Most Companies Fail to Accurately Forecast Working Capital Needs And the Cash to Support Them, Says New Study by REL Consulting

26 April 2012 - 11:30PM

Business Wire

Despite a global business environment where companies can be

harshly punished by Wall Street for even small missteps in

predicting revenue or earnings, most large companies say they

cannot correctly forecast operational basics like inventory,

receivables, payables, and the underlying cash requirements to

support them, according to the results of a new study from REL

Consulting, a division of The Hackett Group, Inc.

(NASDAQ:HCKT).

According to the REL study, typical companies potentially miss

quarterly working capital forecasts (including inventory,

receivables, and payables) by up to 23 percent, which amounts to up

to $600 million for a typical Global 1000 company (with $29 billion

annual revenue).

The new REL performance study, "Working Capital: Successes,

Challenges, and 2012 Objectives," found that most companies have

been unable to improve the long-term efficiency or effectiveness of

their working capital performance over the past decade. Typical

large companies in the annual REL 1000 analysis could generate

nearly $2 billion in additional cash annually by optimizing working

capital management to match the performance of top companies in

their industry. This included an opportunity to net over $680

million from optimizing receivables, over $620 million from

payables, and over $680 billion from inventory.

"It's disappointing that even after the economic turmoil of the

last few years, companies are still struggling to get this key area

under control, and failing to drive sustainable improvements in

working capital," said Veronica Heald, Director, REL Consulting.

"In some ways, forecasting cash is even more critical than

forecasting earnings or revenue. You can take a hit quarter after

quarter for missing earnings. But you can only run out of cash

once. Failures in this area easily lead to everything from the need

to turn to emergency credit lines to lost sales and missed

opportunities.

"At the same time, it's not surprising to see companies

continuing to miss the mark on working capital optimization," said

Ms. Heald. "At most companies, finance takes full responsibility

for working capital. But truly, optimizing receivables, payables,

and inventory requires a cross-functional effort. And often

different parts of the organization may have very conflicting

interests, and different priorities and goals that prevent them

from achieving their working capital goals."

The research offers some recommendations for companies seeking

to improve performance in this area: working capital improvement

should be a strategic objective led by C-suite executives and

involve all related functions; ensure an accurate forecasting

process is in place to monitor improvements; streamline the cross

functional elements of the operational processes that impact

working capital; reconcile conflicting functional objectives to the

overall strategic objectives of the organization; measure and hold

people accountable for the root causes vs. the symptoms;

incorporate working capital performance as a permanent component of

the reward structure; and train all staff to understand why working

capital management is important to the business and what they can

do to help.

About REL

REL, a division of The Hackett Group, Inc. (NASDAQ:HCKT), is a

world-leading consulting firm dedicated to delivering sustainable

cash flow improvement from working capital and across business

operations. REL’s tailored working capital management solutions

balance client trade-offs between working capital, operating costs,

service performance and risk. REL’s expertise has helped clients

free up billions of dollars in cash, creating the financial freedom

to fund acquisitions, product development, debt reduction and share

buy-back programs. In-depth process expertise, analytical rigor and

collaborative client relationships enable REL to deliver an

exceptional return on investment in a short timeframe. REL has

delivered work in over 60 countries for Fortune 500 and global

Fortune 500 companies.

More information on REL is available: by phone at (770)

225-7300; by e-mail at info@relconsultancy.com; or on the Web at

www.relconsultancy.com.

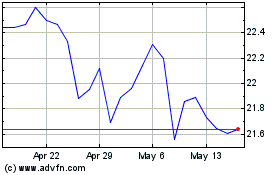

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

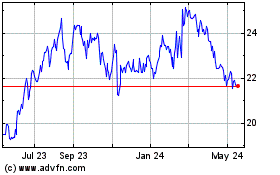

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024