UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 2)

Tender Offer Statement Under Section 13(e)(1)

of the Securities Exchange Act of 1934

ASSURE HOLDINGS CORP.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

9% CONVERTIBLE DEBENTURES DUE 2023 AND 2024

(Title of Class of Securities)

|

04625J303

(CUSIP Number of Common Stock Underlying Debentures) |

| |

|

John Farlinger

Executive Chairman and Chief Executive Officer

7887 East Belleview Avenue, Suite 240

Denver, Colorado 80111

Telephone: 720-287-3093 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person) |

| |

| |

| Copies to: |

| |

|

Jason K Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, Colorado 80202

Telephone: (303) 352-1133

Fax Number: (303) 629-3450 |

| |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| ¨ |

third party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 2 (“Amendment No.

2”) amends the Tender Offer Statement on Schedule TO originally filed by Assure Holdings Corp., a Nevada corporation (the “Company”,

“we”, “us” or “our”), on June 21, 2024, as amended on July 3, 2024 (the “First

Amended Schedule TO”), in connection with an offer (the “Convertible Note Exchange Offer”) by Assure

to exchange, for each $1,000 claim, consisting of principal amount, and accrued and unpaid interest through, and including, July 19, 2024,

of the Company’s 9% Convertible Debentures due 2023 and 2024 (the “Assure Convertible Debentures”), 238.44 shares

(4,291.85 shares on a pre-reverse split basis) of the Company’s common stock (the “Common Stock”) equal to the

quotient of $1,000 divided by a per share price of $4.194 ($0.233 on a pre-reverse split basis), as adjusted for a 1-for-18 reverse stock

split which took effect on July 9, 2024. Assure is seeking to exchange any and all outstanding Assure Convertible Debentures in

the Convertible Note Exchange Offer for the offered shares of Common Stock.

The Convertible Note Exchange Offer commenced

on June 21, 2024 and will expire at 11:59 p.m. (Denver time) on July 19, 2024, unless extended by the Company.

This Amendment No. 2 is being filed solely to

provide as an exhibit the Letter to Holders from the Company’s Chief Executive Officer, dated July 9, 2024. The letter reminds holders

of Assure Convertible Notes to tender into the Convertible Note Exchange Offer, if they determine to do so, and confirms that the Company’s

planned 1-for-18 reverse stock split took effect on July 9, 2024 and, as disclosed in the First Amended Schedule TO and the Offer Letter

as amended by the Amendment No.1 to Offer Lettter dated July 3, 2024, the consideration being offered in the Convertible Note Exchange

Offer has been proportionately adjusted to reflect the effectiveness of the reverse stock split, such that for each $1,000 claim, consisting

of principal amount, and accrued and unpaid interest through, and including, July 19, 2024, of the Assure Convertible Debentures, holders

that tender into the Convertible Note Exchange Offer will receive 238.44 shares (4,291.85 shares on a pre-reverse split basis) of Common

Stock equal to the quotient of $1,000 divided by a per share price of $4.194 ($0.233 on a pre-reverse split basis). The terms of the Convertible

Note Exchange Offer have not changed, except to make the adjustment for the reverse stock split, which precise adjustment was previously

disclosed in the Offer Letter as amended by Amendment No.1 to the Offer Letter.

This Amendment No. 2 amends and supplements only

Items 11 and 12. Except to the extent specifically provided herein, the information contained in the Original Schedule TO, the Offer Letter,

filed as Exhibit (a)(1)(i) to the Original Schedule TO, the infomration in Amendment No. 1 to Offer Letter, filed as Exhibit (a)(1)(ii)

to the amended Scheudle TO filed on July 3, 2024, and the other exhibits to the Schedule TO, as amended throught the date hereof, remain

unchanged and are hereby expressly incorporated into this Amendment No. 2 by reference in response to Items 1 through 13. This Amendment

No. 2 should be read with the Original Schedule TO, as amended, the Offer Letter and the Amendment No.1 to Offer Letter.

Item 11. Additional Information

Item 11 of the Amended Schedule TO is hereby amended and supplemented

by adding the following:

On July 9, 2024, the Company sent to the holders

of the Assure Convertible Debentures a letter from the CEO reminding the holders to tender into the Convertible Note Exchange Offer, if

they determine to do so, and nd confirms that the Company’s planned 1-for-18 reverse stock split took effect on July 9, 2024 and,

as disclosed in the First Amended Schedule TO and the Offer Letter as amended by the Amendment No.1 to Offer Lettter dated July 3, 2024,

the consideration being offered has been proportionately adjusted to reflect the effectiveness of the reverse stock split, such that for

each $1,000 claim, consisting of principal amount, and accrued and unpaid interest through, and including, July 19, 2024, of the Assure

Convertible Debentures, holders that tender into the Convertible Note Exchange Offer will receive 238.44 shares (4,291.85 shares on a

pre-reverse split basis) of Common Stock equal to the quotient of $1,000 divided by a per share price of $4.194 ($0.233 on a pre-reverse

split basis).

