UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 001-41385

Visionary Holdings Inc.

(Registrant's Name)

105 Moatfield Dr. Unit 1003

Toronto, Ontario, Canada M3B OA2 905-739-0593

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ 40-F

☐

Entry into Material Definitive Agreements

On

December 30, 2024, Visionary Holdings Inc. (the “Company”) entered into a Cooperation Agreement (the “UBX Agreement”)

with UBX Technology Inc. (“UBX”) for the establishment of a joint venture company to be named Goldmine Technology Finance

Group Inc. (“Goldmine”) and engaging in the business of digital currency technology digital currency exchange. Pursuant to

the UBX Agreement, the Company will invest $1.5 million in exchange for a 51% equity interest in Goldmine, and UBX will invest cash and

tangible and intangible assets including licenses and permits, patents and personnel relating to digital currency technology and digital

currency exchange, in exchange for a 49% equity interests in Goldmine. The transaction is expected to close in the first half 2025, subject

to customary closing conditions.

On

the same day, the Company also entered into a Cooperation Agreement (the “Gensea Agreement”) with Gensea International

Co. Limited (“Gensea”) and Gensea’s controlling shareholder for the establishment of a joint venture company, to

be named American Precision Biotech Inc. (“APB”) and engaging in the business of research & development,

manufacturing and sales of cancer self-test kits. Pursuant to the Gensea Agreement, the Company will invest $1 million in exchange

for a 51% equity interests in APB, and Gensea will invest patent license, licenses and permits, customer resources and existing

projects relating to cancer self-test kits, in exchange for a 49% equity interests in APB. The transaction is expected to close in

the first half of 2025, subject to customary closing conditions.

The

foregoing descriptions of the UBX Agreement and the Gensea Agreement do not purport to be complete and are qualified in its entirety by

reference to each of the UBS Agreement and the Gensea Agreement. English translations of the agreements are filed as Exhibits 4.1 and

4.2 hereto and are incorporated herein by reference.

Financial Statements and Exhibits

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereto duly authorized.

| |

VISIONARY HOLDINGS INC. |

| |

|

| |

By: |

/s/ Xiyong Hou |

January 31, 2025 |

Name:

Title: |

Xiyong Hou

Chief Executive Officer |

Exhibit 4.1

Cooperation Agreement

Party A: Visionary Holdings Inc. (NASDAQ:

GV)

Party B: UBX Technology Inc. (File No:250104000668)

This Cooperation and Restructuring Listing Agreement

(hereinafter referred to as the "Agreement") is entered into by and between the following parties on December 30, 2024:

1. Introduction

1.1 Party A: Visionary Holdings Inc. is

a corporation incorporated and existing under the laws of Canada, publicly listed on NASDAQ. Its core businesses include high technology,

life sciences, and education industries. It is recognized as the first listed education company and the first Chinese diaspora-led public

company in Canada. Party A owns four buildings and operates six schools in Canada, including two landmark buildings in Toronto, with total

tangible and intangible assets exceeding USD 300 million.

Party A has extensive experience in North American capital operations and listings, including expertise in technical processes for transitioning

between different tiers of capital markets. Party A also has access to North American and Chinese government resources and global market

networks. Party A’s registered office is located at 105 Moatfield Dr, Unit 1003, Toronto, Ontario, Canada, M3B 0A2 (hereinafter

referred to as "Party A").

1.2 Party B: Party B is a professional

technical Institution investor with substantial group of expertise and resources in cryptocurrency assets and trading. Party B operates

a global cryptocurrency and social integration trading platform with over 300,000 registered users and 90,000 daily active users. The

platform holds operational compliance licenses in Canada (MSB), Australia (AUSTRAC), and the United States (MSB). Party B is committed

to providing secure, efficient, and reliable cryptocurrency trading services for global investors, reducing barriers to digital finance,

and promoting legal compliance in the global cryptocurrency market to contribute to the progress and development of the digital asset

industry.

2. Purpose

To embrace the booming development of future fintech,

seize market opportunities, and leverage the U.S. capital market to drive Party B's global business expansion, Party A and Party B will

fully utilize their respective advantages and integrate resources. Based on mutual benefit and joint development, both parties will establish

a new company in the United States, aiming to achieve a Nasdaq listing through OTC by 2025.

