Host Hotels & Resorts Announces Pricing Of $700 Million Of 5.500% Senior Notes Due 2035, By Host Hotels & Resorts, L.P.

08 August 2024 - 6:30AM

Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the

nation’s largest lodging real estate investment trust, today

announced that Host Hotels & Resorts, L.P. ("Host L.P."), for

whom the Company acts as sole general partner, has priced its

offering (the "Offering") of $700 million aggregate principal

amount of 5.500% Senior Notes due 2035 (the "Notes"). The Notes are

the Company’s senior unsecured obligations. The Offering is

expected to close on August 12, 2024, subject to the satisfaction

or waiver of customary closing conditions.

The estimated net proceeds of the Offering, after deducting the

underwriting discount, de minimis original issue discount and fees

and expenses, are expected to be approximately $683 million. Host

L.P. intends to use the net proceeds from the sale of the Notes to

repay all $525 million of its borrowings outstanding under the

revolver portion of its senior credit facility, including amounts

borrowed in connection with the recent acquisitions of The

Ritz-Carlton O’ahu, Turtle Bay and 1 Hotel Central Park, and for

general corporate purposes, which may include capital expenditures,

dividends and/or funding for future acquisitions of hotel

properties.

Goldman Sachs & Co. LLC, BofA Securities, Inc., J.P. Morgan

Securities LLC, Wells Fargo Securities, LLC, Morgan Stanley &

Co. LLC and PNC Capital Markets LLC are the joint book-running

managers for the Offering.

The Offering is being made pursuant to an effective shelf

registration statement and accompanying prospectus filed with the

Securities and Exchange Commission on April 9, 2024 and a

preliminary prospectus supplement filed with the Securities and

Exchange Commission on August 7, 2024. A copy of the final

prospectus supplement and the accompanying prospectus relating to

the Notes may be obtained, when available, by contacting Goldman

Sachs & Co. LLC, at 200 West Street, New York, New York 10282,

telephone: (866) 471-2526, or by email:

prospectus-ny@ny.email.gs.com; BofA Securities, Inc., at 201 North

Tryon Street, NC1-022-02-25, Charlotte, NC 28255, Attention:

Prospectus Department, or Toll-free: 1-800-294-1322, or by email at

dg.prospectus_requests@bofa.com; J.P. Morgan Securities LLC, at 383

Madison Avenue, New York, New York 10179, Attention: Investment

Grade Syndicate Desk – 3rd Floor, or by calling (collect) (212)

834-4533; and Wells Fargo Securities, LLC, 608 2nd Avenue South,

Suite 1000 Minneapolis, MN 55402, Attention: WFS Customer Service,

by email: wfscustomerservice@wellsfargo.com or Toll-Free:

1-800-645-3751. This press release does not constitute an offer to

sell or the solicitation of an offer to buy any of the securities,

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of such

state.

This press release contains information about pending

transactions, and there can be no assurance that these transactions

will be completed.

FORWARD LOOKING STATEMENTS

Note: This press release contains forward-looking statements

within the meaning of federal securities regulations. These

forward-looking statements are identified by their use of terms and

phrases such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “should,” “plan,” “predict,” “project,”

“will,” “continue” and other similar terms and phrases, including

references to assumptions and forecasts of future results.

Forward-looking statements are not guarantees of future performance

and involve known and unknown risks, uncertainties and other

factors which may cause the actual results to differ materially

from those anticipated at the time the forward-looking statements

are made. These risks include, but are not limited to: general

economic uncertainty in U.S. markets where we own hotels and a

worsening of economic conditions or low levels of economic growth

in these markets; our ability to close this Offering and apply the

proceeds as currently intended; other changes in national and local

economic and business conditions and other factors such as natural

disasters and weather that will affect occupancy rates at our

hotels and the demand for hotel products and services; the impact

of geopolitical developments outside the U.S. on lodging demand;

volatility in global financial and credit markets; operating risks

associated with the hotel business; risks and limitations in our

operating flexibility associated with the level of our indebtedness

and our ability to meet covenants in our debt agreements; risks

associated with our relationships with property managers and joint

venture partners; our ability to maintain our properties in a

first-class manner, including meeting capital expenditure

requirements; the effects of hotel renovations on our hotel

occupancy and financial results; our ability to compete effectively

in areas such as access, location, quality of accommodations and

room rate structures; risks associated with our ability to complete

acquisitions and develop new properties and the risks that

acquisitions and new developments may not perform in accordance

with our expectations; our ability to continue to satisfy complex

rules in order for us to remain a real estate investment trust for

federal income tax purposes; risks associated with our ability to

effectuate our dividend policy, including factors such as operating

results and the economic outlook influencing our board’s decision

whether to pay further dividends at levels previously disclosed or

to use available cash to make special dividends; and other risks

and uncertainties associated with our business described in the

Company’s annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K filed with the SEC. Although

the Company believes the expectations reflected in such

forward-looking statements are based upon reasonable assumptions,

it can give no assurance that the expectations will be attained or

that any deviation will not be material. All information in this

release is as of the date of this release and the Company

undertakes no obligation to update any forward-looking statement to

conform the statement to actual results or changes in the Company’s

expectations.

|

|

|

| SOURAV GHOSHChief Financial Officer (240)

744-5267 |

JAIME MARCUSInvestor Relations (240) 744-5117

ir@hosthotels.com |

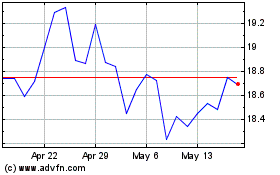

Host Hotels and Resorts (NASDAQ:HST)

Historical Stock Chart

From Oct 2024 to Nov 2024

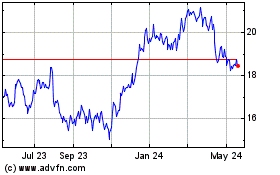

Host Hotels and Resorts (NASDAQ:HST)

Historical Stock Chart

From Nov 2023 to Nov 2024