Second Quarter 2023 and Recent Selected Highlights:

- Record revenues of $33.5 million, an increase of 44% over $23.3

million in the prior-year quarter and an increase of 28% over $26.1

million in the sequential quarter.

- GAAP net loss of ($4.2) million.

- Record adjusted EBITDA of $11.0 million, an increase of 144%

over $4.5 million in the prior‑year quarter and an increase of 108%

over $5.3 million in the sequential quarter.

- Completed public offering of common stock for aggregate gross

proceeds of $69 million.

- Expanded Oaktree Loan from $100 million to $112.50

million.

- Acquired certain commercial rights to FLAREX®, NATACYN®,

TOBRADEX® ST, VERKAZIA®, ZERVIATE®, and Non-Prescription Brands

FRESHKOTE® and Cationorm® PLUS.

- Acquired North American commercial rights to VEVYE®, a novel

FDA-approved drug labeled to treat both the signs and symptoms of

dry eye disease.

- Completed transfer of New Drug Application for VIGAMOX®.

Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical

company, today announced results for the second quarter and six

months ended June 30, 2023. The Company also posted its second

quarter Letter to Stockholders and corporate presentation to the

“Investors” section of its website, harrow.com.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230809749685/en/

“Our team has made great progress positioning Harrow as a

top-tier U.S.-focused ophthalmic pharmaceutical company,” said Mark

L. Baum, CEO of Harrow. “Since January of 2023, through a series of

transactions, we have not only improved Harrow’s balance sheet, but

we’ve dramatically improved Harrow’s product portfolio, which is

now one of the most comprehensive ophthalmic pharmaceutical

offerings in the U.S. market. With what we now have in our “bag”

and continued execution and operational performance by the Harrow

team, we believe we are on our way to achieving the highest

financial goals for Harrow’s stockholders.”

Second quarter 2023 figures of merit:

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2023

2022

2023

2022

Net revenues

$

33,470,000

$

23,323,000

$

59,573,000

$

45,443,000

Gross margin

70

%

72

%

69

%

72

%

Core gross margin(1)

78

%

73

%

77

%

74

%

Net loss

(4,229,000

)

(6,239,000

)

(10,872,000

)

(8,677,000

)

Core net (loss) income(1)

(494,000

)

254,000

(1,536,000

)

967,000

Adjusted EBITDA(1)

11,005,000

4,505,000

16,347,000

9,445,000

Basic net loss per share

(0.14

)

(0.23

)

(0.36

)

(0.32

)

Diluted net loss per share

(0.14

)

(0.23

)

(0.36

)

(0.32

)

Core basic net (loss) income per

share(1)

(0.02

)

0.01

(0.05

)

0.04

Core diluted net (loss) income per

share(1)

(0.02

)

0.01

(0.05

)

0.03

(1)

Core gross margin, core net (loss) income,

core basic and diluted net (loss) income per share (collectively,

“Core Results”), and Adjusted EBITDA are non GAAP measures. For

additional information, including a reconciliation of such Core

Results and Adjusted EBITDA to the most directly comparable

measures presented in accordance with GAAP, see the explanation of

non-GAAP measures and reconciliation tables in the financial tables

section.

Conference Call and Webcast

The Company’s management team will host a conference call and

live webcast today at 4:45 p.m. Eastern Time to discuss the second

quarter 2023 results and provide a business update. To participate

in the call, see details below:

Conference Call Details:

Date:

Wednesday, August 9, 2023

Time:

4:45 p.m. Eastern time

Participant Dial-in:

1-833-953-2434 (U.S.) 1-412-317-5763

(International)

Replay Dial-in (Passcode

3750229):

(telephonic replay through August 16,

2023)

1-877-344-7529 (U.S.) 1-412-317-0088

(International)

Webcast: (online replay through August

9, 2024)

harrow.com

About Harrow

Harrow Health, Inc. (Nasdaq: HROW) is a leading eyecare

pharmaceutical company engaged in the discovery, development, and

commercialization of innovative ophthalmic pharmaceutical products

for the U.S. market. Harrow helps U.S. eyecare professionals

preserve the gift of sight by making its comprehensive portfolio of

prescription and non-prescription pharmaceutical products

accessible and affordable to millions of Americans each year. For

more information about Harrow, please visit harrow.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Any statements in this release that are not historical facts

may be considered such “forward-looking statements.”

