UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted

by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

HEALTHCARE TRIANGLE, INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) of

Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

PRELIMINARY INFORMATION

STATEMENT

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

HEALTHCARE TRIANGLE, INC.

7901 Stoneridge Drive, Suite 220

Pleasanton, California 94588

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU

ARE REQUESTED NOT TO SEND US A PROXY. NO PROXY CARD HAS BEEN ENCLOSED WITH THIS INFORMATION STATEMENT.

To the Stockholders of Healthcare Triangle, Inc.:

NOTICE

IS HEREBY GIVEN THAT SecureKloud Technologies, Inc., a Nevada corporation (“SecureKloud”) and Suresh Venkatachari (together,

the “Majority Stockholders”), who collectively own 83.8% of the voting power of Healthcare Triangle, Inc., a Delaware corporation

(the “Company”), acting by written consent in lieu of a special meeting pursuant to Section 228 of the General Corporation

Law of the State of Delaware (the “DGCL”), approved, to the extent required by Nasdaq Listing Rules 5635(a) and 5635(b),

the issuance by the Company of 12,000,000 shares of the Company’s restricted common stock (“Common Stock”) to SecureKloud

pursuant to the terms and conditions of an Asset Transfer Agreement dated August 27, 2024, between the Company and SecureKloud. Pursuant

to the Asset Transfer Agreement, in exchange for the 12,000,000 shares of Common Stock to be issued to SecureKloud, the Company will acquire

substantially all of the business, assets, and operations relating to cloud and technology domain that currently form part of SecureKloud.

The Majority Stockholders executed their written consent approving the Asset Transfer Agreement and the issuance of the 12,000,000 shares

of Common Stock to SecureKloud on September [*], 2024 (the “Written Consent”). Pursuant to Rule 14c-2 promulgated

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the actions approved by the Written Consent

may not be taken until 20 days after the date that we transmit this Information Statement to our stockholders.

No

action is required by you. The accompanying Information Statement is furnished only to inform our stockholders who did not execute the

Written Consent, in accordance with the requirements of the Securities and Exchange Commission’s rules and regulations and will

serve as written notice to stockholders of the Company pursuant to Section 228 of DGCL.

This

Information Statement is being transmitted on or about September [*], 2024 to our stockholders of record as of the close of business on

September 3, 2024.

Pursuant

to rules adopted by the Securities and Exchange Commission, you may access a copy of the information statement at www.siebertnet.com.

By Order of the Board

of Directors

|

Dated: September __, 2024 |

Sincerely, |

| |

|

| |

/s/ Thyagarajan

Ramachandran |

| |

Name: |

Thyagarajan Ramachandran |

| |

Title: |

Chief Financial Officer |

HEALTHCARE TRIANGLE, INC.

7901 Stoneridge Drive, Suite 220

Pleasanton, California 94588

INFORMATION STATEMENT

September ___, 2024

This Information Statement is furnished to inform

our shareholders of actions taken by SecureKloud Technologies, Inc. and Suresh Venkatachari (together, the “Majority Stockholders”).

THE ACTIONS TAKEN HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE FAIRNESS OR MERITS

OF THE ACTIONS TAKEN, NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT. ANY REPRESENTATION

TO THE CONTRARY IS UNLAWFUL.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU

ARE REQUESTED NOT TO SEND US A PROXY. NO PROXY CARD HAS BEEN ENCLOSED WITH THIS INFORMATION STATEMENT.

Healthcare Triangle, Inc. a Delaware corporation

(“we”, “us”, “our” or the “Company”) has filed this Information Statement with the Securities

and Exchange Commission (the “Commission”). Our board of directors (the “Board”) is transmitting this Information

Statement to our shareholders of record as of the close of business on September 3, 2024 (the “Record Date”), pursuant to

Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). By furnishing

this Information Statement to our shareholders, we are also providing notice of the action taken by written consent of the Majority Shareholder

as required by Section 228 of the Delaware General Corporation Law (the “DGCL”).

The cost of preparing, printing and transmitting

this Information Statement will be paid by us. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable

expenses incurred by them in transmitting this Information Statement to the beneficial owners of our common stock.

This Information Statement informs our shareholders

that on September 3, 2024, the Majority Stockholders, acting by written consent in lieu of a special meeting, approved, to the extent

required by Nasdaq Listing Rules 5635(a) and 5635(b), the issuance of 12,000,000 shares of our common stock pursuant to that certain Asset

Transfer Agreement, dated as of August 27, 2024 between the Company and SecureKloud, Technologies, Inc., a Nevada corporation, the owner

of 44.1% of our common stock and 24.7% of our voting power (the “Purchase Agreement”).

On September 3, 2024, Suresh Venkatachari owned

75,000 shares of our common stock representing 1.8% of the issues and outstanding shares of our common stock and 6,000 shares of our Series

A Super Voting Preferred Stock, which vote with our common stock at a rate of 1,000 to 1 and together with his shares of common stock

represent 59.2% of our voting power and SecureKloud owned 2,550,000 shares of our common stock, representing 44.1% of the issue and outstanding

shares of our common stock and 24.7% of our voting power. SecureKloud is the Company’s largest owner of its common stock.

Accordingly, all necessary corporate approvals

to comply with Nasdaq Listing Rules 5635(a) and 5635(b) have been obtained. We are not seeking approval from our remaining stockholders.

This Information Statement is furnished solely for the purpose of informing our shareholders, in the manner required by the Exchange

Act and Section 228 of the DGCL of the action taken by written consent of the Majority Stockholders. Pursuant to Rule 14c-2 under

the Exchange Act, the action approved by written consent may not be taken until 20 days after the date that we transmit this Information

Statement to our shareholders. This Information Statement is first being transmitted to our record date shareholders on or about September

[*], 2024.

QUESTIONS AND ANSWERS ABOUT THIS INFORMATION

STATEMENT

Q. Why am I being furnished with this Information

Statement?

A. The Exchange Act and the DGCL

require us to provide you with information regarding the actions taken by written consent of the Majority Stockholders in lieu of a

meeting. Your vote is neither required nor requested.

Q. Was stockholder approval of the potential

issuance of common stock pursuant to the Asset Transfer Agreement required?

A. Shareholder approval of the

issuance of common stock is required under Nasdaq Listing Rules 5635(a) and 5635(b). Nasdaq Listing Rule 5635(a) in relevant part

requires listed companies to obtain shareholder approval prior to the issuance of securities in connection with the acquisition of

the stock or assets of another company if (x) the common stock has or will have upon issuance voting power equal

to or in excess of 20% of the voting power outstanding before the issuance of stock or securities convertible into or exercisable for

common stock or (y) any director, officer or substantial shareholder of the Company has a 5% or greater

interest directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction and

the potential issuance of common stock could result in an increase in outstanding common shares or voting power of 5% or more.

