UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO SECTION 13A-16 OR 15D-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2023

Commission

File Number: 001-41634

HUB

Cyber Security Ltd.

(Exact

Name of Registrant as Specified in Its Charter)

30

Ha’Masger St.

Tel

Aviv 6721117, Israel

+972-3-924-4074

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

Proxy

Statement for Annual General Meeting of Shareholders

On

September 29, 2023, HUB Cyber Security Ltd. (the “Company”) published a notice that it will hold an Annual General

Meeting of Shareholders (the “2023 Annual Meeting”) on November 2, 2023. As noted in the attached proxy statement for the

2023 Annual Meeting, the 2023 Annual Meeting will take place instead on November 3, 2023.

Furnished

herewith as Exhibit 99.1 is the following document:

| 1. | Proxy

statement for the 2023 Annual Meeting to be held on November 3, 2023. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

Hub Cyber Security Ltd. |

| |

|

|

| Date: October 5, 2023 |

By: |

/s/ Uzi Moskovich |

| |

|

Uzi Moskovich |

| |

|

Chief Executive Officer |

EXHIBIT

INDEX

3

Exhibit 99.1

HUB Cyber Security Ltd.

October 5, 2023

Dear Shareholder,

You are cordially invited

to attend the 2023 Annual General Meeting of Shareholders (the “Annual Meeting”) of HUB Cyber Security Ltd. (“HUB”

or the “Company”), to be held at HUB’s offices at 30 Ha’Masger Street, Tel Aviv, Israel 6721117 on November

3, 2023, at 9:00 a.m. Israel time.

At the Annual Meeting, the

Company’s shareholders will be asked to consider and vote on the matters listed in the enclosed Notice of Annual General Meeting

of Shareholders (the “Notice”). HUB’s board of directors unanimously recommends that you vote “FOR”

each proposal listed in the Notice. Management will also report on the affairs of the Company, and a discussion period will be provided

for questions and comments of general interest to shareholders.

Whether or not you plan

to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, after reading

the enclosed Notice and proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided or if you hold your

shares in street name and the proxy card allows this, vote by telephone or over the Internet in accordance with the instructions on your

proxy card.

We urge all of our shareholders

to review our annual report on Form 20-F and our quarterly results of operations furnished to the U.S. Securities and Exchange Commission

(the “SEC”) on Form 6-K, all of which are available on our website at www.hubsecurity.com or on the SEC’s website

at www.sec.gov.

We look forward to greeting

as many of you as can attend the Annual Meeting.

| |

Sincerely, |

| |

|

| |

/s/ Kasbian Nuriel Chirich |

| |

Kasbian Nuriel Chirich |

| |

Chairman of the Board of Directors |

HUB CYBER SECURITY LTD.

Notice of Annual General Meeting of Shareholders

NOTICE IS HEREBY GIVEN that

the 2023 Annual General Meeting (the “Annual Meeting”) of shareholders of HUB Cyber Security Ltd. (“HUB”

or the “Company”) will be held on November 3, 2023, at 9:00 a.m. Israel time, at our offices at 30 Ha’Masger

Street, Tel Aviv, Israel 6721117.

The Annual Meeting is being

called for the following purposes:

| 1. | To re-elect each of Beth Michelson, Ilan

Flato and Noah Hershcoviz as a Class I Director of the Board of Directors of

the Company (the “Board” or the “Board of Directors”),

to serve until the 2026 annual general meeting of shareholders and until his or her successor has been duly elected and qualified, or

until his or her office is vacated in accordance with the Company’s Articles of Association or the Israel Companies Law, 5759-1999

(the “Israel Companies Law”). |

| 2. | To authorize our Board of Directors to effect

a reverse share split of all of our ordinary shares, no par value each, at a ratio in the range of 1-for-10 to 1-for-20, with the

final ratio and effective date to be determined by the Board, and to approve

amendments to the Company’s Articles of Association and Memorandum of Association. |

| 3. | To approve a new compensation policy for the Company’s directors and officers. |

| 4. | To approve the compensation payable to the Company’s current and future directors. |

| 5. | To approve the compensation payable to the Company’s Chief Executive Officer. |

| 6. | To approve the reappointment of Kost Forer

Gabbay & Kasierer, a member of Ernst & Young Global, as the Company’s independent registered public accounting firm until

the next annual meeting of shareholders, and to authorize the Board of Directors, to fix the remuneration of said accounting firm or to

delegate such authority to the Audit Committee of the Board as contemplated by the Sarbanes-Oxley Act of 2002. |

| 7. | To discuss the Company’s audited financial statements for the year ended December 31, 2022. |

The foregoing proposals are

described in detail in the enclosed proxy statement (the “Proxy Statement”), which we urge you to read in its entirety.

Our Board of Directors unanimously

recommends that you vote “FOR” each of the above proposals.

Only shareholders of record

at the close of business on October 4, 2023 (the “Record Date”) will be entitled to notice of, and to vote at, the

Annual Meeting, or any adjournment or postponement thereof.

The Proxy Statement, along

with a proxy card enabling shareholders to indicate their vote on each matter presented at the Annual Meeting, is included with this Notice

of Annual General Meeting of Shareholders (the “Notice”) and is being mailed on or about October 6, 2023 to all shareholders

entitled to vote at the Annual Meeting. Such proxy statement shall also be furnished to the U.S. Securities and Exchange Commission (the

“SEC”) under cover of a Form 6-K and will be available on the Company’s website at www.hubsecurity.com and on

the SEC’s website at www.sec.gov. Signed proxy cards must be received by Broadridge Financial Solutions, Inc. at Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, or at our registered office no later than forty-eight (48) hours before the

time fixed for the Annual Meeting in order for the proxy to be qualified to participate in the Annual Meeting. Pursuant to the Israel

Companies Law and the applicable regulations promulgated thereunder, shareholders wishing to express their position on an agenda item

for the Annual Meeting may do so by submitting a written statement to the Company’s Chief Legal Officer at 30 Ha’Masger Street,

Tel Aviv, Israel 6721117, no later than October 24, 2023. Position statements received will be published by the Company in a manner permitted

under applicable law for the publication of notices of shareholder meetings. The deadline for the submission of shareholder proposals

is October 6, 2023. Detailed proxy voting instructions are provided in the proxy statement as well as on the enclosed proxy card.

Whether or not you plan

to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, after reading

the Notice and proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided, or if you hold your shares

in street name and the proxy card allows this, vote by telephone or over the Internet in accordance with the instructions on your proxy

card.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Kasbian Nuriel Chirich |

| |

Kasbian Nuriel Chirich |

| |

Chairman of the Board of Directors |

| |

|

| Tel Aviv, Israel |

|

| October 5, 2023 |

|

HUB CYBER SECURITY LTD.

PROXY STATEMENT

2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

ABOUT THE ANNUAL MEETING

| Q: | When and where is the 2023 Annual General Meeting of Shareholders

being held? |

| A: | The Annual Meeting will be held on November 3, 2023, at 9:00 a.m. Israel time, at our offices at 30 Ha’Masger

Street, Tel Aviv, Israel 6721117. |

| Q: | Who can attend the Annual Meeting? |

| A: | Any shareholder may attend. Proof of ownership of the Company’s shares as of the Record Date and

the date of the Annual Meeting, as well as a form of personal photo identification, must be presented in order to be admitted to the Annual

Meeting. If your shares are held in the name of a bank, broker or other holder of record, you must bring a current brokerage statement

or other proof of ownership with you to the Annual Meeting. |

| Q: | Who is entitled to vote? |

| A: | Only holders of record of the Company’s ordinary shares, no par value each (the “Ordinary

Shares”) at the close of business on October 4, 2023 are entitled to vote at the Annual Meeting. |

Joint holders of Ordinary Shares should

note that, pursuant to Article 32(d) of the Company’s Articles of Association, the right to vote at the Annual Meeting will be conferred

exclusively upon the “senior” among the joint owners attending the Annual Meeting, in person or by proxy, and for this purpose,

seniority will be determined by the order in which the names appear in the Company’s register of shareholders.