Forward-looking statements are based on management's current

expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the

statements contained herein. Some of the potential risks and

uncertainties that could cause actual results to differ from those

predicted include, among others, risks related to: liquidity or

results of operations; our ability to successfully implement our

business plan, develop and commercialize our products, product

candidates and proprietary formulations in a timely manner or at

all, identify and acquire additional products, manage our pharmacy

operations, service our debt, obtain financing necessary to operate

our business, recruit and retain qualified personnel, manage any

growth we may experience and successfully realize the benefits of

our previous acquisitions and any other acquisitions and

collaborative arrangements we may pursue; competition from

pharmaceutical companies, outsourcing facilities and pharmacies;

general economic and business conditions, including inflation and

supply chain challenges; regulatory and legal risks and

uncertainties related to our pharmacy operations and the pharmacy

and pharmaceutical business in general; physician interest in and

market acceptance of our current and any future formulations and

compounding pharmacies generally. These and additional risks and

uncertainties are more fully described in Harrow’s filings with the

Securities and Exchange Commission, including its Annual Report on

Form 10-K and its Quarterly Reports on Form 10-Q. Such documents

may be read free of charge on the SEC's web site at sec.gov. Undue

reliance should not be placed on forward-looking statements, which

speak only as of the date they are made. Except as required by law,

Harrow undertakes no obligation to update any forward-looking

statements to reflect new information, events, or circumstances

after the date they are made, or to reflect the occurrence of

unanticipated events.

HARROW HEALTH, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30, 2023

December 31, 2022

(unaudited)

ASSETS

Cash and cash equivalents

$

22,754,000

$

96,270,000

All other current assets

37,542,000

21,990,000

Total current assets

60,296,000

118,260,000

All other assets

163,693,000

39,118,000

TOTAL ASSETS

$

223,989,000

$

157,378,000

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

$

23,011,000

$

18,632,000

Loans payable, net of current portion and

unamortized debt discount

169,712,000

104,174,000

All other liabilities

9,214,000

7,332,000

TOTAL LIABILITIES

201,937,000

130,138,000

TOTAL STOCKHOLDERS' EQUITY

22,052,000

27,240,000

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

223,989,000

$

157,378,000

HARROW HEALTH, INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2023

2022

2023

2022

Total revenues

$

33,470,000

$

23,323,000

$

59,573,000

$

45,443,000

Cost of sales

10,000,000

6,534,000

18,271,000

12,497,000

Gross profit

23,470,000

16,789,000

41,302,000

32,946,000

Selling, general and administrative

19,957,000

14,185,000

35,845,000

27,583,000

Research and development

1,161,000

914,000

1,895,000

1,572,000

Total operating expenses

21,118,000

15,099,000

37,740,000

29,155,000

Income from operations

2,352,000

1,690,000

3,562,000

3,791,000

Total other expense, net

6,596,000

7,889,000

14,737,000

12,428,000

Income tax benefit (expense)

15,000

(40,000

)

303,000

(40,000

)

Net loss attributable to Harrow

Health, Inc.

$

(4,229,000

)

$

(6,239,000

)

$

(10,872,000

)

$

(8,677,000

)

Net loss per share of common stock,

basic and diluted

$

(0.14

)

$

(0.23

)

$

(0.36

)

$

(0.32

)

HARROW HEALTH, INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Six Months

Ended

June 30,

2023

2022

Net cash (used in) provided by:

Operating activities

$

(3,648,000

)

$

5,827,000

Investing activities

(132,219,000

)

(669,000

)

Financing activities

62,351,000

(887,000

)

Net change in cash and cash

equivalents

(73,516,000

)

