0001468492

false

0001468492

2023-11-15

2023-11-15

0001468492

HSCS:CommonStock0.001ParValuePerShareMember

2023-11-15

2023-11-15

0001468492

HSCS:WarrantsToPurchaseCommonStockMember

2023-11-15

2023-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2023

HEART TEST LABORATORIES, INC.

(Exact name of registrant as specified in its charter)

| Texas |

|

001-41422 |

|

26-1344466 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

550 Reserve Street, Suite 360

Southlake, Texas 76092

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including

area code: 682-237-7781

n/a

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value per share |

|

HSCS |

|

The Nasdaq Stock

Market LLC |

| Warrants to purchase common stock |

|

HSCSW |

|

The Nasdaq Stock

Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement.

Note Conversion and Warrant Amendments

As previously reported, Heart Test

Laboratories, Inc. (the “Company”) on September 7, 2023, entered into a Senior Unsecured Promissory Drawdown Loan Note

(the “MSW Note”) with Matthews Southwest Holdings, Inc. (“MSW”). The MSW Note provided for an unsecured

drawdown loan of up to $1,000,000. As of November 14, 2023, the Company had drawn $500,000 under the MSW Note and issued 1,000,000

Warrants (the “Existing MSW Warrants”) to purchase shares of common stock, $0.001 par value per share, of the Company

(the “Common Stock”) in lieu of certain fees payable under the MSW Note.

In addition, also as previously reported, on January

24, 2023, the Company entered into Amendment No. 4 to the Loan and Security Agreement, dated April 24, 2020 (the “Loan and Security

Agreement”), by and among the Company, Front Range Ventures LLC (“FRV”) and John Q. Adams (“Adams”). Pursuant

to the Loan and Security Agreement, a secured promissory note in the original principal amount of $500,000 was issued to FRV (the “FRV

Note”) and a secured promissory note in the original principal amount of $500,000 was issued to Adams (the “Adams Note”).

The Loan and Security Agreement was further amended on September 29, 2023 to amend the dates on which principal and accrued interest

are due under the Adams Note, such that accrued and unpaid interest since June 28, 2022 will be due and payable on December 31,

2023, and the principal amount together with all accrued and unpaid interest after December 31, 2023 will be due and payable on March 31,

2024. As consideration for such extension, on October 2, 2023, the Company issued FRV and Adams warrants (the “$1M Lender Warrants”)

to purchase an aggregate of 200,000 shares of Common Stock at an exercise price of $0.44 per share.

On November 15, 2023, MSW and Adams (collectively,

the “Lenders”) and the Company, entered into two separate note conversion letter agreements (collectively, the “Note

Conversion Letter Agreements”). Pursuant to the Note Conversion Letter Agreements, in consideration for the conversion of the aggregate

principal and interest amount due under the MSW Note and the Adams Note (collectively, the “Notes”), on November 16, 2023,

the Company: (1) issued an aggregate of 6,781,288 shares of Common Stock to the Lenders, comprised of (a) 3,125,000 shares of Common Stock

to MSW and (b) 3,656,288 shares of Common Stock issued to Adams; (2) entered into a Warrant Amendment Agreement with MSW, amending the

Existing MSW Warrants to reduce the exercise price of an aggregate of 1,000,000 Existing MSW Warrants to $0.16 per share (the “MSW

Warrant Amendment”); and (3) entered into a Warrant Amendment Agreement with Adams, amending the $1M Lender Warrants owned by Adams

to reduce the exercise price of an aggregate of 107,575 $1M Lender Warrants to $0.16 per share (the “Adams Warrant Amendment”).

Except as expressly set forth in the MSW Warrant Amendment and the Adams Warrant Amendment, the terms and provisions of the warrants held

by the Lenders shall remain in full force and effect.

The description of terms and conditions of the Note

Conversion Letter Agreements, the MSW Warrant Amendment and the Adams Warrant Amendment set forth herein does not purport to be complete

and is qualified in its entirety by reference to the full text of the form of the Note Conversion Letter Agreement with MSW, the Note

Conversion Letter Agreement with Adams, the MSW Warrant Amendment and the Adams Warrant Amendment attached hereto as Exhibits 10.1, 10.2,

10.3 and 10.4, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Closing of

Mount Sinai Transaction

As previously reported, on September 20, 2023,

the Company entered into a Securities Purchase Agreement (the “SPA”) and entered into multiple definitive license agreements

(each, a “License Agreement” and collectively, the “License Agreements”) with Icahn School of Medicine at Mount

Sinai (“Mount Sinai”) to commercialize a range of AI-based cardiovascular algorithms developed by Mount Sinai, as well

as a memorandum of understanding for ongoing cooperation encompassing de-identified data access, on-going research, and the

evaluation of the Company’s MyoVista device.

Also as previously reported, the effectiveness

of the licenses under the License Agreements was subject to the satisfaction or waiver of certain conditions, including that the Company

complete one or more financings in which we receive aggregate gross proceeds of at least $5,000,000 (the “Financing Requirement”)

prior to December 31, 2023. On November 15, 2023, the Company satisfied the Financing Requirement and, accordingly, the licenses

under the License Agreements were deemed effective.

