false

0001360214

0001360214

2024-08-07

2024-08-07

0001360214

HROW:CommonStock0.001ParValuePerShareMember

2024-08-07

2024-08-07

0001360214

HROW:Sec8.625SeniorNotesDue2026Member

2024-08-07

2024-08-07

0001360214

HROW:Sec11.875SeniorNotesDue2027Member

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 7, 2024

HARROW,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35814 |

|

45-0567010 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 102

Woodmont Blvd., Suite 610 |

|

|

| Nashville,

Tennessee |

|

37205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (615) 733-4730

| |

Not

Applicable |

|

| |

(Former

Name or Former Address, if Changed Since Last Report) |

|

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

on exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

HROW |

|

The

Nasdaq Stock Market LLC |

| 8.625%

Senior Notes due 2026 |

|

HROWL |

|

The

Nasdaq Stock Market LLC |

| 11.875%

Senior Notes due 2027 |

|

HROWM |

|

The

Nasdaq Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Act of 1934: Emerging growth company ☐

If

any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 7, 2024, Harrow, Inc. (the “Company”) issued a press release and a letter to stockholders announcing its financial

results for the period ended June 30, 2024 and an update on recent corporate events. The press release and letter to stockholders are

being furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K.

The

information furnished under this Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed

to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section. The information in this Item 2.02, including Exhibits 99.1 and 99.2, shall not

be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the

extent it is specifically incorporated by reference but regardless of any general incorporation language in such filing.

The

information furnished under this Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed

to constitute an admission that such information or exhibit is required to be furnished pursuant to Regulation FD or that such information

or exhibit contains material information that is not otherwise publicly available. In addition, the Company does not assume any obligation

to update such information or exhibit in the future.

Item

9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HARROW,

INC. |

| |

|

|

| Dated:

August 7, 2024 |

By: |

/s/

Andrew R. Boll |

| |

Name: |

Andrew

R. Boll |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

99.1

Harrow

Announces Second Quarter 2024 Financial Results

Second

Quarter 2024 and Recent Selected Highlights:

| |

● |

Record

revenues of $48.9 million |

| |

● |

GAAP

net loss of $(6.5) million |

| |

● |

Adjusted

EBITDA of $8.8 million |

| |

● |

Cash

and cash equivalents of $71.0 million as of June 30, 2024 |

| |

● |

IHEEZO®

customer unit demand volume increased by 98% from the first quarter of 2024 |

| |

● |

IHEEZO

supply agreements total 24 agreements to date in 2024, including a recent win with the largest and highest volume U.S. retina practice

group |

| |

● |

VEVYE®

total prescriptions increased by 212% from the first quarter of 2024 |

| |

● |

Anterior

Segment revenues up over 40% from the first quarter of 2024 |

| |

● |

Record

quarterly revenues from Harrow’s ImprimisRx subsidiary |

NASHVILLE,

Tenn., August 7, 2024 – Harrow (Nasdaq: HROW), a leading North American eyecare pharmaceutical company, announced results for the

second quarter and six months ended June 30, 2024. The Company also posted its second quarter Letter to Stockholders and corporate

presentation to the “Investors” section of its website, harrow.com. The Company encourages all Harrow stockholders

to review these documents, which provide additional details concerning the historical quarterly period and future expectations for the

business.

“The

second quarter of 2024 marked a financial and operational turning point for Harrow, with revenues surging 46% compared to the same quarter

last year and 42% over the previous quarter,” said Mark L. Baum, Chief Executive Officer of Harrow. “This remarkable growth,

which was years in the making, was driven by exceptional performance across all Harrow business segments, most notably IHEEZO and VEVYE.

Our team also continues to advance the relaunch of TRIESENCE® during 2024, with initial analytical test results for the

second process performance qualification (PPQ) batch demonstrating in-specification results and the third PPQ batch scheduled to be manufactured

in a matter of days. This outstanding quarterly report is a testament to the dedication of the entire Harrow Family, which is being continuously

strengthened by the addition of experienced and motivated high-impact individuals. We are excited about where we are today, confident

that we are poised for, and expect to achieve, further revenue and profitability expansion in the coming quarters and years.”

Second

quarter 2024 figures of merit:

| | |

For

the Three Months Ended

June 30, | | |

For

the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 48,939,000 | | |

$ | 33,470,000 | | |

$ | 83,526,000 | | |

$ | 59,573,000 | |

| Gross margin | |

| 74 | % | |

| 70 | % | |

| 72 | % | |

| 69 | % |

| Core gross margin(1) | |

| 79 | % | |

| 78 | % | |

| 77 | % | |

| 77 | % |

| Net loss | |

| (6,473,000 | ) | |

| (4,229,000 | ) | |

| (20,038,000 | ) | |

| (10,872,000 | ) |

| Core net loss(1) | |

| (2,047,000 | ) | |

| (494,000 | ) | |

| (11,836,000 | ) | |

| (1,536,000 | ) |

| Adjusted EBITDA(1) | |

| 8,803,000 | | |

| 11,005,000 | | |

| 9,030,000 | | |

| 16,347,000 | |

| Basic and diluted net loss per share | |

| (0.18 | ) | |

| (0.14 | ) | |

| (0.56 | ) | |

| (0.36 | ) |

| Core basic and diluted

net loss per share(1) | |

| (0.06 | ) | |

| (0.02 | ) | |

| (0.33 | ) | |

| (0.05 | ) |

| (1) | Core

gross margin, core net loss, core basic and diluted net loss per share (collectively, “Core

Results”), and Adjusted EBITDA are non-GAAP measures. For additional information, including

a reconciliation of such Core Results and Adjusted EBITDA to the most directly comparable

measures presented in accordance with GAAP, see the explanation of non-GAAP measures and

reconciliation tables at the end of this release. |

-MORE-

Harrow

Announces Second Quarter 2024 Financial Results

Page

2

August

7, 2024

Conference

Call and Webcast

The

Company’s management team will host a conference call and live webcast tomorrow morning, Thursday, August 8, 2024, at 8:00 a.m.

Eastern time to discuss the second quarter 2024 results and provide a business update. Participants can access the live conference call

via webcast on the “Investors” page of Harrow’s website. To participate via telephone, please register in advance using

this link. Upon registration, all telephone participants will receive a confirmation email with detailed instructions, including

a unique dial-in number and PIN, for accessing the call. A replay of the conference call webcast will be archived on the Company’s

website for one year.