Nasdaq Listing Rule 5635(b) requires listed companies to obtain stockholder

consent prior to the issuance of securities when the issuance or potential issuance will result in a change of control of the company.

Nasdaq generally considers a change of control occurs when, as a result of the issuance, an investor or a group would own, or have the

right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power would be the

largest ownership position.

Q. What do I need to do now?

A. Nothing. This Information Statement

is furnished to you solely for your information and does not require or request you to do anything.

There are no rights of appraisal or similar

rights of dissenters with respect to the Nasdaq Stockholder Approval.

PLEASE BE ADVISED THAT THIS IS ONLY AN INFORMATION

STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Our executive offices are located at 7901 Stoneridge

Drive, Suite 220, Pleasanton, California 94588.

This Information Statement is first being sent

or given to the holders of our outstanding shares of common stock and the holder of our Series A Super Voting Preferred Stock, our only

classes of voting securities outstanding, on or about September ___, 2024. Each holder of record of shares of our shares of common stock

and Series A Super Voting Preferred Stock at the close of business on September 3, 2024, is entitled to receive a copy of this Information

Statement.

THE PROPOSED ACQUISITION AND STOCK ISSUANCE

Purpose of the Asset Transfer Agreement and the Transaction

The Board believes it is in the best interests

of the Company to enter into the current transaction acquiring the assets from the buyer, in the amount of up to $7,200,000, which will

be payable in shares of our Common Stock. The terms of the Asset Transfer Agreement are complex and only briefly summarized below. For

further information, please see the full text of the Asset Transfer Agreement, which is attached as Annex A hereto. The discussion

herein is qualified in its entirety by reference to the Asset Transfer Agreement. Please see the subsection entitled “—The

Asset Transfer” below, for additional information and a summary of certain terms of the Asset Transfer Agreement. You are urged

to carefully read the agreement in its entirety. The Board approved the Asset Transfer Agreement and the Transaction on August 27, 2024,

and the Majority Stockholders approved the Asset Transfer Agreement and the Transaction by written consent delivered

to the Company on September ___, 2024.

The Companies

Healthcare Triangle, Inc.

We are a healthcare information technology company

focused on advancing innovative industry-transforming solutions in the sectors of cloud services, data science, and professional and managed

services for the electronic health record (EHR), healthcare and life sciences industry.

Our approach leverages our proprietary technology

platforms, extensive industry knowledge, and healthcare domain expertise to provide solutions and services that reinforce healthcare progress.

Through our platform, solutions, and services, we support healthcare delivery organizations, healthcare insurance companies, pharmaceutical

and Life Sciences, biotech companies, and medical device manufacturers in their efforts to improve data management, develop analytical

insights into their operations, and deliver measurable clinical, financial, and operational improvements.

We offer a comprehensive suite of software, solutions,

platforms and services that enables some of the world’s leading healthcare and pharma organizations to deliver personalized healthcare,

precision medicine, advances in drug discovery, development and efficacy, collaborative research and development, respond to real world

evidence, and accelerate their digital transformation. We combine our expertise in the healthcare technology domain, cloud technologies,

DevOps and automation, data engineering, advanced analytics, AI/ML, Internet of things (“IoT”), security, compliance, and

governance to deliver platforms and solutions that drive improved results in the complex workflows of Life Sciences, biotech, healthcare

providers, and payers. Our differentiated solutions, enabled by intellectual property platforms provide advanced analytics, data science

applications, and data aggregation in a secure, compliant and cost-effective manner to our customers. Our approach reinforces healthcare

progress through advanced technology, extensive industry knowledge, and domain expertise.

Our deep expertise in healthcare allows us to

reinforce our clients’ progress by accelerating their innovation. Our healthcare IT services include EHR and software implementation,

optimization, extension to community partners, as well as application managed services, and backup and disaster recovery capabilities

on public cloud. Our 24x7 managed services are used by hospitals and health systems, payers, Life Sciences, and biotech organizations

in their effort to improve health outcomes and deliver deeper, more meaningful patient and consumer experiences. Through our services,

our customers achieve return on investment in their technology by delivering measurable improvements. Combined with our software and solutions,

our services provide clients with an end-to-end partnership for their technology innovation.

SecureKloud Technologies, Inc.

SecureKloud Technologies, Inc., a Nevada corporation

(“SecureKloud”), and our largest shareholder of the Company, is a leading global information technology business

transformation, secure cloud solutions and managed services provider headquartered in Plainsboro, NJ providing solutions – SMAC

(Social, Mobile, Analytics and Cloud) for seamless connectivity between consumers, small, mid-size and large enterprises (the “Business”).

The principal executive offices of SecureKloud

are located at 666 Plainsboro Road, Suite 448, Plainsboro, NJ 08536, USA.

Description of the Asset Transfer Agreement

This subsection of the information statement describes

the material provisions of the Transaction and Asset Transfer Agreement, but does not purport to describe all of the terms of the Asset

Transfer Agreement. The following summary is qualified in its entirety by reference to the complete text of the Asset Transfer Agreement,

which is attached as Annex A hereto. You are urged to read the Asset Transfer Agreement in its entirety because it is the primary

legal document that governs the proposed acquisition.

The Asset Transfer Agreement contains representations,

warranties and covenants that the respective parties made to each other as of the date of the Asset Transfer Agreement or other specific

dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective

parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the Asset

Transfer Agreement. The representations, warranties and covenants in the Asset Transfer Agreement are also modified in important part

by the underlying disclosure schedules, which are not filed publicly and which are subject to a contractual standard of materiality different

from that generally applicable to stockholders and were used for the purpose of allocating risk among the parties rather than establishing

matters as facts.

Consideration

The aggregate purchase price for our acquisition

of SecureKloud’s assets as described in the Asset Transfer Agreement is $7,200,000, subject to adjustment as described below. The

purchase price is completely comprised of newly issued 12,000,000 shares of our Common Stock, pegged at $0.60 per share.

