0001790340FALSE00017903402024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

__________________________________

Immuneering Corporation

(Exact name of Registrant as Specified in Its Charter)

__________________________________

| | | | | | | | |

| Delaware | 001-40675 | 26-1976972 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

245 Main St.

Second Floor

Cambridge, MA 02142

(Address of principal executive offices) (Zip Code)

(617) 500-8080

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.001 per share | | IMRX | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2024, Immuneering Corporation (the “Company”) announced its financial results for the quarter ended September 30, 2024 and provided operational updates. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K (the “Current Report”).

The information in this Item 2.02 of this Current Report, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

The following exhibits relate to Item 2.02, which shall be deemed to be furnished, and not filed:

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| IMMUNEERING CORPORATION |

| |

Date: November 13, 2024 | By: | /s/ Benjamin J. Zeskind |

| | Name: Benjamin J. Zeskind, Ph.D. |

| | Title: Co-Founder, President, Chief Executive Officer and Director (Principal Executive Officer) |

Exhibit 99.1

Immuneering Reports Third Quarter 2024 Financial Results and Provides Business Updates

- Announced Positive Initial Data, Including Complete and Partial Responses, with IMM-1-104 in Combination with Chemotherapy in First-Line Pancreatic Cancer Patients -

- Granted FDA Orphan Drug Designation for IMM-1-104 in the Treatment of Pancreatic Cancer and Fast Track Designation in First-line Pancreatic Cancer -

- Initial Data From At Least One Additional Arm of the Phase 2a Portion of the IMM-1-104 Phase 1/2a Trial Expected by Year End -

- Cash Runway into Fourth Quarter 2025 -

CAMBRIDGE, Mass., November 13, 2024 - Immuneering Corporation (Nasdaq: IMRX), a clinical-stage oncology company seeking to develop and commercialize universal-RAS/RAF medicines for broad populations of cancer patients, today reported financial results for the third quarter ended September 30, 2024, and provided business updates.

“We were extremely pleased to share positive initial response data in September for IMM-1-104 in combination with modified gemcitabine/nab-paclitaxel in pancreatic cancer as part of the ongoing Phase 2a clinical trial,” said Ben Zeskind, Ph.D., Co-founder and Chief Executive Officer of Immuneering. “While still early, it is highly encouraging to already see responses – including a complete response – as well as impressive disease control, both at levels that would represent a meaningful improvement over the existing standard of care. If these results continue, we believe we will have a clear path forward for clinical development of IMM-1-104 in combination with gemcitabine/nab-paclitaxel for pancreatic cancer. Importantly, our recent Fast Track and Orphan Drug designations from the FDA may help advance development of this potentially important new therapy for the treatment of pancreatic cancer. With enrollment progressing well in our Phase 2a arms, we expect to share further data by year end and we look forward to providing updates on our progress at that time.”

Corporate Highlights

•FDA Orphan Drug Designation for IMM-1-104 in the Treatment of Pancreatic Cancer: In October 2024, the U.S. Food and Drug Administration (FDA) granted Orphan Drug designation to IMM-1-104 in the treatment of pancreatic cancer.

•Positive Initial Phase 2a Data Including Complete and Partial Responses with IMM-1-104 in Combination with Chemotherapy in First-Line Pancreatic Cancer Patients: In September 2024, Immuneering announced positive initial response data from the first five patients treated with IMM-1-104 in combination with modified gemcitabine/nab-paclitaxel in first line pancreatic cancer as part of its ongoing Phase 2a clinical trial. If the early trends with IMM-1-104 in combination with modified gemcitabine/nab-paclitaxel continue, management believes there is a clear path forward for clinical development of IMM-1-104 in pancreatic cancer, which has the potential to improve the prognosis for a drastically underserved patient population.

•FDA Fast Track Designation for IMM-1-104 in First-line Pancreatic Cancer: In July 2024, the FDA granted Fast Track designation for IMM-1-104, as a first-line treatment for patients with pancreatic ductal adenocarcinoma (PDAC).

