, payable in a lump sum within 70 days of the Employee’s termination of employment

(or such shorter period as may allow the severance payment to be exempt from Code Section 409A).

3.2

Remuneration upon Termination by the Company with Cause or by the Employee without Good Reason. Upon termination of Employee’s

employment by the Company with Cause or by the Employee without Good Reason, Employee will only be entitled to the Accrued Amounts.

3.3

No Further Obligations of the Company. Except as expressly provided in this Article 3, following the termination of Employee’s

employment with the Company, the Company will have no further obligation or liability to Employee or Employee’s heirs, administrators

or executors with respect to compensation, severance, bonus or any other benefits except as provided by any benefit plan or by law.

Article

IV.

MISCELLANEOUS PROVISIONS

4.1

Conditions to Employment. This offer is contingent on:

| a) | Verification

of Employee’s right to work in the United States, as demonstrated by Employee’s

completion of the Form I-9 upon hire and Employee’s submission of acceptable documentation

(as listed on the last page of the Form I-9) verifying Employee’s identity and work

authorization within three (3) days of starting employment. |

| b) | Employee

signing the Confidential Information and Invention Assignment Agreement (“CIIAA”)

attached hereto as Attachment A. |

| c) | Employee

signing the Mutual Arbitration Agreement attached hereto as Attachment B. |

4.2

No Breach of Duty. Employee represents that Employee’s performance of this Agreement and employment with the Company does

not and will not breach any agreement or duty to keep in confidence proprietary information acquired by Employee before their employment

with the Company. Employee has not and will not enter into any agreement, either written or oral, in conflict with this Agreement. Employee

represents that they are not currently restricted from being employed by the Company or entering into this Agreement.

4.3

Notice. All notices and other communications under this Agreement must be in writing and are deemed duly delivered when (a) delivered,

if delivered personally or by nationally recognized overnight courier service (costs prepaid), (b) sent by electronic mail with confirmation

of transmission (or, the first business day following such transmission if the date of transmission is not a business day), or (c) received

or rejected by the addressee, if sent by United States of America certified or registered mail, return receipt requested; in each case

to the following addresses and marked to the attention of the individual (by name or title) designated below (or to such other address,

or individual as a Party may designate by notice to the other Parties):

| |

If to the Employee: |

Alan Urban |

[****]

Email:

[****]

| |

If to the Company: |

c/o GT Biopharma, Inc. |

8000

Marina Blvd. Suite 100. Brisbane CA 94005

Attn:

Michael Breen

Email:

mb@gtbiopharma.com

4.4

Code Section 409A. The Parties intend that this Agreement and the benefits provided hereunder be interpreted and construed to

be exempt from or to otherwise comply with Code Section 409A to the extent applicable thereto. Notwithstanding any provision of this

Agreement to the contrary, this Agreement shall be interpreted and construed consistent with this intent, provided that the Company shall

not be required to assume any increased economic burden in connection therewith. Although the Company intends to administer this Agreement

so that it will be exempt from, or otherwise comply with, the requirements of Code Section 409A, the Company does not represent or warrant

that this Agreement will be exempt from or otherwise comply with Code Section 409A, or any other provisions of federal, state, local,

or non-United States laws. None of the Company, its affiliates, or their respective directors, officers, employees or advisors shall

be liable to Employee (or any individual claiming a benefit through Employee) for any tax, interest, or penalties that Employee may owe

as a result of compensation or benefits paid under this Agreement, and the Company and its affiliates shall have no obligation to indemnify,

reimburse, or otherwise protect Employee from the obligation to pay any taxes pursuant to Code Section 409A or otherwise. For purposes

of this Agreement, the terms “terminate,” “termination,” “termination of employment,” and variations

thereof as used in this Agreement, are intended to mean a termination of employment that constitutes a “separation from service”

as such term is defined under Code Section 409A, to the extent necessary or advisable to comply with Code Section 409A. Notwithstanding

any provision of this Agreement to the contrary, in the event that any payment to Employee or any benefit hereunder is made upon, or

by reference to, Employee’s termination of employment, and Employee is a “specified employee” (as that term is defined

under Code Section 409A) upon the Employee’s termination of employment, and provided further that such payment or benefit does

not otherwise qualify for an applicable exemption from Code Section 409A, then no such payment or benefit shall be paid or commenced

to be paid to Employee under this Agreement until the date that is the earlier to occur of: (i) Employee’s death, or (ii) six (6)

months and one (1) day following Employee’s termination of employment (the “Delay Period”). Any payments which Employee

would otherwise have received during the Delay Period shall be payable to Employee in a lump sum on the date that is six (6) months and

one (1) day following the effective date of Employee’s termination.