HOW TO VOTE YOUR SHARES

| A: | You may vote by mail. You can do this by completing your proxy card (if you are a shareholder of

record) and returning it in the enclosed, prepaid, and addressed envelope or your voting instruction card (if you are a “street

name” beneficial owner) and returning it to the location specified therein. If you return a signed card but do not provide voting

instructions, your shares will be voted as recommended by the Board, except for matters that require you to indicate the existence or

absence of a personal interest, which will not be voted upon if you do not provide voting instructions and such an indication. |

You may vote in

person. Ballots will be passed out at the Annual Meeting to anyone who wants to vote at the Annual Meeting. If you choose to do so,

please bring the enclosed proxy card or proof of identification. If you are a shareholder of record and your shares are held directly

in your name, you may vote in person at the Annual Meeting. However, if your shares are held in “street name,” you must first

obtain a signed proxy from the your bank, broker or other nominee in order to vote at the Annual Meeting.

“Street name”

holders may be able to vote by phone or through an Internet website in accordance with instructions included on their proxy cards.

| Q: | What is the difference between holding shares as a shareholder of record and holding shares in “street

name”? |

| A: | Many HUB shareholders hold their shares through a bank, broker, or other nominee rather than directly

in their own name. As explained in this proxy statement, there are some distinctions in voting procedures between shares held of record

and shares owned in “street name.” |

Shareholders of Record

If your shares are registered directly

in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the

shareholder of record. In such case, these proxy materials are being sent directly to you. As the shareholder of record, you have the

right to grant your voting proxy directly or to vote in person at the Annual Meeting.

“Street Name” Beneficial

Owners

If your shares are held through a bank,

broker or other nominee, they are considered to be held in “street name” and you are the beneficial owner. If your shares

are held in street name, these proxy materials are being forwarded to you by or on behalf of your bank, broker, or other nominee, which

has the authority to vote those shares. As the beneficial owner, you have the right to direct the bank, broker, or nominee how to vote

your shares for the Annual Meeting. You also may attend the Annual Meeting. However, because you are not the shareholder of record, you

may not vote these shares in person at the Annual Meeting, unless you first obtain a “legal proxy” from your bank, broker,

or other nominee giving you the right to vote the shares. Your bank, broker or nominee has enclosed a voting instruction card for you

to use in directing the bank, broker, or nominee regarding how to vote your shares.

Brokers that hold shares in “street

name” for clients typically have authority to vote on “routine” proposals even when they have not received instructions

from beneficial owners. The only item on the Annual Meeting agenda that may be considered routine is Proposal 6 relating to the reappointment

of HUB’s independent registered public accounting firm; however, we cannot be certain whether this will be treated as a routine

matter since our proxy statement is prepared in compliance with the Israel Companies Law, rather than the rules applicable to domestic

U.S. reporting companies. Therefore, it is important for a shareholder that holds Ordinary Shares through a bank, broker, or other nominee

to instruct such bank, broker, or other nominee how to vote its shares, if the shareholder wants its shares to count for the proposals.

| Q: | Does HUB recommend I vote in advance of the Annual Meeting? |

| A: | Yes. Even if you plan to attend the Annual Meeting, HUB recommends that you vote your shares in

advance so that your vote will be counted if you later decide not to attend the Annual Meeting. |

| Q: | If I vote by proxy, can I change my vote or revoke my

proxy? |

| A: | Yes. You may change your proxy instructions at any time prior to the vote at the Annual Meeting.

If you are a shareholder of record, you may do this by: |

| ● | delivering a written notice of revocation with the Secretary of the Company, delivered to the Company’s

address above or Broadridge at Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; |

| ● | delivering a new proxy card bearing a later date; or |

| ● | attending the Annual Meeting and voting in person (attendance at the Annual Meeting will not cause your

previously granted proxy to be revoked unless you submit another vote at the Annual Meeting). |

If you hold shares

through a bank, broker or other nominee, you must contact that firm to revoke any prior voting instructions.

| Q: | How are my votes cast when I submit a proxy vote? |

| A: | When you submit a proxy vote, you appoint Osher Partok Rheinisch, the Company’s Chief Legal Officer

and Lior Davidson, the Company’s Vice President of Finance and Interim Chief Financial Officer, as your representatives at the Annual

Meeting. Your Ordinary Shares will be voted at the Annual Meeting as you have instructed. |

Upon the receipt of a properly submitted

proxy card, which is received in time (by 9:00 a.m., Israel Time, on November 1, 2023, 48 hours prior to the Annual Meeting) and not revoked

prior to the Annual Meeting, the persons named as proxies will vote the Ordinary Shares represented thereby at the Annual Meeting in accordance

with the Board’s recommendations as indicated in the instructions outlined on the proxy card.

| Q: | What does it mean if I receive more than one proxy card? |

| A: | It means that you have multiple accounts at the transfer agent or with brokers. Please sign and return

all proxy cards to ensure that all of your shares are voted. |

ABOUT THE VOTING PROCEDURE AT THE ANNUAL MEETING

| Q: | What constitutes a quorum? |

| A: | To conduct business at the Annual Meeting, two or more shareholders must be present, in person or by proxy,

holding shares conferring in the aggregate at least twenty-five percent (25%) of the voting power of the Company. |

Ordinary Shares represented in person

or by proxy will be counted for purposes of determining whether a quorum exists. A “broker non-vote” occurs when a bank, broker

or other holder of record holding shares for a beneficial owner submits a proxy card but does not vote on a particular proposal

because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial

owner. Abstentions and broker non-votes will be counted as present in determining if a quorum is present.

| Q: | What happens if a quorum is not present? |

| A: | If a quorum is not present, the Annual Meeting will be adjourned to the same day in the next week, at

the same time and place, or to such day and at such time and place as the Chairperson of the Annual Meeting may determine. |

| Q: | How will votes be counted? |

| A: | Each outstanding Ordinary Share is entitled to one vote. The Company’s Articles of Association do

not provide for cumulative voting. |

| Q: | What vote is required to approve each proposal presented at the Annual Meeting? |

| A: | Each of Proposals 1.a., 1.b. and 1.c (election of each of three Class I Directors), Proposal 4 (approval

of the compensation payable to the Company’s current and future directors) and Proposal 6 (reappointment of our independent registered

public accounting firm) requires that a simple majority of the Ordinary Shares voted in person or by proxy at the Annual Meeting on the

proposal be voted “FOR” the adoption of the proposal. |

Each of Proposals 2.a and 2.b (approval

of a reverse share split and amendments to the Memorandum and Articles of Association) requires that at least seventy-five percent (75%)

of the Ordinary Shares voted in person or by proxy at the Annual Meeting on the proposal be voted “FOR” the adoption of the

proposal.

Proposal 3 (approval of a new compensation

policy for directors and officers of the Company) and Proposal 5 (approval of the compensation payable to the Company’s Chief Executive

Officer) requires, in addition to the affirmative vote of a simple majority of the Ordinary Shares voted in person or by proxy at the

Annual Meeting on the proposal, that either: (1) a simple majority of shares voted at the Annual Meeting, excluding the shares

of controlling shareholders and of shareholders who have a personal interest in the approval of the resolution, be voted in favor of the

proposed resolution, or (2) the total number of shares of non-controlling shareholders and of shareholders who do not have a personal

interest in the resolution that are voted against approval of the resolution does not exceed two percent (2%) of the outstanding voting

power in the Company.

Item 7 on the agenda (discussion of

financial statements) will not entail a shareholder vote.