Item 12. Exhibits.

*

- Previously filed

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ASSURE HOLDINGS CORP. |

|

| |

|

|

| By: |

/s/ John Farlinger |

|

| |

John Farlinger |

|

| |

Chief Executive Officer |

|

Dated: July 9, 2024

INDEX TO EXHIBITS

*

- Previously filed

Exhibit (a)(1)(vii)

July 9, 2024

[ADDRESS]

[EMAIL ADDRESS]

Re: Offer to Exchange Convertible Notes for

Shares of Common Stock

Dear Holder:

We are writing to inform you of important information

relating to the Convertible Note Exchange Offer by Assure Holdings Corp. (the “Company”). The Convertible Note Exchange Offer

relates to an offer by the Company to all the holders (“Holder(s)”) of our outstanding 9% convertible debentures due 2023

and 2024 (the “Assure Convertible Debentures”), to exchange the Assure Convertible Debentures for shares of common stock of

the Company.

The Convertible Note Exchange Offer period

began on June 21, 2024, and ends at 11:59 p.m., Mountain Time, on July 19, 2024, at which point the Convertible Note Exchange Offer will

expire.

Please

note that, as disclosed in Amendment No. 1 to Offer Letter dated July 3, 2024, the Company effected a 1-for-18 reverse stock split in

its shares of common stock on July 9, 2024. As previously disclosed, as a result of the reverse stock split the consideration being

offered in the Convertible Note Exchange Offer has been proportionately adjusted to reflect the effectiveness of the reverse stock split,

such that for each $1,000 claim, consisting of principal amount, and accrued and unpaid interest through, and including, July 19, 2024,

of the Assure Convertible Debentures, holders that tender into the Convertible Note Exchange Offer will receive 238.44 shares (4,291.85

shares on a pre-reverse split basis) of Common Stock equal to the quotient of $1,000 divided by a per share price of $4.194 ($0.233 on

a pre-reverse split basis). The terms of the Convertible Note Exchange Offer have not changed, except to note the adjustment for the reverse

stock split, which precise adjustment was previously disclosed in the Offer Letter dated June 21, 2023, as amended by Amendment No.1 to

the Offer Letter dated July 3, 2024.

We

encourage you to carefully read the Offer Letter dated June 21, 2024, as amended by Amendment No. 1 to Offer Letter dated July 3, 2024,

which have been provided to you, prior to making any decision to tender into the Convertible Note Exchange Offer as these documents contain

important information regarding the Convertible Note Exchange Offer. If you require free additional copies of either document, please

send a request to the address or e-mail address below. These documents are also available on the United States Securities and Exchange

Commission’s (the “SEC”) website under the Company’s profile at www.sec.gov as part of the

Company’s Schedule TO filed with the SEC on June 21, 2024, as amended on July 3, 2024.

Participation in the Convertible Note Exchange

Offer is important to the Company’s plans to maintain the listing of the Common Stock on the Nasdaq Capital Market and the Company

strongly encourages each Holder to carefully consider participating in the Convertible Note Exchange Offer in light of these plans.

Should you wish to tender your Assure Convertible

Debentures for exchange by the Company during this Convertible Note Exchange Offer period, please complete and return the previously provided

Amended Letter of Transmittal by mail to 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111 or email to ir@assureiom.com no

later than 11:59 p.m., Mountain Time, on July 19, 2024. NO ACTION IS REQUIRED IF YOU DO NOT WISH TO HAVE YOUR DEBENTURES CONVERTED.

If you have any questions, please refer to the

Offer Letter, which contains additional important information about the tender offer, or call or email Assure Holdings Corp. at ir@assureiom.com or

720-287-3093.

Sincerely,

/s/ John Farlinger

John Farlinger

Chief Executive Officer

Assure Holdings Corp.

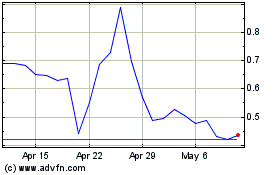

Assure (NASDAQ:IONM)

Historical Stock Chart

From Jan 2025 to Feb 2025

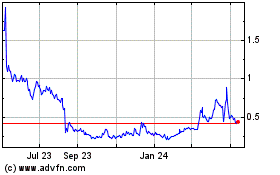

Assure (NASDAQ:IONM)

Historical Stock Chart

From Feb 2024 to Feb 2025