4,271,000

Cash and cash equivalents at beginning of

the period

96,270,000

42,167,000

Cash and cash equivalents at end of the

period

$

22,754,000

$

46,438,000

Non-GAAP Financial Measures

In addition to the Company’s results of operations determined in

accordance with U.S. generally accepted accounting principles

(GAAP), which are presented and discussed above, management also

utilizes Adjusted EBITDA and Core Results, unaudited financial

measures that are not calculated in accordance with GAAP, to

evaluate the Company’s financial results and performance and to

plan and forecast future periods. Adjusted EBITDA and Core Results

are considered “non‑GAAP” financial measures within the meaning of

Regulation G promulgated by the SEC. Management believes that these

non-GAAP financial measures reflect an additional way of viewing

aspects of the Company’s operations that, when viewed with GAAP

results, provide a more complete understanding of the Company’s

results of operations and the factors and trends affecting its

business. Management believes Adjusted EBITDA and Core Results

provide meaningful supplemental information regarding the Company’s

performance because (i) they allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making; (ii) they exclude the impact of

non-cash or, when specified, non-recurring items that are not

directly attributable to the Company’s core operating performance

and that may obscure trends in the Company’s core operating

performance; and (iii) they are used by institutional investors and

the analyst community to help analyze the Company’s results.

However, Adjusted EBITDA, Core Results, and any other non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for, or superior to, the corresponding measures

calculated in accordance with GAAP. Further, non‑GAAP financial

measures used by the Company and the way they are calculated may

differ from the non-GAAP financial measures or the calculations of

the same non‑GAAP financial measures used by other companies,

including the Company’s competitors.

Adjusted EBITDA

The Company defines Adjusted EBITDA as net (loss) income,

excluding the effects of stock‑based compensation and expenses,

interest, taxes, depreciation, amortization, investment (loss)

income, net, and, if any and when specified, other non-recurring

income or expense items. Management believes that the most directly

comparable GAAP financial measure to Adjusted EBITDA is net (loss)

income. Adjusted EBITDA has limitations and should not be

considered as an alternative to gross profit or net (loss) income

as a measure of operating performance or to net cash provided by

(used in) operating, investing, or financing activities as a

measure of ability to meet cash needs.

The following is a reconciliation of Adjusted EBITDA, a non-GAAP

measure, to the most comparable GAAP measure, net loss, for the

three months and six months ended June 30, 2023, and for the same

periods in 2022:

HARROW HEALTH, INC.

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2023

2022

2023

2022

GAAP net loss

$

(4,229,000

)

$

(6,239,000

)

$

(10,872,000

)

$

(8,677,000

)

Stock-based compensation and expenses

5,412,000

1,993,000

7,045,000

4,009,000

Interest expense, net

5,704,000

1,794,000

10,451,000

3,586,000

Income tax expense (benefit)

(15,000

)

40,000

(303,000

)

40,000

Depreciation

398,000

424,000

690,000

843,000

Amortization of intangible assets

2,843,000

398,000

5,050,000

802,000

Investment loss (income), net

714,000

6,095,000

(1,328,000

)

8,842,000

Other expense, net

178,000

-

5,614,000

(1)

-

Adjusted EBITDA

$

11,005,000

$

4,505,000

$

16,347,000

$

9,445,000

(1)

Includes $5,465,000 for the loss on

extinguishment of debt.

Core Results

Harrow Core Results, including core gross margin, core net

income (loss), core operating income, core basic and diluted income

(loss) per share, and core operating margin, exclude all

amortization and impairment charges of intangible assets, excluding

software development costs, net gains and losses on investments and

equity securities, including equity method gains and losses and

equity valued at fair value through profit and loss (“FVPL”),

preferred stock dividends, and gains/losses on forgiveness of debt.

In other periods, Core Results may also exclude fair value

adjustments of financial assets in the form of options to acquire a

company carried at FVPL, obligations related to product recalls,

certain acquisition‑related items, restructuring charges/releases

and associated items, related legal items, gains/losses on early

extinguishment of debt or debt modifications, impairments of

property, plant and equipment and software, as well as income and

expense items that management deems exceptional and that are or are

expected to accumulate within the year to be over a $100,000

threshold.