Under this provision, SecureKloud shall deliver

to the Company, without any encumbrances, “Transferred Assets” as used in the Asset Purchase Agreement, and which shall

include all assets of the Business involved in cloud and technology domain, including, without limitation, each of the following:

| ● | all assets (business contracts and employees); |

| ● | all immigration-related interests, obligations and liabilities of SecureKloud; |

| ● | all agreements, contracts, franchises, insurance policies, leases, property licenses, purchase orders,

software licenses, software escrow agreements, technology licenses understandings, or arrangements relating to SecureKloud’s cloud

and technology business, entered into by SecureKloud for or in connection with SecureKloud’s cloud and technology business; |

| ● | all government and regulatory permits, licenses, concessions, or other similar consents held by SecureKloud

for or in connection with the SecureKloud’s cloud and technology business; |

| | | |

| ● | the release from employment by SecureKloud of the employees connected with the SecureKloud’s cloud

and technology business, who have been offered employment by the Company as on the closing date, and who have accepted such employment; |

| ● | all business and financial records and documents connected with or relating to SecureKloud’s cloud

and technology business, including vouchers, invoices, books of accounts, tax records, tax returns, notices, filings, and all other documents

and records (whether proprietary, confidential or otherwise) used for or in connected with SecureKloud’s cloud and technology business,

owned, or controlled by SecureKloud or its agents, including any tax advisors, accountants, auditors or legal advisors. |

Reasons for the Proposed Transaction

In evaluating the Asset Transfer Agreement and

the proposed acquisition, our Board of Directors consulted with our management and its advisors and, in reaching its decision to approve

the Asset Transfer Agreement and the Transactions contemplated by the Asset Transfer Agreement, our Board of Directors considered a variety

of factors.

Our Board of Directors believed that, overall,

the potential benefits of the proposed acquisition to our stockholders outweighed the risks and uncertainties of the proposed acquisition.

In reaching its decision regarding the proposed acquisition, our Board did not quantify or otherwise assign relative weights to the specific

factors. Moreover, each member of our Board applied his or her own personal business judgment and may have given different weights to

different factors. Our Board did not undertake to make any specific determination as to whether any factor, or any particular aspect of

any factor, supported or did not support its ultimate determination. Our Board based its recommendation on the totality of the information

presented.

Consideration Offered to Stockholders

There is no consideration being offered to the

Company’s stockholders.

Issuance Of Common Stock

Pursuant to the terms of the Asset Transfer Agreement,

at the closing of the Transaction (the “Closing”), the Company will issue to SecureKloud approximately 12,000,000 shares

of its restricted Common Stock as payment of the Purchase Price. The Purchase Agreement has been unanimously approved by the boards of

directors of the Company and SecureKloud.

The Closing of the Transaction, currently scheduled

for September 29, 2024, is subject to customary closing conditions including receiving required regulatory approvals and obtaining approval

from the Company’s shareholders of the issuance of Common Stock in payment of the purchase price.

Reason for Stockholder Approval

Pursuant to Nasdaq Listing Rule 5635(a), if

(x) the common stock has or will have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before

the issuance of stock or securities convertible into or exercisable for common stock or (y) an issuer intends to issue common stock

or securities convertible into or exercisable for common stock, in connection with the acquisition of stock or assets of another

company, which may equal or exceed 20% of the outstanding common stock or voting power on a pre-transaction basis, the issuer

generally must obtain the prior approval of its stockholders. Pursuant to Nasdaq Stock Market Listing Rule 5635(b) requires listed

companies to obtain stockholder consent prior to the issuance of securities when the issuance or potential issuance will result in a

change of control of the company. Nasdaq generally considers a change of control occurs when, as a result of the issuance, an

investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power

and such ownership or voting power would be the largest ownership position. The number of shares of common stock to be issued to the

seller in the Asset Purchase Agreement upon would result in the issuance of a number of shares exceeding the threshold for which

stockholder approval is required under Nasdaq Listing Rule 5635(a) and Nasdaq Listing Rule 5635(b). To ensure compliance with Nasdaq

Listing Rule 5635(a) and Nasdaq Listing Rule(b), the Majority Stockholders approved the Asset Purchase Agreement and the

Transaction.

No Interests of Related Persons

No director or executive officer of our company

at any time since the beginning of the last fiscal year has any interest in the proposed acquisition.

No Appraisal Rights

Appraisal rights are not available to our stockholders

in connection with the proposed acquisition.

Accounting Treatment

We will account for the proposed acquisition using

the acquisition method of accounting in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 805

“Business Combinations” (“ASC 805”). In accordance with ASC 805, we will use our best estimates and assumptions

to assign fair value to the tangible and intangible assets acquired and liabilities assumed at the acquisition date. Goodwill of Appliances

Connection will be measured as the excess of the purchase consideration over the fair value of the net tangible assets and identifiable

assets acquired.

ACTIONS AUTHORIZED AND APPROVED

The actions that were taken by the Company’s

Board of Directors and by its majority stockholder were the authorization and approval of the Asset Purchase Agreement and the Nasdaq

Stockholder Approval, respectively.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth information with

respect to the beneficial ownership of our common stock and our Series A Super Voting Preferred Stock, our only outstanding classes of

capital stock having the right to vote on this matter, known by us as of the Record Date, by:

|

|

● |

each person or entity known by us to be the beneficial owner of more than 5% of our common stock; |

| |

|

|

| |

● |

each of our directors; |

| |

|

|

| |

● |

each of our executive officers; and |

| |

|

|

| |

● |

all of our directors and executive officers as a group. |

Beneficial ownership of the voting stock is determined

in accordance with the rules of the United States Securities and Exchange Commission (the “SEC”) and includes any

shares of Company voting stock over which a person exercises sole or shared voting or investment power, or of which a person has a right

to acquire ownership at any time within 60 days of August 29, 2024. Except as otherwise indicated, we believe that the persons named

in this table have sole voting and investment power with respect to all shares of voting stock held by them. Applicable percentage ownership

in the following table is based on 5,666,781 shares of our common stock and 6,000 shares of our Series A Super Voting preferred stock

issued and outstanding on August 29, 2024. As of August 29, 2024, there were 47 holders of our common stock and one holder of our Series

A Super Voting preferred stock.