Pursuant to the SPA, on November 16, 2023, the

Company issued to Mount Sinai:

| ● | 4,854,853 shares of Common Stock; |

| |

● |

pre-funded common stock purchase warrants (the “MTS Pre-Funded Warrants”) to purchase up to 710,605 shares of Common Stock, with an exercise price per share of $0.00001, in lieu of shares of Common Stock issuable to Mount Sinai to ensure that the number of shares of Common Stock held by Mount Sinai did not exceed the Beneficial Ownership Limitation (as defined in the MTS Pre-Funded Warrants); and |

| |

● |

common stock purchase warrants to purchase up to 914,148 shares of Common Stock, having an exercise price per share equal to $0.5060 (the “MTS Warrants”), which warrants shall be exercisable immediately upon (x) completion of any financing of at least $10,000,000 raised by the Company (the “Additional Financing”) from the period commencing August 1, 2023 and ending on or prior to June 30, 2024 or (y) waiver by Mount Sinai of the Company’s requirement to complete the Additional Financing. |

The License Agreements may be terminated by Mount

Sinai if we have not completed the Additional Financing by June 30, 2024.

The foregoing

description of the SPA, the MTS Pre-Funded Warrants, and MTS Warrants does not purport to

be complete and is qualified in its entirety by reference to the complete text of the SPA, the MTS Pre-Funded Warrants, and MTS

Warrants, which were filed as exhibits 10.1, 4.1 and 4.2, respectively, to the Company’s Current

Report on Form 8-K, dated September 20, 2023, filed with the U.S. Securities and Exchange Commission on September 21, 2023, and

are incorporated herein by reference.

Second Amended Equity Distribution Agreement with

Maxim Group LLC

As previously reported, on September 18, 2023, the

Company entered into an Equity Distribution Agreement (the “Original EDA”), with Maxim Group LLC (“Maxim Group”)

as sales agent (the “Sales Agent”) pursuant to which the Company may offer and sell, from time to time, an aggregate

of up to $3,250,000 of shares of Common Stock, in an “at the market” offering (as defined in Rule 415(a)(4) under the Securities

Act of 1933, as amended (the “Securities Act”)).

On November 9, 2023, the Company entered into Amendment

No. 1 to the Original EDA (the “First Amended EDA”) with Maxim Group pursuant to which, among other things, the Company may

issue and sell up to $10,000,000 of its shares of Common Stock from time to time through the Sales Agent subject to certain selling limitations.

On November 17, 2023, the Company entered into Amendment

No. 2 to the Original EDA (the “Second Amended EDA” and, together with the Original EDA and the First Amended EDA, the “EDA”)

with Maxim Group pursuant to which, among other things, the Company may issue and sell $15,000,000 of its shares of Common Stock (the

“Shares”) from time to time through the Sales Agent; provided, however, that in no event will the Company issue or sell through

the Sales Agent such number of shares of Common Stock that would cause the Company or the offering of its shares of Common Stock to not

satisfy the eligibility and transaction requirements for use of Form S-3 (including General Instruction I.B.6 of Form S-3). Pursuant to

the Second Amended EDA, Maxim will be entitled to compensation at a commission rate equal to 4.0% of the gross sales price per share sold

on or after November 17, 2023 pursuant to the EDA (for any shares of Common Stock sold under the Original EDA and the First Amended EDA,

Maxim was entitled to compensation at a commission rate equal to 3.0% of the gross sales price per share sold), and the Company has agreed

to reimburse Maxim Group’s legal fees and expenses up to $90,000. As of November 17, 2023,

the aggregate market value of the Company’s outstanding shares of Common Stock held by non-affiliates was $33,108,931, which was

calculated based on 47,707,393 outstanding shares of Common Stock held by non-affiliates on November17, 2023 and a price per share of

$0.69, which was the closing price of the Common Stock on September 18, 2023 and is the highest closing sale price of Common Stock on

the Nasdaq Capital Market within the prior 60 days. Pursuant to General Instruction I.B.6 of Form S-3, in no event will the Company sell

the shelf securities in a public primary offering with a value exceeding more than one-third of the aggregate market value of the Company’s

voting and non-voting ordinary shares held by non-affiliates in any 12-month period as long as the aggregate market value of the Company’s

outstanding ordinary shares held by non-affiliates is less than $75 million. During the 12 calendar months prior to and including

the date of this Current Report on Form 8-K, the Company has sold approximately $6.0 million worth of shares of Common Stock pursuant

to General Instruction I.B.6 of Form S-3.

The shares of Common Stock issuable pursuant to the

EDA have been registered under the Securities Act, pursuant to the Company’s shelf registration statement on Form S-3 (Registration

No. 333-274554) (the “Registration Statement”), which was declared effective by the SEC on September 28, 2023, and will be

issued and sold pursuant to the at the market offering prospectus contained therein, as amended

and supplemented by the prospectus supplement dated November 9, 2023 and filed with the Securities and Exchange Commission pursuant to

Rule 424(b) under the Securities Act on November 13, 2023, and as it may be further amended and supplement from time to time.

The foregoing

description of the EDA does not purport to be complete and is qualified in its entirety by reference to the complete text of the Original

EDA, which was filed as an exhibit to the Company’s Current Report on Form 8-K, dated September 22, 2023, the First Amended EDA

which was filed as an exhibit to the Company’s Current Report on Form 8-K dated November 9, 2023, and the Second Amended EDA which

is filed as Exhibit 1.3 to this Current Report on Form 8-K, and incorporated herein by reference. The legal opinion of Foley

Shechter Ablovatskiy LLP, counsel to the Company, relating to the validity of the additional shares of Common Stock being offered pursuant

to the EDA is filed as Exhibit 5.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 1.02

Termination of Material Definitive Agreement

On November 16, 2023, in connection with entering

into the Note Conversion Letter Agreements, the MSW Warrant Amendment and the Adams Warrant Amendment, the Company repaid in full all

outstanding loans, together with interest and all other amounts due in connection with such repayment under the MSW Note and Adams

Note and those agreements terminated in accordance with their terms.

Item 3.02 Unregistered Sales of Equity Securities.

