Immuneering Reports First Quarter 2024 Financial Results and Provides Business Updates

08 May 2024 - 6:05AM

Immuneering Corporation (Nasdaq: IMRX), a clinical-stage oncology

company seeking to develop and commercialize universal-RAS/RAF

medicines for broad populations of cancer patients, today reported

financial results for the first quarter ended March 31, 2024, and

provided business updates.

“Never before have we had more evidence that

IMM-1-104 performs as intended in patients, or that Deep Cyclic

Inhibition - the mechanism by which it aims to attack cancer while

sparing healthy cells - is capable of shrinking tumors in a

well-tolerated way relative to other MAPK pathway inhibitors,” said

Ben Zeskind, Ph.D., Co-founder, and Chief Executive Officer of

Immuneering. “We believe the positive topline results from the

Phase 1 portion of our Phase 1/2a study, along with the preclinical

data we recently presented at AACR, further de-risk IMM-1-104 and

bode well for the five arms of our ongoing Phase 2a study – all of

which have tumor objective response rate (ORR) as a primary

endpoint. Initial data readouts from multiple arms of the Phase 2a

study of IMM-1-104 are expected this year, along with initial PK,

PD and safety data from our Phase 1/2a study of IMM-6-415. We

expect the rest of 2024 to be a data-rich time for Immuneering, and

we look forward to providing updates in the coming months.”

Corporate Highlights

-

Preclinical Data Presented at AACR Demonstrating that

IMM-1-104 is Synergistic with Chemotherapy in Pancreatic Cancer

Models: In April, Immuneering presented preclinical data

at the American Association for Cancer Research (AACR) Annual

Meeting, which the Company views as supportive of its ongoing Phase

2a clinical trial of IMM-1-104 in RAS-mutated advanced or

metastatic solid tumors.

-

Announced Positive Topline Results from the Phase 1 Portion

of a Phase 1/2a Clinical Trial of IMM-1-104 in RAS-Mutant Solid

Tumors: In March, the Company reported positive topline

results from the Phase 1 portion of its Phase 1/2a trial of

IMM-1-104. As reported at the data cutoff date of February 20,

2024, IMM-1-104 was observed to be well-tolerated, demonstrating

the potential for a differentiated safety profile. In addition, one

hundred percent suppression of acquired RAS alterations was

observed in evaluable patients profiled for ctDNA and treated with

IMM-1-104, supporting the Company’s goal of Universal-RAS activity

for this drug candidate. Through the data cutoff date, target

lesion regression was observed in over half of patients treated

with IMM-1-104 at 320mg or 240mg QD, with a best individual lesion

regression of -35.7% and best RECIST sum of longest diameters (SLD)

of -18.9%, both at 320mg. The candidate recommended Phase 2 dose –

a key objective of the Phase 1 portion - of 320mg QD is supported

by tolerability, PK/PD, ctDNA results and initial anti-tumor

activity.

- Dosed

the First Patient in the Phase 2a Clinical Trial of

IMM-1-104: In March, the Company announced it had dosed

the first patient in the Phase 2a portion of its Phase 1/2a

clinical trial of IMM-1-104, which includes three monotherapy and

two combination arms in earlier lines of treatment, including first

line, with initial data from multiple arms expected in 2024.

- First

Patient Dosed in a Phase 1/2a Trial of IMM-6-415 to Treat Advanced

Solid Tumors with RAF or RAS Mutations: In March,

Immuneering dosed the first patient in its Phase 1/2a trial of

IMM-6-415. IMM-6-415 is a Deep Cyclic Inhibitor (DCI) of the MAPK

pathway designed with unique drug-like properties including a

shorter half-life than IMM-1-104 for an accelerated cadence that

will be evaluated as an oral, twice-daily treatment in humans. In

animal studies, IMM-6-415 strongly inhibited the growth of tumors

with RAF or RAS mutations, as both a monotherapy and in

combinations.

-

Appointed Thomas J. Schall, Ph.D. to the Board of

Directors: In March, Immuneering announced the appointment

of Thomas J. Schall, Ph.D., former Chairman, CEO and Founder of

ChemoCentryx before its acquisition by Amgen, to its Board of

Directors.

- Received

FDA Fast Track Designation for IMM-1-104 in Pancreatic

Cancer: In February, Immuneering announced that the U.S.

Food and Drug Administration (FDA) has granted Fast Track

designation for IMM-1-104, for the treatment of patients with

pancreatic ductal adenocarcinoma (PDAC) who have failed one line of

treatment. Fast Track Designation is a program designed to

facilitate the development and expedite the review of medicines

with the potential to treat serious conditions and fulfill an unmet

medical need. An investigational medicine that receives Fast Track

Designation may be eligible for more frequent interactions with the

FDA to discuss the candidate’s development plan and, if relevant

criteria are met, may be eligible for accelerated approval and

priority review.