Except as otherwise indicated, the persons listed

below have sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent such power

may be shared with a spouse. To our knowledge, none of the shares listed below are held under a voting trust or similar agreement, except

as noted. To our knowledge, there is no arrangement, including any pledge by any person of securities of the Company, the operation of

which may at a subsequent date result in a change in control of the Company.

| | |

Number of Shares

Beneficially

Owned | |

Beneficial Ownership Percentages | | |

| |

| Name and Address of Beneficial

Owner(1) | |

Title | |

Common

Stock | | |

Series A

Super Voting

Preferred

Stock(2) | | |

Percent of

Common

Stock | | |

Percent of

Series A Super Voting

Preferred

Stock | | |

Percent of

Voting

Stock(3) | |

| Officers and Directors | |

| |

| | |

| | |

| | |

| | |

| |

| Thyagarajan Ramachandran | |

Chief Financial Officer | |

| 56,186 | (5) | |

| — | | |

| 1.0 | % | |

| — | | |

| 0.5 | % |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Shibu Kizhakevilayil | |

Director | |

| 32,732 | (6) | |

| — | | |

| 0.6 | % | |

| — | | |

| 0.3 | % |

| Ronald McClurg | |

Director | |

| — | | |

| — | | |

| * | | |

| — | | |

| * | |

| Dave Rosa | |

Director | |

| — | | |

| — | | |

| * | | |

| — | | |

| * | |

| Jainal Bhuiyan | |

Director | |

| — | | |

| — | | |

| * | | |

| — | | |

| * | |

| Officers and Directors as a Group | |

| |

| | | |

| | | |

| | | |

| | | |

| — | |

| | |

| |

| 88,918 | | |

| | | |

| 1.5 | % | |

| N/A | | |

| 0.8 | % |

| 5% Stockholders | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| SecureKloud Technologies, Inc.(4) | |

| |

| 2,550,000 | | |

| — | | |

| 44.1 | % | |

| N/A | | |

| 21.6 | % |

| Suresh Venkatachari | |

| |

| 137,152 | (7) | |

| 6,000 | | |

| 2.4 | % | |

| 100 | | |

| 52.1 | % |

|

(1) |

The principal address of the named officers, directors and 5% stockholders of the Company is c/o Healthcare Triangle, Inc, 7901, Stoneridge Dr, Suite # 220, Pleasanton, California 94588. |

| (2) |

Entitles the holder to 1,000 votes per share and votes with the common stock as a single class. |

| (3) |

Represents total ownership percentage with respect to all shares of common stock, options and Series A Super Voting Preferred Stock, as a single class. |

| |

|

| (4) |

SecureKloud Technologies, Inc. is 60.71% owned by SecureKloud Technologies Limited which is a publicly traded company in India. |

| |

|

| (5) |

Includes 41,186 shares of our common stock underlying stock options that have vested or are exercisable within 60 days of August 29, 2024. |

| |

|

| (6) |

Includes 12,732 shares of our common stock underlying stock options that have vested or are exercisable within 60 days of August 29, 2024. |

| |

|

| (7) |

Includes 62,152 shares of our common stock underlying stock options that have vested or are exercisable within 60 days of August 29, 2024. |

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION

TO

MATTERS TO BE ACTED UPON

None of the persons who have served as our officers

or directors since the beginning of our last fiscal year, or any associates of such persons, have any substantial interest, direct or

indirect, in the authorization and approval of the Asset Purchase Agreement or in the Nasdaq Stockholder Approval, other than the interests

held by such persons through their respective beneficial ownership of the shares of our capital stock set forth above in the section entitled

“Security Ownership of Certain Beneficial Owners and Management.” None of our directors opposed the authorization and approval

of the Asset Purchase Agreement.

VOTE OBTAINED — DELAWARE LAW

Section 228 of the DGCL generally provides that

any action required to be taken at a meeting of stockholders may be taken without a meeting, without prior notice and without a vote,

if a written consent thereto is signed by stockholders having not less than the minimum number of votes that would be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Pursuant to the Nasdaq Listing Rules,

a majority of the outstanding voting shares of stock entitled to vote thereon is required in order to effectuate the Nasdaq Stockholder

Approval. In order to eliminate the costs and management time involved in obtaining proxies and to effect the above action as early as

possible in order to accomplish the purposes of the Company as herein described, the Board consented to the utilization of, and successfully

obtained, written consent of the Majority Stockholder.

As of August 29, 2024, there were 5,666,781 shares

of common stock of the Company and 6,000 shares of the Series A Super Voting Preferred Stock issued and outstanding. Each holder of common

stock is entitled to one vote for each share held by such holder and the holder of the Series A Super Voting Preferred Stock has 1,000

votes per share and votes with the common stock as a single class. On August 29, 2024, stockholders holding in the aggregate 2,625,000

shares of common stock and 6,000 shares of the Series A Super Voting Preferred Stock or approximately 46.3% of the capital stock

outstanding on such date having the right to vote on the Nasdaq Stockholder Approval, approved the Nasdaq Stockholder Approval.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING

AN ADDRESS

Only one Information Statement is being delivered

to multiple security holders sharing an address unless the Company has received contrary instructions from one or more of its security

holders. The Company undertakes to deliver promptly and without charge, upon written or oral request, a separate copy of the information

statement to a security holder at a shared address to which a single copy of the documents was delivered. Security holders sharing an

address and receiving a single copy may send a request to receive separate information statements to the Company at the following address:

Healthcare Triangle, Inc., 7901 Stoneridge Drive, Suite 220, Pleasanton, California 94588. Telephone: (925) 270-4812.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and file annual, quarterly, and special reports,

proxy statements, and other information with the SEC. Our SEC filings are available to you on the SEC’s website at www.sec.gov.

Documents we have filed with the SEC are also available on our website through the investors link at www.applieduvinc.com.

Information contained on our website does not constitute a part of this prospectus and is not incorporated by reference herein.

You may request a copy of these filings, at no

cost, by writing Healthcare Triangle, Inc. at 7901 Stoneridge Drive, Suite 220, Pleasanton, California 94588 or telephoning the Company

at (925) 270-4812. Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes

to the extent that a statement contained in this Information Statement (or in any other document that is subsequently filed with the SEC

and incorporated by reference) modifies or is contrary to such previous statement. Any statement so modified or superseded will not be

deemed a part of this Information Statement except as so modified or superseded.

Our common stock is traded on the Nasdaq Capital Market under the symbol

“HCTI.”

Our transfer agent is VStock Transfer, LLC. Their

address is 18 Lafayette Place, Woodmere, New York 11598 and their telephone number is (212) 828-8436.

INCORPORATION BY REFERENCE

Statements contained in this information statement,

or in any document incorporated in this information statement by reference regarding the contents of other documents, are not necessarily

complete and each such statement is qualified in its entirety by reference to that contract or other document filed as an exhibit with

the SEC. The SEC allows us to “incorporate by reference” into this information statement certain documents we file with the

SEC. This means that we can disclose important information to you by referring you to another document filed separately with the SEC.