Near-Term Milestone Expectations

IMM-1-104

•Initial data from at least one additional arm of the Phase 2a portion of the Company’s Phase 1/2a trial is expected by year end.

IMM-6-415

•Initial PK, PD and safety data from the Phase 1 portion of the Company’s Phase 1/2a trial is expected by year end.

Third Quarter 2024 Financial Highlights

Cash Position: Cash, cash equivalents and marketable securities as of September 30, 2024 were $50.7 million, compared with $85.7 million as of December 31, 2023. The September 30, 2024 figure includes $4.2 million of net proceeds from the Company’s ATM facility.

Research and Development (R&D) Expenses: R&D expenses for the third quarter of 2024, were $11.3 million compared with $10.1 million for the third quarter of 2023. The increase in R&D expenses was primarily attributable to higher clinical costs related to the Company’s lead program and increased personnel to support ongoing research and development activities.

General and Administrative (G&A) Expenses: G&A expenses for the third quarter of 2024 were $4.0 million, compared with $3.9 million for the third quarter of 2023. The increase in G&A expenses was primarily attributable to an increase in the Company’s stock-based compensation costs and employee-related costs in connection with general and administrative functions.

Net Loss: Net loss attributable to common stockholders was $14.6 million, or $0.49 per share, for the third quarter ended September 30, 2024, compared to $12.6 million, or $0.43 per share, for the third quarter ended September 30, 2023.

2024 Financial Guidance

Based on cash, cash equivalents and marketable securities as of September 30, 2024, and current operating plans, the Company expects its cash runway to be sufficient to fund operations into the fourth quarter of 2025.

About Immuneering Corporation

Immuneering is a clinical-stage oncology company seeking to develop and commercialize universal-RAS/RAF medicines for broad populations of cancer patients with an initial aim to develop a universal-RAS therapy. The Company aims to achieve universal activity through Deep Cyclic Inhibition of the MAPK pathway, impacting cancer cells while sparing healthy cells. Immuneering’s lead product candidate, IMM-1-104, is an oral, once-daily Deep Cyclic Inhibitor currently in a Phase 2a trial in patients with advanced solid tumors including those harboring RAS mutations. IMM-6-415 is an oral, twice-daily Deep Cyclic Inhibitor currently in a Phase 1/2a trial in patients with advanced solid tumors harboring RAS or RAF mutations. The Company’s development pipeline also includes several early-stage programs. For more information, please visit www.immuneering.com.

Forward-Looking Statements

This press release contains forward-looking statements, including within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding: Immuneering’s plans to develop, manufacture and commercialize its product candidates; the treatment potential of IMM-1-104, alone or in combination with other agents, including chemotherapy; the design, enrollment and conduct of the Phase 1/2a IMM-1-104 clinical trial; the possible incentives and other benefits that could result from fast track and / or orphan drug designation of IMM-1-104; and the timing of additional results from the Phase 2a portion of the trial for IMM-1-104 and the Phase 1 portion of the trial for IMM-6-415.

These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the risks inherent in oncology drug research and development, including target discovery, target validation, lead compound identification, and lead compound optimization; we have incurred significant losses, are not currently profitable and may never become profitable; our projected cash runway; our need for additional funding; our unproven approach to therapeutic intervention; our ability to address regulatory questions and the uncertainties relating to regulatory filings, reviews and approvals; the lengthy, expensive, and uncertain process of clinical drug development, including potential delays in or failure to obtain regulatory approvals; our reliance on third parties and collaborators to conduct our clinical trials, manufacture our product candidates, and develop and commercialize our product candidates, if approved; failure to compete successfully against other drug companies; protection of our proprietary technology and the confidentiality of our trade secrets; potential lawsuits for, or claims of, infringement of third-party intellectual property or challenges to the ownership of our intellectual property; our patents being found invalid or unenforceable; costs and resources of operating as a public company; and unfavorable or no analyst research or reports.