3. Terms

1.

Definitions

1.1. "Agreement" refers to this Merger

and Listing Agreement

1.2. "Closing" refers to the completion

of the transaction contemplated under this Agreement.

1.3. "Closing Date" refers to the date

on which the transaction is completed.

1.4. "Effective Date" refers to the

date the merger becomes effective.

1.5. "Exchange Act" refers to the United

States Securities Exchange Act.

2.

Establishment

2.1. Establishment: As of the Effective

Date and pursuant to the terms and conditions of this Agreement, the parties will proceed with the restructuring under applicable U.S.

securities laws and Canadian laws, merging with Party A.

2.2. Effective Date: This Agreement will

take effect on the date the parties sign the Agreement ("Effective Date").

3.

Cooperation, Investment, Shares, Listing Goals, Share Transfer

3.1. The two parties jointly acquired Goldmine

Technology Finance Group Inc. (formerly known as Gensea International Limited) established in the Cayman Islands in 2021, through investments

in cash, assets, and resources.

3.2. Party B will invest operating cash, assets,

and resources, including but not limited to tangible and intangible assets, legally operated fintech licenses, patented technologies,

market clients, viable projects, and business operations (see attached list for details), acquiring 49% of GTFG's shares.

3.3 Listing Goals

3.3.1. GTFG will be listed on OTC by March 31,

2025.

3.3.2 By June 30, 2025, GTFG will sign an uplisting

agreement with a U.S. intermediary agency, officially launching the uplisting process. Party A will be responsible for coordinating with

intermediary service providers, including corporate governance structuring, business model determination, financial statement auditing,

team building, and business development, while Party B will provide full support. Both parties will align their efforts in business growth

and performance targets, aiming to achieve uplisting as quickly as possible. The company will pursue a dual-track strategy of independent

development and mergers & acquisitions.

3.3.3 By April 30, 2026, GTFG will submit its

uplisting application to Nasdaq, with a target of successfully uplisting on Nasdaq by October 2026.

3.4. To incentivize and encourage Party B, Party

A agrees to transfer 20% of GTFG's shares to Party B before the uplisting, based on a $3 million valuation. The transfer price for the

20% stake will be $600,000. (If financing occurs before the listing, the shareholding will be proportionally diluted.)

4. Board of Directors and Financial Management

4.1 Board Composition: GTFG will have a

seven-member board, with three members appointed by Party A, three by Party B, and one independent director or chairperson, who will be

a notable figure from North American industry or government circles.

4.2 Financial Management: GTFG’s

financial management will be jointly overseen by both parties, with Party A appointing the treasurer and Party B appointing the accountant.

All financial operations will comply with the rules of the SEC, Nasdaq, and GTFG’s bylaws.

5. Representations and Warranties

5.1 Representations

and Warranties of Party B:

(a) Organization,

Standing, and Authority: Party B represents that it is a reputable individual or entity, and the information provided is accurate and

truthful.

(b) Authorization:

Party B has the authority to execute and deliver this Agreement and to consummate the transactions contemplated herein.

(c) No

Conflicts: The execution and delivery of this Agreement by Party B will not conflict with any applicable law, regulation, or agreement

to which Party B is a party.

(d) Operations

and Management: Party B agrees to ensure stable operations of GTFG while adhering to SEC and Nasdaq regulations.

5.2

Representations and Warranties of Party A:

(a) Organization, Standing, and Authority: Party

A represents that it is a corporation validly existing under Canadian law.

(b) Authorization: Party A has the corporate authority

to execute, deliver, and perform this Agreement, with approval from its board of directors.

(c) No Conflicts: The execution and delivery of

this Agreement by Party A will not conflict with its corporate charter or applicable laws.

(d) Management: Party A will ensure that Party

B’s existing management team continues to operate GTFG.

6. Obligations and Covenants

From the date of signing this Agreement, Party

B will commence the transfer of assets and operations to GTFG. GTFG shall conduct its daily operations to meet listing targets and refrain

from activities that negatively impact its financial position or operations.

7. Conditions Precedent to Restructuring

7.1 Obligations: The restructuring is contingent

on the fulfilment of obligations by all parties.