The information incorporated by reference is considered to be part of this Information Statement, and later information that we file with

the SEC, prior to the effective date of the actions set forth herein, will automatically update and supersede that information. We incorporate

by reference all of the documents we filed since January 1, 2023 with the SEC and any documents filed by us pursuant to Section 13(a),

13(c), 14 or 15(d) of the Exchange Act after the date of this Information Statement and prior to the effective date of the actions set

forth herein. These include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, as well as information or proxy statements (except for information furnished to the SEC that is not deemed to be “filed”

for purposes of the Securities Exchange Act of 1934). Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of

any Current Report on Form 8-K, including the related exhibits, is not incorporated by reference into this information statement.

Any person, including any beneficial owner, to

whom this Information Statement is delivered may request copies of reports, proxy statements or other information concerning us, without

charge, as described above in “Where You Can Find More Information.”

You should rely only on information contained

in or incorporated by reference in this information statement. No persons have been authorized to give any information or to make any

representations other than those contained in this information statement and, if given or made, such information or representations must

not be relied upon as having been authorized by us or any other person.

THIS INFORMATION STATEMENT IS DATED SEPTEMBER

___, 2024. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THAT

DATE, AND THE MAILING OF THIS INFORMATION STATEMENT TO STOCKHOLDERS DOES NOT CREATE ANY IMPLICATION TO THE CONTRARY.

This Information Statement is first being mailed

or furnished to stockholders on or about September ___, 2024. The Company will pay all costs associated with the distribution of this

Information Statement, including the costs of printing and mailing. The Company will reimburse brokerage firms and other custodians, nominees

and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of the Common

Stock.

This Information Statement is provided to the

stockholders only for information purposes in connection with the Certificate of Amendment, pursuant to and in accordance with Rule 14c-2

of the Exchange Act. Please carefully read this Information Statement.

By Order of the Board of Directors:

|

Dated: September ___, 2024 |

Healthcare Triangle, Inc. |

| |

|

| |

/s/ Thyagarajan Ramachandran |

| |

Name: |

Thyagarajan Ramachandran |

| |

Title: |

Chief Financial Officer |

ANNEX A

ASSET

TRANSFER AGREEMENT

AUGUST

27, 2024

ASSET TRANSFER AGREEMENT

This ASSET TRANSFER AGREEMENT (the “Agreement”)

is entered into as of August 27, 2024 (“Execution Date”) by and between:

| (1) | SecureKloud Technologies, Inc., a Nevada corporation, having its registered office at 666 Plainsboro Road, Suite 448, Plainsboro, NJ 08536,

USA (the “Seller” which expression shall unless repugnant to the context or meaning thereof, mean and include its successors

and administrators); and |

| (2) | Healthcare Triangle, Inc., a Delaware corporation, having its principal office at 7901, Stoneridge Drive, Suite 220, Pleasanton,

CA 94588 (hereinafter referred to as the “Purchaser” which expression shall unless repugnant to the context or

meaning thereof, mean and include its successors and administrators). |

(The Seller and the Purchaser are individually referred to in this

Agreement as a “Party” and together as the “Parties”).

RECITALS:

WHEREAS: the Seller is a leading global information technology

business transformation, secure cloud solutions and managed services provider headquartered in Plainsboro, NJ providing solutions –

SMAC (Social, Mobile, Analytics and Cloud) for seamless connectivity between consumers, small, mid-size and large enterprises, (the “Business”);

WHEREAS: The Seller

wishes to sell, transfer, convey and assign to the Purchaser, and the Purchaser wishes to purchase from the Seller the business, assets,

and operations relating to cloud and technology domain that currently form part of the Seller’s Business (the “Transferred

Assets”), as a whole and as a going concern in exchange for the issuance by the Purchaser to the Seller of 12,000,000 shares

of the Purchaser’s Common Stock, on and subject to the terms and subject to the conditions specified in this Agreement (the

“Purchaser Equity”).

WHEREAS: The Purchaser and Seller have passed appropriate board

resolutions authorizing the execution, delivery and performance of this Agreement and the transactions contemplated hereby and authorizing

their respective representatives to execute all documentation and undertake all actions in relation thereto; and

WHEREAS: The Seller and the Purchaser wish to record in this

Agreement the terms of the proposed transfer of the Transferred Assets in consideration for the issuance of the Purchaser Equity by the

Purchaser to the Seller.

AGREEMENT:

NOW THEREFORE, THE PARTIES

AGREE AS FOLLOWS:

1. AGREEMENT

TO SELL AND PURCHASE

1.1 Subject

to the other provisions of this Agreement, the Seller hereby sells, conveys, transfers and assigns the Transferred Assets to the Purchaser,

as a whole, and as a going concern, in consideration for the issuance to the Seller of the Purchaser Equity, in the manner and on

the terms specified in this Agreement.

1.2 Subject

to the other provisions of this Agreement, and based on the representations of the Seller contained in this Agreement (“Representations”),

the Purchaser hereby purchases from the Seller the Transferred Assets in consideration for the issuance to the Seller of the Purchaser

Equity of 12,000,000 shares at $0.60 per share1 valuing the transferred assets at USD 7.20 million, in the manner

and on the terms specified in this Agreement.

1.3 The

consideration of USD 7.20 million is payable in equity, subject to applicable withholding, in the form of applicable number of shares

of Buyer’s capital stock calculated based on the average of the VWAPs for the 20 Trading Days immediately prior to the Closing Date

(the “Closing Equity Consideration”).

1.4 Without

prejudice to the generality of the foregoing, and subject to Clause 1.4 below, the term “Transferred Assets”

as used in this Agreement shall include all assets of the Business involved in cloud and technology domain, including, without limitation,

each of the following:

(i) All assets (business

contracts and employees) owned by the Seller identified in Schedule 1.3(i): Transferred Tangible Assets to this Agreement (collectively,

the “Transferred Tangible Assets”), free and clear of any liens, pledges, charges, mortgages, defects in title, objections,

security interests, claims, options, rights of first offer or refusal, hypothecations, restrictions on transfer, or other encumbrances

of any kind (“Encumbrances”);

(ii) all

immigration-related interests, obligations and liabilities of the Seller as the original petitioning employer, including but not limited

to those obligations, liabilities, and undertakings arising from and under attestations contained in the Labor Condition Applications

(LCAs) filed with the U.S. Department of Labor for H-1B petitions filed by the Seller;

(iii) All agreements,

contracts, franchises, insurance policies, leases, property licenses, purchase orders, software licenses, software escrow agreements,

technology licenses understandings, or arrangements relating to the Seller’s cloud and technology business (“Arrangements”)

entered into by the Seller for or in connection with the Seller’s cloud and technology business (“Transferred Contracts”)

and listed and identified in Schedule 1.3(iii): Transferred Contracts to this Agreement;