Under the Israel Companies Law, a “personal

interest” of a shareholder (i) includes a personal interest of the shareholder and any member of the shareholder’s

family, family members of the shareholder’s spouse, or a spouse of any of such family members, or a personal interest of a company

with respect to which the shareholder (or such family member) serves as a director or chief executive officer, owns at least five percent

(5%) of the shares or has the right to appoint a director or chief executive officer, and (ii) excludes an interest arising solely

from the ownership of our Ordinary Shares.

The Israel Companies Law requires that

each shareholder voting on a personal interest proposal indicate whether or not the shareholder is a controlling shareholder or has a

personal interest in the proposed resolution. The enclosed form of proxy includes a box you can mark to confirm that you are not a “controlling

shareholder” and do not have a personal interest in this matter. If you do not mark this box, your vote will not be counted.

If you are unable to make this confirmation,

please contact the Company’s Chief Legal Officer for guidance at +972-3-924-4074; if you hold your shares in “street name,”

you may also contact the representative managing your account, who could contact us on your behalf.

HOW TO FIND VOTING RESULTS

| Q: | Where do I find the voting results of the Annual Meeting? |

| A: | We plan to announce preliminary voting results at the Annual Meeting and to report the final voting results

following the Annual Meeting in a Report of Foreign Private Issuer on Form 6-K that we will furnish to the SEC. |

SOLICITATION OF PROXIES

| Q: | Who will bear the costs of solicitation of proxies for

the Annual Meeting? |

| A: | The Company will bear the costs of solicitation of proxies for the Annual Meeting. In addition to solicitation

by mail, directors, officers, and employees of the Company may solicit proxies from shareholders by telephone, personal interview or otherwise.

Such directors, officers and employees will not receive additional compensation, but may be reimbursed for reasonable out-of-pocket expenses

in connection with such solicitation. Brokers, nominees, fiduciaries, and other custodians have been requested to forward soliciting material

to the beneficial owners of Ordinary Shares held of record by them, and such custodians will be reimbursed by the Company for their reasonable

out-of-pocket expenses. The Company may also retain an independent advisor to assist in the solicitation of proxies. If retained for such

services, the costs will be paid by the Company. |

AVAILABILITY OF PROXY MATERIALS

Copies of the proxy card,

the notice of the Annual Meeting and this proxy statement will be available at the “Company--Investor Relations” section of

our Company’s website at www.hubsecurity.com. The contents of that website are not a part of this proxy statement, and the inclusion

of the website address in this proxy statement is an inactive textual reference only.

SHARES OUTSTANDING

As of September 30, 2023

(the “Calculation Date”), the Company had 98,283,058 Ordinary Shares outstanding. American Stock Transfer & Trust

Company is the transfer agent and registrar for our Ordinary Shares.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Major Shareholders

The

following table sets forth information regarding the beneficial ownership of our outstanding Ordinary Shares as of the Calculation Date,

by:

| ● | each person known by HUB to beneficially own more than five percent (5%) of the outstanding shares of

HUB; |

| ● | each of HUB’s current executive officers and directors; and |

| ● | all of HUB’s current executive officers and directors as a group. |

Unless

otherwise indicated, HUB believes that all persons named in the table have sole voting and investment power with respect to all shares

beneficially owned by them. Except as otherwise noted herein, the number and percentage of Ordinary Shares beneficially owned is determined

in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the information

is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, a person is deemed to be a beneficial owner

of a security if that person has sole or shared voting power, which includes the power to vote or to direct the voting of the security,

or investment power, which includes the power to dispose of or to direct the disposition of the security. In determining beneficial ownership

percentages, HUB deems Ordinary Shares that a shareholder has the right to acquire, including the Ordinary Shares issuable pursuant to

options that are currently exercisable or exercisable within 60 days of the Calculation Date, if any, to be outstanding and to be beneficially

owned by the person with such right to acquire additional Ordinary Shares for the purposes of computing the percentage ownership of that

person (including in the total when calculating the applicable beneficial owner’s percentage of ownership), but we do not treat

them as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise stated, the address of

each named executive officer and director is c/o HUB Cyber Security Ltd., 30 Ha’Masger Street, Tel Aviv, Israel 6721117.

The

calculation of the percentage of beneficial ownership is based on 98,283,058 outstanding Ordinary Shares, as of the Calculation Date.

| Name and Address of Beneficial Owner | |

Amount and

Nature of

Beneficial

Ownership | | |

% of

Outstanding

Shares | |

| Directors and Executive Officers of HUB Security: | |

| | |

| |

| Uzi Moskovich (1) | |

| 131,777 | | |

| * | |

| Osher Partok Rheinisch | |

| 178,108 | | |

| * | |

| Andrey Iaremenko | |

| 5,271,074 | | |

| 5.36 | % |

| Alon Saban | |

| 79,493 | | |

| * | |

| Kasbian Nuriel Chirich | |

| 35,622 | | |

| * | |

| Beth Michelson | |

| — | | |

| — | |

| Liat Aronson | |

| — | | |

| — | |

| Ilan Flato | |

| — | | |

| — | |

| Noah Hershcoviz (2) | |

| 3,375,306 | | |

| 3.41 | % |

| Matthew Kearney (3) | |

| 318,685 | | |

| * | |

| All executive officers and directors as a group (10 individuals) | |

| 6,014,759 | | |

| 6.11 | % |

| | |

| | | |

| | |

| Five Percent or More Holders: | |

| | | |

| | |

| Vizerion Ltd (4) | |

| 9,621,760 | | |

| 9.79 | % |

| AVP EARLY STAGE II S.L.P (5) | |

| 8,785,035 | | |

| 8.94 | % |

| Eyal Moshe | |

| 5,007,520 | | |

| 5.09 | % |

| * | Less than one percent (1%) of our outstanding Ordinary

Shares. |

| (1) | Consists of 131,777 Ordinary Shares subject to options exercisable within 60 days of September 30,

2023. |

| (2) | Consists of 2,770,043 Ordinary Shares and warrants to purchase 605,263 Ordinary Shares held by The 12.64

Fund, of which Mr. Hershcoviz is Managing General Partner. Mr. Hershcoviz disclaims beneficial ownership of such Ordinary Shares except

to the extent of his pecuniary interest therein. |

| (3) | Consists of (i) 311,941 Ordinary Shares and (ii) 6,743 Ordinary Shares subject to options exercisable

within 60 days of September 30, 2023. |

| (4) | As of the date hereof, Galia Ben-Artzi, Eyal Hertzog, Yehuda Levy, Guy Ben-Artzi and Amatzia Ben-Artzi

are the ultimate beneficial owners of Viserion Ltd. The member of the board of directors of Viserion Ltd. may be deemed to have shared

voting and dispositive control over the shares. The member of the board of directors of Viserion Ltd. is Guy Ben-Artzi. The business address

of the sole director is 1 HaIrus St., Rishpon, Israel. |

| (5) | AVP Early Stage II, SLP (“AVP”) is a French special limited partnership. AVP is managed

by AXA Venture Partners, which possesses sole voting and dispositive power over the Ordinary Shares held by AVP. The Board of Directors

of AXA Venture Partners is comprised of 17 members, none of whom may be deemed individually to have dispositive power over the funds and

entities managed by AXA Venture Partners. The business address of each of the foregoing entities is 10 bd Haussmann, 75009 Paris, France. |

COMPENSATION

OF DIRECTORS AND EXECUTIVE OFFICERS

For

information concerning the total compensation earned during 2022 by our five most highly-compensated office holders (as defined in the

Israel Companies Law), including base salary, share-based compensation, directors’ fees (where applicable) and all other compensation,

please see “Item 6.B. Compensation of Officers and Directors” of our Annual Report on Form 20-F for the year ended December

31, 2022, filed with the SEC on August 15, 2023 (the “2022 Annual Report”), a copy of which is available at the “Company--Investor

Relations” section of our website at www.hubsecurity.com or on the SEC’s website at www.sec.gov. Information contained on

or accessible through our website or the SEC’s website is not a part of this proxy statement, and the inclusion of the website addresses

in this proxy statement is an inactive textual reference only.

