Intel Raises Outlook, Sending Shares Higher--2nd Update

25 October 2019 - 8:47AM

Dow Jones News

By Sarah E. Needleman

Intel Corp. reported stronger third-quarter earnings and again

raised its full-year outlook, helping ease investor concerns about

chip-supply bottlenecks at the company and a broader slowdown in

demand.

Shares of the chip maker jumped more than 7% in after-market

trading.

Intel on Thursday reported adjusted earnings of $1.42 a share,

compared with $1.40 for the year-prior period. Analysts surveyed by

FactSet were expecting earnings of $1.23 a share.

Third-quarter revenue for the Santa Clara, Calif., company rose

to $19.19 billion from $19.16 billion, also topping

expectations.

Intel, the largest chip maker in the U.S. by revenue, said sales

of chips used in data centers helped deliver the

stronger-than-expected result. Those chips are heavily used in the

booming cloud-computing market. Microsoft Corp., the No. 2 in cloud

computing behind Amazon.com Inc., gave an upbeat outlook for its

cloud business.

Intel also said its memory business, which has been

underperforming this year compared with last, is starting to turn

around. "It's still down, but it's coming back," Intel finance

chief George Davis said. He said the momentum helped give the

company confidence to raise its full-year outlook for a second

period in a row.

The company reported a 5% drop in PC-related revenue despite

healthy demand for the computers.

PC shipments globally rose to 70.9 million units, marking the

best third-quarter performance since 2015, according to data from

Canalys. The 4.7% increase from a year earlier was the strongest

growth since the first quarter in 2012, the research firm said.

"Last year, there was so much demand for PC processors that we

were actually selling down our inventory," Mr. Davis said. Without

that buffer, he said, Intel has struggled to keep pace this year.

"As we get back to having the supply, we expect those volumes to go

back."

Intel said it expects $19.2 billion in sales in the current

quarter. That outlook could help investors overcome broader

concerns that technology spending by large businesses is

slowing.

Texas Instruments Inc. this week gave muted guidance for the

current quarter, saying customers were more cautious.

Intel raised its full-year revenue outlook by $1.5 billion to

$71 billion. It also boosted its full-year earnings outlook to

$4.60 a share from $4.40.

"We now expect to deliver a fourth record year in a row," Intel

Chief Executive Bob Swan said in a statement.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

October 24, 2019 17:32 ET (21:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

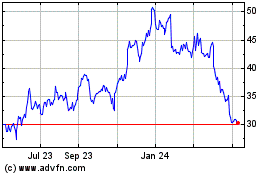

Intel (NASDAQ:INTC)

Historical Stock Chart

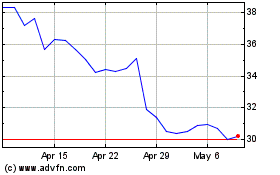

From Jun 2024 to Jul 2024

Intel (NASDAQ:INTC)

Historical Stock Chart

From Jul 2023 to Jul 2024