The following is a reconciliation of Core Results, non-GAAP

measures, to the most comparable GAAP measures for the three and

six months ended June 30, 2023, and for the same periods in

2022:

For the Three Months Ended

June 30, 2023

GAAP

Results

Amortization of Certain

Intangible Assets

Investment

Gains

Other

Items

Core

Results

Gross profit

$

23,470,000

$

2,649,000

$

-

$

-

$

26,119,000

Gross margin

70

%

78

%

Operating income

2,352,000

2,843,000

-

-

5,195,000

(Loss) income before taxes

(4,244,000

)

2,843,000

714,000

178,000

(509,000

)

Tax benefit

15,000

-

-

-

15,000

Net (loss) income

(4,229,000

)

2,843,000

714,000

178,000

(494,000

)

Basic and diluted loss per share

($)(1)

(0.14

)

(0.02

)

Weighted average number of shares of

common stock outstanding, basic and diluted

30,458,677

30,458,677

For the Six Months Ended June

30, 2023

GAAP

Results

Amortization of Certain

Intangible Assets

Investment

Losses

Other

Items

Core

Results

Gross profit

$

41,302,000

$

4,694,000

$

-

$

-

$

45,996,000

Gross margin

69

%

77

%

Operating income

3,562,000

5,050,000

-

-

8,612,000

(Loss) income before taxes

(11,175,000

)

5,050,000

(1,328,000

)

5,614,000

(1,839,000

)

Tax benefit

303,000

-

-

-

303,000

Net (loss) income

(10,872,000

)

5,050,000

(1,328,000

)

5,614,000

(1,536,000

)

Basic and diluted loss per share

($)(1)

(0.36

)

(0.05

)

Weighted average number of shares of

common stock outstanding, basic and diluted

30,379,354

30,379,354

For the Three Months Ended

June 30, 2022

GAAP

Results

Amortization of Certain

Intangible

Assets

Investment

Gains

Core

Results

Gross profit

$

16,789,000

$

341,000

$

-

$

17,130,000

Gross margin

72

%

73

%

Operating income

1,690,000

398,000

-

2,088,000

(Loss) income before taxes

(6,199,000

)

398,000

6,095,000

294,000

Taxes

(40,000

)

-

-

(40,000

)

Net (loss) income

(6,239,000

)

398,000

6,095,000

254,000

Basic (loss) earnings per share ($)(1)

(0.23

)

0.01

Diluted (loss) earnings per share

($)(1)

(0.23

)

0.01

Weighted average number of shares of

common stock outstanding:

Basic

27,303,458

27,303,458

Diluted

27,303,458

28,234,177

For the Six Months Ended June

30, 2022

GAAP

Results

Amortization of Certain

Intangible

Assets

Investment

Gains

Core

Results

Gross profit

$

32,946,000

$

682,000

$

-

$

33,628,000

Gross margin

72

%

74

%

Operating income

3,791,000

802,000

-

4,593,000

(Loss) Income before taxes

(8,637,000

)

802,000

8,842,000

1,007,000

Taxes

(40,000

)

-

-

(40,000

)

Net (loss) income

(8,677,000

)

802,000

8,842,000

967,000

Basic (loss) earnings per share ($)(1)

(0.32

)

0.04

Diluted (loss) earnings per share

($)(1)

(0.32

)

0.03

Weighted average number of shares of

common stock outstanding:

Basic

27,265,350

27,265,350

Diluted

27,265,350

28,270,639

(1)

Core basic and diluted (loss) earnings per

share is calculated using the weighted-average number of shares of

common stock outstanding during the period. Core basic and diluted

(loss) earnings per share also contemplates dilutive shares

associated with equity-based awards as described in Note 2 and

elsewhere in the Condensed Consolidated Financial Statements

included in the Company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230809749685/en/

Jamie Webb, Director of Communications and Investor Relations

jwebb@harrowinc.com 615-733-4737

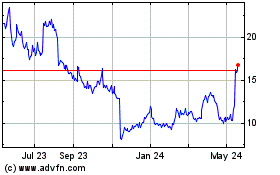

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

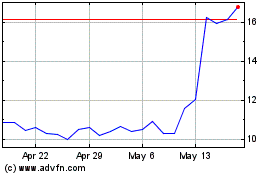

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Jan 2024 to Jan 2025