0001839285

false

0001839285

2023-11-29

2023-11-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November

29, 2023

HEALTHCARE

TRIANGLE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40903 |

|

84-3559776 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

7901

Stoneridge Dr., Suite

220 Pleasanton, CA

94588

(Address

of principal executive offices)

(925)-270-4812

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

Stock, par value $0.00001 per share |

|

HCTI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 29, 2023, the Board of Directors (the “Board”) of Healthcare Triangle, Inc., a Delaware corporation (the “Company”) adopted the Healthcare Triangle, Inc. Clawback Policy for the recovery of erroneously awarded incentive-based compensation (the “Clawback Policy”), with an effective date of December 1, 2023, in order to comply with Section 10D of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 of the Exchange Act (“Rule 10D-1”), and the listing rules adopted by The Nasdaq Stock Market, LLC (collectively, the “Final Clawback Rules”). The Board has designated the Compensation Committee of the Board as the administrator of the Clawback Policy.

The Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers as defined in Rule 10D-1 (“Covered Officers”) of the Company in the event that the Company is required to prepare an accounting restatement, in accordance with the Final Clawback Rules. The recovery of such compensation applies regardless of whether a Covered Officer engaged in misconduct or otherwise caused or contributed to the requirement of an accounting restatement. Under the Clawback Policy, the Company may recoup from the Covered Officers erroneously awarded incentive-based compensation received within a lookback period of the three completed fiscal years preceding the date on which the Company is required to prepare an accounting restatement.

The foregoing description of the Clawback Policy does not purport to be complete and is qualified in its entirety by reference to the full text of the Clawback Policy, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Healthcare

Triangle, Inc. |

| |

|

| Date:

November 29, 2023 |

By:

/s/ Thyagarajan Ramachandran |

| |

Name:

Thyagarajan Ramachandran |

| |

Title:

Chief Financial Officer |

HEALTHCARE

TRIANGLE, INC.

CLAWBACK

POLICY

Introduction

The

Board of Directors (“Board”) of Healthcare Triangle, Inc. (the “Company”) believes that it is in

the best interests of the Company and its shareholders to adopt this policy which provides for the recoupment of certain executive compensation

in the event of an accounting restatement resulting from material noncompliance with financial reporting requirements under the federal

securities laws (the “Policy”). This Policy is designed to comply with Section 10D of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), Rule 10D-1 promulgated under the Exchange Act (“Rule 10D-1”)

and Listing Rule 5608 of The Nasdaq Stock Market LLC (“Nasdaq”).

Administration

This

Policy shall be administered by the Board or, if so designated by the Board, the Compensation Committee of the Board (the “Compensation

Committee”) or the Audit Committee of the Board (the “Audit Committee”), or any special committee comprised

of members of the Compensation Committee or Audit Committee (the “Administrator”). Any determinations made by the

Administrator shall be final and binding on all affected individuals. Subject to any limitation at applicable law, the Administrator

may authorize and empower any officer or employee of the Company to take any and all actions necessary or appropriate to carry out the

purpose and intent of this Policy (other than with respect to any recovery under this Policy involving such officer or employee).

Covered

Executives

This

Policy applies to the Company’s current and former executive officers, as determined by the Administrator in accordance with Section

10D of the Exchange Act and the listing standards of the national securities exchange on which the Company’s securities are listed,

and such other senior executives/employees who may from time to time be deemed subject to the Policy by the Administrator (each, a “Covered

Executive”).

For

the purposes of this Policy, “executive officers” shall include persons subject to reporting and short-swing liability provisions

of Section 16 under the Exchange Act. This shall include the Company’s president, principal financial officer, principal accounting

officer (or if there is no such accounting officer, the controller), any vice president in charge of a principal business unit, division,

or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person

who performs similar policy-making functions for the Company and any person identified under Regulation S-K Rule 401(b) in the Company’s

annual reports and proxy statements. Executive officers of a parent or subsidiary are deemed executive officers of the listed company

if they perform such policy-making functions for the listed company or such parent or subsidiary. The policy-making function is not intended

to include policy-making functions that are not significant.

Recoupment;

Accounting Restatement

In

the event the Company is required to prepare an accounting restatement of its financial statements due to the Company's material noncompliance

with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error

in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material

misstatement if the error were corrected in the current period or left uncorrected in the current period, the Administrator will require,

as promptly as it reasonably can, reimbursement or forfeiture of any Incentive Compensation, as defined below, received by any Covered

Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an accounting

restatement (the “Restatement Date”), so long as the Incentive Compensation received by such Covered Executive is in excess

of what would have been awarded or vested after giving effect to the accounting restatement. The amount to be recovered will be the excess

of Incentive Compensation paid to the Covered Executive based on the erroneous data in the original financial statements over the Incentive

Compensation that would have been paid to the Covered Executive had it been based on the restated results, without respect to any taxes

paid.

The

Restatement Date is defined as the earlier of (i) the date the Board, a Board committee, or management (if no Board action is required)

concludes, or reasonably should have concluded, that the Company is required to prepare an accounting restatement or (ii) the date a

court, regulator, or other legally authorized body directs the Company to prepare an accounting restatement.