The information disclosed in Item 1.01 of this Current

Report on Form 8-K regarding the unregistered sale of the Existing Warrants is incorporated herein by reference.

Item 3.03. Material Modifications to Rights of

Security Holders.

The information disclosed in Item 1.01 of this Current

Report on Form 8-K regarding the Note Conversion Letter Agreements and Warrant Amendments is incorporated herein by reference.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 1.1 |

|

Equity Distribution

Agreement, dated September 18, 2023 between Heart Test Laboratories, Inc. and Maxim Group LLC (incorporated by reference to Exhibit

1.1 to our Current Report on Form 8-K filed September 22, 2023). |

| |

|

|

| 1.2 |

|

Amendment No. 1 to Equity

Distribution Agreement dated November 9, 2023 between Heart Test Laboratories, Inc. and Maxim Group LLC (incorporated by reference

to Exhibit 1.2 to our Current Report on Form 8-K filed November 13, 2023). |

| |

|

|

| 1.3* |

|

Amendment No. 2 to Equity

Distribution Agreement dated November 17, 2023 between Heart Test Laboratories, Inc. and Maxim Group LLC |

| |

|

|

| 4.1 |

|

Form of $1M Lender Warrant and $1.5M Lender Warrant (incorporated by

reference to Exhibit 4.6 to the Company’s Registration Statement on Form S-1 filed May 17, 2022). |

| |

|

|

| 4.2 |

|

Form of Pre-Funded Warrant, dated as of September 20, 2023 (incorporated

by reference to Exhibit 4.1 to our Current Report on Form 8-K filed September 21, 2023). |

| |

|

|

| 4.3 |

|

Form of Common Stock Warrant, dated as of September 20, 2023 (incorporated

by reference to Exhibit 4.2 to our Current Report on Form 8-K filed September 21, 2023) |

| |

|

|

| 5.1* |

|

Opinion of

Foley Shechter Ablovatskiy LLP |

| |

|

|

| 10.1* |

|

Note Conversion Letter

Agreement, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and Matthews Southwest Holdings, Inc. |

| |

|

|

| 10.2* |

|

Note Conversion Letter

Agreement, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and John Q. Adams. |

| |

|

|

| 10.3* |

|

Warrant Amendment, dated

November 16, 2023, by and between Heart Test Laboratories, Inc. and Matthews Southwest Holdings, Inc. |

| |

|

|

| 10.4* |

|

Warrant Amendment, dated

November 16, 2023, by and between Heart Test Laboratories, Inc. and John Q. Adams. |

| |

|

|

| 10.5 |

|

Amendment No. 5 to the

$1M Loan and Security Agreement, dated September 29, 2023 (incorporated by reference to exhibit 10.45 to our Registration Statement

on Form S-1 filed October 16, 2023). |

| |

|

|

| 10.6 |

|

Securities Purchase Agreement,

dated as of September 20, 2023, by and between the Company and Icahn School of Medicine at Mount Sinai (incorporated by reference

to Exhibit 10.1 to our Current Report on Form 8-K filed September 21, 2023). |

| |

|

|

| 23.1* |

|

Consent of Foley Shechter

Ablovatskiy LLP (contained in Exhibit 5.1) |

| |

|

|

| 104 |

|

Cover Page Interactive

Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

HEART TEST LABORATORIES, INC. |

| |

|

| |

By: |

/s/ Andrew Simpson |

| Date: November 17, 2023 |

Name: |

Andrew Simpson |

| |

Title: |

President, Chief Executive Officer and

Chairman of the Board of Directors |

5

Exhibit

1.3

Heart

Test Laboratories, Inc.

AMENDMENT

NO. 2 TO equity distribution AGREEMENT

November

17, 2023

Maxim

Group LLC

300

Park Avenue, 16th Floor

New

York, New York 10022

Ladies

and Gentlemen:

Reference

is made to that certain equity distribution agreement, dated as of September 18, 2023, as amended on November 9, 2023 (the “Sales

Agreement”), by and between Heart Test Laboratories, Inc., a Texas Corporation (the “Company”),

and Maxim Group LLC (the “Agent”). Capitalized terms used herein but not otherwise defined are used herein

as defined in the Sales Agreement.

The

Company and Agent (collectively, the “Parties”) wish to further amend the Sales Agreement, pursuant to Section 15

of the Sales Agreement, on the terms and conditions set forth in this letter (this “Amendment No. 2”). Therefore,

for and in consideration of the mutual covenants and agreements herein contained, and contained in the Sales Agreement, the Company,

on the one hand, and the Agent, on the other hand, the Parties therefore hereby agree as follows effective as of the date hereof:

1. Increase

in the Aggregate Offering Price of Shares. The reference to “US$10,000,000” in the heading, introductory paragraph, Sections

2 and 7 of the Sales Agreement regarding the aggregate offering price of the shares of Common Stock is hereby amended and replaced with

“US$15,000,000.”

2.

Increase in the Transaction Fee. The reference to “three percent (3%)” in Section 2(a)(vi) of the Sales Agreement

regarding the Transaction Fee is hereby amended and replaced with “four percent (4%)”. For the avoidance of doubt, the Transaction

Fee payable in connection with any sales of the Shares prior to the date hereof shall continue to be three percent (3%) and any sales

from and after the date hereof shall be the increased Transaction Fee.

3. Definition

of Prospectus Supplement. The Parties agree that the definition of “Prospectus Supplement” under Section 1(a)(i)

of the Sales Agreement shall include the prospectus supplement to the Base Prospectus, dated the date hereof, and the prospectus supplement

to the Base Prospectus, dated November 9, 2023, filed by the Company with the Commission pursuant to Rule 424(b) under the Securities

Act.

