ImmuCell Corporation (Nasdaq: ICCC)

(“ImmuCell” or the “Company”), a growing animal health company that

develops, manufactures and markets scientifically proven and

practical products that improve the health and productivity of

dairy and beef cattle, today announced its unaudited financial

results for the quarter ended September 30, 2024.

Q3 2024 Highlights:

- Product sales increased 11% over the comparable quarter in

2023.

- Product sales increased 51% over the comparable nine-month

period in 2023.

- Product sales increased 46% over the previous trailing

twelve-month period ended September 30, 2023.

Management’s Discussion:“Our preliminary,

unaudited product sales for the third quarter of 2024 were first

reported on October 8, 2024,” commented Michael F. Brigham,

President and CEO of ImmuCell. “We have no changes to those

figures.”

“We are excited about our sales growth compared to the prior

periods,” continued Mr. Brigham. “We have operated without another

contamination event since April of 2024, which leads us to believe

that the remediation steps that we have implemented in our

production process are keeping the bioburden within specification.

Now, we are focused on fixing our process yields to improve our

gross margin.”

“We have improved our cash position during 2024 pursuant to an

at the market offering at the expense of some stockholder ownership

dilution,” continued Mr. Brigham. “We think this has been necessary

to advance our strategic plan, which includes continuing to provide

First Defense® to the market as

we stabilize our production systems at a higher output level and

revolutionizing the way that subclinical mastitis is treated in

today’s dairy market with

Re-Tain®, our novel alternative

to traditional antibiotics that is in the FDA approval

process.”

“We continue to work to achieve FDA approval to commercialize

Re-Tain®,” concluded Mr. Brigham. “We plan to

provide an update when we have filed our Non-Administrative NADA,

which will include our fourth submission of the CMC Technical

Section, responding to the minor issues from the Incomplete Letter

issued in May of 2024, together with All Other Information and

Product Labeling. We anticipate making this submission shortly

after the inspectional observations at our contract manufacturer

are resolved to the satisfaction of the FDA. We have been in

discussions with the FDA to seek an expedited review once that

submission is made.”

Certain Financial Results:

- Product sales increased by 11%, or $615,000, to $6 million

during the three-month period ended September 30, 2024 compared to

$5.4 million during the three-month period ended September 30,

2023.

- Product sales increased by 51%, or $6.4 million, to $18.7

million during the nine-month period ended September 30, 2024

compared to $12.4 million during the nine-month period ended

September 30, 2023.

- Product sales increased by 46%, or $7.6 million, to $23.8

million during the trailing twelve-month period ended September 30,

2024 compared to $16.3 million during the trailing twelve-month

period ended September 30, 2023.

- Gross margin earned was 26% and 23% of product sales during the

three-month periods ended September 30, 2024 and 2023,

respectively. Gross margin earned was 27% and 21% of product sales

during the nine-month periods ended September 30, 2024 and 2023,

respectively.

- Net loss was $702,000, or $0.09 per basic share, during the

three-month period ended September 30, 2024 in comparison to a net

loss of $940,000, or $0.12 per basic share, during the three-month

period ended September 30, 2023. Net loss was $2.7 million, or

$0.34 per basic share, during the nine-month period ended September

30, 2024 in comparison to a net loss of $4.6 million, or $0.60 per

basic share during the nine-month period ended September 30,

2023.

- EBITDA (a non-GAAP financial measure described on page 5 of

this press release) improved to approximately $119,000 during the

three-month period ended September 30, 2024 in contrast to

approximately ($95,000) during the three-month period ended

September 30, 2023. EBITDA improved to approximately ($221,000)

during the nine-month period ended September 30, 2024 in comparison

to approximately ($2.3) million during the nine-month period ended

September 30, 2023.

Balance Sheet Data as of September 30,

2024:

- Cash and cash equivalents increased to $3.8 million as of

September 30, 2024 from $979,000 as of December 31, 2023, with no

draw outstanding on the available $1 million line of credit as of

these dates.

- Net working capital increased to approximately $9.4 million as

of September 30, 2024 from $7.3 million as of December 31,

2023.

- Stockholders’ equity increased to $26.4 million as of September

30, 2024 from $25 million as of December 31, 2023.