(iv) Subject to obtaining

approvals of any third parties as may be required, all Arrangements entered into by the Seller for or in connection with the Seller’s

cloud and technology cloud and technology business (“Future Transferred Contracts”) and listed and identified in Schedule

1.3(iv):: Future Transferred Contracts to this Agreement, which Future Transferred Contracts shall be deemed assigned automatically

and immediately upon receipt of the appropriate approvals of any third parties, as required;

(v) All government and

regulatory permits, licenses, concessions, or other similar consents held by the Seller for or in connection with the Seller’s

cloud and technology business (“Permits”), if and to the extent such Permits are valid and subsisting on the Closing

Date and are capable of being transferred or assigned in accordance with applicable law, as listed and identified in Schedule 1.3(v):

Permits to this Agreement;

| 1 | Based upon, and over and above the last reported closing price

of Healthcare Triangle, Inc.’s Common Stock on Nasdaq, which was $0.58 per share. |

(vi) The release from

employment by the Seller of the employees connected with the Seller’s cloud and technology business, who have been offered employment

by the Purchaser as on the Closing Date, who have accepted such employment, and who are identified in Schedule 1.3(vi): Transferred

Employees to this Agreement (“Transferred Employees”);

(vii) All

business and financial records and documents connected with or relating to the Seller’s cloud and technology business, including

vouchers, invoices, books of accounts, tax records, tax returns, notices, filings, and all other documents and records (whether proprietary,

confidential or otherwise) used for or in connected with the Seller’s cloud and technology business (“Business Records”),

owned, or controlled by the Seller or its agents, including any tax advisors, accountants, auditors or legal advisors.

1.5 Notwithstanding

anything contained in any other provision of this Agreement, the Seller’s cloud and technology business specifically and expressly

excludes any and all libilities and obligations associated with the Seller’s Business and outstanding on the date hereof, other

than those listed on Schedule 1.4: Transferred Liabilities.

2. CONSIDERATION

In consideration for the sale,

transfer, assignment and conveyance of the Transferred Assets by the Seller, in accordance with the provisions hereof, the Purchaser shall

issue to the Seller the Purchaser Equity pursuant to a Common Stock Purchase Agreement, in substantially the form attached as Exhibit

A hereto.

3. TAX

MATTERS AND OTHER COSTS

3.1 The

Purchaser shall issue the Purchaser Equity to the Seller, in accordance with Clause 2 of this Agreement, for a transfer of the

Transferred Assets, as a whole and on a going concern basis only, and accordingly the Parties agree that no goods and services tax, sales

tax or customs duty or similar tax, or surcharge thereon shall be payable by the Purchaser to the Seller in connection with the sale of

the Transferred Assets. If any goods and services tax, sales tax or customs duty or similar tax, or surcharge thereon is payable on the

sale of the Transferred Assets, then such tax (other than any tax on the Seller’s income or the Seller’s capital gains) shall

be borne by the Seller.

3.2 Where

any tax is required to be withheld or deducted at source on any payment by any Party pursuant to this Agreement, the payor shall be entitled

to withhold or deduct the same at source, as required by law, provided that the payor shall issue the recipient thereof with necessary

certificates of such withholding or deduction at source in accordance with applicable law, and within the time periods stipulated.

3.3 The

Seller shall bear all income and capital gains taxes payable by the Seller on account of the sale of the Transferred Assets pursuant to

this Agreement.

3.4 The

Purchaser shall bear the applicable taxes levied by any authorities whatsoever payable in connection with any deed or document required

to be executed in relation to the conveyance or assignment, as the case may be, of any property included in the Transferred Assets.

3.5 Each

Party shall bear the costs and charges of its own professional and legal advisors.

4. CLOSING

4.1 Closing

shall take place at the Seller’s place of business on September 29, 2024, at 5:00 pm PST.

4.2 At

Closing, the Seller shall execute and deliver the Assignment Deed, in substantially the form attached as Exhibit B hereto.

4.3 At

Closing, the Parties shall complete each of the actions and steps required to complete the sale of the Transferred from the Seller to

the Purchaser and the issuance of Purchaser Equity to Seller.

5. REPRESENTATIONS

AND WARRANTIES

5.1 Each

Party represents and warrants to the other as follows.

(i) It

has all requisite power and authority to enter into and perform all its obligations under this Agreement.

(ii) It

has taken all actions, obtained all regulatory, corporate and contractual authorizations, and submitted all notices or filings required

to be submitted, for it to validly enter into this Agreement and perform all its obligations under this Agreement.

(iii) The

execution and delivery of, or the performance of obligations under, this Agreement do not violate or conflict with any statute, rule,

regulation, directive, other law, judgment, order, decree or award applicable to it or to any provision of its constituent documents,

or any agreement, contract, promise, covenant, undertaking, representation or warranty, applicable to or made by it.

(iv) This

Agreement constitutes legal, valid and binding obligations, enforceable against it in accordance with its terms.

5.2 The

Seller hereby represents to the Purchaser, that to the best of its knowledge, each of the Representations set out in Schedule 5.2:

Representations to this Agreement is true, materially accurate, and not misleading, as on the date of this Agreement and as on the

Closing Date. Provided that such Representations are made subject to the following:

(i) The

Representations are qualified to the extent such qualifications have been expressly set out in the disclosure schedule set out in Disclosure

Schedule to this Agreement (“Disclosure Schedule”), in substantially the form attached as Exhibit C

hereto;

(ii) Where

any Representation is stated to be made to the Seller’s best knowledge, or where any Representation is similarly qualified, such

Representation has been

(iii) made

and shall be deemed to have been made after the exercise of reasonable diligence by the Seller;

(iv) Any

Representation made expressly as of a specific date is true and correct as of that specific date only;

(v) Any

Representation that addresses any specific circumstances or facts does not allow recourse to a general statement;

(vi) Each

Representation is separate and independent and, save as expressly provided to the contrary, shall not be limited by inference from any

other Representation or any other term of this Agreement.

5.3 The

Seller shall not do, allow or procure to be done, any act or omission that would constitute a breach of any Representation, or that would

make any Representation false, incomplete, inaccurate or misleading if they were so given.

5.4 The

Seller covenants to disclose promptly to the Purchaser in writing, immediately upon becoming aware of the same, any matter, event, or

circumstance (including any omission to act) that may arise or become known between the date of this Agreement and the Closing Date and

that would render any Representation to be inaccurate or incomplete or that relate to the occurrence of any material adverse event.