MATTERS SUBMITTED TO SHAREHOLDERS

PROPOSAL 1

ELECTION OF CLASS I DIRECTORS

Our Board currently consists

of seven directors. Our Articles of Association provide that our Board may consist of not less than three and up to eleven directors.

Under our Articles of Association,

our directors are divided into three classes, as nearly equal in number as practicable. At each annual general meeting of our shareholders,

the election or reelection of directors following the expiration of the term of office of the directors of that class of directors is

for a term of office that expires on the third annual general meeting following such election or reelection and their respective successors

shall have been elected and qualified, such that each year the term of office of one class of directors expires.

Each director serves through

the term of his or her class, except in the event of his or her earlier death, resignation, removal or termination otherwise. The terms

of our Class I directors, Beth Michelson and Noah Hershcoviz, expire at the Annual Meeting. Our Class II directors, Ilan Flato and Uzi

Moskovich, are serving terms that expire at the 2024 annual general meeting of shareholders (the “2024 Annual Meeting”),

and our Class III directors, Kasbian Nuriel Chirich, Matthew Kearney and Liat Aaronson, are serving terms that expire at the 2025 annual

general meeting of shareholders. In order equalize the number of directors in each class, the Board redesignated Ilan Flato as a Class

I director and Matthew Kearney as a Class II director.

Upon recommendation of our

Board’s Nominating, Governance, Compliance and Sustainability Committee (the “N&G Committee”), our Board

nominated each of Beth Michelson, Ilan Flato and Noah Hershcoviz for election at the Annual Meeting as a Class I Director to serve until

the 2026 annual general meeting of shareholders, and until his or her successor has been duly elected and qualified, or until his or her

office is vacated in accordance with our Amended Articles of Association or the Israel Companies Law. Mr. Herschcoviz was initially appointed

by our Board to fill a vacancy as a Class I director on October 3, 2023 in connection with his appointment as our Chief Strategy Officer.

Beth Michelson and Ilan Flato

each qualify as an independent director under the Nasdaq Stock Market LLC (“Nasdaq”) listing standards. In accordance

with the Israel Companies Law, each of Beth Michelson, Ilan Flato and Noah Hershcoviz has certified to us that he or she meets all the

requirements of the Israel Companies Law for election as a director of a public company, and possesses the necessary qualifications and

has sufficient time to fulfill his or her duties as a director of HUB, taking into account the size and special needs of HUB. Such certifications

are available for review at the Company’s offices during regular working hours upon prior coordination with the Company’s

Chief Legal Officer. Beth Michelson and Ilan Flato are currently members of the Board’s Audit Committee (the “Audit Committee”)

and N&G Committee and each satisfies the independence requirements under Nasdaq listing standards and Rule 10A-3(b)(1) under the Exchange

Act. Ilan Flato is also a member of the Board’s Compensation Committee (the “Compensation Committee”).

Since the commencement of

their respective terms on our Board, each of Beth Michelson and Ilan Flato attended (i) over seventy-five percent (75%) of all Board meetings

and (ii) over seventy-five percent (75%) of all of the meetings of each committee of the Board on which he or she serves.

Biographical information concerning

each of our Class I director nominees is provided below.

Nominees for Re-election to the Board as Class

I Directors

Beth Michelson, 54,

has served as a member of our Board of Directors since June 2023. Ms. Michelson is a Partner with Cartesian Capital Group, a New York

City-based global private equity firm. She has been with Cartesian since its inception in 2006 and has more than 20 years of experience

building businesses globally. Prior to Cartesian, she was a Partner and Vice President with PH Capital a fund manager for AIG Capital

Partners and an Associate at Wasserstein Perella. She has led investments and acquisitions across 20 countries. Ms. Michelson is also

the Chief Financial Officer and a director of Cartesian Growth Corporation (Nasdaq: RENE), a special purpose acquisition company which

is targeting transnational businesses. Ms. Michelson currently serves on the board of directors of Safeguard Scientifics (Nasdaq:SFE),

NorthStar Earth & Space (Canada), Thermal Management Solutions (UK), Brilia (Brazil), and Tiendamia (Latin America), as well as the

Global Advisory Board of Columbia Business School Chazen Institute for Global Business. Ms. Michelson was selected as a 2019 92Y Women

in Power Fellow. She is a member of the Economic Club of New York, 100 Women in Finance, and the Private Equity Women’s Investor

Network. She also serves on the board of Replications Inc., which focuses on improving outcomes in NYC public schools. Ms. Michelson has

an MBA from Columbia University Graduate School of Business, a Masters in International Affairs from Columbia University School of International

and Public Affairs, and a BA with distinction from the University of Michigan. She is also a Chartered Financial Analyst.

Ilan Flato, 67, has

served as a member of our Board of Directors director since April 2023. Mr. Flato has served as President of The Association of Publicly

Traded Companies on the Tel-Aviv Stock Exchange since January 2012. Since 2011, Mr. Flato has been a member of the Israel Bar Association.

From 2009 until 2018, Mr. Flato served as a director in two Provident Funds. From 2009 until April 2018, Mr. Flato served as Chairman

of the Business Executive of Kibbutz Kfar Blum. From January 2018 until April 2020, Mr. Flato served as Chairman of the Business Executive

Kibbutz “NAAN”. Since 2004, Mr. Flato has functioned as an independent financial adviser. Until 2004, Mr. Flato served as

the VP for planning, economics and online banking in United Mizrahi Bank and as the Chief Economist of the bank. From 1992 until 1996,

Mr. Flato served as the Economic Advisor to the Prime Minister of Israel. Prior to that position, Mr. Flato served in the Treasury Office

as the deputy director of the budget department. Additionally, Mr. Flato has served as a director of Tower Semiconductor Ltd. since February

2009 and served as a member of the board of directors of many government-owned companies as well. Mr. Flato holds a B.A. degree in economics

from Tel-Aviv University, an LL.B. degree from Netanya College, an M.A. degree in law from Bar-Ilan University and an MSIT from Clark

University.

Noah Hershcoviz, 41,

was appointed as a member of our Board on October 3, 2023 in connection with his appointment as our Chief Strategy Officer. Mr. Hershcoviz

has served as a member of the boards of BlackSwan Technologies AI and Sency.Ai since 2021 and 2020, respectively, and served as a member

of the board of Oceansix Future Paths Ltd. (TSXV: OSIX.V) from 2020 to 2022. Mr. Hershcoviz has also served as Managing General Partner

of The 12.64 Fund since 2021 and as Managing Partner, Head of Investing Banking of A-Labs Finance and Advisory since 2017. Prior to such

roles, between 2016 and 2017, Mr. Hershcoviz served as VP Strategy of MCE Systems Ltd. Mr. Hershcoviz holds an LL.B in law and a B.A.

in accounting from The Interdisciplinary Center, Herzliya, Israel and is a certified public accountant in Israel and a member of the Israeli

Bar Association.

Proposed Resolutions

You are requested to adopt

the following resolutions:

“1.a. RESOLVED,

that Beth Michelson be elected as a Class I director, to serve until the 2026 annual general meeting of shareholders, and until her successor

has been elected and qualified, or until her office is vacated in accordance with the Company’s Articles of Association or the Israel

Companies Law, 5759-1999;

1.b. RESOLVED,

that Ilan Flato be elected as a Class I director, to serve until the 2026 annual general meeting of shareholders, and until his

successor has been elected and qualified, or until his office is vacated in accordance with the Company’s Articles of

Association or the Israel Companies Law, 5759-1999; and

1.c. RESOLVED,

that Noah Hershcoviz be elected as a Class I director, to serve until the 2026 annual general meeting of shareholders, and until his

successor has been elected and qualified, or until his office is vacated in accordance with the Company’s Articles of

Association or the Israel Companies Law, 5759-1999.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Annual Meeting in person or by proxy and voting thereon is required to adopt

each of the foregoing resolutions.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE “FOR” THE ADOPTION OF EACH OF THE FOREGOING RESOLUTIONS.