4.5

Severability. If any term, provision, covenant or condition of this Agreement is held to be invalid, void, or unenforceable, the

remainder of the provisions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated

thereby.

4.6

Entire Agreement; Employment Amendments; Waiver. This Agreement, together with the CIIAA and the Mutual Arbitration Agreement,

contains the entire agreement and understanding between the Parties hereto concerning the subject matter hereof and supersede and replace

all prior or contemporaneous agreements or understandings between the Parties. This Agreement may not be amended or modified in any manner,

except by an instrument in writing signed by Employee and an authorized representative of the Company. Failure of either party to enforce

any of the provisions of this Agreement or any rights with respect thereto or failure to exercise any election provided for herein shall

in no way be considered to be a waiver of such provisions, rights or elections or in any way effect the validity of this Agreement. The

failure of either party to exercise any of said provisions, rights or elections shall not preclude or prejudice such party from later

enforcing or exercising the same or other provisions, rights or elections which it may have under this Agreement.

4.7

Successors and Assigns: Assignment. Except as otherwise provided in this Agreement, this Agreement, and the rights and obligations

of the Parties, will be binding upon and inure to the benefit of their respective successors, assigns, heirs, executors, administrators

and legal representatives. The Company may assign any of its rights and obligations under this Agreement. Employee’s obligations

under this Agreement are personal to Employee and may not be delegated.

4.8

Governing Law. This Agreement shall be governed by and construed in all respects in accordance with the laws of California, provided

that disputes arising out of this Agreement will be subject to the Mutual Arbitration Agreement attached hereto as Attachment B

and the Federal Arbitration Act (9 U.S.C. §§ 1 et seq.).

4.9

Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered will

be deemed an original, and all of which together shall constitute one and the same agreement.

IN

WITNESS WHEREOF, the Parties have executed this Agreement as of the day and year first above written.

| “Employee” |

|

“Company”

|

| |

|

|

|

|

| |

|

|

GT Biopharma, Inc. |

| |

|

|

|

|

| By: |

|

|

By: |

|

| |

ALAN

LOUIS URBAN |

|

|

MICHAEL

BREEN |

|

|

|

Title: |

EXECUTIVE

CHAIRMAN & INTERIM CHIEF EXECUTIVE OFFICER |

ATTACHMENT

A

CONFIDENTIAL

INFORMATION AND INVENTION ASSIGNMENT AGREEMENT

ATTACHMENT

B

MUTUAL

ARBITRATION AGREEMENT

v3.24.1.1.u2

Cover

|

Jun. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity File Number |

1-40023

|

| Entity Registrant Name |

GT

Biopharma, Inc.

|

| Entity Central Index Key |

0000109657

|

| Entity Tax Identification Number |

94-1620407

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8000

Marina Blvd.

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Brisbane

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94005

|

| City Area Code |

(800)

|

| Local Phone Number |

304-9888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.001 par value

|

| Trading Symbol |

GTBP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

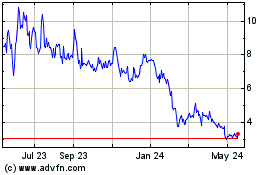

GT Biopharma (NASDAQ:GTBP)

Historical Stock Chart

From Dec 2024 to Jan 2025

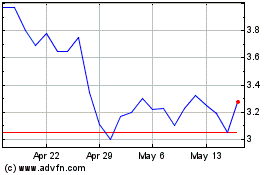

GT Biopharma (NASDAQ:GTBP)

Historical Stock Chart

From Jan 2024 to Jan 2025