6. CONFIDENTIALITY

6.1 For

purposes of this Agreement, Confidential Information means all scientific, technical, trade, financial or business information

or materials that are either proprietary or not publicly known that any Party (Discloser) may from time to time disclose or otherwise

make available to the other Party (Recipient) in connection with or pursuant to this Agreement. Without prejudice to the generality

of the foregoing, Confidential Information includes the provisions of this Agreement, and information and materials related to any activities

of the Discloser whether or not such information is marked or identified as confidential or proprietary. Provided that in relation to

any and all Confidential Information connected in any manner with the Transferred Assets, the Seller shall be deemed the Discloser of

such Confidential Information prior to the Closing Date, and the Purchaser shall be deemed the Discloser of such Confidential Information

after the Closing Date (notwithstanding the earlier disclosure of such information by the Seller to the Purchaser).

6.2 Notwithstanding

anything contained in Clause 6.1, Confidential Information shall not include information that:

(i) at

the time of disclosure, is known publicly or thereafter becomes known publicly through no fault attributable to the Recipient;

(ii) becomes

available to the Recipient from a third party that is not legally prohibited from disclosing such information, provided such information

was not acquired from the Discloser;

(iii) was

developed by the Recipient independently of information obtained from the Discloser, as shown by the Recipient’s written records

that predate the receipt of such information from the Discloser;

(iv) was

already known to the Recipient before receipt from the Discloser, as shown by the Recipient’s written records that predate the receipt

of such information from the Discloser; or

(v) is

released with the prior written consent of the Discloser.

6.3 A

disclosure of Confidential Information made by or on behalf of the Discloser, including by its employees, agents, consultants, affiliates

or associates, as well as disclosure by any means (whether written or oral) or through any medium, and any disclosure made prior or subsequent

to the date of this Agreement shall be deemed to be a disclosure of Confidential Information for purposes of this Agreement.

6.4 Each

Discloser hereby represents, warrants and covenants that it is entitled to and will be entitled to disclose all Confidential Information

disclosed pursuant to or in connection with this Agreement.

6.5 The

Recipient hereby covenants to do each of the following for a period of two (2) years following the earlier of (a) the Closing Date or

(b) the expiry or termination of this Agreement for any reason:

(i) Keep

all Confidential Information in strict confidence, with at least the same level of care as it applies to keeping its own personal, financial

or proprietary information confidential, and in any event no less than reasonable care to prevent the unauthorized disclosure or use of

any Confidential Information;

(ii) Not

use, modify, create any derivative works from, or otherwise deal in any Confidential Information, except when the Recipient is required

to do so solely in connection with this Agreement, and then only as specified by the Discloser;

(iii) Not

disclose any Confidential Information to any other persons or entities except persons who need access to the Confidential Information

in connection with this Agreement, and who are bound by equivalent obligations of confidentiality; and

(iv) Notify

the Discloser in writing immediately upon discovery of any unauthorized use or disclosure of any Confidential Information and reasonably

cooperate with the Discloser to prevent any unauthorized disclosure or use of the Confidential Information and to mitigate any losses

arising from such unauthorized disclosure or use.

Provided that if the Recipient

is required to disclose any Confidential Information by reason of a legal requirement or by the order of a judicial or administrative

authority or by the listing requirements of a recognized stock exchange on which the securities of the Recipient are publicly traded,

the Recipient, to the extent reasonably practicable, shall send to the Discloser prior notice of such requirement in order to allow the

Discloser reasonable opportunity to oppose such process or to obtain protective or confidential treatment of the Confidential Information,

and to the extent that a protective order or other legal protection is not obtained by the Discloser, the Recipient shall disclose only

that portion of the information that is legally required to be disclosed.

6.6 Subject

to the other provisions of this Clause 6, the Recipient shall be liable for any breach of its covenants in Clause 6.5 by

any person to whom any Confidential Information is disclosed or provided by the Recipient, and the Recipient undertakes to take any and

all necessary actions, at its own cost and expense, to prevent or remedy such breach.

6.7 Upon

expiration or termination of this Agreement or earlier upon receipt of a written request from the Discloser, the Recipient shall cease

all use of the Confidential Information and promptly return to the Discloser all documents and materials of the Discloser that relate

to or contain any Confidential Information without retaining copies thereof, except for one (1) copy that may be made and retained by

the Recipient solely for record-keeping and purposes of assuring continued compliance with its obligations under this Agreement.

6.8 Unless

otherwise expressly provided in this Agreement, the disclosure of Confidential Information shall not of itself grant the Recipient any

right, title or interest in the Confidential Information, except the limited right to use the Confidential Information solely for the

purposes specified pursuant to and in accordance with this Agreement.

6.9 The

Recipient acknowledges and agrees that the Discloser is not making and shall not be deemed to have made any implied representations or

warranties regarding the accuracy or completeness of any Confidential Information, but nothing contained in this Clause 6 shall

affect any Representation or any other express representation or warranty made with regard to the accuracy or completeness of any Confidential

Information.

6.10 The

Parties agree that in addition to any other rights or remedies available under this Agreement, in the event of any breach or any threatened

breach of any obligations under this Clause 6 where such breach or threatened breach is in any way attributable to the Recipient,

monetary damages do not provide a sufficient remedy, and the Discloser shall be entitled to an injunction restraining and to seek specific

performance by the Recipient of any obligation under this Clause 6.

7. INDEMNIFICATION

7.1 Subject

to the other provisions of this Clause 7, from and after the Closing, the Seller shall indemnify the Purchaser and save and hold

the Purchaser harmless against any and all judgments, awards, liabilities, losses, costs or damages, including reasonable fees and expenses

of attorneys, accountants and other professional advisors, actually incurred, whether involving a dispute solely among the Parties or

otherwise, and any costs, including reasonable fees and expenses of attorneys, accountants and other professional advisors, incurred in

investigating, defending or settling any claim, action or cause of action (“Losses”) suffered, incurred or paid, directly

or indirectly, by any of them as a result of, arising out of or related to any third party claims made against the Purchaser as a result

of:

(i) any

failure of any Representation of the Seller, in each case as qualified and modified by the relevant Disclosure Letter, to be true and

correct in all material respects, in accordance with the provisions hereof; and/or

(ii) any

breach of any covenant by the Seller in this Agreement.

7.2 The

Representations contained in this Agreement, including the Disclosure Schedule and any document delivered pursuant to this Agreement,

shall survive Closing until the date that is twenty-four (24) months after the Closing Date.