Continuing Directors

Class II Directors, Whose Terms

Continues Until the 2024 Annual General Meeting of Shareholders

Uzi

Moskovich, 57, has served as our Chief Executive Officer since February 2, 2023 and as a member of our board of directors since

June 2021. Prior to becoming our Chief Executive Officer, Mr. Moskovich served as Executive Chairman from April 2022 to February

1, 2023. From February 2019 to February 2023, Mr. Moskovich served as the Chief Executive Officer of Wave Guard Technologies

Ltd. and from January 2017 to February 2023 as the V.P. of the Missile Division at Israel Aerospace Industries. Mr. Moskovich

has also served on the boards of BrandShield Systems Plc (LSE: BRSD.L) and Migdal Insurance and Financial Holdings Ltd (TASE: MGDL.TA)

since February 2021 and April 2018, respectively. Mr. Moskovich received his B.Sc. in Engineering from the Technion Israel

Institute of Technology, his M.B.A. from New York University and his M.Sc. from the US Army War College.

Matthew

Kearney, 59, has served as a member of our Board of Directors since March 2023, upon the completion of our business combination

with Mount Rainier Acquisition Corp. (NASDAQ: RNER). Mr. Kearney previously served as Mount Rainier’s Chief Executive Officer

and a member of its board of directors since its inception in February of 2021 and became the

Chairman of its board of directors upon the consummation of its IPO. Mr. Kearney has over 30 years of experience as an investor,

Chief Executive Officer, Executive Chairman, and Board member in mergers and acquisitions in the United States and United Kingdom in the

areas of private equity, technology and wealth management. After graduating from the London Business School and as Investment Director

at 3i PLC, Mr. Kearney joined Carlton Communications PLC, the acquisitive FTSE 100 media conglomerate, as head of Mergers & Acquisitions,

becoming an officer of the board in the process. Mr. Kearney moved to New York in 2002 to take up his first Chief Executive Officer

position at Screenvision, LLC, a Carlton/Thomson joint venture where he grew revenue by 300%, with strong EBITDA margins leading to a

profitable sale of Screenvision LLC to the Disney Family’s Shamrock PE fund in 2010. Mr. Kearney has since launched the global

news site Mail Online in the United States, then ran a Carlyle Group Portfolio Company as Executive Chairman and today is the Chief Executive

Officer of ICV’s portfolio company, LeadingResponse. Mr. Kearney holds or has held board positions on companies in Rock Holdings

Inc. (NYSE: RKT) and Telenor ASA (NORWAY: TEL). He was a member of the investor group of MI Acquisitions, a NASDAQ listed special purpose

acquisition company (“SPAC”) that completed its initial business combination in 2018 to become Priority Technology Holdings

(NASDAQ: PRTH). Mr. Kearney was subsequently appointed board director and audit chair of Priority Technology. Mr. Kearney’s

not for profit affiliations have included board positions at the British Academy of Film and Television Arts (“BAFTA”) and

the American Financial Education Alliance (“AFEA”), which is dedicated to improving the public’s understanding of personal

wealth management. Matthew has an MBA from London Business School, a BSc (Hons) in Aeronautical Engineering from Manchester University,

and C.Eng. (“RAeS”).

Class III Directors, Whose Terms

Continue Until the 2025 Annual General Meeting of Shareholders

Kasbian

Nuriel Chirich has served as the Chairman of our Board of Directors since February 2023. Mr. Chirich currently serves as the

Honorary Consul of Tanzania in Israel. Mr. Chirich founded Cellect Biotherapeutics in 2011 and served as chairman of its board of directors

from 2013 until 2020 prior to the completion of its business combination with Quoin Pharmaceuticals, Inc. in 2021. Mr. Chirich is an entrepreneur

and businessman with extensive financial and business expertise with innovative ventures throughout East Africa and Israel. Mr. Chirich

is a real estate developer and was previously the founder and general manager of Leadcom Kasbian, which is credited, among other thing,

with establishing the national television of Tanzania and building the infrastructure of two cellular networks in Tanzania.

Liat

Aaronson, 53, has served as a member of our Board of Directors since March 2023. Ms. Aaronson is co-founder and Managing Director

of Horizen Labs Ventures (HLV), a Web3 advisory and venture investment company that was launched out of Horizen Labs. Ms. Aaronson co-founded

and served as Chief Operating Officer of Horizen Labs from its inception as a blockchain technology company until 2022. Ms. Aaronson holds

a B.A. in political economy of industrial societies (economics and political science, cum laude) from the University of California at

Berkeley, an LL.B. and MBA from Tel Aviv University, and an LL.M. in European Law from the University of Leiden in the Netherlands (cum

laude).

CORPORATE GOVERNANCE

External Directors

Under

the Israel Companies Law, companies incorporated under the laws of the State of Israel that are “public companies,” including

companies with shares listed on Nasdaq, are required to appoint at least two external directors. Pursuant to regulations promulgated under

the Israel Companies Law, companies with shares traded on certain U.S. stock exchanges, including Nasdaq, which do not have a “controlling

shareholder” may, subject to certain conditions, “opt out” from the Israel Companies Law requirements to appoint external

directors and related Israel Companies Law rules concerning the composition of the audit committee and compensation committee of the board

of directors. In accordance with these regulations, we have elected to “opt out” from these requirements under the Israel

Companies Law.

Director Independence

Our Board has determined that

each of Kasbian Nuriel Chirich, Beth Michelson, Liat Aaronson and Ilan Flato is an “independent director” under the Nasdaq

listing rules.

Our Board has further determined

that each director who is expected to serve as a member of the Audit Committee following the Annual Meeting is “independent”

for purposes of Rule 10A-3(b)(1) under the Exchange Act and that each member of the Compensation Committee satisfies the additional independence

requirements applicable to compensation committees under the Nasdaq listing rules. All members of the Audit Committee also are financially

sophisticated as required by the Nasdaq’s listing rules, and our Board has determined that each of Ilan Flato and Beth Michelson

qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements

of the Nasdaq listing rules.

Board Committees

If the Class I director nominees

are reelected at the Annual Meeting, our Board committees will be constituted as follows:

The Audit Committee will be comprised

of Ilan Flato (Chair), Liat Aaronson and Beth Michelson.

The Compensation Committee will be

comprised of Kasbian Nuriel Chirich (Chair) and Ilan Flato.

The N&G Committee will be comprised

of Beth Michelson (Chair), Ilan Flato, and Liat Aaronson.

PROPOSAL 2

APPROVAL OF REVERSE SHARE SPLIT AND

AMENDMENTS TO THE MEMORANDUM AND ARTICLES OF

ASSOCIATION

Background

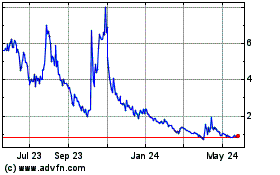

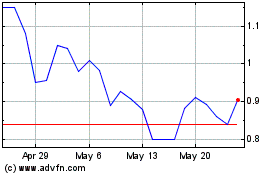

As reported in our report

furnished on Form 6-K to the SEC on June 13, 2023, we received a notification letter from Nasdaq on June 9, 2023 (the “Nasdaq

Notice”), notifying the Company that it is no longer in compliance with Nasdaq Listing Rule 5450(a)(1) because for the 30 consecutive

business days preceding the date of the Nasdaq Notice, the bid price per share of the Ordinary Shares had closed below the $1.00 per share

minimum bid price required for continued listing on Nasdaq (the “Minimum Bid Price Requirement”).