About

Harrow

Harrow,

Inc. (Nasdaq: HROW) is a leading eyecare pharmaceutical company engaged in the discovery, development, and commercialization of innovative

ophthalmic pharmaceutical products for the North American market. Harrow helps eyecare professionals preserve the gift of sight by making

its comprehensive portfolio of prescription and non-prescription pharmaceutical products accessible and affordable to millions of patients

each year. For more information about Harrow, please visit harrow.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to: liquidity or results of operations;

our ability to successfully implement our business plan, develop and commercialize our products, product candidates and proprietary formulations

in a timely manner or at all, identify and acquire additional products, manage our pharmacy operations, service our debt, obtain financing

necessary to operate our business, recruit and retain qualified personnel, manage any growth we may experience and successfully realize

the benefits of our previous acquisitions and any other acquisitions and collaborative arrangements we may pursue; competition from pharmaceutical

companies, outsourcing facilities and pharmacies; general economic and business conditions, including inflation and supply chain challenges;

regulatory and legal risks and uncertainties related to our pharmacy operations and the pharmacy and pharmaceutical business in general;

physician interest in and market acceptance of our current and any future formulations and compounding pharmacies generally. These and

additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange Commission (SEC),

including its Annual Report on Form 10-K for the year ended December 31, 2023, subsequent Quarterly Reports on Form 10-Q, and other filings

with the SEC. Such documents may be read free of charge on the SEC’s web site at sec.gov. Undue reliance should not be placed

on forward-looking statements, which speak only as of the date they are made. Except as required by law, Harrow undertakes no obligation

to update any forward-looking statements to reflect new information, events, or circumstances after the date they are made, or to reflect

the occurrence of unanticipated events.

Contact:

Jamie

Webb, Director of Communications and Investor Relations

jwebb@harrowinc.com

615-733-4737

-MORE-

Harrow

Announces Second Quarter 2024 Financial Results

Page

3

August

7, 2024

HARROW,

INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June

30, 2024 | | |

December

31,

2023 | |

| |

(unaudited) | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 70,968,000 | | |

$ | 74,085,000 | |

| All other current assets | |

| 68,422,000 | | |

| 65,397,000 | |

| Total

current assets | |

| 139,390,000 | | |

| 139,482,000 | |

| All other assets | |

| 167,240,000 | | |

| 172,682,000 | |

| TOTAL

ASSETS | |

$ | 306,630,000 | | |

$ | 312,164,000 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’

EQUITY | |

| | | |

| | |

| Current liabilities | |

$ | 53,551,000 | | |

$ | 49,344,000 | |

| Loans payable, net of unamortized debt discount | |

| 185,023,000 | | |

| 183,172,000 | |

| All other liabilities | |

| 9,879,000 | | |

| 9,237,000 | |

| TOTAL

LIABILITIES | |

| 248,453,000 | | |

| 241,753,000 | |

| TOTAL

STOCKHOLDERS’ EQUITY | |

| 58,177,000 | | |

| 70,411,000 | |

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 306,630,000 | | |

$ | 312,164,000 | |

HARROW,

INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| | |

For

the Three Months Ended

June 30, | | |

For

the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 48,939,000 | | |

$ | 33,470,000 | | |

$ | 83,526,000 | | |

$ | 59,573,000 | |

| Cost of sales | |

| 12,539,000 | | |

| 10,000,000 | | |

| 23,092,000 | | |

| 18,271,000 | |

| Gross

profit | |

| 36,400,000 | | |

| 23,470,000 | | |

| 60,434,000 | | |

| 41,302,000 | |

| Selling, general and administrative | |

| 31,817,000 | | |

| 19,957,000 | | |

| 60,630,000 | | |

| 35,845,000 | |

| Research and development | |

| 3,053,000 | | |

| 1,161,000 | | |

| 5,202,000 | | |

| 1,895,000 | |

| Total

operating expenses | |

| 34,870,000 | | |

| 21,118,000 | | |

| 65,832,000 | | |

| 37,740,000 | |

| Income

(loss) from operations | |

| 1,530,000 | | |

| 2,352,000 | | |

| (5,398,000 | ) | |

| 3,562,000 | |

| Total other expense, net | |

| (7,348,000 | ) | |

| (6,596,000 | ) | |

| (13,985,000 | ) | |

| (14,737,000 | ) |

| Income

tax (expense) benefit | |

| (655,000 | ) | |

| 15,000 | | |

| (655,000 | ) | |

| 303,000 | |

| Net

loss attributable to Harrow, Inc. | |

$ | (6,473,000 | ) | |

$ | (4,229,000 | ) | |

$ | (20,038,000 | ) | |

$ | (10,872,000 | ) |

| Net

loss per share of common stock, basic and diluted | |

$ | (0.18 | ) | |

$ | (0.14 | ) | |

$ | (0.56 | ) | |

$ | (0.36 | ) |

HARROW,

INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | |

For

the Six Months Ended June

30, | |

| | |

2024 | | |

2023 | |

| Net cash (used in) provided by: | |

| | | |

| | |

| Operating activities | |

$ | (7,374,000 | ) | |

$ | (3,648,000 | ) |

| Investing activities | |

| 4,993,000 | | |

| (132,219,000 | ) |

| Financing

activities | |

| (736,000 | ) | |

| 62,351,000 | |

| Net change in cash and cash equivalents | |

| (3,117,000 | ) | |

| (73,516,000 | ) |

| Cash and cash equivalents

at beginning of the period | |

| 74,085,000 | | |

| 96,270,000 | |

| Cash and cash equivalents

at end of the period | |

$ | 70,968,000 | | |

$ | 22,754,000 | |

-MORE-

Harrow

Announces Second Quarter 2024 Financial Results

Page

4

August

7, 2024

Non-GAAP

Financial Measures

In

addition to the Company’s results of operations determined in accordance with U.S. generally accepted accounting principles (GAAP),

which are presented and discussed above, management also utilizes Adjusted EBITDA and Core Results, unaudited financial measures that

are not calculated in accordance with GAAP, to evaluate the Company’s financial results and performance and to plan and forecast

future periods. Adjusted EBITDA and Core Results are considered “non-GAAP” financial measures within the meaning of Regulation

G promulgated by the SEC. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of

the Company’s operations that, when viewed with GAAP results, provide a more complete understanding of the Company’s results

of operations and the factors and trends affecting its business. Management believes Adjusted EBITDA and Core Results provide meaningful

supplemental information regarding the Company’s performance because (i) they allow for greater transparency with respect to key

metrics used by management in its financial and operational decision-making; (ii) they exclude the impact of non-cash or, when specified,

non-recurring items that are not directly attributable to the Company’s core operating performance and that may obscure trends

in the Company’s core operating performance; and (iii) they are used by institutional investors and the analyst community to help

analyze the Company’s results. However, Adjusted EBITDA, Core Results, and any other non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Further,

non-GAAP financial measures used by the Company and the way they are calculated may differ from the non-GAAP financial measures or the

calculations of the same non-GAAP financial measures used by other companies, including the Company’s competitors.