8. TERMINATION

This Agreement may not be terminated

except by mutual consent of the Parties recorded in writing and then only on such terms as shall be recorded.

9. MISCELLANEOUS

9.1 The

section and clause headings and captions used in this Agreement are for convenience and identification only; otherwise, they form no part

of this Agreement and do not affect its interpretation or construction.

9.2 References

to sections, clauses or schedules without further specification are references to sections and clauses of this Agreement.

9.3 References

to this Agreement include all sections, clauses and schedules in this Agreement and all recitals to this Agreement, as amended from time

to time in writing by the Parties in accordance with the provisions of this Agreement.

9.4 Any

reference to a statute or any provision of a statute includes a reference to that statute or provision and any rule, regulation, notification,

circular, or direction made or issued pursuant to that statute or provision, as may be from time to time modified or re-enacted, whether

prior to or after the date of this Agreement.

9.5 References

to the singular include references to the plural and vice versa.

9.6 Words

denoting one grammatical gender include references to all grammatical genders.

9.7 When

the term “include”, “including” or “including in particular” is used in this Agreement, such use means

“include without limitation”, “including without limitation” and “including in particular and without limitation”

respectively.

9.8 The

laws of the State in California shall govern all matters arising out of or relating to this Agreement, including, its validity, interpretation,

construction, performance, expiry, termination and enforcement.

9.9 Any

controversy, claim, or dispute arising out of or in connection with this Agreement, including any question regarding its existence, validity

or termination, shall be settled by arbitration administered by the American Arbitration Association in accordance with its arbitration

rules, and judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. A notice of, or request

for, arbitration will not operate to stay, postpone or rescind the effectiveness of any demand for performance.

9.10 Subject

to the provisions of Clause 9.9, the Parties hereby confirm that the courts in Alameda County, California have jurisdiction over

the Parties in connection with this Agreement.

9.11 Any

notice, communication, document or other instrument required to be given under this Agreement shall be in writing and given by sending

it by recognized courier with acknowledgement of receipt requested, or by electronic mail to the addresses specified below, or such other

addresses as have been previously notified by each Party to the other in accordance with the provisions of this Clause 9.11.

IF TO THE PURCHASER:

Healthcare Triangle, Inc.

Address: 7901 Stoneridge Dr, Suite 220

Pleasanton, CA 94588

Attn: Thyagarajan Ramachandran

Tel.: 708-289-5111

Email: rt@healthcaretriangle.com

IF TO THE SELLER:

SecureKloud Technologies, Inc.

Address: 666 Plainsboro Road, Suite 448, Plainsboro,

NJ 08536, USA

Attn: PK Chandrasekher

Tel.: 609-933-7196

Email: pk@securekloud.com

Any notice, direction or other

instrument required or permitted to be given under this Agreement shall be deemed to have been validly and effectively given (i) if

sent by recognized courier with acknowledgement of receipt requested, then on the date of such delivery or receipt if such date is a working

day in the city where the recipient’s address is located or otherwise on the next working day, or (ii) if transmitted by electronic

mail, then on the working day (in the city where the recipient’s address is located) following the date of transmission.

9.12 This

Agreement contains all the promises, agreements, conditions and understandings between the Parties with respect to the subject matter

of this Agreement, and supersedes all prior or contemporaneous promises, agreements, conditions and understandings, whether oral or written,

with respect to such subject matter.

9.13 Each

Party agrees to execute and deliver all further instruments and documents and to perform all other acts that may be reasonably necessary

or expedient to further the purposes of this Agreement. Each Party will not, directly or indirectly, permit or condone any action or engage

in any omission or inaction that might cause any undertaking or covenant, or any representation or warranty not to be satisfied or fulfilled,

including any action or inaction that might cause any undertaking, covenant, representation or warranty not to be true, correct and accurate

during the term of or the term required under this Agreement.

9.14 This

Agreement may be executed in one or more counterparts, all of which together shall constitute one and the same instrument. Any Party may

enter into this Agreement by executing a counterpart, and a delivery by email to the other Party of a scanned copy of any such executed

counterpart shall be deemed to constitute delivery of the original counterpart.

9.15 No

amendment of, supplement to or suspension of this Agreement shall be effective unless it is in writing and duly executed by both Parties.

9.16 No

Party, without the prior written consent of the other Party, may assign to any other person any of its rights, or delegate or sub-contract

to any other person, the performance of any of its obligations arising under or related to this Agreement.

9.17 This

Agreement binds and benefits the successors and permitted assigns of each Party. Without prejudice to the foregoing, this Agreement does

not confer any enforceable rights or remedies upon any person other than the Parties.

9.18 Nothing

in this Agreement shall or shall be deemed to constitute a partnership between the Parties or to constitute any Party as the agent of

the other Party for any purpose.

9.19 A

Party shall not make or publish any announcement or press release concerning or connected with this Agreement, without the prior written

consent of the other Party, unless otherwise required by law.

9.20 No

provision of this Agreement shall be construed against a Party on the ground that it or its agents or advisors drafted such provision.

9.21 If

any provision of this Agreement should be or become entirely or partly invalid or unenforceable, such invalidity or unenforceability shall

not affect the validity or enforceability of any other provision of this Agreement. Any invalid or unenforceable provision shall be regarded

as replaced by such valid and enforceable provision that as closely as possible reflects the economic purpose that the Parties hereto

had pursued with the invalid or unenforceable provision.

[The remainder of this page has been deliberately

left blank. The signature page and schedules follow]

IN

WITNESS WHEREOF, the Parties have executed and delivered this Agreement effective as of the day and year first written above.

| |

SELLER: |

| |

|

|

| |

SecureKloud Technologies, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

PK Chandrasekher |

| |

Title: |

VP, Finance |

| |

|

|

| |

Address: |

666 Plainsboro Road, |

| |

|

Suite 448, Plainsboro, |

| |

|

NJ 08536, USA |

| |

Email: |

pk@securekloud.com |

| |

|

|

| |

PURCHASER: |

| |

|

|

| |

HEALTHCARE TRIANGLE, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Thyagarajan Ramachandran |

| |

Title: |

Chief Financial Officer |

| |

|

| |

Address: |

7901 Stoneridge Dr, |

| |

|

Suite 220, Pleasanton, CA 94588 |

| |

Email: |

rt@healthcaretriangle.com |

A-11

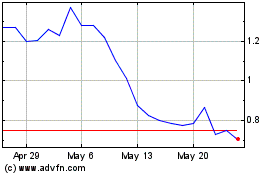

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Feb 2024 to Feb 2025