The Nasdaq Notice has no immediate

effect on the listing of the Company’s Ordinary Shares, and the Company’s Ordinary Shares continue to trade on Nasdaq under

the symbol “HUBC”.

Pursuant to Nasdaq Listing

Rule 5810(c)(3)(A), the Company has been provided with an initial 180-calendar day period, ending on December 6, 2023 (the “Initial

Compliance Period”) to regain compliance with the Minimum Bid Price Requirement. If at any time during the Initial Compliance

Period, the closing bid price per share of the Company’s Ordinary Shares is at least $1.00 for a minimum of 10 consecutive business

days, it is expected that Nasdaq will provide the Company a written confirmation of compliance and the matter will be closed.

If the Company does not regain

compliance within the Initial Compliance Period, it may be eligible for an additional 180-calendar day compliance period, pursuant to

Nasdaq Listing Rule 5810(c)(3)(A)(ii), provided that it meets the applicable market value of publicly held shares requirement for continued

listing and all applicable standards for initial listing on the Nasdaq Capital Market (except the Minimum Bid Price Requirement) and notifies

Nasdaq of its intent to cure this deficiency during this second compliance period. If the Company has not regained compliance within the

period(s) granted by Nasdaq, including any extensions, the Company’s Ordinary Shares will be subject to delisting, pending an appeal

to the Nasdaq Hearing Panel.

Purpose and Effect of the Reverse Share Split

As of the date of this Proxy

Statement, we have not yet come into compliance with Nasdaq Listing Rule 5450(a)(1), and there can be no assurance that the closing bid

price for our ordinary shares will be compliant within the Initial Compliance Period. Accordingly, we are proposing to authorize the Board

to effect a reverse share split of our Ordinary Shares in order to increase the market price per share of our Ordinary Shares. We believe

that the continued listing of our Ordinary Shares on the Nasdaq Capital Market will enable us to have better access to the public capital

markets while providing for greater liquidity for our shareholders. In addition, we believe that the reverse share split is advisable

in order to make our Ordinary Shares more attractive to a broader range of investors, including professional investors, institutional

investors and the general investing public. Our Board intends to effect such reverse share split only if it believes that a decrease

in the number of Ordinary Shares outstanding is likely to improve the trading price of our Ordinary Shares and is necessary to continue

our listing on the Nasdaq Capital Market.

The principal effects of the

reverse share split would be that:

| ● | the per-share exercise price of any outstanding stock options would be increased proportionately and the

number of Ordinary Shares issuable upon the exercise of such awards would be reduced proportionately, and the number of shares issuable

under outstanding restricted share units, restricted share awards and all other outstanding equity-based awards would be reduced proportionately

to maintain the intrinsic value of such awards; |

| ● | the number of Ordinary Shares authorized for future issuance under our equity plans would be proportionately

reduced and other similar adjustments will be made under the equity plans to reflect the reverse share split; |

| ● | the exercise, exchange or conversion price of all other outstanding securities (including warrants) that

are exercisable or exchangeable for or convertible into Ordinary Shares would be proportionately adjusted to maintain the intrinsic value

of such securities and the number of Ordinary Shares issuable upon such exercise, exchange or conversion would be proportionately adjusted; |

| ● | the reverse share split would likely increase the number of shareholders who own odd lots (less than 100

shares). Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally

higher than the costs of transactions in “round lots” of even multiples of 100 shares; and |

| ● | after the effective time of the reverse share split, the Ordinary Shares would have a new CUSIP number,

which is a number used to identify our Ordinary Shares. |

After the reverse share split,

all Ordinary Shares would continue to have the same voting rights and rights to any dividends or other distributions by the Company.

We are therefore seeking approval

of the shareholders to effect a reverse share split of our outstanding Ordinary Shares within a range of 1-for-10 to 1-for-20, with the

exact reverse share split ratio and share capital reduction amount to be determined by our Board within the above range, and to amend

our Articles of Association and Memorandum of Association by reducing

the Company’s authorized share capital in proportion with the reverse share split ratio.

Since we were incorporated

prior to the February 1, 2000 effective date of the Israel Companies Law, we have both a Memorandum of Association and an Articles of

Association. In connection with the reverse share split, we are also seeking approval to amend our Memorandum of Association to add a

provision that it may be amended by our shareholders by the affirmative vote of a simple majority of the shares voted on the matter.

Our Board has requested that

shareholders approve a reverse share split ratio range, as opposed to approval of a specific reverse share split ratio, in order to give

our Board the required discretion and flexibility to determine such parameters based upon, among other factors:

| ● | the per share price of our Ordinary Shares immediately prior to the reverse share split; |

| ● | the expected stability of the per share price of our Ordinary Shares following the reverse share split; |

| ● | the likelihood that the reverse split will result in increased marketability and liquidity of our Ordinary

Shares; and |

| ● | prevailing market, business and economic conditions at the time. |

We believe that granting our

Board the authority to set the ratio for the reverse split is essential because it allows us to take these factors into consideration

and to react to changing market conditions. If the Board chooses to implement the reverse share split, no further action on the part of

the shareholders will be required to either effect or abandon the reverse share split. Following such determination by our Board, we will

issue a press release announcing the effective date of the reverse share split and will amend our Articles of Association and Memorandum

of Association to effect such.

Fractional Shares

In order to avoid the expense

and inconvenience of issuing fractional shares (or payment therefor), no certificates or scrip representing fractional Ordinary Shares

will be issued upon consummation of the reverse share split, and such fractional share interests will not entitle the owner thereof to

vote or to any rights of a holder of our Ordinary Shares. All fractional shares to which a shareholder would be entitled will be rounded

down to the nearest whole number.

Tax Consequences of the Reverse Share Split

Israeli Tax Law

Generally, a reverse share

split will not result in the recognition of gain or loss for Israeli income tax purposes, except with respect to any shares issued, or

payment made, as a result of rounding up of fractional shares (but see above under “Fractional Shares”). The adjusted tax

basis of the aggregate number of new Ordinary Shares will be the same as the adjusted tax basis of the aggregate number of Ordinary Shares

held by a shareholder immediately prior to the reverse share split, and the holding period of the new Ordinary Shares after the reverse

share split will include the holding period of the Ordinary Shares held prior to the reverse share split. No gain or loss will be recognized

by the Company as a result of the reverse share split.

U.S. Federal Income Tax

The following summary describes

certain U.S. federal income tax consequences relating to the reverse share split for U.S. Holders (as defined below). This summary addresses

only the U.S. federal income tax consequences to U.S. Holders that hold their Ordinary Shares as capital assets. This summary does not

discuss all tax considerations that may be relevant to U.S. Holders in connection with the reverse share split and does not address tax

considerations applicable to U.S. Holders that may be subject to special tax rules, including, without limitation: banks, financial institutions

or insurance companies; brokers, dealers or traders in securities, commodities or currencies; tax-exempt entities or organizations, including

an “individual retirement account” or “Roth IRA” as defined in Section 408 or 408A of the U.S. Internal Revenue

Code of 1986, as amended (the “Code”), respectively; certain former citizens or long-term residents of the United States;

persons that received our securities as compensation for the performance of services; persons that hold our securities as part of a “hedging,”

“integrated” or “conversion” transaction or as a position in a “straddle” for U.S. federal income

tax purposes; partnerships (including entities classified as partnerships for U.S. federal income tax purposes) or other pass-through

entities, or holders that hold our Ordinary Shares through such an entity; persons whose “functional currency” is not the

U.S. Dollar; persons subject to the alternative minimum tax; or persons that own directly, indirectly or through attribution 10.0% or

more of the voting power or value of our Ordinary Shares. Moreover, this summary does not address the U.S. federal estate, gift or alternative

minimum tax consequences, or any state, local or foreign tax consequences, of the reverse share split.