Near-Term Milestone

Expectations

IMM-1-104

- Initial data

from multiple arms of the Phase 2a portion of the Company’s Phase

1/2a study expected in 2024.

IMM-6-415

- Initial

pharmacokinetic (PK), pharmacodynamic (PD) and safety data expected

in 2024.

First Quarter 2024 Financial

Highlights

- Cash

Position: Cash, cash equivalents and marketable securities

as of March 31, 2024, were $71.3 million, compared with $85.7

million as of December 31, 2023.

- Research

and Development (R&D) Expenses: R&D expenses for

the first quarter of 2024 were $11.2 million compared with $10.2

million for the first quarter of 2023. The increase in R&D

expenses was primarily attributable to higher clinical costs

related to the Company’s lead program and increased personnel to

support ongoing research and development activities.

- General

and Administrative (G&A) Expenses: G&A expenses

for the first quarter of 2024 were $4.1 million compared with $4.5

million for the same period of 2023. The decrease in G&A is

primarily attributed to a decrease in the Company’s external

professional fees related to the general and administrative

functions supporting the business.

- Net

Loss: Net loss attributable to common stockholders was

$14.3 million, or $0.49 per share, for the first quarter ended

March 31, 2024, compared to $13.6 million, or $0.51 per share, for

the first quarter ended March 31, 2023.

2024 Financial Guidance

- Based on cash,

cash equivalents and marketable securities, as of March 31, 2024,

and current operating plans, the Company expects its cash runway to

be sufficient to fund operations into the second half of 2025.

About Immuneering

Corporation

Immuneering is a clinical-stage oncology company

seeking to develop and commercialize universal-RAS/RAF medicines

for broad populations of cancer patients with an initial aim to

develop a universal-RAS therapy. The Company aims to achieve

universal activity through Deep Cyclic Inhibition of the MAPK

pathway, impacting cancer cells while sparing healthy cells.

Immuneering’s lead product candidate, IMM-1-104, is an oral,

once-daily Deep Cyclic Inhibitor currently in a Phase 1/2a trial in

patients with advanced solid tumors harboring RAS mutations.

IMM-6-415 is an oral, twice-daily Deep Cyclic Inhibitor currently

in a Phase 1/2a trial in patients with advanced solid tumors

harboring RAS or RAF mutations. The Company’s development pipeline

also includes several early-stage programs. For more information,

please visit www.immuneering.com.

Forward-Looking Statements

This press release contains forward-looking

statements, including within the meaning of the Private Securities

Litigation Reform Act of 1995. All statements contained in this

press release that do not relate to matters of historical fact

should be considered forward-looking statements, including, without

limitation, statements regarding: Immuneering’s plans to develop,

manufacture and commercialize its product candidates; the treatment

potential of IMM-1-104 and IMM-6-415, alone or in combination with

other agents, including the ability to shrink tumors in a

well-tolerated way relative to other MAPK pathway inhibitors; the

design, enrollment criteria and conduct of the Phase 1/2a clinical

trials of IMM-1-104 and IMM-6-415; the translation of preclinical

data into human clinical data; the potential advantages and

effectiveness of Immuneering’s clinical and preclinical candidates;

and the timing of results of the Phase 2a portion of the trial for

IMM-1-104 and initial data for IMM-6-415.

These forward-looking statements are based on

management’s current expectations. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements, including, but not

limited to, the following: the risks inherent in oncology drug

research and development, including target discovery, target

validation, lead compound identification, and lead compound

optimization; we have incurred significant losses, are not

currently profitable and may never become profitable; our projected

cash runway; our need for additional funding; our unproven approach

to therapeutic intervention; our ability to address regulatory

questions and the uncertainties relating to regulatory filings,

reviews and approvals; the lengthy, expensive, and uncertain

process of clinical drug development, including potential delays in

or failure to obtain regulatory approvals; our reliance on third

parties and collaborators to conduct our clinical trials,

manufacture our product candidates, and develop and commercialize

our product candidates, if approved; failure to compete

successfully against other drug companies; protection of our

proprietary technology and the confidentiality of our trade

secrets; potential lawsuits for, or claims of, infringement of

third-party intellectual property or challenges to the ownership of

our intellectual property; our patents being found invalid or

unenforceable; costs and resources of operating as a public

company; and unfavorable or no analyst research or reports.