Cautionary Note Regarding Forward-Looking Statements

(Safe Harbor

Statement):

This Press Release and the statements to be made in the related

conference call referenced herein contain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts and will often include words such as

“expects”, “may”, “anticipates”, “aims”, “intends”, “would”,

“could”, “should”, “will”, “plans”, “believes”, “estimates”,

“targets”, “projects”, “forecasts”, “seeks” and similar words and

expressions. Such statements include, but are not limited to, any

forward-looking statements relating to: our plans and strategies

for our business; projections of future financial or operational

performance; the timing and outcome of pending or anticipated

applications for regulatory approvals; future demand for our

products; the scope and timing of ongoing and future product

development work and commercialization of our products; future

costs of product development efforts; the expected efficacy of new

products; estimates about the market size for our products; future

market share of and revenue generated by current products and

products still in development; our ability to increase production

output and reduce costs of goods sold per unit; the adequacy of our

own manufacturing facilities or those of third parties with which

we have contractual relationships to meet demand for our products

on a timely basis; the likelihood, severity or impact of future

contamination events; the robustness of our manufacturing processes

and related technical issues; estimates about our production

capacity, efficiency and yield; the salability of products

currently held in inventory pending FDA approval; future regulatory

requirements relating to our products; future expense ratios and

margins; the effectiveness of our investments in our business;

anticipated changes in our manufacturing capabilities and

efficiencies; our effectiveness in competing against competitors

within both our existing and our anticipated product markets; our

ability to convert the backlog of orders into sales; and any other

statements that are not historical facts. These statements are

intended to provide management's current expectation of future

events as of the date of this press release, are based on

management's estimates, projections, beliefs and assumptions as of

the date hereof; and are not guarantees of future performance. Such

statements involve known and unknown risks and uncertainties that

may cause the Company's actual results, financial or operational

performance or achievements to be materially different from those

expressed or implied by these forward-looking statements,

including, but not limited to, those risks and uncertainties

relating to: difficulties or delays in development, testing,

regulatory approval, production and marketing of our products

(including the First Defense®

product line and Re-Tain®),

competition within our anticipated product markets, customer

acceptance of our new and existing products, product performance,

alignment between our manufacturing resources and product demand

(including the consequences of backlogs), uncertainty associated

with the timing and volume of customer orders as we come out of a

prolonged backlog, adverse impacts of supply chain disruptions on

our operations and customer and supplier relationships, commercial

and operational risks relating to our current and planned expansion

of production capacity, and other risks and uncertainties detailed

from time to time in filings we make with the Securities and

Exchange Commission (SEC), including our Quarterly Reports on Form

10-Q, our Annual Reports on Form 10-K and our Current Reports on

Form 8-K. Such statements involve risks and uncertainties and are

based on our current expectations, but actual results may differ

materially due to various factors. In addition, there can be no

assurance that future risks, uncertainties or developments

affecting us will be those that we anticipate. We undertake no

obligation to update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

|

Condensed Statements of Operations

(Unaudited) |

|

|

| |

During the Three-Month Periods Ended September

30, |

|

During the Nine-MonthPeriods Ended

September 30, |

|

(In thousands, except per share amounts) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Product sales |

$6,012 |

|

|

$5,397 |

|

|

$18,742 |

|

|

$12,376 |

|

| Costs of goods sold |

|

4,428 |

|

|

|

4,130 |

|

|

|

13,633 |

|

|

|

9,764 |

|

|

Gross margin |

|

1,584 |

|

|

|

1,267 |

|

|

|

5,109 |

|

|

|

2,612 |

|

| |

|

|

|

|

|

|

|

| Product development

expenses |

|

786 |

|

|

|

1,118 |

|

|

|

3,079 |

|

|

|

3,328 |

|

| Sales, marketing and

administrative expenses |

|

1,374 |

|

|

|

1,333 |

|

|

|

4,292 |

|

|

|

4,028 |

|

|

Operating expenses |

|

2,160 |

|

|

|

2,451 |

|

|

|

7,371 |

|

|

|

7,356 |

|

| |

|

|

|

|

|

|

|

| NET OPERATING

LOSS |

|

(576) |

|

|

|

(1,184) |

|

|

|

(2,262) |

|

|

|

(4,744) |

|

| |

|

|

|

|

|

|

|

| Other expenses (income),

net |

|

124 |

|

|

|

(244) |

|

|

|

405 |

|

|

|

(113) |

|

| |

|

|

|

|

|

|

|

| LOSS BEFORE INCOME

TAXES |

|

(700) |

|

|

|

(940) |

|

|

|

(2,667) |

|

|

|

(4,631) |

|

| |

|

|

|

|

|

|

|

| Income tax expense |

|

2 |

|

|

|

- |

|

|

|

4 |

|

|

|

4 |

|

| |

|

|

|

|

|

|

|

| NET LOSS |

($702 |

) |

|

($940 |

) |

|

($2,671 |

) |

|

($4,635 |

) |

| |

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

8,164 |

|

|

|

7,747 |

|

|

|

7,908 |

|

|

|

7,747 |

|

|

Basic net loss per share |

($0.09 |

) |

|

($0.12 |

) |

|

($0.34 |

) |

|

($0.60 |

) |

|

|

|

|

|

|

|

|

|

|

Diluted weighted average common shares outstanding |

|

8,164 |

|

|

|

7,747 |

|

|

|

7,908 |

|

|

|

7,747 |

|

|

Diluted net loss per share |

($0.09 |

) |

|

($0.12 |

) |

|

($0.34 |

) |

|

($0.60 |

) |

| |

|

|

|

|

|

|

|

|

Selected Balance Sheet Data (In thousands)