This description is based

on the Code, existing, proposed and temporary United States Treasury Regulations and judicial and administrative interpretations thereof,

in each case as in effect and available on the date hereof. All of the foregoing is subject to change, which change could apply retroactively

and could affect the tax consequences described below. There can be no assurances that the U.S. Internal Revenue Service will not take

a different position concerning the tax consequences of the reverse share split or that such a position would not be sustained. Shareholders

should consult their own tax advisors concerning the U.S. federal, state, local and foreign tax consequences of the reverse share split

in their particular circumstances.

For purposes of this description,

a “U.S. Holder” is a beneficial owner of our Ordinary Shares that, for United States federal income tax purposes, is:

| ● | a citizen or resident of the United States; |

| ● | a corporation (or other entity treated as a corporation for U.S.

federal income tax purposes) created or organized in or under the laws of the United States or any state thereof, including the District

of Columbia; |

| ● | an estate the income of which is subject to U.S. federal income

taxation regardless of its source; or |

| ● | a trust if such trust has validly elected to be treated as a

United States person for U.S. federal income tax purposes or if (1) a court within the United States is able to exercise primary supervision

over its administration and (2) one or more United States persons have the authority to control all of the substantial decisions of such

trust. |

If a partnership (or any other

entity treated as a partnership for U.S. federal income tax purposes) holds our securities, the tax treatment of a partner in such partnership

will generally depend on the status of the partner and the activities of the partnership. Such a partner or partnership should consult

its tax advisor as to the particular U.S. federal income tax consequences of the reverse share split in its particular circumstance.

You should consult your tax advisor with

respect to the U.S. federal, state, local and foreign tax consequences of the reverse share split.

The reverse share split is

intended to be treated as a recapitalization for U.S. federal income tax purposes. Therefore, in general, subject to the discussion regarding

passive foreign investment company (“PFIC”) status below, a U.S. Holder will not recognize any gain or loss for U.S. federal

income tax purposes as a result of the reverse share split. In the aggregate, a U.S. Holder’s tax basis in its post-reverse share

split shares generally will equal the U.S. Holder’s tax basis in its pre-reverse share split shares, and the holding period of the

post-reverse share split shares will include the holding period of the pre-reverse share split shares.

U.S. Holders that have acquired

different blocks of our Ordinary Shares at different times or at different prices are urged to consult their own tax advisors regarding

the allocation of their aggregated adjusted tax basis among, and the holding period of, our Ordinary Shares.

Pursuant to Section 1291(f)

of the Code, to the extent provided in U.S. Treasury regulations, if a U.S. person transfers stock in a PFIC in a transaction that does

not result in full recognition of gain, then any unrecognized gain is required to be recognized notwithstanding any nonrecognition provision

in the Code. The U.S. Treasury has issued proposed regulations under Section 1291(f) of the Code, but they have not been finalized. The

IRS could take the position that Section 1291(f) of the Code is effective even in the absence of finalized regulations, or the regulations

could be finalized with retroactive effect. Accordingly, no assurances can be provided as to the potential applicability of Section 1291(f)

of the Code to the Reverse Share Split.

Based on the current and anticipated

composition of the income, assets and operations of the Company and its subsidiaries, there is a substantial risk that the Company was

a PFIC for U.S. federal income tax purposes for 2022, and the Company may be a PFIC for U.S. federal income tax purposes for current or

future taxable years. Because PFIC status is determined annually and is based on our income, assets and activities for the entire taxable

year, it is not possible to determine with certainty whether the Company will be characterized as a PFIC for the 2023 taxable year until

after the close of the year. If we are treated as a PFIC with respect to a United States holder for the 2023 taxable year and Section

1291(f) applies to the United States holder’s exchange of pre-reverse share split ordinary shares for post-reverse share split ordinary

shares pursuant to the reverse share split, the United States holder may be required to recognize any gain realized on such transfer,

in which case such gain generally would be subject to the “excess distribution” rules under Section 1291 of the Code. United

States holders are urged to consult their own tax advisors regarding the application of the PFIC rules to the reverse share split.

Implementation of the Reverse Share Split

Beneficial Holders of Shares

Banks, brokers, custodians

or other nominees will be instructed to effect the reverse share split for their beneficial holders holding our Ordinary Shares in street

name. However, these banks, brokers, custodians or other nominees may have their own procedures for processing the reverse share split.

If a shareholder holds Ordinary Shares with a bank, broker, custodian or other nominee and has any questions in this regard, such shareholder

is encouraged to contact their bank, broker, custodian or other nominee.

Registered “Book-Entry” Holders

of Shares

Our registered shareholders

may hold some or all of their Ordinary Shares electronically in book-entry form. These shareholders will not have share certificates evidencing

their ownership. They are provided with a statement reflecting the number of Ordinary Shares registered in their accounts. If a shareholder

holds registered Ordinary Shares in a book-entry form, the shareholder does not need to take any action to receive their Ordinary Shares

post-reverse-split in registered book-entry form. Such a shareholder that is entitled to post-reverse-split Ordinary Shares will automatically

be sent a transaction statement at the shareholder’s address of record as soon as practicable after the reverse share split indicating

the whole number of Ordinary Shares held.

Holders of Certificated Shares

Some registered shareholders

hold their Ordinary Shares in certificate form or a combination of certificate form and book-entry form. If any of a shareholder’s

Ordinary Shares are held in certificate form, that shareholder will receive a transmittal letter from the Company’s transfer agent

as soon as practicable after the effective time of the reverse share split. The transmittal letter will be accompanied by instructions

specifying how the shareholder may exchange their certificates representing the pre-reverse-split Ordinary Shares for a statement of holding.

When that shareholder submits their certificates representing the pre-reverse-split Ordinary Shares, the post-reverse-split Ordinary Shares

will be held electronically in book-entry form. This means that, instead of receiving a new share certificate, that shareholder will receive

a statement of holding that indicates the number of post-reverse-split Ordinary Shares held in book-entry form. The Company will no longer

issue physical share certificates unless a shareholder makes a specific request for a physical share certificate representing the shareholder’s

post-reverse-split Ordinary Share ownership interest.

Beginning at the effective

time of the reverse share split, each certificate representing pre-reverse-split Ordinary Shares will be deemed for all corporate purposes

to evidence ownership of post-reverse-split Ordinary Shares. Shareholders will need to exchange their old certificates in order to effect

transfers of shares on Nasdaq. If an old certificate bears a restrictive legend, the registered shares in book-entry form will bear the

same restrictive legend.

Certain Risks and Potential Disadvantages Associated

with the Reverse Share Split and the Change in Authorized Capital

The reverse share split could result in a significant

devaluation of our market capitalization and the trading price of our Ordinary Shares.

We cannot assure you that the reverse share split,

if implemented, will increase the market price of our Ordinary Shares in proportion to the reduction in the number of issued and outstanding

Ordinary Shares or result in a permanent increase in the market price. Accordingly, the total market capitalization of our Ordinary Shares

after the reverse share split may be lower than the total market capitalization before the reverse share split and, in the future, the

market price of our Ordinary Shares following the reverse share split may not exceed or remain higher than the market price prior to the

reverse share split. The effect the reverse share split may have upon the market price of our Ordinary Shares cannot be predicted with

any certainty, and the history of similar reverse share splits for companies in similar circumstances to ours is varied. The market price

of our Ordinary Shares is dependent on many factors, including our business and financial performance, general market conditions, prospects

for future success and other factors detailed from time to time in the reports we file with the SEC. If the reverse share split is

implemented and the market price of our Ordinary Shares declines, the percentage decline as an absolute number and as a percentage of

our overall market capitalization may be greater than would occur in the absence of the reverse share split.

Even if we effect the reverse share split,

we will still be subject to the continued listing requirements of the Nasdaq Capital Market.

