Leading Independent Proxy Advisory Firm Glass Lewis Joins ISS in Recommending that Territorial Shareholders Vote “FOR” Merger with Hope Bancorp

25 October 2024 - 10:30PM

Territorial Bancorp Inc. (NASDAQ: TBNK) (“Territorial” or the

“Company”) today announced that leading independent proxy advisory

firm Glass, Lewis & Co., LLC (“Glass Lewis”) has joined

Institutional Shareholder Services (“ISS”) in recommending that

Territorial shareholders vote “FOR” the Company’s pending merger

with Hope Bancorp, Inc. (NASDAQ: HOPE) (“Hope Bancorp”).

The Company’s Special Meeting of Stockholders to vote on the

transaction is scheduled to be held on November 6, 2024 at 8:30am,

Hawai‘i Time. Time is short. The Special Meeting is fast

approaching. Territorial shareholders are urged to vote TODAY.

Voting is simple. For more information, visit the Company’s website

at https://www.territorialandhopecombination.com.

Commenting on the Glass Lewis and ISS reports, Territorial

issued the following statement:

The Territorial Board of Directors

and management team collectively own 9.2% of Territorial’s

outstanding shares. We are confident that the Hope Bancorp

transaction is the best path forward for Territorial, our

shareholders, customers, employees and the local communities we

serve. We have already voted all of our shares FOR the transaction,

and we urge our fellow Territorial shareholders to join us and also

follow the recommendations from the Territorial Board, Glass Lewis

and ISS by voting FOR the Hope Bancorp transaction today.

Glass Lewis stated in its October 24, 2024 reporti:

On the favorable financial aspects associated with the Hope

Bancorp merger:

- “Since the merger consideration in the proposed Hope

transaction solely comprises Hope shares, current Territorial

shareholders will have the opportunity to benefit from ongoing

participation in a profitable, enlarged bank that is expected to be

better equipped, compared to Territorial on a standalone basis, to

work through various challenges and headwinds amid an uncertain

economic environment.”

- “From a quantitative perspective, the results of the dividend

discount model analysis performed by KBW suggest that the implied

value of the proposed Exchange Ratio is relatively favorable.”

On the uncertainty, risks and concerns associated with Blue

Hill’s preliminary indication of interest, including its lack of

financing, the secrecy of its investors and doubts about its

ability to close a transaction at all:

- “We also believe that, to date, Blue

Hill has provided insufficient disclosures to the Board and to

shareholders regarding key details of its proposal.”

- “In our view, the lack of such

crucial information, which Blue Hill insists on keeping

confidential, coupled with the uncertainties connected with Blue

Hill's need to conduct due diligence to confirm its offer price,

casts serious doubts as to the risks and closing certainty of Blue

Hill's proposed deal.”

- “Blue Hill has not provided any form of supporting evidence as

to why the Blue Hill Investors would not be considered as ‘acting

in concert’ by the relevant regulatory authorities, which may

validate the Board's concerns regarding the complexity and

uncertainties connected to the Blue Hill Proposal.”

In affirming that the Territorial Board reached the right

conclusion with respect to the Blue Hill preliminary indication of

interest and the determination that it is not a superior proposal

or likely to lead to a proposal that is superior to the Hope

Bancorp transaction:

- “any direct engagement between the Board and Blue Hill could be

seen as a breach of the covenants in the Merger Agreement.”

- “we ultimately believe the Board's decision not to deem the

Blue Hill Proposal a superior proposal to be the most prudent

approach, particularly given Blue Hill's lack of serious attempts

to address the Board's concerns regarding the uncertainties of the

Blue Hill Proposal.”

- “We acknowledge that the Blue Hill Proposal offers a

meaningfully higher headline price to Territorial

shareholders...However, we believe the Board has raised valid

concerns regarding the uncertainty and significant conditionality

of the Blue Hill Proposal.”

|

Your Vote is ImportantTerritorial Shareholders are

Urged to Vote FOR the Hope Bancorp Merger TODAY.Voting is quick and

easy. Vote well in advance of the Special Meeting on November 6,

2024 at 8:30 a.m. HST.Call toll-free:(888) 742-1305Banks and

brokers should call:(516) 933-3100Email:

info@laurelhill.comElectronically: www.proxyvote.com |

About Us

Territorial Bancorp Inc., headquartered in Honolulu, Hawaiʻi, is

the stock holding company for Territorial Savings Bank. Territorial

Savings Bank is a state-chartered savings bank which was originally

chartered in 1921 by the Territory of Hawaiʻi. Territorial Savings

Bank conducts business from its headquarters in Honolulu, Hawaiʻi,

and has 28 branch offices in the state of Hawaiʻi. For additional

information, please visit https://www.tsbhawaii.bank/.