4.

Increase in Legal Fees for the Agent. The reference to “US$65,000” in Sections 3(g) of the Sales Agreement regarding

the actual and documented fees and out-of-pocket expenses of the Agent’s legal counsel is hereby amended and replaced with “US$90,000.”

5.

Company Counsel Opinion. On the date hereof, the Company shall cause Foley Shechter Ablovatskiy LLP, counsel for the Company,

to furnish to the Agent its written opinion and negative assurance letter, in form and substance reasonably acceptable to the Agent.

6.

Officer’s Certificate. On the date hereof, the Company shall furnish to the Agent an officer’s certificate, dated

as of the date hereof and addressed to the Agent, signed by the chief executive officer and by the chief financial officer of the Company,

to the effect that:

(i) The

representations and warranties of the Company in the Sales Agreement are true and correct in all material respects as if made at and

as of the date of the certificate, and the Company has complied in all material respects with all the agreements and satisfied all the

conditions on its part to be performed or satisfied at or prior to the date of the certificate;

(ii) No

stop order or other order suspending the effectiveness of the Registration Statement or any part thereof or any amendment thereof or

the qualification of the Shares for offering or sale or notice that would prevent use of the Registration Statement, nor suspending or

preventing the use of the Base Prospectus, Prospectus Supplement, the Prospectus or any Permitted Free Writing Prospectus, has been issued,

and no proceeding for that purpose has been instituted or, to the best of their knowledge, is contemplated by the Commission or any state

or regulatory body;

(iii) The

Shares have been duly and validly authorized by the Company and all corporate action required to be taken for the authorization, issuance

and sale of the Shares on that date has been validly and sufficiently taken;

(iv) Subsequent

to the respective dates as of which information is given in the Base Prospectus, Prospectus Supplement, the Prospectus or any Permitted

Free Writing Prospectus, as amended and supplemented, and except for pending transactions disclosed therein, the Company has not incurred

any material liabilities or obligations, direct or contingent, or entered into any material transactions, not in the ordinary course

of business, or declared or paid any dividends or made any distribution of any kind with respect to its capital stock, and there has

not been any change in the capital stock or any issuance of options, warrants, convertible securities or other rights to purchase the

capital stock (other than as a result of the exercise of any currently outstanding restricted stock units or warrants that are disclosed

in the Prospectus), or any material change in the short-term or long-term debt, of the Company, or any Material Adverse Effect or any

development that would reasonably be likely to result in a Material Adverse Effect (whether or not arising in the ordinary course of

business), or any material loss by strike, fire, flood, earthquake, accident, epidemic, pandemic or other calamity, whether or not covered

by insurance, incurred by the Company;

(v) Except

as stated in the Base Prospectus, Prospectus Supplement, the Prospectus, and any Permitted Free Writing Prospectus, as amended and supplemented,

there is not pending, or, to the knowledge of the Company, threatened or contemplated, any action, suit or proceeding to which the Company

is a party before or by any court or governmental agency, authority or body, or any arbitrator, which would reasonably be likely to result

in any Material Adverse Effect;

(vi) In connection with

the Agreement, the statements (collectively, the “Regulatory Statements”) related to the regulations of the

United States Food and Drug Administration (the “FDA”) and related regulations (collectively, the

“Applicable Regulations”) are true and correct in all material respects as they relate to the Company included or

incorporated by reference in the Registration Statement, Base Prospectus, Prospectus Supplement, the Prospectus, as amended and

supplemented, which incorporate by reference documents that the Company has filed or will file in accordance with the provisions of

the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder;

(vi) The

Regulatory Statements insofar as such statements constitute summaries of the Applicable Regulations and related legal matters, fairly

present, to the extent required by the Securities Act, in all material respects, such law and legal matters;

(vii) The

Company is and has been in material compliance with the Applicable Regulations. The Company has not been informed by the FDA that the

FDA will prohibit the marketing, sale, license or use in the United States of any product proposed to be developed, produced or marketed

by the Company nor has the FDA expressed any concern as to approving or clearing for marketing any product being developed or proposed

to be developed by the Company; and

(viii) There are no actions, suits, claims, proceedings, audits or investigations pending or threatened in writing against the Company pursuant

to the Applicable Regulations or by any federal government or regulatory authorities engaged in the regulation of the Company’s

products and brands.

7.

Secretary’s Certificate. On the date hereof, the Company shall furnish to the Agent a certificate from the Company’s

corporate secretary, dated as of the date hereof and addressed to the Agent, certifying: (i) that each of the Charter and Bylaws

is true and complete, has not been modified and is in full force and effect; (ii) that the resolutions of the Company’s board

of directors relating to the Offering are in full force and effect and have not been modified; (iii) the good standing of the Company;

and (iv) as to the incumbency of the officers of the Company. The documents referred to in such certificate shall be attached to

such certificate.

8. Governing

Law. THIS AMENDMENT NO. 2 SHALL BE SUBJECT TO THE PROVISIONS REGARDING APPLICABLE LAW AND WAIVER OF JURY TRIAL SET FORTH IN SECTIONS

12 AND 16 OF THE SALES AGREEMENT, AND SUCH PROVISIONS ARE INCORPORATED HEREIN BY THIS REFERENCE, MUTATIS MUTANDIS.

9. Counterparts.

This Amendment No. 2 may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Delivery of an executed Amendment No. 2 by one party to the other may be made by facsimile

or electronic transmission.

10. Agreement

Remains in Effect. Except as provided herein, all provisions, terms and conditions of the Sales Agreement shall remain in full force

and effect. As amended hereby, the Sales Agreement is ratified and confirmed in all respects. On and after the date of this Amendment

No. 2, each reference in the Sales Agreement to the “Agreement”, “hereinafter”, “herein”, “hereinafter”,

“hereunder”, “hereof”, or words of like import shall mean and be a reference to the Sales Agreement as amended

by this Amendment No. 2.