These and other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the period ended September 30, 2024, and our other reports filed with the U.S. Securities and Exchange Commission, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management's estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Media Contact:

Gina Nugent

gina@nugentcommunications.com

Investor Contact:

Laurence Watts

619-916-7620

laurence@newstreetir.com

IMMUNEERING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Operating expenses | | | | | | | |

| Research and development | $ | 11,252,850 | | | $ | 10,050,198 | | | $ | 33,107,222 | | | $ | 29,713,835 | |

| General and administrative | 4,013,581 | | | 3,868,823 | | | 12,384,074 | | | 12,375,114 | |

| Amortization of intangible asset | 7,317 | | | 7,317 | | | 21,950 | | | 21,950 | |

| Total operating expenses | 15,273,748 | | | 13,926,338 | | | 45,513,246 | | | 42,110,899 | |

| Loss from operations | (15,273,748) | | | (13,926,338) | | | (45,513,246) | | | (42,110,899) | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Interest income | 547,072 | | | 855,532 | | | 2,178,060 | | | 2,852,852 | |

| Other income, net | 129,310 | | | 475,595 | | | 350,063 | | | 869,917 | |

| Net loss | $ | (14,597,366) | | | $ | (12,595,211) | | | $ | (42,985,123) | | | $ | (38,388,130) | |

| | | | | | | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (0.49) | | | $ | (0.43) | | | $ | (1.45) | | | $ | (1.36) | |

| Weighted-average common shares outstanding, basic and diluted | 29,841,883 | | 29,266,309 | | 29,622,670 | | 28,129,005 |

| | | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| Unrealized gains from marketable securities | 7,845 | | | 7,825 | | | 8,624 | | | 35,727 | |

| Comprehensive Loss | $ | (14,589,521) | | | $ | (12,587,386) | | | $ | (42,976,499) | | | $ | (38,352,403) | |

IMMUNEERING CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45,205,577 | | | $ | 59,405,817 | |

| Marketable securities | 5,452,155 | | | 26,259,868 | |

| | | |

| Prepaids and other current assets | 4,601,769 | | | 3,417,984 | |

| Total current assets | 55,259,501 | | | 89,083,669 | |

| | | |

| | | |

| Property and equipment, net | 1,205,095 | | | 1,400,582 | |

| Goodwill | 6,690,431 | | | 6,690,431 | |

| Intangible asset, net | 357,730 | | | 379,680 | |

| Right-of-use assets, net | 3,748,565 | | | 3,995,730 | |

| Other assets | 1,295,782 | | | 1,034,446 | |

| Total assets | $ | 68,557,104 | | | $ | 102,584,538 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,942,782 | | | $ | 2,111,666 | |

| Accrued expenses | 4,592,825 | | | 5,173,960 | |

| Other liabilities | 59,657 | | | 259,770 | |

| Lease liabilities | 324,702 | | | 300,107 | |

| Total current liabilities | 6,919,966 | | | 7,845,503 | |

| | | |

| Long-term liabilities: | | | |

| Lease liabilities, net of current portion | 3,916,324 | | | 4,162,852 | |

| Total liabilities | 10,836,290 | | | 12,008,355 | |

| Commitments and contingencies (Note 10) | | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.001 par value; 10,000,000 shares authorized at September 30, 2024 and December 31, 2023; 0 shares issued or outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Class A common stock, $0.001 par value, 200,000,000 shares authorized at September 30, 2024 and December 31, 2023; 31,050,448 and 29,271,629 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 31,050 | | | 29,272 | |

| Class B common stock, $0.001 par value, 20,000,000 shares authorized at September 30, 2024 and December 31, 2023; 0 shares issued and outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

| Additional paid-in capital | 263,925,619 | | | 253,806,267 | |

| Accumulated other comprehensive loss | 7,845 | | | (778) | |

| Accumulated deficit | (206,243,700) | | | (163,258,578) | |

| Total stockholders' equity | 57,720,814 | | | 90,576,183 | |

| Total liabilities and stockholders' equity | $ | 68,557,104 | | | $ | 102,584,538 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

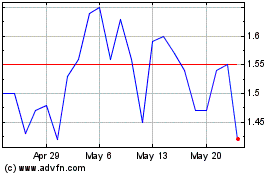

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Nov 2023 to Nov 2024