Adjusted

EBITDA

The

Company defines Adjusted EBITDA as net loss, excluding the effects of stock-based compensation and expenses, interest, taxes, depreciation,

amortization, investment loss (income), net, and, if any and when specified, other non-recurring income or expense items. Management

believes that the most directly comparable GAAP financial measure to Adjusted EBITDA is net loss. Adjusted EBITDA has limitations and

should not be considered as an alternative to gross profit or net loss as a measure of operating performance or to net cash (used in)

provided by operating, investing, or financing activities as a measure of ability to meet cash needs.

The

following is a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most comparable GAAP measure, net loss, for the three months

and six months ended June 30, 2024 and for the same periods in 2023:

HARROW,

INC. RECONCILIATION

OF NET LOSS TO ADJUSTED EBITDA |

| | |

For

the Three Months Ended

June

30, | | |

For

the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024

| | |

2023 | |

| GAAP net loss | |

$ | (6,473,000 | ) | |

$ | (4,229,000 | ) | |

$ | (20,038,000 | ) | |

$ | (10,872,000 | ) |

| Stock-based compensation and expenses | |

| 4,271,000 | | |

| 5,412,000 | | |

| 8,440,000 | | |

| 7,045,000 | |

| Interest expense, net | |

| 5,471,000 | | |

| 5,704,000 | | |

| 10,886,000 | | |

| 10,451,000 | |

| Income taxes | |

| 655,000 | | |

| (15,000 | ) | |

| 655,000 | | |

| (303,000 | ) |

| Depreciation | |

| 453,000 | | |

| 398,000 | | |

| 885,000 | | |

| 690,000 | |

| Amortization of intangible assets | |

| 2,549,000 | | |

| 2,843,000 | | |

| 5,103,000 | | |

| 5,050,000 | |

| Investment loss (income), net | |

| 1,923,000 | | |

| 714,000 | | |

| 3,171,000 | | |

| (1,328,000 | ) |

| Other (income) expense,

net | |

| (46,000 | ) | |

| 178,000 | | |

| (72,000 | ) | |

| 5,614,000 | (1) |

| Adjusted EBITDA | |

$ | 8,803,000 | | |

$ | 11,005,000 | | |

$ | 9,030,000 | | |

$ | 16,347,000 | |

| (1) | Includes

$5,465,000 for the loss on extinguishment of debt. |

-MORE-

Harrow

Announces Second Quarter 2024 Financial Results

Page

5

August

7, 2024

Core

Results

Harrow

Core Results, including core gross margin, core net loss, and core basic and diluted loss per share exclude (1) all amortization and

impairment charges of intangible assets, excluding software development costs, (2) net gains and losses on investments and equity securities,

including equity method gains and losses and equity valued at fair value through profit and loss (FVPL), and preferred stock dividends,

and (3) gains/losses on forgiveness of debt. In other periods, Core Results may also exclude fair value adjustments of financial assets

in the form of options to acquire a company carried at FVPL, obligations related to product recalls, certain acquisition-related items,

restructuring charges/releases and associated items, related legal items, gains/losses on early extinguishment of debt or debt modifications,

impairments of property, plant and equipment and software, as well as income and expense items that management deems exceptional and

that are or are expected to accumulate within the year to be over a $100,000 threshold.

The

following is a reconciliation of Core Results, non-GAAP measures, to the most comparable GAAP measures for the three months and six months

ended June 30, 2024 and for the same periods in 2023:

| For

the Three Months Ended June 30, 2024 |

| | |

GAAP Results | | |

Amortization

of Certain Intangible Assets | | |

Investment Gains | | |

Other

Items | | |

Core Results | |

| Gross profit | |

$ | 36,400,000 | | |

$ | 2,140,000 | | |

$ | - | | |

$ | - | | |

$ | 38,540,000 | |

| Gross margin | |

| 74 | % | |

| | | |

| | | |

| | | |

| 79 | % |

| Operating income | |

| 1,530,000 | | |

| 2,549,000 | | |

| - | | |

| - | | |

| 4,079,000 | |

| (Loss) income before taxes | |

| (5,818,000 | ) | |

| 2,549,000 | | |

| 1,923,000 | | |

| (46,000 | ) | |

| (1,392,000 | ) |

| Taxes | |

| (655,000 | ) | |

| - | | |

| - | | |

| - | | |

| (655,000 | ) |

| Net (loss) income | |

| (6,473,000 | ) | |

| 2,549,000 | | |

| 1,923,000 | | |

| (46,000 | ) | |

| (2,047,000 | ) |

Basic

and diluted loss per

share ($)(1) | |

| (0.18 | ) | |

| | | |

| | | |

| | | |

| (0.06 | ) |

Weighted average number

of shares of common

stock outstanding,

basic and diluted | |

| 35,618,977 | | |

| | | |

| | | |

| | | |

| 35,618,977 | |

| For

the Six Months Ended June 30, 2024 |

| | |

GAAP Results | | |

Amortization

of Certain Intangible Assets | | |

Investment Gains | | |

Other

Items | | |

Core Results | |

| Gross profit | |

$ | 60,434,000 | | |

$ | 4,280,000 | | |

$ | - | | |

$ | - | | |

$ | 64,714,000 | |

| Gross margin | |

| 72 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating loss | |

| (5,398,000 | ) | |

| 5,103,000 | | |

| - | | |

| - | | |

| (295,000 | ) |

| (Loss) income before taxes | |

| (19,383,000 | ) | |

| 5,103,000 | | |

| 3,171,000 | | |

| (72,000 | ) | |

| (11,181,000 | ) |

| Taxes | |

| (655,000 | ) | |

| - | | |

| - | | |

| - | | |

| (655,000 | ) |

| Net (loss) income | |

| (20,038,000 | ) | |

| 5,103,000 | | |

| 3,171,000 | | |

| (72,000 | ) | |

| (11,836,000 | ) |

Basic and diluted loss

per share ($)(1) | |

| (0.56 | ) | |

| | | |

| | | |

| | | |

| (0.33 | ) |

Weighted average number

of shares of common

stock outstanding,

basic and diluted | |

| 35,544,312 | | |

| | | |

| | | |

| | | |

| 35,544,312 | |

-MORE-

Harrow

Announces Second Quarter 2024 Financial Results

Page

6

August

7, 2024

| For

the Three Months Ended June 30, 2023 |

| | |

| | |

Amortization

of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 23,470,000 | | |

$ | 2,649,000 | | |

$ | - | | |

$ | - | | |

$ | 26,119,000 | |

| Gross margin | |

| 70 | % | |

| | | |

| | | |

| | | |

| 78 | % |

| Operating income | |

| 2,352,000 | | |

| 2,843,000 | | |

| - | | |

| - | | |

| 5,195,000 | |

| (Loss) income before taxes | |

| (4,244,000 | ) | |

| 2,843,000 | | |

| 714,000 | | |

| 178,000 | | |

| (509,000 | ) |

| Taxes | |

| 15,000 | | |

| - | | |

| - | | |

| - | | |

| 15,000 | |

| Net (loss) income | |

| (4,229,000 | ) | |

| 2,843,000 | | |

| 714,000 | | |

| 178,000 | | |

| (494,000 | ) |

Basic

and diluted loss per

share ($)(1) | |

| (0.14 | ) | |

| | | |

| | | |

| | | |

| (0.02 | ) |

Weighted average number

of shares of common

stock outstanding,

basic and diluted | |

| 30,458,677 | | |

| | | |

| | | |

| | | |

| 30,458,677 | |

| For

the Six Months Ended June 30, 2023 |

| | |

| | |

Amortization

of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 41,302,000 | | |

$ | 4,694,000 | | |

$ | - | | |

$ | - | | |

$ | 45,996,000 | |

| Gross margin | |

| 69 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating income | |

| 3,562,000 | | |

| 5,050,000 | | |

| - | | |

| - | | |

| 8,612,000 | |

| (Loss) income before taxes | |

| (11,175,000 | ) | |

| 5,050,000 | | |

| (1,328,000 | ) | |

| 5,614,000 | | |

| (1,839,000 | ) |

| Taxes | |

| 303,000 | | |

| - | | |

| - | | |

| - | | |

| 303,000 | |

| Net (loss) income | |

| (10,872,000 | ) | |

| 5,050,000 | | |

| (1,328,000 | ) | |

| 5,614,000 | | |

| (1,536,000 | ) |

Basic and diluted loss

per share ($)(1) | |

| (0.36 | ) | |

| | | |

| | | |

| | | |

| (0.05 | ) |

Weighted average number

of shares of common

stock outstanding,

basic and diluted | |

| 30,379,354 | | |

| | | |

| | | |

| | | |

| 30,379,354 | |

| (1) | Core

basic and diluted loss per share is calculated using the weighted-average number of shares

of common stock outstanding during the period. Core basic and diluted loss per share also

contemplates dilutive shares associated with equity-based awards as described in Note 2 and

elsewhere in the Condensed Consolidated Financial Statements included in the Company’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. |

-END-

EXHIBIT

99.2

Letter

to Stockholders

August

7, 2024

Dear

Harrow Stockholders:

My

last Letter to Stockholders outlined three of Harrow’s key operational initiatives from our Five-Year Strategic Plan (see page

2 of my March 23, 2023 Letter to Stockholders): (1) building a formidable dry eye disease franchise, including successfully launching

VEVYE®; (2) continuing to lay the foundation for Harrow’s retina franchise with IHEEZO® and TRIESENCE®;

and (3) stabilizing ImprimisRx® and our recently acquired Anterior Segment Products and returning them to a growth trajectory.

The Harrow team made significant progress on each objective during the second quarter, delivering record financial results and positioning

the business to accelerate financial growth and relevance in the coming years.

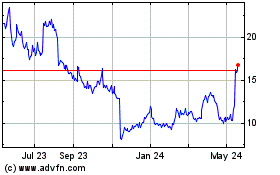

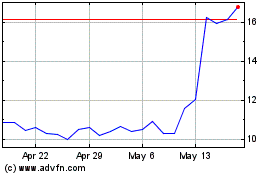

Revenues

for the second quarter of 2024 surged to a record of $48.9 million, a 46% increase over the prior year’s second quarter revenues

of $33.5 million and a 42% sequential increase over the first quarter of 2024 revenues of $34.6 million. Despite investing in growing

the VEVYE commercial team to capitalize on the product’s new prescription and refill momentum, our GAAP net loss for the second

quarter of 2024 was $(6.5) million, and Adjusted EBITDA (a non-GAAP measure1) was $8.8 million. GAAP gross margins were

74% for the second quarter of 2024 compared to 70% in the same period in 2023, with core gross margins (a non-GAAP measure) floating

up to 79% in the second quarter of 2024 from 78% in the same period in 2023. Two final points related to our second quarter results that

illustrate that our promises are being kept and our plans are paying off: (1) our ImprimisRx compounding subsidiary achieved the highest

quarterly revenue in its history, and (2) the second quarter of 2024 marked the first quarter in which revenues from our branded products

meaningfully exceeded those from ImprimisRx – a trend we believe should accelerate.

We

expect that revenue in the back half of 2024 should substantially outperform revenue in the first half of this year, especially if TRIESENCE

is relaunched. I remain confident that our 2024 revenue will be “greater than” $180 million (excluding any TRIESENCE contribution),

and given our progress and momentum, I believe that it’s really a question of how much “greater than” $180 million

it will be.

Harrow’s

Dry Eye Disease Franchise

Our

presence in the Dry Eye Disease (DED) market, a multi-billion-dollar annual opportunity, is anchored by VEVYE, a patented formulation

of 0.1% cyclosporine delivered in a semifluorinated alkane vehicle, which is indicated for the treatment of the signs and symptoms of

dry eye disease. The prescribing momentum for VEVYE is intensifying as total prescription volumes for the second quarter increased 212%

from the first quarter of 2024.

For

patients suffering from DED – whether they are newly diagnosed or have failed many of the other not-so-great prescription choices

– VEVYE works quickly, has strong data demonstrating efficacy as far out as 56 weeks, only requires twice daily (or BID) dosing,

and is extraordinarily tolerable relative to nearly all other product choices. Harrow provides DED patients and their prescribers with

a generous access program – to ensure that DED patients who are prescribed VEVYE can get their prescriptions filled. There is more

work to do, but we believe we are building a powerful DED franchise and that over time, VEVYE’s market share will continue to grow,

giving it a chance to become a category leading prescription DED product.

More

good news as we continue to achieve VEVYE Market Access wins, including New York Medicaid and in California, MediCal. MediCal

patients now receive VEVYE without a co-pay! Other notable successes include adding Michigan Medicaid (2.2 million lives), which began

August 1st, and Texas Medicaid (3.4 million lives), which will begin August 8th. We anticipate having 100% Medicaid

access by the time we report results for the third quarter. In addition, VEVYE access to commercial payers has now increased to 58%.

1

A reconciliation of all non-GAAP measures can be found starting on page 8 of this letter.