Incentive

Compensation

For

purposes of this Policy, “Incentive Compensation” means any of the following; provided that, such compensation is

granted, earned, or vested based wholly or in part on the attainment of a financial reporting measure:

| • | Annual

bonuses and other short- and long-term cash incentives. |

| • | Stock

appreciation rights. |

| • | Non-equity

incentive plan awards. |

Financial

reporting measures include any measure that is determined and presented in accordance with the accounting principles used in preparing

the Company’s financial statements, and any measure that is derived wholly or in-part from such measure. The following examples

(and any measures derived therefrom) are non-exhaustive:

| • | Total

shareholder return. |

| • | Earnings

before interest, taxes, depreciation, and amortization (EBITDA). |

| • | Funds

from operations and adjusted funds from operations. |

| • | Liquidity

measures such as working capital or operating cash flow. |

| • | Return

measures such as return on invested capital or return on assets. |

| • | Earnings

measures such as earnings per share. |

| • | Profitability

of one or more reportable segments. |

| • | Financial

Ratios such as accounts receivable turnover and inventory turnover rates. |

| • | Sales

per square foot or same store sales, where sales is subject to an accounting restatement. |

| • | Revenue

per user or average revenue per user. |

| • | Cost

per employee, where cost is subject to any accounting restatement. |

| • | Any

of such financial reporting measures relative to a peer group, where the Company’s

financial reporting measure is subject to an accounting restatement; and tax basis income. |

| • | Capital

raised through debt or equity financing. |

| • | Reductions

in accounts receivables. |

For

the avoidance of doubt, Incentive Compensation does not include annual salary, compensation awarded based on completion of a specified

period of service, or compensation awarded based on subjective standards, strategic measures, or operational measures.

Incentive

Compensation includes incentive-based compensation received by a person:

| • | after

beginning service as an executive officer; |

| • | who

serves as an executive officer at any time during the performance period for the incentive-based

compensation; |

| • | who

served as an executive officer while the Company has a class of securities listed on a national

securities exchange; and |

| • | who

serves as an executive officer during the three fiscal years preceding the Restatement Date). |

For

the avoidance of doubt, subsequent changes in a Covered Executive’s employment status, including retirement or termination of employment,

do not affect the Company’s rights to recover Incentive-Based Compensation pursuant to this Policy.

Excess

Incentive Compensation: Amount Subject to Recovery

The

amount to be recovered will be the excess of the Incentive Compensation paid to the Covered Executive based on the erroneous data over

the Incentive Compensation that would have been paid to the Covered Executive had it been based on the restated results, as determined

by the Administrator. Incentive Compensation is deemed “received” during the fiscal period during which the financial reporting

measure specified in the incentive-based compensation award is attained, even if payment or grant of the Incentive Compensation occurs

after the end of the period.

If

the Administrator cannot determine the amount of excess Incentive Compensation received by the Covered Executive directly from the information

in the accounting restatement, then it will make its determination based on a reasonable estimate of the effect of the accounting restatement.

Method

of Recoupment

The

Administrator will determine, in its sole discretion, the method for recouping excess Incentive Compensation hereunder, which may include,

without limitation:

(a)

requiring reimbursement of cash Incentive Compensation previously paid;

(b)

seeking recovery of any gain realized on the vesting, exercise, settlement, sale, transfer, or other disposition of any equity-based

awards;

(c)

offsetting the recouped amount from any compensation otherwise owed by the Company to the Covered Executive;

(d))

cancelling outstanding vested or unvested equity awards; and/or

(e)

taking any other remedial and recovery action permitted by law, as determined by the Administrator.

No

Indemnification of Covered Executives

The

Company shall not indemnify any current or former Covered Executive against the loss of any incorrectly awarded Incentive Compensation,

and shall not pay, or reimburse any Covered Executive for premiums for any insurance policy to fund such executive’s potential

recovery obligations.

Indemnification

of the Administrator

Any

members of the Administrator who assist in the administration of this Policy, shall not be personally liable for any action, determination,

or interpretation made with respect to this Policy and shall be fully indemnified by the Company to the fullest extent under applicable

law and Company policy with respect to any such action, determination or interpretation. The foregoing sentence shall not limit any other

rights to indemnification of the Administrator under applicable law or Company policy.

Interpretation

The

Administrator is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable

for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements

of Section 10D of the Exchange Act, Rule 10D-1, Nasdaq Listing Rule 5608, and any other applicable rules or standards adopted by the

Securities and Exchange Commission or any national securities exchange on which the Company's securities are then listed.

Effective

Date

This

Policy shall be effective as of the date it is adopted by the Administrator (the “Effective Date”) and shall apply

to Incentive Compensation that is approved, awarded, or granted to any Covered Executive on or after that date.

Amendment;

Termination

The

Board may amend this Policy from time to time in its discretion and shall amend this Policy as it deems necessary to reflect final regulations

adopted by the Securities and Exchange Commission under Section 10D of the Exchange Act, Rule 10D-1 and Nasdaq Listing Rule 5608 and

to comply with any other rules or standards adopted by a national securities exchange on which the Company’s securities are then

listed. The Board may terminate this Policy at any time.

Other

Recoupment Rights

The

Administrator intends that this Policy will be applied to the fullest extent of the law. The Administrator may require that any employment

agreement, equity award agreement, or similar agreement entered into on or after the Effective Date shall, as a condition to the grant

of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. Any right of recoupment under this

Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company pursuant

to the terms of any similar policy in any employment agreement, equity award agreement, or similar agreement and any other legal remedies

available to the Company.

Impracticability

The

Administrator shall recover any excess Incentive Compensation in accordance with this Policy unless such recovery would be impracticable,

as determined by the Administrator in accordance with Rule 10D-1 of the Exchange Act and the listing standards of the national securities

exchange on which the Company's securities are listed.

Successors

This

Policy shall be binding and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other

legal representatives.

Exhibit

Filing Requirement

A

copy of this Policy and any amendments thereto shall be posted on the Company’s website and filed as an exhibit to the Company’s

Annual Report on Form 10-K.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

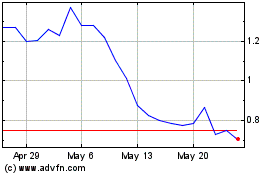

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Jan 2024 to Jan 2025