[Signature

Page Follows]

If

the foregoing is in accordance with your understanding of our agreement, please sign and return to the Company the enclosed duplicate

of this Amendment No. 2, whereupon this letter and your acceptance shall represent a binding agreement between the Company and the Agent

in accordance with its terms.

| |

Very truly yours, |

| |

|

| |

HEART TEST LABORATORIES, INC. |

| |

|

| |

By |

/s/

Andrew Simpson |

| |

Name: |

Andrew Simpson |

| |

Title: |

Chief Executive Officer |

| Confirmed as of the date first above mentioned. |

|

| |

|

| MAXIM GROUP LLC, as Agent |

|

| |

|

|

| By |

/s/ Clifford

A. Teller |

|

| Name: |

Clifford A. Teller |

|

| Title: |

Co-President |

|

[Signature Page to Amendment No. 2 to Equity Distribution

Agreement]

Exhibit 5.1

Attorneys at Law

1180 Avenue of the Americas | 8th Floor

New York, New York 10036

Dial: 212.335.0466

Fax: 917.688.4092

info@foleyshechter.com

www.foleyshechter.com

November 17, 2023

Heart Test Laboratories, Inc.

550 Reserve Street, Suite 360

Southlake, TX 76092

Re: Registration Statement on Form S-3

(File No. 333-274554)

Ladies and Gentlemen:

We have acted as counsel to

Heart Test Laboratories, Inc., a Texas corporation (the “Company”), in connection with the proposed issuance and sale

by the Company, from time to time, of up to $11,036,310 of shares (the “Shares”) of common stock, $0.001 par value

per share (“Common Stock”), of the Company pursuant to that certain Equity Distribution Agreement, dated September

18, 2023, as amended by that certain Amendment No. 1 to Equity Distribution Agreement, dated as of November 9, 2023, and as further amended

by that certain Amendment No. 2 to Equity Distribution Agreement, dated as of November 17, 2023 (collectively, the “Agreement”),

entered into by and between the Company and Maxim Group LLC, as sales agent pursuant to an “at the market” offering prospectus,

dated September 28, 2023 (the “Prospectus”) as amended and supplemented by a prospectus supplement dated November 9,

2023 (the “Prospectus Supplement No. 1”) and a prospectus supplement No. 2 dated November 17, 2023 (the “Prospectus

Supplement No. 2”) that form a part of the Company’s Registration Statement on Form S-3 (File No. 333-274554)

(as amended or supplemented from time to time, the “Registration Statement”), originally filed with the U.S. Securities

and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”),

on September 18, 2023, and declared effective by the Commission on September 28, 2023.

In connection with this opinion

letter, we have examined the Agreement, the Registration Statement, the Prospectus, the Prospectus Supplement No. 1, the Prospectus Supplement

No. 2 and originals, or copies certified or otherwise identified to our satisfaction, of the Company’s certificate of formation

and bylaws, both as currently in effect, certain resolutions of the Company’s Board of Directors relating to the issuance and sale

of the Shares and such other documents, records and other instruments as we have deemed appropriate for purposes of the opinion set forth

herein. As to various questions of fact material to this opinion, we have relied upon representations of officers or directors of the

Company and documents furnished to us by the Company without independent verification of their accuracy.

In our examination of the

foregoing documents, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals,

the conformity to original documents of all documents submitted to us as copies, the authenticity of the originals of such latter documents

and the legal competence of all signatories to such documents.

Based upon and subject to

the foregoing, and assuming the receipt of the appropriate consideration for the Shares, we are of the opinion that the Shares have been

duly authorized, and when the Shares are issued and paid for in accordance with the terms and conditions of the Agreement, will be validly

issued, fully paid and nonassessable.

Our opinions set forth herein

are limited to the laws of the State of Texas (the “Covered Law”). We do not express any opinion with respect to the law of

any jurisdiction other than Covered Law or as to the effect of any such non-Covered Law on the opinions herein.

We hereby consent to the filing

of this opinion as Exhibit 5.1 to the Current Report on Form 8-K filed by the Company in connection with the issuance and sale of the

Shares in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act and incorporated by reference into the Registration

Statement and to the reference to us under the heading “Legal Matters” in the Prospectus Supplement No. 2. In giving such

consent, we do not thereby admit that we are acting within the category of persons whose consent is required under Section 7 of the

Act or the rules and regulations of the Commission thereunder.

Please note that we are opining

only as to the matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is expressed

as of the date hereof unless otherwise expressly stated and is based upon currently existing statutes, rules, regulations and judicial

decisions, and we disclaim any obligation to advise you of any change in any of these sources of law or subsequent legal or factual developments

which might affect any matters or opinions set forth herein.

Very truly yours,

/s/ Foley Shechter Ablovatskiy

LLP

Exhibit 10.1

550 Reserve St, Suite 360

Southlake, Texas 76092

November 16, 2023

| To: | Adam Miller, CFO, Matthews Southwest Holdings, Inc. |

| Re: | Conversion of Senior Unsecured Promissory Drawdown Loan Note into Equity ($500,000 Drawn) |

Dear Adam:

This Note Conversion

Letter Agreement (this “Agreement”), dated as of the first date written above, is entered into between Heart Test

Laboratories, Inc., a Texas corporation (the “Company”), and You the undersigned holder (the

“Noteholder”) of the Company’s Senior Unsecured Promissory Drawdown Loan Note dated September 6, 2023 (the

“Notes”), to confirm the agreement between the Company and the Noteholder to convert such principal amount of the

Noteholder’s Notes and accrued and unpaid interest due thereon, as of November 16, 2023 (as indicated on the signature page

hereto) (collectively, the “Conversion Amount”), into shares of the Company’s common stock, $0.001 par

value per share (the “Common Stock”), at the rate of $0.16 per share (the “Conversion Price”).