Since

VEVYE’s launch in January 2024, despite having a small (but mighty) sales force, a growing number of eyecare professionals

have prescribed VEVYE, allowing it to gain market traction quickly. The U.S. DED market is among the largest market opportunities in

eyecare, and despite our progress to date, VEVYE’s share is only a tiny percentage of the overall DED prescription market –

we’ve barely scratched the surface of what this product can achieve! That said, because of the Harrow team’s outstanding

work executing the VEVYE launch (see slide #8 of our updated corporate presentation), positive ongoing prescribing and refilling trends,

and market access wins, we opened additional VEVYE territories, expanding our field force to drive growth. This investment is a strategic

bet – supported by evidence that the odds of success are heavily in our favor – that VEVYE has a long way to go and will

be a major driver of cash flow and stockholder value for many years.

Serving

the Retina Market

Harrow

remains committed to building and growing a presence in the U.S. retina market. Currently, our portfolio is led by (1) IHEEZO, a novel

topical anesthetic gel indicated for ocular surface anesthesia and utilized by retina specialists for anesthetizing the eye during office-based

procedures such as intravitreal injections, and (2) TRIESENCE, the only product indicated for visualization of the vitreous during vitrectomy

and the treatment of posterior uveitis and other posterior segment conditions.

I

recently attended the 2024 American Society of Retina Specialists (ASRS) Annual Meeting, which took place in Stockholm, Sweden. While

at the conference, I and other members of Harrow’s management team met with more than a dozen leading U.S. retina specialists.

Our objective was to begin to create Harrow’s persona in the U.S. retina market. The retina community is highly concentrated in

terms of the number of retina-focused pharmaceutical companies, the retina specialists themselves, and the private equity groups that

control large swaths of this attractive market. During our meetings, we introduced Harrow and shared our story, discussed the many benefits

of IHEEZO, updated potential customers about when they might expect to be able to order TRIESENCE again, and discussed other retina programs

we have been considering. (Yes, we remain on the hunt for reasonably priced assets and businesses with wonderful economics that will

further Harrow’s long-term value and reputation). It was a terrific meeting; and we made a lot of headway beginning to introduce

Harrow to this tremendously exciting segment of the ophthalmic market.

IHEEZO

Update

On

March 12, 2024, the Centers for Medicare & Medicaid Services (CMS) confirmed separate reimbursement of IHEEZO in the physician’s

office. In a separate communication that same day, CMS confirmed IHEEZO payment for both unilateral and bilateral same-day procedures,

which began July 1, 2024, and is retroactive to January 1, 2024. On April 12, 2024, the American Academy of Ophthalmology (AAO) published

a recognition that IHEEZO was payable in the office setting of care.

IHEEZO

sales have begun to ramp up. Specifically, quarterly customer unit demand volumes nearly doubled – up 98%, from 15,176 units

in the first quarter of 2024 to 30,016 units in the second quarter of 2024. This surge helped push IHEEZO revenue to $11.3 million during

the second quarter of 2024. (Keep in mind that customer unit demand and product-specific revenue, although somewhat correlated, are not

one and the same, and we recognize revenue based on distributor purchases – not sales to an end user/customer.) These strong numbers

are a nice tailwind, but we have a lot more work to do. For example, our team is making significant progress in increasing the overall

number of IHEEZO accounts and the number of procedures IHEEZO is used for within the practice. Remember, like VEVYE, we have barely scratched

the surface of what IHEEZO can achieve, given its unique properties and performance characteristics.

We’ve

made great strides in signing new IHEEZO agreements with strategic accounts, which will fuel the IHEEZO growth we expect in the back

half of 2024 and for years to come. As of the close of the second calendar quarter, we had signed 17 supply contracts for IHEEZO, including

10 new ones in the second quarter alone. Furthermore, without preempting the third quarter results announcement in November, since the

close of the second quarter, we’ve signed seven additional strategic account supply agreements, including a recent agreement with

the largest and highest volume U.S. retina practice group. Like the other IHEEZO agreements we’ve signed, we expect this agreement

will be phased in, beginning in the third quarter and kicking in with higher volumes in the fourth quarter of this year and, to a greater

extent, during 2025. These agreements, and especially the last agreement I referenced, are phenomenal achievements and are an early indication

of the impact that Greg DiPasquale is having as he begins to lead our commercial organization!

TRIESENCE

Update

I

am also pleased to confirm that the second commercial-scale process performance qualification (PPQ) batch of TRIESENCE (Batch 2) was

produced during the week of July 8. Thus far, Batch 2 has passed initial analytical tests. However, before we declare victory for this

batch, we must pass a few remaining critical tests, and we expect to have the final data set very shortly. That said, the Batch 2 analytical

data, thus far, evidences that it was closer to the optimal specifications than PPQ Batch 1 – providing us with confidence that

our proprietary process is robust and repeatable. Assuming Batch 2 remains in specification, with one more successful PPQ batch and the

filing of some paperwork needed before the commercial relaunch of TRIESENCE, the third and hopefully final TRIESENCE PPQ batch (Batch

3) is now scheduled for manufacture this month. More work is left to be done, but we remain upbeat about a potential

2024 TRIESENCE relaunch.

I

also want to highlight that after my meetings with leading retina specialists at ASRS, I remain confident about the market need and interest

in TRIESENCE and our ability to monetize the units we produce – in the near and medium term.

Harrow’s

Anterior Segment Franchise and ImprimisRx

Harrow’s

anterior segment business continues to perform, providing our customers with a broad portfolio of high-value, accessible, and affordable

products to choose from. It is worth noting that Anterior Segment revenue in the second quarter of 2024 grew by over 40% from the first

quarter of 2024. Not bad! While we expect to experience quarter-to-quarter revenue variability, the overall revenue trend for this part

of our business is improving.

ImprimisRx,

Harrow’s compounding business, as promised, has stabilized and is now firmly back in a growth mode, producing record quarterly

revenues during the second quarter of 2024.

From

a financial perspective, these two parts of our business are now generating stable streams of cash for Harrow stockholders.

Opening

Additional Markets For Harrow Products

Recently,

Harrow announced that it had entered into an agreement with Apexus™ to make IHEEZO and other key Harrow products available

through its 340B Prime Vendor Program (PVP). This agreement provides Harrow access to the hospital setting of care and an opportunity

to sell its products to Apexus PVP participants, which include 44% of all U.S. hospitals. Through this agreement, PVP hospital participants

and their patients, especially vulnerable patient populations, will now have access to high-quality products, such as IHEEZO, at discounted

prices. Apexus handles all marketing, promotional activities, support services, and training for PVP participants. It is also important

to note that, under the 340B PVP program terms, units sold are excluded from a company’s Average Sales Price (ASP) calculation.

In

addition, we are constantly reviewing new technologies and relationships in order to advance customer access and decrease our cost structures

(e.g., distribution and other “middle-man” costs). This is an active process, and our team is in advanced discussions with

several potential vendor partners who may be able to reduce commercial friction and improve our share of what we keep in the transactions

for our products that our team facilitates.