7.2 No Injunctions: There shall be no court orders

or legal restrictions preventing the completion of the restructuring.

7.3 Debt and Profit Allocation: Prior to restructuring,

all debts, liabilities, and profits of GTFG will belong to its original shareholders. Post-restructuring, they will be allocated based

on equity proportions.

8. Miscellaneous

8.1 Notices: All notices under this Agreement

shall be delivered via email.

8.2 Entire Agreement: This Agreement constitutes

the complete understanding between the parties and supersedes any prior agreements.

8.3 Governing Law: This Agreement shall be governed

by the laws of the United States and Canada.

8.4 Amendments: Any amendments to this Agreement

must be in writing and signed by all parties.

9. Breach of Contract

9.1. Breach Consequences: After the effective

date of this Agreement, no party shall breach its obligations. If a breach occurs, the non-breaching party shall hold the breaching party

liable for all economic losses and legal responsibilities arising from the breach.

9.2. Dispute Resolution: Any unresolved matters

shall be resolved through amicable negotiation among the three parties. If negotiations fail, disputes shall be submitted to the Hong

Kong Arbitration Commission for resolution.

This agreement shall take effect upon signing

by both parties. After the agreement takes effect, Party B shall actively cooperate with Party A to ensure the successful completion of

the restructuring and uplisting process.

Party A: Visionary Holdings Inc.

Signature: _____________________________

Party B: UBX Technology Pte. Ltd, Singapore

Signature: _____________________________

Exhibit 4.2

Cooperation Agreement

Party A: Visionary Holdings Inc. (NASDAQ: GV)

Party B: Gensea Investment Co. Limited

Party : Miao Jinchao (Passport No.: 566512276)

This Cooperation and Restructuring

Listing Agreement (hereinafter referred to as the "Agreement") is entered into by and between the following parties on December

30, 2024:

Party A: Visionary Holdings

Inc. is a corporation incorporated and existing under the laws of Canada, publicly listed on NASDAQ. Its core businesses include high

technology, life sciences, and education industries. It is recognized as the first listed education company and the first Chinese diaspora-led

public company in Canada. Party A owns four buildings and operates six schools in Canada, including two landmark buildings in Toronto,

with total tangible and intangible assets exceeding USD 300 million.

Party A has extensive experience in

North American capital operations and listings, including expertise in technical processes for transitioning between different tiers of

capital markets. Party A also has access to North American and Chinese government resources and global market networks. Party A’s

registered office is located at 105 Moatfield Dr, Unit 1003, Toronto, Ontario, Canada, M3B 0A2 (hereinafter referred to as "Party

A").

Party B: Party B is a company

established and existing in the British Virgin Islands (BVI). The company is mainly engaged in the research and development, production

and sales of early cancer screening and home self-testing technology products. The company has established an integrated platform for

cancer diagnosis research and development, testing, and production, and has successfully developed a variety of monoclonal antibodies

and immunodiagnostic kits. The company has a group of experienced and skilled professional scientific researchers and senior managers.

The company's current products include E7 oncoprotein home self-testing kits, and the products to be launched include early home self-testing

kits for colorectal cancer, vaginal cancer, vulvar cancer, anal cancer, oral cancer, pharyngeal cancer, penis cancer and other cancers.

Party

C:

Party C is a renowned expert in cancer

diagnostic research and development, with extensive professional knowledge and clinical experience in the field. Party C holds global

patents for the E7 cancer protein and colorectal cancer at-home self-test kits, as well as pending patents for early at-home self-test

kits for cancers such as vaginal cancer, vulvar cancer, anal cancer, oral cancer, pharyngeal cancer, and penile cancer. Party B is the

sole global permanent licensee and collaborative partner for all of Party C’s cancer diagnostic patents. Additionally, Party C is

the majority shareholder of Party B, holding over 60% of its shares.