As an example, a Noteholder holding the Note with the Conversion Amount of $100,000 would receive upon conversion of such Note

625,000 shares of Common Stock.

NOW THEREFORE,

in consideration of the mutual covenants and agreements herein contained, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged by each of the parties, the parties mutually agree as follows:

1.

Upon the execution of this Agreement, the Note owned by the Noteholder, and accrued and unpaid interest due thereon, shall be automatically

converted into shares of Common Stock (and/or Pre-Funded Warrants (as defined below)) at the Conversion Price (the “Conversion

Shares”), without any additional action by the Noteholder. As a result of the conversion pursuant to this Section 1(a), the

Noteholder’s Note shall be deemed fully satisfied, null and void, and the Company shall no longer owe any amounts, sums or any other

payments or consideration to the Noteholder in connection with the Note (other than the Conversion Shares and/or Pre-Funded Warrants).

Promptly after the date hereof, the Company shall deliver to the Holder a certificate for his, her or its respective number of Conversion

Shares and/or Pre-Funded Warrants duly authorized and executed by the Company.

Notwithstanding

anything herein to the contrary, to the extent that the Noteholder determines, in its sole discretion, that such Noteholder (together

with such Noteholder’s affiliates, and any person acting as a group together with such Noteholder or any of such Noteholder’s

affiliates) would beneficially own in excess of the Beneficial Ownership Limitation (as defined below), or as the Noteholder may otherwise

choose, the Noteholder may elect to convert Noteholder’s Note into the Conversion Shares and/or Pre-Funded Warrants (in the form

attached hereto as Exhibit A) in lieu of some or all of the Conversion Shares, as applicable. The “Beneficial Ownership Limitation”

shall be 9.99% of the number of Common Stock outstanding immediately after giving effect to the issuance of the Conversion Shares.

2.

As of the date hereof, with respect the Conversion Shares and the Pre-Funded Warrants and the shares of Common Stock underlying

the Pre-Funded Warrants (collectively, the “Securities”), the Noteholder reaffirms each of the representations and

warranties made, if any, in the Notes, including, but not limited to, that the Noteholder is an “accredited investor” within

the meaning of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

3.

This Agreement is made by the Company in reliance upon the Noteholder’s representations to the Company, which by the Noteholder’s

execution of this Agreement, the Noteholder hereby confirms, that the Securities to be received by the Noteholder will be acquired for

investment for the Noteholder’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any

part thereof, and that the Noteholder has no present intention of selling, granting any participation in or otherwise distributing the

same. By executing this Agreement, the Noteholder further represents that the Noteholder does not have any contract, undertaking, agreement

or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to any of

the Securities.

4.

Each party represents and warrants to the other party that such first party has full power and authority to enter into this Agreement

and perform his, her or its obligations hereunder, and such agreement constitutes his valid and legally binding obligation, enforceable

in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of

general application affecting enforcement of creditors’ rights generally and (ii) as limited bylaws relating to the availability

of specific performance, injunctive relief or other equitable remedies.

5.

The Noteholder understands that the Securities have not been registered under the Securities Act by reason of a specific exemption

there from, which exemption depends upon, among other things, the bonafide nature of the Noteholder’s investment intent as expressed

herein.

6.

The Noteholder is familiar with the provisions of Rule 144 promulgated under the Securities Act, which, in substance, permits limited

public resale of “restricted securities” acquired, directly or indirectly, from the issuer thereof (or from an affiliate of

such issuer), in a non-public offering subject to the satisfaction of certain conditions.

7. This Agreement shall

be governed by and construed in accordance with the laws of the State of Texas, without regard to its conflicts of laws rules or

provisions. Each of the parties hereby irrevocably and unconditionally submits to the jurisdiction of all state and federal courts

sitting in the City of Dallas, State of Texas, the venue of the City of Dallas, State of Texas and all actions, disputes, claims and

proceedings arising out of or relating to this Agreement shall be heard and determined in any state or federal court located in the

City of Dallas, State of Texas.

8.

The parties agree to take all such further action(s) as may reasonably be necessary to carry outland consummate this Agreement

as soon as practicable, and to take whatever steps may be necessary to obtain any governmental approval in connection with or otherwise

qualify the issuance of the Conversion Shares that are the subject of this Agreement.

9.

This Agreement shall inure to the benefit of and shall be binding on and shall be enforceable by the parties and their respective,

successors and permitted assigns.

10.

This Agreement may be executed in one or more counterparts and by the parties in separate counterparts, each of which when executed

shall be deemed to be an original, but all of which when taken together shall constitute one and the same agreement. Delivery of an executed

counterpart of a signature page to this Agreement by facsimile or by email shall be effective as delivery of a manually executed counterpart

of this Agreement.