Even if the market price per Ordinary Share on

a post-reverse share split basis remains in excess of $1.00 per share, we may be delisted from the Nasdaq Capital Market due to a failure

to meet other continued listing requirements, including Nasdaq requirements related to the minimum shareholders’ equity, the minimum

number of shares that must be in the public float, the minimum market value of the public float and the minimum number of round lot holders.

A “public holder” is any holder other than an executive officer, director or beneficial owner (an owner with voting or dispositive

power over such shares, as defined in Rule 13d-3 under the Exchange Act) of more than 10% of our outstanding Ordinary Shares.

In the event that our Ordinary Shares are not

eligible for continued listing on the Nasdaq Capital Market or another national securities exchange, trading of our Ordinary Shares could

be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities such as the OTCQX,

the OTCQB or the Pink Market. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our

Ordinary Shares.

The reverse share split may result in some

shareholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell.

The reverse share split may result in some shareholders

owning “odd lots” of less than 100 Ordinary Shares on a post-reverse share split basis. These odd lots may be more

difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of

100 Ordinary Shares.

The reduced number of Ordinary Shares resulting

from the reverse share split could adversely affect the liquidity of our Ordinary Shares.

Although the Board believes that the decrease

in the number of Ordinary Shares outstanding as a consequence of the reverse share split and the anticipated increase in the market price

of Ordinary Shares could encourage interest in our Ordinary Shares and possibly promote greater liquidity for our shareholders, such liquidity

could also be adversely affected by the reduced number of shares outstanding after the reverse share split.

Interests of Certain Persons

Certain of our executive officers

and directors have an interest in this proposal as a result of their ownership of Ordinary Shares. However, we do not believe that our

executive officers or directors have interests in this proposal that are different than or greater than those of any of our other shareholders.

Proposed Resolution

You are requested to adopt

the following resolutions:

“2.a. RESOLVED, to

approve a reverse share split of the Company’s ordinary shares, no par value, at a ratio in the range of 1-for-10 to 1-for-20, with

the final ratio and effective date to be determined by the Company’s Board of Directors and related amendments to the Company’s

Articles of Association and Memorandum of Association, including reducing the Company’s authorized share capital by a corresponding

proportion.”

2.b. “RESOLVED, to

amend the Company’s Memorandum of Association by adding a provision that it may be amended by the Company’s shareholders by

the affirmative vote of a simple majority of the shares voted on the matter.”

Vote Required

The affirmative vote of at

least seventy-five percent (75%) of the Ordinary Shares represented at the Annual Meeting in person or by proxy and voting thereon is

required to adopt the foregoing resolutions.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE “FOR” THE ADOPTION OF THE FOREGOING RESOLUTIONS.

PROPOSAL 3

APPROVAL OF A COMPENSATION POLICY

FOR OUR DIRECTORS AND OFFICERS

Background

Under the Israel Companies

Law, each executive officer’s and director’s terms of compensation, including fixed remuneration, bonuses, equity compensation,

retirement or termination payments, indemnification, liability insurance and the grant of an exemption from liability, must comply with

a compensation policy, and must be approved by a company’s compensation committee and the board of directors, in that order. In

addition, the terms of compensation of directors, the chief executive officer, and any employee or service provider who is considered

a controlling shareholder must also be approved separately by the shareholders of the company, after the approval first by the company’s

compensation committee and then of the board of directors.

The Israel Companies Law requires

a company’s board of directors to adopt a compensation policy in respect of its executive officers and directors and to reevaluate

it from time to time, and upon any material change in the circumstances that existed at the time the policy was formulated. Additionally,

the Israel Companies Law requires the compensation policy be reviewed and reapproved at least once every three years. The compensation

policy must be recommended by the compensation committee, approved by the board of directors and approved by the shareholders of the company,

in that order.

The Compensation Committee

and Board propose adopting a new compensation policy (the “Compensation Policy”), in the form attached to this Proxy

Statement as Annex A.

The Compensation Policy, if

approved by our shareholders, will become effective immediately following the Annual Meeting, for a period of three years. If the Compensation

Policy will not be approved by our shareholders, the Board may nevertheless override that decision, provided that the Compensation Committee

and then the Board decide, on the basis of detailed reasons and after further review of the Compensation Policy, that the approval of

the Compensation Policy is for the benefit of the Company despite the opposition of the shareholders.

Summary of the Compensation Policy

The following is a summary

of the Compensation Policy and is qualified by reference to the full text thereof.

| ● | Objectives: To attract, motivate and retain highly experienced personnel who will provide leadership

for HUB’s success and enhance shareholder value, and to promote for each executive officer an opportunity to advance in a growing

organization. |

| ● | Compensation instruments: Includes base salary; benefits and perquisites; cash bonuses; equity-based

awards; and retirement and termination arrangements. |

| ● | Ratio between fixed and variable compensation: HUB aims to balance the mix of fixed compensation

(base salary, benefits and perquisites) and variable compensation (cash bonuses and equity-based awards) pursuant to the ranges set forth

in the Compensation Policy in order, among other things, to tie the compensation of each executive officer to HUB’s financial and

strategic achievements and enhance the alignment between the executive officer’s interests and the long-term interests of HUB and

its shareholders. |

| ● | Internal compensation ratio: HUB has examined the ratio between overall compensation of the executive

officers and the average and median salary of the other employees of HUB, as set forth in the Compensation Policy, to ensure that levels

of executive compensation will not have a negative impact on work relations in HUB. |

| ● | Base salary, benefits and perquisites: The Compensation Policy provides guidelines and criteria

for determining base salary, benefits and perquisites for executive officers. |

| ● | Cash bonuses: HUB’s policy is to allow annual cash bonuses, which may be awarded to executive

officers pursuant to the guidelines and criteria, including caps, set forth in the Compensation Policy. |

| ● | “Clawback”: On February 22, 2023, Nasdaq proposed listing rules mandating that companies

with listed securities adopt clawback policies pursuant to which incentive compensation paid to executive officers must be returned to

the Company in the case of certain restatements of the Company’s financial statements under the terms required by Nasdaq. Nasdaq

requires companies to adopt such clawback policies by December 1, 2023. The Compensation Policy accordingly includes a “clawback

policy” attached as Appendix A to the Compensation Policy. |

| ● | Equity-based awards: HUB’s policy is to provide equity-based awards in the form of stock

options, restricted stock units and other forms of equity, which may be awarded to executive officers pursuant to the guidelines and criteria,

including minimum vesting period and performance criteria, as set forth in the Compensation Policy. |

| ● | Retirement and termination: The Compensation Policy provides guidelines and criteria for determining

retirement and termination arrangements of executive officers, including limitations thereon. |

| ● | Exculpation, indemnification and insurance: The Compensation Policy provides guidelines and criteria

for providing directors and executive officers with exculpation, indemnification and insurance. |

| ● | Directors: The Compensation Policy provides guidelines for the compensation of our directors and

for equity-based awards that may be granted to directors pursuant to the guidelines and criteria, including minimum vesting period and

performance criteria, as set forth in the Compensation Policy. |

| ● | Applicability: The Compensation Policy will apply to all compensation agreements and arrangements

that will be approved after the Compensation Policy is approved by the shareholders. |

| ● | Review: The compensation and nomination committee and the Board shall review and reassess the adequacy

of the Compensation Policy from time to time, as required by the Israel Companies Law. |

Proposed Resolution

You are requested to adopt

the following resolution:

“3. RESOLVED, to

approve the compensation policy for the Company’s directors and officers, in the form attached to the Proxy Statement as Annex

A.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Annual Meeting in person or by proxy and voting thereon is required to adopt

the foregoing resolution. In addition, this proposal also requires that either: (1) a simple majority of shares voted at the Annual

Meeting, excluding the shares of controlling shareholders and of shareholders who have a personal interest in the approval of the