These and other important factors discussed

under the caption “Risk Factors” in our Quarterly Report on Form

10-Q for the quarterly period ended March 31, 2024, and our other

reports filed with the U.S. Securities and Exchange Commission,

could cause actual results to differ materially from those

indicated by the forward-looking statements made in this press

release. Any such forward-looking statements represent management's

estimates as of the date of this press release. While we may elect

to update such forward-looking statements at some point in the

future, except as required by law, we disclaim any obligation to do

so, even if subsequent events cause our views to change. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Media Contact:Gina

Nugentgina@nugentcommunications.com

Investor Contact:Laurence

Watts619-916-7620laurence@newstreetir.com

| |

|

IMMUNEERING CORPORATIONCONSOLIDATED BALANCE

SHEETS |

| |

| |

March 31,2024 |

December 31,2023 |

| |

|

|

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

66,287,148 |

|

$ |

59,405,817 |

|

|

Marketable securities |

|

4,991,200 |

|

|

26,259,868 |

|

|

Accounts receivable |

|

- |

|

|

- |

|

|

Prepaids and other current assets |

|

3,169,089 |

|

|

3,417,984 |

|

|

Total current assets |

|

74,447,437 |

|

|

89,083,669 |

|

| |

|

|

|

Property and equipment, net |

|

1,347,852 |

|

|

1,400,582 |

|

|

Goodwill |

|

6,690,431 |

|

|

6,690,431 |

|

|

Intangible asset, net |

|

372,363 |

|

|

379,680 |

|

|

Right-of-use assets, net |

|

3,905,575 |

|

|

3,995,730 |

|

|

Other assets |

|

1,219,182 |

|

|

1,034,446 |

|

|

Total assets |

$ |

87,982,840 |

|

$ |

102,584,538 |

|

| |

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

Current liabilities: |

|

|

|

Accounts payable |

$ |

2,270,862 |

|

$ |

2,111,666 |

|

|

Accrued expenses |

|

2,584,359 |

|

|

5,173,960 |

|

|

Other liabilities |

|

23,634 |

|

|

259,770 |

|

|

Lease liabilities |

|

298,543 |

|

|

300,107 |

|

|

Total current liabilities |

|

5,177,398 |

|

|

7,845,503 |

|

| |

|

|

|

Long-term liabilities: |

|

|

|

Lease liabilities, net of current portion |

|

4,082,713 |

|

|

4,162,852 |

|

|

Total liabilities |

|

9,260,111 |

|

|

12,008,355 |

|

|

Commitments and contingencies (Note 10) |

|

|

|

Stockholders’ equity: |

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized at

September 30, 2022 and December 31, 2022; 0 shares issued or

outstanding at June 30, 2023 and December 31, 2021 |

|

- |

|

|

- |

|

|

Class A common stock, $0.001 par value, 200,000,000 shares

authorized at June 30, 2023 and December 31, 2022; 26,404,732 and

26,320,199 shares issued and outstanding at June 30, 2023 and

December 31, 2021, respectively |

|

29,653 |

|

|

29,272 |

|

|

Class B common stock, $0.001 par value, 20,000,000 shares

authorized at June 30, 2023 and December 31, 2022; 0 shares issued

and outstanding at June 30, 2023 and December 31, 2022 |

|

- |

|

|

- |

|

|

Additional paid-in capital |

|

256,260,567 |

|

|

253,806,267 |

|

|

Accumulated other comprehensive loss |

|

(1,084 |

) |

|

(778 |

) |

|

Accumulated deficit |

|

(177,566,407 |

) |

|

(163,258,578 |

) |

|

Total stockholders' equity |

|

78,722,729 |

|

|

90,576,183 |

|

|

Total liabilities and stockholders' equity |

$ |

87,982,840 |

|

$ |

102,584,538 |

|

| |

|

|

| |

|

IMMUNEERING CORPORATIONCONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS(Unaudited) |

| |

| |

Three Months Ended March 31 |

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

Operating expenses |

|

|

|

Research and development |

|

11,202,414 |

|

|

10,210,926 |

|

|

General and administrative |

|

4,116,019 |

|

|

4,461,331 |

|

|

Amortization of intangible asset |

|

7,317 |

|

|

7,317 |

|

|

Total operating expenses |

|

15,325,750 |

|

|

14,679,574 |

|

|

Loss from operations |

|

(15,325,750 |

) |

|

(14,679,574 |

) |

| |

|

|

|

Other income (expense) |

|

|

|

Interest income |

|

804,884 |

|

|

831,274 |

|

|

Other income, net |

|

213,037 |

|

|

244,129 |

|

|

Net loss |

$ |

(14,307,829 |

) |

$ |

(13,604,171 |

) |

| |

|

|

|

Net loss per share attributable to common stockholders, basic and

diluted |

$ |

(0.49 |

) |

$ |

(0.51 |

) |

|

Weighted-average common shares outstanding, basic and diluted |

|

29,370,357 |

|

|

26,442,216 |

|

| |

|

|

|

Other comprehensive loss: |

|

|

|

Unrealized gains (losses) from marketable securities |

|

(306 |

) |

|

30,626 |

|

|

Comprehensive Loss |

$ |

(14,308,135 |

) |

$ |

(13,573,545 |

) |

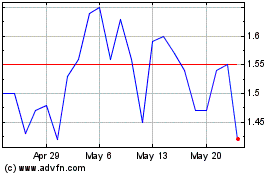

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Jan 2024 to Jan 2025