[Signature page follows]

The parties agree for and on behalf of their respective party as of

the first date written above.

| |

NOTEHOLDER: |

| |

|

| |

Matthews Holdings Southwest, Inc. |

| |

(name of Noteholder) |

| |

|

|

| |

By: |

/s/ Adam Miller |

| |

Name: |

Adam Miller |

| |

Title: |

Chief Financial Officer |

| |

Aggregate Notes Conversion Amount (together with interest) being converted as of |

| |

November

16, 2023: |

$500,000 |

| |

|

|

| |

# of Conversion Shares: |

3,125,000 |

| |

# of Pre-Funded Warrants: |

NIL |

| |

COMPANY: |

| |

|

|

| |

Heart Test Laboratories, Inc. |

| |

|

|

| |

By: |

/s/ Andrew Simpson |

| |

Name: |

Andrew Simpson |

| |

Title: |

Chief Executive Officer |

3

Exhibit 10.2

550 Reserve St, Suite 360

Southlake, Texas 76092

November 16, 2023

| Re: | Conversion of $500,000 Amended and Restated Secured Promissory

Note into Equity |

Dear John:

This Note Conversion

Letter Agreement (this “Agreement”), dated as of the first date written above, is entered into between Heart Test Laboratories,

Inc., a Texas corporation (the “Company”), and You the undersigned holder (the “Noteholder”) of

the Company’s 12% Amended and Restated Secured Promissory Note date September 29, 2023 (the “Notes”), to confirm

the agreement between the Company and the Noteholder to convert such principal amount of the Noteholder’s Notes and accrued and

unpaid interest due thereon, as of November 16, 2023 (as indicated on the signature page hereto) (collectively, the “Conversion

Amount”), into shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”),

at the rate of $0.16 per share (the “Conversion Price”). As an example, a Noteholder holding the Note with the Conversion

Amount of $100,000 would receive upon conversion of such Note 625,000 shares of Common Stock.

NOW THEREFORE,

in consideration of the mutual covenants and agreements herein contained, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged by each of the parties, the parties mutually agree as follows:

1. Upon

the execution of this Agreement, the Note owned by the Noteholder, and accrued and unpaid interest due thereon, shall be automatically

converted into shares of Common Stock at the Conversion Price (the “Conversion Shares”), without any additional action

by the Noteholder. As a result of the conversion pursuant to this Section 1(a), the Noteholder’s Note shall be deemed fully satisfied,

null and void, and the Company shall no longer owe any amounts, sums or any other payments or consideration to the Noteholder in connection

with the Note (other than the Conversion Shares). Promptly after the date hereof, the Company shall deliver to the Holder a certificate

for his, her or its respective number of Conversion Shares duly authorized and executed by the Company.

2. As

of the date hereof, with respect the Conversion Shares, the Noteholder reaffirms each of the representations and warranties made, if

any, in the Note Purchase Agreement entered into between the Company and the Noteholder with respect to the Note, including, but not

limited to, that the Noteholder is an “accredited investor” within the meaning of Regulation D promulgated under the

Securities Act of 1933, as amended (the “Securities Act”).

3. This

Agreement is made by the Company in reliance upon the Noteholder’s representations to the Company, which by the Noteholder’s

execution of this Agreement, the Noteholder hereby confirms, that the Conversion Shares to be received by the Noteholder will be acquired

for investment for the Noteholder’s own account, not as a nominee or agent, and not with a view to the resale or distribution of

any part thereof, and that the Noteholder has no present intention of selling, granting any participation in or otherwise distributing

the same. By executing this Agreement, the Noteholder further represents that the Noteholder does not have any contract, undertaking,

agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect

to any of the Conversion Shares.

4. Each

party represents and warrants to the other party that such first party has full power and authority to enter into this Agreement, and

such agreement constitutes his valid and legally binding obligation, enforceable in accordance with its terms, except (i) as limited by

applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’

rights generally and (ii) as limited bylaws relating to the availability of specific performance, injunctive relief or other equitable

remedies.

5. The

Noteholder understands that the Conversion Shares have not been registered under the Securities Act by reason of a specific exemption

there from, which exemption depends upon, among other things, the bonafide nature of the Noteholder’s investment intent as expressed

herein.

6. The

Noteholder is familiar with the provisions of Rule 144 promulgated under the Securities Act, which, in substance, permits limited public

resale of “restricted securities” acquired, directly or indirectly, from the issuer thereof (or from an affiliate of such

issuer), in a non-public offering subject to the satisfaction of certain conditions.

7. This

Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard to its conflicts of laws

rules or provisions. Each of the parties hereby irrevocably and unconditionally submits to the jurisdiction of all state and federal courts

sitting in the City of Dallas, State of Texas, the venue of the City of Dallas, State of Texas and all actions, disputes, claims and proceedings

arising out of or relating to this Agreement shall be heard and determined in any state or federal court located in the City of Dallas,

State of Texas.

8. The

parties agree to take all such further action(s) as may reasonably be necessary to carry outland consummate this Agreement as soon as

practicable, and to take whatever steps may be necessary to obtain any governmental approval in connection with or otherwise qualify the

issuance of the Conversion Shares that are the subject of this Agreement.

9. This

Agreement shall inure to the benefit of and shall be binding on and shall be enforceable by the parties and their respective, successors

and permitted assigns.

10. This Agreement may be

executed in one or more counterparts and by the parties in separate counterparts, each of which when executed shall be deemed to be

an original, but all of which when taken together shall constitute one and the same agreement. Delivery of an executed counterpart

of a signature page to this Agreement by facsimile or by email shall be effective as delivery of a manually executed counterpart of

this Agreement.