Hiring

All-Star Talent to Fuel Our Success

We

are working to attract talent with the experience to turn the promise of our Five-Year Strategic Plan into reality. Given our humble

beginnings, it’s more than exciting to meet some of the highly respected and well-connected people who have recently been interested

in or who have joined the Harrow Family. Over the coming quarters, I expect additional big-impact executives to join Harrow – attracted

to the growing recognition of the Harrow brand in ophthalmology and phenomenal opportunities for career growth, incentive-based financial

rewards, and the ability to truly be the CEO of one’s position. The bottom line is that Harrow continues to add high-performance,

disciplined, and highly successful individuals – who can fit into our unique entrepreneurial culture. Harrow is evolving to build

an even more extraordinary team to drive growth and long-term value to you, our stockholders.

Melt

Pharmaceuticals

Melt

Pharmaceuticals, Inc. (Melt), founded as a subsidiary of Harrow before being deconsolidated, separately funded, and separately managed

in 2018, is a clinical-stage pharmaceutical company focused on developing non-opioid, non-IV, sedation therapeutics for medical procedures

in the hospital, outpatient, and in-office settings. Melt intends to seek regulatory approval through the U.S. Food and Drug Administration’s

(FDA) 505(b)(2) regulatory pathway for its patented small-molecule product candidates. Melt’s core intellectual property is the

subject of multiple granted patents in North America, Europe, Asia, and the Middle East. Using funding from its recent $24 million Series

B Preferred Stock financing, Melt is conducting its pivotal Phase 3 program for its lead drug candidate, MELT-300, and expects to announce

its topline readout in the fourth quarter of 2024. Harrow owns approximately 46% of Melt’s equity interests and a 5% royalty interest

in MELT-300.

The

promise of Melt to a patient needing sedation for a procedure is a needle-free experience without the use of opioid-based medications.

For many millions of annual procedures in the U.S. alone, a sublingual non-opioid form of sedation can do the trick! Imagine a world

where a small wafer “melts” under your tongue and provides a sufficient level of sedation to complete a procedure –

say, for example, a cataract surgery – without the use of opioids. We have high hopes that MELT-300 can eventually be used for

numerous other procedures in eyecare and beyond. It’s a very exciting opportunity and something I am proud to have been a part

of – especially as Melt approaches generating pivotal data on its lead MELT-300 program.

According

to Melt, as of the publication of this Letter to Stockholders, enrollment in its MELT-300 Phase 3 study, which began in late May, is

going exceptionally well. Over 300 patients of the expected 528 patients have completed the study. Because of the rapid enrollment to

date, I expect Melt may receive a topline readout before I write my next Letter to Stockholders.

Some

Harrow stockholders have asked how positive MELT-300 Phase 3 data or an FDA-approval would affect Harrow. To be clear, upon approval

of MELT-300, ImprimisRx would lose revenue from the compounded MKO Melt formulation. However, in return, Harrow expects to realize an

increase in the value of our Melt equity and, depending on the pricing for MELT-300, a royalty that should far exceed the profits we

earn selling MKO Melt. From a commercial perspective, in 2024, with a forecast of selling over 150,000 MKO Melt units to approximately

700 accounts, if there is an FDA-approved alternative to MKO Melt, overall commercial interest should increase markedly, creating a near

“no-brainer” product launch opportunity.

In

summary, from my perspective, Melt is a wonderful (and potentially large) upside-only option for Harrow stockholders.

Conclusion

While

even greater accomplishments await us, our growing success is undeniable. This Letter to Stockholders underscores the strong foundation

we have built, positioning us to grow into a leadership role in our industry.

Harrow

is led by Harrow stockholders and is managed for the benefit of Harrow stockholders. Every member of the Harrow Family is vested in the

sustainable value of Harrow’s stock. Our commitment to aligning stockholders’ and customers’ interests is central to

how we’ve built our business and will continue to drive our unwavering commitment to providing innovative solutions to help eyecare

professionals safeguard the precious gift of sight.

Finally,

as excited as I am to report on the second quarter, the third quarter has started just as strongly, and we are well positioned to meet

all our targets for the second half of the year.

Thank

you for your continued trust and investment in our journey.

Sincerely,

Mark

L. Baum

Founder,

Chairman of the Board, and Chief Executive Officer

Nashville,

Tennessee

Index

to Previous Letters to Stockholders

| 2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

| |

|

4Q

2023 |

|

4Q

2022 |

|

4Q

2021 |

|

4Q

2020 |

|

4Q

2019 |

| |

|

3Q

2023 |

|

3Q

2022 |

|

3Q

2021 |

|

3Q

2020 |

|

3Q

2019

|

| |

|

2Q

2023 |

|

2Q

2022 |

|

2Q

2021 |

|

2Q

2020 |

|

|

| 1Q

2024 |

|

1Q

2023 |

|

1Q

2022 |

|

1Q

2021 |

|

1Q

2020 |

|

|

Second

Quarter 2024 Financial Overview

GAAP

Operating Results

Selected

financial highlights regarding GAAP operating results for the three months and six months ended June 30, 2024 and for the same periods

in 2023 are as follows:

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 48,939,000 | | |

$ | 33,470,000 | | |

$ | 83,526,000 | | |

$ | 59,573,000 | |

| Cost of sales | |

| 12,539,000 | | |

| 10,000,000 | | |

| 23,092,000 | | |

| 18,271,000 | |

| Gross profit | |

| 36,400,000 | | |

| 23,470,000 | | |

| 60,434,000 | | |

| 41,302,000 | |

| Selling, general and administrative | |

| 31,817,000 | | |

| 19,957,000 | | |

| 60,630,000 | | |

| 35,845,000 | |

| Research and development | |

| 3,053,000 | | |

| 1,161,000 | | |

| 5,202,000 | | |

| 1,895,000 | |

| Total operating expenses | |

| 34,870,000 | | |

| 21,118,000 | | |

| 65,832,000 | | |

| 37,740,000 | |

| Income (loss) from operations | |

| 1,530,000 | | |

| 2,352,000 | | |

| (5,398,000 | ) | |

| 3,562,000 | |

| Total other expense, net | |

| 7,348,000 | | |

| 6,596,000 | | |

| 13,985,000 | | |

| 14,737,000 | |

| Income tax (expense) benefit | |

| (655,000 | ) | |

| 15,000 | | |

| (655,000 | ) | |

| 303,000 | |

| Net loss attributable to Harrow, Inc. | |

$ | (6,473,000 | ) | |

$ | (4,229,000 | ) | |

$ | (20,038,000 | ) | |

$ | (10,872,000 | ) |

Net

loss per share of common stock, basic and diluted | |

$ | (0.18 | ) | |

$ | (0.14 | ) | |

$ | (0.56 | ) | |

$ | (0.36 | ) |

Core

Results (Non-GAAP Measures)