Considering

the rapid growth in the life sciences and biopharmaceutical industries, and to seize market opportunities, this agreement seeks to

leverage the U.S. capital markets to drive Party B's global business expansion. Parties A, B, and C aim to maximize their respective

advantages and integrate resources based on mutual benefit and shared development.

| 1.1. | “Agreement” refers to this Merger and Public Listing Agreement. |

| | 1.2. | “Completion” refers to the consummation of the transactions contemplated under this Agreement. |

| 1.3. | “Closing Date” refers to the date on which Completion occurs. |

| 1.4. | “Effective Date” refers to the effective date of the merger. |

| 1.5. | “Securities Law” refers to the United States Securities Exchange Act. |

2.1.

Establishment Party A, Party B and Party C reconstruct Party B by investing cash, assets and resources, and change Party

B’s name to America Precision Biotech Inc. (hereinafter referred to as APB).

2.2.

The Effective Date of this Agreement will be the date on which all three parties have signed the Agreement (the "Effective

Date").

| 3. | Establishment, Investment, Shares, Listing Goals, and Share Transfer |

3.1.

Party A and Party B, through investments in cash, assets, and resources, will establish a joint venture in the United States.

The company will be temporarily named American Precision Biotech Inc (hereinafter referred to as APB).

3.2.

Party A will invest $1 million along with listing, market, and other resources, acquiring 51% of APB's shares. This includes, but

is not limited to, all resources owned by Party A, as well as the capital, listing, technology, and market resources held by Party A’s

directors. Party B will invest assets, patent rights, medical production licenses, market clients, valid projects, and business operations

(see attached list for details), acquiring 49% of APB’s shares.

3.3.

Listing Goals

3.3.1 By March 10, 2025, APB will be listed on OTC.

3.3.2

By September 30, 2025, Party A will sign an uplisting agreement with a U.S. intermediary agency, officially launching APB’s uplisting

process. Party A will coordinate with intermediary service providers, including corporate governance structuring, business model determination,

financial statement auditing, team building, and business development. Party A, Party B, and Party C will provide full cooperation. Especially

in business development, performance targets, and growth, all three parties will align their efforts to achieve the uplisting as quickly

as possible, with a dual-track strategy of independent development and mergers & acquisitions.

3.3.3 Party A, Party B, and Party C agree that, if financing

is required during the project and APB’s uplisting process, Party A will be responsible for leading the first round of financing

before the uplisting. The valuation of APB will not be less than $50 million, and the three parties will dilute their shares proportionally

by 5-10% to raise $2.5 million to $5 million.

3.3.4 To accelerate the uplisting process, all three parties

will fulfill their respective duties and cooperate fully to achieve the goal of $12

million in sales revenue within 12 months, including revenue generated from acquired distribution channels.

3.3.5. By March

2026, the application for Nasdaq uplisting will be submitted, with the goal of successful

uplisting on Nasdaq by October 2026.

3.4.

Share Transfer

To incentivize and encourage Party C, Party A agrees to

transfer 25% of APB’s shares to Party C and other shareholders at a price of $2 million before the uplisting. (If the terms of 3.3.3

are met, the proportion of shares will be reduced accordingly.).

| 4. | Board of Directors, Financial Management |

4.1.

APB has 7 board members, including 3 from Party A, 3 from Party B and Party C, and 1 independent director or chairman who is a

well-known figure in the North American industry or politics.

4.2.

APB's financial management is jointly managed by both parties. Party A sends people to supervise cashiers and accountants and strictly

implements the legal provisions and requirements of the U.S. Securities and Exchange Commission, Nasdaq and APB's charter.

| 5. | Representations and Warranties |

| |

5.1. | Representations and Warranties of Parties B and C: |

Parties B and C represent and warrant to Party A the following:

(a)

Organization, Status, and Authority: Party B is a company duly incorporated, validly existing, and in good standing under

the laws of the Cayman Islands. The description provided above regarding Party B is true and accurate.

(b)

Authorization: Party B has the authority and authorization to sign and deliver this Agreement and to complete the transactions

contemplated hereby. The signing and delivery of this Agreement, as well as the completion of the transactions outlined in this Agreement,

have been formally and validly authorized by Party B's Board of Directors.

(c)

No Conflicts: The execution and delivery of this Agreement by Parties B and C will not conflict with any provisions of Party

B’s articles of incorporation or bylaws, nor with any applicable laws, regulations, rules, judgments, orders, decrees, or agreements

binding on Parties B and C.