[Signature page follows]

The parties agree for and on

behalf of their respective party as of the first date written above.

| |

NOTEHOLDER: |

| |

|

| |

John Q. Adams Snr. |

| |

(name of Noteholder) |

| |

|

| |

/s/ John Q. Adams Snr. |

| |

(signature) |

| |

|

| |

Aggregate Notes Conversion Amount (together with interest) being converted as

of |

| |

November

16, 2023: |

$585,006.12 |

| |

|

|

| |

# of Conversion Shares: |

3,656,288 |

| |

COMPANY: |

| |

|

| |

Heart Test Laboratories, Inc. |

| |

|

|

| |

By: |

/s/ Andrew Simpson |

| |

Name: |

Andrew Simpson |

| |

Title: |

Chief Executive Officer |

3

Exhibit 10.3

November 16, 2023

Holder of Warrants

to Purchase Common Stock set forth on Exhibit A attached hereto

Re: Amendment to Existing Warrants

Dear Holder:

Reference is

hereby made to the conversion of the promissory note into equity on the date hereof (the “Debt Conversion”) by Heart

Test Laboratories, Inc., (the “Company”) and Matthews Holdings Southwest, Inc. (“Holder”).

This letter confirms that, in contemporaneous with the

Debt Conversion, the Company hereby amends, effective as of the closing of the Debt Conversion and upon the satisfaction of the other

terms and conditions referenced below, the warrants to purchase Common Stock, par value $0.001 per share, of the Company set forth on

Exhibit A hereto (the “Existing Warrants”) by reducing the Exercise Price (as defined therein) of the Existing

Warrants to $0.16 per share (the “Warrant Amendment”).

Except as expressly

set forth herein, the terms and provisions of the Existing Warrants shall remain in full force and effect after the execution of this

letter and shall not be in any way changed, modified or superseded except by the terms set forth herein.

From and after

the effectiveness of the Warrant Amendment, the Company agrees to promptly deliver to the Holder, upon request, amended Existing Warrants

that reflect the Warrant Amendments in exchange for the surrender for cancellation of the Holder’s Existing Warrants to be amended

as provided herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto

have caused this agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

| HEART TEST LABORATORIES, INC. |

|

| |

|

| By: |

/s/ Andrew Simpson |

|

| Name: |

Andrew Simpson |

|

| Title: |

Chief Executive Officer |

|

Name of Holder: Matthews Holdings Southwest, Inc.

Signature of Authorized Signatory of Holder: /s/ Adam

Miller

Name of Authorized Signatory: Adam Miller, CFO

[Signature Page

to Heart Test Laboratories, Inc. Warrant Amendment Agreement]

EXHIBIT A

EXISTING WARRANTS

| Transaction/Warrant Date | |

Shares | | |

Strike Price | |

| September 7, 2023 | |

| 500,000 | | |

$ | 1.00 | |

| September 7, 2023 | |

| 250,000 | | |

$ | 1.25 | |

| September 7, 2023 | |

| 250,000 | | |

$ | 1.50 | |

Exhibit 10.4

November 16, 2023

Holder of Warrants

to Purchase Common Stock set forth on Exhibit A attached hereto

Re: Amendment to Existing Warrants

Dear Holder:

Reference is

hereby made to the conversion of the promissory note into equity on the date hereof (the “Debt Conversion”) by Heart

Test Laboratories, Inc., (the “Company”) and John Q. Adams. Snr. (“Holder”).

This letter confirms that, in contemporaneous with the

Debt Conversion, the Company hereby amends, effective as of the closing of the Debt Conversion and upon the satisfaction of the other

terms and conditions referenced below, the warrants to purchase Common Stock, par value $0.001 per share, of the Company set forth on

Exhibit A hereto (the “Existing Warrants”) by reducing the Exercise Price (as defined therein) of the Existing

Warrants to $0.16 per share (the “Warrant Amendment”).

Except as expressly

set forth herein, the terms and provisions of the Existing Warrants shall remain in full force and effect after the execution of this

letter and shall not be in any way changed, modified or superseded except by the terms set forth herein.

From and after

the effectiveness of the Warrant Amendment, the Company agrees to promptly deliver to the Holder, upon request, amended Existing Warrants

that reflect the Warrant Amendments in exchange for the surrender for cancellation of the Holder’s Existing Warrants to be amended

as provided herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto

have caused this agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

| HEART TEST LABORATORIES, INC. |

|

| |

|

|

| By: |

/s/ Andrew Simpson |

|

| Name: |

Andrew Simpson |

|

| Title: |

Chief Executive Officer |

|

Name of Holder: John Q. Adams Snr.

Signature of Authorized Signatory of Holder: /s/ John Q. Adams

Snr.

Name of Authorized Signatory: John Q. Adams Snr.

[Signature Page

to Heart Test Laboratories, Inc. Warrant Amendment Agreement]

EXHIBIT A

EXISTING WARRANTS

| Transaction/Warrant Date | |

Shares | | |

Strike Price | |

| November 17, 2021 | |

| 7,575 | | |

$ | 2.89 | |

| October 2, 2023 | |

| 100,000 | | |

$ | 0.44 | |

v3.23.3

Cover

|

Nov. 15, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 15, 2023

|

| Entity File Number |

001-41422

|

| Entity Registrant Name |

HEART TEST LABORATORIES, INC.

|

| Entity Central Index Key |

0001468492

|

| Entity Tax Identification Number |

26-1344466

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

550 Reserve Street, Suite 360

|

| Entity Address, City or Town |

Southlake

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

76092

|

| City Area Code |

682

|

| Local Phone Number |

237-7781

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

HSCS

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase common stock |

|

| Title of 12(b) Security |

Warrants to purchase common stock

|

| Trading Symbol |

HSCSW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HSCS_CommonStock0.001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HSCS_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

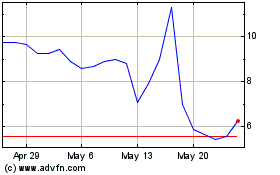

HeartSciences (NASDAQ:HSCS)

Historical Stock Chart

From Dec 2024 to Dec 2024

HeartSciences (NASDAQ:HSCS)

Historical Stock Chart

From Dec 2023 to Dec 2024