Core

Results (non-GAAP measures), which we define as the after-tax earnings and other operational and financial metrics generated from our

principal business, for the three months and six months ended June 30, 2024 and for the same periods in 2023 are as follows:

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 48,939,000 | | |

$ | 33,470,000 | | |

$ | 83,526,000 | | |

$ | 59,573,000 | |

| Gross margin | |

| 74 | % | |

| 70 | % | |

| 72 | % | |

| 69 | % |

| Core gross margin(1) | |

| 79 | % | |

| 78 | % | |

| 77 | % | |

| 77 | % |

| Net loss | |

| (6,473,000 | ) | |

| (4,229,000 | ) | |

| (20,038,000 | ) | |

| (10,872,000 | ) |

| Core net loss(1) | |

| (2,047,000 | ) | |

| (494,000 | ) | |

| (11,836,000 | ) | |

| (1,536,000 | ) |

| Adjusted EBITDA(1) | |

| 8,803,000 | | |

| 11,005,000 | | |

| 9,030,000 | | |

| 16,347,000 | |

| Basic and diluted net loss per share | |

| (0.18 | ) | |

| (0.14 | ) | |

| (0.56 | ) | |

| (0.36 | ) |

| Core basic and diluted net loss per share(1) | |

| (0.06 | ) | |

| (0.02 | ) | |

| (0.33 | ) | |

| (0.05 | ) |

| (1) | Core

gross margin, core net loss, core basic and diluted net loss per share (collectively, “Core

Results”), and Adjusted EBITDA are non-GAAP measures. For additional information, including

a reconciliation of such Core Results and Adjusted EBITDA to the most directly comparable

measures presented in accordance with GAAP, see the explanation of non-GAAP measures and

reconciliation tables at the end of this Letter to Stockholders. |

FORWARD-LOOKING

STATEMENTS

Management’s

remarks in this stockholder letter include forward-looking statements within the meaning of federal securities laws. Forward-looking

statements are subject to numerous risks and uncertainties, many of which are beyond Harrow’s control, including risks and uncertainties

described from time to time in its Securities and Exchange (SEC) filings, such as the risks and uncertainties related to the Company’s

ability to make commercially available its FDA-approved products and compounded formulations and technologies, and FDA approval of certain

drug candidates in a timely manner or at all.

For

a list and description of those risks and uncertainties, please see the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, subsequent Quarterly Reports on Form 10-Q, and other filings with the SEC.

Harrow’s

results may differ materially from those projected. Harrow disclaims any intention or obligation to update or revise any financial projections

or forward-looking statements whether because of new information, future events or otherwise. This stockholder letter contains time-sensitive

information and is accurate only as of today.

Additionally,

Harrow refers to non-GAAP financial measures, specifically Adjusted EBITDA, adjusted earnings, core gross margin, core net income (loss),

and core basic and diluted net income (loss) per share. A reconciliation of non-GAAP measures with the most directly comparable GAAP

measures is included in this letter.

No

compounded formulation is FDA-approved. All compounded formulations are customizable. Other than drugs compounded at a registered outsourcing

facility, all compounded formulations require a prescription for an individually identified patient consistent with federal and state

laws.

All

trademarks, service marks, and trade names included or referenced in this publication are the property of their respective owners.

Non-GAAP

Financial Measures

In

addition to the Company’s results of operations determined in accordance with U.S. generally accepted accounting principles (GAAP),

which are presented and discussed above, management also utilizes Adjusted EBITDA and Core Results, unaudited financial measures that

are not calculated in accordance with GAAP, to evaluate the Company’s financial results and performance and to plan and forecast

future periods. Adjusted EBITDA and Core Results are considered “non-GAAP” financial measures within the meaning of Regulation

G promulgated by the SEC. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of

the Company’s operations that, when viewed with GAAP results, provide a more complete understanding of the Company’s results

of operations and the factors and trends affecting its business. Management believes Adjusted EBITDA and Core Results provide meaningful

supplemental information regarding the Company’s performance because (i) they allow for greater transparency with respect to key

metrics used by management in its financial and operational decision-making; (ii) they exclude the impact of non-cash or, when specified,

non-recurring items that are not directly attributable to the Company’s core operating performance and that may obscure trends

in the Company’s core operating performance; and (iii) they are used by institutional investors and the analyst community to help

analyze the Company’s results. However, Adjusted EBITDA, Core Results, and any other non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Further,

non-GAAP financial measures used by the Company and the way they are calculated may differ from the non-GAAP financial measures or the

calculations of the same non-GAAP financial measures used by other companies, including the Company’s competitors.

Adjusted

EBITDA

The

Company defines Adjusted EBITDA as net loss, excluding the effects of stock-based compensation and expenses, interest, taxes, depreciation,

amortization, investment loss (income), net, and, if any and when specified, other non-recurring income or expense items. Management

believes that the most directly comparable GAAP financial measure to Adjusted EBITDA is net loss. Adjusted EBITDA has limitations and

should not be considered as an alternative to gross profit or net loss as a measure of operating performance or to net cash (used in)

provided by operating, investing, or financing activities as a measure of ability to meet cash needs.

The

following is a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most comparable GAAP measure, net loss, for the three months

and six months ended June 30, 2024 and for the same periods in 2023:

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| GAAP net loss | |

$ | (6,473,000 | ) | |

$ | (4,229,000 | ) | |

$ | (20,038,000 | ) | |

$ | (10,872,000 | ) |

| Stock-based compensation and expenses | |

| 4,271,000 | | |

| 5,412,000 | | |

| 8,440,000 | | |

| 7,045,000 | |

| Interest expense, net | |

| 5,471,000 | | |

| 5,704,000 | | |

| 10,886,000 | | |

| 10,451,000 | |

| Income taxes | |

| 655,000 | | |

| (15,000 | ) | |

| 655,000 | | |

| (303,000 | ) |

| Depreciation | |

| 453,000 | | |

| 398,000 | | |

| 885,000 | | |

| 690,000 | |

| Amortization of intangible assets | |

| 2,549,000 | | |

| 2,843,000 | | |

| 5,103,000 | | |

| 5,050,000 | |

| Investment loss (income), net | |

| 1,923,000 | | |

| 714,000 | | |

| 3,171,000 | | |

| (1,328,000 | ) |

| Other (income) expense, net | |

| (46,000 | ) | |

| 178,000 | | |

| (72,000 | ) | |

| 5,614,000 (1) | |

| Adjusted EBITDA | |

$ | 8,803,000 | | |

$ | 11,005,000 | | |

$ | 9,030,000 | | |

$ | 16,347,000 | |

| (1) | Includes

$5,465,000 for the loss on extinguishment of debt. |

Core

Results

Harrow

Core Results, including core gross margin, core net loss, and core basic and diluted loss per share exclude (1) all amortization and

impairment charges of intangible assets, excluding software development costs, (2) net gains and losses on investments and equity securities,

including equity method gains and losses and equity valued at fair value through profit and loss (FVPL), and preferred stock dividends,

and (3) gains/losses on forgiveness of debt. In other periods, Core Results may also exclude fair value adjustments of financial assets

in the form of options to acquire a company carried at FVPL, obligations related to product recalls, certain acquisition-related items,

restructuring charges/releases and associated items, related legal items, gains/losses on early extinguishment of debt or debt modifications,

impairments of property, plant and equipment and software, as well as income and expense items that management deems exceptional and

that are or are expected to accumulate within the year to be over a $100,000 threshold.