(d)

Operations and Management: To maintain the stable operation and development of Party B's assets and business as they transition

to APB, Party C shall oversee APB’s business operations. All operations must adhere to the legal and regulatory requirements of

the SEC, NASDAQ, and APB’s corporate governance policies.

(e)

Uplisting: Parties B and C agree to actively cooperate with Party A to meet the requirements for OTC uplisting and comply

with the legal and regulatory standards for APB’s NASDAQ uplisting. Party A will develop the uplisting plan in accordance with U.S.

listing laws and capital market requirements.

| 5.2. | Representations and Warranties of Party A: |

Party A represents and warrants to Parties B and C the following:

Organization, Status, and Authority:

Party A is a duly incorporated, validly existing, and reputable company under the laws of Canada.

Authorization: Party A has

the authority to execute and deliver this Agreement and to complete the transactions contemplated herein. The execution, delivery, and

completion of this Agreement have been duly authorized by Party A’s Board of Directors

No Conflicts: The execution

and delivery of this Agreement by Party A will not conflict with any provisions of its articles of incorporation or bylaws, nor with any

applicable laws, regulations, rules, judgments, orders, decrees, or agreements binding on Party A.

Operations and Management: To ensure APB’s

stable operation and development, Party A agrees that Party B’s original management team shall remain unchanged and shall continue

to manage and operate APB.

Client Development: To facilitate

APB’s listing, Party A shall focus on expanding major client markets, while Parties B and C agree to actively maintain existing

client relationships and support Party A’s efforts in developing new major client markets, ensuring the achievement of APB’s

listing goals.

Uplisting: Party A will lead

all efforts related to APB’s uplisting. Parties B and C shall actively cooperate, and Party A shall fully execute the uplisting

plan in accordance with U.S. listing laws and capital market requirements.

From the date of signing this Agreement,

Parties B and C will commence the transfer of assets and operations to APB. APB shall conduct its daily operations to meet listing targets

and refrain from activities that negatively impact its financial position or operations.

| 7. | Conditions Precedent to Restructuring |

7.1

Obligations: The restructuring is contingent on the fulfillment of obligations by all parties.

7.2

No Injunctions: There shall be no court orders or legal restrictions preventing the completion of the restructuring.

8.1 Notice All notices and other communications under this Agreement

shall be made via email to the other party.

8.2 Entire Agreement This Agreement constitutes the complete and exclusive

agreement between the parties regarding the subject matter hereof and supersedes all prior written or oral agreements and understandings

between the parties with respect to such subject matter.

8.3 Governing Law This Agreement shall be governed by and construed

in accordance with the laws of the United States and Canada, without regard to principles of conflict of laws.

8.4 Amendments and Waivers This Agreement may only be amended, modified,

or supplemented by a written agreement signed by all parties.

9.1 After

the Agreement becomes effective, no party shall breach the Agreement. In the event of a breach, the non-breaching party may pursue compensation

for any direct or indirect economic losses and legal liabilities incurred as a result of the breach.

9.2 Any

unresolved matters will be amicably negotiated by the three parties. If negotiations fail, any disputes among the parties shall be submitted

to the American Arbitration Association for arbitration resolution.

Remainder of Page Intentionally Left Blank; Signature

pages follow

This Agreement shall become effective

upon the signatures of all four parties. After it becomes effective, Parties B and C shall actively cooperate with Party A’s work

and ensure the successful completion of APB’s uplisting.

Signatures:

Party A: Visionary Holdings Inc.

Signature: _____________________________

Party B: Gensea Investment Co. Limited

Signature: _____________________________

Party C: Miao Jinchao

Signature: _____________________________

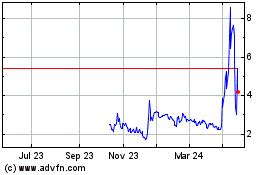

Visionary (NASDAQ:GV)

Historical Stock Chart

From Jan 2025 to Feb 2025

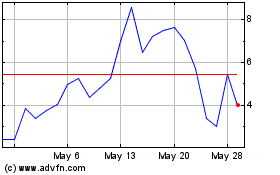

Visionary (NASDAQ:GV)

Historical Stock Chart

From Feb 2024 to Feb 2025