(Unaudited) |

|

|

|

|

| |

As ofSeptember 30, 2024 |

|

As of December 31, 2023 |

|

| Cash and cash equivalents |

$3,809 |

|

$979 |

|

|

Net working capital |

|

9,422 |

|

|

7,272 |

|

| Total assets |

|

44,449 |

|

|

43,808 |

|

| Stockholders’ equity |

$26,412 |

|

$24,993 |

|

Non-GAAP Financial Measures:

Generally, a non-GAAP financial measure is a numerical measure

of a company’s performance, financial position or cash flow that

either excludes or includes amounts that are not normally excluded

or included in the most directly comparable measure calculated and

presented in accordance with GAAP. The non-GAAP measures included

in this press release should be considered in addition to, and not

as a substitute for or superior to, the comparable measure prepared

in accordance with GAAP. We believe that considering the non-GAAP

measure of Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) assists management and investors by looking

at our performance across reporting periods on a consistent basis

excluding these certain charges that are not uses of cash from our

reported loss before income taxes. We calculate EBITDA

as described in the following table:

| |

| |

During the Three-Month Periods Ended September

30, |

|

During the Nine-Month Periods Ended

September 30, |

|

|

(In thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

| |

|

|

|

|

|

|

|

|

| Loss before income taxes |

($700) |

|

|

($940) |

|

|

($2,667) |

|

|

($4,631) |

|

|

| Interest expense (excluding

debt issuance and debt discount costs) |

|

133 |

|

|

|

136 |

|

|

|

401 |

|

|

|

311 |

|

|

| Depreciation |

|

670 |

|

|

|

696 |

|

|

|

1,999 |

|

|

|

2,027 |

|

|

| Amortization (including debt

issuance and debt discount costs) |

|

16 |

|

|

|

13 |

|

|

|

46 |

|

|

|

27 |

|

|

| EBITDA |

$119 |

|

|

($95) |

|

|

($221) |

|

|

($2,266) |

|

|

EBITDA included stock-based compensation expense (which is a

non-cash expense that management adds back to EBITDA when assessing

its cash flows) of approximately $78,000 and $96,000 during the

three-month periods ended September 30, 2024 and 2023 and $257,000

and $268,000 during the nine-month periods ended September 30,

2024, and 2023, respectively. Cash payments to satisfy debt

repayment obligations or to make capital expenditure investments

are other uses of cash that are not included in the calculation of

EBITDA, which management also considers when assessing its cash

flows.

Conference Call:

The Company is planning to host a conference call on Thursday,

November 14, 2024 at 9:00 AM ET to discuss the unaudited financial

results for the quarter ended September 30, 2024. Interested

parties can access the conference call by dialing (844) 855-9502

(toll free) or (412) 317-5499 (international). A teleconference

replay of the call will be available until November 21, 2024 at

(877) 344-7529 (toll free) or (412) 317-0088 (international),

utilizing replay access code #6807288. Investors are encouraged to

review the Company’s updated Corporate Presentation slide deck that

provides an overview of the Company’s business and is available

under the “Investors” tab of the Company’s website at

www.immucell.com, or by request to the Company. An updated version

of the slide deck will be made available under the “Investors” tab

of the Company’s website after the market closes on Wednesday,

November 13, 2024.

About ImmuCell:

ImmuCell Corporation's (Nasdaq: ICCC) purpose

is to create scientifically proven and practical products that

improve the health and productivity of dairy and beef

cattle. ImmuCell manufactures and markets First

Defense®, providing Immediate Immunity™

to newborn dairy and beef calves, and is in the late stages of

developing Re-Tain®, a novel treatment for

subclinical mastitis in dairy cows without FDA-required milk

discard or meat withhold label restrictions that provides an

alternative to traditional antibiotics. Press releases and other

information about the Company are available at:

http://www.immucell.com.

Contacts:

Michael F. Brigham, President and CEO

ImmuCell

Corporation

(207) 878-2770

Joe

Diaz, Robert Blum and Joe Dorame

Lytham Partners, LLC

(602)

889-9700iccc@lythampartners.com

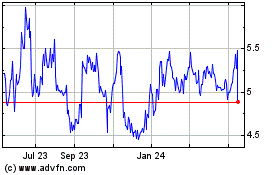

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Jan 2025 to Feb 2025

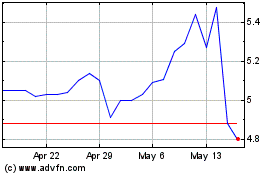

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Feb 2024 to Feb 2025