Additional Information about the Hope Merger and Where

to Find It

In connection with the proposed Hope Merger, Hope has filed with

the U.S. Securities and Exchange Commission (the “SEC”) a

Registration Statement on Form S-4, containing the Proxy

Prospectus, which has been mailed or otherwise delivered to

Territorial’s stockholders on or about August 29, 2024, as

supplemented September 12, 2024. Hope and Territorial may file

additional relevant materials with the SEC. INVESTORS AND

STOCKHOLDERS ARE URGED TO READ THE PROXY PROSPECTUS, AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR

FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION AND RELATED MATTERS. You may obtain any of the

documents filed with or furnished to the SEC by Hope or Territorial

at no cost from the SEC’s website at www.sec.gov.

Forward-Looking Statements

Some statements in this news release may constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, expectations regarding

the low-cost core deposit base, diversification of the loan

portfolio, expansion of market share, capital to support growth,

strengthened opportunities, enhanced value, geographic expansion,

and statements about the proposed transaction being immediately

accretive. Forward-looking statements include, but are not limited

to, statements preceded by, followed by or that include the words

“will,” “believes,” “expects,” “anticipates,” “intends,” “plans,”

“estimates” or similar expressions. With respect to any such

forward-looking statements, Territorial Bancorp claims the

protection provided for in the Private Securities Litigation Reform

Act of 1995. These statements involve risks and uncertainties. Hope

Bancorp’s actual results, performance or achievements may differ

significantly from the results, performance or achievements

expressed or implied in any forward-looking statements. The closing

of the proposed transaction is subject to regulatory approvals, the

approval of Territorial Bancorp stockholders, and other customary

closing conditions. There is no assurance that such conditions will

be met or that the proposed merger will be consummated within the

expected time frame, or at all. If the transaction is consummated,

factors that may cause actual outcomes to differ from what is

expressed or forecasted in these forward-looking statements

include, among things: difficulties and delays in integrating Hope

Bancorp and Territorial Bancorp and achieving anticipated

synergies, cost savings and other benefits from the transaction;

higher than anticipated transaction costs; deposit attrition,

operating costs, customer loss and business disruption following

the merger, including difficulties in maintaining relationships

with employees and customers, may be greater than expected; and

required governmental approvals of the merger may not be obtained

on its proposed terms and schedule, or without regulatory

constraints that may limit growth. Other risks and uncertainties

include, but are not limited to: possible further deterioration in

economic conditions in Hope Bancorp’s or Territorial Bancorp’s

areas of operation or elsewhere; interest rate risk associated with

volatile interest rates and related asset-liability matching risk;

liquidity risks; risk of significant non-earning assets, and net

credit losses that could occur, particularly in times of weak

economic conditions or times of rising interest rates; the failure

of or changes to assumptions and estimates underlying Hope

Bancorp’s or Territorial Bancorp’s allowances for credit losses;

potential increases in deposit insurance assessments and regulatory

risks associated with current and future regulations; the outcome

of any legal proceedings that may be instituted against Hope

Bancorp or Territorial Bancorp; the risk that any announcements

relating to the proposed transaction could have adverse effects on

the market price of the common stock of either or both parties to

the proposed transaction; and diversion of management’s attention

from ongoing business operations and opportunities. For additional

information concerning these and other risk factors, see Hope

Bancorp’s and Territorial Bancorp’s most recent Annual Reports on

Form 10-K. Hope Bancorp and Territorial Bancorp do not undertake,

and specifically disclaim any obligation, to update any

forward-looking statements to reflect the occurrence of events or

circumstances after the date of such statements except as required

by law.

Investor / Media Contacts:Walter IdaSVP,

Director of Investor

Relations808-946-1400walter.ida@territorialsavings.net

i Permission to use quotes neither sought nor obtained

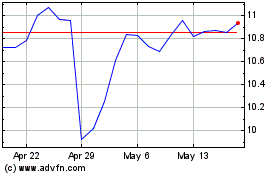

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

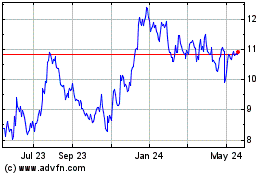

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Nov 2023 to Nov 2024