The

following is a reconciliation of Core Results, non-GAAP measures, to the most comparable GAAP measures for the three months and six months

ended June 30, 2024 and for the same periods in 2023:

| For the Three Months Ended June 30, 2024 |

| | |

| | |

Amortization of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 36,400,000 | | |

$ | 2,140,000 | | |

$ | - | | |

$ | - | | |

$ | 38,540,000 | |

| Gross margin | |

| 74 | % | |

| | | |

| | | |

| | | |

| 79 | % |

| Operating income | |

| 1,530,000 | | |

| 2,549,000 | | |

| - | | |

| - | | |

| 4,079,000 | |

| (Loss) income before taxes | |

| (5,818,000 | ) | |

| 2,549,000 | | |

| 1,923,000 | | |

| (46,000 | ) | |

| (1,392,000 | ) |

| Taxes | |

| (655,000 | ) | |

| - | | |

| - | | |

| - | | |

| (655,000 | ) |

| Net (loss) income | |

| (6,473,000 | ) | |

| 2,549,000 | | |

| 1,923,000 | | |

| (46,000 | ) | |

| (2,047,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.18 | ) | |

| | | |

| | | |

| | | |

| (0.06 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 35,618,977 | | |

| | | |

| | | |

| | | |

| 35,618,977 | |

| For the Six Months Ended June 30, 2024 |

| | |

| | |

Amortization

of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 60,434,000 | | |

$ | 4,280,000 | | |

$ | - | | |

$ | - | | |

$ | 64,714,000 | |

| Gross margin | |

| 72 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating loss | |

| (5,398,000 | ) | |

| 5,103,000 | | |

| - | | |

| - | | |

| (295,000 | ) |

| (Loss) income before taxes | |

| (19,383,000 | ) | |

| 5,103,000 | | |

| 3,171,000 | | |

| (72,000 | ) | |

| (11,181,000 | ) |

| Taxes | |

| (655,000 | ) | |

| - | | |

| - | | |

| - | | |

| (655,000 | ) |

| Net (loss) income | |

| (20,038,000 | ) | |

| 5,103,000 | | |

| 3,171,000 | | |

| (72,000 | ) | |

| (11,836,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.56 | ) | |

| | | |

| | | |

| | | |

| (0.33 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 35,544,312 | | |

| | | |

| | | |

| | | |

| 35,544,312 | |

| For the Three Months Ended June 30, 2023 |

| | |

| | |

Amortization of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 23,470,000 | | |

$ | 2,649,000 | | |

$ | - | | |

$ | - | | |

$ | 26,119,000 | |

| Gross margin | |

| 70 | % | |

| | | |

| | | |

| | | |

| 78 | % |

| Operating income | |

| 2,352,000 | | |

| 2,843,000 | | |

| - | | |

| - | | |

| 5,195,000 | |

| (Loss) income before taxes | |

| (4,244,000 | ) | |

| 2,843,000 | | |

| 714,000 | | |

| 178,000 | | |

| (509,000 | ) |

| Taxes | |

| 15,000 | | |

| - | | |

| - | | |

| - | | |

| 15,000 | |

| Net (loss) income | |

| (4,229,000 | ) | |

| 2,843,000 | | |

| 714,000 | | |

| 178,000 | | |

| (494,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.14 | ) | |

| | | |

| | | |

| | | |

| (0.02 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 30,458,677 | | |

| | | |

| | | |

| | | |

| 30,458,677 | |

| For the Six Months Ended June 30, 2023 |

| | |

| | |

Amortization

of Certain Intangible Assets | | |

| | |

| | |

| |

| Gross profit | |

$ | 41,302,000 | | |

$ | 4,694,000 | | |

$ | - | | |

$ | - | | |

$ | 45,996,000 | |

| Gross margin | |

| 69 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating income | |

| 3,562,000 | | |

| 5,050,000 | | |

| - | | |

| - | | |

| 8,612,000 | |

| (Loss) income before taxes | |

| (11,175,000 | ) | |

| 5,050,000 | | |

| (1,328,000 | ) | |

| 5,614,000 | | |

| (1,839,000 | ) |

| Taxes | |

| 303,000 | | |

| - | | |

| - | | |

| - | | |

| 303,000 | |

| Net (loss) income | |

| (10,872,000 | ) | |

| 5,050,000 | | |

| (1,328,000 | ) | |

| 5,614,000 | | |

| (1,536,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.36 | ) | |

| | | |

| | | |

| | | |

| (0.05 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 30,379,354 | | |

| | | |

| | | |

| | | |

| 30,379,354 | |

| (1) | Core

basic and diluted loss per share is calculated using the weighted-average number of shares

of common stock outstanding during the period. Core basic and diluted loss per share also

contemplates dilutive shares associated with equity-based awards as described in Note 2 and

elsewhere in the Condensed Consolidated Financial Statements included in the Company’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. |

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity File Number |

001-35814

|

| Entity Registrant Name |

HARROW,

INC.

|

| Entity Central Index Key |

0001360214

|

| Entity Tax Identification Number |

45-0567010

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

102

Woodmont Blvd.

|

| Entity Address, Address Line Two |

Suite 610

|

| Entity Address, City or Town |

Nashville

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37205

|

| City Area Code |

(615)

|

| Local Phone Number |

733-4730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

HROW

|

| Security Exchange Name |

NASDAQ

|

| 8.625% Senior Notes due 2026 |

|

| Title of 12(b) Security |

8.625%

Senior Notes due 2026

|

| Trading Symbol |

HROWL

|

| Security Exchange Name |

NASDAQ

|

| 11.875% Senior Notes due 2027 |

|

| Title of 12(b) Security |

11.875%

Senior Notes due 2027

|

| Trading Symbol |

HROWM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |